Key Insights

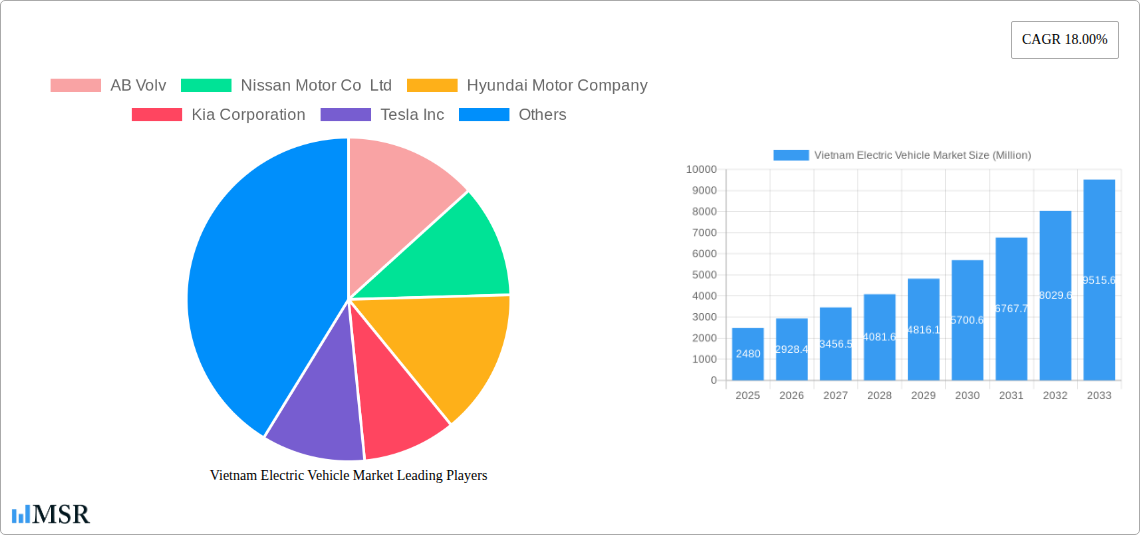

The Vietnam electric vehicle (EV) market is experiencing rapid growth, projected to reach a market size of $2.48 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 18% from 2025 to 2033. This surge is driven by several factors. Government incentives aimed at promoting sustainable transportation, coupled with rising environmental awareness among consumers, are significantly boosting EV adoption. Furthermore, improving charging infrastructure and decreasing battery costs are making EVs more accessible and practical for Vietnamese consumers. The market is segmented by vehicle type (passenger cars and commercial vehicles) and propulsion type (Battery Electric Vehicles, Plug-in Hybrid Electric Vehicles, Hybrid Electric Vehicles, and Fuel Cell Electric Vehicles). Passenger cars currently dominate the market, but commercial vehicle adoption is expected to increase steadily as technology advances and cost-effectiveness improves. Leading automotive manufacturers like VinFast, Toyota, Hyundai, and Tesla are actively investing in the Vietnamese market, introducing competitive models and contributing to the market's dynamic expansion. The focus on local manufacturing and the development of a robust domestic supply chain for EV components also contribute to the market's positive trajectory.

Vietnam Electric Vehicle Market Market Size (In Billion)

Looking ahead to 2033, the continued high CAGR suggests a substantial market expansion. Factors such as further government support, technological advancements leading to improved battery range and performance, and the growing middle class with increased purchasing power will all play crucial roles in shaping the future of the Vietnamese EV market. While challenges remain, such as overcoming range anxiety and ensuring the widespread availability of charging stations, the overall outlook for the EV sector in Vietnam remains exceptionally promising. The country’s commitment to reducing carbon emissions and fostering technological progress positions it favorably for significant growth in the coming years.

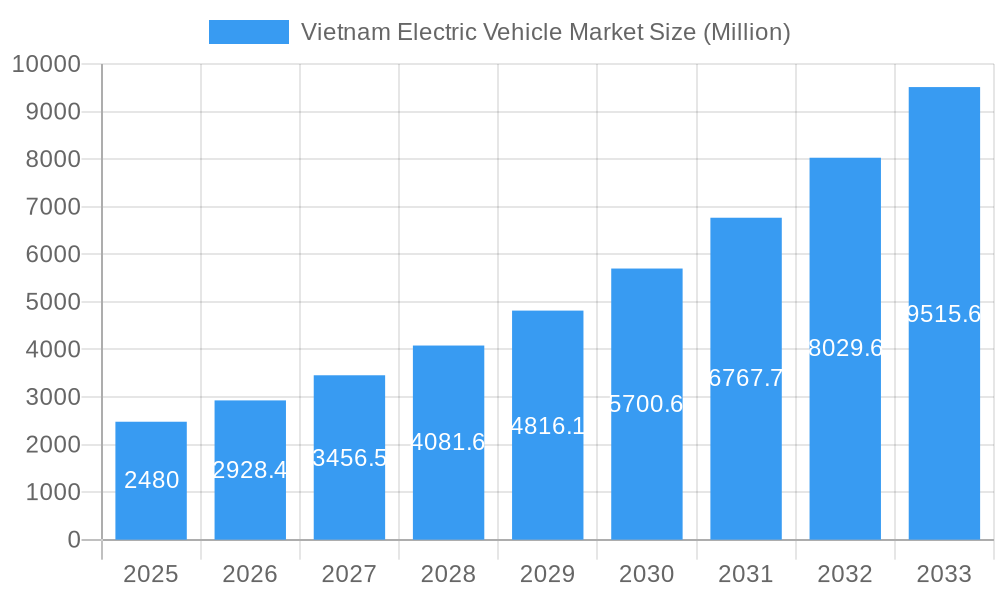

Vietnam Electric Vehicle Market Company Market Share

Vietnam Electric Vehicle Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Vietnam electric vehicle (EV) market, offering crucial data and forecasts for industry stakeholders. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's dynamics, trends, and future potential. The report is meticulously crafted, incorporating high-ranking keywords such as "Vietnam electric vehicle market," "EV market Vietnam," "Vietnam EV industry," "electric vehicle sales Vietnam," and "Vietnam EV market forecast" to enhance search engine optimization (SEO) and reach a wider audience. The report’s value extends beyond simple data; it provides actionable insights for informed decision-making in this rapidly evolving sector. Expected market size values are provided where precise figures were unavailable.

Vietnam Electric Vehicle Market Concentration & Dynamics

The Vietnam EV market is experiencing a period of rapid growth, driven by government incentives, increasing environmental awareness, and technological advancements. Market concentration is currently moderate, with several key players vying for market share. However, the presence of VinFast, a domestic player, is significantly impacting the market dynamics. The innovation ecosystem is developing rapidly, with investments in battery technology, charging infrastructure, and R&D increasing steadily.

- Market Share: VinFast currently holds an estimated xx% market share in 2025, followed by [Company Name] at xx%, and [Company Name] at xx%. Other players including international brands hold the remaining market share.

- M&A Activity: The number of M&A deals in the Vietnam EV sector has increased from xx in 2019 to an estimated xx in 2024, reflecting the growing interest and investment in the market. This indicates a growing number of partnerships and acquisitions in the industry, shaping its dynamics.

- Regulatory Framework: The Vietnamese government's supportive policies, including tax incentives and subsidies for EV adoption, are major catalysts for market growth. However, regulatory clarity on certain aspects such as standardization and infrastructure development remains crucial for long-term sustainability.

- Substitute Products: Internal combustion engine (ICE) vehicles remain the primary substitute, but their market share is expected to decrease significantly over the forecast period. The competition from ICE vehicles, as a substitute, is progressively decreasing.

- End-User Trends: Increasing consumer awareness about environmental issues and rising disposable incomes are driving the demand for EVs among young urbanites, particularly in major cities.

Vietnam Electric Vehicle Market Industry Insights & Trends

The Vietnam EV market is projected to experience substantial growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). The market size is estimated at xx Million USD in 2025, projected to reach xx Million USD by 2033. This growth is primarily fueled by several factors: government incentives promoting EV adoption, improving charging infrastructure, a growing middle class with higher purchasing power, and the increasing availability of diverse EV models. Technological advancements in battery technology, particularly in terms of range and charging speed, are also boosting consumer confidence. Furthermore, evolving consumer behavior, including preferences for eco-friendly vehicles and the trend of environmentally aware purchasing decisions, contributes to this growth. The transition to electric vehicles is gaining momentum, especially in urban areas.

Key Markets & Segments Leading Vietnam Electric Vehicle Market

The passenger car segment is expected to dominate the Vietnam EV market, representing approximately xx% of the total market value in 2025. However, the commercial vehicle segment is also demonstrating significant growth potential, fueled by government initiatives to electrify public transportation.

- By Vehicle Type:

- Passenger Cars: Drivers include rising disposable incomes, government incentives, and a growing preference for environmentally friendly vehicles.

- Commercial Vehicles: Drivers include government mandates for electrifying public transport, the potential for cost savings in the long run, and environmental concerns.

- By Propulsion:

- Battery Electric Vehicles (BEVs): This segment holds the largest share, driven by technological advancements and decreasing battery costs.

- Plug-in Hybrid Electric Vehicles (PHEVs): This segment is expected to exhibit moderate growth, catering to consumers seeking a balance between electric and conventional power.

- Hybrid Electric Vehicles (HEVs): This segment is experiencing a steady growth trajectory.

- Fuel Cell Electric Vehicles (FCEVs): This segment currently has limited market presence in Vietnam, with limited availability.

Vietnam Electric Vehicle Market Product Developments

Recent product innovations showcase significant advancements in battery technology, resulting in extended ranges and faster charging capabilities. Manufacturers are focusing on enhancing the user experience through advanced features such as smart connectivity and autonomous driving capabilities. These innovations aim to establish a competitive edge in the market. The focus is on developing localized supply chains and improving affordability to meet the needs of the broader Vietnamese market.

Challenges in the Vietnam Electric Vehicle Market Market

The Vietnam EV market faces several challenges, including:

- Limited Charging Infrastructure: The lack of widespread charging infrastructure remains a major barrier to widespread EV adoption. Expansion of charging networks, especially outside major urban areas, is critical.

- High Initial Purchase Price: The higher upfront cost of EVs compared to traditional vehicles remains a deterrent for many potential buyers.

- Supply Chain Disruptions: Global supply chain disruptions may hinder the production and availability of EVs. The impact is expected to be xx Million USD in losses in 2025.

Forces Driving Vietnam Electric Vehicle Market Growth

Several key factors are driving the growth of the Vietnam EV market, including:

- Government Support: Subsidies, tax incentives, and supportive policies are crucial in boosting EV adoption rates.

- Technological Advancements: Improvements in battery technology, range, and charging speed are increasing consumer interest.

- Economic Growth: The rising middle class with increasing disposable incomes contributes to higher purchasing power for EVs.

Long-Term Growth Catalysts in the Vietnam Electric Vehicle Market

Long-term growth catalysts will depend on continued investment in R&D, particularly in battery technology, which will enable increased range and faster charging times, further driving consumer demand. Strategic partnerships between local and international manufacturers to share technological expertise and build a strong domestic supply chain, combined with expansion into new segments like commercial vehicles and expansion of public charging networks, will be critical for sustained growth.

Emerging Opportunities in Vietnam Electric Vehicle Market

Emerging opportunities lie in the development of specialized EVs for the commercial vehicle sector, targeting segments like delivery services and public transport. Furthermore, the expansion of charging infrastructure and battery swapping technology will help reduce range anxiety and increase accessibility. Meeting the evolving consumer preference for smart, connected vehicles also presents a significant opportunity for market expansion.

Leading Players in the Vietnam Electric Vehicle Market Sector

Key Milestones in Vietnam Electric Vehicle Market Industry

- October 2023: VinFast Auto Ltd launched two variants of the VF 6 EV in Vietnam, boosting the availability of affordable electric vehicle options and furthering domestic production.

- November 2023: VinFast Auto Ltd introduced the VF 7, expanding its electric SUV lineup and increasing customer choices for electric vehicles in Vietnam.

Strategic Outlook for Vietnam Electric Vehicle Market Market

The Vietnam EV market holds significant long-term growth potential. By addressing the challenges and capitalizing on the opportunities, the market can continue its upward trajectory. Strategic partnerships, investments in infrastructure, and government support will remain crucial. The market is expected to see a significant increase in both domestic and international players, leading to increased competition and innovation. Continued advancements in battery technology and the expansion of charging infrastructure will be pivotal in realizing the market's full potential.

Vietnam Electric Vehicle Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Propulsion

- 2.1. Battery Electric Vehicles

- 2.2. Plug-in Hybrid Electric Vehicles

- 2.3. Fuel Cell Electric Vehicles

Vietnam Electric Vehicle Market Segmentation By Geography

- 1. Vietnam

Vietnam Electric Vehicle Market Regional Market Share

Geographic Coverage of Vietnam Electric Vehicle Market

Vietnam Electric Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives are Expected to Enhance the Electric Vehicle Sale

- 3.3. Market Restrains

- 3.3.1. Lack of Charging Stations

- 3.4. Market Trends

- 3.4.1. The Battery Electric Vehicles Segment is Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Electric Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Propulsion

- 5.2.1. Battery Electric Vehicles

- 5.2.2. Plug-in Hybrid Electric Vehicles

- 5.2.3. Fuel Cell Electric Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AB Volv

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nissan Motor Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hyundai Motor Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kia Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tesla Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mercedes-Benz Group AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Great Wall Motors (Haval Brand)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Toyota Motor Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Vinfast Motor Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Honda Motor Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 AB Volv

List of Figures

- Figure 1: Vietnam Electric Vehicle Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnam Electric Vehicle Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Electric Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Vietnam Electric Vehicle Market Revenue Million Forecast, by Propulsion 2020 & 2033

- Table 3: Vietnam Electric Vehicle Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Vietnam Electric Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Vietnam Electric Vehicle Market Revenue Million Forecast, by Propulsion 2020 & 2033

- Table 6: Vietnam Electric Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Electric Vehicle Market?

The projected CAGR is approximately 18.00%.

2. Which companies are prominent players in the Vietnam Electric Vehicle Market?

Key companies in the market include AB Volv, Nissan Motor Co Ltd, Hyundai Motor Company, Kia Corporation, Tesla Inc, Mercedes-Benz Group AG, Great Wall Motors (Haval Brand), Toyota Motor Corporation, Vinfast Motor Ltd, Honda Motor Co Ltd.

3. What are the main segments of the Vietnam Electric Vehicle Market?

The market segments include Vehicle Type, Propulsion.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.48 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives are Expected to Enhance the Electric Vehicle Sale.

6. What are the notable trends driving market growth?

The Battery Electric Vehicles Segment is Dominating the Market.

7. Are there any restraints impacting market growth?

Lack of Charging Stations.

8. Can you provide examples of recent developments in the market?

November 2023: VinFast Auto Ltd introduced the VF 7, the 6th smart electric SUV in Vietnam. The VF7 is equipped with a 75.3 kWh battery pack and has a range of up to 431 km on a single charge.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Electric Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Electric Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Electric Vehicle Market?

To stay informed about further developments, trends, and reports in the Vietnam Electric Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence