Key Insights

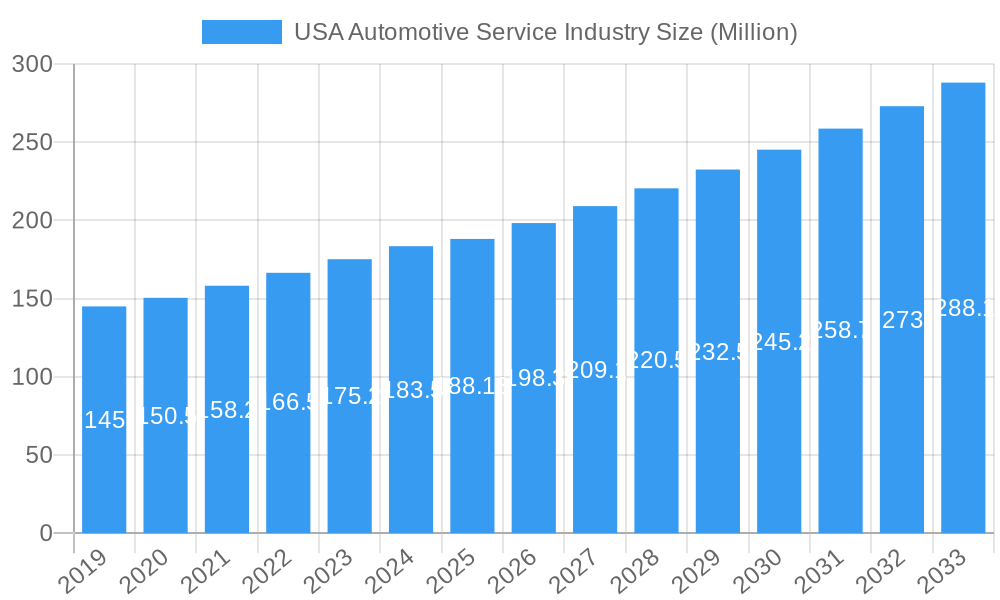

The U.S. automotive service industry is poised for robust expansion, projected to reach approximately $188.13 million by 2025, with a Compound Annual Growth Rate (CAGR) of 5.98% anticipated to sustain this momentum through 2033. This growth is significantly propelled by several key drivers. An aging vehicle parc, with a considerable portion of cars exceeding 10 years old, necessitates more frequent and extensive maintenance and repairs. Furthermore, the increasing complexity of modern vehicles, incorporating advanced electronics, sensors, and sophisticated engine components, requires specialized diagnostic and repair services, thus driving demand for skilled technicians and advanced equipment. The rise of the "do-it-for-me" trend, where vehicle owners increasingly opt for professional services over DIY repairs, further bolsters the market. Moreover, the growing adoption of electric vehicles (EVs) presents both opportunities and challenges; while EV maintenance requirements differ, the overall service needs for these vehicles will contribute to market expansion, particularly in areas like battery diagnostics and software updates.

USA Automotive Service Industry Market Size (In Million)

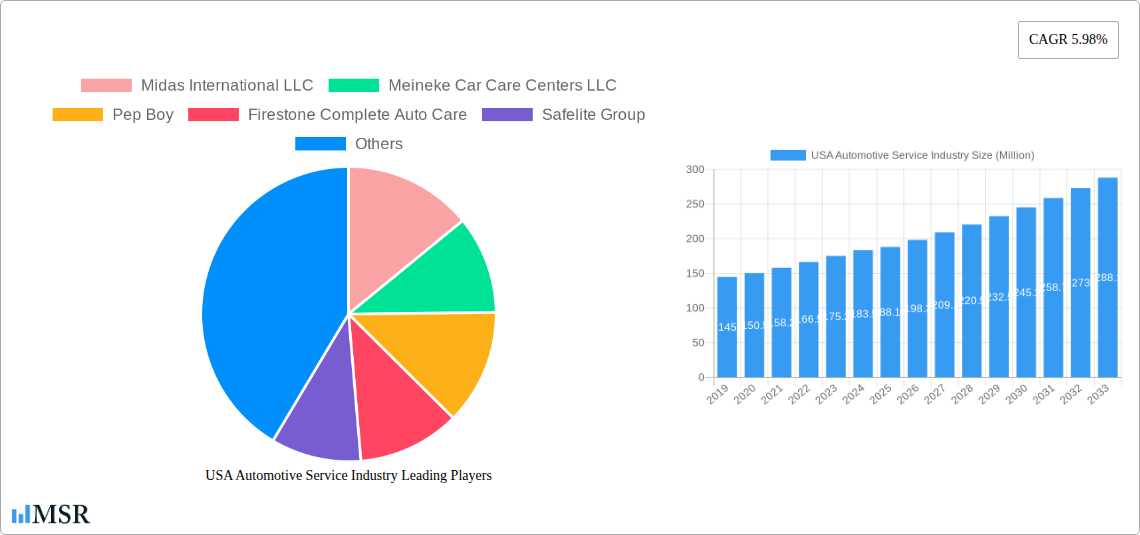

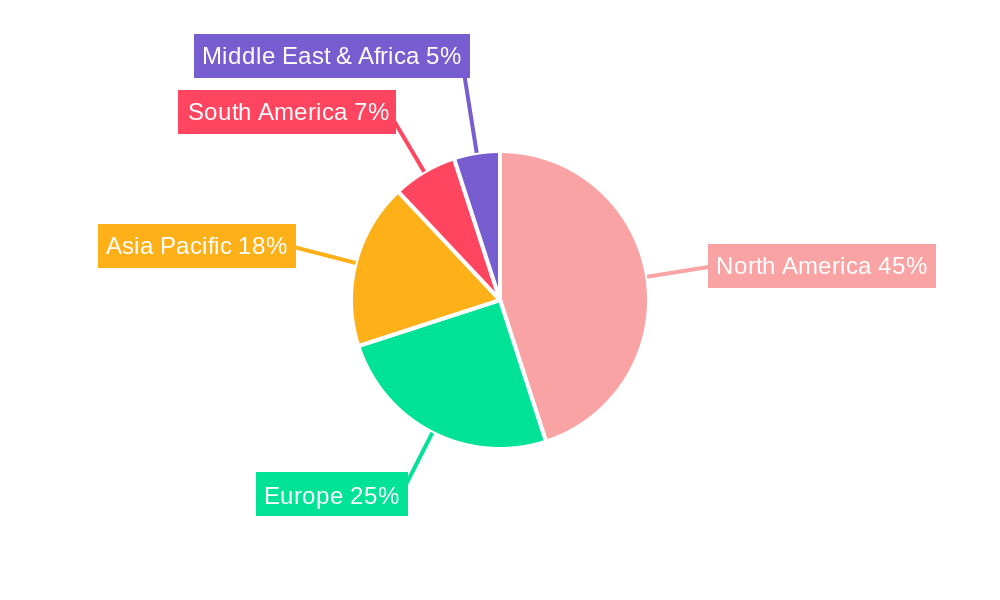

The market is segmented across various vehicle types, including passenger cars and commercial vehicles, each with distinct service demands. Service types range from routine mechanical and exterior/structural repairs to intricate electrical and electronics diagnostics. Equipment types, such as tires, batteries, and other essential components, represent significant revenue streams. Leading companies like Midas International LLC, Meineke Car Care Centers LLC, Pep Boys, Firestone Complete Auto Care, Safelite Group, Monro Inc., Jiffy Lube International Inc., and Walmart Inc. are actively competing and innovating to capture market share. Geographically, North America, particularly the United States, is the dominant region, driven by high vehicle ownership and a mature automotive service infrastructure. However, the Asia Pacific region, fueled by rapid economic growth and an expanding automotive market, is expected to witness substantial growth in the forecast period. Challenges such as a shortage of skilled labor and the increasing DIY trend among younger demographics could temper growth, but the overarching demand for professional, specialized automotive care is expected to outweigh these restraints.

USA Automotive Service Industry Company Market Share

Dive deep into the dynamic USA Automotive Service Industry with this comprehensive report, meticulously crafted to empower stakeholders, investors, and industry leaders. Explore critical market insights, growth drivers, emerging trends, and competitive landscapes from 2019–2033, with a detailed focus on the 2025 base and estimated year. This indispensable resource provides actionable intelligence for navigating the evolving aftermarket services sector, featuring an in-depth analysis of key players, technological advancements, and strategic opportunities.

USA Automotive Service Industry Market Concentration & Dynamics

The USA Automotive Service Industry, a colossal sector projected to reach USD 1,000 Billion by 2025, exhibits a moderately concentrated market structure. Leading entities like Midas International LLC, Meineke Car Care Centers LLC, Pep Boys, Firestone Complete Auto Care, Safelite Group, Monro Inc., Jiffy Lube International Inc., and Walmart Inc. command significant market share, estimated at XX% collectively. The innovation ecosystem thrives on advancements in diagnostic tools, electric vehicle (EV) servicing, and data analytics, fostering a competitive edge. Regulatory frameworks, primarily focused on consumer protection and emissions standards, play a crucial role in shaping industry practices. Substitute products, such as DIY repair kits and in-home diagnostic services, offer niche alternatives but are largely outpaced by professional service offerings. End-user trends reveal a growing demand for convenience, transparency, and specialized EV maintenance. Mergers and acquisitions (M&A) are a significant feature, with over XXX deals recorded during the historical period (2019-2024), indicating strategic consolidation and expansion efforts.

- Market Concentration: Moderate, with a few key players holding substantial share.

- Innovation Ecosystem: Driven by EV servicing, diagnostics, and digital integration.

- Regulatory Frameworks: Focus on consumer rights and environmental compliance.

- Substitute Products: Limited impact compared to professional services.

- End-User Trends: Demand for convenience, transparency, and EV expertise.

- M&A Activities: Active consolidation and strategic partnerships, with XXX deals in the historical period.

USA Automotive Service Industry Industry Insights & Trends

The USA Automotive Service Industry is poised for robust growth, driven by an expanding vehicle parc, increasing vehicle complexity, and a rising demand for specialized maintenance. The market size is projected to reach USD 1,000 Billion by 2025, with a Compound Annual Growth Rate (CAGR) of XX% projected for the forecast period (2025-2033). Technological disruptions, including the proliferation of electric vehicles (EVs) and the increasing integration of advanced driver-assistance systems (ADAS), necessitate continuous investment in technician training and specialized equipment. Evolving consumer behaviors highlight a strong preference for digital booking platforms, transparent pricing, and personalized service experiences. The aging vehicle fleet also contributes significantly to sustained demand for repair and maintenance services. Furthermore, the growing emphasis on vehicle longevity and performance encourages regular servicing, bolstering industry revenues. The increasing adoption of telematics and connected car technology offers opportunities for predictive maintenance and proactive servicing, further driving market expansion and customer loyalty. The shift towards sustainability also influences service providers, encouraging the adoption of eco-friendly practices and parts.

Key Markets & Segments Leading USA Automotive Service Industry

The dominance within the USA Automotive Service Industry is multifaceted, with Passenger Cars representing the largest vehicle type segment. This is driven by the sheer volume of passenger vehicles on American roads and their consistent need for routine maintenance and repairs. Within service types, Mechanical services continue to lead due to the fundamental requirements of engine, transmission, and brake upkeep. However, the growing complexity of vehicle electronics is rapidly elevating the importance of Electrical and Electronics services. In terms of equipment, Tires remain a cornerstone of the aftermarket, accounting for a substantial portion of service revenue. The increasing adoption of advanced materials and technologies in vehicle manufacturing also influences the demand for specialized Other Equipment Types services. Geographically, the Southern and Western regions are emerging as high-growth markets, fueled by population expansion and economic development.

- Vehicle Type:

- Passenger Cars: Dominant due to high vehicle population.

- Commercial Vehicles: Growing demand for specialized fleet maintenance.

- Service Type:

- Mechanical: Core service area, consistently high demand.

- Electrical and Electronics: Rapidly growing segment due to vehicle complexity.

- Exterior and Structural: Essential for collision repair and aesthetics.

- Equipment Type:

- Tires: Primary revenue driver, consistent demand.

- Batteries: Essential for all vehicle types, ongoing replacement needs.

- Other Equipment Types: Increasing importance with advanced vehicle technologies.

USA Automotive Service Industry Product Developments

Product innovations in the USA Automotive Service Industry are largely centered around enhancing diagnostic capabilities, improving repair efficiency, and catering to the evolving needs of electric and hybrid vehicles. Advanced diagnostic scanners, intelligent repair software, and specialized tools for EV battery servicing are gaining prominence. The market relevance of these developments lies in their ability to reduce repair times, improve accuracy, and enable technicians to service increasingly complex vehicle systems. Furthermore, the development of sustainable and eco-friendly parts and repair materials is also a growing area of focus, aligning with broader environmental concerns and consumer preferences.

Challenges in the USA Automotive Service Industry Market

The USA Automotive Service Industry faces several significant challenges. Regulatory hurdles, including evolving emissions standards and data privacy concerns, can increase compliance costs. Supply chain disruptions, as witnessed in recent years, can lead to part shortages and increased lead times, impacting service delivery and profitability. Intense competitive pressures from independent repair shops, dealerships, and even direct-to-consumer service models create a constant need for differentiation and customer retention. The skilled labor shortage, particularly for specialized EV technicians, remains a persistent obstacle.

- Regulatory Hurdles: Evolving environmental and data protection laws.

- Supply Chain Disruptions: Impacting part availability and costs.

- Competitive Pressures: From diverse service providers.

- Skilled Labor Shortage: Especially for EV and complex system expertise.

Forces Driving USA Automotive Service Industry Growth

Several powerful forces are propelling the growth of the USA Automotive Service Industry. The ever-increasing complexity of modern vehicles, with their advanced electronics and integrated systems, necessitates specialized knowledge and tools, driving demand for professional services. The aging vehicle parc across the nation ensures a sustained need for maintenance and repair, as older cars require more frequent attention. The rapid adoption of electric vehicles (EVs) is creating a new service segment, requiring specialized training and equipment, thus opening up new revenue streams. Furthermore, the growing consumer emphasis on vehicle longevity and performance encourages proactive maintenance.

Emerging Opportunities in USA Automotive Service Industry

Emerging opportunities within the USA Automotive Service Industry are abundant, driven by technological advancements and shifting consumer preferences. The burgeoning electric vehicle (EV) market presents a significant growth area, with a demand for specialized battery maintenance, charging infrastructure servicing, and unique EV repair expertise. The increasing adoption of connected car technologies and telematics opens doors for predictive maintenance, remote diagnostics, and personalized service offerings, enhancing customer experience and operational efficiency. Furthermore, the demand for mobile and on-demand automotive repair services, offering convenience to busy consumers, is on the rise. The integration of AI and machine learning in diagnostic tools promises to revolutionize repair accuracy and speed.

Leading Players in the USA Automotive Service Industry Sector

- Midas International LLC

- Meineke Car Care Centers LLC

- Pep Boys

- Firestone Complete Auto Care

- Safelite Group

- Monro Inc.

- Jiffy Lube International Inc.

- Walmart Inc.

Key Milestones in USA Automotive Service Industry Industry

- December 2022: AutoNation Inc. acquired RepairSmith, a full-service mobile solution for automotive repair and maintenance, significantly expanding its reach in the southern and western United States. This move highlights the growing trend of integrating mobile services within the automotive retail landscape.

- May 2022: American Tire Distributors (ATD) and Monro, Inc. announced a definitive agreement for ATD to acquire Monro's wholesale tire distribution assets, operating under the "Tires Now" name. This strategic acquisition aims to consolidate market share and enhance distribution capabilities within the tire segment.

- March 2022: Monro Inc. signed an agreement to acquire Mountain View Tire & Service Inc., adding USD 45 million in expected annualized sales and bolstering its presence in the western region with an additional 116 stores. This expansion underscores Monro's strategic growth initiatives and focus on regional market penetration.

Strategic Outlook for USA Automotive Service Industry Market

The strategic outlook for the USA Automotive Service Industry is overwhelmingly positive, characterized by sustained growth and evolving opportunities. Key growth accelerators include the continued expansion of the vehicle parc, the increasing complexity of automotive technology, and the accelerating transition to electric vehicles. Strategic opportunities lie in embracing digital transformation, investing in specialized EV servicing capabilities, and enhancing customer experience through personalized and convenient service offerings. Partnerships and acquisitions will continue to play a crucial role in market consolidation and expansion, allowing companies to leverage synergies and expand their geographic reach. The industry is set to benefit from ongoing innovation in diagnostic tools and repair methodologies.

USA Automotive Service Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Service Type

- 2.1. Mechanical

- 2.2. Exterior and Structural

- 2.3. Electrical and Electronics

-

3. Equipment Type

- 3.1. Tires

- 3.2. Seats

- 3.3. Batteries

- 3.4. Other Equipment Types

USA Automotive Service Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

USA Automotive Service Industry Regional Market Share

Geographic Coverage of USA Automotive Service Industry

USA Automotive Service Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sales of Electric Vehicles are Expected to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Lack of Infrastructure May Hamper the growth of the Market

- 3.4. Market Trends

- 3.4.1. Growing Demand for Commercial Vehicles Likely to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global USA Automotive Service Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Mechanical

- 5.2.2. Exterior and Structural

- 5.2.3. Electrical and Electronics

- 5.3. Market Analysis, Insights and Forecast - by Equipment Type

- 5.3.1. Tires

- 5.3.2. Seats

- 5.3.3. Batteries

- 5.3.4. Other Equipment Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America USA Automotive Service Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Cars

- 6.1.2. Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Service Type

- 6.2.1. Mechanical

- 6.2.2. Exterior and Structural

- 6.2.3. Electrical and Electronics

- 6.3. Market Analysis, Insights and Forecast - by Equipment Type

- 6.3.1. Tires

- 6.3.2. Seats

- 6.3.3. Batteries

- 6.3.4. Other Equipment Types

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. South America USA Automotive Service Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Cars

- 7.1.2. Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Service Type

- 7.2.1. Mechanical

- 7.2.2. Exterior and Structural

- 7.2.3. Electrical and Electronics

- 7.3. Market Analysis, Insights and Forecast - by Equipment Type

- 7.3.1. Tires

- 7.3.2. Seats

- 7.3.3. Batteries

- 7.3.4. Other Equipment Types

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Europe USA Automotive Service Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Cars

- 8.1.2. Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Service Type

- 8.2.1. Mechanical

- 8.2.2. Exterior and Structural

- 8.2.3. Electrical and Electronics

- 8.3. Market Analysis, Insights and Forecast - by Equipment Type

- 8.3.1. Tires

- 8.3.2. Seats

- 8.3.3. Batteries

- 8.3.4. Other Equipment Types

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Middle East & Africa USA Automotive Service Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Cars

- 9.1.2. Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Service Type

- 9.2.1. Mechanical

- 9.2.2. Exterior and Structural

- 9.2.3. Electrical and Electronics

- 9.3. Market Analysis, Insights and Forecast - by Equipment Type

- 9.3.1. Tires

- 9.3.2. Seats

- 9.3.3. Batteries

- 9.3.4. Other Equipment Types

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Asia Pacific USA Automotive Service Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Passenger Cars

- 10.1.2. Commercial Vehicles

- 10.2. Market Analysis, Insights and Forecast - by Service Type

- 10.2.1. Mechanical

- 10.2.2. Exterior and Structural

- 10.2.3. Electrical and Electronics

- 10.3. Market Analysis, Insights and Forecast - by Equipment Type

- 10.3.1. Tires

- 10.3.2. Seats

- 10.3.3. Batteries

- 10.3.4. Other Equipment Types

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Midas International LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Meineke Car Care Centers LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pep Boy

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Firestone Complete Auto Care

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Safelite Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Monro Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Jiffy Lube International Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Walmart Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Midas International LLC

List of Figures

- Figure 1: Global USA Automotive Service Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America USA Automotive Service Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America USA Automotive Service Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America USA Automotive Service Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 5: North America USA Automotive Service Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 6: North America USA Automotive Service Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 7: North America USA Automotive Service Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 8: North America USA Automotive Service Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America USA Automotive Service Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America USA Automotive Service Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 11: South America USA Automotive Service Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: South America USA Automotive Service Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 13: South America USA Automotive Service Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 14: South America USA Automotive Service Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 15: South America USA Automotive Service Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 16: South America USA Automotive Service Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: South America USA Automotive Service Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe USA Automotive Service Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 19: Europe USA Automotive Service Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Europe USA Automotive Service Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 21: Europe USA Automotive Service Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Europe USA Automotive Service Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 23: Europe USA Automotive Service Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 24: Europe USA Automotive Service Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe USA Automotive Service Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa USA Automotive Service Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 27: Middle East & Africa USA Automotive Service Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Middle East & Africa USA Automotive Service Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 29: Middle East & Africa USA Automotive Service Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 30: Middle East & Africa USA Automotive Service Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 31: Middle East & Africa USA Automotive Service Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 32: Middle East & Africa USA Automotive Service Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa USA Automotive Service Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific USA Automotive Service Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 35: Asia Pacific USA Automotive Service Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 36: Asia Pacific USA Automotive Service Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 37: Asia Pacific USA Automotive Service Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 38: Asia Pacific USA Automotive Service Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 39: Asia Pacific USA Automotive Service Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 40: Asia Pacific USA Automotive Service Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific USA Automotive Service Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global USA Automotive Service Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global USA Automotive Service Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 3: Global USA Automotive Service Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 4: Global USA Automotive Service Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global USA Automotive Service Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global USA Automotive Service Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: Global USA Automotive Service Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 8: Global USA Automotive Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global USA Automotive Service Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 13: Global USA Automotive Service Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: Global USA Automotive Service Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 15: Global USA Automotive Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global USA Automotive Service Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 20: Global USA Automotive Service Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 21: Global USA Automotive Service Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 22: Global USA Automotive Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global USA Automotive Service Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 33: Global USA Automotive Service Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 34: Global USA Automotive Service Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 35: Global USA Automotive Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global USA Automotive Service Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 43: Global USA Automotive Service Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 44: Global USA Automotive Service Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 45: Global USA Automotive Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific USA Automotive Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA Automotive Service Industry?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the USA Automotive Service Industry?

Key companies in the market include Midas International LLC, Meineke Car Care Centers LLC, Pep Boy, Firestone Complete Auto Care, Safelite Group, Monro Inc, Jiffy Lube International Inc, Walmart Inc.

3. What are the main segments of the USA Automotive Service Industry?

The market segments include Vehicle Type, Service Type, Equipment Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 188.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sales of Electric Vehicles are Expected to Drive the Market.

6. What are the notable trends driving market growth?

Growing Demand for Commercial Vehicles Likely to Drive the Market.

7. Are there any restraints impacting market growth?

Lack of Infrastructure May Hamper the growth of the Market.

8. Can you provide examples of recent developments in the market?

In December 2022, AutoNation Inc., one of America's largest automotive retailers, announced the acquisition of RepairSmith, a full-service mobile solution for automotive repair and maintenance headquartered in Los Angeles, CA, with a significant operational footprint in the southern and western United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA Automotive Service Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA Automotive Service Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA Automotive Service Industry?

To stay informed about further developments, trends, and reports in the USA Automotive Service Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence