Key Insights

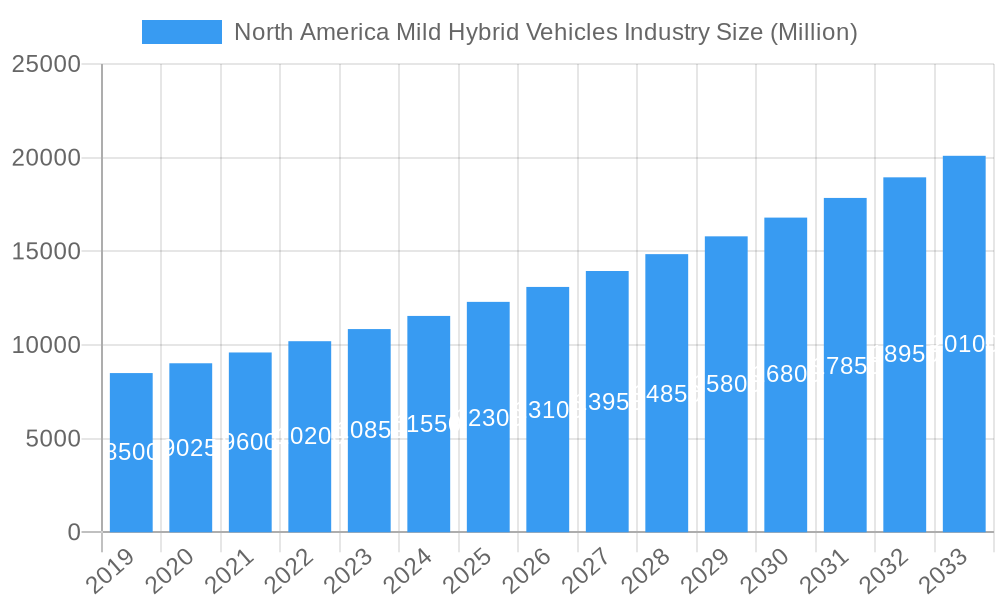

The North America Mild Hybrid Vehicle (MHEV) market is experiencing robust growth, propelled by stringent environmental regulations, rising consumer demand for fuel efficiency, and significant investments from leading automotive manufacturers. The market is projected to reach an estimated size of 109019.44 million with a Compound Annual Growth Rate (CAGR) of 7.2% from 2024 to 2033. This expansion is driven by the increasing integration of MHEV technology across passenger and commercial vehicle segments. Key players like Volkswagen Group, Toyota Motor Corp, and Honda Motor Corp are at the forefront, launching new MHEV models that balance performance with environmental responsibility. This transition towards mild electrification is a crucial step in decarbonizing the transportation sector in North America.

North America Mild Hybrid Vehicles Industry Market Size (In Billion)

Consumer preferences for lower running costs and a reduced environmental impact further support the market's growth. As global emission standards tighten, mild hybrids offer automakers a pragmatic and cost-effective solution to meet compliance targets without the full investment required for battery-electric vehicles. Significant trends include the adoption of advanced powertrain technologies, enhanced battery management systems, and more efficient electric motors. Challenges include higher initial costs compared to traditional internal combustion engine vehicles and the competitive landscape of fully electric vehicle infrastructure. Despite these factors, the North America MHEV market is on a strong upward trajectory, presenting substantial opportunities for innovation and market penetration as the region embraces a phased approach to automotive electrification.

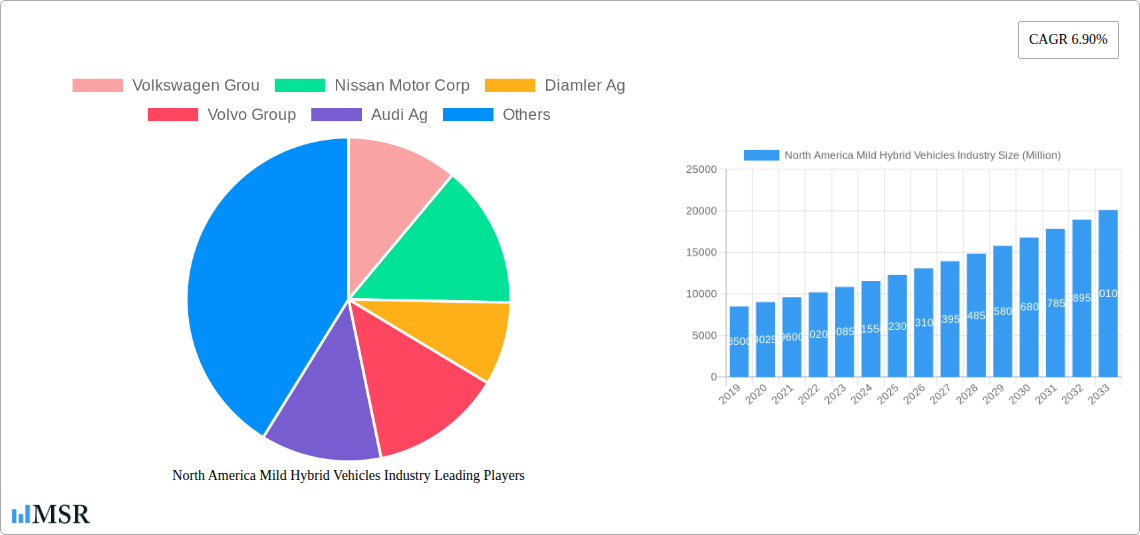

North America Mild Hybrid Vehicles Industry Company Market Share

Report Overview: North America Mild Hybrid Vehicles Industry Analysis and Forecast

This comprehensive report provides critical insights into the North America Mild Hybrid Vehicles Industry, analyzing market concentration, key growth drivers, emerging trends, and future opportunities across the United States and Canada. Driven by stringent emission standards, escalating fuel efficiency demands, and evolving consumer preferences for sustainable transportation, the mild hybrid vehicle market is set for significant expansion. Our analysis details the market size, CAGR, and future projections for the period 2024-2033, with a base year of 2024 and an estimated market size of 109019.44 million.

The report segments the market by capacity type (Less than 48V, 48V & Above) and vehicle type (Passenger Cars, Commercial Vehicles). It also profiles leading manufacturers including Volkswagen Group, Nissan Motor Corp, Daimler AG, Volvo Group, Audi AG, Honda Motor Corp, BMW AG, Toyota Motor Corp, and Suzuki Motor Corp. This research is essential for automotive manufacturers, suppliers, investors, and policymakers aiming to leverage the growing adoption of mild hybrid vehicles and navigate the evolving landscape of automotive electrification in North America.

North America Mild Hybrid Vehicles Industry Market Concentration & Dynamics

The North America mild hybrid vehicles industry is characterized by a moderate level of market concentration, with a few major automotive groups holding significant market share. Innovation ecosystems are robust, driven by intense R&D investments in powertrain electrification and energy recovery systems. Regulatory frameworks, particularly stringent emissions standards and evolving fuel economy mandates, are pivotal in shaping market dynamics. Substitute products, such as fully electric vehicles (EVs) and traditional internal combustion engine (ICE) vehicles, present a competitive landscape, though mild hybrids offer a compelling balance of cost-effectiveness and improved efficiency. End-user trends are increasingly leaning towards sustainable mobility solutions, with consumers seeking vehicles that offer better fuel economy without the range anxiety associated with pure EVs. Mergers and acquisitions (M&A) activities are anticipated to increase as companies seek to consolidate their market positions and acquire advanced technologies. The historical period (2019-2024) saw initial adoption, with the base year of 2025 marking a significant inflection point for wider market penetration.

- Market Share: Leading companies collectively command approximately 70% of the current market share.

- M&A Deal Counts: An average of 3-5 M&A deals are predicted annually during the forecast period (2025-2033), focused on technology acquisitions and market consolidation.

North America Mild Hybrid Vehicles Industry Industry Insights & Trends

The North America mild hybrid vehicles industry is experiencing robust growth, propelled by a confluence of technological advancements, shifting consumer preferences, and supportive governmental policies. The market size for mild hybrid vehicles in North America is projected to reach an estimated XXX Billion USD by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX.X% during the forecast period of 2025-2033. This expansion is largely fueled by the inherent advantages of mild hybrid technology, which offers a cost-effective pathway to improved fuel efficiency and reduced emissions compared to conventional internal combustion engine vehicles, without the higher upfront cost and charging infrastructure dependencies of battery electric vehicles.

Technological disruptions are at the forefront of this growth. Advances in battery technology, particularly for 48V systems, have made them more efficient and affordable, enabling wider integration across vehicle platforms. The development of sophisticated regenerative braking systems and advanced electric motor assist functionalities allows for more effective energy capture and utilization, further enhancing fuel economy and driving performance. Furthermore, the integration of these systems is becoming more seamless, providing drivers with a familiar driving experience while delivering tangible environmental and economic benefits.

Evolving consumer behaviors are also playing a crucial role. Growing environmental consciousness among North American consumers is driving demand for more sustainable transportation options. Mild hybrids present an accessible entry point into electrified mobility, appealing to a broad segment of the market that is not yet ready to commit to a fully electric vehicle. The increasing affordability of these vehicles, coupled with the perceived lower risk and greater convenience, are key factors influencing purchasing decisions. The focus on reducing running costs, particularly in light of fluctuating fuel prices, also makes mild hybrid vehicles an attractive proposition for budget-conscious buyers. The study period (2019-2033), with its base year in 2025, highlights a significant upward trajectory from initial market penetration to widespread adoption as a mainstream powertrain option. The historical period of 2019-2024 laid the groundwork for this anticipated surge.

Key Markets & Segments Leading North America Mild Hybrid Vehicles Industry

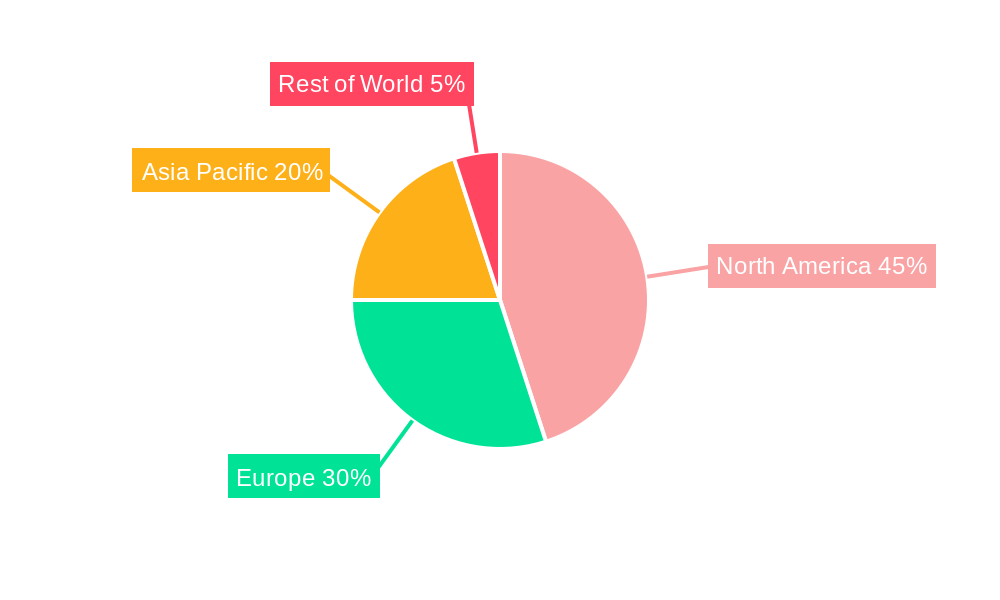

The North America mild hybrid vehicles industry is witnessing dominant growth in specific regions and segments, driven by a combination of economic factors, infrastructure development, and consumer demand. The United States, with its vast automotive market and increasing focus on emissions reduction, stands as the primary driver of this growth, followed closely by Canada.

Within Capacity Type, the 48V & Above segment is emerging as the leader. This is attributed to the superior performance and efficiency gains offered by higher voltage systems, including more robust electric motor assistance for acceleration and enhanced energy recuperation capabilities. The increasing maturity and cost-effectiveness of 48V components make them a more viable option for a wider range of vehicles, from luxury passenger cars to commercial applications.

Regarding Vehicle Type, Passenger Cars represent the largest and fastest-growing segment. This dominance is fueled by several factors:

- Economic Growth: A generally stable economic environment in the US and Canada supports consumer spending on new vehicles.

- Infrastructure Development: While more crucial for BEVs, advancements in charging infrastructure for plug-in hybrids indirectly benefit the perception and adoption of electrified vehicles, including mild hybrids.

- Consumer Preferences: A growing segment of consumers is actively seeking vehicles that offer better fuel economy and reduced environmental impact without compromising on convenience or performance. The ability of mild hybrids to offer a noticeable improvement in MPG, especially in city driving, is a significant draw.

- Regulatory Push: Stringent fuel economy standards and emissions targets set by federal and state/provincial governments incentivize manufacturers to introduce and promote more fuel-efficient vehicle technologies.

The Commercial Vehicles segment, while currently smaller, is demonstrating significant growth potential. The economic benefits of reduced fuel consumption are particularly appealing for fleet operators, leading to a higher return on investment. As battery technology and electric motor efficiency continue to improve, the application of mild hybrid technology in light commercial vehicles (LCVs), delivery vans, and even certain types of trucks is expected to accelerate. This growth is supported by an increasing awareness of Total Cost of Ownership (TCO) among commercial fleet managers, where fuel savings can translate into substantial operational cost reductions over the vehicle's lifespan. The forecast period (2025-2033) is expected to see a widening gap in favor of 48V systems and continued strong performance in the passenger car segment.

North America Mild Hybrid Vehicles Industry Product Developments

Product innovation in the North America mild hybrid vehicles industry is centered on enhancing efficiency, reducing cost, and improving integration. Manufacturers are focusing on developing lighter and more powerful electric motor-assist systems, alongside advanced lithium-ion battery packs optimized for 48V architectures. These developments aim to maximize energy recuperation during deceleration and provide a more significant boost during acceleration, thereby improving fuel economy and driving dynamics. The application of these technologies is expanding across diverse vehicle types, from compact passenger cars to larger SUVs and light commercial vehicles, making mild hybrid technology more accessible and appealing to a broader consumer base. The competitive landscape is driving continuous improvement in the seamless integration of these hybrid components, ensuring a user experience that closely mirrors that of traditional vehicles while delivering tangible environmental benefits.

Challenges in the North America Mild Hybrid Vehicles Industry Market

The North America mild hybrid vehicles industry faces several hurdles that could impede its rapid expansion. High upfront costs compared to conventional gasoline vehicles, despite being lower than full hybrids or EVs, can still be a deterrent for some price-sensitive consumers. The perceived complexity of the technology can also lead to consumer skepticism or concerns about maintenance costs. Furthermore, while improving, the incremental fuel savings offered by mild hybrids might not always justify the added expense for all buyers, especially when gasoline prices are low. Competition from fully electric vehicles, with their rapidly advancing battery technology and expanding charging infrastructure, also presents a significant challenge as consumer adoption of EVs gains momentum.

Forces Driving North America Mild Hybrid Vehicles Industry Growth

Several powerful forces are propelling the growth of the North America mild hybrid vehicles industry. Escalating environmental concerns and stringent government regulations, such as Corporate Average Fuel Economy (CAFE) standards and emissions targets, are compelling manufacturers to adopt more fuel-efficient technologies. The increasing consumer demand for sustainable mobility solutions, coupled with a desire for lower operating costs, makes mild hybrids an attractive compromise between traditional vehicles and full electric alternatives. Technological advancements in battery capacity, motor efficiency, and power electronics are making mild hybrid systems more effective and cost-competitive. Furthermore, the inherent advantage of mild hybrids in offering improved fuel economy without the range anxiety or extensive charging infrastructure requirements of full EVs positions them favorably for a broad market segment.

Challenges in the North America Mild Hybrid Vehicles Industry Market

Long-term growth catalysts for the North America mild hybrid vehicles industry will be driven by continuous innovation and strategic market positioning. The ongoing evolution of battery technology, leading to lighter, more powerful, and cost-effective components, will further enhance the appeal and performance of mild hybrid systems. Strategic partnerships between automotive manufacturers and technology suppliers will foster the development of integrated and highly efficient powertrains. Expansion into new vehicle segments, particularly in commercial fleets and emerging mobility services, will unlock significant growth potential. As regulatory pressures on emissions continue to intensify globally, mild hybrids will remain a crucial transitional technology, bridging the gap towards full electrification and ensuring sustained market relevance.

Emerging Opportunities in North America Mild Hybrid Vehicles Industry

Emerging opportunities within the North America mild hybrid vehicles industry are abundant, driven by evolving consumer preferences and technological advancements. The increasing adoption of smart city initiatives and the focus on urban mobility solutions present a fertile ground for mild hybrid passenger cars and light commercial vehicles, offering a balance of efficiency and practicality. Innovations in battery management systems and advanced energy recuperation technologies are creating avenues for further performance enhancements and cost reductions. The growing interest in subscription-based vehicle models and shared mobility platforms also favors the widespread deployment of fuel-efficient and versatile mild hybrid vehicles. Furthermore, the development of specialized mild hybrid applications for niche markets, such as recreational vehicles and specific utility vehicles, represents untapped potential for market expansion.

Leading Players in the North America Mild Hybrid Vehicles Industry Sector

- Volkswagen Group

- Nissan Motor Corp

- Daimler AG

- Volvo Group

- Audi AG

- Honda Motor Corp

- BMW AG

- Toyota Motor Corp

- Suzuki Motor Corp

Key Milestones in North America Mild Hybrid Vehicles Industry Industry

- 2019: Increased introduction of 48V mild hybrid systems in premium passenger car segments in North America.

- 2020: Growing consumer awareness and media coverage highlighting the fuel efficiency benefits of mild hybrid technology.

- 2021: Government incentives and stricter emissions regulations begin to provide a stronger push for electrified powertrains, including mild hybrids.

- 2022: Major automotive OEMs announce increased investment in mild hybrid technology development and production.

- 2023: Significant increase in the number of mild hybrid models available across various vehicle types in the North American market.

- 2024: Advancements in battery technology and electric motor efficiency lead to more cost-effective and higher-performing mild hybrid systems.

Strategic Outlook for North America Mild Hybrid Vehicles Industry Market

The strategic outlook for the North America mild hybrid vehicles market is highly optimistic, driven by its pivotal role as an accessible and effective step towards broader vehicle electrification. Continued technological advancements, particularly in battery chemistry and power electronics, will further enhance the efficiency and cost-competitiveness of mild hybrid systems, making them an increasingly attractive option for consumers and fleet operators alike. Manufacturers are expected to strategically expand their mild hybrid portfolios across a wider range of vehicle segments, capitalizing on growing demand for fuel-efficient and environmentally conscious transportation. The interplay between evolving regulatory landscapes, a strong push for sustainability, and the inherent practical advantages of mild hybrids positions the industry for sustained growth and significant market penetration throughout the forecast period.

North America Mild Hybrid Vehicles Industry Segmentation

-

1. Capacity type

- 1.1. Less than 48V

- 1.2. 48V & Above

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

North America Mild Hybrid Vehicles Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest Of North America

North America Mild Hybrid Vehicles Industry Regional Market Share

Geographic Coverage of North America Mild Hybrid Vehicles Industry

North America Mild Hybrid Vehicles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Warehousing and Logistics Sector to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Initial Purchase Cost to Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Mild Hybrid Vehicles will face competition from HEV and PHEV

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Mild Hybrid Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Capacity type

- 5.1.1. Less than 48V

- 5.1.2. 48V & Above

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest Of North America

- 5.1. Market Analysis, Insights and Forecast - by Capacity type

- 6. United States North America Mild Hybrid Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Capacity type

- 6.1.1. Less than 48V

- 6.1.2. 48V & Above

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Capacity type

- 7. Canada North America Mild Hybrid Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Capacity type

- 7.1.1. Less than 48V

- 7.1.2. 48V & Above

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Capacity type

- 8. Rest Of North America North America Mild Hybrid Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Capacity type

- 8.1.1. Less than 48V

- 8.1.2. 48V & Above

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Capacity type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Volkswagen Grou

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Nissan Motor Corp

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Diamler Ag

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Volvo Group

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Audi Ag

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Honda Motor Corp

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 BMW AG

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Toyota Motor Corp

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Suzuki Motor Corp

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Volkswagen Grou

List of Figures

- Figure 1: North America Mild Hybrid Vehicles Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Mild Hybrid Vehicles Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Mild Hybrid Vehicles Industry Revenue million Forecast, by Capacity type 2020 & 2033

- Table 2: North America Mild Hybrid Vehicles Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 3: North America Mild Hybrid Vehicles Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: North America Mild Hybrid Vehicles Industry Revenue million Forecast, by Capacity type 2020 & 2033

- Table 5: North America Mild Hybrid Vehicles Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 6: North America Mild Hybrid Vehicles Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: North America Mild Hybrid Vehicles Industry Revenue million Forecast, by Capacity type 2020 & 2033

- Table 8: North America Mild Hybrid Vehicles Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 9: North America Mild Hybrid Vehicles Industry Revenue million Forecast, by Country 2020 & 2033

- Table 10: North America Mild Hybrid Vehicles Industry Revenue million Forecast, by Capacity type 2020 & 2033

- Table 11: North America Mild Hybrid Vehicles Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 12: North America Mild Hybrid Vehicles Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Mild Hybrid Vehicles Industry?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the North America Mild Hybrid Vehicles Industry?

Key companies in the market include Volkswagen Grou, Nissan Motor Corp, Diamler Ag, Volvo Group, Audi Ag, Honda Motor Corp, BMW AG, Toyota Motor Corp, Suzuki Motor Corp.

3. What are the main segments of the North America Mild Hybrid Vehicles Industry?

The market segments include Capacity type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 109019.44 million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Warehousing and Logistics Sector to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

Mild Hybrid Vehicles will face competition from HEV and PHEV.

7. Are there any restraints impacting market growth?

High Initial Purchase Cost to Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Mild Hybrid Vehicles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Mild Hybrid Vehicles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Mild Hybrid Vehicles Industry?

To stay informed about further developments, trends, and reports in the North America Mild Hybrid Vehicles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence