Key Insights

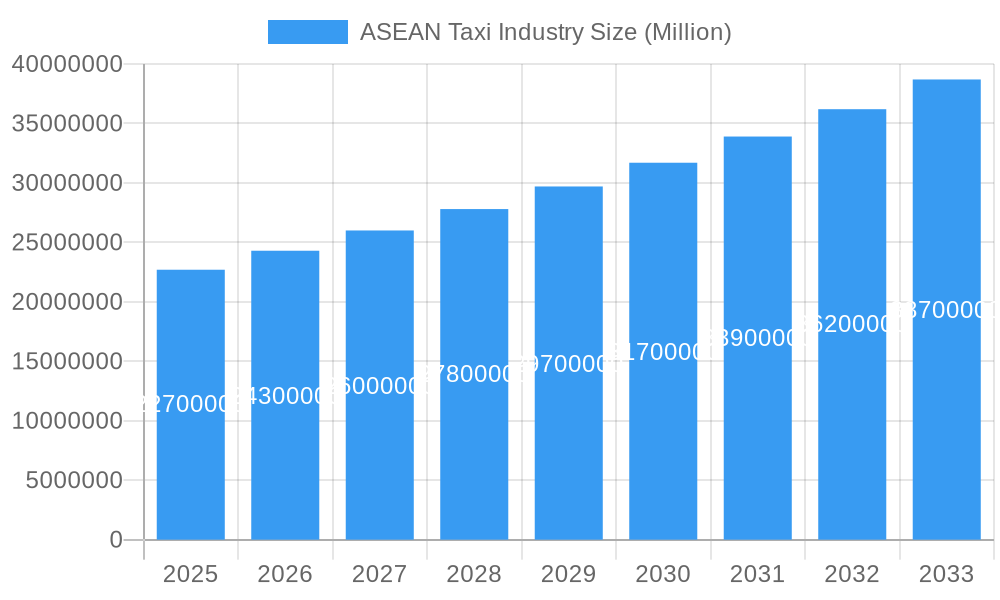

The ASEAN taxi industry is poised for substantial growth, projected to reach a market size of approximately USD 22.70 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 7.40% anticipated to sustain this momentum throughout the forecast period of 2025-2033. This robust expansion is primarily driven by the increasing adoption of digital platforms and the burgeoning demand for convenient and efficient transportation solutions across the region. The escalating urbanization and a growing middle class with higher disposable incomes are significant contributors, fueling the demand for both ride-hailing and ride-sharing services. Furthermore, the integration of advanced technologies such as AI-powered dispatch systems, real-time tracking, and cashless payment options is enhancing user experience and operational efficiency, thereby consolidating the industry's growth trajectory. The surge in smartphone penetration and internet accessibility across Southeast Asia has democratized access to these services, making them a preferred choice for daily commutes and intercity travel.

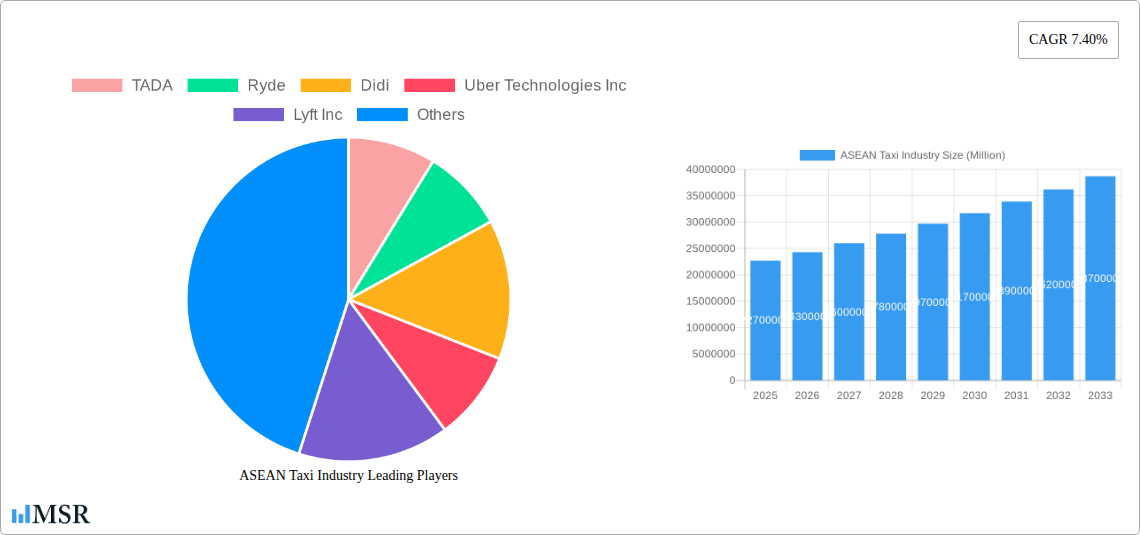

ASEAN Taxi Industry Market Size (In Million)

Key trends shaping the ASEAN taxi market include a strong preference for online booking platforms, which have revolutionized the traditional taxi service model by offering greater convenience, transparency, and competitive pricing. While offline bookings will continue to hold a share, particularly in less digitized areas, the digital segment is expected to dominate. Vehicle type segmentation reveals a significant demand for cars, reflecting their suitability for various passenger needs, alongside a growing niche for motorcycles in congested urban environments for quicker transit. Service-wise, ride-hailing services are expected to lead the market due to their on-demand nature and widespread availability, while ride-sharing is gaining traction as a more cost-effective and environmentally conscious option. Major players like Grab, Gojek, Uber, and Didi are aggressively innovating and expanding their service offerings, intensifying competition but also stimulating market development. Despite this promising outlook, challenges such as regulatory hurdles in certain countries and the need for continuous infrastructure development to support growing demand present moderating factors to the overall growth.

ASEAN Taxi Industry Company Market Share

ASEAN Taxi Industry Market Analysis: Growth, Trends, and Opportunities (2019-2033)

This comprehensive report offers an in-depth analysis of the ASEAN Taxi Industry, a rapidly evolving sector driven by technological advancements, changing consumer preferences, and robust economic growth. Spanning the Study Period: 2019–2033, with a Base Year: 2025 and Forecast Period: 2025–2033, this report provides actionable insights for stakeholders, including ride-hailing platforms, traditional taxi operators, investors, and policymakers. We delve into market concentration, key industry insights, leading segments, product developments, challenges, growth drivers, emerging opportunities, and strategic outlooks, supported by data from the Historical Period: 2019–2024.

ASEAN Taxi Industry Market Concentration & Dynamics

The ASEAN taxi industry exhibits a dynamic market concentration, heavily influenced by the dominance of major ride-hailing players and ongoing consolidation activities. Key market participants such as Grab Holdings Inc, PT Gojek, TADA, Ryde, Didi, Uber Technologies Inc, Lyft Inc, Public Cab Sdn Bhd, and Blue Cab Malaysia are continuously vying for market share, which is estimated to be over 75% controlled by the top three ride-hailing giants. Innovation ecosystems are thriving, fueled by significant investments in technology, including AI-powered dispatch systems and dynamic pricing models. Regulatory frameworks across ASEAN nations are a critical factor, with governments increasingly focusing on passenger safety, driver welfare, and fair competition, impacting operational models and market entry. The threat of substitute products, such as public transportation, personal vehicle ownership, and the emerging micro-mobility solutions, remains a constant consideration. End-user trends are overwhelmingly shifting towards convenience, affordability, and digital-first booking experiences, significantly impacting offline booking channels. Merger and acquisition (M&A) activities, with an estimated 20+ deals over the historical period, have been instrumental in shaping market concentration, allowing established players to expand their geographical reach and service offerings. The market is characterized by intense competition, with players constantly innovating to retain and grow their customer base.

ASEAN Taxi Industry Industry Insights & Trends

The ASEAN Taxi Industry is poised for substantial growth, projected to reach an estimated market size of USD 25 Billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 18% during the forecast period. This expansion is primarily fueled by several interconnected factors. Firstly, rapid urbanization across Southeast Asia, leading to increased population density in major cities, directly translates to a higher demand for efficient and accessible transportation solutions. The burgeoning middle class, with its growing disposable income, is increasingly adopting ride-hailing services for their convenience and perceived value compared to traditional taxis.

Technological disruptions are at the forefront of industry transformation. The widespread adoption of smartphones and mobile internet connectivity has been a foundational enabler for the growth of online booking platforms. Advanced algorithms for route optimization, real-time tracking, and dynamic pricing are enhancing operational efficiency and customer satisfaction. Furthermore, the integration of Artificial Intelligence (AI) is paving the way for predictive analytics, personalized user experiences, and improved safety features. The increasing investment in electric vehicles (EVs) by major players and governments alike signals a significant shift towards sustainable transportation, appealing to environmentally conscious consumers and aligning with regional climate goals.

Evolving consumer behaviors are a critical driver. Modern consumers, particularly the younger demographic, prioritize seamless digital experiences, expecting instant booking, transparent pricing, and a wide array of service options. This has led to a decline in the reliance on traditional, offline taxi booking methods. The demand for on-demand services, flexible scheduling, and integrated payment solutions further solidifies the dominance of app-based platforms. Moreover, the pandemic has accelerated the adoption of contactless services and increased the perceived safety and hygiene standards associated with ride-hailing, further solidifying its position in the market. The trend towards ride-sharing options, driven by cost-consciousness and environmental awareness, is also gaining traction, offering an additional layer of service diversification.

Key Markets & Segments Leading ASEAN Taxi Industry

The ride-hailing segment, particularly through Online booking types, is undeniably the dominant force shaping the ASEAN taxi industry. This dominance is propelled by a confluence of factors, including widespread smartphone penetration, robust mobile internet infrastructure, and a digitally-savvy population eager for convenient, on-demand transportation. The Cars vehicle type remains the most significant contributor to the market, catering to the majority of commuter needs, from daily commutes to inter-city travel.

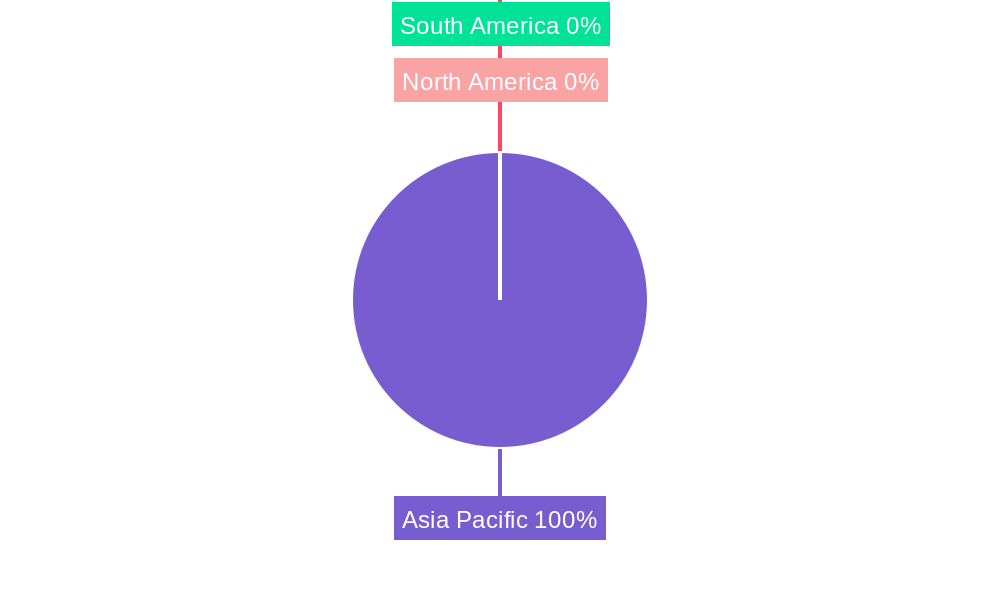

- Dominant Region: Southeast Asia, characterized by its rapidly growing economies and large, young populations, is the primary growth engine. Countries like Indonesia, the Philippines, Vietnam, and Thailand exhibit particularly high adoption rates for ride-hailing services due to significant urbanization and a burgeoning middle class.

- Dominant Country: Indonesia, with its vast population and major metropolitan centers like Jakarta, leads the market in terms of ride volume and revenue. The Philippines and Vietnam follow closely, driven by similar urban growth dynamics and increasing digital adoption.

- Dominant Booking Type: Online booking is king, accounting for over 90% of all taxi transactions. This is a direct consequence of the widespread availability and affordability of smartphones and mobile data plans across the region. The ease of use, real-time tracking, and cashless payment options offered by online platforms have made them the preferred choice for most consumers.

- Dominant Vehicle Type: Cars constitute the largest share of the market, fulfilling the diverse transportation needs of urban dwellers. While Motorcycles are highly prevalent in countries like Vietnam and Indonesia for their agility in congested traffic and affordability, cars offer greater comfort and capacity for longer journeys and group travel, making them indispensable. Other Vehicle Types, including premium cars and specialized services, cater to a niche but growing segment of the market seeking enhanced comfort and specific amenities.

- Dominant Service Type: Ride-hailing services, where drivers are independent contractors affiliated with a platform, command the largest market share. This model offers flexibility for drivers and on-demand availability for users. Ride-sharing, while growing, is still a secondary service type, appealing to cost-conscious travelers and those prioritizing environmental impact. The seamless integration of these services within single platforms like Grab and Gojek further solidifies their dominance. Economic growth, increasing disposable incomes, and supportive government initiatives aimed at improving urban mobility infrastructure are critical drivers for the continued expansion of these dominant segments.

ASEAN Taxi Industry Product Developments

Product innovations in the ASEAN taxi industry are intensely focused on enhancing user experience, operational efficiency, and safety. Companies are investing heavily in AI-driven features, including predictive dispatch systems to minimize wait times, intelligent route optimization to reduce travel duration and fuel consumption, and personalized recommendations for users. The integration of advanced safety features, such as driver and passenger verification through facial recognition, in-car camera monitoring, and real-time trip monitoring by designated contacts, is becoming standard. Furthermore, the development of eco-friendly ride options, including a growing fleet of electric vehicles and the promotion of ride-sharing, reflects a commitment to sustainability. Payment gateway integrations are becoming more sophisticated, offering a wider array of cashless options, including digital wallets and buy-now-pay-later solutions, catering to the diverse financial preferences of consumers across the region.

Challenges in the ASEAN Taxi Industry Market

The ASEAN taxi industry faces several significant challenges that impact its growth and operational landscape. Regulatory hurdles remain a primary concern, with varying and often evolving legal frameworks across different countries regarding ride-hailing operations, driver licensing, and fare structures. This complexity can hinder scalability and necessitate costly compliance efforts. Intense competition from both established ride-hailing giants and emerging local players exerts constant pressure on pricing and profitability, leading to price wars that can erode margins. Supply chain issues, particularly concerning the availability and maintenance of vehicle fleets, especially for electric vehicles, can affect service reliability. Furthermore, driver retention and welfare remain a critical challenge, as driver satisfaction and fair compensation are crucial for maintaining a consistent service supply and mitigating driver churn. The threat of counterfeit services and safety breaches also poses a continuous risk, demanding robust security protocols.

Forces Driving ASEAN Taxi Industry Growth

Several powerful forces are propelling the growth of the ASEAN taxi industry. Technological advancements, including the proliferation of smartphones, affordable mobile data, and sophisticated app development, have been instrumental in enabling the ride-hailing revolution. The increasing urbanization and population growth across Southeast Asia create a perpetual demand for efficient and accessible transportation. Economic development and rising disposable incomes among the growing middle class allow more individuals to opt for convenient ride-hailing services. Supportive government initiatives aimed at improving urban mobility, reducing traffic congestion, and promoting digital economies also play a crucial role. The growing demand for on-demand services and the preference for cashless transactions further bolster the industry's expansion.

Emerging Opportunities in ASEAN Taxi Industry

The ASEAN taxi industry is rife with emerging opportunities, driven by evolving consumer needs and technological innovation. The expansion of electric vehicle (EV) fleets presents a significant opportunity to cater to environmentally conscious consumers and leverage government incentives for sustainable transportation. The integration of ancillary services, such as food delivery, grocery delivery, and parcel services onto existing ride-hailing platforms, creates new revenue streams and enhances user stickiness. The development of autonomous driving technology, while long-term, holds the potential to revolutionize the industry by reducing operational costs and increasing efficiency. Furthermore, the untapped potential in tier-2 and tier-3 cities across ASEAN offers substantial growth prospects for ride-hailing services that can adapt to local needs and infrastructure. The increasing demand for specialized mobility solutions, such as wheelchair-accessible vehicles and premium transport options, also presents niche market opportunities.

Leading Players in the ASEAN Taxi Industry Sector

- Grab Holdings Inc

- PT Gojek

- TADA

- Ryde

- Didi

- Uber Technologies Inc

- Lyft Inc

- Public Cab Sdn Bhd

- Blue Cab Malaysia

Key Milestones in ASEAN Taxi Industry Industry

- 2019: Significant expansion of ride-sharing services by major players like Grab and Gojek across multiple ASEAN countries.

- 2020: Accelerated adoption of contactless payment and ride-hailing services due to the COVID-19 pandemic, leading to increased safety protocols.

- 2021: Increased investment in electric vehicle pilot programs by several ride-hailing companies in response to growing environmental concerns and government mandates.

- 2022: Strategic partnerships formed between ride-hailing platforms and e-commerce companies to integrate delivery services, expanding the scope beyond passenger transport.

- 2023: Increased regulatory scrutiny and policy adjustments by various ASEAN governments concerning driver welfare, data privacy, and fair competition.

- 2024: Continued consolidation and diversification of services by leading players, with a focus on super-app strategies.

Strategic Outlook for ASEAN Taxi Industry Market

The strategic outlook for the ASEAN taxi industry is exceptionally positive, characterized by sustained growth driven by technological innovation, expanding consumer adoption, and increasing integration of diversified services. Future growth will likely be accelerated by the continued electrification of fleets, offering a competitive edge and aligning with regional sustainability goals. Strategic partnerships will be crucial for expanding service offerings beyond transportation, transforming ride-hailing platforms into comprehensive lifestyle super-apps. Further investment in AI and data analytics will enable hyper-personalization of services and optimize operational efficiency. As regulatory landscapes mature, companies that can effectively navigate compliance requirements while prioritizing driver well-being and passenger safety will be best positioned for long-term success. The untapped potential in emerging markets within ASEAN, coupled with the evolving preferences of a young, digitally connected demographic, provides fertile ground for innovation and market expansion.

ASEAN Taxi Industry Segmentation

-

1. Booking Type

- 1.1. Online

- 1.2. Offline

-

2. Vehicle Type

- 2.1. Motorcycles

- 2.2. Cars

- 2.3. Other Vehicle Types

-

3. Service Type

- 3.1. Ride Hailing

- 3.2. Ride Sharing

ASEAN Taxi Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

ASEAN Taxi Industry Regional Market Share

Geographic Coverage of ASEAN Taxi Industry

ASEAN Taxi Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand From Online Channel

- 3.3. Market Restrains

- 3.3.1. Increasing Traffic Problems And Reliability Issues

- 3.4. Market Trends

- 3.4.1. Increasing Penetration of Online Channels for Booking Taxis

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 5.1.1. Online

- 5.1.2. Offline

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Motorcycles

- 5.2.2. Cars

- 5.2.3. Other Vehicle Types

- 5.3. Market Analysis, Insights and Forecast - by Service Type

- 5.3.1. Ride Hailing

- 5.3.2. Ride Sharing

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 6. North America ASEAN Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Booking Type

- 6.1.1. Online

- 6.1.2. Offline

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Motorcycles

- 6.2.2. Cars

- 6.2.3. Other Vehicle Types

- 6.3. Market Analysis, Insights and Forecast - by Service Type

- 6.3.1. Ride Hailing

- 6.3.2. Ride Sharing

- 6.1. Market Analysis, Insights and Forecast - by Booking Type

- 7. South America ASEAN Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Booking Type

- 7.1.1. Online

- 7.1.2. Offline

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Motorcycles

- 7.2.2. Cars

- 7.2.3. Other Vehicle Types

- 7.3. Market Analysis, Insights and Forecast - by Service Type

- 7.3.1. Ride Hailing

- 7.3.2. Ride Sharing

- 7.1. Market Analysis, Insights and Forecast - by Booking Type

- 8. Europe ASEAN Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Booking Type

- 8.1.1. Online

- 8.1.2. Offline

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Motorcycles

- 8.2.2. Cars

- 8.2.3. Other Vehicle Types

- 8.3. Market Analysis, Insights and Forecast - by Service Type

- 8.3.1. Ride Hailing

- 8.3.2. Ride Sharing

- 8.1. Market Analysis, Insights and Forecast - by Booking Type

- 9. Middle East & Africa ASEAN Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Booking Type

- 9.1.1. Online

- 9.1.2. Offline

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Motorcycles

- 9.2.2. Cars

- 9.2.3. Other Vehicle Types

- 9.3. Market Analysis, Insights and Forecast - by Service Type

- 9.3.1. Ride Hailing

- 9.3.2. Ride Sharing

- 9.1. Market Analysis, Insights and Forecast - by Booking Type

- 10. Asia Pacific ASEAN Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Booking Type

- 10.1.1. Online

- 10.1.2. Offline

- 10.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.2.1. Motorcycles

- 10.2.2. Cars

- 10.2.3. Other Vehicle Types

- 10.3. Market Analysis, Insights and Forecast - by Service Type

- 10.3.1. Ride Hailing

- 10.3.2. Ride Sharing

- 10.1. Market Analysis, Insights and Forecast - by Booking Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 TADA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ryde

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Didi

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Uber Technologies Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lyft Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Public Cab Sdn Bhd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PT Gojek

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Blue Cab Malaysi

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Grab Holdings Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 TADA

List of Figures

- Figure 1: Global ASEAN Taxi Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America ASEAN Taxi Industry Revenue (Million), by Booking Type 2025 & 2033

- Figure 3: North America ASEAN Taxi Industry Revenue Share (%), by Booking Type 2025 & 2033

- Figure 4: North America ASEAN Taxi Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 5: North America ASEAN Taxi Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America ASEAN Taxi Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 7: North America ASEAN Taxi Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 8: North America ASEAN Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America ASEAN Taxi Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America ASEAN Taxi Industry Revenue (Million), by Booking Type 2025 & 2033

- Figure 11: South America ASEAN Taxi Industry Revenue Share (%), by Booking Type 2025 & 2033

- Figure 12: South America ASEAN Taxi Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 13: South America ASEAN Taxi Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 14: South America ASEAN Taxi Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 15: South America ASEAN Taxi Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: South America ASEAN Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: South America ASEAN Taxi Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe ASEAN Taxi Industry Revenue (Million), by Booking Type 2025 & 2033

- Figure 19: Europe ASEAN Taxi Industry Revenue Share (%), by Booking Type 2025 & 2033

- Figure 20: Europe ASEAN Taxi Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 21: Europe ASEAN Taxi Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Europe ASEAN Taxi Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 23: Europe ASEAN Taxi Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 24: Europe ASEAN Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe ASEAN Taxi Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa ASEAN Taxi Industry Revenue (Million), by Booking Type 2025 & 2033

- Figure 27: Middle East & Africa ASEAN Taxi Industry Revenue Share (%), by Booking Type 2025 & 2033

- Figure 28: Middle East & Africa ASEAN Taxi Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 29: Middle East & Africa ASEAN Taxi Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Middle East & Africa ASEAN Taxi Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 31: Middle East & Africa ASEAN Taxi Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 32: Middle East & Africa ASEAN Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa ASEAN Taxi Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific ASEAN Taxi Industry Revenue (Million), by Booking Type 2025 & 2033

- Figure 35: Asia Pacific ASEAN Taxi Industry Revenue Share (%), by Booking Type 2025 & 2033

- Figure 36: Asia Pacific ASEAN Taxi Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 37: Asia Pacific ASEAN Taxi Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 38: Asia Pacific ASEAN Taxi Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 39: Asia Pacific ASEAN Taxi Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 40: Asia Pacific ASEAN Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific ASEAN Taxi Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN Taxi Industry Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 2: Global ASEAN Taxi Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global ASEAN Taxi Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Global ASEAN Taxi Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global ASEAN Taxi Industry Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 6: Global ASEAN Taxi Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 7: Global ASEAN Taxi Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: Global ASEAN Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global ASEAN Taxi Industry Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 13: Global ASEAN Taxi Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 14: Global ASEAN Taxi Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 15: Global ASEAN Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global ASEAN Taxi Industry Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 20: Global ASEAN Taxi Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 21: Global ASEAN Taxi Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 22: Global ASEAN Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global ASEAN Taxi Industry Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 33: Global ASEAN Taxi Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 34: Global ASEAN Taxi Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 35: Global ASEAN Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global ASEAN Taxi Industry Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 43: Global ASEAN Taxi Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 44: Global ASEAN Taxi Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 45: Global ASEAN Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Taxi Industry?

The projected CAGR is approximately 7.40%.

2. Which companies are prominent players in the ASEAN Taxi Industry?

Key companies in the market include TADA, Ryde, Didi, Uber Technologies Inc, Lyft Inc, Public Cab Sdn Bhd, PT Gojek, Blue Cab Malaysi, Grab Holdings Inc.

3. What are the main segments of the ASEAN Taxi Industry?

The market segments include Booking Type, Vehicle Type, Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand From Online Channel.

6. What are the notable trends driving market growth?

Increasing Penetration of Online Channels for Booking Taxis.

7. Are there any restraints impacting market growth?

Increasing Traffic Problems And Reliability Issues.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Taxi Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Taxi Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Taxi Industry?

To stay informed about further developments, trends, and reports in the ASEAN Taxi Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence