Key Insights

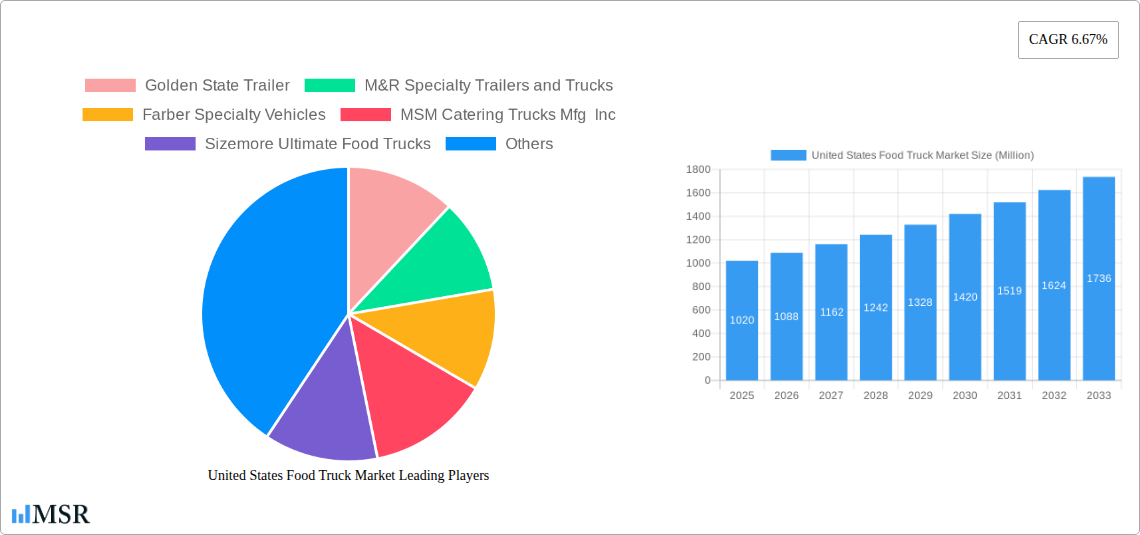

The United States food truck market is poised for significant expansion, projected to reach approximately $1.02 billion in value. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 6.67%, indicating a dynamic and expanding sector. The market's expansion is largely driven by the increasing consumer demand for convenient, diverse, and often more affordable dining options, coupled with the entrepreneurial spirit of individuals and businesses seeking lower overhead compared to traditional brick-and-mortar restaurants. The rise of gourmet food trucks, offering specialized cuisines and high-quality ingredients, has further elevated the perception and appeal of food trucks, transforming them from a niche concept into a mainstream culinary force. Furthermore, evolving consumer preferences towards global flavors and unique dining experiences are fueling the adoption of specialized food truck concepts.

United States Food Truck Market Market Size (In Billion)

Key segments contributing to this market growth include the "Vans" and "Customized Trucks" categories, reflecting the flexibility and adaptability of food truck operations. On the application front, "Fast Food," "Vegan and Plant Meat," and "Barbeque and Snacks" are experiencing substantial traction, aligning with current dietary trends and consumer interests. The "Up to 15 Feet" and "16-25 Feet" size segments are particularly popular, offering a balance of operational efficiency and service capacity. Leading companies such as Golden State Trailer, M&R Specialty Trailers and Trucks, and Farber Specialty Vehicles are at the forefront of this market, innovating in design, customization, and manufacturing to meet the evolving needs of food truck entrepreneurs. The market's growth trajectory is further supported by favorable economic conditions and a culture that embraces mobile culinary innovation, particularly within major metropolitan areas.

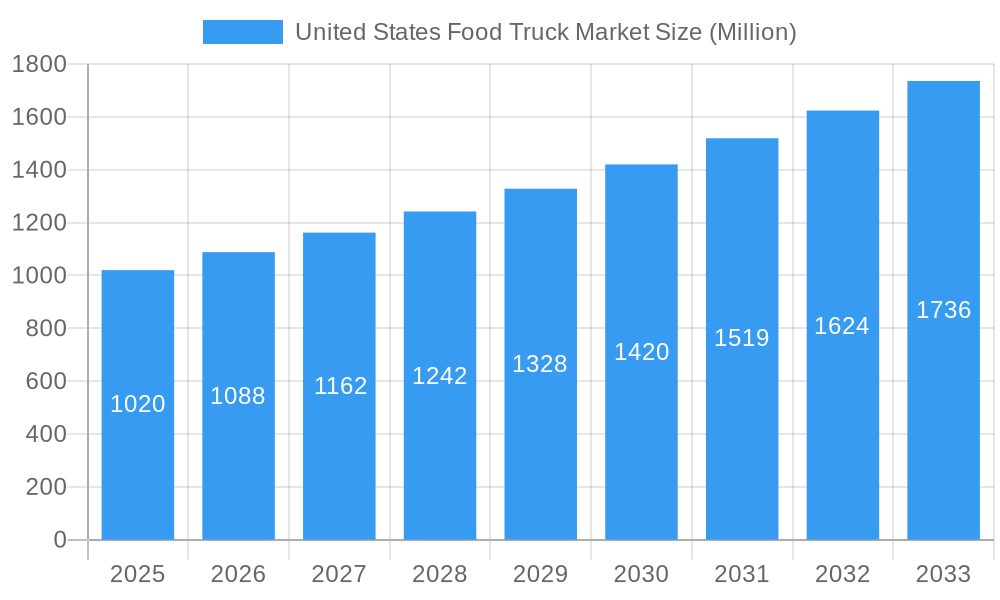

United States Food Truck Market Company Market Share

Unlock unparalleled insights into the booming United States food truck market with this in-depth report. Covering the historical period (2019-2024) and extending to a forecast period (2025-2033), this analysis provides a definitive roadmap for industry stakeholders. Explore market dynamics, segment dominance, product innovations, and strategic opportunities. This report leverages high-ranking keywords such as "food truck industry," "mobile food vending," "food truck manufacturing," "food truck trends," and "food truck business" to ensure maximum search visibility. Understand the intricate workings of this dynamic sector, from vans, trailers, and customized trucks to fast food, vegan and plant-based, and BBQ applications.

United States Food Truck Market Market Concentration & Dynamics

The United States food truck market exhibits a moderate to highly fragmented concentration, with a significant number of small to medium-sized enterprises alongside a growing presence of established manufacturers. Innovation is a key differentiator, driven by specialized builders like Golden State Trailer, M&R Specialty Trailers and Trucks, Farber Specialty Vehicles, MSM Catering Trucks Mfg Inc, Sizemore Ultimate Food Trucks, The Fud Trailer Company, Custom Concessions, Titan Trucks Manufacturing, All American Food Trucks, US Food Truck Factory, Prestige Food Trucks, and United Food Truck LLC. These companies continuously introduce advanced features and customization options, fostering a competitive innovation ecosystem. Regulatory frameworks, though varying by state and municipality, are a crucial aspect influencing market entry and operations. The rise of substitute products, such as ghost kitchens and fast-casual restaurants, presents a constant challenge, yet the inherent mobility and lower overhead of food trucks continue to attract end-users. Merger and acquisition (M&A) activities are gradually increasing as larger players seek to consolidate market share and expand their offerings. In 2023, there were approximately 15-20 significant M&A deals within the broader food service equipment and mobile vending sector, indicating consolidation potential.

United States Food Truck Market Industry Insights & Trends

The United States food truck market is poised for substantial growth, projected to reach a market size of approximately USD 6,500 Million by 2033, expanding at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This expansion is fueled by a confluence of factors, including the persistent consumer demand for convenient, diverse, and affordable food options, especially in urban and suburban settings. The entrepreneurial spirit driving the food truck industry remains robust, with individuals and small businesses leveraging mobile vending as a viable pathway to enter the food service sector. Technological advancements in kitchen equipment, refrigeration, and point-of-sale systems are enhancing operational efficiency and expanding the culinary capabilities of food trucks. Furthermore, the increasing acceptance of food trucks at events, festivals, and corporate campuses has broadened their reach and revenue streams. Evolving consumer behaviors, such as a growing preference for vegan and plant-based offerings and the desire for unique culinary experiences, are compelling food truck operators to diversify their menus and adapt to changing tastes. The integration of online ordering platforms and social media marketing has become instrumental in customer engagement and driving foot traffic, further solidifying the market's upward trajectory.

Key Markets & Segments Leading United States Food Truck Market

The United States food truck market is experiencing robust growth across various segments. Within the Type segment, Customized Trucks are dominating, accounting for an estimated 40% of the market share in 2025, driven by the demand for bespoke solutions catering to specific culinary needs and branding. Trailers follow closely, holding approximately 30% of the market, valued at around USD 1,950 Million in 2025, due to their cost-effectiveness and flexibility.

- Fast Food application remains the cornerstone of the food truck industry, contributing an estimated 35% of the market revenue in 2025, valued at USD 2,275 Million. This is propelled by the inherent convenience and speed associated with traditional fast-food offerings.

- The Vegan and Plant Meat segment is exhibiting the highest growth rate, projected to expand by xx% annually. Its market share is expected to reach 20% by 2033, driven by increasing consumer health consciousness and ethical considerations.

- Barbeque and Snacks represent a significant 15% of the market, with an estimated value of USD 975 Million in 2025.

- Desserts and Confectionery and Others (Fruits and Vegetables, etc.) collectively hold the remaining market share, with emerging potential in niche culinary experiences.

In terms of Size, food trucks ranging from 16-25 Feet are the most popular, capturing 45% of the market in 2025, valued at USD 2,925 Million, offering an optimal balance of kitchen space and maneuverability.

United States Food Truck Market Product Developments

Product developments in the United States food truck market are largely focused on enhancing efficiency, sustainability, and operational versatility. Manufacturers are increasingly incorporating energy-efficient appliances, advanced climate control systems, and smart technology for inventory management and order processing. Innovations in expandable food truck designs, allowing for increased serving space when stationary, are gaining traction. The emphasis on health and safety standards is also driving the adoption of antimicrobial surfaces and improved ventilation systems, making these mobile kitchens more appealing to a wider range of culinary entrepreneurs.

Challenges in the United States Food Truck Market Market

Despite its growth, the United States food truck market faces several challenges. Navigating complex and often inconsistent local zoning laws and permitting processes remains a significant hurdle. Limited parking availability in high-demand urban areas and competition for prime locations can impact revenue. Supply chain disruptions for specialized components and ingredients can affect operational continuity. Furthermore, the intense competition within the market necessitates continuous innovation and effective marketing strategies to stand out. The estimated annual impact of regulatory hurdles on new entrants is approximately 10-15% of initial investment.

Forces Driving United States Food Truck Market Growth

Several forces are propelling the growth of the United States food truck market. The increasing demand for unique and diverse culinary experiences, coupled with a preference for affordable and convenient dining options, is a primary driver. The entrepreneurial appeal of lower startup costs compared to traditional brick-and-mortar restaurants continues to attract new entrants. Technological advancements in food truck design and equipment are enhancing operational efficiency and expanding menu possibilities. Supportive local initiatives and the growing acceptance of food trucks at public events, festivals, and private gatherings further contribute to market expansion.

Challenges in the United States Food Truck Market Market

Long-term growth catalysts for the United States food truck market lie in continued innovation and strategic market expansion. The development of more sustainable and energy-efficient food truck designs will appeal to a growing eco-conscious consumer base. Partnerships with local businesses, event organizers, and technology providers can unlock new revenue streams and operational efficiencies. The expansion into underserved suburban and rural areas, coupled with a focus on specialized or niche cuisines, presents significant untapped potential for sustained market growth.

Emerging Opportunities in United States Food Truck Market

Emerging opportunities in the United States food truck market are abundant. The burgeoning demand for vegan and plant-based options presents a significant niche market with high growth potential. The integration of advanced digital platforms for order management, delivery services, and customer loyalty programs is creating new avenues for engagement and revenue. The growing popularity of food truck rallies, themed events, and collaborations with breweries and wineries offers lucrative opportunities for operators. Furthermore, the development of modular and customizable food truck units catering to specific dietary needs or culinary styles will cater to evolving consumer preferences.

Leading Players in the United States Food Truck Market Sector

- Golden State Trailer

- M&R Specialty Trailers and Trucks

- Farber Specialty Vehicles

- MSM Catering Trucks Mfg Inc

- Sizemore Ultimate Food Trucks

- The Fud Trailer Company

- Custom Concessions

- Titan Trucks Manufacturing

- All American Food Trucks

- US Food Truck Factory

- Prestige Food Trucks

- United Food Truck LLC

Key Milestones in United States Food Truck Market Industry

- March 2024: The National Park of Boston announced a call for bids for food truck vendors at the Charlestown Navy Yard, offering lease opportunities with a minimum rent of USD 40 per shift per day, indicating increased public space utilization for mobile vending.

- April 2023: The University of California, Davis, launched "AggieEats," a food truck initiative in partnership with campus services to combat student food insecurity, operating at multiple campus locations, highlighting the role of food trucks in addressing social needs.

Strategic Outlook for United States Food Truck Market Market

The strategic outlook for the United States food truck market remains highly positive, driven by sustained consumer demand for convenient, diverse, and experiential food offerings. Future growth will be accelerated by continued product innovation, particularly in areas of sustainability and technological integration. Strategic partnerships between food truck manufacturers, operators, and technology providers will streamline operations and enhance customer reach. Expansion into new geographical markets and the exploration of niche culinary segments will further fuel market penetration. The increasing institutional adoption of food trucks for events and employee welfare will also contribute significantly to long-term market potential.

United States Food Truck Market Segmentation

-

1. Type

- 1.1. Vans

- 1.2. Trailers

- 1.3. Customized Trucks

- 1.4. Others (Expandable Food Trucks, etc.)

-

2. Application

- 2.1. Fast Food

- 2.2. Vegan and Plant Meat

- 2.3. Barbeque and Snacks

- 2.4. Desserts and Confectionery

- 2.5. Others (Fruits and Vegetables, etc.)

-

3. Size

- 3.1. Up to 15 Feet

- 3.2. 16-25 Feet

- 3.3. Above 25 Feet

United States Food Truck Market Segmentation By Geography

- 1. United States

United States Food Truck Market Regional Market Share

Geographic Coverage of United States Food Truck Market

United States Food Truck Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Preference toward Fast Food Consumption Fosters the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Rapid Integration of Online Food Delivery Services Hampers the Growth of the Market

- 3.4. Market Trends

- 3.4.1. The Customized Truck Segment is Expected to Gain Traction Between 2024 and 2029

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Food Truck Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Vans

- 5.1.2. Trailers

- 5.1.3. Customized Trucks

- 5.1.4. Others (Expandable Food Trucks, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Fast Food

- 5.2.2. Vegan and Plant Meat

- 5.2.3. Barbeque and Snacks

- 5.2.4. Desserts and Confectionery

- 5.2.5. Others (Fruits and Vegetables, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Size

- 5.3.1. Up to 15 Feet

- 5.3.2. 16-25 Feet

- 5.3.3. Above 25 Feet

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Golden State Trailer

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 M&R Specialty Trailers and Trucks

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Farber Specialty Vehicles

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MSM Catering Trucks Mfg Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sizemore Ultimate Food Trucks

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Fud Trailer Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Custom Concessions

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Titan Trucks Manufacturing

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 All American Food Trucks

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 US Food Truck Factory

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Prestige Food Trucks

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 United Food Truck LLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Golden State Trailer

List of Figures

- Figure 1: United States Food Truck Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Food Truck Market Share (%) by Company 2025

List of Tables

- Table 1: United States Food Truck Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: United States Food Truck Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: United States Food Truck Market Revenue Million Forecast, by Size 2020 & 2033

- Table 4: United States Food Truck Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United States Food Truck Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: United States Food Truck Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: United States Food Truck Market Revenue Million Forecast, by Size 2020 & 2033

- Table 8: United States Food Truck Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Food Truck Market?

The projected CAGR is approximately 6.67%.

2. Which companies are prominent players in the United States Food Truck Market?

Key companies in the market include Golden State Trailer, M&R Specialty Trailers and Trucks, Farber Specialty Vehicles, MSM Catering Trucks Mfg Inc, Sizemore Ultimate Food Trucks, The Fud Trailer Company, Custom Concessions, Titan Trucks Manufacturing, All American Food Trucks, US Food Truck Factory, Prestige Food Trucks, United Food Truck LLC.

3. What are the main segments of the United States Food Truck Market?

The market segments include Type, Application, Size.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Preference toward Fast Food Consumption Fosters the Growth of the Market.

6. What are the notable trends driving market growth?

The Customized Truck Segment is Expected to Gain Traction Between 2024 and 2029.

7. Are there any restraints impacting market growth?

Rapid Integration of Online Food Delivery Services Hampers the Growth of the Market.

8. Can you provide examples of recent developments in the market?

March 2024: The National Park of Boston in the United States announced the call for bids for food truck vendors to operate at the Charlestown Navy Yard through a Request for Bids (RFB) proposal. The administration is willing to lease two spaces identified by the National Park Service (NPS) as suitable for mobile food and beverage vending in the Charlestown Navy Yard at Boston National Historical Park. Further, the administration stated that the minimum rent for the lease is USD 40 per shift per day.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Food Truck Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Food Truck Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Food Truck Market?

To stay informed about further developments, trends, and reports in the United States Food Truck Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence