Key Insights

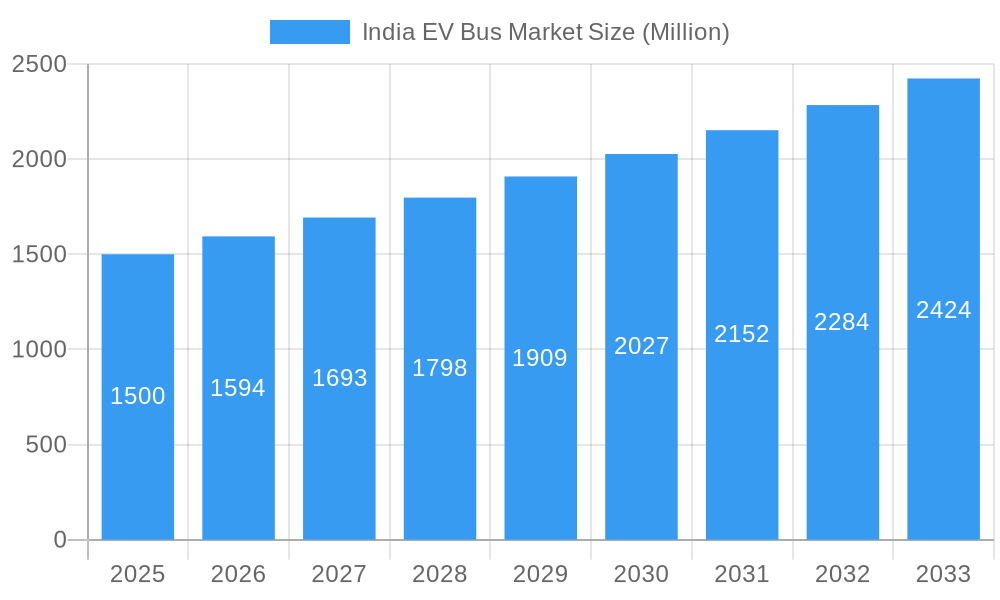

The India electric vehicle (EV) bus market is experiencing robust growth, driven by government initiatives promoting sustainable transportation, increasing environmental concerns, and the declining cost of EV batteries. The market, valued at approximately ₹1500 million (estimated) in 2025, is projected to witness a Compound Annual Growth Rate (CAGR) of 5.89% from 2025 to 2033. This growth is fueled by significant investments in charging infrastructure, favorable government policies like the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles (FAME) scheme, and a rising demand for cleaner public transportation in major cities across India. Key segments within the market include Battery Electric Vehicles (BEVs), Fuel Cell Electric Vehicles (FCEVs), Hybrid Electric Vehicles (HEVs), and Plug-in Hybrid Electric Vehicles (PHEVs), with BEVs expected to dominate due to technological advancements and cost reductions. Leading players like Tata Motors, Solaris Bus & Coach, and Olectra Greentech are actively shaping the market landscape through innovative product offerings and strategic partnerships. Regional variations exist, with states like Maharashtra, Gujarat, and Karnataka leading the adoption of EV buses due to supportive policies and higher population density. However, challenges such as limited charging infrastructure in certain regions, high initial investment costs, and the need for skilled workforce remain hurdles to overcome for widespread market penetration.

India EV Bus Market Market Size (In Billion)

The sustained growth trajectory is further supported by the expanding network of bus rapid transit systems (BRTS) in metropolitan areas, which provides an ideal environment for EV bus deployment. Furthermore, increasing awareness about the environmental benefits of EVs, coupled with rising fuel prices, is pushing both public and private sector entities toward adopting these cleaner alternatives. While the initial investment cost remains a factor, government subsidies and operational cost savings associated with EVs are contributing to a positive return on investment for operators. The coming years will see intense competition among manufacturers, leading to technological innovation, improved battery performance, and ultimately, more affordable and accessible electric buses for the Indian market. Future growth will be significantly influenced by the success of government policies in overcoming infrastructure limitations and fostering a supportive ecosystem for EV adoption.

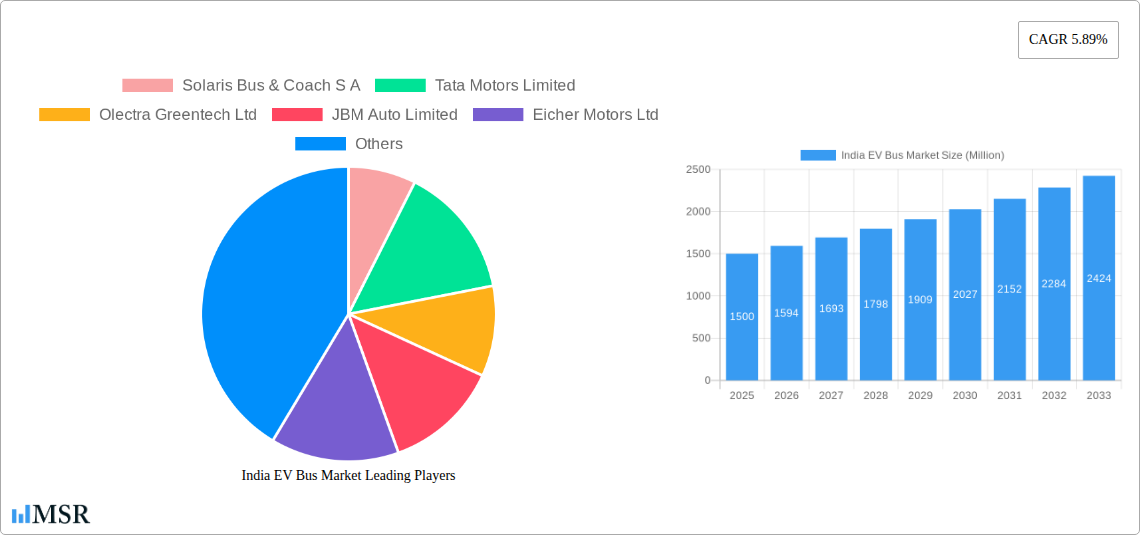

India EV Bus Market Company Market Share

India EV Bus Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning India EV Bus Market, offering crucial insights for industry stakeholders, investors, and policymakers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence on market dynamics, key players, and future growth opportunities. The report leverages extensive data analysis to offer a granular understanding of market trends, technological advancements, and regulatory landscapes. Expect detailed breakdowns of market segments by fuel category (BEV, FCEV, HEV, PHEV) and key players like Tata Motors, Olectra Greentech, and JBM Auto. This report projects a market value of xx Million by 2033, presenting a compelling opportunity for strategic investments.

India EV Bus Market Concentration & Dynamics

The Indian EV bus market is characterized by moderate concentration, with a few dominant players vying for market share. Tata Motors, Olectra Greentech, and JBM Auto currently hold significant positions, although the market remains open to new entrants and rapid technological advancements. The innovation ecosystem is dynamic, fueled by government initiatives promoting electric mobility and significant investments in R&D by both domestic and international players. Regulatory frameworks, while supportive, are still evolving, impacting the pace of adoption. Substitute products, primarily diesel and CNG buses, face increasing pressure due to environmental concerns and government regulations. End-user trends show a growing preference for electric buses due to their lower operational costs and reduced emissions. M&A activity is expected to increase as larger players seek to consolidate their market positions and expand their reach.

- Market Share: Tata Motors holds an estimated xx% market share in 2025, followed by Olectra Greentech with xx% and JBM Auto with xx%.

- M&A Deal Counts: An estimated xx M&A deals were recorded in the EV bus sector between 2019 and 2024. The forecast for 2025-2033 is xx deals.

India EV Bus Market Industry Insights & Trends

The Indian EV bus market is experiencing robust growth, driven by a confluence of factors. Government policies promoting electric mobility, including substantial financial incentives and emission reduction targets, are primary drivers. Technological advancements in battery technology, charging infrastructure, and vehicle design are enhancing the viability and appeal of electric buses. Evolving consumer behavior, particularly among urban populations, increasingly favors sustainable and environmentally friendly transportation options. The market size is projected to reach xx Million by 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth trajectory is further bolstered by increasing urbanization, expanding public transportation networks, and a rising middle class with greater disposable income. The transition to electric buses is also being accelerated by rising fuel prices and the growing awareness of environmental sustainability.

Key Markets & Segments Leading India EV Bus Market

The Indian EV bus market is currently dominated by the Battery Electric Vehicle (BEV) segment, owing to its relative maturity and cost-effectiveness compared to other fuel categories. While FCEV and PHEV technologies are emerging, BEV remains the dominant force. Major metropolitan areas and state governments are leading the adoption of electric buses, driven by their commitment to cleaner air and reduced carbon footprints. The rapid expansion of charging infrastructure, particularly in urban centers, is also fueling BEV's dominance.

- Drivers of BEV segment dominance:

- Favorable government policies and subsidies.

- Lower operational costs compared to diesel buses.

- Growing public awareness of environmental sustainability.

- Improvement in battery technology and charging infrastructure.

- Large scale deployments in major cities.

India EV Bus Market Product Developments

Recent product developments in the Indian EV bus market are focusing on enhancing battery range, improving charging speeds, and incorporating advanced safety features. Manufacturers are also concentrating on optimizing vehicle designs to reduce weight and improve energy efficiency. These advancements are leading to increased operational efficiency and reduced total cost of ownership, making electric buses more attractive to both public and private operators. Competition is driving innovation, leading to a rapid pace of product improvements and diversification in offerings.

Challenges in the India EV Bus Market Market

The Indian EV bus market faces several challenges. High upfront capital costs of electric buses remain a barrier to entry for smaller operators. The availability and reliability of charging infrastructure, particularly outside major cities, are significant concerns. Supply chain disruptions and the availability of critical raw materials needed for battery production pose further challenges. Stringent regulatory compliance requirements and the complexity of obtaining necessary permits can also hamper market expansion. These factors can reduce the overall speed of market development.

Forces Driving India EV Bus Market Growth

Several forces are propelling the growth of the India EV bus market. Government policies, including the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India (FAME) scheme, provide substantial financial incentives for the adoption of electric buses. Technological advancements in battery technology are reducing costs and improving performance. Growing environmental awareness and concerns about air pollution are driving demand for cleaner transportation solutions. The decreasing cost of electricity compared to diesel fuel makes electric buses economically viable. The increasing focus on sustainable transportation in urban planning initiatives contributes significantly.

Challenges in the India EV Bus Market Market

Long-term growth in the Indian EV bus market hinges on continued government support for EV adoption, including policies to address the high initial cost of electric buses. Increased investment in R&D to enhance battery technology and reduce its environmental impact is also critical. Collaboration between manufacturers, charging infrastructure providers, and government agencies is needed for a coordinated market expansion. The development of robust domestic battery and charging infrastructure manufacturing capabilities will bolster the sector's long-term competitiveness.

Emerging Opportunities in India EV Bus Market

Emerging opportunities lie in expanding electric bus adoption in smaller cities and towns, developing specialized electric buses for niche applications (e.g., school buses, tourist buses), and exploring innovative business models such as battery-swapping and shared charging infrastructure. The integration of smart technologies and data analytics for improved fleet management and operational efficiency offers further potential. Growth also lies in collaborations between EV manufacturers and private operators to address specific transportation needs in different regions.

Leading Players in the India EV Bus Market Sector

Key Milestones in India EV Bus Market Industry

- September 2023: Tata Motors supplied 400 Starbus EV buses to the Delhi Transport Corporation (DTC), a significant step towards fulfilling a larger 1,500-bus order. This demonstrates the growing demand for large-scale EV bus deployments in major cities.

- August 2023: VE Commercial Vehicles received a INR 5 Billion order for 550 intercity buses, showcasing the expanding market for electric buses in the intercity travel segment.

- July 2023: Tata Motors' substantial R&D investment (INR 202.65 Billion) and filing of 158 patents underscore the commitment to innovation and technological leadership in the EV bus sector.

Strategic Outlook for India EV Bus Market Market

The India EV bus market is poised for significant growth over the next decade, driven by supportive government policies, technological advancements, and rising environmental concerns. Strategic opportunities abound for companies that can effectively navigate the challenges related to infrastructure development, supply chain management, and technological innovation. The market’s future potential hinges on the continued collaboration between government agencies, private sector players, and technological innovators. Focusing on cost reduction, range enhancement, and developing robust charging infrastructure will be crucial for maximizing market penetration and long-term success.

India EV Bus Market Segmentation

-

1. Fuel Category

- 1.1. BEV

- 1.2. FCEV

- 1.3. HEV

- 1.4. PHEV

India EV Bus Market Segmentation By Geography

- 1. India

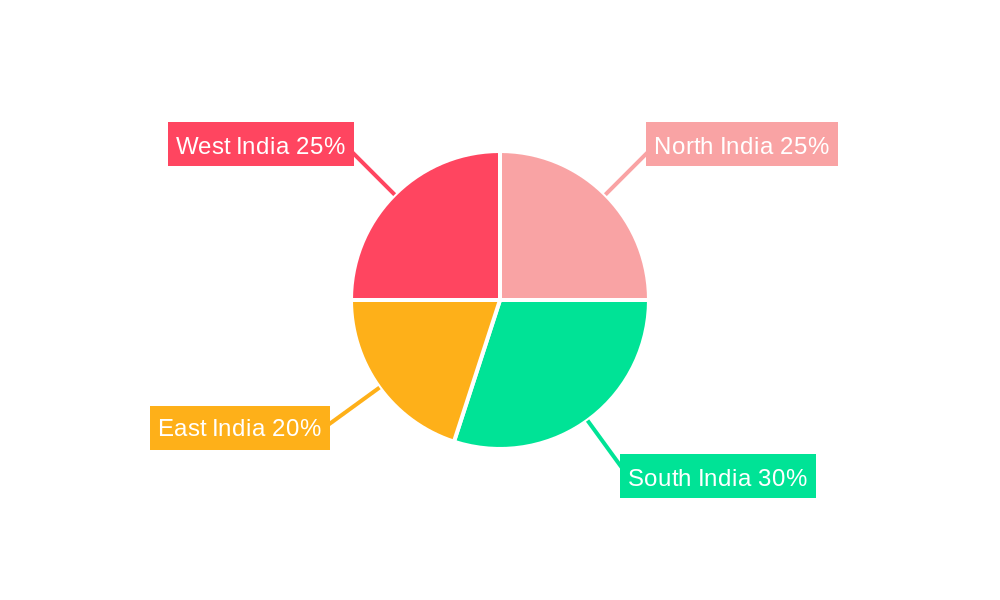

India EV Bus Market Regional Market Share

Geographic Coverage of India EV Bus Market

India EV Bus Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Traffic Congestion and Increasing Urban Population to Foster Market Growth

- 3.3. Market Restrains

- 3.3.1. Strict Government Regulations and Policies Toward Ride-hailing Services Impact the Market Growth

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India EV Bus Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Category

- 5.1.1. BEV

- 5.1.2. FCEV

- 5.1.3. HEV

- 5.1.4. PHEV

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Fuel Category

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Solaris Bus & Coach S A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tata Motors Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Olectra Greentech Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JBM Auto Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eicher Motors Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 VE Commercial Vehicles Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Switch Mobility (Ashok Leyland Limited)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PMI Electro Mobility Solutions Pvt Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Volvo Buses India Private Limite

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Solaris Bus & Coach S A

List of Figures

- Figure 1: India EV Bus Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India EV Bus Market Share (%) by Company 2025

List of Tables

- Table 1: India EV Bus Market Revenue undefined Forecast, by Fuel Category 2020 & 2033

- Table 2: India EV Bus Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: India EV Bus Market Revenue undefined Forecast, by Fuel Category 2020 & 2033

- Table 4: India EV Bus Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India EV Bus Market?

The projected CAGR is approximately 12.72%.

2. Which companies are prominent players in the India EV Bus Market?

Key companies in the market include Solaris Bus & Coach S A, Tata Motors Limited, Olectra Greentech Ltd, JBM Auto Limited, Eicher Motors Ltd, VE Commercial Vehicles Limited, Switch Mobility (Ashok Leyland Limited), PMI Electro Mobility Solutions Pvt Ltd, Volvo Buses India Private Limite.

3. What are the main segments of the India EV Bus Market?

The market segments include Fuel Category.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Traffic Congestion and Increasing Urban Population to Foster Market Growth.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Strict Government Regulations and Policies Toward Ride-hailing Services Impact the Market Growth.

8. Can you provide examples of recent developments in the market?

September 2023: Tata Motors announced that it supplied 400 Starbus EV buses to the Delhi Transport Corporation (DTC), via its subsidiary TML CV Mobility Solutions Ltd, as a part of its larger order from DTC to supply, maintain, and operate 1,500 low-floor, air-conditioned electric buses for a period 12-years.August 2023: Ve Commercial Vehicles Limited announced that it has received an order for 550 Intercity Buses from Vijayan Travels and VT, worth INR 5 billion. The order includes 500 Eicher Intercity 13.5m AC and non AC sleeper coaches and 50 Volvo 9600 luxury sleeper coaches.July 2023: Tata Motors, India filed 158 Patents in FY 2022-23, R&D spend reaches INR 202.65 billion

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India EV Bus Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India EV Bus Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India EV Bus Market?

To stay informed about further developments, trends, and reports in the India EV Bus Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence