Key Insights

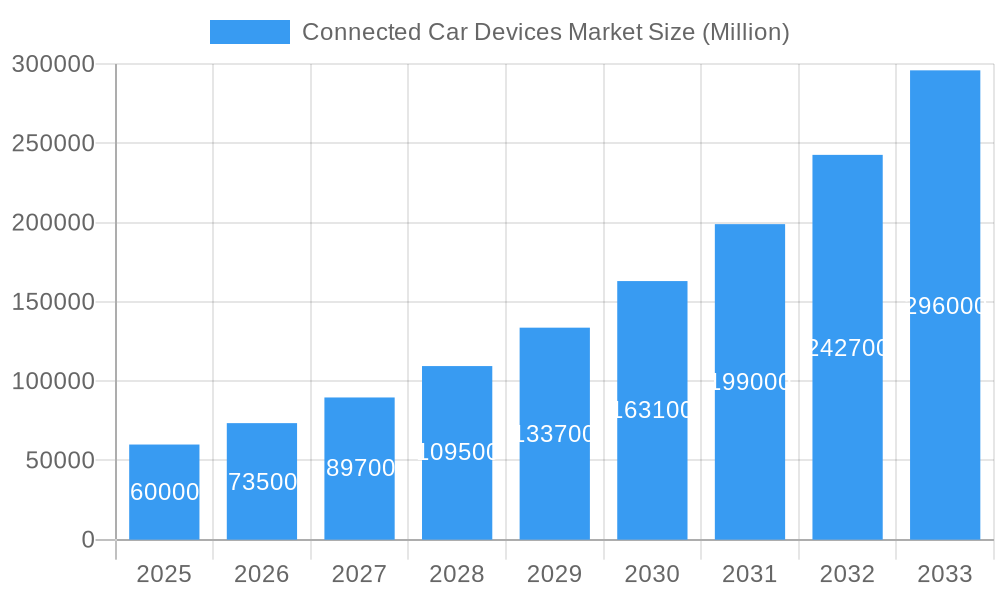

The Connected Car Devices Market is projected to experience substantial growth, expanding from an estimated market size of $63.27 billion in the 2025 base year, with a Compound Annual Growth Rate (CAGR) of 14.83% through 2033. Key growth drivers include increasing consumer demand for enhanced in-car experiences and advanced safety features, alongside the widespread adoption of telematics solutions for real-time data exchange. The integration of Driver Assistance Systems (DAS) and the advancement of Vehicle-to-Everything (V2X) communication technologies are revolutionizing automotive functionality and safety. Major industry players such as Robert Bosch GmbH, Continental AG, and Denso Corporation are significantly investing in and innovating next-generation connected car technologies, further shaping market dynamics.

Connected Car Devices Market Market Size (In Billion)

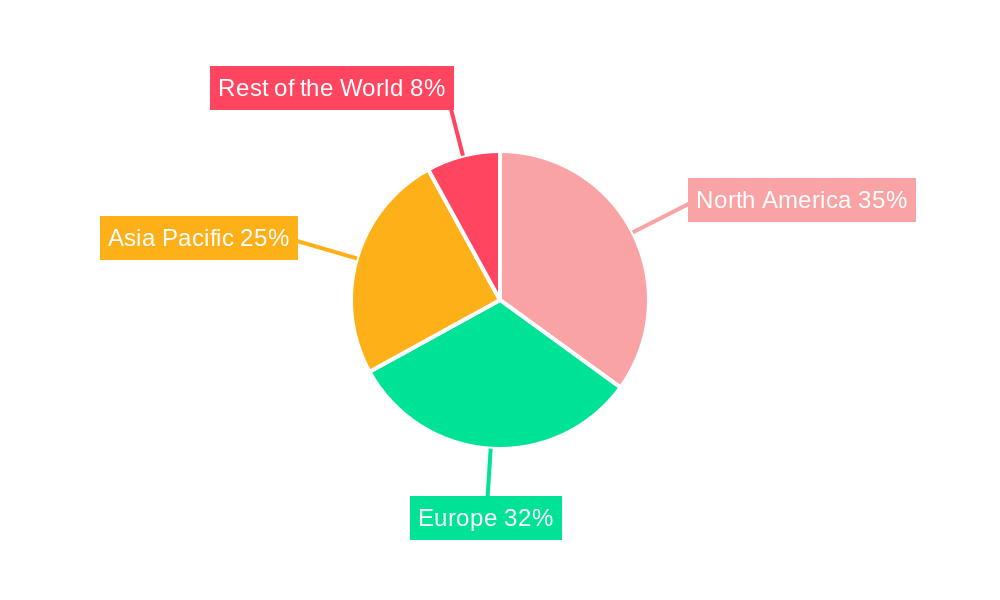

Market expansion is further propelled by the rapid adoption of electric vehicles (EVs), which inherently incorporate advanced connectivity features. Demand for sophisticated aftermarket solutions is also rising. However, market growth may be moderated by high implementation costs, data privacy and cybersecurity concerns, and the need for standardized communication protocols. Geographically, North America and Europe are expected to maintain leadership due to early adoption and stringent safety regulations, while the Asia Pacific region, particularly China, is anticipated to exhibit the fastest growth, driven by its expanding automotive sector and increasing consumer purchasing power.

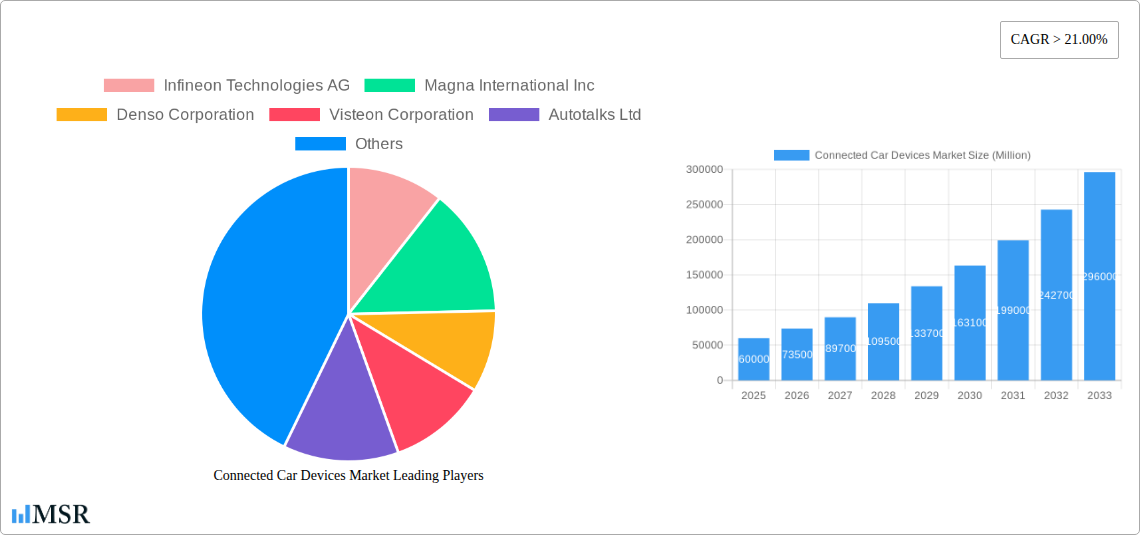

Connected Car Devices Market Company Market Share

Explore the dynamic Connected Car Devices Market with our in-depth report, designed to deliver actionable intelligence for industry stakeholders. This comprehensive analysis covers the forecast period up to 2033, with 2025 identified as the base year for market size estimates of $63.27 billion.

Our report is optimized for maximum visibility and impact, utilizing high-ranking keywords to reach the intended audience. Gain a competitive advantage by understanding the intricate landscape of automotive connectivity, from essential hardware to advanced software solutions.

Connected Car Devices Market Market Concentration & Dynamics

The Connected Car Devices Market exhibits a moderate to high concentration, driven by significant investment in research and development and strategic alliances among key players. The innovation ecosystem is rapidly evolving, fueled by advancements in AI, 5G connectivity, and sensor technology. Regulatory frameworks, while nascent in some regions, are increasingly focusing on data security, privacy, and interoperability standards, influencing product development and market entry strategies. Substitute products, such as standalone navigation systems, are becoming increasingly obsolete as integrated in-car infotainment and safety features gain prominence. End-user trends are heavily influenced by consumer demand for enhanced safety, personalized experiences, and seamless integration with digital lifestyles. Merger and acquisition (M&A) activities are on the rise as larger players seek to acquire innovative technologies and expand their market share. Notable M&A deals in the historical period (2019-2024) are estimated to be around 15-20, indicating a strong consolidation drive. Market share is fragmented, with leading companies like Robert Bosch GmbH, Continental AG, and Denso Corporation holding significant portions, yet emerging players are carving out niches with specialized solutions.

Connected Car Devices Market Industry Insights & Trends

The Connected Car Devices Market is experiencing unprecedented growth, driven by a confluence of technological advancements, evolving consumer expectations, and supportive governmental initiatives. The market size is projected to reach approximately $85,000 Million by 2025, with a substantial Compound Annual Growth Rate (CAGR) of around 15-18% during the forecast period of 2025-2033. This expansion is fueled by the increasing adoption of advanced driver-assistance systems (ADAS), which are becoming standard across various vehicle segments, and the burgeoning demand for telematics services for fleet management, remote diagnostics, and enhanced vehicle security. The proliferation of 5G networks is a significant catalyst, enabling faster data transmission and paving the way for more sophisticated V2X (Vehicle-to-Everything) communication, including V2V (Vehicle-to-Vehicle), V2I (Vehicle-to-Infrastructure), and V2P (Vehicle-to-Pedestrian) applications. Consumer behavior is shifting towards a desire for connected experiences that mirror their smartphone usage, demanding seamless infotainment, over-the-air (OTA) updates, and personalized driving profiles. The integration of AI and machine learning algorithms is further enhancing these capabilities, leading to predictive maintenance, intelligent navigation, and personalized driver feedback. Cybersecurity remains a critical focus, with ongoing investments in robust security protocols to protect sensitive vehicle data and prevent unauthorized access, further bolstering consumer trust and market adoption. The rise of electric vehicles (EVs) and autonomous driving technologies is also intrinsically linked to the connected car ecosystem, necessitating advanced connectivity for battery management, charging infrastructure integration, and real-time decision-making.

Key Markets & Segments Leading Connected Car Devices Market

The Connected Car Devices Market is experiencing robust growth across all segments, but certain regions and product categories are demonstrating exceptional leadership.

- Dominant Region: North America and Europe are currently leading the market, driven by early adoption of advanced automotive technologies, stringent safety regulations, and a high disposable income among consumers. Asia-Pacific, however, is poised for rapid growth, fueled by the expanding automotive industry, increasing disposable incomes, and government initiatives promoting smart cities and connected infrastructure.

- End-user Type Dominance: The OEM (Original Equipment Manufacturer) segment is the primary driver of the Connected Car Devices Market. Manufacturers are increasingly integrating these technologies as standard features, recognizing their value in enhancing vehicle safety, performance, and consumer appeal. The Aftermarket segment is also growing, offering upgrade options for older vehicles and specialized solutions.

- Communication Type Dominance: While V2V (Vehicle-to-Vehicle) communication is foundational for safety applications like collision avoidance, V2I (Vehicle-to-Infrastructure) communication is gaining significant traction with the development of smart city initiatives and intelligent traffic management systems. V2P (Vehicle-to-Pedestrian) is an emerging but crucial segment for enhancing pedestrian safety.

- Product Type Dominance: The Driver Assistance System (DAS) segment is currently the largest and fastest-growing, encompassing a wide range of safety features such as adaptive cruise control, lane-keeping assist, and automatic emergency braking. Telematics is also a significant segment, providing essential services for fleet management, vehicle tracking, and remote diagnostics.

- Vehicle Type Dominance: While IC Engine vehicles still represent a substantial portion of the market, Electric Vehicles (EVs), including Battery Electric Vehicles (BEVs), Hybrid Electric Vehicles (HEVs), and Fuel Cell Vehicles (FCVs), are rapidly gaining market share. The inherent technological sophistication and connectivity requirements of EVs, such as battery management and charging infrastructure integration, make them prime candidates for advanced connected car solutions.

Connected Car Devices Market Product Developments

Product innovation in the Connected Car Devices Market is characterized by the relentless pursuit of enhanced safety, convenience, and personalization. Key developments include advanced sensor fusion for superior ADAS capabilities, AI-powered predictive maintenance solutions that alert drivers to potential issues before they occur, and the seamless integration of infotainment systems with cloud-based services for personalized entertainment and information. The development of robust cybersecurity protocols to protect sensitive vehicle data is also a major focus. Over-the-air (OTA) update capabilities are becoming standard, allowing for continuous improvement and feature enhancements, ensuring vehicles remain at the cutting edge of technology. The increasing sophistication of V2X communication modules is enabling real-time data exchange for improved traffic flow and accident prevention.

Challenges in the Connected Car Devices Market Market

The Connected Car Devices Market faces several significant challenges that impact its growth trajectory. Regulatory hurdles, particularly concerning data privacy and cybersecurity standards across different regions, can slow down product development and deployment. Supply chain disruptions, as experienced in recent years, can affect the availability of critical semiconductor components and impact production volumes. Intense competitive pressures from both established automotive giants and agile tech companies lead to pricing pressures and the need for continuous innovation. The substantial upfront cost of advanced connectivity features can also be a barrier to widespread adoption, especially in price-sensitive markets.

Forces Driving Connected Car Devices Market Growth

Several powerful forces are propelling the Connected Car Devices Market forward. Technological advancements, including the widespread availability of 5G networks, AI, and advanced sensor technology, are creating new possibilities for connected car functionalities. Growing consumer demand for enhanced safety features, seamless connectivity, and personalized in-car experiences is a major market pull. Government initiatives promoting smart city development, intelligent transportation systems, and vehicle safety standards are also significant growth accelerators. The increasing integration of connected technologies in electric vehicles further amplifies this growth, as EVs rely heavily on connectivity for battery management and charging.

Challenges in the Connected Car Devices Market Market

Beyond immediate hurdles, long-term growth catalysts for the Connected Car Devices Market lie in continuous innovation and strategic market expansion. The evolution towards fully autonomous driving will necessitate even more sophisticated and reliable connectivity solutions, opening up new revenue streams for advanced hardware and software. Strategic partnerships between automotive manufacturers, technology providers, and telecommunications companies will be crucial for developing integrated ecosystems and shared platforms. Furthermore, expanding into emerging markets with tailored solutions and addressing affordability concerns will unlock significant untapped potential. The development of a robust aftermarket for connected car services and upgrades will also contribute to sustained growth.

Emerging Opportunities in Connected Car Devices Market

The Connected Car Devices Market is ripe with emerging opportunities. The burgeoning field of in-car biometrics for personalized settings and enhanced security presents a significant avenue. The development of sophisticated data analytics platforms utilizing connected car data for predictive maintenance, traffic management, and insurance purposes is another key opportunity. The integration of connected cars with smart home ecosystems and other IoT devices offers a pathway to a truly integrated digital life. Furthermore, the growing demand for over-the-top (OTT) content and gaming services within vehicles opens up new monetization models for content providers and automotive OEMs. The expansion of specialized connected services for commercial fleets, such as real-time tracking and driver behavior monitoring, also represents a substantial growth area.

Leading Players in the Connected Car Devices Market Sector

- Infineon Technologies AG

- Magna International Inc

- Denso Corporation

- Visteon Corporation

- Autotalks Ltd

- Panasonic Corp

- Continental AG

- Autoliv Inc

- Harman International Industries Incorporated

- Robert Bosch GmbH

- Valeo SA

- ZF Friedrichshafen AG

Key Milestones in Connected Car Devices Market Industry

- 2019: Increased adoption of 5G technology begins to influence connected car development, enabling faster data transfer and enhanced V2X capabilities.

- 2020: Growing focus on cybersecurity measures as data breaches become a greater concern, leading to stricter industry standards and product hardening.

- 2021: Significant advancements in AI and machine learning integration for predictive maintenance and personalized driver experiences become more prominent.

- 2022: Expansion of OTA (Over-the-Air) update capabilities becomes a key differentiator for automotive manufacturers, allowing for continuous software improvements.

- 2023: Increased investment in V2I (Vehicle-to-Infrastructure) communication technologies, driven by smart city initiatives and the need for optimized traffic management.

- 2024: Continued consolidation within the market through strategic mergers and acquisitions aimed at acquiring innovative technologies and expanding market reach.

Strategic Outlook for Connected Car Devices Market Market

The strategic outlook for the Connected Car Devices Market is overwhelmingly positive, driven by ongoing technological innovation and a growing consumer appetite for advanced automotive features. Key growth accelerators include the continued development of autonomous driving technologies, which are heavily reliant on sophisticated connectivity, and the widespread adoption of electric vehicles, which inherently require advanced connected functionalities for battery management and charging. Furthermore, strategic collaborations between automotive manufacturers, technology providers, and telecommunications companies will be crucial for developing integrated ecosystems and unlocking new revenue streams through data-driven services. Focusing on cybersecurity and data privacy will remain paramount for building consumer trust and ensuring long-term market sustainability. Expanding into emerging economies and offering scalable, cost-effective solutions will also be critical for capturing future market share.

Connected Car Devices Market Segmentation

-

1. End-user Type

- 1.1. OEM

- 1.2. Aftermarket

-

2. Communication Type

- 2.1. V2V

- 2.2. V2I

- 2.3. V2P

-

3. Product Type

- 3.1. Driver Assistance System (DAS)

- 3.2. Telematics

-

4. Vehicle Type

- 4.1. IC Engine

-

4.2. Electric

- 4.2.1. Battery Electric Vehicle

- 4.2.2. Hybrid Electric Vehicle

- 4.2.3. Fuel Cell Vehicle

Connected Car Devices Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East

Connected Car Devices Market Regional Market Share

Geographic Coverage of Connected Car Devices Market

Connected Car Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Safety Awareness is Driving the Market Growth

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Concerns is Anticipated to Restrain the Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Electrification and Automation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Connected Car Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Type

- 5.1.1. OEM

- 5.1.2. Aftermarket

- 5.2. Market Analysis, Insights and Forecast - by Communication Type

- 5.2.1. V2V

- 5.2.2. V2I

- 5.2.3. V2P

- 5.3. Market Analysis, Insights and Forecast - by Product Type

- 5.3.1. Driver Assistance System (DAS)

- 5.3.2. Telematics

- 5.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.4.1. IC Engine

- 5.4.2. Electric

- 5.4.2.1. Battery Electric Vehicle

- 5.4.2.2. Hybrid Electric Vehicle

- 5.4.2.3. Fuel Cell Vehicle

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by End-user Type

- 6. North America Connected Car Devices Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Type

- 6.1.1. OEM

- 6.1.2. Aftermarket

- 6.2. Market Analysis, Insights and Forecast - by Communication Type

- 6.2.1. V2V

- 6.2.2. V2I

- 6.2.3. V2P

- 6.3. Market Analysis, Insights and Forecast - by Product Type

- 6.3.1. Driver Assistance System (DAS)

- 6.3.2. Telematics

- 6.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.4.1. IC Engine

- 6.4.2. Electric

- 6.4.2.1. Battery Electric Vehicle

- 6.4.2.2. Hybrid Electric Vehicle

- 6.4.2.3. Fuel Cell Vehicle

- 6.1. Market Analysis, Insights and Forecast - by End-user Type

- 7. Europe Connected Car Devices Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Type

- 7.1.1. OEM

- 7.1.2. Aftermarket

- 7.2. Market Analysis, Insights and Forecast - by Communication Type

- 7.2.1. V2V

- 7.2.2. V2I

- 7.2.3. V2P

- 7.3. Market Analysis, Insights and Forecast - by Product Type

- 7.3.1. Driver Assistance System (DAS)

- 7.3.2. Telematics

- 7.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.4.1. IC Engine

- 7.4.2. Electric

- 7.4.2.1. Battery Electric Vehicle

- 7.4.2.2. Hybrid Electric Vehicle

- 7.4.2.3. Fuel Cell Vehicle

- 7.1. Market Analysis, Insights and Forecast - by End-user Type

- 8. Asia Pacific Connected Car Devices Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Type

- 8.1.1. OEM

- 8.1.2. Aftermarket

- 8.2. Market Analysis, Insights and Forecast - by Communication Type

- 8.2.1. V2V

- 8.2.2. V2I

- 8.2.3. V2P

- 8.3. Market Analysis, Insights and Forecast - by Product Type

- 8.3.1. Driver Assistance System (DAS)

- 8.3.2. Telematics

- 8.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.4.1. IC Engine

- 8.4.2. Electric

- 8.4.2.1. Battery Electric Vehicle

- 8.4.2.2. Hybrid Electric Vehicle

- 8.4.2.3. Fuel Cell Vehicle

- 8.1. Market Analysis, Insights and Forecast - by End-user Type

- 9. Rest of the World Connected Car Devices Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Type

- 9.1.1. OEM

- 9.1.2. Aftermarket

- 9.2. Market Analysis, Insights and Forecast - by Communication Type

- 9.2.1. V2V

- 9.2.2. V2I

- 9.2.3. V2P

- 9.3. Market Analysis, Insights and Forecast - by Product Type

- 9.3.1. Driver Assistance System (DAS)

- 9.3.2. Telematics

- 9.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.4.1. IC Engine

- 9.4.2. Electric

- 9.4.2.1. Battery Electric Vehicle

- 9.4.2.2. Hybrid Electric Vehicle

- 9.4.2.3. Fuel Cell Vehicle

- 9.1. Market Analysis, Insights and Forecast - by End-user Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Infineon Technologies AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Magna International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Denso Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Visteon Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Autotalks Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Panasonic Corp

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Continental AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Autoliv Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Harman International Industries Incorporated

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Robert Bosch GmbH

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Valeo SA

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 ZF Friedrichshafen AG

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Global Connected Car Devices Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Connected Car Devices Market Revenue (billion), by End-user Type 2025 & 2033

- Figure 3: North America Connected Car Devices Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 4: North America Connected Car Devices Market Revenue (billion), by Communication Type 2025 & 2033

- Figure 5: North America Connected Car Devices Market Revenue Share (%), by Communication Type 2025 & 2033

- Figure 6: North America Connected Car Devices Market Revenue (billion), by Product Type 2025 & 2033

- Figure 7: North America Connected Car Devices Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 8: North America Connected Car Devices Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 9: North America Connected Car Devices Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: North America Connected Car Devices Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Connected Car Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Connected Car Devices Market Revenue (billion), by End-user Type 2025 & 2033

- Figure 13: Europe Connected Car Devices Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 14: Europe Connected Car Devices Market Revenue (billion), by Communication Type 2025 & 2033

- Figure 15: Europe Connected Car Devices Market Revenue Share (%), by Communication Type 2025 & 2033

- Figure 16: Europe Connected Car Devices Market Revenue (billion), by Product Type 2025 & 2033

- Figure 17: Europe Connected Car Devices Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Connected Car Devices Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 19: Europe Connected Car Devices Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Europe Connected Car Devices Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Europe Connected Car Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Connected Car Devices Market Revenue (billion), by End-user Type 2025 & 2033

- Figure 23: Asia Pacific Connected Car Devices Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 24: Asia Pacific Connected Car Devices Market Revenue (billion), by Communication Type 2025 & 2033

- Figure 25: Asia Pacific Connected Car Devices Market Revenue Share (%), by Communication Type 2025 & 2033

- Figure 26: Asia Pacific Connected Car Devices Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Asia Pacific Connected Car Devices Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Connected Car Devices Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 29: Asia Pacific Connected Car Devices Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Asia Pacific Connected Car Devices Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Connected Car Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World Connected Car Devices Market Revenue (billion), by End-user Type 2025 & 2033

- Figure 33: Rest of the World Connected Car Devices Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 34: Rest of the World Connected Car Devices Market Revenue (billion), by Communication Type 2025 & 2033

- Figure 35: Rest of the World Connected Car Devices Market Revenue Share (%), by Communication Type 2025 & 2033

- Figure 36: Rest of the World Connected Car Devices Market Revenue (billion), by Product Type 2025 & 2033

- Figure 37: Rest of the World Connected Car Devices Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Rest of the World Connected Car Devices Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 39: Rest of the World Connected Car Devices Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 40: Rest of the World Connected Car Devices Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Rest of the World Connected Car Devices Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Connected Car Devices Market Revenue billion Forecast, by End-user Type 2020 & 2033

- Table 2: Global Connected Car Devices Market Revenue billion Forecast, by Communication Type 2020 & 2033

- Table 3: Global Connected Car Devices Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 4: Global Connected Car Devices Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global Connected Car Devices Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Connected Car Devices Market Revenue billion Forecast, by End-user Type 2020 & 2033

- Table 7: Global Connected Car Devices Market Revenue billion Forecast, by Communication Type 2020 & 2033

- Table 8: Global Connected Car Devices Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 9: Global Connected Car Devices Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 10: Global Connected Car Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of North America Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Connected Car Devices Market Revenue billion Forecast, by End-user Type 2020 & 2033

- Table 15: Global Connected Car Devices Market Revenue billion Forecast, by Communication Type 2020 & 2033

- Table 16: Global Connected Car Devices Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: Global Connected Car Devices Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 18: Global Connected Car Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Germany Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Spain Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Connected Car Devices Market Revenue billion Forecast, by End-user Type 2020 & 2033

- Table 25: Global Connected Car Devices Market Revenue billion Forecast, by Communication Type 2020 & 2033

- Table 26: Global Connected Car Devices Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 27: Global Connected Car Devices Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 28: Global Connected Car Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 29: China Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Japan Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: India Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Global Connected Car Devices Market Revenue billion Forecast, by End-user Type 2020 & 2033

- Table 34: Global Connected Car Devices Market Revenue billion Forecast, by Communication Type 2020 & 2033

- Table 35: Global Connected Car Devices Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 36: Global Connected Car Devices Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 37: Global Connected Car Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 38: South America Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Middle East Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Connected Car Devices Market?

The projected CAGR is approximately 14.83%.

2. Which companies are prominent players in the Connected Car Devices Market?

Key companies in the market include Infineon Technologies AG, Magna International Inc, Denso Corporation, Visteon Corporation, Autotalks Ltd, Panasonic Corp, Continental AG, Autoliv Inc, Harman International Industries Incorporated, Robert Bosch GmbH, Valeo SA, ZF Friedrichshafen AG.

3. What are the main segments of the Connected Car Devices Market?

The market segments include End-user Type, Communication Type, Product Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.27 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Safety Awareness is Driving the Market Growth.

6. What are the notable trends driving market growth?

Increasing Electrification and Automation.

7. Are there any restraints impacting market growth?

Cybersecurity Concerns is Anticipated to Restrain the Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Connected Car Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Connected Car Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Connected Car Devices Market?

To stay informed about further developments, trends, and reports in the Connected Car Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence