Key Insights

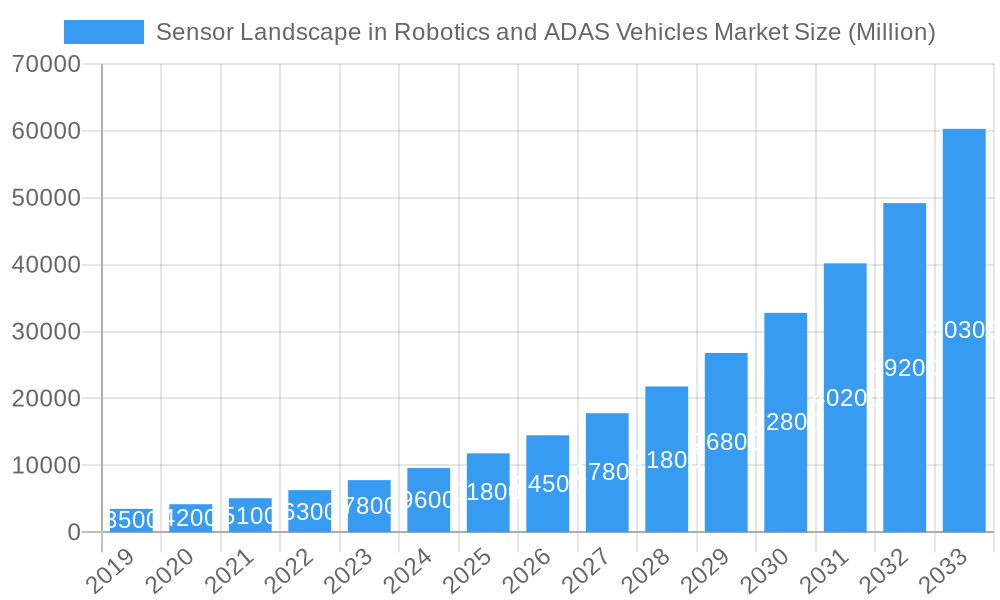

The Sensor Landscape in Robotics and ADAS Vehicles Market is poised for extraordinary growth, projected to reach a substantial market size of approximately $15,500 million by 2025, driven by an impressive Compound Annual Growth Rate (CAGR) of 28.70% through 2033. This rapid expansion is fueled by the accelerating adoption of autonomous driving technologies in both robotic vehicles and Advanced Driver-Assistance Systems (ADAS) for passenger cars. LiDAR technology, particularly for robotic vehicles, is a significant contributor, offering unparalleled environmental perception. Radar systems are also crucial, providing robust object detection in various weather conditions, and their dual application in both robotic and ADAS vehicles underscores their widespread demand. Cameras, essential for visual data processing, and GNSS and IMUs, vital for precise localization and motion tracking in robotic applications, further solidify the diverse sensor ecosystem. This surge is underpinned by continuous advancements in sensor resolution, processing power, and cost-effectiveness, making sophisticated sensing capabilities more accessible.

Sensor Landscape in Robotics and ADAS Vehicles Market Market Size (In Billion)

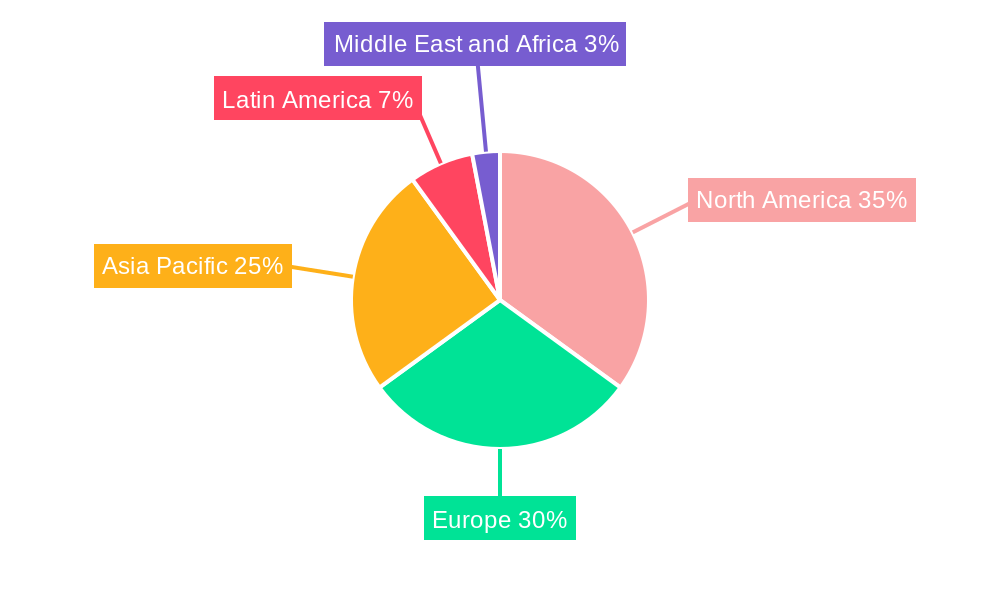

The market's dynamic nature is shaped by key trends such as the increasing complexity of autonomous functionalities, stringent safety regulations, and the competitive landscape among leading technology providers and automotive manufacturers. Emerging trends include the integration of sensor fusion techniques to enhance reliability and redundancy, the development of solid-state LiDAR for improved durability and cost, and the growing demand for AI-powered sensor processing. However, challenges such as high development costs, regulatory hurdles for widespread deployment of fully autonomous vehicles, and the need for extensive validation and testing present restraints to market growth. Geographically, North America and Europe are currently leading the adoption due to their established automotive industries and early investment in autonomous technologies. The Asia Pacific region, however, is expected to witness the fastest growth, propelled by its burgeoning automotive market and government initiatives supporting smart mobility and robotics.

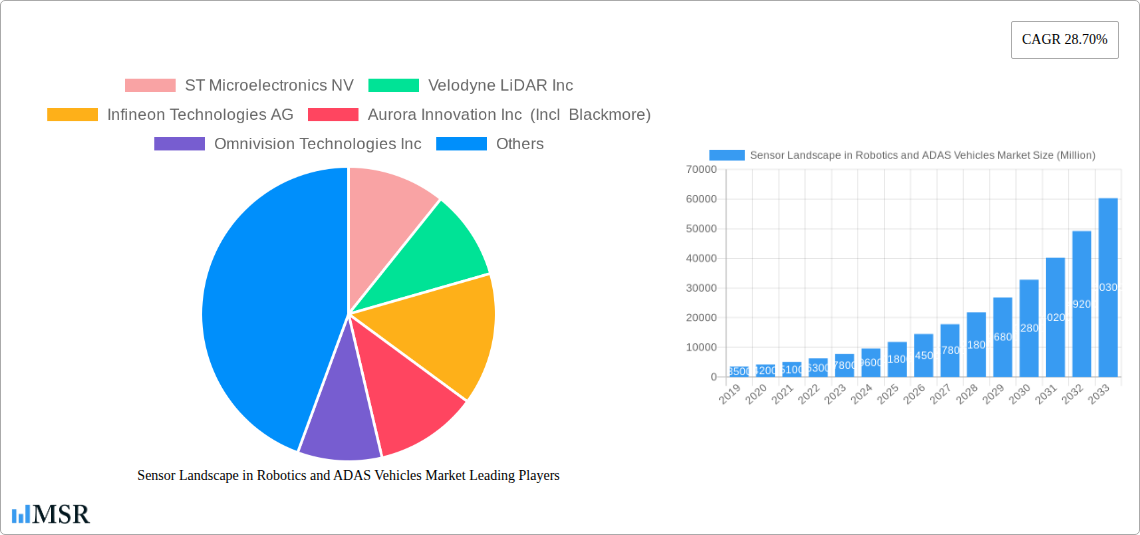

Sensor Landscape in Robotics and ADAS Vehicles Market Company Market Share

This comprehensive report, "Sensor Landscape in Robotics and ADAS Vehicles Market," offers an in-depth analysis of the critical technologies enabling autonomous systems. Covering the study period of 2019–2033, with a base year of 2025 and forecast period of 2025–2033, this report provides unparalleled insights into the market dynamics, key players, and future trajectory of sensor solutions for robotic vehicles and Advanced Driver-Assistance Systems (ADAS) in vehicles. Dive into the evolving LiDAR, Radar, Camera M, GNSS, and Inertial Measurement Units segments, understanding their applications in both robotic vehicles and ADAS applications.

Sensor Landscape in Robotics and ADAS Vehicles Market Market Concentration & Dynamics

The Sensor Landscape in Robotics and ADAS Vehicles Market exhibits a dynamic and evolving concentration, with a growing number of innovative players entering the space. While established automotive suppliers like Robert Bosch GmbH, Continental AG, and Valeo SA maintain significant influence, the rise of specialized sensor companies such as Velodyne LiDAR Inc, Ouster Inc, and Luminar Technologies Inc, alongside technology giants like ST Microelectronics NV, Infineon Technologies AG, and NXP Semiconductor N V, is reshaping the competitive landscape. Aurora Innovation Inc (Incl Blackmore) and Waymo LLC, pioneers in autonomous driving, also significantly impact sensor adoption and development. Omnivision Technologies Inc and ON Semiconductor Corp are crucial for camera imaging solutions, while Texas Instruments Incorporated plays a vital role in processing and connectivity. The market is characterized by intense R&D investment, a robust innovation ecosystem driven by partnerships between sensor manufacturers and automotive OEMs, and an increasing focus on sensor fusion. Regulatory frameworks, though still evolving globally, are increasingly pushing for enhanced safety features, directly influencing sensor technology adoption. The threat of substitute products, while present, is largely mitigated by the complementary nature of different sensor types in achieving robust perception. End-user trends are heavily skewed towards enhanced safety, comfort, and the eventual realization of full autonomy, driving demand for more sophisticated and reliable sensor suites. Mergers and acquisitions are becoming a key strategy for market consolidation and technology acquisition, with an estimated XX M&A deals observed in the historical period.

- Market Share Analysis: Detailed breakdown of market share by sensor type and application.

- Innovation Ecosystem: Overview of R&D investments and collaborative initiatives.

- Regulatory Impact: Analysis of how evolving safety standards influence sensor deployment.

- Substitute Products: Evaluation of the viability of alternative sensing technologies.

- End-User Trends: Mapping consumer demand for autonomous features.

- M&A Activities: Tracking key acquisitions and their strategic implications.

Sensor Landscape in Robotics and ADAS Vehicles Market Industry Insights & Trends

The Sensor Landscape in Robotics and ADAS Vehicles Market is poised for extraordinary growth, driven by a confluence of technological advancements, increasing consumer demand for safety and convenience, and supportive government initiatives. The global market size for automotive sensors, encompassing those crucial for ADAS and robotic vehicles, is projected to reach an estimated USD XXX Billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX% from 2025. Technological disruptions are at the forefront, with continuous improvements in LiDAR resolution and cost-effectiveness, the maturation of high-performance radar systems capable of all-weather operation, and the advancement of sophisticated camera technologies including thermal and event-based vision sensors. The increasing sophistication of AI and machine learning algorithms is further enhancing the interpretability and utility of sensor data, enabling more accurate object detection, tracking, and prediction. Evolving consumer behaviors are a significant growth catalyst, with a growing acceptance and demand for autonomous driving features, perceived safety benefits of ADAS, and the convenience offered by advanced vehicle functionalities. This surge in demand is prompting automakers to integrate a wider array and higher density of sensors into their vehicle platforms, from entry-level ADAS features like automatic emergency braking and lane keeping assist to the complex sensor suites required for Level 4 and Level 5 autonomous driving in robotic vehicles. The integration of sensor fusion techniques, combining data from multiple sensor modalities, is becoming a standard practice to overcome individual sensor limitations and create a more comprehensive and reliable perception of the environment. The increasing complexity and data processing requirements are also driving innovation in embedded processing units and edge AI solutions.

Key Markets & Segments Leading Sensor Landscape in Robotics and ADAS Vehicles Market

North America and Europe currently lead the Sensor Landscape in Robotics and ADAS Vehicles Market, driven by stringent safety regulations and early adoption of ADAS technologies by consumers. Within these regions, Germany, the United States, and China are prominent markets due to their strong automotive manufacturing bases and significant investments in autonomous vehicle research and development.

LiDAR (Robotic Vehicles Vs. ADAS Vehicles):

- Dominance: Robotic vehicles, particularly in logistics and industrial automation, are early adopters of advanced LiDAR for precise navigation and mapping. However, ADAS vehicles are increasingly integrating LiDAR for enhanced object detection and environmental perception, especially for highway pilot and urban autonomous driving.

- Drivers: Decreasing cost, increasing resolution, and improved performance in diverse weather conditions are key drivers for LiDAR adoption in both segments. The growing development of solid-state LiDAR is further accelerating its integration.

Radar (Robotics Vehicles Vs. ADAS Vehicles):

- Dominance: Radar remains a cornerstone for ADAS vehicles due to its cost-effectiveness and robust performance in adverse weather. It is essential for adaptive cruise control, blind-spot detection, and front-end collision warning. In robotic vehicles, radar is used for close-range sensing and as a complementary sensor for redundancy.

- Drivers: Advancements in radar technology, including higher resolution imaging radar and 4D radar, are expanding its capabilities and application scope in both autonomous and ADAS systems.

Camera M:

- Dominance: Camera M, encompassing mono and stereo cameras, is ubiquitous in ADAS for lane detection, traffic sign recognition, and pedestrian detection. Its role in robotic vehicles is expanding for visual odometry and scene understanding.

- Drivers: Increasing resolution, wider dynamic range, and the integration of AI for image processing are crucial for camera performance. The development of specialized cameras like thermal and event-based cameras is opening new avenues.

GNSS (Robotic Vehicles):

- Dominance: GNSS is fundamental for the localization and navigation of robotic vehicles, particularly in outdoor environments. Its accuracy and reliability are critical for precise path planning and execution.

- Drivers: Integration with IMUs and advances in RTK (Real-Time Kinematic) GNSS are improving positional accuracy for demanding robotic applications.

Inertial Measurement Units (Robotic Vehicles):

- Dominance: IMUs are indispensable for robotic vehicles, providing crucial data on acceleration and angular velocity for dead reckoning, attitude estimation, and motion stabilization, especially during GNSS outages.

- Drivers: Miniaturization, improved accuracy, and reduced drift are key trends in IMU development for robotic systems.

Sensor Landscape in Robotics and ADAS Vehicles Market Product Developments

Product innovations are central to the Sensor Landscape in Robotics and ADAS Vehicles Market. Leading companies are continuously introducing advanced LiDAR sensors with higher resolution and longer ranges, such as Luminar Technologies Inc's Iris sensor, and cost-effective solid-state LiDAR solutions. Radar technology is evolving with the introduction of 4D imaging radar by Continental AG, offering enhanced environmental perception. Camera manufacturers like Omnivision Technologies Inc are pushing the boundaries with higher resolution and low-light performance sensors. ST Microelectronics NV and Infineon Technologies AG are developing powerful processing units and robust chips crucial for sensor data interpretation. The market is witnessing the development of integrated sensor modules that combine multiple sensor types for improved efficiency and performance, catering to the increasing demands of both ADAS and fully autonomous robotic vehicles.

Challenges in the Sensor Landscape in Robotics and ADAS Vehicles Market Market

The Sensor Landscape in Robotics and ADAS Vehicles Market faces several critical challenges. High development and integration costs remain a significant barrier, particularly for advanced LiDAR systems, impacting widespread adoption in mass-market ADAS. Regulatory hurdles, including the standardization of safety protocols and certification processes for autonomous systems, can slow down deployment. Supply chain vulnerabilities, as highlighted by recent global events, pose a risk to consistent production and availability of critical components. Furthermore, the competitive pressure from numerous players necessitates continuous innovation and cost optimization, making it challenging for smaller companies to compete. The need for robust sensor fusion algorithms to overcome individual sensor limitations in all weather and lighting conditions is a persistent technical challenge.

Forces Driving Sensor Landscape in Robotics and ADAS Vehicles Market Growth

Several key forces are propelling the growth of the Sensor Landscape in Robotics and ADAS Vehicles Market. Technological advancements in sensor miniaturization, cost reduction, and performance enhancement are making advanced sensing capabilities more accessible. Increasing consumer demand for enhanced vehicle safety features, driven by a desire to reduce accidents and improve driving comfort, is a significant market pull. Government mandates and incentives promoting the development and deployment of ADAS and autonomous vehicle technologies are creating a favorable regulatory environment. The burgeoning logistics and industrial robotics sectors, requiring sophisticated perception for automation, are also contributing substantially to market expansion.

Challenges in the Sensor Landscape in Robotics and ADAS Vehicles Market Market

Long-term growth in the Sensor Landscape in Robotics and ADAS Vehicles Market is underpinned by several critical factors. Continued innovation in AI and machine learning for sensor data processing will be paramount, enabling vehicles to understand and react to complex scenarios with greater precision. Strategic partnerships and collaborations between sensor manufacturers, automotive OEMs, and technology providers are crucial for accelerating development cycles and integrating solutions seamlessly. Market expansion into emerging economies, as infrastructure and consumer acceptance of autonomous features grow, presents substantial future potential. The development of highly reliable and redundant sensor systems that can operate under all environmental conditions will unlock the full potential of autonomous mobility.

Emerging Opportunities in Sensor Landscape in Robotics and ADAS Vehicles Market

Emerging opportunities in the Sensor Landscape in Robotics and ADAS Vehicles Market are diverse and exciting. The rapid growth of robotaxi services and autonomous delivery vehicles presents a significant market for high-performance sensor suites. Advancements in sensor technology for in-cabin monitoring, such as driver attention detection and passenger sensing, are opening new revenue streams. The integration of sensors for vehicle-to-everything (V2X) communication will enable a more connected and safer transportation ecosystem. Furthermore, the development of specialized sensors for niche applications, such as agricultural robotics and autonomous mining equipment, offers significant untapped market potential. The increasing focus on cybersecurity for sensor systems is also creating opportunities for specialized solutions.

Leading Players in the Sensor Landscape in Robotics and ADAS Vehicles Market Sector

- ST Microelectronics NV

- Velodyne LiDAR Inc

- Infineon Technologies AG

- Aurora Innovation Inc (Incl Blackmore)

- Omnivision Technologies Inc

- Ouster Inc

- NXP Semiconductor N V

- ON Semiconductor Corp

- Continental AG

- Waymo LLC

- Luminar Technologies Inc

- Robert Bosch GmbH

- Valeo SA

- Texas Instruments Incorporated

Key Milestones in Sensor Landscape in Robotics and ADAS Vehicles Market Industry

- 2019: Increased adoption of radar and camera-based ADAS features in mainstream passenger vehicles.

- 2020: Significant advancements in LiDAR resolution and cost reduction, making it more viable for ADAS.

- 2021: Growth in partnerships between sensor manufacturers and autonomous vehicle developers for R&D.

- 2022: Introduction of 4D imaging radar prototypes demonstrating enhanced environmental perception.

- 2023: Increased investment in solid-state LiDAR technology for mass-market applications.

- 2024: Growing focus on sensor fusion and AI integration for improved autonomous driving capabilities.

- 2025 (Estimated): Widespread deployment of advanced Level 2+ ADAS features across various vehicle segments.

- 2026-2033 (Forecast): Expected significant growth in sensor integration for Level 3 and Level 4 autonomous driving, alongside continued expansion in robotic vehicle applications.

Strategic Outlook for Sensor Landscape in Robotics and ADAS Vehicles Market Market

The Sensor Landscape in Robotics and ADAS Vehicles Market is set for a transformative future, characterized by rapid innovation and increasing adoption. Growth accelerators will include the continued maturation of sensor technologies, particularly LiDAR and advanced radar, leading to more affordable and capable solutions. The expansion of autonomous driving features into commercial vehicle fleets, such as trucking and delivery services, will significantly drive demand. Strategic collaborations and the development of standardized sensor integration platforms will be crucial for seamless deployment. The market is also expected to witness increased consolidation through mergers and acquisitions, as companies seek to strengthen their technological portfolios and market positions, further shaping the competitive landscape and driving towards a future of safer, more efficient, and autonomous mobility.

Sensor Landscape in Robotics and ADAS Vehicles Market Segmentation

-

1. Type

- 1.1. LiDAR (Robotic Vehicles Vs. ADAS Vehicles)

- 1.2. Radar (Robotics Vehicles Vs. ADAS Vehicles)

- 1.3. Camera M

- 1.4. GNSS (Robotic Vehicles)

- 1.5. Inertial Measurement Units (Robotic Vehicles)

Sensor Landscape in Robotics and ADAS Vehicles Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Sensor Landscape in Robotics and ADAS Vehicles Market Regional Market Share

Geographic Coverage of Sensor Landscape in Robotics and ADAS Vehicles Market

Sensor Landscape in Robotics and ADAS Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 28.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Rising awareness on worker safety & stringent regulations; Steady increase in industrial sector in key emerging countries in Asia-Pacific

- 3.2.2 coupled with expansion projects

- 3.3. Market Restrains

- 3.3.1. High Intial Investment

- 3.4. Market Trends

- 3.4.1. Radar Sensor is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sensor Landscape in Robotics and ADAS Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. LiDAR (Robotic Vehicles Vs. ADAS Vehicles)

- 5.1.2. Radar (Robotics Vehicles Vs. ADAS Vehicles)

- 5.1.3. Camera M

- 5.1.4. GNSS (Robotic Vehicles)

- 5.1.5. Inertial Measurement Units (Robotic Vehicles)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Sensor Landscape in Robotics and ADAS Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. LiDAR (Robotic Vehicles Vs. ADAS Vehicles)

- 6.1.2. Radar (Robotics Vehicles Vs. ADAS Vehicles)

- 6.1.3. Camera M

- 6.1.4. GNSS (Robotic Vehicles)

- 6.1.5. Inertial Measurement Units (Robotic Vehicles)

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Sensor Landscape in Robotics and ADAS Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. LiDAR (Robotic Vehicles Vs. ADAS Vehicles)

- 7.1.2. Radar (Robotics Vehicles Vs. ADAS Vehicles)

- 7.1.3. Camera M

- 7.1.4. GNSS (Robotic Vehicles)

- 7.1.5. Inertial Measurement Units (Robotic Vehicles)

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Sensor Landscape in Robotics and ADAS Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. LiDAR (Robotic Vehicles Vs. ADAS Vehicles)

- 8.1.2. Radar (Robotics Vehicles Vs. ADAS Vehicles)

- 8.1.3. Camera M

- 8.1.4. GNSS (Robotic Vehicles)

- 8.1.5. Inertial Measurement Units (Robotic Vehicles)

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Sensor Landscape in Robotics and ADAS Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. LiDAR (Robotic Vehicles Vs. ADAS Vehicles)

- 9.1.2. Radar (Robotics Vehicles Vs. ADAS Vehicles)

- 9.1.3. Camera M

- 9.1.4. GNSS (Robotic Vehicles)

- 9.1.5. Inertial Measurement Units (Robotic Vehicles)

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Sensor Landscape in Robotics and ADAS Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. LiDAR (Robotic Vehicles Vs. ADAS Vehicles)

- 10.1.2. Radar (Robotics Vehicles Vs. ADAS Vehicles)

- 10.1.3. Camera M

- 10.1.4. GNSS (Robotic Vehicles)

- 10.1.5. Inertial Measurement Units (Robotic Vehicles)

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ST Microelectronics NV

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Velodyne LiDAR Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Infineon Technologies AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aurora Innovation Inc (Incl Blackmore)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Omnivision Technologies Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ouster Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NXP Semiconductor N V

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ON Semiconductor Corp

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Continental AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Waymo LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Luminar Technologies Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Robert Bosch GmbH

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Valeo SA

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Texas Instruments Incorporated*List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 ST Microelectronics NV

List of Figures

- Figure 1: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million), by Type 2025 & 2033

- Figure 7: Europe Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Asia Pacific Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Latin America Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Latin America Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Middle East and Africa Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Middle East and Africa Sensor Landscape in Robotics and ADAS Vehicles Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Sensor Landscape in Robotics and ADAS Vehicles Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sensor Landscape in Robotics and ADAS Vehicles Market?

The projected CAGR is approximately 28.70%.

2. Which companies are prominent players in the Sensor Landscape in Robotics and ADAS Vehicles Market?

Key companies in the market include ST Microelectronics NV, Velodyne LiDAR Inc, Infineon Technologies AG, Aurora Innovation Inc (Incl Blackmore), Omnivision Technologies Inc, Ouster Inc, NXP Semiconductor N V, ON Semiconductor Corp, Continental AG, Waymo LLC, Luminar Technologies Inc, Robert Bosch GmbH, Valeo SA, Texas Instruments Incorporated*List Not Exhaustive.

3. What are the main segments of the Sensor Landscape in Robotics and ADAS Vehicles Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Rising awareness on worker safety & stringent regulations; Steady increase in industrial sector in key emerging countries in Asia-Pacific. coupled with expansion projects.

6. What are the notable trends driving market growth?

Radar Sensor is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

High Intial Investment.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sensor Landscape in Robotics and ADAS Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sensor Landscape in Robotics and ADAS Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sensor Landscape in Robotics and ADAS Vehicles Market?

To stay informed about further developments, trends, and reports in the Sensor Landscape in Robotics and ADAS Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence