Key Insights

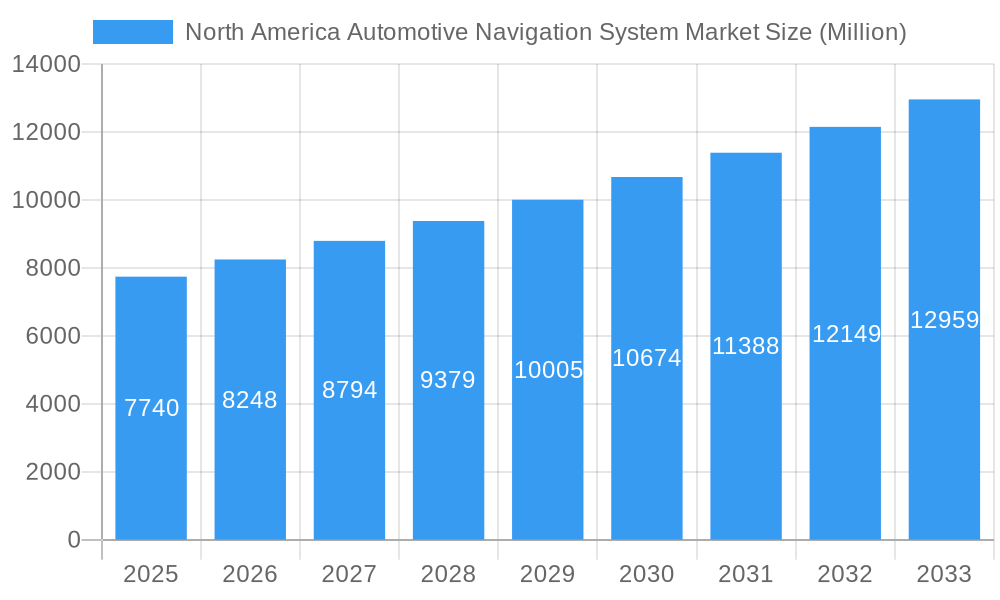

The North American automotive navigation system market, valued at $7.74 billion in 2025, is projected to experience robust growth, driven by increasing vehicle production, rising consumer demand for advanced driver-assistance systems (ADAS), and the integration of navigation with infotainment systems. The market's Compound Annual Growth Rate (CAGR) of 6.50% from 2025 to 2033 indicates a significant expansion, fueled by technological advancements such as improved mapping accuracy, real-time traffic updates, and the incorporation of augmented reality features. The OEM segment currently holds a larger market share compared to the aftermarket, reflecting the growing trend of integrating navigation systems directly into new vehicles. Passenger vehicles constitute the dominant vehicle type segment, aligning with the overall higher sales volume of passenger cars in North America. Within the North American region, the United States represents the largest market, due to its substantial automotive industry and high consumer spending power. However, growth is expected across Canada and Mexico, reflecting the increasing adoption of advanced automotive technologies in these regions. Competition is intense, with major players like Denso, Robert Bosch, and Harman International vying for market share through product innovation and strategic partnerships. The market will likely witness a shift towards cloud-based navigation solutions and greater integration with smartphone applications, improving the user experience and enhancing safety features. Growth constraints might include increasing data costs associated with real-time updates and the potential for cybersecurity vulnerabilities in connected navigation systems.

North America Automotive Navigation System Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued growth, propelled by several factors. The increasing adoption of connected car technologies and the rising demand for personalized navigation experiences will significantly contribute to market expansion. Furthermore, government regulations promoting road safety and the development of autonomous driving capabilities are indirectly driving demand for sophisticated and reliable navigation systems. The aftermarket segment is expected to witness a moderate growth rate, primarily driven by the replacement and upgrade of older navigation systems in existing vehicles. The ongoing development of advanced features such as voice-activated navigation, lane guidance, and parking assistance will further enhance the appeal of automotive navigation systems, attracting a wider consumer base. The market’s competitive landscape is likely to remain dynamic, with companies investing in research and development to deliver innovative and user-friendly navigation solutions.

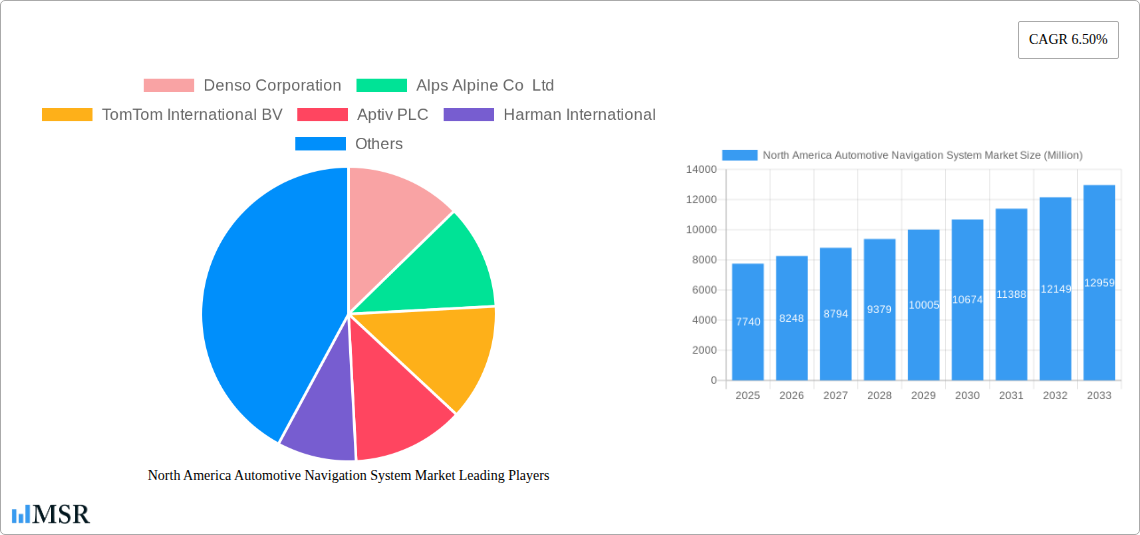

North America Automotive Navigation System Market Company Market Share

North America Automotive Navigation System Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America Automotive Navigation System market, offering invaluable insights for stakeholders across the automotive and technology sectors. Covering the period from 2019 to 2033, with a focus on 2025, this study unveils market dynamics, growth drivers, key players, and emerging trends shaping the future of automotive navigation. The report analyzes market size, CAGR, and competitive landscape, providing actionable strategies for success.

North America Automotive Navigation System Market Market Concentration & Dynamics

The North America automotive navigation system market exhibits a moderately concentrated structure, with a handful of major players holding significant market share. The market is characterized by intense competition driven by technological innovation and evolving consumer demands for advanced features. The presence of both OEM and aftermarket players contributes to a dynamic landscape.

- Market Share: Top 5 players collectively hold an estimated xx% market share in 2025. Precise figures vary by segment.

- M&A Activity: The historical period (2019-2024) witnessed approximately xx M&A deals, indicating consolidation and strategic expansion within the industry. The forecast period is expected to see continued M&A activity, albeit at a potentially slower pace compared to the recent past.

- Innovation Ecosystems: The market thrives on collaborative innovation, with partnerships between automotive manufacturers, technology providers (such as Qualcomm and Mapbox), and mapping companies driving advancements in AI, augmented reality, and cloud-based services. This ecosystem fosters rapid technological development and integration.

- Regulatory Frameworks: Government regulations concerning data privacy, cybersecurity, and autonomous driving significantly influence market developments. Adherence to these regulations is crucial for market players.

- Substitute Products: Smartphone navigation apps pose a significant competitive threat, especially in the aftermarket segment. However, the increasing integration of advanced features and seamless in-car experiences are retaining OEM dominance.

- End-User Trends: Consumers increasingly demand sophisticated features like voice control, real-time traffic updates, augmented reality overlays, and seamless integration with other in-vehicle infotainment systems. This fuels innovation and drives market growth.

North America Automotive Navigation System Market Industry Insights & Trends

The North America automotive navigation system market is experiencing robust growth, driven by factors such as increasing vehicle production, rising disposable incomes, and escalating demand for advanced driver-assistance systems (ADAS). Technological disruptions, especially the integration of AI and cloud-based services, are transforming the market landscape. Consumer behavior trends show a strong preference for user-friendly interfaces, personalized experiences, and integrated infotainment solutions.

The market size in 2025 is estimated at $xx Million, demonstrating significant growth from the $xx Million recorded in 2019. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%. This growth is fuelled by increased vehicle sales, the integration of navigation systems into more affordable vehicles and an increasing preference for advanced navigation features. The introduction of AI-powered navigation and advanced mapping technologies is further bolstering market expansion.

Key Markets & Segments Leading North America Automotive Navigation System Market

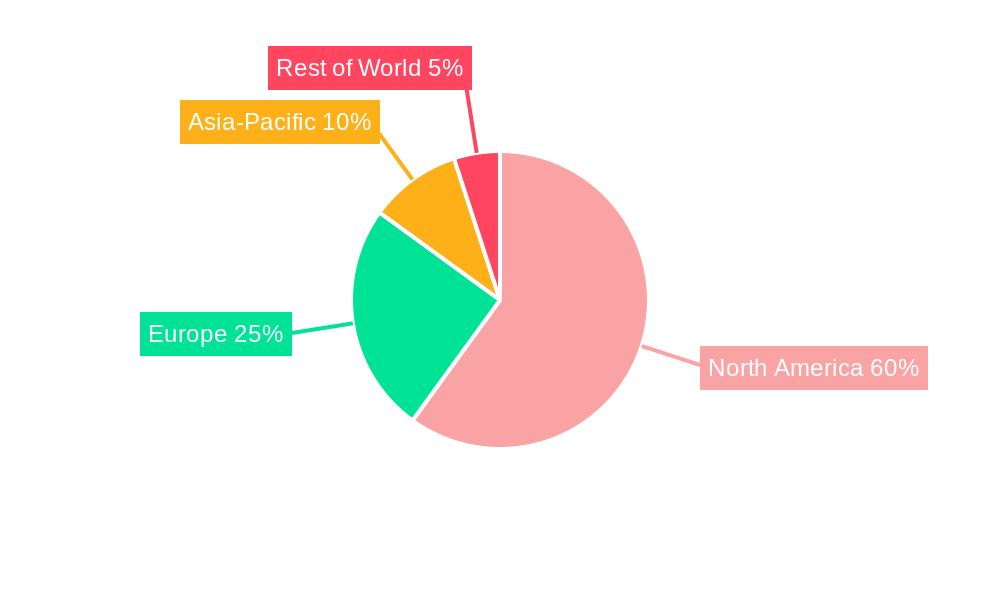

The United States holds the largest market share within North America, followed by Canada and the Rest of North America. The OEM segment dominates the sales channel, owing to the widespread integration of navigation systems in new vehicles. Passenger vehicles contribute the larger share in the vehicle type segment.

- By Sales Channel:

- OEM: Dominant due to factory-installed systems, offering a seamless user experience. The integration of advanced features into new vehicles drives substantial OEM market share.

- Aftermarket: Smaller market share, but displays growth potential through the increasing availability of advanced aftermarket navigation units.

- By Vehicle Type:

- Passenger Vehicles: The major segment due to the high volume of passenger car sales in North America. The integration of navigation systems is becoming increasingly standard across all vehicle classes.

- Commercial Cars: Represents a steadily growing segment with increasing demand for advanced navigation and fleet management solutions.

- By Country:

- United States: Largest market due to higher vehicle ownership, stronger purchasing power and well-developed infrastructure.

- Canada: Significant market, driven by increasing vehicle sales and higher adoption of connected car technologies.

- Rest of North America: A smaller market compared to the US and Canada, but is expected to experience modest growth.

North America Automotive Navigation System Market Product Developments

Recent product innovations focus on AI-powered navigation, augmented reality (AR) overlays for enhanced visualization, and seamless integration with smartphone apps. Mapbox’s MapGPT and Qualcomm's Snapdragon Cockpit Platforms exemplify this trend, offering superior user experiences and driving competitive advantage. Advanced features such as cloud-based updates, offline map access, and improved voice recognition are rapidly gaining traction.

Challenges in the North America Automotive Navigation System Market Market

The market faces challenges such as increasing competition from smartphone navigation, the need to overcome data privacy concerns, and ensuring system reliability and security against potential cyber threats. Supply chain disruptions and the rising cost of components also pose significant hurdles. These factors can lead to cost increases and delays in product launches, impacting market growth. Estimates suggest that supply chain issues alone could impact the market by approximately xx Million annually.

Forces Driving North America Automotive Navigation System Market Growth

Technological advancements such as AI and machine learning, coupled with improved mapping technologies and the integration of connected car features, are major growth catalysts. Government regulations promoting autonomous driving and increasing safety standards indirectly promote investment in more advanced navigation systems. Furthermore, the growing adoption of in-car entertainment and infotainment systems integrates navigation tightly, driving higher demand.

Long-Term Growth Catalysts in North America Automotive Navigation System Market

Long-term growth relies on continued technological innovation, strategic partnerships between automotive and technology firms, and expansion into emerging applications like autonomous vehicles and fleet management. The development of more accurate and comprehensive mapping data, including improved 3D mapping capabilities, will drive sustained market growth.

Emerging Opportunities in North America Automotive Navigation System Market

Emerging trends highlight significant opportunities in augmented reality navigation, the integration of AI-powered personalized recommendations, and advanced safety features leveraging real-time data analysis. The expansion into new segments such as commercial vehicles and the development of sustainable, eco-friendly navigation solutions represent significant growth avenues.

Leading Players in the North America Automotive Navigation System Market Sector

- Denso Corporation

- Alps Alpine Co Ltd

- TomTom International BV

- Aptiv PLC

- Harman International

- Robert Bosch GmbH

- Marelli Holdings Co Ltd

- what3words Ltd

- Faurecia Clarion Electronics Co Ltd

- Pioneer Corporation

- Panasonic Holdings Corporation

- Alpine Electronics

Key Milestones in North America Automotive Navigation System Market Industry

- October 2023: Mapbox, Inc. launched MapGPT, an AI-powered voice navigation system, and Mapbox Autopilot, a map positioning system for self-driving vehicles. This significantly impacts the market by introducing advanced AI capabilities to navigation.

- September 2023: Qualcomm Technologies, Ltd. partnered with Mercedes-Benz AG to integrate Snapdragon Cockpit Platforms into the new E-Class Sedan, enhancing in-car multimedia and navigation capabilities. This partnership underlines the importance of advanced technology in high-end vehicles.

- September 2023: BMW Group and Qualcomm Technologies, Inc. expanded their partnership to integrate Snapdragon Digital Chassis solutions, enhancing safety features and navigation precision in new BMW vehicles. This highlights the growing trend of integrating advanced navigation with safety features.

Strategic Outlook for North America Automotive Navigation System Market Market

The North America automotive navigation system market exhibits substantial growth potential driven by technological advancements, increased connectivity, and the growing demand for enhanced safety and convenience features. Strategic partnerships, focus on developing innovative solutions, and leveraging AI and machine learning will be key for companies seeking to thrive in this dynamic and competitive market. The market is projected to experience a significant surge in demand for advanced features such as AR navigation, predictive routing, and voice-activated controls, creating compelling opportunities for market players who can deliver on these consumer expectations.

North America Automotive Navigation System Market Segmentation

-

1. Sales Channel

- 1.1. Original Equipment Manufacturer (OEM)

- 1.2. Aftermarket

-

2. Vehicle Type

- 2.1. Passenger Vehicles

- 2.2. Commercial Cars

North America Automotive Navigation System Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Automotive Navigation System Market Regional Market Share

Geographic Coverage of North America Automotive Navigation System Market

North America Automotive Navigation System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumer Trend Towards In-dash Navigation System

- 3.3. Market Restrains

- 3.3.1. High Cost of Installing Navigation System May Hamper the Market Growth

- 3.4. Market Trends

- 3.4.1. Passenger Car Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Automotive Navigation System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sales Channel

- 5.1.1. Original Equipment Manufacturer (OEM)

- 5.1.2. Aftermarket

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Vehicles

- 5.2.2. Commercial Cars

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Sales Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Denso Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alps Alpine Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 TomTom International BV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aptiv PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Harman International

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Robert Bosch GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Marelli Holdings Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 what3words Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Faurecia Clarion Electronics Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Pioneer Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Panasonic Holdings Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Alpine Electronics

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Denso Corporation

List of Figures

- Figure 1: North America Automotive Navigation System Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Automotive Navigation System Market Share (%) by Company 2025

List of Tables

- Table 1: North America Automotive Navigation System Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 2: North America Automotive Navigation System Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: North America Automotive Navigation System Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Automotive Navigation System Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 5: North America Automotive Navigation System Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: North America Automotive Navigation System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States North America Automotive Navigation System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Automotive Navigation System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Automotive Navigation System Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Automotive Navigation System Market?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the North America Automotive Navigation System Market?

Key companies in the market include Denso Corporation, Alps Alpine Co Ltd, TomTom International BV, Aptiv PLC, Harman International, Robert Bosch GmbH, Marelli Holdings Co Ltd, what3words Ltd, Faurecia Clarion Electronics Co Ltd, Pioneer Corporation, Panasonic Holdings Corporation, Alpine Electronics.

3. What are the main segments of the North America Automotive Navigation System Market?

The market segments include Sales Channel, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumer Trend Towards In-dash Navigation System.

6. What are the notable trends driving market growth?

Passenger Car Hold Major Market Share.

7. Are there any restraints impacting market growth?

High Cost of Installing Navigation System May Hamper the Market Growth.

8. Can you provide examples of recent developments in the market?

In October 2023, Mapbox, Inc. introduced the MapGPT voice navigation system, that employs generative artificial intelligence (AI), as well as the Mapbox Autopilot Map position information system for self-driving vehicles. The MapGPT system incorporates real-time vehicle, destination, and environmental information into the company's location information service, delivering route and desired facility information.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Automotive Navigation System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Automotive Navigation System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Automotive Navigation System Market?

To stay informed about further developments, trends, and reports in the North America Automotive Navigation System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence