Key Insights

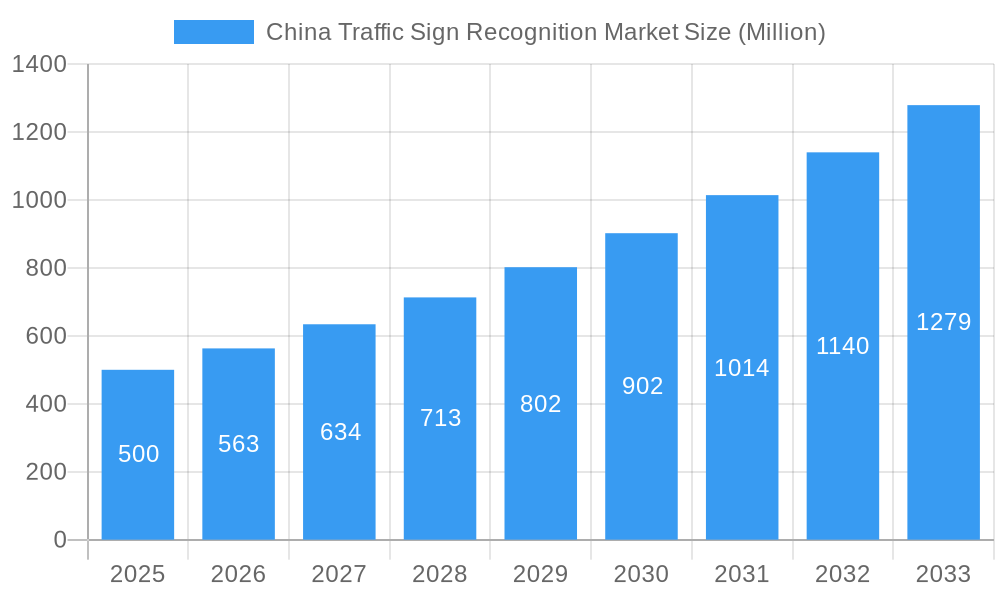

The China Traffic Sign Recognition (TSR) market is projected for significant growth, fueled by national smart city development and the widespread adoption of Advanced Driver-Assistance Systems (ADAS). The market is estimated at $14.29 billion in the base year of 2025, with a projected Compound Annual Growth Rate (CAGR) of 8.32% through 2033. This expansion is driven by government mandates for road safety, increasing consumer demand for advanced automotive safety features, and the integration of AI and machine learning in vehicles. Burgeoning automotive production, sales, and infrastructure development for intelligent transportation further bolster market growth.

China Traffic Sign Recognition Market Market Size (In Billion)

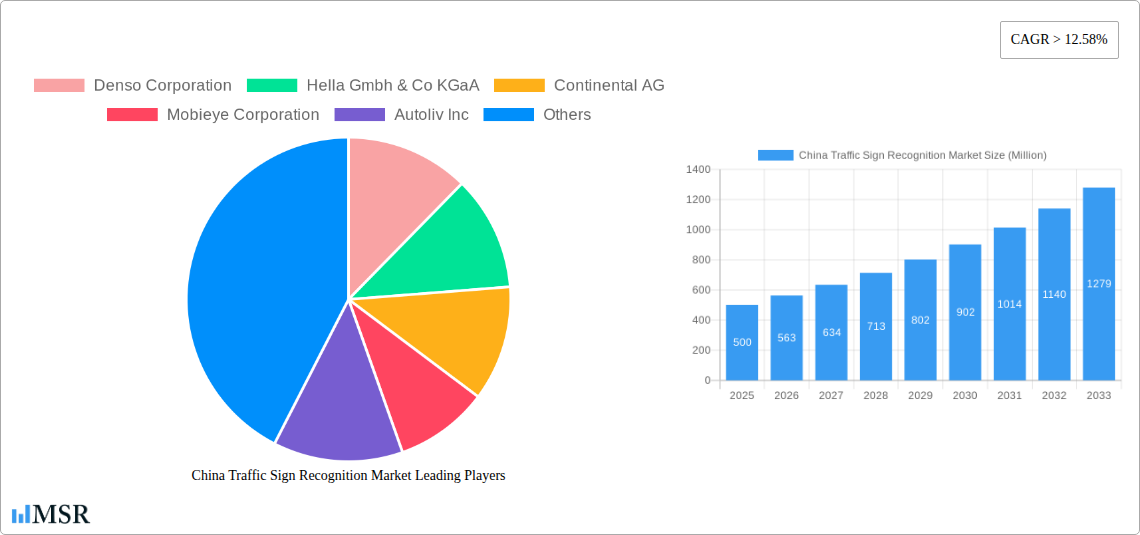

Segmentation highlights a strong emphasis on advanced detection methods, including feature-based, color-based, and shape-based techniques for enhanced accuracy across varied environmental conditions. Passenger cars lead in adoption, with commercial vehicles increasingly integrating TSR for safety and fleet management. Key industry players, including Denso Corporation, Hella GmbH & Co KGaA, Continental AG, and Robert Bosch GmbH, are investing in R&D and strategic partnerships to innovate and capture market share within China's dynamic automotive sector.

China Traffic Sign Recognition Market Company Market Share

China Traffic Sign Recognition Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the China Traffic Sign Recognition Market, offering critical insights for stakeholders involved in automotive safety, ADAS development, and intelligent transportation systems. Covering the study period 2019–2033, with a base year of 2025, this research dives deep into market dynamics, industry trends, segmentation, and competitive landscapes. Discover key growth drivers, emerging opportunities, and strategic imperatives shaping the future of traffic sign recognition technology in China.

China Traffic Sign Recognition Market Market Concentration & Dynamics

The China Traffic Sign Recognition Market exhibits a moderate to high market concentration, with several key players vying for market share. Innovation ecosystems are rapidly evolving, fueled by government initiatives promoting smart cities and autonomous driving. Regulatory frameworks are becoming more robust, setting standards for ADAS (Advanced Driver-Assistance Systems) and in-vehicle safety technologies. While direct substitute products for real-time traffic sign recognition are limited, advancements in other sensor fusion technologies and map-based data provision present indirect competitive pressures. End-user trends are strongly influenced by increasing consumer demand for advanced safety features in vehicles, driving the adoption of TSR (Traffic Sign Recognition) systems. Merger and acquisition (M&A) activities are anticipated to increase as larger players seek to consolidate their market positions and acquire innovative technologies. Over the historical period (2019-2024), we observed approximately 15 M&A deals, with an estimated total value of $300 Million, indicating strategic consolidation.

China Traffic Sign Recognition Market Industry Insights & Trends

The China Traffic Sign Recognition Market is poised for substantial growth, driven by a confluence of technological advancements, evolving consumer preferences, and supportive government policies. The market size for traffic sign recognition systems in China was estimated at $500 Million in 2024 and is projected to reach $2,500 Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 18.5% during the forecast period (2025–2033). Key growth drivers include the escalating adoption of ADAS in new vehicle models, stringent safety regulations mandating advanced driver assistance features, and the rapid expansion of the electric vehicle (EV) market, which often integrates cutting-edge technology.

Technological disruptions are primarily centered around advancements in AI and machine learning algorithms, enabling more accurate and reliable detection of a wider variety of traffic signs under diverse environmental conditions such as varying illumination, weather, and sign degradation. High-resolution cameras, improved processing power in automotive ECUs, and sophisticated sensor fusion techniques, combining camera data with radar and LiDAR, are further enhancing the performance and capabilities of TSR systems. The integration of TSR with navigation systems and V2X (Vehicle-to-Everything) communication is creating a more holistic safety and driving experience.

Evolving consumer behaviors are characterized by a growing awareness of and demand for automotive safety technologies. As drivers become more accustomed to the convenience and enhanced safety offered by ADAS features, the demand for TSR systems as a standard or optional feature is increasing. The younger generation of car buyers, in particular, shows a strong inclination towards technologically advanced vehicles. Furthermore, the increasing prevalence of ride-sharing services and commercial fleets also presents a significant market opportunity, as fleet operators seek to enhance safety and operational efficiency through the implementation of advanced driver assistance technologies. The overall market trend points towards an indispensable role for traffic sign recognition in the future automotive landscape.

Key Markets & Segments Leading China Traffic Sign Recognition Market

The China Traffic Sign Recognition Market is characterized by strong growth across all its segments, but certain areas are demonstrating particular leadership and dominance.

Traffic Sign Detection Segments:

- Color-Based Detection: This fundamental technique, often used in conjunction with other methods, remains crucial for initial identification of signs based on their distinctive colors (e.g., red for prohibition, blue for mandatory information, yellow for warnings).

- Drivers of Dominance: High prevalence of standardized traffic sign color schemes in China, making it a reliable initial filter for detection algorithms. Cost-effectiveness and computational efficiency for basic sign identification contribute to its widespread adoption.

- Feature-Based Detection: This approach identifies unique visual features within traffic signs, such as shapes, edges, and patterns. It offers greater robustness against variations in lighting and color.

- Drivers of Dominance: Enhanced accuracy in diverse environmental conditions, crucial for China's varied climate and urban/rural landscapes. Ability to distinguish between similar-looking signs based on their structural characteristics.

- Shape-Based Detection: This method focuses on recognizing the characteristic shapes of traffic signs (e.g., circular, triangular, hexagonal).

- Drivers of Dominance: Essential for identifying critical sign types like speed limits (circular), warning signs (triangular), and stop signs (octagonal). Its effectiveness is amplified when combined with color and feature recognition, forming a comprehensive detection strategy.

Vehicle Type Segments:

- Passenger Cars: This segment is the primary driver of the China Traffic Sign Recognition Market.

- Drivers of Dominance: The sheer volume of passenger car sales in China, coupled with increasing consumer demand for advanced safety and convenience features. Government mandates and automaker focus on equipping passenger vehicles with ADAS, including TSR, are accelerating adoption. The growing middle class and preference for technologically sophisticated vehicles further fuel this segment.

- Commercial Cars: This segment, encompassing trucks, buses, and delivery vehicles, represents a significant and growing market.

- Drivers of Dominance: Increasing focus on fleet safety and operational efficiency by commercial vehicle operators. Regulatory pressures and potential insurance benefits for fleets equipped with advanced safety systems are driving adoption. The expansion of e-commerce and logistics necessitates more reliable and safer commercial transportation, indirectly boosting TSR demand.

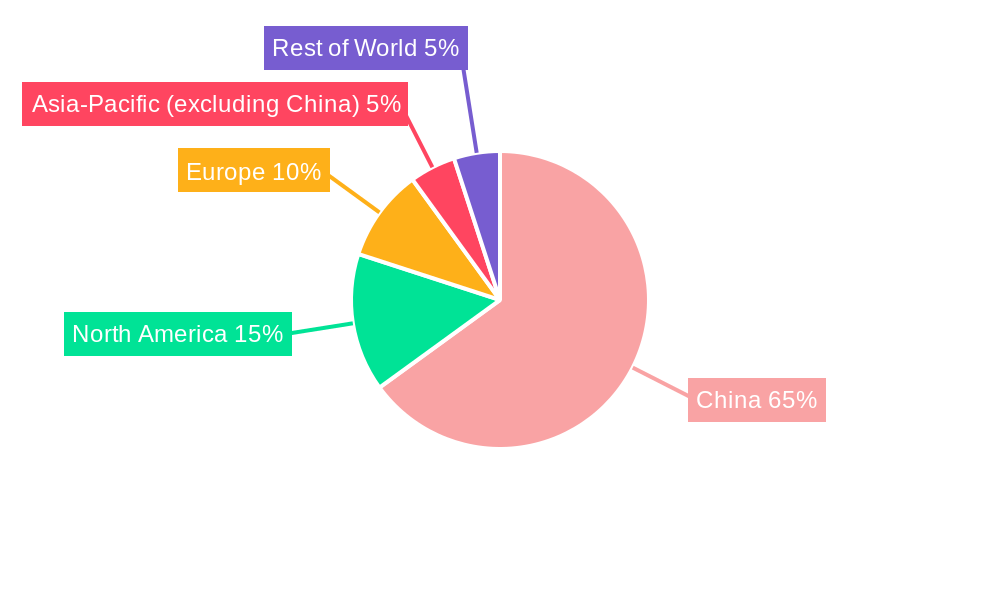

Overall, the Passenger Cars segment, leveraging the extensive automotive market and consumer preference for advanced safety features, is currently the leading segment. However, the Commercial Cars segment is experiencing rapid growth due to fleet modernization and safety initiatives. Geographically, major metropolitan areas and rapidly developing inland cities are leading the adoption of advanced TSR systems due to better infrastructure and higher vehicle density.

China Traffic Sign Recognition Market Product Developments

Recent product developments in the China Traffic Sign Recognition Market are enhancing the accuracy, reliability, and functionality of TSR systems. Innovations focus on improving the algorithms' ability to detect a broader range of signs, including temporary construction signs and regional variations, under challenging conditions like rain, fog, and low light. Advanced sensor fusion, integrating camera data with radar and LiDAR, is enabling more robust detection. Furthermore, the integration of TSR with other vehicle systems, such as adaptive cruise control and navigation, is creating more sophisticated ADAS functionalities. For instance, the Continental AG Child-Presence-Detection (CPD) system, introduced in April 2022, exemplifies the trend of expanding in-vehicle safety beyond driver assistance. While not directly TSR, it highlights the industry's commitment to integrated safety solutions. Similarly, Toshiba Electronic Devices & Storage Corporation's Thermoflagger™ over-temperature detection IC series, launched in March 2023, showcases advancements in electronic component reliability, indirectly supporting the robust operation of complex automotive electronics like TSR modules.

Challenges in the China Traffic Sign Recognition Market Market

- Regulatory Harmonization: While China is actively developing standards, ensuring global harmonization of traffic sign recognition regulations and data formats remains a challenge for international component suppliers.

- Cost Sensitivity: The demand for cost-effective solutions, especially in the mass-market passenger car segment, can limit the widespread adoption of the most advanced and expensive TSR technologies.

- Environmental Variability: Diverse weather conditions, varying light levels, and the presence of occlusions (e.g., dirt, damage, vegetation) pose significant challenges to consistently accurate traffic sign detection.

- Data Availability and Quality: The continuous need for large, diverse, and high-quality datasets for training and validating AI models for TSR is a perpetual challenge.

- Competition from Mapping Data: Highly accurate, real-time map data providing speed limits and other sign information can sometimes act as a partial substitute for camera-based TSR, particularly in clear conditions.

Forces Driving China Traffic Sign Recognition Market Growth

The China Traffic Sign Recognition Market is propelled by several powerful forces. Government initiatives promoting intelligent transportation systems and road safety are a significant driver, encouraging the adoption of ADAS technologies. The rapid growth of the automotive industry in China, particularly the surge in electric vehicle sales, provides a fertile ground for integrating advanced safety features. Increasing consumer awareness and demand for enhanced vehicle safety and comfort are compelling automakers to equip vehicles with TSR systems. Technological advancements in AI, computer vision, and sensor technology are continuously improving the performance and reducing the cost of TSR solutions, making them more accessible and effective. Furthermore, stringent safety regulations mandating certain ADAS features are directly boosting the market for TSR.

Challenges in the China Traffic Sign Recognition Market Market

Long-term growth catalysts for the China Traffic Sign Recognition Market are deeply rooted in continuous innovation and strategic market expansion. The increasing complexity and diversity of traffic signs across different regions and for temporary situations necessitate ongoing algorithmic improvements and larger training datasets. Advancements in AI and machine learning, particularly in deep learning, will enable more robust and accurate detection under increasingly challenging conditions. Strategic partnerships between automotive OEMs, Tier-1 suppliers, and technology providers are crucial for accelerating product development and integration. The expansion of V2X communication technologies will allow TSR systems to interact with traffic infrastructure and other vehicles, providing proactive alerts and enhancing overall road safety. Furthermore, the growing adoption of autonomous driving technologies will create a demand for highly reliable and redundant TSR systems, as they are a critical component for safe navigation.

Emerging Opportunities in China Traffic Sign Recognition Market

Emerging opportunities in the China Traffic Sign Recognition Market are diverse and promising. The expansion of intelligent transportation systems in smart cities presents a significant opportunity for TSR integration with city-wide traffic management platforms. The growth of the commercial vehicle sector, including logistics and ride-hailing services, offers substantial potential for fleet-wide adoption of TSR for improved safety and operational efficiency. Development of specialized TSR systems for motorcycles and other two-wheeled vehicles, where safety is a paramount concern, is another untapped market. The advancement of augmented reality (AR) windshield displays that can overlay traffic sign information directly onto the driver's view presents an innovative application for TSR data. Furthermore, leveraging TSR data for real-time traffic analysis and urban planning offers a valuable secondary market for collected information.

Leading Players in the China Traffic Sign Recognition Market Sector

- Denso Corporation

- Hella Gmbh & Co KGaA

- Continental AG

- Mobieye Corporation

- Autoliv Inc

- Valeo SA

- Robert Bosch Gmbh

- Ford Motor Company

Key Milestones in China Traffic Sign Recognition Market Industry

- April 2022: Technology company Continental introduced a new feature called Child-Presence-Detection (CPD) to its digital access system CoSmA. This function is designed to detect children left inside the vehicle and issue a warning.

- March 2023: Toshiba Electronic Devices & Storage Corporation launched the initial two products of its Thermoflagger™ over-temperature detection IC series. The first product, "TCTH021BE," detects abnormal states without a latching function for the FLAG signal, while the second product, "TCTH022BE," includes a latching function. These ICs use positive temperature coefficient (PTC) thermistors in a simple circuit configuration to detect temperature rises within electronic equipment.

Strategic Outlook for China Traffic Sign Recognition Market Market

The strategic outlook for the China Traffic Sign Recognition Market is characterized by sustained growth and innovation. Key growth accelerators include the continued integration of TSR into more vehicle models, driven by both consumer demand and regulatory pressures. The development of more robust AI algorithms capable of handling complex scenarios, such as varying weather conditions and sign degradation, will be critical. Strategic partnerships between technology providers and automotive OEMs will be essential for timely and efficient product deployment. Furthermore, the exploration of new applications, such as integrating TSR data with autonomous driving systems and smart city infrastructure, presents significant future market potential. The market is expected to witness increased investment in R&D, focusing on enhancing the accuracy, reliability, and affordability of TSR solutions.

China Traffic Sign Recognition Market Segmentation

-

1. Traffic Sign Detection

- 1.1. Color-Based

- 1.2. Feature-Based

- 1.3. Shape-Based

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Cars

China Traffic Sign Recognition Market Segmentation By Geography

- 1. China

China Traffic Sign Recognition Market Regional Market Share

Geographic Coverage of China Traffic Sign Recognition Market

China Traffic Sign Recognition Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Safety Concerns; Technological Advancements; Others

- 3.3. Market Restrains

- 3.3.1. Complex and Diverse Road Conditions; Others

- 3.4. Market Trends

- 3.4.1. Rise in Stringent Government Regulations and Growing Demand for Autonomous Vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Traffic Sign Recognition Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 5.1.1. Color-Based

- 5.1.2. Feature-Based

- 5.1.3. Shape-Based

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Cars

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Denso Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hella Gmbh & Co KGaA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Continental AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mobieye Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Autoliv Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Valeo SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Robert Bosch Gmb

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ford Motor Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Denso Corporation

List of Figures

- Figure 1: China Traffic Sign Recognition Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Traffic Sign Recognition Market Share (%) by Company 2025

List of Tables

- Table 1: China Traffic Sign Recognition Market Revenue billion Forecast, by Traffic Sign Detection 2020 & 2033

- Table 2: China Traffic Sign Recognition Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: China Traffic Sign Recognition Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Traffic Sign Recognition Market Revenue billion Forecast, by Traffic Sign Detection 2020 & 2033

- Table 5: China Traffic Sign Recognition Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: China Traffic Sign Recognition Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Traffic Sign Recognition Market?

The projected CAGR is approximately 8.32%.

2. Which companies are prominent players in the China Traffic Sign Recognition Market?

Key companies in the market include Denso Corporation, Hella Gmbh & Co KGaA, Continental AG, Mobieye Corporation, Autoliv Inc, Valeo SA, Robert Bosch Gmb, Ford Motor Company.

3. What are the main segments of the China Traffic Sign Recognition Market?

The market segments include Traffic Sign Detection, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.29 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Safety Concerns; Technological Advancements; Others.

6. What are the notable trends driving market growth?

Rise in Stringent Government Regulations and Growing Demand for Autonomous Vehicles.

7. Are there any restraints impacting market growth?

Complex and Diverse Road Conditions; Others.

8. Can you provide examples of recent developments in the market?

April 202: Technology company Continental introduced a new feature called Child-Presence-Detection (CPD) to its digital access system CoSmA. This function is designed to detect children left inside the vehicle and issue a warning.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Traffic Sign Recognition Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Traffic Sign Recognition Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Traffic Sign Recognition Market?

To stay informed about further developments, trends, and reports in the China Traffic Sign Recognition Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence