Key Insights

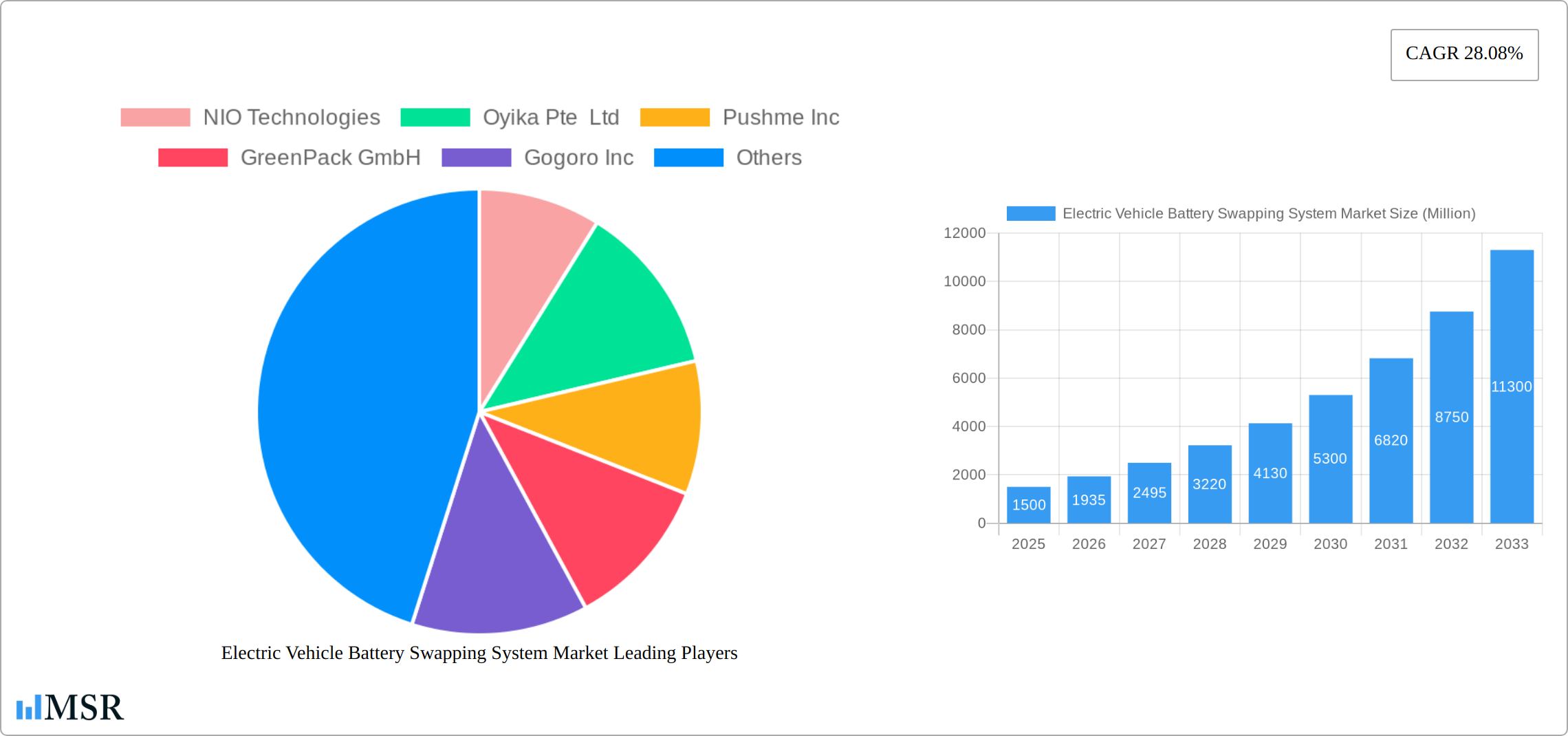

The Electric Vehicle (EV) Battery Swapping System market is experiencing rapid growth, projected to reach a substantial size by 2033. A Compound Annual Growth Rate (CAGR) of 28.08% from 2025 to 2033 indicates significant market expansion driven by several key factors. Increasing EV adoption globally, coupled with the inherent limitations of traditional charging infrastructure (long charging times and limited availability), is fueling demand for faster and more convenient battery swapping solutions. Furthermore, the rising concerns surrounding environmental sustainability and the need for reduced carbon emissions are bolstering the adoption of EVs and, consequently, battery swapping systems. The market is segmented by service type (pay-per-use and subscription models) and battery type (lithium-ion and lead-acid), with lithium-ion batteries dominating due to their superior energy density and performance. Leading companies like NIO Technologies, Gogoro Inc., and others are actively investing in research and development, driving innovation in battery technology and swapping station infrastructure. Geographic growth is expected across regions, with North America, Europe, and Asia Pacific emerging as key markets. However, challenges remain, including standardization issues across different battery technologies and the need for substantial investment in building robust swapping station networks to ensure widespread adoption. Overcoming these hurdles will be crucial to unlocking the full potential of this burgeoning market.

The competitive landscape is marked by both established players and emerging startups. While companies like NIO and Gogoro are already establishing significant market presence, smaller players are innovating with cost-effective solutions and niche applications. The market's evolution will depend heavily on technological advancements, policy support, and collaborative efforts to overcome infrastructural limitations. The shift towards subscription-based models, offering greater cost predictability and convenience to consumers, is expected to gain traction in the coming years. Ultimately, the success of the EV battery swapping system market hinges on seamless integration with existing EV ecosystems, addressing consumer concerns about safety and reliability, and the creation of a standardized approach to battery technology and swapping protocols. Continued advancements in battery technology will also play a crucial role, leading to improved energy density, longer lifespans, and reduced costs.

Electric Vehicle Battery Swapping System Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Electric Vehicle (EV) Battery Swapping System Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, trends, and opportunities within this rapidly evolving sector. The global market is projected to reach xx Million by 2033, exhibiting a significant CAGR during the forecast period (2025-2033).

Electric Vehicle Battery Swapping System Market Concentration & Dynamics

The EV battery swapping system market exhibits a moderately concentrated landscape, with key players like NIO Technologies, Gogoro Inc, and BattSwap Inc holding significant market share. However, the market is also characterized by a growing number of emerging players and startups, leading to increased competition. Innovation is a key driver, with companies constantly developing new battery technologies and swapping station designs. The regulatory framework varies across regions, significantly impacting market growth. Substitutes, such as traditional charging infrastructure, pose a challenge, while consumer preference for convenience and reduced charging times fuels the adoption of battery swapping systems. M&A activity has been moderate, with xx deals recorded between 2019 and 2024, indicating consolidation and strategic partnerships within the industry.

- Market Concentration: Moderately concentrated, with key players controlling xx% of the market share in 2024.

- Innovation Ecosystems: Robust, driven by advancements in battery technology, station design, and software integration.

- Regulatory Frameworks: Vary significantly across geographies, influencing market access and adoption rates.

- Substitute Products: Traditional charging infrastructure presents a key competitive challenge.

- End-User Trends: Increasing preference for convenient and fast charging solutions drives demand.

- M&A Activities: Moderate activity (xx deals between 2019 and 2024) reflecting strategic consolidation and expansion.

Electric Vehicle Battery Swapping System Market Industry Insights & Trends

The global EV battery swapping system market is experiencing robust growth, fueled by several key factors. The rising adoption of electric vehicles, particularly in urban areas with limited parking and charging infrastructure, is a primary driver. The increasing focus on reducing charging times and enhancing the overall EV user experience further propels market expansion. Technological advancements in battery technology, such as improved energy density and lifespan, enhance the appeal and efficiency of battery swapping systems. The shift towards sustainable transportation, coupled with government incentives and policies promoting EV adoption, plays a crucial role. The market is witnessing a significant increase in the number of battery swapping stations being deployed globally, with an estimated xx Million units operational by 2025. This number is expected to grow at a CAGR of xx% during the forecast period. Furthermore, evolving consumer behaviors, including a preference for subscription-based services, further fuel market expansion.

Key Markets & Segments Leading Electric Vehicle Battery Swapping System Market

The Asia-Pacific region currently dominates the EV battery swapping system market, driven primarily by strong government support for EV adoption and the presence of major market players. China, particularly, is leading with substantial investments in battery swapping infrastructure and technological advancements.

- Dominant Region: Asia-Pacific (Specifically China)

- Dominant Service Type: Pay-Per-Use Model (higher initial adoption)

- Dominant Battery Type: Lithium-ion Battery (higher energy density and performance)

Drivers for Asia-Pacific Dominance:

- Robust government support and incentives for EV adoption.

- High population density and urbanization, leading to charging infrastructure limitations.

- Significant investments in research and development of battery swapping technology.

- Presence of major EV manufacturers and battery swapping service providers.

Detailed Dominance Analysis: The Pay-Per-Use model is currently the most popular service type due to its flexibility and affordability. However, the Subscription model is projected to gain significant traction in the coming years due to its predictable cost and enhanced convenience. Lithium-ion batteries dominate the market due to their higher energy density and longer lifespan. However, lead-acid batteries continue to hold a niche segment, mainly in lower-cost applications and regions with less stringent environmental regulations.

Electric Vehicle Battery Swapping System Market Product Developments

Significant advancements in battery technology, including improved energy density, faster charging capabilities, and enhanced safety features, are driving product innovation. New designs for swapping stations focus on increased efficiency, reduced downtime, and automated processes. The integration of smart technologies and data analytics enables optimized battery management and predictive maintenance, enhancing operational efficiency and user experience. These innovations directly contribute to the competitiveness of the market players, offering compelling advantages to attract consumers and expand market share.

Challenges in the Electric Vehicle Battery Swapping System Market

Several challenges hinder market growth. Standardization issues across different battery types and swapping systems limit interoperability and hinder widespread adoption. High initial investment costs for setting up swapping stations and associated infrastructure remain a barrier for many players, particularly smaller companies. Competition from established charging infrastructure providers also represents a significant challenge. Supply chain disruptions in critical components, like batteries and electronics, impact manufacturing capabilities and market availability. Regulatory uncertainties and variations in governmental support for battery swapping initiatives in different regions add complexities. These challenges, if not mitigated effectively, can hinder the market's overall growth trajectory.

Forces Driving Electric Vehicle Battery Swapping System Market Growth

Several factors are driving market growth. Government policies promoting EV adoption and incentives for battery swapping infrastructure are crucial. Technological advancements in battery technology, improving energy density, longevity and safety, are crucial. The increasing demand for faster charging solutions and improved convenience are key. Growing concerns about environmental sustainability and the desire for cleaner transportation drive market growth. The expansion of the EV market and rising sales of electric vehicles directly impact the need for efficient charging solutions like battery swapping.

Long-Term Growth Catalysts in the Electric Vehicle Battery Swapping System Market

Long-term growth will be driven by continued technological innovation, particularly in battery technology and station automation. Strategic partnerships between EV manufacturers, battery suppliers, and swapping infrastructure providers will accelerate market penetration. Expansion into new geographical markets, especially in developing countries with growing EV demand, presents significant opportunities. The development of standardized battery formats and improved interoperability across different systems will encourage wider acceptance and adoption.

Emerging Opportunities in Electric Vehicle Battery Swapping System Market

Emerging opportunities lie in the development of advanced battery chemistries (e.g., solid-state batteries) offering superior performance. Integration with smart grids and renewable energy sources offers potential for sustainable operations. The emergence of subscription-based models provides recurring revenue streams and encourages broader market participation. Expansion into new transportation sectors, such as two-wheelers and commercial vehicles, opens up further growth avenues. Furthermore, the exploration of innovative business models, such as battery-as-a-service, fosters broader adoption.

Leading Players in the Electric Vehicle Battery Swapping System Market Sector

- NIO Technologies

- Oyika Pte Ltd

- Pushme Inc

- GreenPack GmbH

- Gogoro Inc

- Kwang Yang Motor Co Ltd

- BattSwap Inc

- Immotor Inc

Key Milestones in Electric Vehicle Battery Swapping System Market Industry

- September 2022: NIO opens its first battery swap station in Germany, showcasing expansion into new markets and demonstrating operational capabilities (312 swaps daily).

- September 2022: Oyika Pte Ltd and NEFIN Group sign an MOU to promote EV adoption in Southeast Asia, highlighting strategic partnerships and regional expansion efforts.

- January 2022: Foxconn, Indonesian Ministry of Investment, PT. IBC, and Gogoro sign an MOU to develop a sustainable energy ecosystem in Indonesia, showcasing large-scale partnerships and government support for EV infrastructure.

Strategic Outlook for Electric Vehicle Battery Swapping System Market Market

The EV battery swapping system market holds significant future potential, driven by technological advancements, supportive government policies, and the growing demand for convenient and fast charging solutions. Strategic opportunities lie in expanding into new geographical markets, developing innovative business models, and fostering collaborative partnerships. Companies that focus on technological innovation, efficient operations, and strategic alliances are well-positioned to capitalize on the substantial growth opportunities within this dynamic sector.

Electric Vehicle Battery Swapping System Market Segmentation

-

1. Service Type

- 1.1. Pay-Per-Use Model

- 1.2. Subscription Model

-

2. Battery Type

- 2.1. Lithium-ion Battery

- 2.2. Lead-acid Battery

-

3. Station Type

- 3.1. Manual

- 3.2. Automated

-

4. Battery Capacity

- 4.1. Up to 1.5 kWh

- 4.2. 1.6 to 3 kWh

- 4.3. More than 3 kWh

-

5. Two-Wheeler Type

- 5.1. E-Scooters/Mopeds

- 5.2. E-Motorcycles

Electric Vehicle Battery Swapping System Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Electric Vehicle Battery Swapping System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 28.08% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Tourism Industry is Expected to Boost the Boat Rental Service Market

- 3.3. Market Restrains

- 3.3.1. Environmental Regulations and Governmental Policies May Hinder the Market Growth

- 3.4. Market Trends

- 3.4.1. Developments in Lithium Batteries Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Vehicle Battery Swapping System Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Pay-Per-Use Model

- 5.1.2. Subscription Model

- 5.2. Market Analysis, Insights and Forecast - by Battery Type

- 5.2.1. Lithium-ion Battery

- 5.2.2. Lead-acid Battery

- 5.3. Market Analysis, Insights and Forecast - by Station Type

- 5.3.1. Manual

- 5.3.2. Automated

- 5.4. Market Analysis, Insights and Forecast - by Battery Capacity

- 5.4.1. Up to 1.5 kWh

- 5.4.2. 1.6 to 3 kWh

- 5.4.3. More than 3 kWh

- 5.5. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 5.5.1. E-Scooters/Mopeds

- 5.5.2. E-Motorcycles

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Electric Vehicle Battery Swapping System Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Pay-Per-Use Model

- 6.1.2. Subscription Model

- 6.2. Market Analysis, Insights and Forecast - by Battery Type

- 6.2.1. Lithium-ion Battery

- 6.2.2. Lead-acid Battery

- 6.3. Market Analysis, Insights and Forecast - by Station Type

- 6.3.1. Manual

- 6.3.2. Automated

- 6.4. Market Analysis, Insights and Forecast - by Battery Capacity

- 6.4.1. Up to 1.5 kWh

- 6.4.2. 1.6 to 3 kWh

- 6.4.3. More than 3 kWh

- 6.5. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 6.5.1. E-Scooters/Mopeds

- 6.5.2. E-Motorcycles

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Electric Vehicle Battery Swapping System Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Pay-Per-Use Model

- 7.1.2. Subscription Model

- 7.2. Market Analysis, Insights and Forecast - by Battery Type

- 7.2.1. Lithium-ion Battery

- 7.2.2. Lead-acid Battery

- 7.3. Market Analysis, Insights and Forecast - by Station Type

- 7.3.1. Manual

- 7.3.2. Automated

- 7.4. Market Analysis, Insights and Forecast - by Battery Capacity

- 7.4.1. Up to 1.5 kWh

- 7.4.2. 1.6 to 3 kWh

- 7.4.3. More than 3 kWh

- 7.5. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 7.5.1. E-Scooters/Mopeds

- 7.5.2. E-Motorcycles

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific Electric Vehicle Battery Swapping System Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Pay-Per-Use Model

- 8.1.2. Subscription Model

- 8.2. Market Analysis, Insights and Forecast - by Battery Type

- 8.2.1. Lithium-ion Battery

- 8.2.2. Lead-acid Battery

- 8.3. Market Analysis, Insights and Forecast - by Station Type

- 8.3.1. Manual

- 8.3.2. Automated

- 8.4. Market Analysis, Insights and Forecast - by Battery Capacity

- 8.4.1. Up to 1.5 kWh

- 8.4.2. 1.6 to 3 kWh

- 8.4.3. More than 3 kWh

- 8.5. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 8.5.1. E-Scooters/Mopeds

- 8.5.2. E-Motorcycles

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Rest of the World Electric Vehicle Battery Swapping System Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Pay-Per-Use Model

- 9.1.2. Subscription Model

- 9.2. Market Analysis, Insights and Forecast - by Battery Type

- 9.2.1. Lithium-ion Battery

- 9.2.2. Lead-acid Battery

- 9.3. Market Analysis, Insights and Forecast - by Station Type

- 9.3.1. Manual

- 9.3.2. Automated

- 9.4. Market Analysis, Insights and Forecast - by Battery Capacity

- 9.4.1. Up to 1.5 kWh

- 9.4.2. 1.6 to 3 kWh

- 9.4.3. More than 3 kWh

- 9.5. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 9.5.1. E-Scooters/Mopeds

- 9.5.2. E-Motorcycles

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. North America Electric Vehicle Battery Swapping System Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Electric Vehicle Battery Swapping System Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Italy

- 11.1.5 Rest of Europe

- 12. Asia Pacific Electric Vehicle Battery Swapping System Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 India

- 12.1.3 Japan

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Electric Vehicle Battery Swapping System Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 South America

- 13.1.2 Middle East and Africa

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 NIO Technologies

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Oyika Pte Ltd

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Pushme Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 GreenPack GmbH

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Gogoro Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Kwang Yang Motor Co Ltd *List Not Exhaustive

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 BattSwap Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Immotor Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.1 NIO Technologies

List of Figures

- Figure 1: Global Electric Vehicle Battery Swapping System Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Electric Vehicle Battery Swapping System Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Electric Vehicle Battery Swapping System Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Electric Vehicle Battery Swapping System Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Electric Vehicle Battery Swapping System Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Electric Vehicle Battery Swapping System Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Electric Vehicle Battery Swapping System Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Electric Vehicle Battery Swapping System Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Electric Vehicle Battery Swapping System Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Electric Vehicle Battery Swapping System Market Revenue (Million), by Service Type 2024 & 2032

- Figure 11: North America Electric Vehicle Battery Swapping System Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 12: North America Electric Vehicle Battery Swapping System Market Revenue (Million), by Battery Type 2024 & 2032

- Figure 13: North America Electric Vehicle Battery Swapping System Market Revenue Share (%), by Battery Type 2024 & 2032

- Figure 14: North America Electric Vehicle Battery Swapping System Market Revenue (Million), by Station Type 2024 & 2032

- Figure 15: North America Electric Vehicle Battery Swapping System Market Revenue Share (%), by Station Type 2024 & 2032

- Figure 16: North America Electric Vehicle Battery Swapping System Market Revenue (Million), by Battery Capacity 2024 & 2032

- Figure 17: North America Electric Vehicle Battery Swapping System Market Revenue Share (%), by Battery Capacity 2024 & 2032

- Figure 18: North America Electric Vehicle Battery Swapping System Market Revenue (Million), by Two-Wheeler Type 2024 & 2032

- Figure 19: North America Electric Vehicle Battery Swapping System Market Revenue Share (%), by Two-Wheeler Type 2024 & 2032

- Figure 20: North America Electric Vehicle Battery Swapping System Market Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Electric Vehicle Battery Swapping System Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Electric Vehicle Battery Swapping System Market Revenue (Million), by Service Type 2024 & 2032

- Figure 23: Europe Electric Vehicle Battery Swapping System Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 24: Europe Electric Vehicle Battery Swapping System Market Revenue (Million), by Battery Type 2024 & 2032

- Figure 25: Europe Electric Vehicle Battery Swapping System Market Revenue Share (%), by Battery Type 2024 & 2032

- Figure 26: Europe Electric Vehicle Battery Swapping System Market Revenue (Million), by Station Type 2024 & 2032

- Figure 27: Europe Electric Vehicle Battery Swapping System Market Revenue Share (%), by Station Type 2024 & 2032

- Figure 28: Europe Electric Vehicle Battery Swapping System Market Revenue (Million), by Battery Capacity 2024 & 2032

- Figure 29: Europe Electric Vehicle Battery Swapping System Market Revenue Share (%), by Battery Capacity 2024 & 2032

- Figure 30: Europe Electric Vehicle Battery Swapping System Market Revenue (Million), by Two-Wheeler Type 2024 & 2032

- Figure 31: Europe Electric Vehicle Battery Swapping System Market Revenue Share (%), by Two-Wheeler Type 2024 & 2032

- Figure 32: Europe Electric Vehicle Battery Swapping System Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Europe Electric Vehicle Battery Swapping System Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Asia Pacific Electric Vehicle Battery Swapping System Market Revenue (Million), by Service Type 2024 & 2032

- Figure 35: Asia Pacific Electric Vehicle Battery Swapping System Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 36: Asia Pacific Electric Vehicle Battery Swapping System Market Revenue (Million), by Battery Type 2024 & 2032

- Figure 37: Asia Pacific Electric Vehicle Battery Swapping System Market Revenue Share (%), by Battery Type 2024 & 2032

- Figure 38: Asia Pacific Electric Vehicle Battery Swapping System Market Revenue (Million), by Station Type 2024 & 2032

- Figure 39: Asia Pacific Electric Vehicle Battery Swapping System Market Revenue Share (%), by Station Type 2024 & 2032

- Figure 40: Asia Pacific Electric Vehicle Battery Swapping System Market Revenue (Million), by Battery Capacity 2024 & 2032

- Figure 41: Asia Pacific Electric Vehicle Battery Swapping System Market Revenue Share (%), by Battery Capacity 2024 & 2032

- Figure 42: Asia Pacific Electric Vehicle Battery Swapping System Market Revenue (Million), by Two-Wheeler Type 2024 & 2032

- Figure 43: Asia Pacific Electric Vehicle Battery Swapping System Market Revenue Share (%), by Two-Wheeler Type 2024 & 2032

- Figure 44: Asia Pacific Electric Vehicle Battery Swapping System Market Revenue (Million), by Country 2024 & 2032

- Figure 45: Asia Pacific Electric Vehicle Battery Swapping System Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: Rest of the World Electric Vehicle Battery Swapping System Market Revenue (Million), by Service Type 2024 & 2032

- Figure 47: Rest of the World Electric Vehicle Battery Swapping System Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 48: Rest of the World Electric Vehicle Battery Swapping System Market Revenue (Million), by Battery Type 2024 & 2032

- Figure 49: Rest of the World Electric Vehicle Battery Swapping System Market Revenue Share (%), by Battery Type 2024 & 2032

- Figure 50: Rest of the World Electric Vehicle Battery Swapping System Market Revenue (Million), by Station Type 2024 & 2032

- Figure 51: Rest of the World Electric Vehicle Battery Swapping System Market Revenue Share (%), by Station Type 2024 & 2032

- Figure 52: Rest of the World Electric Vehicle Battery Swapping System Market Revenue (Million), by Battery Capacity 2024 & 2032

- Figure 53: Rest of the World Electric Vehicle Battery Swapping System Market Revenue Share (%), by Battery Capacity 2024 & 2032

- Figure 54: Rest of the World Electric Vehicle Battery Swapping System Market Revenue (Million), by Two-Wheeler Type 2024 & 2032

- Figure 55: Rest of the World Electric Vehicle Battery Swapping System Market Revenue Share (%), by Two-Wheeler Type 2024 & 2032

- Figure 56: Rest of the World Electric Vehicle Battery Swapping System Market Revenue (Million), by Country 2024 & 2032

- Figure 57: Rest of the World Electric Vehicle Battery Swapping System Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 4: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Station Type 2019 & 2032

- Table 5: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Battery Capacity 2019 & 2032

- Table 6: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Two-Wheeler Type 2019 & 2032

- Table 7: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of North America Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Germany Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United Kingdom Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: France Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Europe Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: China Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: South America Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Middle East and Africa Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 28: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 29: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Station Type 2019 & 2032

- Table 30: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Battery Capacity 2019 & 2032

- Table 31: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Two-Wheeler Type 2019 & 2032

- Table 32: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: United States Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Canada Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Rest of North America Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 37: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 38: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Station Type 2019 & 2032

- Table 39: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Battery Capacity 2019 & 2032

- Table 40: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Two-Wheeler Type 2019 & 2032

- Table 41: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Germany Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: United Kingdom Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: France Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Italy Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Spain Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Europe Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 49: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 50: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Station Type 2019 & 2032

- Table 51: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Battery Capacity 2019 & 2032

- Table 52: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Two-Wheeler Type 2019 & 2032

- Table 53: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: China Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Japan Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Korea Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Asia Pacific Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 60: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 61: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Station Type 2019 & 2032

- Table 62: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Battery Capacity 2019 & 2032

- Table 63: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Two-Wheeler Type 2019 & 2032

- Table 64: Global Electric Vehicle Battery Swapping System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 65: South America Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Middle East and Africa Electric Vehicle Battery Swapping System Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Vehicle Battery Swapping System Market?

The projected CAGR is approximately 28.08%.

2. Which companies are prominent players in the Electric Vehicle Battery Swapping System Market?

Key companies in the market include NIO Technologies, Oyika Pte Ltd, Pushme Inc, GreenPack GmbH, Gogoro Inc, Kwang Yang Motor Co Ltd *List Not Exhaustive, BattSwap Inc, Immotor Inc.

3. What are the main segments of the Electric Vehicle Battery Swapping System Market?

The market segments include Service Type, Battery Type, Station Type, Battery Capacity, Two-Wheeler Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Tourism Industry is Expected to Boost the Boat Rental Service Market.

6. What are the notable trends driving market growth?

Developments in Lithium Batteries Driving the Market.

7. Are there any restraints impacting market growth?

Environmental Regulations and Governmental Policies May Hinder the Market Growth.

8. Can you provide examples of recent developments in the market?

In September 2022, NIO announced the official opening of its first battery swap station in Germany in Zusmarshausen, which is situated along the busy A8 highway between Munich and Stuttgart. Each day, the battery swap station can perform up to 312 power conversions. The vehicle's electric control system, motor, and the battery will all be thoroughly examined prior to each swap to ensure that they are in working order.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Vehicle Battery Swapping System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Vehicle Battery Swapping System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Vehicle Battery Swapping System Market?

To stay informed about further developments, trends, and reports in the Electric Vehicle Battery Swapping System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence