Key Insights

The Asia-Pacific automotive seat market is projected for substantial growth, expected to reach $75.33 billion by 2025. Driven by a CAGR of 2.7%, the market will experience sustained expansion through 2033. Key growth factors include rising vehicle demand in emerging economies like China, India, and Southeast Asia, increasing disposable incomes, and evolving consumer preferences for enhanced comfort and safety. Government initiatives supporting domestic automotive manufacturing also act as significant catalysts. The market is seeing a strong shift towards premium and technologically advanced seating solutions, such as powered and ventilated seats, as manufacturers innovate to meet discerning customer demands.

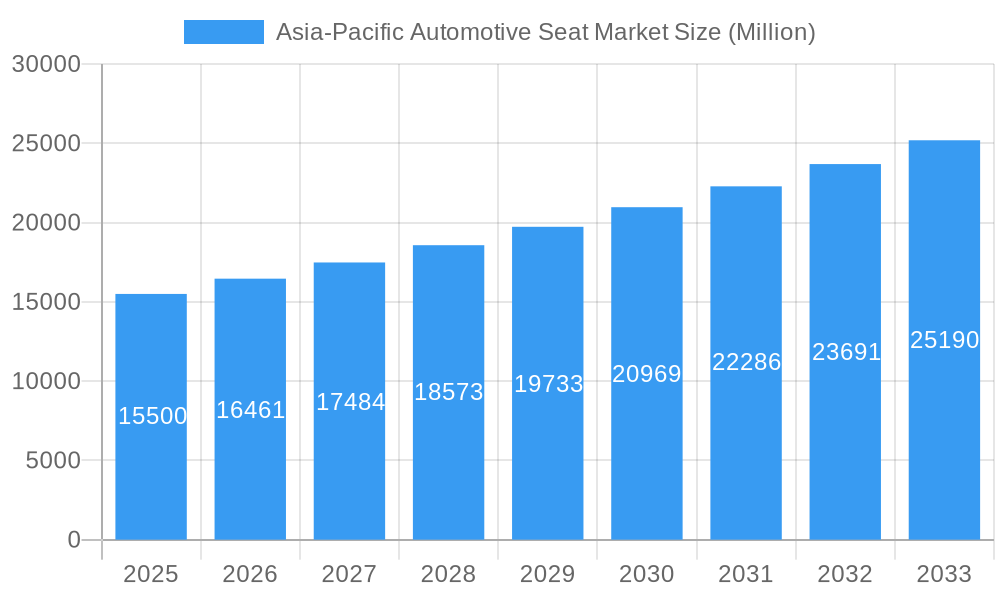

Asia-Pacific Automotive Seat Market Market Size (In Billion)

Segmentation reveals "Fabric" as a dominant material due to cost-effectiveness, while "Leather" caters to the premium segment. "Standard Seats" maintain a significant share, but "Powered Seats" are rapidly adopted, driven by advanced features in mid-range and luxury vehicles. "Passenger Cars" heavily influence the vehicle type segment, alongside notable growth in "Commercial Vehicles," particularly in logistics hubs. Leading players such as Magna International Inc., Toyota Boshoku, and Lear Corporation are investing in R&D for innovative seating solutions focusing on lightweight materials, ergonomics, and safety. Strategic collaborations, mergers, and acquisitions are prevalent as companies aim to expand market reach and technological capabilities.

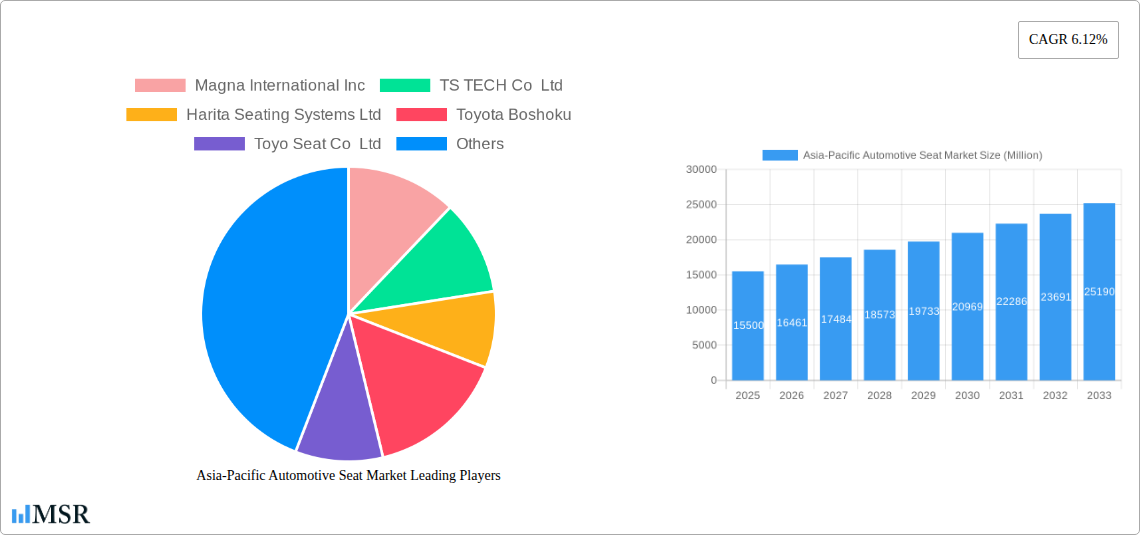

Asia-Pacific Automotive Seat Market Company Market Share

This comprehensive report offers a strategic analysis of the Asia-Pacific automotive seat market, providing deep insights into market dynamics, growth drivers, challenges, and future outlook. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period through 2033, this report delivers actionable intelligence for stakeholders. Explore the latest advancements in automotive seat technology, material innovations, and vehicle interior trends shaping the future of mobility in the APAC region.

Asia-Pacific Automotive Seat Market Market Concentration & Dynamics

The Asia-Pacific automotive seat market is characterized by a moderate to high level of concentration, with key players like Magna International Inc., TS TECH Co Ltd, Harita Seating Systems Ltd, Toyota Boshoku, Toyo Seat Co Ltd, TACHI-S Co Ltd, Lear Corporation, Faurecia, NHK Spring, and Adient PLC holding significant market share. The innovation ecosystem is robust, driven by an increasing focus on lightweight seating solutions, enhanced safety features, and premium comfort. Regulatory frameworks, particularly concerning child safety seats and emissions standards impacting vehicle design, are continuously evolving and influencing product development. Substitute products, such as aftermarket seat covers and accessories, offer some competition but do not significantly detract from the demand for integrated automotive seating solutions. End-user trends are leaning towards customizable and ergonomic designs, with a growing preference for sustainable materials. Mergers and acquisitions (M&A) activities are observed, albeit with a moderate deal count, as companies seek to expand their geographical reach and technological capabilities. For instance, there were approximately 15-20 M&A deals in the last five years, primarily focused on technology acquisition and market consolidation. This strategic landscape underscores the dynamic nature of the automotive seating industry in the Asia-Pacific region.

Asia-Pacific Automotive Seat Market Industry Insights & Trends

The Asia-Pacific automotive seat market is poised for significant expansion, driven by robust economic growth, rising disposable incomes, and an ever-increasing vehicle production and sales volume across key economies like China, India, Japan, and South Korea. The market size for automotive seats in the APAC region is estimated to reach approximately USD 30,000 Million by 2025, with a projected Compound Annual Growth Rate (CAGR) of around 5.5% during the forecast period (2025-2033). Technological disruptions are a major catalyst, with a pronounced shift towards powered seats, ventilated seats, and advanced ergonomic seating systems designed to enhance passenger comfort and safety. The increasing adoption of electric vehicles (EVs) is also influencing seat design, necessitating lighter and more integrated solutions that optimize space and energy efficiency. Evolving consumer behaviors are a crucial factor, with a growing demand for personalized interiors, advanced infotainment integration within seats, and premium material finishes such as high-quality leather and sustainable fabrics. The increasing popularity of SUVs and premium passenger cars, coupled with government initiatives promoting automotive manufacturing and adoption, further fuels market growth. The automotive seat market share by technology type is expected to see a significant rise in powered and ventilated seat segments, reflecting consumer willingness to invest in enhanced comfort features.

Key Markets & Segments Leading Asia-Pacific Automotive Seat Market

The Asia-Pacific automotive seat market is dominated by the Passenger Car segment, which accounts for a substantial market share of approximately 70% in 2025. Within vehicle types, the increasing demand for personal mobility and the growing middle class in countries like China and India are primary drivers for passenger car sales, directly impacting the automotive seat market. Economically, the strong automotive manufacturing base in Japan and South Korea, coupled with the burgeoning production in Southeast Asian nations, contributes significantly to the dominance of this segment. Infrastructure development and favorable government policies supporting the automotive industry further bolster this trend.

When examining Material Type, the Fabric segment holds a leading position, projected to capture around 55% of the market share in 2025. This is attributed to its cost-effectiveness, durability, and wide range of customization options, making it a popular choice across various vehicle segments. However, the Leather segment is experiencing robust growth, driven by consumer preferences for premium interiors and a rising demand for luxury vehicles. The Other material segment, which includes sustainable and innovative composite materials, is also gaining traction due to increasing environmental consciousness and the push for lightweight solutions.

In terms of Technology Type, Standard Seats continue to command a significant market share, reflecting their widespread adoption in entry-level and mid-range vehicles. However, the Powered Seats and Ventilated Seats segments are projected to exhibit the highest growth rates. This surge is fueled by consumer demand for enhanced comfort, convenience, and advanced features, particularly in mid-to-high-end vehicles. The growing awareness and stringent regulations surrounding child safety are also driving the demand for Child Safety Seats, although this segment is more specialized. The Other Seats category, encompassing specialized seats for commercial vehicles and innovative designs, is also expected to contribute to market diversification.

Asia-Pacific Automotive Seat Market Product Developments

Product developments in the Asia-Pacific automotive seat market are largely focused on enhancing occupant safety, comfort, and sustainability. Innovations include advanced materials for reduced weight and improved recyclability, smart seating technologies that monitor occupant health and posture, and integrated heating, cooling, and massage functions. The rise of electric vehicles is also spurring the development of modular seat designs that optimize interior space and integrate battery management systems. Companies are investing heavily in research and development to meet evolving OEM demands for sophisticated and integrated seating solutions that enhance the overall in-cabin experience.

Challenges in the Asia-Pacific Automotive Seat Market Market

Despite the positive growth trajectory, the Asia-Pacific automotive seat market faces several challenges. These include fluctuating raw material prices, particularly for plastics and metals used in seat manufacturing, which can impact profit margins. Stringent environmental regulations and the growing demand for sustainable materials add complexity to production processes and supply chains. Intense price competition among manufacturers and the need for continuous investment in R&D to keep pace with technological advancements also pose significant hurdles. Furthermore, geopolitical uncertainties and trade tensions can disrupt supply chains and impact demand in key export markets.

Forces Driving Asia-Pacific Automotive Seat Market Growth

Several key forces are propelling the growth of the Asia-Pacific automotive seat market. The burgeoning automotive industry across countries like China, India, and Southeast Asia, fueled by increasing disposable incomes and urbanization, is a primary driver. Technological advancements in seat design, leading to lighter, safer, and more comfortable seating solutions, are attracting consumer interest. Government initiatives supporting the automotive sector, coupled with a rising demand for premium features and personalized in-cabin experiences, are further accelerating market expansion. The increasing adoption of electric vehicles also necessitates innovative seating solutions, creating new market opportunities.

Challenges in the Asia-Pacific Automotive Seat Market Market

Long-term growth catalysts for the Asia-Pacific automotive seat market lie in continuous innovation and strategic partnerships. The development of highly integrated smart seating systems, incorporating advanced sensor technologies for occupant monitoring and personalized climate control, represents a significant opportunity. Collaborations between seat manufacturers, automotive OEMs, and technology providers will be crucial for developing next-generation seating solutions. Expanding into emerging markets within the APAC region and catering to the growing demand for premium and customized seating experiences will also be key to sustained growth.

Emerging Opportunities in Asia-Pacific Automotive Seat Market

Emerging opportunities in the Asia-Pacific automotive seat market are abundant, particularly in the development of sustainable and lightweight seating solutions. The growing demand for electric vehicles presents a significant avenue for innovation in space-saving and energy-efficient seat designs. The increasing penetration of autonomous driving technology will necessitate reconfigurable and highly comfortable interior spaces, opening doors for advanced seating concepts. Furthermore, the rise of shared mobility services and the demand for durable and easily maintainable seats in commercial vehicles represent untapped market potential.

Leading Players in the Asia-Pacific Automotive Seat Market Sector

- Magna International Inc.

- TS TECH Co Ltd

- Harita Seating Systems Ltd

- Toyota Boshoku

- Toyo Seat Co Ltd

- TACHI-S Co Ltd

- Lear Corporation

- Faurecia

- NHK Spring

- Adient PLC

Key Milestones in Asia-Pacific Automotive Seat Market Industry

- 2019: Increased adoption of advanced driver-assistance systems (ADAS) influencing seat design for better camera and sensor integration.

- 2020: Growing focus on sustainable materials in automotive seating due to environmental regulations and consumer demand.

- 2021: Significant surge in R&D for lightweight seating solutions to improve fuel efficiency and EV range.

- 2022: Launch of innovative ventilated and heated seat technologies in mid-range vehicles, expanding consumer access.

- 2023: Increased M&A activity targeting companies with expertise in smart seating technology and sustainable materials.

- 2024: Stronger emphasis on modular seat designs to cater to evolving vehicle architectures, especially in EVs.

Strategic Outlook for Asia-Pacific Automotive Seat Market Market

The strategic outlook for the Asia-Pacific automotive seat market is highly optimistic, driven by sustained demand for vehicles and continuous technological advancements. Future growth will be accelerated by a focus on developing intelligent seating systems that integrate advanced comfort, safety, and connectivity features. Strategic investments in R&D for sustainable and lightweight materials, alongside collaborations with OEMs to co-develop innovative interior solutions for electric and autonomous vehicles, will be paramount. Expanding market presence in rapidly developing economies and catering to evolving consumer preferences for premium and personalized in-cabin experiences will be key to capitalizing on the vast market potential.

Asia-Pacific Automotive Seat Market Segmentation

-

1. Material Type

- 1.1. Leather

- 1.2. Fabric

- 1.3. Other

-

2. Technology Type

- 2.1. Standard Seats

- 2.2. Powered Seats

- 2.3. Ventilated Seats

- 2.4. Child Safety Seats

- 2.5. Other Seats

-

3. Vehicle Type

- 3.1. Passenger Car

- 3.2. Commercial Vehicle

Asia-Pacific Automotive Seat Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

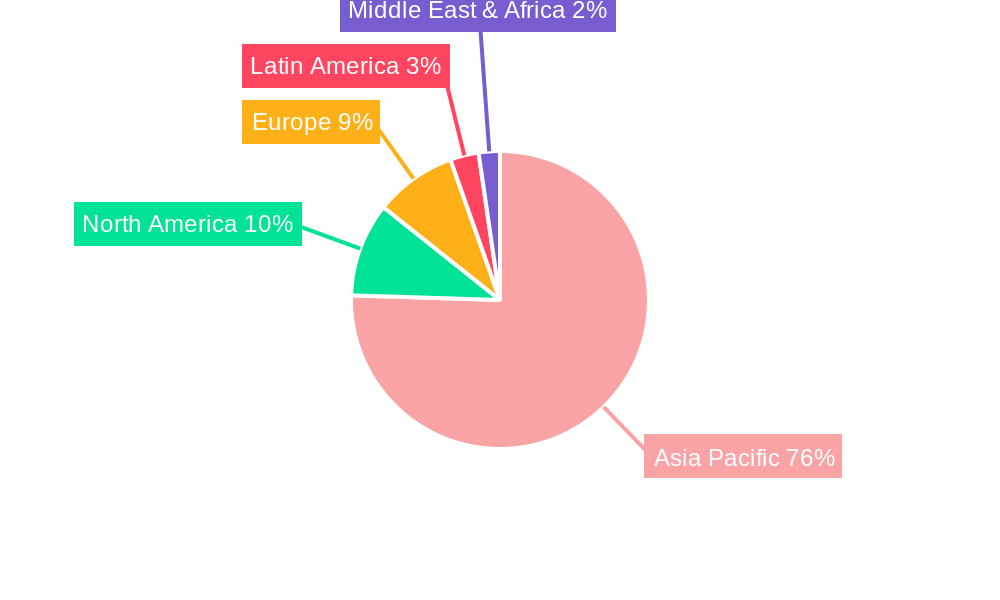

Asia-Pacific Automotive Seat Market Regional Market Share

Geographic Coverage of Asia-Pacific Automotive Seat Market

Asia-Pacific Automotive Seat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Increase in Automotive Sector

- 3.3. Market Restrains

- 3.3.1. Digitization of R&D Operations in Automotive Sector

- 3.4. Market Trends

- 3.4.1. Increase in Electric Vehicle Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Automotive Seat Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Leather

- 5.1.2. Fabric

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Technology Type

- 5.2.1. Standard Seats

- 5.2.2. Powered Seats

- 5.2.3. Ventilated Seats

- 5.2.4. Child Safety Seats

- 5.2.5. Other Seats

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Car

- 5.3.2. Commercial Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Magna International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TS TECH Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Harita Seating Systems Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toyota Boshoku

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toyo Seat Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TACHI-S Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lear Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Faurecia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 NHK Sprin

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Adient PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Magna International Inc

List of Figures

- Figure 1: Asia-Pacific Automotive Seat Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Automotive Seat Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Automotive Seat Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Asia-Pacific Automotive Seat Market Revenue billion Forecast, by Technology Type 2020 & 2033

- Table 3: Asia-Pacific Automotive Seat Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: Asia-Pacific Automotive Seat Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Automotive Seat Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Asia-Pacific Automotive Seat Market Revenue billion Forecast, by Technology Type 2020 & 2033

- Table 7: Asia-Pacific Automotive Seat Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 8: Asia-Pacific Automotive Seat Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Automotive Seat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia-Pacific Automotive Seat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific Automotive Seat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: India Asia-Pacific Automotive Seat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific Automotive Seat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia-Pacific Automotive Seat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia-Pacific Automotive Seat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia-Pacific Automotive Seat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia-Pacific Automotive Seat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia-Pacific Automotive Seat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia-Pacific Automotive Seat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia-Pacific Automotive Seat Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Automotive Seat Market?

The projected CAGR is approximately 2.7%.

2. Which companies are prominent players in the Asia-Pacific Automotive Seat Market?

Key companies in the market include Magna International Inc, TS TECH Co Ltd, Harita Seating Systems Ltd, Toyota Boshoku, Toyo Seat Co Ltd, TACHI-S Co Ltd, Lear Corporation, Faurecia, NHK Sprin, Adient PLC.

3. What are the main segments of the Asia-Pacific Automotive Seat Market?

The market segments include Material Type, Technology Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 75.33 billion as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in Automotive Sector.

6. What are the notable trends driving market growth?

Increase in Electric Vehicle Production.

7. Are there any restraints impacting market growth?

Digitization of R&D Operations in Automotive Sector.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Automotive Seat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Automotive Seat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Automotive Seat Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Automotive Seat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence