Key Insights

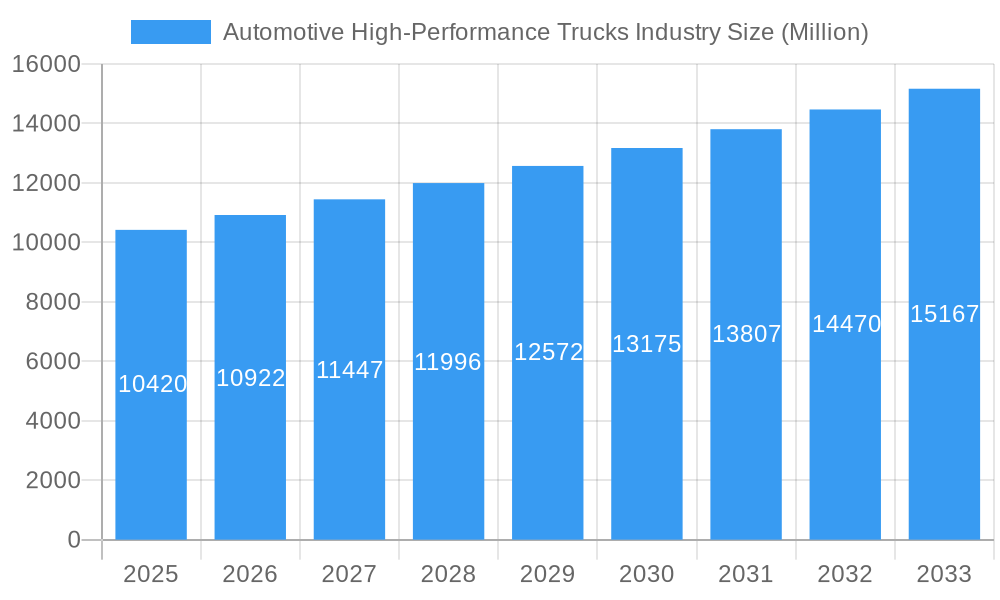

The Automotive High-Performance Trucks industry is poised for substantial growth, projected to reach a market size of $10.42 billion in 2025. This upward trajectory is underscored by a Compound Annual Growth Rate (CAGR) of 4.8% over the forecast period of 2025-2033. This robust expansion is largely driven by increasing demand for specialized trucking applications, advancements in engine technology, and the growing need for efficient logistics solutions across various sectors. The industry is witnessing a significant shift towards more powerful, durable, and fuel-efficient trucks designed to handle demanding operational environments, from long-haul freight to specialized construction and mining. The increasing adoption of advanced telematics and IoT solutions further enhances operational efficiency, contributing to the sustained growth momentum.

Automotive High-Performance Trucks Industry Market Size (In Billion)

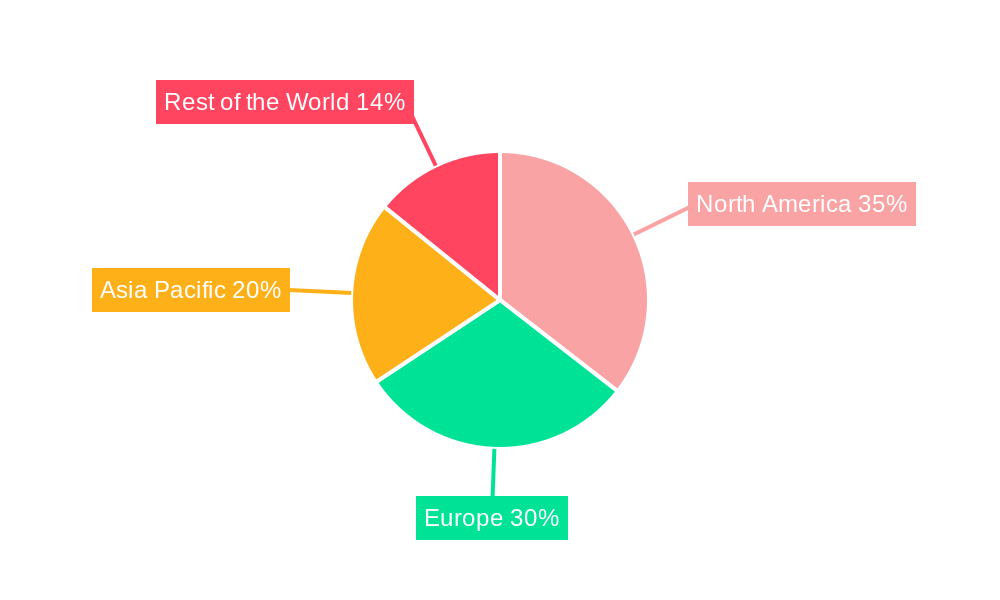

The market is segmented by truck type into Light-duty, Medium-duty, and Heavy-duty Trucks, with Heavy-duty trucks expected to dominate due to their critical role in global supply chains and infrastructure projects. In terms of drive type, the transition towards Electric or Hybrid powertrains is gaining significant traction, driven by stricter environmental regulations and a growing corporate focus on sustainability. While the Internal Combustion Engine (ICE) still holds a considerable share, the long-term outlook favors greener technologies. Key restraints include high initial investment costs for advanced technologies and the need for extensive charging/refueling infrastructure for electric and hybrid models. Geographically, North America and Europe are anticipated to lead market revenue, with Asia Pacific showing the fastest growth potential due to rapid industrialization and infrastructure development.

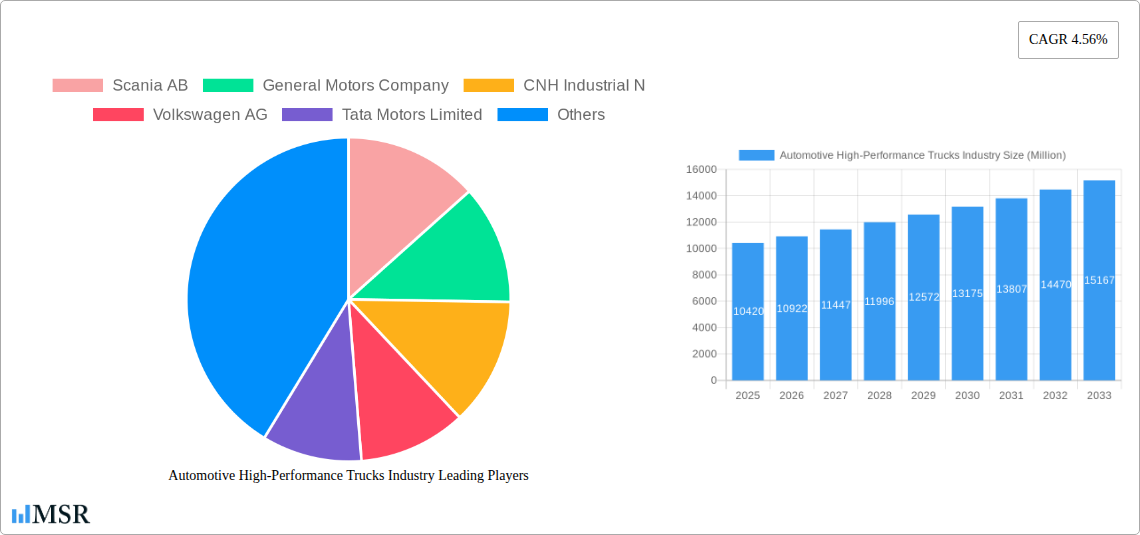

Automotive High-Performance Trucks Industry Company Market Share

Automotive High-Performance Trucks Industry: Market Analysis, Trends & Future Outlook (2019–2033)

This comprehensive report provides an in-depth analysis of the global Automotive High-Performance Trucks Industry, a sector experiencing robust growth driven by infrastructure development, technological innovation, and the increasing demand for efficiency and sustainability. The study covers the historical period from 2019 to 2024, with a base year of 2025, and offers a detailed forecast through 2033. Explore market dynamics, key segments, product developments, challenges, and emerging opportunities shaping the future of high-performance commercial vehicles.

Automotive High-Performance Trucks Industry Market Concentration & Dynamics

The Automotive High-Performance Trucks Industry is characterized by a moderate level of market concentration, with a few dominant players holding significant market share, estimated to be over 60% of the total market value. Innovation ecosystems are thriving, fueled by substantial R&D investments aimed at developing more fuel-efficient, powerful, and environmentally friendly trucks. Regulatory frameworks, particularly emission standards like BS VI and Euro 7, are increasingly stringent, pushing manufacturers to adopt advanced technologies. Substitute products, such as alternative fuel vehicles and specialized rail transport for certain long-haul logistics, pose a moderate threat. End-user trends are shifting towards a preference for trucks offering higher payload capacities, improved fuel economy, advanced telematics, and enhanced driver comfort and safety features. Merger and acquisition (M&A) activities have been observed, with an estimated XX number of significant deals in the historical period, focusing on consolidating market share, acquiring new technologies, and expanding geographical reach. The estimated market value for high-performance trucks is projected to reach over $250 billion by the end of the forecast period.

Automotive High-Performance Trucks Industry Industry Insights & Trends

The Automotive High-Performance Trucks Industry is poised for significant expansion, projected to reach a market size of over $250 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period (2025–2033). This growth is primarily fueled by escalating global infrastructure projects, particularly in developing economies, which necessitate robust and reliable heavy-duty transportation solutions. Technological disruptions are at the forefront, with a pronounced shift towards electrification and hybridization. Manufacturers are heavily investing in developing electric and hybrid powertrain technologies to meet increasingly stringent emission regulations and growing environmental consciousness among fleet operators. The integration of advanced telematics, Artificial Intelligence (AI) for predictive maintenance, and autonomous driving features are further revolutionizing the industry, enhancing operational efficiency and safety. Evolving consumer behaviors are characterized by an increasing demand for total cost of ownership (TCO) optimization, leading to a preference for vehicles that offer superior fuel efficiency, reduced maintenance costs, and longer operational lifespans. The rise of e-commerce and the need for faster delivery times are also driving demand for specialized high-performance trucks capable of handling higher volumes and operating in demanding urban and inter-city environments. The industry is witnessing a growing emphasis on driver well-being, with manufacturers incorporating advanced cabin designs and ergonomic features to attract and retain skilled drivers.

Key Markets & Segments Leading Automotive High-Performance Trucks Industry

The Automotive High-Performance Trucks Industry is witnessing dominant growth across several key markets and segments. Heavy-duty Trucks represent the largest segment by revenue, accounting for over 70% of the total market value, driven by their indispensable role in long-haul logistics, construction, and mining operations.

Drive Type: Internal Combustion Engine remains the leading drive type, contributing over 85% of the current market share, primarily due to established infrastructure, proven reliability, and ongoing advancements in diesel engine efficiency and emissions control. However, the Electric Or Hybrid segment is experiencing the fastest growth, with a projected CAGR of over 15% during the forecast period, fueled by regulatory mandates and corporate sustainability goals.

Geographically, Asia-Pacific is emerging as the leading market, projected to account for over 35% of the global market share by 2033. This dominance is attributed to:

- Rapid Infrastructure Development: Massive investments in roads, bridges, and logistics networks across countries like China, India, and Southeast Asian nations.

- Growing Industrial Output: Expansion of manufacturing and production sectors requiring efficient and high-capacity transportation.

- Increasing Fleet Modernization: Replacement of older, less efficient fleets with advanced, high-performance trucks to meet evolving operational demands and emission standards.

- Government Initiatives: Supportive policies and incentives for commercial vehicle manufacturing and adoption.

Within the Truck Type segmentation, the Heavy-duty Trucks segment is the primary revenue generator. Key drivers for its dominance include:

- Construction and Mining Boom: Significant global investments in infrastructure projects and resource extraction activities directly fuel the demand for heavy-duty haulers, dump trucks, and specialized mining vehicles.

- Long-Haul Logistics: The backbone of global trade relies on heavy-duty trucks for transporting goods over long distances, a segment that continues to grow with increasing consumption patterns.

- Technological Advancements: Manufacturers are continuously innovating, offering more powerful engines, improved fuel efficiency, and enhanced payload capabilities in heavy-duty trucks to meet stringent operational requirements.

For Drive Type, while Internal Combustion Engine (ICE) trucks continue to lead, the trajectory of Electric Or Hybrid trucks is a critical trend:

- Environmental Regulations: Increasingly stringent emission standards globally are a major catalyst for the adoption of electric and hybrid powertrains, pushing manufacturers to innovate and fleet operators to consider sustainable options.

- Total Cost of Ownership (TCO) Reductions: While initial purchase costs for electric trucks can be higher, lower operating costs, reduced maintenance, and government incentives are making them increasingly attractive for fleet operators.

- Technological Maturity: Advancements in battery technology, charging infrastructure, and electric powertrain efficiency are making electric trucks a viable and increasingly competitive option for various applications.

- Corporate Sustainability Goals: Many companies are setting ambitious targets for reducing their carbon footprint, leading to increased procurement of zero-emission commercial vehicles.

Automotive High-Performance Trucks Industry Product Developments

The Automotive High-Performance Trucks Industry is witnessing a flurry of product innovations focused on enhancing performance, efficiency, and sustainability. Manufacturers are integrating advanced powertrain technologies, including more powerful and fuel-efficient internal combustion engines meeting stringent emission norms like BS VI, alongside a significant push towards electric and hybrid drivetrains. Innovations in aerodynamics, lightweight materials, and intelligent telematics systems are further optimizing operational efficiency and driver experience. The market relevance of these developments lies in their ability to address critical industry challenges such as rising fuel costs, environmental regulations, and the growing demand for reliable, high-capacity transportation solutions across various demanding applications like construction, mining, and long-haul logistics.

Challenges in the Automotive High-Performance Trucks Industry Market

The Automotive High-Performance Trucks Industry faces several significant challenges. High upfront costs for advanced technologies, particularly electric and hybrid powertrains, remain a barrier for many fleet operators, despite potential long-term savings. Inadequate charging infrastructure for electric trucks in many regions hinders widespread adoption. Supply chain disruptions, as seen in recent years, can impact production timelines and component availability, affecting market stability. Furthermore, regulatory complexities and varying emission standards across different countries add to the challenges of global market entry and product standardization. The market also grapples with skilled labor shortages, particularly for technicians trained in maintaining new, complex vehicle technologies.

Forces Driving Automotive High-Performance Trucks Industry Growth

Several key forces are driving the growth of the Automotive High-Performance Trucks Industry. Escalating global infrastructure development, particularly in emerging economies, creates a sustained demand for robust and high-capacity trucks for construction, mining, and logistics. Increasing environmental consciousness and stringent emission regulations are compelling manufacturers to invest heavily in cleaner technologies like electric and hybrid powertrains, which are becoming increasingly viable and demanded. Technological advancements in engine efficiency, lightweight materials, and advanced telematics are enhancing vehicle performance, fuel economy, and operational efficiency, making high-performance trucks more attractive. The growth of e-commerce and evolving consumer demands for faster delivery times necessitate more efficient and specialized transportation solutions.

Challenges in the Automotive High-Performance Trucks Industry Market

Long-term growth catalysts for the Automotive High-Performance Trucks Industry are deeply rooted in continuous innovation and strategic market expansion. The ongoing development and refinement of alternative fuel technologies, including hydrogen fuel cells, present a significant long-term opportunity to address sustainability concerns and reduce reliance on fossil fuels. Strategic partnerships and collaborations between OEMs, technology providers, and infrastructure developers are crucial for accelerating the adoption of new technologies and establishing robust ecosystems for electric and other alternative fuel vehicles. Furthermore, expanding into underserved or emerging markets with tailored product offerings that address local needs and infrastructure limitations can unlock substantial growth potential. The increasing focus on autonomous driving and platooning technologies promises to revolutionize logistics efficiency and safety in the long run.

Emerging Opportunities in Automotive High-Performance Trucks Industry

Emerging opportunities in the Automotive High-Performance Trucks Industry are diverse and promising. The rapid expansion of the electric and hybrid truck segment offers substantial growth potential as battery technology improves and charging infrastructure expands. The growing demand for specialized trucks for urban logistics and last-mile delivery, often requiring smaller yet highly efficient and maneuverable vehicles, presents a niche market. The integration of advanced data analytics and AI for predictive maintenance, route optimization, and fleet management creates opportunities for value-added services and enhanced operational efficiency. Furthermore, the increasing global focus on circular economy principles is fostering opportunities in truck refurbishment, remanufacturing, and end-of-life vehicle management. The development of sustainable materials in truck manufacturing also opens new avenues for innovation and market differentiation.

Leading Players in the Automotive High-Performance Trucks Industry Sector

- Scania AB

- General Motors Company

- CNH Industrial N

- Volkswagen AG

- Tata Motors Limited

- Mercedes-Benz Group AG

- Toyota Motor Corporation

- Paccar Inc

- AB Volvo

- Ford Motor Company

Key Milestones in Automotive High-Performance Trucks Industry Industry

- January 2023: BharatBenz showcased their latest high-performance construction and mining trucks at Bauma 2023, including the 3532CM and 2832CM mining tippers, and the 5532 Tip Trailer. These vehicles feature a robust 320hp BS VI diesel powertrain, delivering exceptional high wheel-end torque for challenging terrain.

- September 2022: AB Volvo announced the launch of electric versions of their renowned heavy-duty truck lineup, including Volvo FH, Volvo FM, and Volvo FMX, initiating production to support sustainable transportation and reduce carbon emissions.

- June 2022: Eicher Trucks and Buses unveiled the Eicher Pro 5000 series, a range of heavy-duty trucks (16T to 40T) powered by the E694 engine with i3 EGR technology from Volvo Group's EMS 3.0, meeting BSIV requirements and offering robust performance.

Strategic Outlook for Automotive High-Performance Trucks Industry Market

The strategic outlook for the Automotive High-Performance Trucks Industry is one of significant growth and transformation. The market will be characterized by a continued push towards electrification and hybridization, driven by global sustainability mandates and technological advancements. Manufacturers will focus on developing integrated solutions that combine advanced vehicle technology with robust digital services, including telematics, predictive maintenance, and fleet management software. Investment in charging infrastructure and alternative fuel solutions will be critical for widespread adoption. Strategic partnerships, mergers, and acquisitions will likely continue as companies seek to consolidate market share, acquire cutting-edge technologies, and expand their global footprint. The industry is expected to capitalize on the growing demand for efficient, reliable, and environmentally responsible transportation solutions to support evolving global logistics and infrastructure needs.

Automotive High-Performance Trucks Industry Segmentation

-

1. Truck Type

- 1.1. Light-duty Trucks

- 1.2. Medium-duty Trucks

- 1.3. Heavy-duty Trucks

-

2. Drive Type

- 2.1. Internal Combustion Engine

- 2.2. Electric Or Hybrid

Automotive High-Performance Trucks Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest Of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive High-Performance Trucks Industry Regional Market Share

Geographic Coverage of Automotive High-Performance Trucks Industry

Automotive High-Performance Trucks Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Specialty Trucks; Others

- 3.3. Market Restrains

- 3.3.1. Availability of Substitute Products; Others

- 3.4. Market Trends

- 3.4.1. Heavy-duty Truck Segment is Projected to Grow at a Fast Pace

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive High-Performance Trucks Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Truck Type

- 5.1.1. Light-duty Trucks

- 5.1.2. Medium-duty Trucks

- 5.1.3. Heavy-duty Trucks

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. Internal Combustion Engine

- 5.2.2. Electric Or Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Truck Type

- 6. North America Automotive High-Performance Trucks Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Truck Type

- 6.1.1. Light-duty Trucks

- 6.1.2. Medium-duty Trucks

- 6.1.3. Heavy-duty Trucks

- 6.2. Market Analysis, Insights and Forecast - by Drive Type

- 6.2.1. Internal Combustion Engine

- 6.2.2. Electric Or Hybrid

- 6.1. Market Analysis, Insights and Forecast - by Truck Type

- 7. Europe Automotive High-Performance Trucks Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Truck Type

- 7.1.1. Light-duty Trucks

- 7.1.2. Medium-duty Trucks

- 7.1.3. Heavy-duty Trucks

- 7.2. Market Analysis, Insights and Forecast - by Drive Type

- 7.2.1. Internal Combustion Engine

- 7.2.2. Electric Or Hybrid

- 7.1. Market Analysis, Insights and Forecast - by Truck Type

- 8. Asia Pacific Automotive High-Performance Trucks Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Truck Type

- 8.1.1. Light-duty Trucks

- 8.1.2. Medium-duty Trucks

- 8.1.3. Heavy-duty Trucks

- 8.2. Market Analysis, Insights and Forecast - by Drive Type

- 8.2.1. Internal Combustion Engine

- 8.2.2. Electric Or Hybrid

- 8.1. Market Analysis, Insights and Forecast - by Truck Type

- 9. Rest of the World Automotive High-Performance Trucks Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Truck Type

- 9.1.1. Light-duty Trucks

- 9.1.2. Medium-duty Trucks

- 9.1.3. Heavy-duty Trucks

- 9.2. Market Analysis, Insights and Forecast - by Drive Type

- 9.2.1. Internal Combustion Engine

- 9.2.2. Electric Or Hybrid

- 9.1. Market Analysis, Insights and Forecast - by Truck Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Scania AB

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 General Motors Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 CNH Industrial N

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Volkswagen AG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Tata Motors Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Mercedes-Benz Group AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Toyota Motor Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Paccar Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 AB Volvo

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Ford Motor Company

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Scania AB

List of Figures

- Figure 1: Global Automotive High-Performance Trucks Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Automotive High-Performance Trucks Industry Revenue (undefined), by Truck Type 2025 & 2033

- Figure 3: North America Automotive High-Performance Trucks Industry Revenue Share (%), by Truck Type 2025 & 2033

- Figure 4: North America Automotive High-Performance Trucks Industry Revenue (undefined), by Drive Type 2025 & 2033

- Figure 5: North America Automotive High-Performance Trucks Industry Revenue Share (%), by Drive Type 2025 & 2033

- Figure 6: North America Automotive High-Performance Trucks Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Automotive High-Performance Trucks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automotive High-Performance Trucks Industry Revenue (undefined), by Truck Type 2025 & 2033

- Figure 9: Europe Automotive High-Performance Trucks Industry Revenue Share (%), by Truck Type 2025 & 2033

- Figure 10: Europe Automotive High-Performance Trucks Industry Revenue (undefined), by Drive Type 2025 & 2033

- Figure 11: Europe Automotive High-Performance Trucks Industry Revenue Share (%), by Drive Type 2025 & 2033

- Figure 12: Europe Automotive High-Performance Trucks Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Automotive High-Performance Trucks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automotive High-Performance Trucks Industry Revenue (undefined), by Truck Type 2025 & 2033

- Figure 15: Asia Pacific Automotive High-Performance Trucks Industry Revenue Share (%), by Truck Type 2025 & 2033

- Figure 16: Asia Pacific Automotive High-Performance Trucks Industry Revenue (undefined), by Drive Type 2025 & 2033

- Figure 17: Asia Pacific Automotive High-Performance Trucks Industry Revenue Share (%), by Drive Type 2025 & 2033

- Figure 18: Asia Pacific Automotive High-Performance Trucks Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Automotive High-Performance Trucks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Automotive High-Performance Trucks Industry Revenue (undefined), by Truck Type 2025 & 2033

- Figure 21: Rest of the World Automotive High-Performance Trucks Industry Revenue Share (%), by Truck Type 2025 & 2033

- Figure 22: Rest of the World Automotive High-Performance Trucks Industry Revenue (undefined), by Drive Type 2025 & 2033

- Figure 23: Rest of the World Automotive High-Performance Trucks Industry Revenue Share (%), by Drive Type 2025 & 2033

- Figure 24: Rest of the World Automotive High-Performance Trucks Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Automotive High-Performance Trucks Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive High-Performance Trucks Industry Revenue undefined Forecast, by Truck Type 2020 & 2033

- Table 2: Global Automotive High-Performance Trucks Industry Revenue undefined Forecast, by Drive Type 2020 & 2033

- Table 3: Global Automotive High-Performance Trucks Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Automotive High-Performance Trucks Industry Revenue undefined Forecast, by Truck Type 2020 & 2033

- Table 5: Global Automotive High-Performance Trucks Industry Revenue undefined Forecast, by Drive Type 2020 & 2033

- Table 6: Global Automotive High-Performance Trucks Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Automotive High-Performance Trucks Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Automotive High-Performance Trucks Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Rest Of North America Automotive High-Performance Trucks Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Automotive High-Performance Trucks Industry Revenue undefined Forecast, by Truck Type 2020 & 2033

- Table 11: Global Automotive High-Performance Trucks Industry Revenue undefined Forecast, by Drive Type 2020 & 2033

- Table 12: Global Automotive High-Performance Trucks Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Automotive High-Performance Trucks Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Automotive High-Performance Trucks Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Automotive High-Performance Trucks Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Automotive High-Performance Trucks Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Automotive High-Performance Trucks Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Automotive High-Performance Trucks Industry Revenue undefined Forecast, by Truck Type 2020 & 2033

- Table 19: Global Automotive High-Performance Trucks Industry Revenue undefined Forecast, by Drive Type 2020 & 2033

- Table 20: Global Automotive High-Performance Trucks Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: India Automotive High-Performance Trucks Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: China Automotive High-Performance Trucks Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Japan Automotive High-Performance Trucks Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: South Korea Automotive High-Performance Trucks Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Automotive High-Performance Trucks Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Automotive High-Performance Trucks Industry Revenue undefined Forecast, by Truck Type 2020 & 2033

- Table 27: Global Automotive High-Performance Trucks Industry Revenue undefined Forecast, by Drive Type 2020 & 2033

- Table 28: Global Automotive High-Performance Trucks Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: South America Automotive High-Performance Trucks Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Middle East and Africa Automotive High-Performance Trucks Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive High-Performance Trucks Industry?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Automotive High-Performance Trucks Industry?

Key companies in the market include Scania AB, General Motors Company, CNH Industrial N, Volkswagen AG, Tata Motors Limited, Mercedes-Benz Group AG, Toyota Motor Corporation, Paccar Inc, AB Volvo, Ford Motor Company.

3. What are the main segments of the Automotive High-Performance Trucks Industry?

The market segments include Truck Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Specialty Trucks; Others.

6. What are the notable trends driving market growth?

Heavy-duty Truck Segment is Projected to Grow at a Fast Pace.

7. Are there any restraints impacting market growth?

Availability of Substitute Products; Others.

8. Can you provide examples of recent developments in the market?

January 2023: BharatBenz showcased their latest high-performance construction and mining trucks at Bauma 2023. Among the impressive lineup were the 3532CM and 2832CM mining tippers, along with the 5532 Tip Trailer. These cutting-edge vehicles come equipped with a robust 320hp BS VI diesel powertrain, providing an exceptional level of high wheel-end torque. This feature enables these trucks to navigate and conquer even the most challenging and steep mining roads with ease.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive High-Performance Trucks Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive High-Performance Trucks Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive High-Performance Trucks Industry?

To stay informed about further developments, trends, and reports in the Automotive High-Performance Trucks Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence