Key Insights

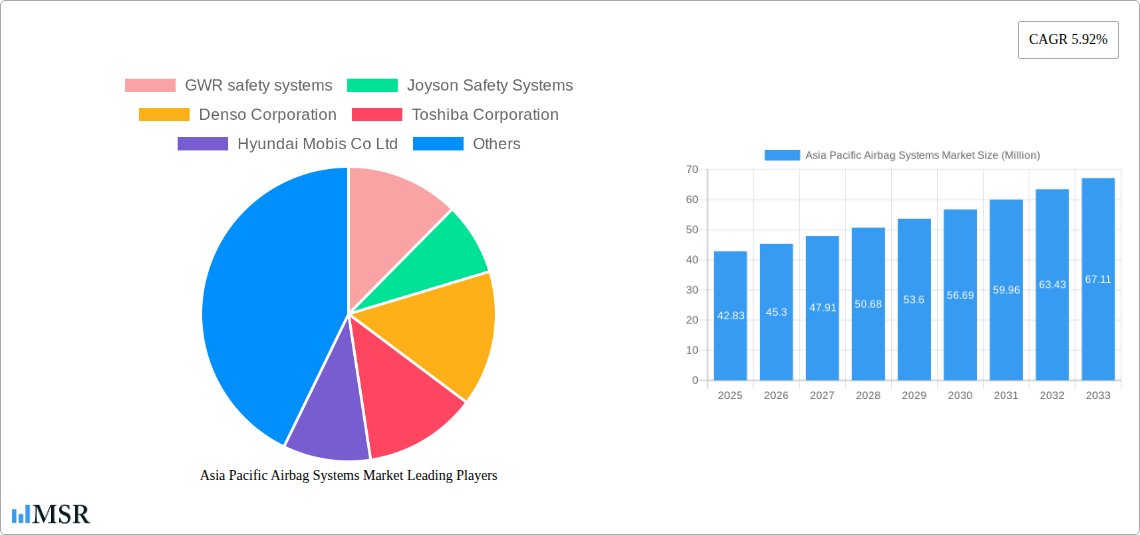

The Asia Pacific Airbag Systems Market is poised for substantial growth, projected to reach $42.83 million by 2025, with a Compound Annual Growth Rate (CAGR) of 5.92% through 2033. This robust expansion is fueled by a confluence of factors, including increasing automotive production across the region, a heightened focus on vehicle safety standards by governments and consumers alike, and the continuous evolution of automotive technologies. China and Japan are anticipated to remain dominant forces within this market, driven by their extensive automotive manufacturing bases and strong adoption of advanced safety features. The increasing demand for passenger vehicles, particularly in emerging economies like India and South Korea, further propels the market forward, as consumers prioritize safety in their purchasing decisions. Furthermore, the aftermarket segment is expected to witness significant growth as older vehicles are retrofitted with enhanced safety systems, contributing to the overall market expansion.

Asia Pacific Airbag Systems Market Market Size (In Million)

Several key trends are shaping the Asia Pacific Airbag Systems Market landscape. The growing prevalence of advanced driver-assistance systems (ADAS) is driving the development and integration of more sophisticated airbag systems, including knee and side-impact airbags, designed to provide comprehensive protection. Manufacturers are investing heavily in research and development to create lighter, more compact, and more efficient airbag modules, aligning with the industry's drive towards fuel efficiency and improved vehicle performance. While the market enjoys strong growth, certain restraints exist, such as the high cost of advanced airbag technologies and potential supply chain disruptions. However, the persistent emphasis on road safety and stringent regulatory frameworks across the Asia Pacific region are expected to outweigh these challenges, ensuring sustained market vitality. The market is characterized by intense competition among major global players, each striving to innovate and secure a significant market share.

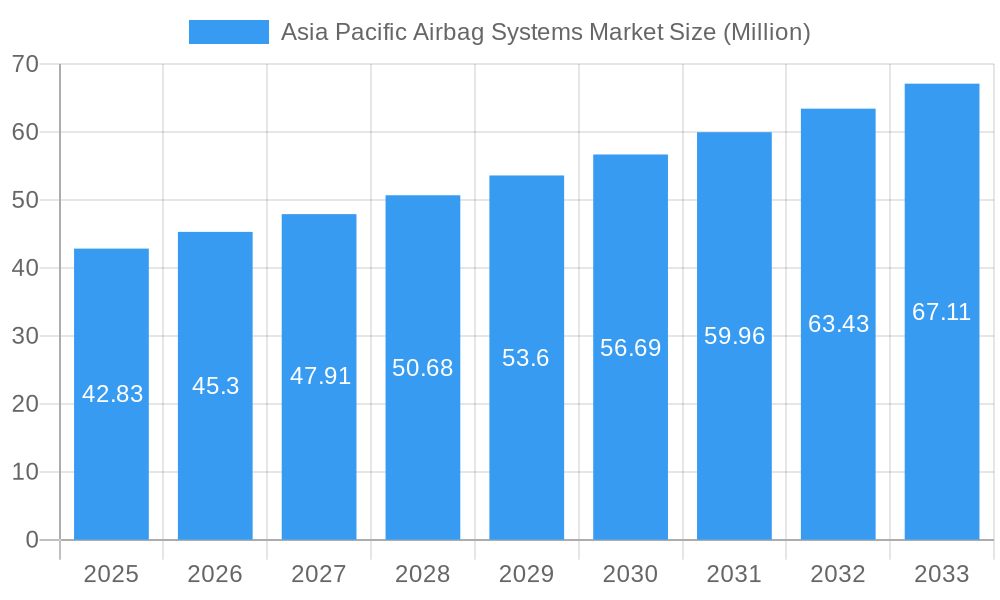

Asia Pacific Airbag Systems Market Company Market Share

Asia Pacific Airbag Systems Market: Driving Safety Through Innovation and Expansion (2019-2033)

Gain critical insights into the rapidly evolving Asia Pacific airbag systems market. This comprehensive report analyzes the dynamics, industry trends, key segments, and competitive landscape shaping the future of automotive safety in the region. Discover growth drivers, emerging opportunities, and challenges impacting stakeholders from OEMs to aftermarket suppliers. Leveraging advanced analytics and extensive primary research, this report provides actionable intelligence for strategic decision-making.

The Asia Pacific airbag systems market is projected for robust growth, driven by increasing vehicle production, stringent safety regulations, and rising consumer awareness regarding automotive safety. This report provides an in-depth analysis covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, building upon historical data from 2019-2024. We delve into market size, CAGR, key players, product developments, and strategic outlook.

Asia Pacific Airbag Systems Market Market Concentration & Dynamics

The Asia Pacific airbag systems market exhibits a moderate to high level of concentration, with a few key global players dominating a significant portion of the market share. Companies like Autoliv Inc., Robert Bosch GmbH, Continental AG, Denso Corporation, and Toyoda Gosei Co Ltd hold substantial sway, leveraging their established R&D capabilities, extensive manufacturing footprints, and strong relationships with leading Original Equipment Manufacturers (OEMs) across the region. Innovation ecosystems are thriving, driven by continuous advancements in airbag technologies, including the development of smarter, more adaptable airbag systems that respond to varying crash scenarios and occupant sizes. Regulatory frameworks, particularly in countries like China, Japan, and South Korea, are increasingly mandating advanced safety features, acting as a significant catalyst for market growth and innovation. Substitute products, while present in the form of advanced driver-assistance systems (ADAS), are largely complementary rather than direct replacements for airbag systems, which remain a fundamental passive safety component. End-user trends are shifting towards a greater demand for comprehensive safety packages, with consumers increasingly prioritizing vehicles equipped with multiple airbags and advanced deployment mechanisms. Merger and acquisition (M&A) activities are observed, though perhaps less frequent than in more mature markets, primarily focused on consolidating regional presence, acquiring new technologies, or expanding manufacturing capacities to meet escalating demand. The number of significant M&A deals in the recent past has been limited, but strategic partnerships and joint ventures are prevalent, especially in emerging economies within the region.

Asia Pacific Airbag Systems Market Industry Insights & Trends

The Asia Pacific airbag systems market is experiencing a dynamic surge, fueled by an escalating demand for enhanced automotive safety. The market size was estimated at approximately USD 4,500 Million in 2025 and is projected to reach USD 7,800 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around 7.2% during the forecast period. This impressive growth is underpinned by a confluence of potent market growth drivers. Foremost among these is the burgeoning automotive production across the region, with countries like China and India leading the charge in vehicle manufacturing. This surge in production directly translates to a higher volume of vehicles requiring essential safety components like airbags. Furthermore, increasingly stringent government regulations and safety mandates are compelling automakers to integrate more advanced airbag systems into their vehicles. For instance, many countries in the Asia Pacific region are aligning their safety standards with global benchmarks, necessitating the inclusion of multiple airbags, including front, side, curtain, and knee airbags, as standard features. Technological disruptions are playing a pivotal role. Innovations such as adaptive airbags, which can adjust their deployment force based on the severity of a crash and the occupant's position, are becoming increasingly sophisticated and sought after. The development of lighter and more compact airbag modules is also a significant trend, allowing for greater design flexibility in vehicles. Evolving consumer behaviors are also shaping the market. As disposable incomes rise in many Asia Pacific nations, there's a growing awareness and preference for vehicles that prioritize safety. Consumers are actively seeking out vehicles with higher safety ratings and advanced safety features, creating a pull for manufacturers to equip their models with comprehensive airbag systems. The rise of electric vehicles (EVs) also presents a unique opportunity, as their distinct architecture often requires novel airbag integration strategies, driving further innovation in the sector. The aftermarket segment is also poised for growth, driven by the need for replacement parts and the retrofitting of older vehicles with enhanced safety features. The penetration of advanced airbag technologies, such as those with improved sensing and deployment capabilities, is expected to accelerate, further contributing to the overall market expansion.

Key Markets & Segments Leading Asia Pacific Airbag Systems Market

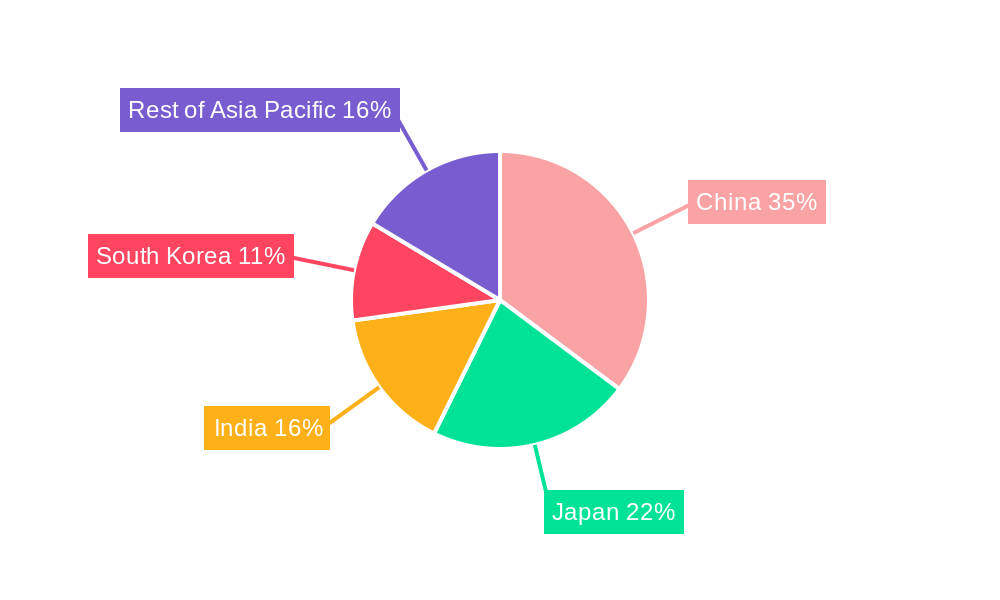

The Asia Pacific airbag systems market is characterized by strong performance across various segments and geographies, with particular dominance stemming from Passenger Vehicles and the China market.

Dominant Geographies:

China: As the world's largest automotive market, China spearheads the demand for airbag systems. Factors contributing to its dominance include:

- Massive Vehicle Production and Sales: Unparalleled production volumes of passenger and commercial vehicles directly translate to substantial airbag system requirements.

- Stringent Safety Regulations: The Chinese government has progressively implemented and enforced stricter automotive safety standards, mandating the inclusion of multiple airbags.

- Growing Consumer Demand for Safety: An increasingly affluent population prioritizes vehicle safety, driving demand for vehicles equipped with advanced airbag technologies.

- Robust OEM Presence: The presence of numerous domestic and international automotive manufacturers ensures a consistent demand for airbag components.

India: Rapidly emerging as a significant market, India's growth is driven by:

- High Vehicle Sales Growth: The burgeoning middle class and increasing urbanization are fueling robust sales of passenger vehicles.

- Government Initiatives for Road Safety: Increased focus on road safety and vehicle occupant protection is leading to mandatory safety features.

- Expansion of Manufacturing Hubs: The establishment of new automotive manufacturing facilities across the country bolsters the demand for local airbag production.

South Korea and Japan: These developed markets continue to be significant contributors due to:

- Advanced Automotive Technology: Leading automotive manufacturers in these countries are at the forefront of integrating cutting-edge airbag technologies.

- High Per Capita Vehicle Ownership: Established automotive cultures with high vehicle ownership rates ensure a steady demand.

- Focus on Premium Safety Features: Consumers in these markets often seek premium safety options.

Dominant Vehicle Types:

- Passenger Vehicles: This segment overwhelmingly dominates the Asia Pacific airbag systems market. The sheer volume of passenger car production and sales, coupled with increasing safety mandates for these vehicles, makes it the primary driver of demand. The proliferation of compact SUVs, sedans, and hatchbacks, all equipped with multiple airbags as a standard, underpins this segment's leadership.

Dominant Airbag Types:

- Front Airbags: As the most fundamental safety feature, front airbags (driver and passenger) are a staple in virtually all vehicles, making them the largest segment by volume.

- Curtain Airbags: With the increasing demand for enhanced side-impact protection, curtain airbags are witnessing significant growth and are becoming a standard feature in many mid-range and premium passenger vehicles.

Dominant Sales Channels:

- OEMs (Original Equipment Manufacturers): The vast majority of airbag system sales are directly to automotive manufacturers for integration into new vehicles. Strong, long-term partnerships between airbag system suppliers and OEMs are crucial for market penetration.

Asia Pacific Airbag Systems Market Product Developments

Recent product developments in the Asia Pacific airbag systems market are focused on enhancing occupant protection through intelligent and adaptive technologies. Innovations include the development of advanced sensing systems that precisely detect crash severity and occupant position, enabling airbags to deploy with optimized force and timing. Furthermore, manufacturers are actively working on integrating smaller, lighter, and more adaptable airbag modules to facilitate sleeker vehicle designs and accommodate evolving automotive architectures, particularly in electric and autonomous vehicles. The focus is also on expanding the range of airbag types, with increasing adoption of knee airbags, seat-integrated airbags, and even external airbags for pedestrian protection, reflecting a holistic approach to automotive safety.

Challenges in the Asia Pacific Airbag Systems Market Market

Despite the robust growth trajectory, the Asia Pacific airbag systems market faces several challenges.

- High Cost of Advanced Technologies: Implementing cutting-edge airbag systems, such as adaptive or multi-stage deployment, can significantly increase vehicle manufacturing costs, potentially impacting affordability for price-sensitive consumers in some emerging economies.

- Supply Chain Disruptions: The global semiconductor shortage and geopolitical uncertainties have previously impacted the availability of critical components for airbag systems, leading to production delays and increased costs.

- Regulatory Harmonization: While regulations are tightening, a lack of complete harmonization across all Asia Pacific countries can create complexity for manufacturers operating in multiple markets.

- Skilled Labor Shortage: The sophisticated nature of modern airbag system manufacturing and installation requires a skilled workforce, and a shortage of trained personnel can pose a bottleneck.

Forces Driving Asia Pacific Airbag Systems Market Growth

Several key forces are propelling the growth of the Asia Pacific airbag systems market.

- Increasing Vehicle Production: The surge in automotive manufacturing, particularly in China and India, is directly boosting the demand for airbag systems.

- Stringent Safety Regulations: Governments across the region are mandating advanced safety features, making airbags an indispensable component of new vehicles.

- Rising Consumer Awareness: Growing awareness of vehicle safety and a desire for enhanced occupant protection are driving consumer preference for airbag-equipped vehicles.

- Technological Advancements: Continuous innovation in airbag technology, leading to more effective and integrated safety solutions, is stimulating market adoption.

Challenges in the Asia Pacific Airbag Systems Market Market

Looking ahead, long-term growth catalysts for the Asia Pacific airbag systems market lie in continued technological innovation and strategic market expansion. The development of next-generation airbag systems, potentially incorporating AI-driven predictive safety features and advanced materials, will be crucial. Furthermore, strategic partnerships and collaborations between established global players and local manufacturers can facilitate technology transfer and market penetration into rapidly growing economies. The increasing adoption of electric vehicles (EVs) and the evolving design requirements for these vehicles present significant opportunities for innovative airbag integration solutions. Expansions into less saturated markets within the broader Asia Pacific region, focusing on localized solutions that balance cost and safety, will also contribute to sustained growth.

Emerging Opportunities in Asia Pacific Airbag Systems Market

Emerging opportunities in the Asia Pacific airbag systems market are abundant and diverse. The rapid growth of the electric vehicle (EV) sector presents a unique avenue for developing specialized airbag systems tailored to EV architectures, which often differ from internal combustion engine vehicles. Furthermore, the expanding aftermarket for vehicle safety upgrades in developing economies offers a significant growth potential for both new and replacement airbag systems. The increasing focus on autonomous driving technologies may also necessitate novel airbag configurations to ensure occupant safety during transitions between manual and automated driving modes. Additionally, the growing demand for customized safety solutions in niche vehicle segments, such as commercial fleets and premium recreational vehicles, opens up new market possibilities.

Leading Players in the Asia Pacific Airbag Systems Market Sector

- GWR Safety Systems

- Joyson Safety Systems

- Denso Corporation

- Toshiba Corporation

- Hyundai Mobis Co Ltd

- Key Safety Systems

- Continental AG

- Autoliv Inc

- Robert Bosch GmbH

- Toyoda Gosei Co Ltd

- Yanfeng KSS (Shanghai) Automotive Safety Systems Co Ltd

- ZF Friedrichshafen AG

Key Milestones in Asia Pacific Airbag Systems Market Industry

- February 2023: Uno Minda announced an investment of USD 21.16 million in Rajasthan, India. Through this expansion, the company expanded its airbag manufacturing facility across the country. This investment signifies a commitment to bolstering domestic airbag production capacity and meeting the growing demand in India's automotive sector.

- May 2022: Yanfeng and US-based company ARC Automotive announced the formation of a new joint venture for the production of airbag inflators for airbag applications. This strategic alliance aims to enhance the production capabilities and technological advancements in airbag inflator technology, crucial components for airbag functionality.

Strategic Outlook for Asia Pacific Airbag Systems Market Market

The strategic outlook for the Asia Pacific airbag systems market is exceptionally promising, driven by a combination of macro-economic factors and technological advancements. Key growth accelerators include the continued expansion of automotive production hubs, particularly in emerging economies, and the persistent push for enhanced vehicle safety standards globally and regionally. Manufacturers are advised to focus on developing cost-effective, innovative airbag solutions that cater to diverse market needs, from entry-level vehicles to high-end autonomous cars. Strategic partnerships with local players and a robust supply chain management strategy will be crucial for navigating the complexities of the regional market. Furthermore, investing in R&D for next-generation airbag technologies, such as those integrated with advanced sensor networks and adaptive deployment systems, will provide a significant competitive advantage. The increasing adoption of electric and connected vehicles will also present unique opportunities for specialized airbag solutions, shaping the future of automotive safety in the region.

Asia Pacific Airbag Systems Market Segmentation

-

1. Airbag Type

- 1.1. Curtain

- 1.2. Front

- 1.3. Knee

- 1.4. Sire

- 1.5. Other Airbag Types

-

2. Vehicle Type

- 2.1. Passenger Vehicles

- 2.2. Commercial Vehicles

- 2.3. Busses

- 2.4. Trucks

-

3. Sales Channel

- 3.1. OEMs

- 3.2. Aftermarket

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. South Korea

- 4.5. Rest of Asia-Pacific

Asia Pacific Airbag Systems Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. South Korea

- 5. Rest of Asia Pacific

Asia Pacific Airbag Systems Market Regional Market Share

Geographic Coverage of Asia Pacific Airbag Systems Market

Asia Pacific Airbag Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Safety Standards Implemented by Governing Bodies; Others

- 3.3. Market Restrains

- 3.3.1. Volatility in Raw Material Price; Others

- 3.4. Market Trends

- 3.4.1. Passenger Car Segment to Witness Momentum

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Airbag Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airbag Type

- 5.1.1. Curtain

- 5.1.2. Front

- 5.1.3. Knee

- 5.1.4. Sire

- 5.1.5. Other Airbag Types

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Vehicles

- 5.2.2. Commercial Vehicles

- 5.2.3. Busses

- 5.2.4. Trucks

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. OEMs

- 5.3.2. Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. South Korea

- 5.4.5. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. South Korea

- 5.5.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Airbag Type

- 6. China Asia Pacific Airbag Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Airbag Type

- 6.1.1. Curtain

- 6.1.2. Front

- 6.1.3. Knee

- 6.1.4. Sire

- 6.1.5. Other Airbag Types

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Vehicles

- 6.2.2. Commercial Vehicles

- 6.2.3. Busses

- 6.2.4. Trucks

- 6.3. Market Analysis, Insights and Forecast - by Sales Channel

- 6.3.1. OEMs

- 6.3.2. Aftermarket

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. South Korea

- 6.4.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Airbag Type

- 7. Japan Asia Pacific Airbag Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Airbag Type

- 7.1.1. Curtain

- 7.1.2. Front

- 7.1.3. Knee

- 7.1.4. Sire

- 7.1.5. Other Airbag Types

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Vehicles

- 7.2.2. Commercial Vehicles

- 7.2.3. Busses

- 7.2.4. Trucks

- 7.3. Market Analysis, Insights and Forecast - by Sales Channel

- 7.3.1. OEMs

- 7.3.2. Aftermarket

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. South Korea

- 7.4.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Airbag Type

- 8. India Asia Pacific Airbag Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Airbag Type

- 8.1.1. Curtain

- 8.1.2. Front

- 8.1.3. Knee

- 8.1.4. Sire

- 8.1.5. Other Airbag Types

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Vehicles

- 8.2.2. Commercial Vehicles

- 8.2.3. Busses

- 8.2.4. Trucks

- 8.3. Market Analysis, Insights and Forecast - by Sales Channel

- 8.3.1. OEMs

- 8.3.2. Aftermarket

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. South Korea

- 8.4.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Airbag Type

- 9. South Korea Asia Pacific Airbag Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Airbag Type

- 9.1.1. Curtain

- 9.1.2. Front

- 9.1.3. Knee

- 9.1.4. Sire

- 9.1.5. Other Airbag Types

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Vehicles

- 9.2.2. Commercial Vehicles

- 9.2.3. Busses

- 9.2.4. Trucks

- 9.3. Market Analysis, Insights and Forecast - by Sales Channel

- 9.3.1. OEMs

- 9.3.2. Aftermarket

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. South Korea

- 9.4.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Airbag Type

- 10. Rest of Asia Pacific Asia Pacific Airbag Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Airbag Type

- 10.1.1. Curtain

- 10.1.2. Front

- 10.1.3. Knee

- 10.1.4. Sire

- 10.1.5. Other Airbag Types

- 10.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.2.1. Passenger Vehicles

- 10.2.2. Commercial Vehicles

- 10.2.3. Busses

- 10.2.4. Trucks

- 10.3. Market Analysis, Insights and Forecast - by Sales Channel

- 10.3.1. OEMs

- 10.3.2. Aftermarket

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. Japan

- 10.4.3. India

- 10.4.4. South Korea

- 10.4.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Airbag Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 GWR safety systems

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Joyson Safety Systems

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Denso Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Toshiba Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hyundai Mobis Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Key Safety Systems

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Continental AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Autoliv Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Robert Bosch GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Toyoda Gosei Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Yanfeng KSS (Shanghai) Automotive Safety Systems Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 ZF Friedrichshafen AG

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 GWR safety systems

List of Figures

- Figure 1: Asia Pacific Airbag Systems Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Airbag Systems Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Airbag Type 2020 & 2033

- Table 2: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 4: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Airbag Type 2020 & 2033

- Table 7: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 9: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Airbag Type 2020 & 2033

- Table 12: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 13: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 14: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Airbag Type 2020 & 2033

- Table 17: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 18: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 19: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Airbag Type 2020 & 2033

- Table 22: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 23: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 24: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 25: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Airbag Type 2020 & 2033

- Table 27: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 28: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 29: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Asia Pacific Airbag Systems Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Airbag Systems Market?

The projected CAGR is approximately 5.92%.

2. Which companies are prominent players in the Asia Pacific Airbag Systems Market?

Key companies in the market include GWR safety systems, Joyson Safety Systems, Denso Corporation, Toshiba Corporation, Hyundai Mobis Co Ltd, Key Safety Systems, Continental AG, Autoliv Inc, Robert Bosch GmbH, Toyoda Gosei Co Ltd, Yanfeng KSS (Shanghai) Automotive Safety Systems Co Ltd, ZF Friedrichshafen AG.

3. What are the main segments of the Asia Pacific Airbag Systems Market?

The market segments include Airbag Type, Vehicle Type, Sales Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Stringent Safety Standards Implemented by Governing Bodies; Others.

6. What are the notable trends driving market growth?

Passenger Car Segment to Witness Momentum.

7. Are there any restraints impacting market growth?

Volatility in Raw Material Price; Others.

8. Can you provide examples of recent developments in the market?

February 2023: Uno Minda announced an investment of USD 21.16 million in Rajasthan, India. Through this expansion, the company expanded its airbag manufacturing facility across the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Airbag Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Airbag Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Airbag Systems Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Airbag Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence