Key Insights

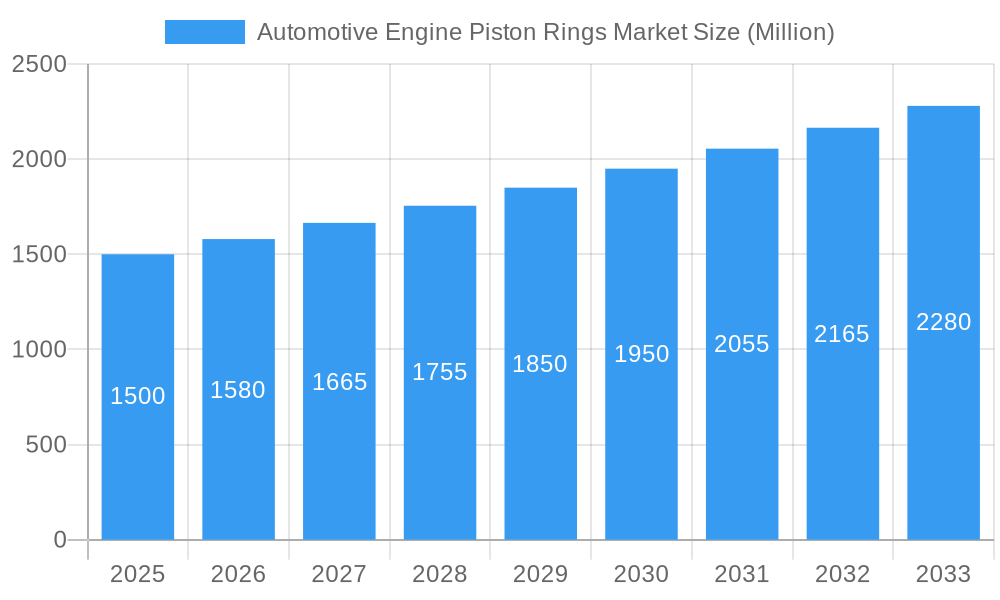

The global Automotive Engine Piston Rings Market is poised for substantial growth, estimated to be valued at approximately $1,500 million in 2025, with a projected Compound Annual Growth Rate (CAGR) exceeding 5.00% throughout the forecast period of 2025-2033. This robust expansion is primarily driven by the increasing global vehicle parc and the consistent demand for engine replacements and upgrades. Key growth catalysts include advancements in engine technology aimed at improving fuel efficiency and reducing emissions, which necessitate sophisticated piston ring designs. The rising production of both passenger vehicles and commercial vehicles worldwide directly translates to a higher demand for piston rings. Furthermore, a growing emphasis on lightweighting in automotive manufacturing is stimulating the use of advanced materials like aluminum in piston rings, alongside traditional steel, to enhance performance and fuel economy. The aftermarket segment also contributes significantly, fueled by the aging vehicle population requiring maintenance and repair.

Automotive Engine Piston Rings Market Market Size (In Billion)

The market dynamics are further shaped by significant trends such as the integration of advanced coatings and surface treatments on piston rings to reduce friction and wear, thereby extending engine life and improving performance. The increasing adoption of electric vehicles (EVs) is a notable factor, though the core internal combustion engine (ICE) market remains strong, especially in emerging economies. However, stringent emission regulations across major automotive hubs like Europe and North America are pushing manufacturers to develop more efficient and durable piston rings, thereby presenting a substantial opportunity for innovation and market penetration. Restraints to market growth include the potential impact of the global shift towards electrification, which could gradually reduce the long-term demand for ICE components. Despite this, the sheer volume of existing ICE vehicles and the continued production in many regions ensure a sustained market for piston rings for the foreseeable future. Leading companies like TPR CO Ltd, Riken Corporation, and Nippon Piston Rings are actively investing in research and development to capitalize on these evolving market demands.

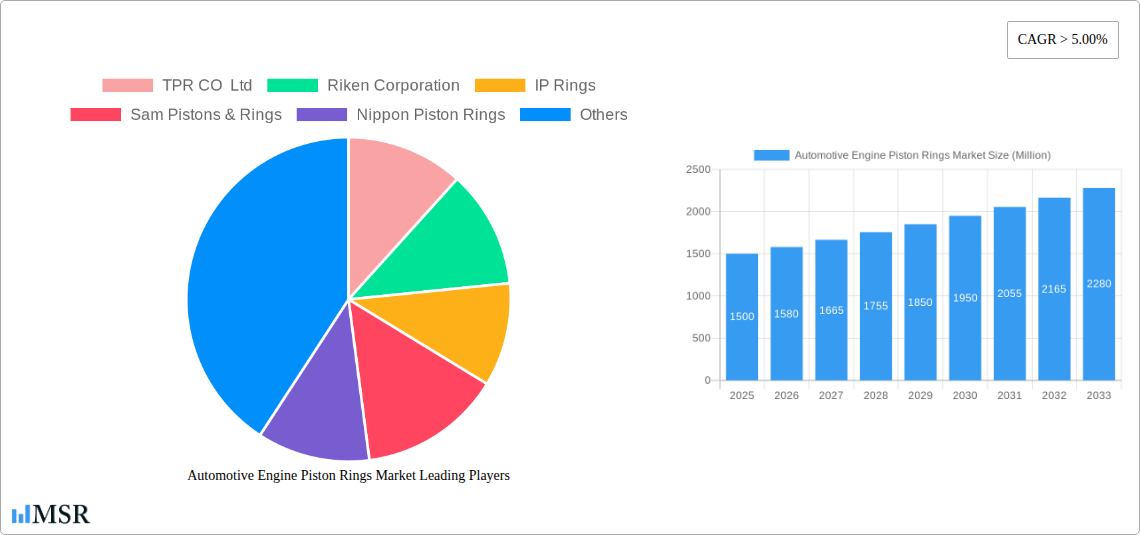

Automotive Engine Piston Rings Market Company Market Share

Here's the SEO-optimized report description for the Automotive Engine Piston Rings Market:

Automotive Engine Piston Rings Market: Comprehensive Analysis & Future Outlook (2019-2033)

Dive deep into the global Automotive Engine Piston Rings Market with this in-depth report, providing critical insights and strategic guidance for stakeholders. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this study analyzes market dynamics, industry trends, key segments, and leading players. Gain a competitive edge with actionable data on market size, growth drivers, technological advancements, and emerging opportunities in the vital automotive aftermarket and OEM sectors.

Automotive Engine Piston Rings Market Market Concentration & Dynamics

The Automotive Engine Piston Rings Market exhibits a moderate to high level of concentration, with key players such as TPR CO Ltd, Riken Corporation, IP Rings, and Nippon Piston Rings holding significant market share. The innovation ecosystem is driven by continuous R&D in material science and manufacturing processes to enhance engine efficiency and reduce emissions. Regulatory frameworks, particularly those focused on emissions standards (e.g., Euro 7, EPA mandates), are increasingly influencing product development and adoption rates. The threat of substitute products is relatively low due to the fundamental role of piston rings in internal combustion engines. End-user trends are shifting towards lighter, more durable, and fuel-efficient piston ring solutions, driven by consumer demand for better fuel economy and lower environmental impact. Mergers and acquisitions (M&A) activities are selective, focusing on consolidating technological capabilities or expanding geographical reach. For instance, a recent notable M&A deal involved the acquisition of a smaller piston ring manufacturer by a larger entity to bolster its product portfolio in the passenger vehicle segment. The market anticipates approximately 15-20 significant M&A deals within the forecast period, aimed at strategic advantage and market expansion.

Automotive Engine Piston Rings Market Industry Insights & Trends

The Automotive Engine Piston Rings Market is poised for robust growth, projected to reach an estimated value of $12,500 Million by 2025 and expand to $16,800 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 3.5% during the forecast period (2025–2033). This expansion is underpinned by several dynamic forces. The increasing global vehicle parc, especially in emerging economies, directly translates to higher demand for replacement piston rings and original equipment. Furthermore, stringent emission regulations worldwide are compelling Original Equipment Manufacturers (OEMs) to adopt advanced piston ring designs that improve combustion efficiency and reduce pollutant emissions. This includes the development of specialized coatings and materials that offer enhanced wear resistance and reduced friction.

Technological disruptions are a significant trend, with a growing emphasis on lightweight materials like advanced aluminum alloys and sophisticated steel compositions. Innovations in surface treatments, such as plasma coatings and nitriding, are crucial for improving performance and extending the lifespan of piston rings, even under extreme operating conditions. The rise of hybrid and electric vehicles, while posing a long-term challenge to the internal combustion engine market, also presents opportunities. Hybrid vehicles still rely on internal combustion engines, which require high-performance piston rings, and advancements in these engines for hybrid applications are a key focus.

Evolving consumer behaviors are also shaping the market. Consumers are increasingly aware of fuel efficiency and environmental impact, driving demand for vehicles that deliver better mileage and lower emissions. This, in turn, influences the types of piston rings that OEMs select for their vehicles. The aftermarket segment is also witnessing growth, fueled by the need for reliable and cost-effective replacement parts. The increasing average age of vehicles on the road in many developed markets contributes to a steady demand for replacement piston rings.

Key Markets & Segments Leading Automotive Engine Piston Rings Market

The Passenger Vehicles segment currently dominates the Automotive Engine Piston Rings Market, accounting for approximately 65% of the global market value. This dominance is driven by the sheer volume of passenger cars produced and the extensive aftermarket for these vehicles. Within this segment, Steel piston rings are the most prevalent material type, favored for their durability, strength, and cost-effectiveness in a wide range of applications. However, there's a notable trend towards advanced aluminum alloys for weight reduction, particularly in high-performance and fuel-efficient passenger vehicles.

The Commercial Vehicles segment, while smaller in volume, represents a significant and growing market for piston rings. This segment includes trucks, buses, and other heavy-duty vehicles that operate under demanding conditions, requiring robust and highly durable piston ring solutions. The demand for commercial vehicles is closely linked to economic growth and infrastructure development, making regions with strong industrial activity key markets.

Dominance Analysis:

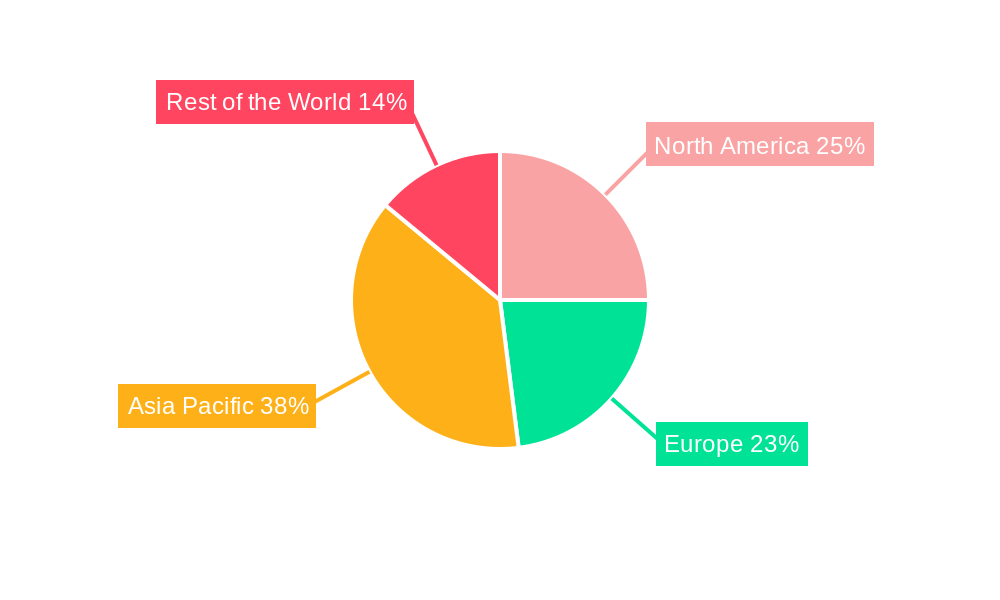

- Geographical Dominance: Asia Pacific, particularly China and India, is the leading region for both production and consumption of automotive engine piston rings. This is attributed to the massive automotive manufacturing base, growing domestic vehicle sales, and increasing adoption of stricter emission standards. The region is expected to maintain its leadership position throughout the forecast period, with an estimated market share of over 40%.

- Vehicle Type Dominance: The Passenger Vehicles segment's leadership is sustained by its high production volumes and continuous model updates, driving demand for both OEM and aftermarket piston rings.

- Material Type Dominance: While Steel piston rings continue to lead due to their established performance and cost-effectiveness, the market is witnessing a gradual shift towards high-performance materials. This includes specialized steel alloys and advanced aluminum composites, particularly in premium passenger vehicles and performance-oriented engines, for improved thermal efficiency and reduced friction.

Automotive Engine Piston Rings Market Product Developments

Product developments in the Automotive Engine Piston Rings Market are primarily focused on enhancing engine performance, durability, and emission compliance. Innovations include advanced surface coatings like DLC (Diamond-Like Carbon) and PVD (Physical Vapor Deposition) for reduced friction and wear. Manufacturers are also developing lighter-weight piston rings using advanced aluminum alloys and optimized designs to improve fuel efficiency and reduce reciprocating mass. Novel ring profiles and tensioning technologies are being introduced to optimize combustion sealing under various operating conditions, contributing to lower oil consumption and improved power output. These advancements are crucial for meeting increasingly stringent emissions regulations and the evolving demands of the automotive industry.

Challenges in the Automotive Engine Piston Rings Market Market

The Automotive Engine Piston Rings Market faces several significant challenges. The increasing penetration of electric vehicles (EVs) poses a long-term threat, as EVs do not utilize internal combustion engines and thus do not require piston rings. Fluctuations in raw material prices, particularly steel and specialized alloys, can impact manufacturing costs and profitability. Stringent and evolving emission regulations necessitate continuous investment in R&D to develop compliant products, which can be a significant financial burden for smaller manufacturers. Supply chain disruptions, as witnessed in recent global events, can lead to production delays and increased lead times. Furthermore, intense price competition, especially in the aftermarket segment, can pressure profit margins.

Forces Driving Automotive Engine Piston Rings Market Growth

Several powerful forces are driving the growth of the Automotive Engine Piston Rings Market. The continuous global demand for internal combustion engine vehicles, especially in developing economies, provides a steady base for market expansion. Stringent emission control norms worldwide are compelling automakers to improve engine efficiency and reduce emissions, directly boosting the demand for advanced piston ring technologies. Technological advancements, such as new materials and coating techniques, enhance the performance and durability of piston rings, creating opportunities for premium products. The growing vehicle parc and the average age of vehicles on the road also fuel the demand for replacement piston rings in the aftermarket segment, which is a substantial revenue stream.

Challenges in the Automotive Engine Piston Rings Market Market

Despite the positive outlook, long-term growth catalysts need careful consideration. The transition towards electric mobility presents a significant long-term challenge, as it gradually reduces the overall demand for internal combustion engine components. Manufacturers must strategically adapt to this shift, perhaps by focusing on niche internal combustion engine applications or diversifying into related areas. Furthermore, the continuous need for substantial investment in research and development to keep pace with technological advancements and emission standards can be a barrier to entry and growth for smaller players. Global economic uncertainties and trade policies can also impact raw material sourcing and market access, requiring robust supply chain management and market diversification strategies.

Emerging Opportunities in Automotive Engine Piston Rings Market

Emerging opportunities in the Automotive Engine Piston Rings Market lie in several key areas. The development of highly efficient and durable piston rings for hybrid vehicle powertrains presents a significant growth avenue as these vehicles continue to gain market share. Customization of piston rings for specialized engines, such as those used in performance vehicles or heavy-duty industrial applications, offers higher profit margins. The growing aftermarket demand in emerging economies, driven by the increasing vehicle parc and rising disposable incomes, provides substantial expansion potential. Furthermore, advancements in material science and manufacturing processes, such as additive manufacturing, could unlock new possibilities for innovative and cost-effective piston ring designs. Exploring partnerships with OEMs for co-development of next-generation engine components also represents a strategic opportunity.

Leading Players in the Automotive Engine Piston Rings Market Sector

- TPR CO Ltd

- Riken Corporation

- IP Rings

- Sam Pistons & Rings

- Nippon Piston Rings

- Abilities India Piston & Ring

- Grover Corporation

- Asimco Technologies

- Feder Mogul LLC

- Shriram Pistons & Rings Ltd

Key Milestones in Automotive Engine Piston Rings Market Industry

- 2019: Increased adoption of advanced PVD coatings for enhanced wear resistance in performance engines.

- 2020: Emergence of lightweight aluminum alloy piston rings for improved fuel efficiency in passenger vehicles.

- 2021: Development of specialized piston rings for enhanced performance in hybrid vehicle powertrains.

- 2022: Significant R&D investment in DLC (Diamond-Like Carbon) coatings for reduced friction and increased durability.

- 2023: Growing focus on sustainable manufacturing practices and recycled materials in piston ring production.

- 2024: Introduction of optimized ring profiles to meet stricter global emission standards.

- 2025 (Estimated): Increased market penetration of piston rings with advanced surface treatments for extended lifespan.

Strategic Outlook for Automotive Engine Piston Rings Market Market

The strategic outlook for the Automotive Engine Piston Rings Market is one of adaptation and innovation. While the long-term shift towards electrification presents a challenge, the continued relevance of internal combustion engines in hybrid powertrains and in developing markets offers sustained growth potential. Key strategies for success will involve a strong focus on research and development to create high-performance, emission-compliant piston rings. Investing in advanced manufacturing technologies and materials science will be crucial for maintaining a competitive edge. Expanding market reach into high-growth emerging economies and strengthening relationships with OEMs for co-development will be vital. Furthermore, exploring diversification into related engine components or aftermarket services could provide additional revenue streams and mitigate risks associated with the evolving automotive landscape.

Automotive Engine Piston Rings Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicles

- 1.2. Commercial Vehicles

-

2. Material Type

- 2.1. Steel

- 2.2. Aluminum

Automotive Engine Piston Rings Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Mexico

- 4.3. United Arab Emirates

- 4.4. Other Countries

Automotive Engine Piston Rings Market Regional Market Share

Geographic Coverage of Automotive Engine Piston Rings Market

Automotive Engine Piston Rings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Travel and Tourism to Fuel Market Demand

- 3.3. Market Restrains

- 3.3.1. High Maintenance cost of RV Rental Fleets

- 3.4. Market Trends

- 3.4.1. Electric Vehicles Sales During the Forecast Period will be a Restraint for the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Engine Piston Rings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicles

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Steel

- 5.2.2. Aluminum

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Automotive Engine Piston Rings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Vehicles

- 6.1.2. Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Material Type

- 6.2.1. Steel

- 6.2.2. Aluminum

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Automotive Engine Piston Rings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Vehicles

- 7.1.2. Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Material Type

- 7.2.1. Steel

- 7.2.2. Aluminum

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Automotive Engine Piston Rings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Vehicles

- 8.1.2. Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Material Type

- 8.2.1. Steel

- 8.2.2. Aluminum

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Automotive Engine Piston Rings Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Vehicles

- 9.1.2. Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Material Type

- 9.2.1. Steel

- 9.2.2. Aluminum

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 TPR CO Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Riken Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 IP Rings

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Sam Pistons & Rings

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Nippon Piston Rings

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Abilities India Piston & Ring

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Grover Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Asimco Technologies

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Feder Mogul LLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Shriram Pistons & Rings Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 TPR CO Ltd

List of Figures

- Figure 1: Global Automotive Engine Piston Rings Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Automotive Engine Piston Rings Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 3: North America Automotive Engine Piston Rings Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Automotive Engine Piston Rings Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 5: North America Automotive Engine Piston Rings Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 6: North America Automotive Engine Piston Rings Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Automotive Engine Piston Rings Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automotive Engine Piston Rings Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 9: Europe Automotive Engine Piston Rings Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: Europe Automotive Engine Piston Rings Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 11: Europe Automotive Engine Piston Rings Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 12: Europe Automotive Engine Piston Rings Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Automotive Engine Piston Rings Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automotive Engine Piston Rings Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 15: Asia Pacific Automotive Engine Piston Rings Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Asia Pacific Automotive Engine Piston Rings Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 17: Asia Pacific Automotive Engine Piston Rings Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 18: Asia Pacific Automotive Engine Piston Rings Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Automotive Engine Piston Rings Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Automotive Engine Piston Rings Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 21: Rest of the World Automotive Engine Piston Rings Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Rest of the World Automotive Engine Piston Rings Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 23: Rest of the World Automotive Engine Piston Rings Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 24: Rest of the World Automotive Engine Piston Rings Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Automotive Engine Piston Rings Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 3: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 6: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 11: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 12: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 18: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 19: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: India Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: China Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Japan Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: South Korea Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 26: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 27: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: Brazil Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Mexico Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: United Arab Emirates Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Other Countries Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Engine Piston Rings Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Automotive Engine Piston Rings Market?

Key companies in the market include TPR CO Ltd, Riken Corporation, IP Rings, Sam Pistons & Rings, Nippon Piston Rings, Abilities India Piston & Ring, Grover Corporation, Asimco Technologies, Feder Mogul LLC, Shriram Pistons & Rings Ltd.

3. What are the main segments of the Automotive Engine Piston Rings Market?

The market segments include Vehicle Type, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Travel and Tourism to Fuel Market Demand.

6. What are the notable trends driving market growth?

Electric Vehicles Sales During the Forecast Period will be a Restraint for the Market.

7. Are there any restraints impacting market growth?

High Maintenance cost of RV Rental Fleets.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Engine Piston Rings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Engine Piston Rings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Engine Piston Rings Market?

To stay informed about further developments, trends, and reports in the Automotive Engine Piston Rings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence