Key Insights

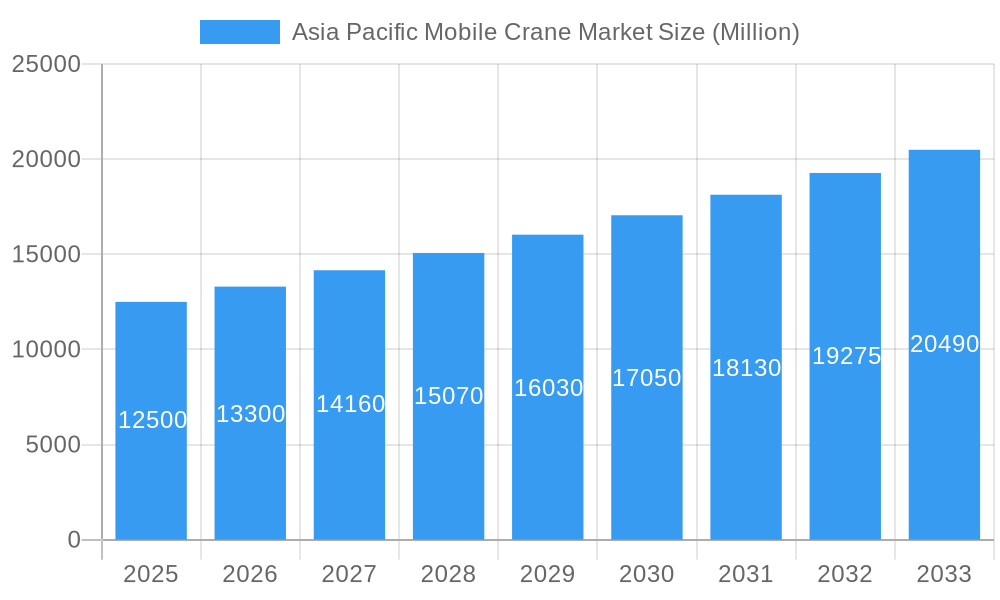

The Asia Pacific mobile crane market is projected for substantial growth, forecasted to reach over $26.52 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.3%. This expansion is primarily driven by significant infrastructure development across the region, especially in China and India, where substantial investments are allocated to construction, urban expansion, and smart city projects. The mining and excavation sector also contributes significantly, requiring heavy-duty mobile cranes for resource extraction. Additionally, growing maritime trade and offshore activities in coastal nations are creating consistent demand for specialized cranes in ports and offshore facilities. The industrial sector's increasing need for efficient material handling and assembly further supports market growth.

Asia Pacific Mobile Crane Market Market Size (In Billion)

Key trends include a strong preference for technologically advanced mobile cranes with enhanced safety, remote operation capabilities, and improved fuel efficiency. The adoption of electric and hybrid models is also rising, driven by the region's commitment to sustainability and emission reduction. However, market restraints include the high initial cost of advanced cranes, stringent regulatory frameworks regarding safety and environmental impact, and potential supply chain disruptions. Despite these challenges, demand from construction, mining, and industrial manufacturing, along with a competitive landscape featuring key players like XCMG, Sumitomo Heavy Industries, Konecranes, and Liebherr, ensures a dynamic and expanding market.

Asia Pacific Mobile Crane Market Company Market Share

Asia Pacific Mobile Crane Market: Comprehensive Market Analysis and Future Outlook (2019–2033)

Unlock critical insights into the booming Asia Pacific Mobile Crane Market with this in-depth report. Covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this analysis provides actionable intelligence for stakeholders seeking to capitalize on the region's rapid infrastructure development and industrial expansion.

Gain a competitive edge by understanding market size, growth drivers, key segments, leading players, and emerging opportunities. This report is essential for manufacturers, distributors, investors, and end-users navigating the dynamic landscape of mobile cranes in Asia Pacific.

Asia Pacific Mobile Crane Market Market Concentration & Dynamics

The Asia Pacific Mobile Crane Market exhibits a moderately consolidated landscape, characterized by the strong presence of global giants alongside emerging regional players. Key players like XCMG, Sumitomo Heavy Industries Construction Cranes Co Ltd, Konecranes PLC, Hitachi Construction Machinery, Liebherr International AG, Cargotec, Kobelco Cranes Co Ltd, Tadano Ltd, Terex Corporation, and Sany dominate market share. Innovation is a crucial differentiator, with companies investing heavily in research and development to introduce more efficient, safer, and technologically advanced mobile crane solutions. Regulatory frameworks across various Asia Pacific countries significantly influence market dynamics, particularly concerning safety standards, emissions, and import/export regulations, impacting operational costs and market access. The threat of substitute products, while present, is relatively low given the specialized nature of mobile cranes for heavy lifting applications. End-user trends are increasingly leaning towards automation, telematics for remote monitoring and diagnostics, and cranes with higher lifting capacities and greater maneuverability. Mergers and acquisitions (M&A) activities, although not at an extremely high volume, have played a role in consolidating market share and expanding product portfolios, with recent deal counts indicating a strategic focus on acquiring advanced technologies or expanding geographical reach. The market share distribution among the top players is estimated to be around 65-70%, with smaller regional manufacturers holding the remaining portion.

Asia Pacific Mobile Crane Market Industry Insights & Trends

The Asia Pacific Mobile Crane Market is poised for substantial growth, driven by a confluence of robust economic expansion and escalating infrastructural development across the region. The market size is projected to reach an estimated value of $18,500 Million in 2025, with a projected Compound Annual Growth Rate (CAGR) of approximately 6.8% during the forecast period of 2025–2033. This upward trajectory is underpinned by significant investments in construction projects, including residential, commercial, and industrial buildings, as well as extensive infrastructure initiatives such as transportation networks (roads, railways, airports) and energy projects (power plants, renewable energy installations). Emerging economies within Asia Pacific are witnessing particularly rapid urbanization, fueling the demand for new construction and, consequently, mobile cranes. Technological disruptions are playing a pivotal role, with manufacturers increasingly integrating advanced features like GPS tracking, remote diagnostics, advanced safety systems, and automation capabilities into their mobile crane offerings. These innovations enhance operational efficiency, reduce downtime, and improve safety on job sites. Evolving consumer behaviors are characterized by a growing emphasis on total cost of ownership, leading to demand for fuel-efficient, durable, and low-maintenance mobile crane models. Furthermore, the increasing adoption of digital technologies, such as IoT and AI, for predictive maintenance and operational optimization is becoming a key trend. The shift towards higher lifting capacities and more versatile cranes capable of handling diverse project requirements is also a significant market trend, catering to the increasing complexity of construction and industrial projects. The demand for specialized cranes, such as those used in marine and offshore applications, is also on the rise due to the expansion of port infrastructure and offshore energy exploration.

Key Markets & Segments Leading Asia Pacific Mobile Crane Market

The Construction application type segment is the dominant force within the Asia Pacific Mobile Crane Market, accounting for an estimated 55% of the market share in 2025. This leadership is driven by unprecedented infrastructure development and urbanization across countries like China, India, and Southeast Asian nations. Economic growth fuels these construction activities, leading to a sustained demand for mobile cranes for building high-rise structures, bridges, transportation hubs, and residential complexes.

- Drivers for Construction Dominance:

- Government Infrastructure Spending: Large-scale public investment in roads, railways, airports, and energy projects creates a continuous pipeline of construction work.

- Urbanization and Housing Demand: Rapid population growth in urban centers necessitates the construction of new housing and commercial spaces.

- Smart City Initiatives: Investments in modern urban infrastructure, including smart grids and advanced public facilities, require substantial construction equipment.

Within the Type segment, Wheel Mounted Mobile Cranes are the most sought-after, representing approximately 40% of the market share in 2025. Their versatility, ease of mobility between job sites, and suitability for a wide range of construction and industrial tasks make them the preferred choice for many applications.

- Drivers for Wheel Mounted Mobile Crane Dominance:

- Mobility and Flexibility: Ability to quickly move to different locations on a construction site or between sites.

- Cost-Effectiveness: Generally lower operational costs and easier setup compared to other crane types for many tasks.

- Versatility: Suitable for a broad spectrum of lifting and material handling operations in various industries.

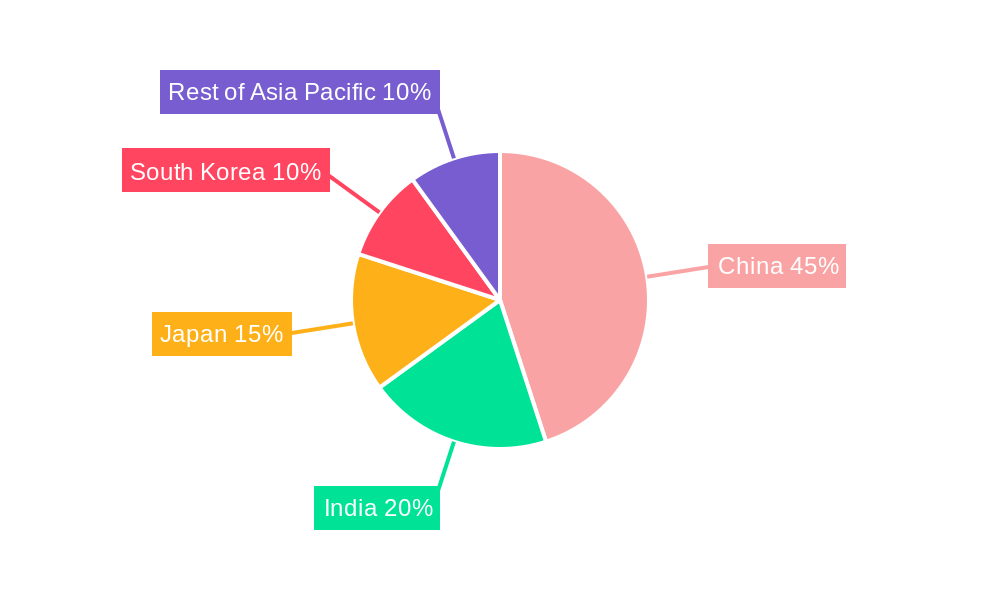

The China market stands as the undisputed leader in the Asia Pacific Mobile Crane Market, holding an estimated 45% of the regional market share in 2025. This dominance is attributable to its massive construction industry, significant manufacturing output, and substantial government investments in infrastructure and industrial projects.

- Drivers for China's Market Leadership:

- Manufacturing Hub: China's role as the world's manufacturing hub necessitates extensive industrial construction and expansion, requiring numerous mobile cranes.

- Belt and Road Initiative: Large-scale infrastructure projects under this initiative span across multiple countries, with China being a major contributor and consumer of construction equipment.

- Technological Advancement: Leading Chinese manufacturers are at the forefront of developing and adopting advanced mobile crane technologies.

Asia Pacific Mobile Crane Market Product Developments

Product development in the Asia Pacific Mobile Crane Market is characterized by a relentless pursuit of enhanced performance, safety, and sustainability. Manufacturers are focusing on introducing cranes with higher lifting capacities, greater reach, and improved boom designs to tackle increasingly complex construction and industrial challenges. Advanced telematics and IoT integration are becoming standard, enabling real-time monitoring, remote diagnostics, and predictive maintenance, thereby minimizing downtime and optimizing operational efficiency. Furthermore, there's a significant push towards developing more fuel-efficient engines and exploring alternative power sources to meet stringent environmental regulations and reduce operating costs. Innovations in safety features, such as advanced anti-collision systems, load moment indicators, and improved operator cabin ergonomics, are also a key focus, ensuring safer working environments.

Challenges in the Asia Pacific Mobile Crane Market Market

Despite the robust growth prospects, the Asia Pacific Mobile Crane Market faces several hurdles. Intense competition among both global and local manufacturers can lead to price wars, impacting profit margins. Fluctuations in raw material prices, particularly steel, can significantly affect manufacturing costs and product pricing. Navigating diverse and often stringent regulatory frameworks across different Asia Pacific countries, including varying safety standards and environmental compliance requirements, adds complexity and cost to market entry and operations. Supply chain disruptions, as witnessed in recent global events, can lead to delays in component sourcing and finished product delivery, impacting project timelines.

Forces Driving Asia Pacific Mobile Crane Market Growth

The primary forces propelling the Asia Pacific Mobile Crane Market are substantial government investments in infrastructure development across countries like China, India, and Southeast Asian nations. The ongoing urbanization trend fuels demand for new residential, commercial, and industrial constructions. Furthermore, the expansion of the manufacturing sector and the growth of key industries such as mining, energy, and marine & offshore are directly contributing to the need for heavy lifting equipment. Technological advancements, including the integration of automation and smart features, are also driving adoption by enhancing efficiency and safety.

Challenges in the Asia Pacific Mobile Crane Market Market

Long-term growth catalysts for the Asia Pacific Mobile Crane Market lie in continuous innovation and adaptation to evolving market demands. The development of more compact and versatile cranes for urban construction sites with limited space is crucial. Further advancements in emission control technologies and the exploration of electric or hybrid-powered cranes will be critical for meeting future environmental regulations and sustainability goals. Strategic partnerships and collaborations between manufacturers, rental companies, and end-users can foster a more integrated ecosystem, leading to better service delivery and customized solutions. Market expansion into emerging economies with developing infrastructure will also be a significant growth driver.

Emerging Opportunities in Asia Pacific Mobile Crane Market

Emerging opportunities in the Asia Pacific Mobile Crane Market are ripe for exploration. The growing demand for cranes in renewable energy projects, such as wind farm installations, presents a significant avenue for growth. The expansion of smart city projects across the region will necessitate specialized and technologically advanced mobile cranes. Furthermore, the increasing adoption of rental and leasing models for mobile cranes, particularly among small and medium-sized enterprises, offers a scalable business opportunity. Technological advancements in autonomous crane operation and augmented reality for remote operation and training are also emerging trends that could reshape the market.

Leading Players in the Asia Pacific Mobile Crane Market Sector

- XCMG

- Sumitomo Heavy Industries Construction Cranes Co Ltd

- Konecranes PLC

- Hitachi Construction Machinery

- Liebherr International AG

- Cargotec

- Kobelco Cranes Co Ltd

- Tadano Ltd

- Terex Corporation

- Sany

Key Milestones in Asia Pacific Mobile Crane Market Industry

- 2019: XCMG launches a series of intelligent telescopic cranes with enhanced safety and efficiency features.

- 2020: Liebherr introduces advanced telematics solutions for its mobile crane fleet, enabling remote monitoring and diagnostics.

- 2021: Tadano completes the acquisition of Demag's mobile crane business, expanding its product portfolio and market reach.

- 2022: Konecranes unveils its first fully electric hybrid mobile crane, demonstrating a commitment to sustainability.

- 2023: Sany announces significant investments in R&D for automated crane operations and AI-driven predictive maintenance.

- 2024: Hitachi Construction Machinery showcases its latest range of fuel-efficient mobile cranes designed for demanding industrial applications.

Strategic Outlook for Asia Pacific Mobile Crane Market Market

The strategic outlook for the Asia Pacific Mobile Crane Market is characterized by a continued focus on innovation, sustainability, and market expansion. Growth accelerators include the increasing adoption of advanced technologies like AI and IoT for operational optimization and predictive maintenance. Manufacturers will increasingly emphasize the development of eco-friendly and energy-efficient crane models to comply with stringent environmental regulations and cater to the growing demand for sustainable solutions. Strategic partnerships with end-users and rental companies will be crucial for understanding evolving market needs and delivering customized solutions. The expansion into developing economies within the Asia Pacific region, coupled with a focus on after-sales service and support, will be key to capturing future market potential.

Asia Pacific Mobile Crane Market Segmentation

-

1. Type

- 1.1. Wheel Mounted Mobile Crane

- 1.2. Commercial truck mounted Crane

- 1.3. Side Boom

- 1.4. Straddle Crane

- 1.5. Railroad Crane

- 1.6. Others

-

2. Application Type

- 2.1. Construction

- 2.2. Mining & Excavation

- 2.3. Marine & Offshore

- 2.4. Industrial Applications

- 2.5. Others

Asia Pacific Mobile Crane Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia Pacific Mobile Crane Market Regional Market Share

Geographic Coverage of Asia Pacific Mobile Crane Market

Asia Pacific Mobile Crane Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Electrification of Construction Equipment May Propel the Market Growth

- 3.3. Market Restrains

- 3.3.1. Construction Rental Business May Hamper Market Growth

- 3.4. Market Trends

- 3.4.1. Government Initiatives Driving Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Mobile Crane Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wheel Mounted Mobile Crane

- 5.1.2. Commercial truck mounted Crane

- 5.1.3. Side Boom

- 5.1.4. Straddle Crane

- 5.1.5. Railroad Crane

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Construction

- 5.2.2. Mining & Excavation

- 5.2.3. Marine & Offshore

- 5.2.4. Industrial Applications

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia Pacific Mobile Crane Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Wheel Mounted Mobile Crane

- 6.1.2. Commercial truck mounted Crane

- 6.1.3. Side Boom

- 6.1.4. Straddle Crane

- 6.1.5. Railroad Crane

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Construction

- 6.2.2. Mining & Excavation

- 6.2.3. Marine & Offshore

- 6.2.4. Industrial Applications

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia Pacific Mobile Crane Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Wheel Mounted Mobile Crane

- 7.1.2. Commercial truck mounted Crane

- 7.1.3. Side Boom

- 7.1.4. Straddle Crane

- 7.1.5. Railroad Crane

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Construction

- 7.2.2. Mining & Excavation

- 7.2.3. Marine & Offshore

- 7.2.4. Industrial Applications

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia Pacific Mobile Crane Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Wheel Mounted Mobile Crane

- 8.1.2. Commercial truck mounted Crane

- 8.1.3. Side Boom

- 8.1.4. Straddle Crane

- 8.1.5. Railroad Crane

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Construction

- 8.2.2. Mining & Excavation

- 8.2.3. Marine & Offshore

- 8.2.4. Industrial Applications

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South Korea Asia Pacific Mobile Crane Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Wheel Mounted Mobile Crane

- 9.1.2. Commercial truck mounted Crane

- 9.1.3. Side Boom

- 9.1.4. Straddle Crane

- 9.1.5. Railroad Crane

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Construction

- 9.2.2. Mining & Excavation

- 9.2.3. Marine & Offshore

- 9.2.4. Industrial Applications

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific Asia Pacific Mobile Crane Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Wheel Mounted Mobile Crane

- 10.1.2. Commercial truck mounted Crane

- 10.1.3. Side Boom

- 10.1.4. Straddle Crane

- 10.1.5. Railroad Crane

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Construction

- 10.2.2. Mining & Excavation

- 10.2.3. Marine & Offshore

- 10.2.4. Industrial Applications

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 XCMG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sumitomo Heavy Industries Construction Cranes Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Konecrance PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hitachi Construction Machiner

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Liebherr International AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cargotec

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kobelco Cranes Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tadano Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Terex Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sany

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 XCMG

List of Figures

- Figure 1: Asia Pacific Mobile Crane Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Mobile Crane Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 9: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 12: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 15: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 18: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Mobile Crane Market?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the Asia Pacific Mobile Crane Market?

Key companies in the market include XCMG, Sumitomo Heavy Industries Construction Cranes Co Ltd, Konecrance PLC, Hitachi Construction Machiner, Liebherr International AG, Cargotec, Kobelco Cranes Co Ltd, Tadano Ltd, Terex Corporation, Sany.

3. What are the main segments of the Asia Pacific Mobile Crane Market?

The market segments include Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.52 billion as of 2022.

5. What are some drivers contributing to market growth?

Electrification of Construction Equipment May Propel the Market Growth.

6. What are the notable trends driving market growth?

Government Initiatives Driving Growth.

7. Are there any restraints impacting market growth?

Construction Rental Business May Hamper Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Mobile Crane Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Mobile Crane Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Mobile Crane Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Mobile Crane Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence