Key Insights

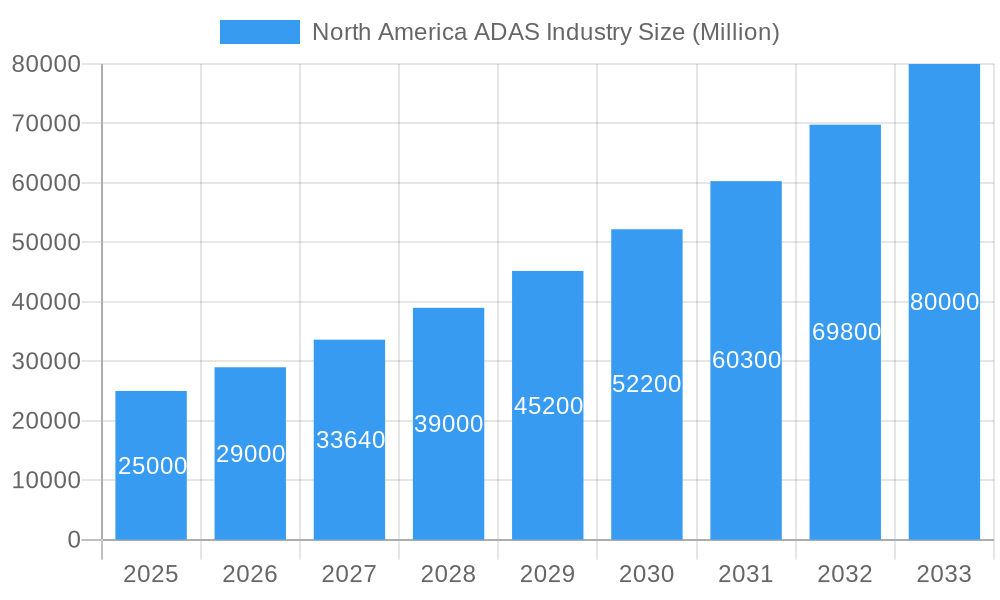

The North American Advanced Driver-Assistance Systems (ADAS) market is exhibiting substantial growth, propelled by rising vehicle production, stringent safety mandates, and increasing consumer preference for advanced safety features. The market, valued at approximately $334 million in 2024, is forecast to expand at a Compound Annual Growth Rate (CAGR) of 11.9%, reaching an estimated $80 billion by 2033. Key growth catalysts include the widespread adoption of Autonomous Emergency Braking (AEB) and Lane-Keeping Assist (LKA) systems, often mandated by North American regulatory bodies. Advancements in sensor technology, encompassing radar, lidar, and cameras, are enabling more sophisticated and cost-effective ADAS solutions, thereby increasing their accessibility across various vehicle types. While passenger vehicles currently lead market share, the commercial vehicle segment is poised for significant expansion driven by fleet efficiency and enhanced safety for large-scale transportation.

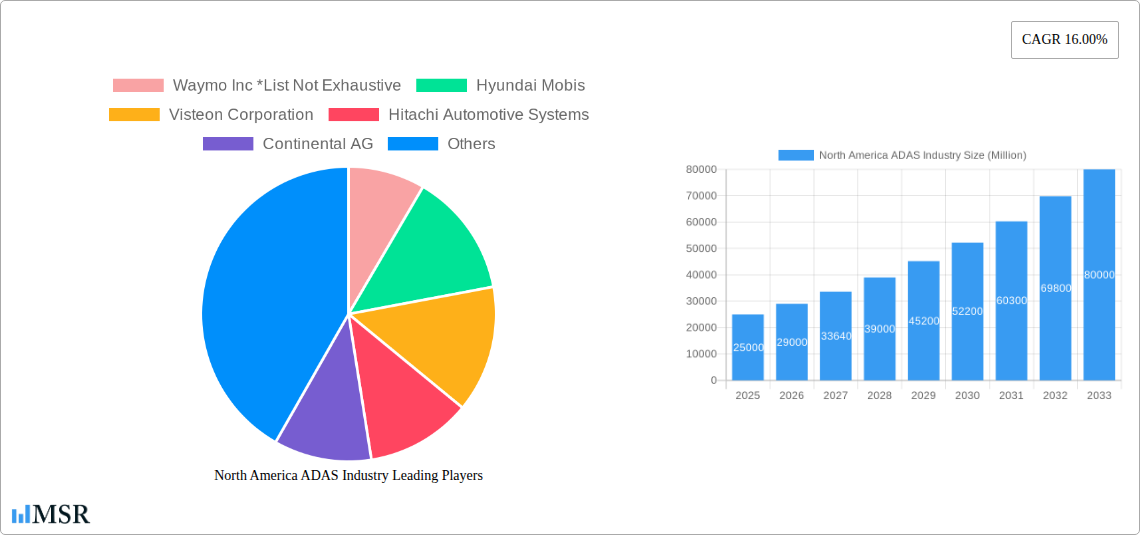

North America ADAS Industry Market Size (In Million)

Within North America, the United States commands the largest market share, attributable to high vehicle penetration, advanced technological infrastructure, and a robust automotive manufacturing ecosystem. Canada and Mexico also play crucial roles, influenced by their integration with the US market and growing adoption of advanced safety technologies. Industry leaders such as Waymo, Hyundai Mobis, and Robert Bosch are strategically investing in research, development, and production to meet the escalating demand for ADAS. Nonetheless, challenges persist, including the initial implementation costs of ADAS, potential cybersecurity risks, and the requirement for advanced infrastructure to support fully autonomous driving capabilities. Despite these considerations, the North American ADAS market presents a highly optimistic outlook with considerable growth potential.

North America ADAS Industry Company Market Share

North America ADAS Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Advanced Driver-Assistance Systems (ADAS) market, offering crucial insights for industry stakeholders, investors, and strategists. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, leading players, technological advancements, and future growth prospects. The report utilizes a robust methodology, incorporating historical data (2019-2024), base year estimations (2025), and future projections (2025-2033) to provide a holistic view of this rapidly evolving sector. Expect detailed analysis of key segments including Adaptive Cruise Control, Autonomous Emergency Braking, and LiDAR technology, across passenger cars and commercial vehicles in the United States, Canada, and Mexico. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

North America ADAS Industry Market Concentration & Dynamics

The North American ADAS market is characterized by a moderately concentrated landscape, with several global giants and emerging players vying for market share. Key players such as Waymo Inc., Hyundai Mobis, Visteon Corporation, Hitachi Automotive Systems, Continental AG, Velodyne Lidar, Robert Bosch GmbH, Delphi Technologies, Magna International, LG Electronics, and ZF Friedrichshafen AG contribute significantly to the overall market volume. However, the presence of numerous smaller, specialized companies fosters a dynamic competitive environment. Market share data for 2024 suggests that the top 5 players hold approximately xx% of the market, indicating room for further consolidation and growth.

Innovation plays a pivotal role, with continuous advancements in sensor technologies (LiDAR, radar, camera), artificial intelligence (AI), and machine learning (ML) driving product differentiation. The regulatory landscape, particularly regarding autonomous driving functionalities, is undergoing constant evolution, influencing market growth and investment decisions. Substitute products, such as enhanced driver training programs, are less effective in addressing the safety and convenience offered by ADAS. End-user trends are shifting towards increased adoption of higher-level ADAS features, pushing technological advancement and competition. The number of mergers and acquisitions (M&A) in the sector has been steadily increasing, indicating a trend of consolidation and strategic partnerships aimed at gaining a competitive advantage. The number of M&A deals in the past 5 years is estimated at xx.

North America ADAS Industry Insights & Trends

The North American ADAS market is experiencing significant growth, driven by several key factors. Rising consumer demand for enhanced vehicle safety and convenience, coupled with increasing government regulations promoting advanced safety features, are major catalysts. Technological advancements, particularly in sensor technology and AI-powered algorithms, are pushing the boundaries of ADAS capabilities, leading to the development of more sophisticated and reliable systems. The escalating adoption of connected car technologies also contributes to market expansion, enabling data-driven insights and improved system performance.

The market has witnessed a notable increase in the adoption of advanced driver-assistance systems in recent years. This growth is fueled by factors such as rising consumer preference for enhanced safety and convenience features, increasing government regulations mandating the implementation of these systems, and technological advancements enabling the creation of more reliable and sophisticated ADAS functionalities. Technological innovations, including improvements in sensor technology and AI algorithms, have played a crucial role in making ADAS systems more efficient, accurate, and capable of handling more complex driving situations. The rising integration of connected car technologies facilitates data-driven improvements, leading to enhanced performance and greater user satisfaction. Furthermore, the growing emphasis on fleet management and autonomous vehicles is accelerating the demand for ADAS solutions across various segments of the automotive sector.

Key Markets & Segments Leading North America ADAS Industry

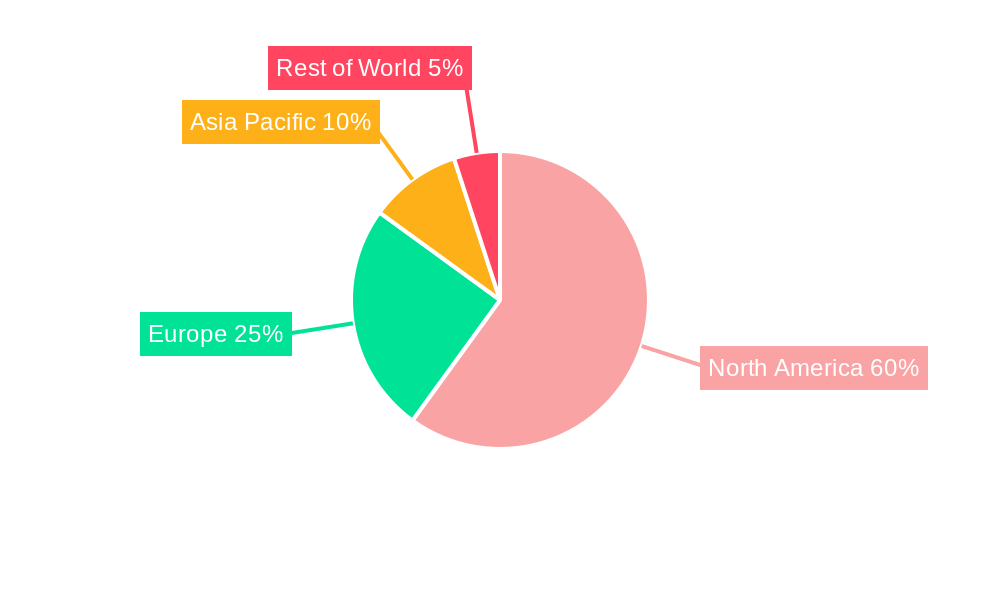

- By Country: The United States dominates the North American ADAS market, driven by strong consumer demand, higher vehicle ownership rates, and a well-developed automotive manufacturing base. Canada and Mexico follow, exhibiting significant but slower growth rates.

- By Vehicle Type: Passenger cars constitute the largest segment, followed by commercial vehicles. The increasing adoption of ADAS in commercial fleets, driven by safety concerns and efficiency improvements, is contributing to the growth of this segment.

- By Technology Type: Camera-based systems hold the largest market share, owing to their cost-effectiveness and wide applicability. However, LiDAR and radar technologies are gaining traction due to their superior performance in challenging conditions.

- By Type: Adaptive Cruise Control (ACC) and Autonomous Emergency Braking (AEB) systems are currently the most widely adopted ADAS features. However, the adoption of advanced features like Lane Keeping Assist (LKA) and Blind Spot Detection (BSD) is rapidly increasing.

The dominance of the United States stems from its large consumer base, high vehicle density, and well-established automotive manufacturing sector, making it an ideal market for ADAS adoption. Government regulations and safety standards in the US also play a significant role in driving market growth. While Canada and Mexico show steady progress in ADAS integration, the United States remains the frontrunner due to these factors.

North America ADAS Industry Product Developments

Recent product developments showcase a rapid shift towards more integrated and sophisticated ADAS systems. This includes the integration of multiple sensor modalities (fusion of camera, radar, LiDAR data) to improve overall system performance and robustness. The advent of AI and machine learning is enabling the development of more intelligent and adaptive ADAS functionalities, such as predictive collision avoidance and automated lane changing. These advancements are not only enhancing safety but also improving the overall driving experience. The market is also witnessing the emergence of specialized ADAS solutions tailored to specific vehicle types and driving conditions.

Challenges in the North America ADAS Industry Market

The North American ADAS market faces several challenges, including regulatory uncertainties surrounding autonomous driving technologies, supply chain disruptions impacting the availability of critical components, and intense competition among established and emerging players. These factors can lead to increased production costs, delayed product launches, and reduced profitability. Further, the high cost of ADAS systems and the complexity of integrating them into vehicles can hinder their wider adoption in lower-cost vehicles. These challenges need to be addressed to ensure sustained market growth.

Forces Driving North America ADAS Industry Growth

Several factors are driving the growth of the North American ADAS market. These include stringent government safety regulations mandating the adoption of certain ADAS features, growing consumer awareness of safety and convenience, and technological advancements leading to the development of more advanced and affordable systems. Furthermore, the increasing integration of ADAS with connected car technologies is expanding the market's scope and potential. The continuous development and implementation of sophisticated ADAS functionalities, enabled by technological advancements in areas such as sensor fusion and artificial intelligence, are also significant growth drivers.

Long-Term Growth Catalysts in the North America ADAS Industry

Long-term growth will be driven by continuous technological innovation, strategic partnerships and collaborations, and expansion into new markets. This includes the development of advanced sensor technologies, AI-powered algorithms, and improved system integration. Strategic collaborations between automotive manufacturers, technology companies, and software providers are likely to accelerate innovation and market penetration. The increasing adoption of ADAS in commercial vehicles and the potential for integration with autonomous driving systems represent significant long-term opportunities.

Emerging Opportunities in North America ADAS Industry

Emerging opportunities lie in the development of advanced driver monitoring systems, personalized ADAS configurations, and integration with smart city infrastructure. The potential for personalized driving experiences and improved in-vehicle safety, enabled by AI and data analysis, offers significant growth prospects. Further, the integration of ADAS with other in-vehicle systems and the development of advanced solutions for commercial vehicle applications offer considerable market expansion opportunities.

Leading Players in the North America ADAS Industry Sector

- Waymo Inc.

- Hyundai Mobis

- Visteon Corporation

- Hitachi Automotive Systems

- Continental AG

- Velodyne Lidar

- Robert Bosch GmbH

- Delphi Technologies

- Magna International

- LG Electronics

- ZF Friedrichshafen AG

Key Milestones in North America ADAS Industry Industry

- October 2022: Waymo expands robotaxi services to Los Angeles.

- October 2022: Mobileye files for IPO, valued at USD 16 Billion.

- June 2022: Stellantis selects Valeo's Scala 3 LiDAR for Level 3 autonomy.

- March 2022: BMW, Qualcomm, and Arriver collaborate on ADAS system development.

Strategic Outlook for North America ADAS Industry Market

The North American ADAS market is poised for robust growth, driven by technological advancements, increasing consumer demand, and supportive government regulations. Strategic partnerships and collaborations will play a vital role in accelerating innovation and market penetration. The development of next-generation ADAS systems, incorporating advanced sensor fusion, AI, and machine learning, will create new opportunities and enhance market competitiveness. Companies focused on developing cost-effective and high-performance ADAS solutions are well-positioned to capture a significant market share in the years to come.

North America ADAS Industry Segmentation

-

1. Type

- 1.1. Adaptive Cruise Control System

- 1.2. Adaptive Front-lighting

- 1.3. Night Vision System

- 1.4. Blind Spot Detection

- 1.5. Autonomous Emergency Braking System

- 1.6. Lane Keeping Assist

- 1.7. Driver Drowsiness Alert

- 1.8. Lane Departure Warning

- 1.9. Other Types

-

2. Technology Type

- 2.1. Radar

- 2.2. Li-Dar

- 2.3. Camera

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

North America ADAS Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America ADAS Industry Regional Market Share

Geographic Coverage of North America ADAS Industry

North America ADAS Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Sales of Passenger Cars

- 3.3. Market Restrains

- 3.3.1. Failure in Garage Equipment may Result in Downtime of the Repair Work

- 3.4. Market Trends

- 3.4.1. Growing Sales of Vehicles Fitted with LiDAR Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America ADAS Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Adaptive Cruise Control System

- 5.1.2. Adaptive Front-lighting

- 5.1.3. Night Vision System

- 5.1.4. Blind Spot Detection

- 5.1.5. Autonomous Emergency Braking System

- 5.1.6. Lane Keeping Assist

- 5.1.7. Driver Drowsiness Alert

- 5.1.8. Lane Departure Warning

- 5.1.9. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Technology Type

- 5.2.1. Radar

- 5.2.2. Li-Dar

- 5.2.3. Camera

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Waymo Inc *List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hyundai Mobis

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Visteon Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hitachi Automotive Systems

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Continental AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Velodyne Lidar

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Robert Bosch GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Delphi Technologies

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Magna International

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LG Electronics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 ZF Friedrichshafen AG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Waymo Inc *List Not Exhaustive

List of Figures

- Figure 1: North America ADAS Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America ADAS Industry Share (%) by Company 2025

List of Tables

- Table 1: North America ADAS Industry Revenue million Forecast, by Type 2020 & 2033

- Table 2: North America ADAS Industry Revenue million Forecast, by Technology Type 2020 & 2033

- Table 3: North America ADAS Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 4: North America ADAS Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: North America ADAS Industry Revenue million Forecast, by Type 2020 & 2033

- Table 6: North America ADAS Industry Revenue million Forecast, by Technology Type 2020 & 2033

- Table 7: North America ADAS Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 8: North America ADAS Industry Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States North America ADAS Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America ADAS Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America ADAS Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America ADAS Industry?

The projected CAGR is approximately 11.9%.

2. Which companies are prominent players in the North America ADAS Industry?

Key companies in the market include Waymo Inc *List Not Exhaustive, Hyundai Mobis, Visteon Corporation, Hitachi Automotive Systems, Continental AG, Velodyne Lidar, Robert Bosch GmbH, Delphi Technologies, Magna International, LG Electronics, ZF Friedrichshafen AG.

3. What are the main segments of the North America ADAS Industry?

The market segments include Type, Technology Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 334 million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Sales of Passenger Cars.

6. What are the notable trends driving market growth?

Growing Sales of Vehicles Fitted with LiDAR Driving the Market.

7. Are there any restraints impacting market growth?

Failure in Garage Equipment may Result in Downtime of the Repair Work.

8. Can you provide examples of recent developments in the market?

October, 2022: Waymo, the robotaxi services providing arm of Alphabet Inc., announced the expansion of its robotaxi taxi services to Los Angeles in California, United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America ADAS Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America ADAS Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America ADAS Industry?

To stay informed about further developments, trends, and reports in the North America ADAS Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence