Key Insights

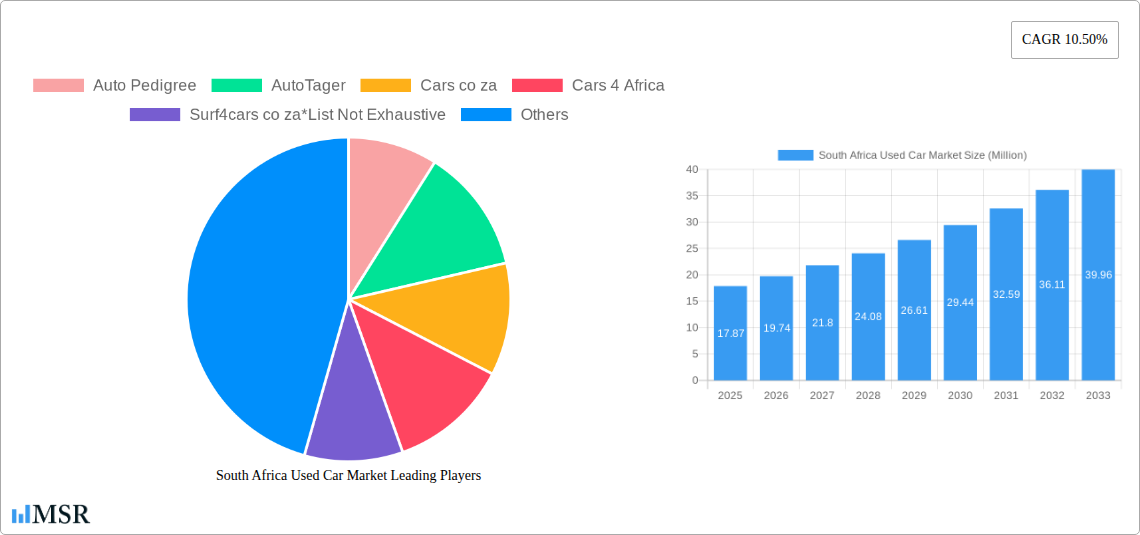

The South African used car market is poised for substantial expansion, projecting a market size of 17.87 Million by 2025, with a compelling compound annual growth rate (CAGR) of 10.50% throughout the forecast period (2025-2033). This robust growth is primarily fueled by several interconnected drivers. A significant factor is the increasing demand for affordable mobility solutions, driven by economic pressures and a growing desire among consumers to own vehicles without the premium associated with new car purchases. This is further amplified by the widespread adoption of online platforms and digital tools for car searching, valuation, and even transactions, making the process more accessible and transparent. Organized vendors are playing a crucial role in building consumer trust through certified pre-owned programs and enhanced warranty offerings, addressing lingering concerns about the quality and reliability of used vehicles. Additionally, the convenience offered by both online and offline booking channels caters to a diverse customer base with varying preferences.

South Africa Used Car Market Market Size (In Million)

The market's dynamism is also shaped by prevailing trends. The proliferation of digital marketplaces and mobile applications has revolutionized how consumers discover and acquire used cars, leading to a more efficient and competitive landscape. The rise of innovative business models, including subscription services and rental platforms for pre-owned vehicles, is further broadening the appeal and accessibility of the used car segment. While the market experiences strong tailwinds, certain restraints warrant consideration. Economic volatility and fluctuations in consumer spending power can directly impact purchasing decisions. Furthermore, regulatory shifts concerning vehicle imports and emissions standards may influence the availability and pricing of certain used car models. Despite these challenges, the underlying demand for cost-effective transportation, coupled with technological advancements and a more organized vendor ecosystem, ensures a promising trajectory for the South African used car market.

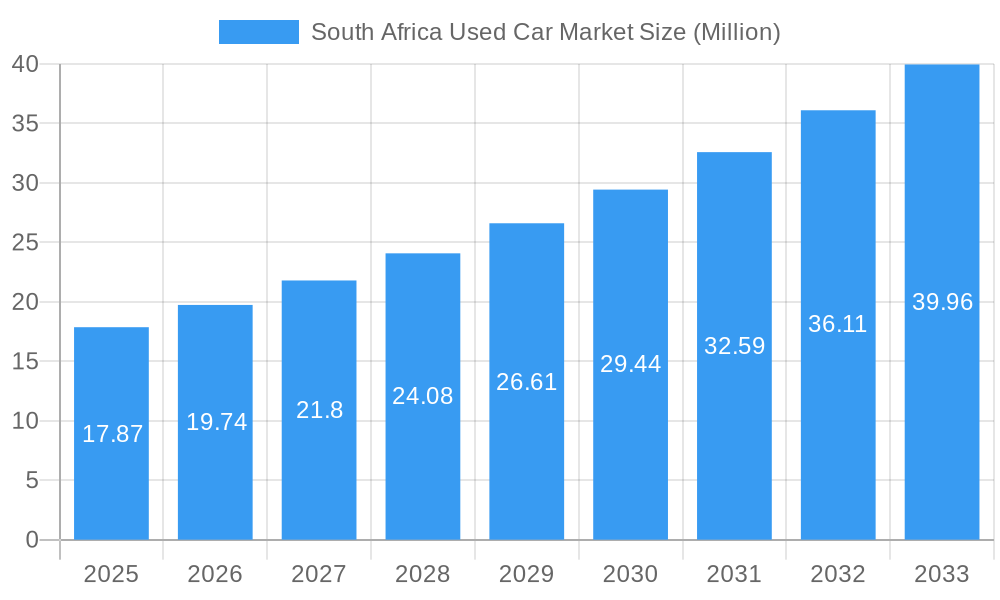

South Africa Used Car Market Company Market Share

This in-depth report delivers unparalleled insights into the South African used car market, a rapidly evolving sector ripe with opportunity. Covering the historical period (2019-2024), base year (2025), and an extensive forecast period (2025-2033), this study is an essential resource for industry stakeholders seeking to navigate South Africa used car market growth drivers, understand South Africa used car market trends, and capitalize on South Africa used car market opportunities. We analyze key segments including hatchbacks, sedans, sports utility vehicles (SUVs), petrol and diesel fuel types, online and offline booking models, and the dynamic interplay between organized and unorganized vendors. Discover the market size of the South Africa used car market, its CAGR, and the strategic moves of leading players like Auto Pedigree, We Buy Cars, and Autochek Africa.

South Africa Used Car Market Market Concentration & Dynamics

The South African used car market exhibits a moderate to high level of concentration, with key players like AutoTrader South Africa and Cars co za dominating online presence and lead generation. The innovation ecosystem is increasingly driven by digital platforms, enhancing transparency and accessibility for buyers and sellers. Regulatory frameworks, while evolving, focus on consumer protection and vehicle history disclosure, impacting the organized used car market. Substitute products, primarily new cars, continue to exert pressure, but economic factors often push consumers towards the more affordable used car segments. End-user trends indicate a growing preference for convenience and digital transactions, particularly among younger demographics. Mergers and acquisitions (M&A) are becoming more prevalent as larger entities seek to consolidate market share and acquire technological capabilities. For instance, the recent funding rounds for companies like Shekel Mobility underscore this trend. While specific M&A deal counts are proprietary, the strategic intent is clear: to gain a competitive edge in this dynamic South Africa used car industry. The market share of organized players is steadily increasing due to trust and standardized processes.

South Africa Used Car Market Industry Insights & Trends

The South African used car market is poised for significant growth, propelled by a confluence of economic, technological, and behavioral shifts. The projected market size for 2025 is estimated at XX Million, with an anticipated CAGR of XX% from 2025 to 2033. A primary growth driver is the increasing affordability of used vehicles compared to new ones, making car ownership accessible to a wider segment of the South African population. This is particularly relevant in the current economic climate where disposable incomes are under pressure. Technological disruptions are revolutionizing the way used cars are bought and sold. Online marketplaces, such as Cars co za and AutoTrader South Africa, have become indispensable, offering wider selection, transparent pricing, and convenient browsing. The integration of AI for vehicle valuation and predictive maintenance is further enhancing the user experience. Evolving consumer behaviors also play a crucial role. There's a growing demand for certified pre-owned vehicles offering peace of mind and warranties, driving the expansion of the organized used car segment. Furthermore, the rise of digital payment solutions and financing options is simplifying transactions. The increasing prevalence of data analytics allows businesses to better understand consumer preferences, leading to more targeted marketing and inventory management. The impact of e-commerce models on the traditional dealership network is profound, forcing both to adapt and innovate. The increasing penetration of smartphones and internet access across South Africa further fuels the growth of online platforms, democratizing access to the used car market.

Key Markets & Segments Leading South Africa Used Car Market

Several key markets and segments are instrumental in driving the South Africa Used Car Market.

Vehicle Type Dominance:

- Hatchbacks: These remain a consistently popular choice due to their fuel efficiency and affordability, making them ideal for urban commuting and budget-conscious buyers. Economic growth and increasing urbanization are key drivers for this segment.

- Sedans: While facing competition from SUVs, sedans continue to hold a significant market share, appealing to families and those seeking a balance of comfort and practicality.

- Sports Utility Vehicles (SUVs): The SUV segment is experiencing robust growth, driven by lifestyle preferences, perceived safety, and their suitability for diverse South African terrains. Infrastructure development, particularly in rural areas, indirectly supports SUV demand.

Fuel Type Trends:

- Petrol: Remains the dominant fuel type, owing to its widespread availability and often lower upfront cost.

- Diesel: Continues to be a strong contender, especially for those who cover longer distances, benefiting from better fuel economy and torque.

Booking Type Evolution:

- Online: This segment is experiencing exponential growth, fueled by convenience, transparency, and wider reach offered by platforms like Cars co za and AutoTrader South Africa. The availability of advanced search filters and virtual tours are significant drivers.

- Offline: Traditional dealerships and independent sellers still hold relevance, particularly for buyers who prefer physical inspection and negotiation. However, their market share is gradually being influenced by the digital shift.

Vendor Type Dynamics:

- Organized: This segment, encompassing franchised dealerships and large independent used car retailers like Auto Pedigree, is gaining traction due to their focus on vehicle inspection, warranties, and customer service. Regulatory compliance and consumer trust are key drivers for organized vendors.

- Unorganized: This segment comprises smaller independent dealers and private sellers. While offering potentially lower prices, they often lack the standardized processes and consumer protections of organized players.

South Africa Used Car Market Product Developments

Product innovations in the South African used car market are primarily focused on enhancing transparency and buyer confidence. Digital inspection tools, AI-powered vehicle history reports, and online valuation platforms are becoming standard. The increasing availability of certified pre-owned (CPO) programs from manufacturers and large dealerships offers buyers extended warranties and rigorous mechanical checks, mitigating risks associated with purchasing used vehicles. Virtual reality (VR) showrooms and augmented reality (AR) tools are emerging to provide immersive online viewing experiences. These advancements aim to bridge the gap between online browsing and physical inspection, making the purchase journey more seamless and trustworthy for consumers.

Challenges in the South Africa Used Car Market Market

The South African used car market faces several challenges that can impede growth. Regulatory hurdles, particularly around vehicle registration and ownership transfer, can sometimes create complexities. Supply chain disruptions, though less pronounced than in new vehicles, can still impact the availability of specific makes and models. Intense competition from a multitude of online and offline players can lead to price wars, affecting profit margins for businesses. Furthermore, the prevalence of fraudulent listings and concerns about vehicle condition in the unorganized sector can erode consumer trust, making it imperative for the industry to self-regulate and promote best practices.

Forces Driving South Africa Used Car Market Growth

Several key forces are propelling the growth of the South Africa used car market. Economically, the affordability of used cars compared to new ones remains a significant driver, particularly for first-time buyers and those with budget constraints. Technologically, the widespread adoption of online platforms and digital tools is enhancing accessibility, transparency, and convenience. Regulatory support for consumer protection in the used car sector also contributes to buyer confidence. Furthermore, evolving consumer preferences towards sustainable consumption and the perceived value proposition of used vehicles are also playing a role.

Challenges in the South Africa Used Car Market Market

Long-term growth catalysts for the South Africa used car market lie in continued technological innovation and strategic market expansion. The increasing integration of blockchain technology for immutable vehicle history records can significantly boost trust. Furthermore, partnerships between financial institutions and used car platforms to offer streamlined financing options will unlock further market potential. Expansion into previously underserved regions within South Africa and exploring cross-border opportunities within the African continent could also serve as substantial growth accelerators.

Emerging Opportunities in South Africa Used Car Market

Emerging opportunities in the South African used car market are abundant. The growing demand for electric and hybrid used vehicles presents a nascent but promising segment. The expansion of subscription-based models for used cars could cater to a younger demographic seeking flexible mobility solutions. Furthermore, leveraging data analytics to offer personalized vehicle recommendations and after-sales services presents significant opportunities for customer retention and upselling. The increasing digitalization of the automotive aftermarket, including parts and servicing for used cars, also opens new avenues for revenue generation.

Leading Players in the South Africa Used Car Market Sector

- Auto Pedigree

- AutoTager

- Cars co za

- Cars 4 Africa

- Surf4cars co za

- We Buy Cars

- Autochek Africa

- AutoTrader South Africa

- CarMag

- Cars

Key Milestones in South Africa Used Car Market Industry

- April 2024: WeBuyCars, a South African used-car platform, announced its target of raising ZAR 7.8 billion (~USD 420 million) when its shares begin trading on the Johannesburg Stock Exchange (JSE). The company has issued 417,181,120 shares at a consideration of ZAR 18.75 per share, significantly impacting market perception and investment interest.

- November 2023: Shekel Mobility, a B2B auto dealers marketplace catering to the African used car market, secured USD 7 million in funding to propel its growth and expansion plans. The investment comprises USD 3.2 million in equity and over USD 4 million in debt, led by Ventures Platform and MaC Venture Capital, signaling robust investor confidence in the broader African used car ecosystem.

- September 2023: Auto24, an Ivorian used car marketplace, announced its expansion into four new African markets: Morocco, Rwanda, Senegal, and South Africa. This strategic expansion highlights the growing pan-African ambition within the used car digital marketplace space.

Strategic Outlook for South Africa Used Car Market Market

The strategic outlook for the South Africa Used Car Market is highly positive, driven by a combination of intrinsic market dynamics and accelerating digital transformation. Future growth will be significantly influenced by the continued expansion of online platforms and the increasing adoption of data-driven strategies. Companies that prioritize customer trust through transparent processes, robust vehicle inspections, and comprehensive warranties will likely capture a larger market share. Furthermore, strategic partnerships with financial institutions, insurance providers, and aftermarket service providers will be crucial for creating a holistic ecosystem that caters to the evolving needs of used car buyers and sellers. The market is expected to witness further consolidation and technological innovation, solidifying its position as a vital component of the South African automotive landscape.

South Africa Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedans

- 1.3. Sports U

-

2. Fuel Type

- 2.1. Petrol

- 2.2. Diesel

- 2.3. Others

-

3. Booking Type

- 3.1. Online

- 3.2. Offline

-

4. Vendor Type

- 4.1. Organized

- 4.2. Unorganized

South Africa Used Car Market Segmentation By Geography

- 1. South Africa

South Africa Used Car Market Regional Market Share

Geographic Coverage of South Africa Used Car Market

South Africa Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increasing Use of Online Platforms

- 3.3. Market Restrains

- 3.3.1. Stringent Governmental Regulations and Import Taxes Restrict the Market Growth

- 3.4. Market Trends

- 3.4.1. The Unorganized Segment Holds a Major Share in the South Africa Used Car Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Used Car Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedans

- 5.1.3. Sports U

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Petrol

- 5.2.2. Diesel

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Booking Type

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Vendor Type

- 5.4.1. Organized

- 5.4.2. Unorganized

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Auto Pedigree

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AutoTager

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cars co za

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cars 4 Africa

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Surf4cars co za*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 We Buy Cars

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Autochek Africa

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AutoTrader South Africa

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CarMag

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cars

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Auto Pedigree

List of Figures

- Figure 1: South Africa Used Car Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Africa Used Car Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Used Car Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: South Africa Used Car Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 3: South Africa Used Car Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 4: South Africa Used Car Market Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 5: South Africa Used Car Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: South Africa Used Car Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 7: South Africa Used Car Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 8: South Africa Used Car Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 9: South Africa Used Car Market Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 10: South Africa Used Car Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Used Car Market?

The projected CAGR is approximately 10.50%.

2. Which companies are prominent players in the South Africa Used Car Market?

Key companies in the market include Auto Pedigree, AutoTager, Cars co za, Cars 4 Africa, Surf4cars co za*List Not Exhaustive, We Buy Cars, Autochek Africa, AutoTrader South Africa, CarMag, Cars.

3. What are the main segments of the South Africa Used Car Market?

The market segments include Vehicle Type, Fuel Type, Booking Type, Vendor Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.87 Million as of 2022.

5. What are some drivers contributing to market growth?

The Increasing Use of Online Platforms.

6. What are the notable trends driving market growth?

The Unorganized Segment Holds a Major Share in the South Africa Used Car Market.

7. Are there any restraints impacting market growth?

Stringent Governmental Regulations and Import Taxes Restrict the Market Growth.

8. Can you provide examples of recent developments in the market?

April 2024: WeBuyCars, a South African used-car platform, announced its target of raising ZAR 7.8 billion (~USD 420 million) when its shares begin trading on the Johannesburg Stock Exchange (JSE). The company has issued 417,181,120 shares at a consideration of ZAR 18.75 per share.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Used Car Market?

To stay informed about further developments, trends, and reports in the South Africa Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence