Key Insights

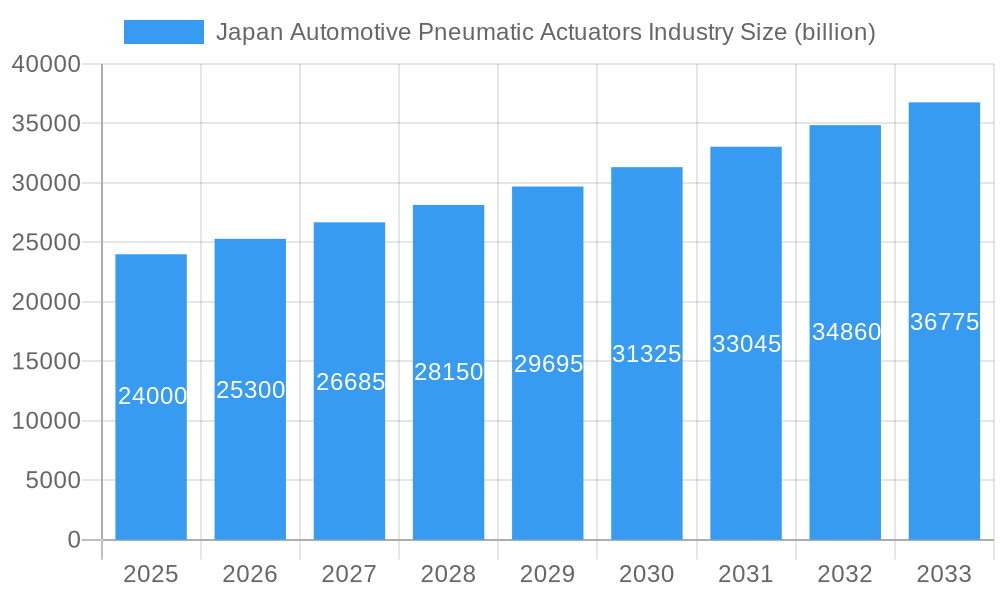

The Japan Automotive Pneumatic Actuators market is poised for significant expansion, projecting a market size of $24 billion in 2025 and a robust CAGR of 5.44% throughout the forecast period of 2025-2033. This growth is primarily fueled by the increasing adoption of advanced driver-assistance systems (ADAS) and the continuous demand for enhanced fuel efficiency and emissions reduction in vehicles. Pneumatic actuators play a crucial role in various automotive systems, including throttle actuation for precise engine control, fuel injection systems for optimal fuel delivery, and brake actuation for improved safety and performance. The rising sophistication of vehicle technologies, coupled with stringent environmental regulations, necessitates more responsive and efficient actuator solutions, thereby driving market demand in Japan. Furthermore, the strong presence of leading automotive manufacturers and component suppliers in Japan creates a fertile ground for the development and deployment of these critical pneumatic components.

Japan Automotive Pneumatic Actuators Industry Market Size (In Billion)

The market is witnessing a notable shift towards sophisticated applications such as electronic throttle control and advanced braking systems, which are increasingly becoming standard in both passenger cars and commercial vehicles. While pneumatic actuators offer inherent advantages like robustness and cost-effectiveness, the market also faces certain challenges. These include the increasing complexity of vehicle electronics, the integration of electro-mechanical actuators in some applications, and the potential for leakage in pneumatic systems that requires diligent maintenance. However, ongoing research and development efforts focused on improving the reliability, efficiency, and integration capabilities of pneumatic actuators are expected to mitigate these restraints. The market is segmented by application type, with throttle and fuel injection actuators holding significant shares, and by vehicle type, with passenger cars dominating the demand landscape. The continuous evolution of automotive technology in Japan, with its emphasis on innovation and quality, will continue to shape the trajectory of the pneumatic actuators market.

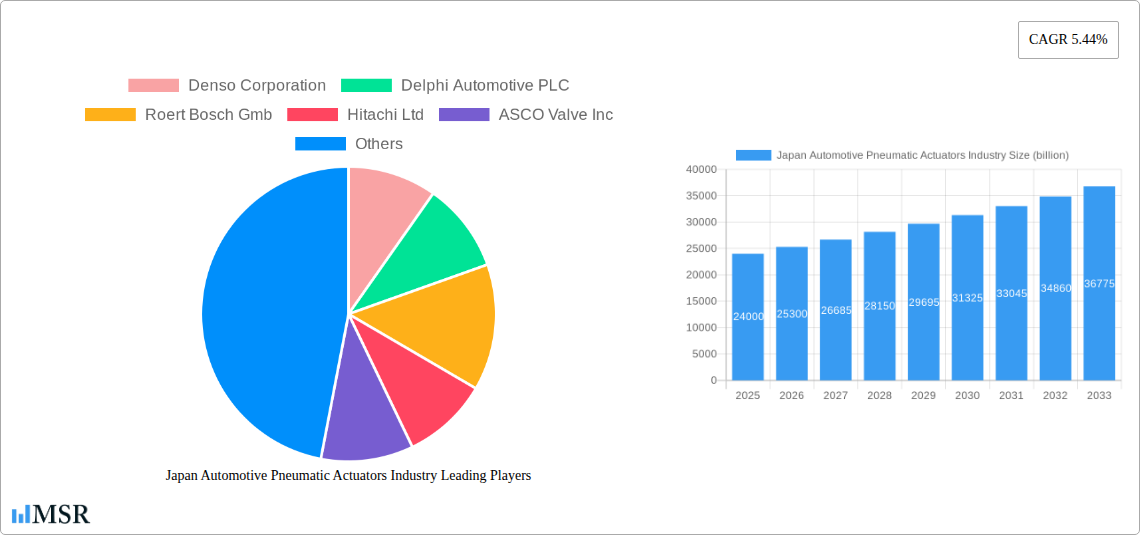

Japan Automotive Pneumatic Actuators Industry Company Market Share

Here is an SEO-optimized, engaging report description for the Japan Automotive Pneumatic Actuators Industry, incorporating your specific requirements and high-ranking keywords.

Japan Automotive Pneumatic Actuators Industry: Market Intelligence & Future Outlook (2019–2033)

Unlock unparalleled insights into Japan's burgeoning automotive pneumatic actuators market. This comprehensive report, meticulously crafted for industry stakeholders, provides an in-depth analysis of market dynamics, key trends, and future growth trajectories. Covering the historical period from 2019–2024 and projecting to 2033 with a base and estimated year of 2025, this research leverages advanced analytics and expert forecasts to deliver actionable intelligence. Dive deep into market concentration, emerging technologies, regulatory landscapes, and competitive strategies of major players like Denso Corporation, Delphi Automotive PLC, and Robert Bosch GmbH. Essential for manufacturers, suppliers, investors, and automotive OEMs seeking to capitalize on this rapidly evolving sector.

Japan Automotive Pneumatic Actuators Industry Market Concentration & Dynamics

The Japan automotive pneumatic actuators market exhibits a moderate level of concentration, characterized by the significant presence of established global players alongside specialized domestic manufacturers. Innovation ecosystems are driven by intense R&D efforts focused on enhancing actuator efficiency, durability, and integration with advanced automotive systems. Regulatory frameworks, particularly concerning emissions standards and vehicle safety, continuously shape product development and market entry strategies. The threat of substitute products, while present from electric actuators, remains relatively subdued due to the established cost-effectiveness and performance of pneumatic systems in specific automotive applications. End-user trends are increasingly leaning towards lighter, more fuel-efficient vehicles, pushing manufacturers to develop compact and high-performance pneumatic actuators. Mergers & Acquisitions (M&A) activities, while not overtly dominant, are strategic and targeted, aimed at consolidating technological expertise or expanding market reach within the Japanese automotive supply chain. The market share distribution indicates a few key players holding substantial portions, with a fragmented landscape of smaller, specialized suppliers contributing to the competitive intensity.

Japan Automotive Pneumatic Actuators Industry Industry Insights & Trends

The Japan automotive pneumatic actuators market is poised for significant expansion, driven by a confluence of technological advancements and evolving automotive demands. The market size is projected to reach an estimated $XX billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% projected between 2025 and 2033. This growth is intrinsically linked to the ongoing evolution of internal combustion engine (ICE) technology, where pneumatic actuators play a crucial role in optimizing performance and fuel efficiency. As automotive manufacturers strive to meet stringent emission regulations, the precision and reliability offered by pneumatic actuators in systems like throttle control and fuel injection become increasingly vital. Furthermore, the growing adoption of advanced driver-assistance systems (ADAS) and the continued presence of commercial vehicles requiring durable and powerful actuation solutions contribute to sustained demand. Technological disruptions, such as the integration of miniaturized sensors and smart control units within pneumatic actuators, are enhancing their capabilities and broadening their application scope. Evolving consumer behaviors, including a growing preference for vehicles with improved performance and reduced environmental impact, indirectly fuel the demand for sophisticated actuation components. The Japanese automotive sector's commitment to innovation and quality ensures a market receptive to high-performance pneumatic solutions that contribute to overall vehicle efficiency and driver experience.

Key Markets & Segments Leading Japan Automotive Pneumatic Actuators Industry

The dominant region within the Japan automotive pneumatic actuators industry is Honshu, driven by its concentration of automotive manufacturing hubs and significant vehicle production volumes. Within this region, the Passenger Cars segment commands the largest market share, reflecting the robust demand for new vehicles and the critical role pneumatic actuators play in various passenger car systems.

Application Type Drivers:

- Throttle Actuators: Essential for precise engine air intake control, crucial for optimizing fuel combustion and meeting emission standards.

- Fuel Injection Actuators: Vital for accurate fuel delivery, enhancing engine performance and fuel efficiency in gasoline and diesel engines.

- Brake Actuators: Increasingly sophisticated pneumatic systems are being integrated for enhanced braking performance and safety features, particularly in commercial vehicles.

- Others: This category encompasses actuators for emission control systems, suspension adjustments, and other auxiliary functions that contribute to overall vehicle performance and comfort.

Vehicle Type Drivers:

- Passenger Cars: The sheer volume of passenger car production in Japan, coupled with the continuous need for efficient and reliable actuation in modern vehicle features, solidifies its dominance.

- Commercial Vehicles: While representing a smaller volume, the higher demands for durability, power, and precise control in trucks, buses, and other commercial vehicles make this segment a significant contributor to market value, particularly for brake and emission control actuators.

The dominance of the Passenger Cars segment is underpinned by Japan's strong domestic automotive market and its position as a global exporter of passenger vehicles. Economic growth, infrastructure development, and consumer spending patterns directly influence the demand for new passenger cars, thereby boosting the sales of pneumatic actuators. Similarly, the consistent need for fleet renewal and the stringent performance requirements for commercial vehicles ensure a steady demand for these actuators. The sophisticated technological integration within Japanese vehicles, from engine management to advanced safety systems, necessitates high-quality and precisely engineered pneumatic actuators, further cementing the importance of these segments.

Japan Automotive Pneumatic Actuators Industry Product Developments

Product development in the Japan automotive pneumatic actuators industry is characterized by a focus on miniaturization, enhanced precision, and improved energy efficiency. Innovations are geared towards actuators that offer faster response times, higher force output in smaller packages, and seamless integration with electronic control units (ECUs). Advanced materials and manufacturing techniques are being employed to increase durability and reduce wear, ensuring longer service life under demanding automotive conditions. The market relevance of these developments lies in their ability to support next-generation vehicle technologies, including more sophisticated engine management systems and advanced braking solutions, providing a competitive edge to manufacturers incorporating these cutting-edge pneumatic actuators.

Challenges in the Japan Automotive Pneumatic Actuators Industry Market

The Japan automotive pneumatic actuators market faces several challenges. Intensifying competition from electric actuation technologies presents a significant long-term threat, particularly in applications where space and power efficiency are paramount. Regulatory hurdles related to evolving emissions standards and the increasing complexity of vehicle electrical architectures demand continuous R&D investment and adaptation. Supply chain disruptions, as evidenced by global events, can impact the availability and cost of raw materials. Furthermore, the mature nature of some automotive segments in Japan may lead to slower adoption rates of new pneumatic actuator technologies. These challenges collectively exert pressure on pricing, margins, and the pace of innovation for market participants.

Forces Driving Japan Automotive Pneumatic Actuators Industry Growth

Several key forces are driving the growth of the Japan automotive pneumatic actuators industry. The continued dominance of internal combustion engines, albeit with increasing efficiency mandates, requires precise pneumatic actuation for optimal performance and emissions control. The robust presence of the commercial vehicle sector, with its demanding operational requirements for durability and power, ensures a consistent demand for robust pneumatic solutions. Furthermore, ongoing advancements in pneumatic actuator technology, such as improved sealing, faster response times, and enhanced controllability, are making them more attractive for a wider range of automotive applications. Government initiatives promoting automotive innovation and stricter environmental regulations indirectly incentivize the development and adoption of efficient pneumatic systems that contribute to fuel economy and reduced emissions.

Challenges in the Japan Automotive Pneumatic Actuators Industry Market

Long-term growth catalysts for the Japan automotive pneumatic actuators industry include the ongoing evolution of ICE technology and the increasing demand for hybrid and advanced powertrain systems. As manufacturers continue to refine these technologies for better efficiency and performance, pneumatic actuators will remain integral for precise control of various engine and transmission functions. Strategic partnerships between pneumatic actuator manufacturers and automotive OEMs are crucial for co-developing solutions that meet the specific needs of future vehicle architectures. Moreover, the potential for pneumatic actuators in niche applications beyond traditional engine control, such as advanced active suspension systems or novel cabin comfort features, presents significant market expansion opportunities.

Emerging Opportunities in Japan Automotive Pneumatic Actuators Industry

Emerging opportunities in the Japan automotive pneumatic actuators industry are centered around several key areas. The continued demand for fuel-efficient and low-emission vehicles will drive innovation in pneumatic actuators for advanced engine management and exhaust gas recirculation (EGR) systems. The growing complexity of commercial vehicle systems, including advanced braking and transmission control, presents a significant opportunity for high-performance pneumatic actuators. Furthermore, the potential integration of pneumatic actuators in emerging automotive applications, such as electric vehicle (EV) thermal management systems or even specialized actuator modules within autonomous driving systems, offers new avenues for growth. Collaborations with research institutions and the exploration of novel materials will also unlock opportunities for next-generation pneumatic actuator designs.

Leading Players in the Japan Automotive Pneumatic Actuators Industry Sector

- Denso Corporation

- Delphi Automotive PLC

- Robert Bosch GmbH

- Hitachi Ltd

- ASCO Valve Inc

- Continental AG

- Sahrader Ducan Limited

- Numatics Inc

- CTS Corporation

Key Milestones in Japan Automotive Pneumatic Actuators Industry Industry

- 2019: Introduction of advanced multi-stage pneumatic throttle actuators by leading manufacturers, enabling finer engine control.

- 2020: Increased focus on miniaturization and weight reduction for pneumatic actuators to meet evolving vehicle platform requirements.

- 2021: Development of enhanced sealing technologies for pneumatic fuel injection actuators, improving durability and precision in diverse operating conditions.

- 2022: Growing adoption of smart control units integrated with pneumatic actuators for better diagnostics and adaptive performance.

- 2023: Increased R&D investment in pneumatic brake actuation systems for enhanced safety features in commercial vehicles.

- 2024: Exploration of advanced materials for improved thermal resistance and longevity of pneumatic actuators in high-performance engines.

Strategic Outlook for Japan Automotive Pneumatic Actuators Industry Market

The strategic outlook for the Japan automotive pneumatic actuators market is one of sustained evolution and adaptation. Growth accelerators will be driven by the continuous pursuit of fuel efficiency and emission reduction, where pneumatic actuators remain critical components. Manufacturers that can successfully integrate smart technologies, enhance miniaturization, and offer highly durable solutions will be well-positioned for success. Strategic partnerships and a proactive approach to regulatory changes will be paramount. The market is expected to see a steady demand from both the passenger car and commercial vehicle segments, with opportunities for expansion into novel automotive applications. Investing in R&D for next-generation pneumatic actuation systems will be key to maintaining a competitive edge and capitalizing on future market potential.

Japan Automotive Pneumatic Actuators Industry Segmentation

-

1. Application Type

- 1.1. Throttle Actuators

- 1.2. Fuel Injection Actuators

- 1.3. Brake Actuators

- 1.4. Others

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicle

Japan Automotive Pneumatic Actuators Industry Segmentation By Geography

- 1. Japan

Japan Automotive Pneumatic Actuators Industry Regional Market Share

Geographic Coverage of Japan Automotive Pneumatic Actuators Industry

Japan Automotive Pneumatic Actuators Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Air Pollution Awareness and Health Concern is Driving the Demand

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation Related to Industrial Robots

- 3.4. Market Trends

- 3.4.1. Growing Demand for Throttle Actuators

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Automotive Pneumatic Actuators Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Throttle Actuators

- 5.1.2. Fuel Injection Actuators

- 5.1.3. Brake Actuators

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicle

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Denso Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Delphi Automotive PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Roert Bosch Gmb

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hitachi Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ASCO Valve Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Continental AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sahrader Ducan Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Numatics Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CTS Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Denso Corporation

List of Figures

- Figure 1: Japan Automotive Pneumatic Actuators Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan Automotive Pneumatic Actuators Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Automotive Pneumatic Actuators Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 2: Japan Automotive Pneumatic Actuators Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: Japan Automotive Pneumatic Actuators Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Japan Automotive Pneumatic Actuators Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 5: Japan Automotive Pneumatic Actuators Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: Japan Automotive Pneumatic Actuators Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Automotive Pneumatic Actuators Industry?

The projected CAGR is approximately 5.44%.

2. Which companies are prominent players in the Japan Automotive Pneumatic Actuators Industry?

Key companies in the market include Denso Corporation, Delphi Automotive PLC, Roert Bosch Gmb, Hitachi Ltd, ASCO Valve Inc, Continental AG, Sahrader Ducan Limited, Numatics Inc, CTS Corporation.

3. What are the main segments of the Japan Automotive Pneumatic Actuators Industry?

The market segments include Application Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 24 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Air Pollution Awareness and Health Concern is Driving the Demand.

6. What are the notable trends driving market growth?

Growing Demand for Throttle Actuators.

7. Are there any restraints impacting market growth?

High Cost of Installation Related to Industrial Robots.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Automotive Pneumatic Actuators Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Automotive Pneumatic Actuators Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Automotive Pneumatic Actuators Industry?

To stay informed about further developments, trends, and reports in the Japan Automotive Pneumatic Actuators Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence