Key Insights

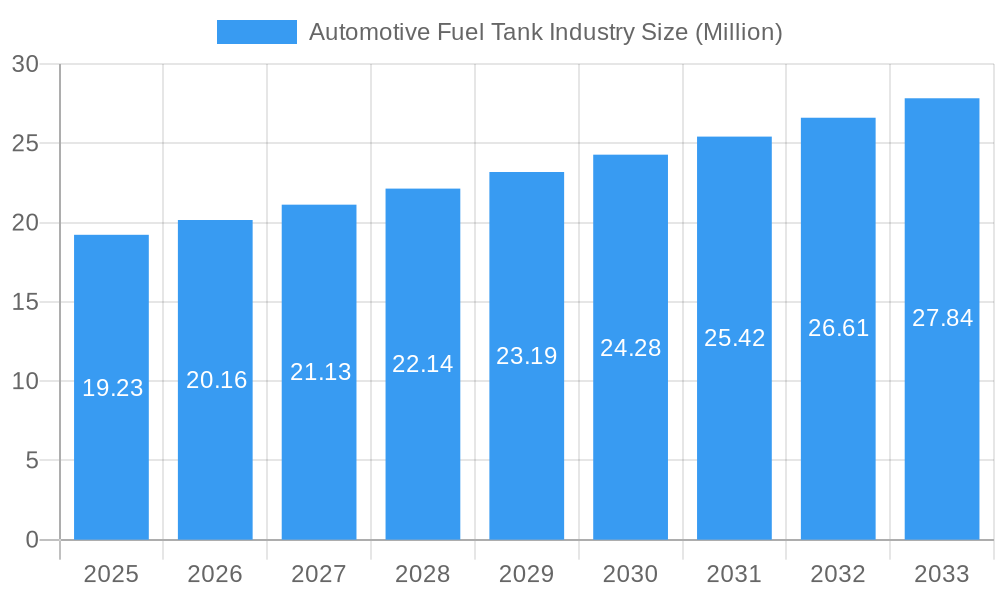

The global Automotive Fuel Tank Industry is poised for robust growth, projected to reach USD 19.23 million in market size and expand at a Compound Annual Growth Rate (CAGR) of 4.80% from 2025 to 2033. This expansion is primarily driven by the sustained demand for internal combustion engine (ICE) vehicles, which continue to dominate global automotive production, particularly in emerging economies. Advancements in fuel tank technology, focusing on enhanced safety features, improved fuel efficiency, and lighter materials for better vehicle performance, are also significant growth catalysts. The increasing stringency of emission regulations worldwide necessitates the adoption of sophisticated fuel tank systems that minimize evaporative emissions, further stimulating market innovation and adoption. Furthermore, the growing production of commercial vehicles, essential for logistics and transportation, directly translates to increased demand for larger capacity fuel tanks.

Automotive Fuel Tank Industry Market Size (In Million)

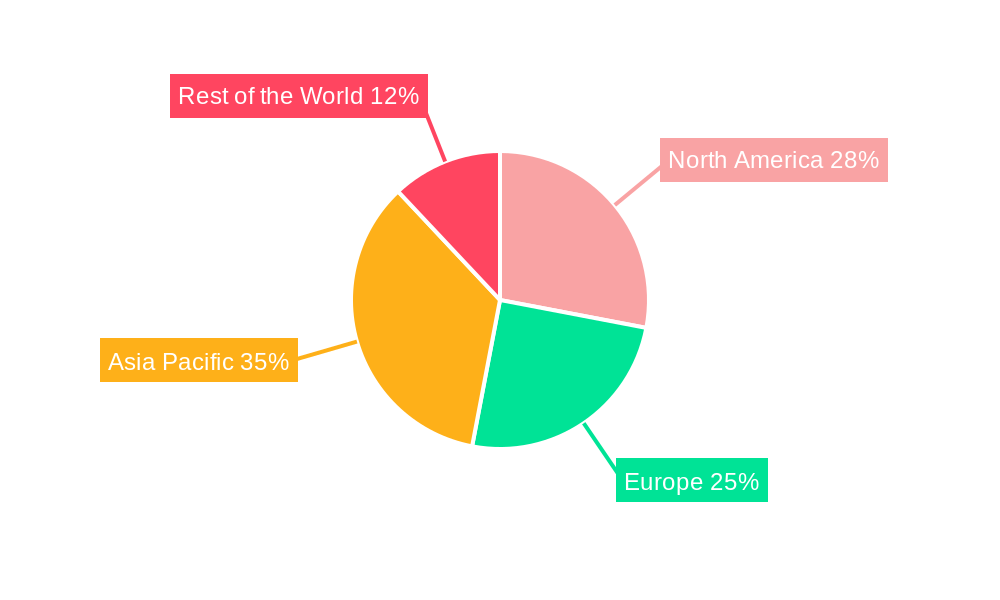

The market segmentation reveals diverse opportunities across different capacity ranges, material types, and vehicle types. The "45-70 liters" capacity segment is expected to witness substantial demand, catering to a wide spectrum of passenger cars. In terms of material, plastic fuel tanks are likely to maintain their dominance due to their cost-effectiveness, durability, and design flexibility, though aluminum and steel will retain their significance, especially in specialized applications and commercial vehicles. Geographically, the Asia Pacific region, led by China and India, is anticipated to be the largest and fastest-growing market, fueled by rapid urbanization, increasing disposable incomes, and a burgeoning automotive manufacturing base. North America and Europe, while mature markets, will continue to be significant due to a strong aftermarket demand and the presence of leading automotive manufacturers. Challenges such as the increasing adoption of electric vehicles (EVs) and evolving regulatory landscapes present long-term considerations, but the immediate and medium-term outlook for the traditional fuel tank market remains strong.

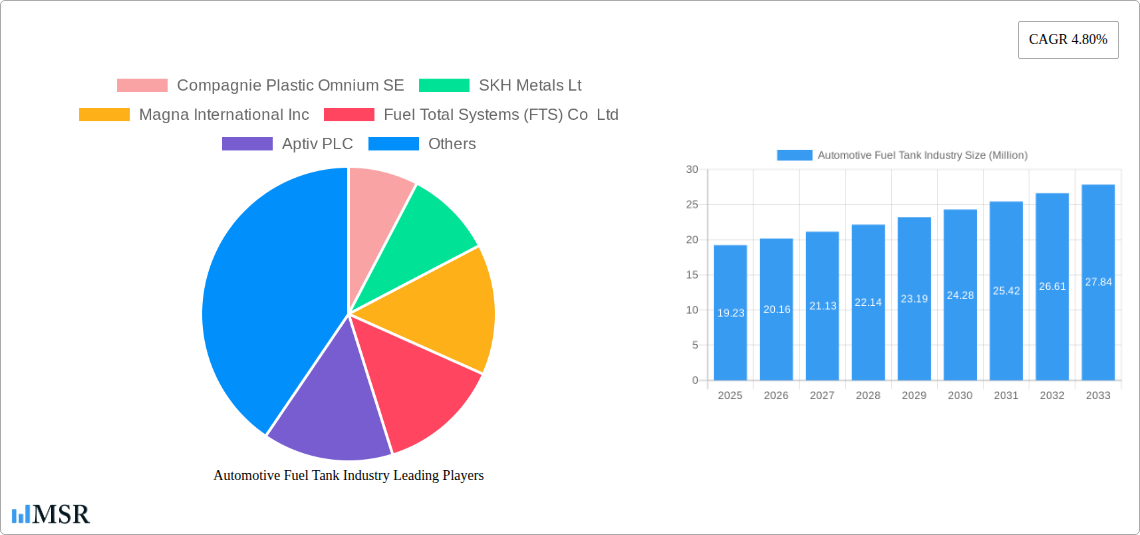

Automotive Fuel Tank Industry Company Market Share

Explore the dynamic landscape of the global Automotive Fuel Tank Industry with this comprehensive, SEO-optimized report. Designed for automotive manufacturers, tier-1 suppliers, R&D professionals, investors, and strategic planners, this in-depth analysis provides critical insights into market dynamics, technological advancements, and future growth trajectories. Discover actionable intelligence to navigate the evolving automotive sector, from traditional fuel systems to the burgeoning hydrogen economy.

Study Period: 2019–2033 | Base Year: 2025 | Estimated Year: 2025 | Forecast Period: 2025–2033 | Historical Period: 2019–2024

Automotive Fuel Tank Industry Market Concentration & Dynamics

The Automotive Fuel Tank Industry is characterized by a moderate market concentration, with a few key players holding significant market share, estimated at over 50% of the global market value. Innovation ecosystems are flourishing, driven by stringent emissions regulations and the increasing demand for advanced fuel storage solutions. Regulatory frameworks, particularly in North America and Europe, are a major influence, pushing for lighter materials and higher safety standards. Substitute products, such as advanced battery electric vehicles (BEVs), pose a growing challenge, yet traditional and alternative fuel tanks continue to see robust demand, especially in emerging markets and for specific vehicle types. End-user trends are shifting towards enhanced fuel efficiency and safety, with a growing interest in multi-material tank designs for optimized performance. Mergers and acquisitions (M&A) activities are relatively moderate, with approximately 5-10 significant deals annually, primarily focused on consolidating market positions and acquiring new technologies. Key M&A strategies often involve collaborations for lightweighting solutions and the development of tanks for new energy vehicles. The market is projected to reach an estimated $35,000 Million by 2033.

- Key Trends:

- Increasing adoption of plastic fuel tanks for weight reduction and design flexibility.

- Growing research and development in composite materials for enhanced durability and safety.

- Focus on integrated fuel system solutions to improve vehicle performance and efficiency.

- Market Share Snapshot: Key players hold approximately 65% of the global market share.

- M&A Activity: An average of 7 M&A deals per year in the past five years, targeting technological advancements and market expansion.

Automotive Fuel Tank Industry Industry Insights & Trends

The Automotive Fuel Tank Industry is experiencing significant growth, projected to expand from an estimated $25,000 Million in 2025 to an impressive $35,000 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period. This expansion is fueled by several critical market growth drivers. The persistent global demand for passenger cars and commercial vehicles, particularly in emerging economies, forms the bedrock of this growth. Furthermore, evolving emissions standards worldwide are compelling automakers to innovate, driving demand for lighter, more efficient, and safer fuel tank systems. Technological disruptions are at the forefront, with significant advancements in materials science leading to the widespread adoption of plastic fuel tanks over traditional steel, owing to their superior weight-saving capabilities and corrosion resistance. Aluminum fuel tanks are also gaining traction, especially for their excellent recyclability and strength-to-weight ratio. The integration of advanced sensors for fuel level monitoring and leak detection further enhances safety and efficiency. Evolving consumer behaviors are also playing a crucial role; consumers are increasingly aware of fuel economy and environmental impact, leading to a preference for vehicles equipped with optimized fuel storage solutions. The ongoing transition towards new energy vehicles, including hydrogen fuel cell vehicles (FCVs), is opening up new avenues for specialized tank development, such as high-pressure composite tanks. The demand for fuel tanks with capacities ranging from 45-70 liters remains dominant, catering to a broad spectrum of passenger vehicles. However, the segment for capacities above 70 liters is witnessing steady growth, driven by the increasing demand for larger SUVs and commercial vehicles with extended range requirements. The emphasis on lightweighting is also a significant trend, pushing manufacturers to explore innovative designs and materials that reduce overall vehicle weight, thereby improving fuel efficiency and reducing emissions. This sustained demand for efficient and safe fuel storage, coupled with regulatory pushes for cleaner automotive technologies, ensures a robust growth trajectory for the Automotive Fuel Tank Industry.

Key Markets & Segments Leading Automotive Fuel Tank Industry

The Asia-Pacific region stands as the dominant market in the Automotive Fuel Tank Industry, accounting for an estimated 40% of the global market share. This dominance is primarily driven by the sheer volume of vehicle production in countries like China, India, and Japan, coupled with a rapidly expanding automotive consumer base and significant investments in manufacturing infrastructure.

- Dominant Markets & Regions:

- Asia-Pacific: Spearheaded by China and India, this region benefits from strong domestic demand for both passenger and commercial vehicles, along with robust automotive manufacturing capabilities.

- North America: Driven by a strong demand for larger vehicles and an increasing focus on lightweighting and advanced materials.

- Europe: Characterized by stringent emission regulations and a high adoption rate of advanced fuel technologies.

Within the Material Type segment, Plastic fuel tanks are leading the market, holding an estimated 60% market share. This is attributed to their inherent advantages in weight reduction, design flexibility, and corrosion resistance, which directly contribute to improved fuel efficiency and lower manufacturing costs.

- Material Type Dominance:

- Plastic: Holds a commanding market share due to its lightweight nature, design versatility, and cost-effectiveness.

- Aluminum: Gaining traction for its recyclability and strength, particularly in premium and specialized vehicles.

- Steel: Continues to be a significant segment, especially in cost-sensitive markets and for certain heavy-duty applications, though its market share is gradually declining.

The Vehicle Type segment is heavily influenced by the Passenger Cars segment, which accounts for approximately 70% of the market demand for fuel tanks. The consistent global demand for personal transportation, coupled with the ongoing evolution of vehicle designs and engine technologies, solidifies its leading position.

- Vehicle Type Dominance:

- Passenger Cars: Represent the largest segment due to high production volumes and diverse model offerings.

- Commercial Vehicles: Showing steady growth, driven by logistics and transportation needs, especially for medium and heavy-duty applications.

In terms of Capacity, the 45-70 liters segment is the most prevalent, catering to the majority of passenger car requirements and offering a balance between range and vehicle packaging.

- Capacity Segment Leadership:

- 45-70 liters: Dominant segment, fulfilling the needs of a wide range of passenger vehicles.

- Less than 45 liters: Niche segment, primarily for smaller vehicles and specific applications.

- Above 70 liters: Growing segment, driven by demand for SUVs, trucks, and long-haul commercial vehicles requiring extended range.

Automotive Fuel Tank Industry Product Developments

Product development in the Automotive Fuel Tank Industry is intensely focused on innovation for enhanced safety, weight reduction, and compatibility with alternative fuels. A significant advancement is the development of advanced polymer composites and multi-layer plastic structures that offer superior permeation resistance and durability. For instance, the December 2023 partnership between Toyota Motor Corporation and UBE Corporation to develop a new polyamide 6 resin (UBE NYLON 1218IU) for high-pressure hydrogen tanks in FCVs highlights the critical role of material science in enabling next-generation vehicles. This innovation directly addresses the stringent requirements for preventing hydrogen leakage, a crucial factor for the widespread adoption of fuel cell technology. Similarly, Robert Bosch GmbH's November 2023 launch of H2 Mobility, a comprehensive technology suite for hydrogen-powered vehicles, underscores the industry's shift towards alternative fuel systems, including specialized tank solutions designed for hydrogen storage. These developments are crucial for manufacturers seeking to meet evolving regulatory demands and consumer preferences for cleaner mobility solutions, providing a competitive edge in the rapidly transforming automotive landscape. The market for these advanced fuel tanks is expected to grow significantly as FCVs and other hydrogen-powered vehicles gain traction.

Challenges in the Automotive Fuel Tank Industry Market

The Automotive Fuel Tank Industry faces several significant challenges. The increasing shift towards electric vehicles (EVs) poses a long-term threat, potentially reducing the overall demand for traditional fuel tanks. Stringent and evolving environmental regulations regarding emissions and material sourcing require continuous investment in R&D and compliance, adding to production costs. Supply chain disruptions, exacerbated by geopolitical events and raw material price volatility, can impact production schedules and profitability. Furthermore, the high cost of developing and implementing new technologies, particularly for alternative fuel tanks like hydrogen, can be a barrier to widespread adoption. Competitive pressures from established players and new entrants also necessitate constant innovation and cost optimization.

Forces Driving Automotive Fuel Tank Industry Growth

Several forces are propelling the growth of the Automotive Fuel Tank Industry. The persistent demand for internal combustion engine (ICE) vehicles, especially in developing economies, continues to drive sales of traditional fuel tanks. Increasingly stringent global emission standards are compelling automakers to adopt lighter and more efficient fuel tank designs, favoring materials like plastic and aluminum. The ongoing development and gradual adoption of alternative fuel vehicles, such as hydrogen fuel cell vehicles (FCVs), are creating new opportunities for specialized and advanced fuel tank systems. Government incentives and support for cleaner transportation technologies also play a crucial role in market expansion. The focus on vehicle lightweighting to improve fuel economy and reduce CO2 emissions is a significant driver for innovative fuel tank solutions.

Challenges in the Automotive Fuel Tank Industry Market

Long-term growth catalysts in the Automotive Fuel Tank Industry are rooted in technological innovation and strategic market adaptation. The ongoing development of advanced composite materials for high-pressure hydrogen tanks is a critical growth catalyst, enabling the transition to a hydrogen-based mobility ecosystem. Partnerships between automotive OEMs and fuel tank manufacturers are essential for co-developing bespoke solutions that meet specific vehicle requirements and performance targets. Market expansions into emerging economies with growing automotive sectors also present significant growth opportunities. Furthermore, the integration of smart technologies for enhanced fuel monitoring, safety, and efficient fuel management will drive demand for next-generation fuel tank systems. The industry's ability to adapt to the evolving powertrain landscape by offering solutions for both ICE and alternative fuel vehicles will be key to sustained growth.

Emerging Opportunities in Automotive Fuel Tank Industry

Emerging opportunities in the Automotive Fuel Tank Industry are manifold, driven by the global push for sustainable mobility. The rapidly growing market for hydrogen fuel cell vehicles (FCVs) presents a substantial opportunity for manufacturers of high-pressure composite fuel tanks. Developing and scaling the production of these advanced tanks is crucial for meeting the demand from this segment. The increasing demand for lightweighting solutions across all vehicle types, including electric vehicles (which may utilize compressed gas storage systems), creates opportunities for innovative material applications and tank designs. Furthermore, the aftermarket for fuel tank replacement and upgrades, particularly for older vehicles, remains a stable revenue stream. Exploring opportunities in niche markets such as specialized industrial vehicles and off-road equipment also presents avenues for growth. The circular economy and recycling initiatives for automotive components are also gaining momentum, offering opportunities for companies that can develop sustainable material solutions and recycling processes.

Leading Players in the Automotive Fuel Tank Industry Sector

- Compagnie Plastic Omnium SE

- SKH Metals Lt

- Magna International Inc

- Fuel Total Systems (FTS) Co Ltd

- Aptiv PLC

- YAPP Automotive Systems Co Ltd

- Yachiyo Industry Co Ltd

- Donghee America Inc

- Sakamoto Industry Co Ltd

- SRD HOLDINGS Ltd

- TI Fluid Systems PLC

- Kautex Textron GmbH & Co KG

Key Milestones in Automotive Fuel Tank Industry Industry

- December 2023: Toyota Motor Corporation partnered with UBE Corporation to develop a new type of polyamide 6 resin called UBE NYLON 1218IU. This innovative resin is used for the plastic liner material in the high-pressure hydrogen tank of the new Toyota Crown fuel-cell vehicle (FCV). The nylon 6 resin meets the stringent requirements to prevent any hydrogen leakage in the FCV's high-pressure hydrogen tank. This milestone is crucial for advancing hydrogen mobility.

- November 2023: Robert Bosch GmbH launched H2 Mobility, a new technology that includes a fuel injection system, tank system, exhaust gas treatment system, sensors, and controllers. The technology is equipped with various components, such as an ignition coil, injectors, control unit, rail, DNOX, spark plug, Pr. sensor-EGT, and throttle valve. The company provides H2E technology for long-haul trucks and offers products for different segments, including SUVs, LCVs, coaches, and heavy-duty buses. This launch signifies a significant step in the development of comprehensive hydrogen powertrain solutions.

Strategic Outlook for Automotive Fuel Tank Industry Market

The strategic outlook for the Automotive Fuel Tank Industry is one of dynamic adaptation and innovation. Companies that can successfully navigate the transition from internal combustion engines to alternative powertrains will be best positioned for future growth. Strategic investments in research and development for lightweight materials, advanced composites for hydrogen storage, and integrated fuel system solutions are paramount. Collaborations and partnerships with automotive OEMs, technology providers, and research institutions will accelerate innovation and market penetration. Expanding manufacturing capabilities in emerging markets and diversifying product portfolios to cater to a wider range of vehicle types and fuel technologies will be crucial for sustained success. The industry's ability to remain agile and responsive to evolving regulatory landscapes and consumer preferences will determine its long-term trajectory in the evolving automotive ecosystem. The projected market size of $35,000 Million by 2033 indicates significant growth potential for strategic players.

Automotive Fuel Tank Industry Segmentation

-

1. Capacity

- 1.1. Less than 45 liters

- 1.2. 45-70 liters

- 1.3. Above 70 liters

-

2. Material Type

- 2.1. Plastic

- 2.2. Aluminum

- 2.3. Steel

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

Automotive Fuel Tank Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Fuel Tank Industry Regional Market Share

Geographic Coverage of Automotive Fuel Tank Industry

Automotive Fuel Tank Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Fuel-efficient Vehicles

- 3.3. Market Restrains

- 3.3.1. High initial costs may obstruct the growth

- 3.4. Market Trends

- 3.4.1. 45-70 Liters Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Fuel Tank Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 5.1.1. Less than 45 liters

- 5.1.2. 45-70 liters

- 5.1.3. Above 70 liters

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Plastic

- 5.2.2. Aluminum

- 5.2.3. Steel

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 6. North America Automotive Fuel Tank Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Capacity

- 6.1.1. Less than 45 liters

- 6.1.2. 45-70 liters

- 6.1.3. Above 70 liters

- 6.2. Market Analysis, Insights and Forecast - by Material Type

- 6.2.1. Plastic

- 6.2.2. Aluminum

- 6.2.3. Steel

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Cars

- 6.3.2. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Capacity

- 7. Europe Automotive Fuel Tank Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Capacity

- 7.1.1. Less than 45 liters

- 7.1.2. 45-70 liters

- 7.1.3. Above 70 liters

- 7.2. Market Analysis, Insights and Forecast - by Material Type

- 7.2.1. Plastic

- 7.2.2. Aluminum

- 7.2.3. Steel

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Cars

- 7.3.2. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Capacity

- 8. Asia Pacific Automotive Fuel Tank Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Capacity

- 8.1.1. Less than 45 liters

- 8.1.2. 45-70 liters

- 8.1.3. Above 70 liters

- 8.2. Market Analysis, Insights and Forecast - by Material Type

- 8.2.1. Plastic

- 8.2.2. Aluminum

- 8.2.3. Steel

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Cars

- 8.3.2. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Capacity

- 9. Rest of the World Automotive Fuel Tank Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Capacity

- 9.1.1. Less than 45 liters

- 9.1.2. 45-70 liters

- 9.1.3. Above 70 liters

- 9.2. Market Analysis, Insights and Forecast - by Material Type

- 9.2.1. Plastic

- 9.2.2. Aluminum

- 9.2.3. Steel

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Cars

- 9.3.2. Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Capacity

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Compagnie Plastic Omnium SE

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 SKH Metals Lt

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Magna International Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Fuel Total Systems (FTS) Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Aptiv PLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 YAPP Automotive Systems Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Yachiyo Industry Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Donghee America Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sakamoto Industry Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 SRD HOLDINGS Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 TI Fluid Systems PLC

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Kautex Textron GmbH & Co KG

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Compagnie Plastic Omnium SE

List of Figures

- Figure 1: Global Automotive Fuel Tank Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Fuel Tank Industry Revenue (Million), by Capacity 2025 & 2033

- Figure 3: North America Automotive Fuel Tank Industry Revenue Share (%), by Capacity 2025 & 2033

- Figure 4: North America Automotive Fuel Tank Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 5: North America Automotive Fuel Tank Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 6: North America Automotive Fuel Tank Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 7: North America Automotive Fuel Tank Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 8: North America Automotive Fuel Tank Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Automotive Fuel Tank Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Fuel Tank Industry Revenue (Million), by Capacity 2025 & 2033

- Figure 11: Europe Automotive Fuel Tank Industry Revenue Share (%), by Capacity 2025 & 2033

- Figure 12: Europe Automotive Fuel Tank Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 13: Europe Automotive Fuel Tank Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 14: Europe Automotive Fuel Tank Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 15: Europe Automotive Fuel Tank Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Europe Automotive Fuel Tank Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Automotive Fuel Tank Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Fuel Tank Industry Revenue (Million), by Capacity 2025 & 2033

- Figure 19: Asia Pacific Automotive Fuel Tank Industry Revenue Share (%), by Capacity 2025 & 2033

- Figure 20: Asia Pacific Automotive Fuel Tank Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 21: Asia Pacific Automotive Fuel Tank Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 22: Asia Pacific Automotive Fuel Tank Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Fuel Tank Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Asia Pacific Automotive Fuel Tank Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Fuel Tank Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Automotive Fuel Tank Industry Revenue (Million), by Capacity 2025 & 2033

- Figure 27: Rest of the World Automotive Fuel Tank Industry Revenue Share (%), by Capacity 2025 & 2033

- Figure 28: Rest of the World Automotive Fuel Tank Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 29: Rest of the World Automotive Fuel Tank Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 30: Rest of the World Automotive Fuel Tank Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 31: Rest of the World Automotive Fuel Tank Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 32: Rest of the World Automotive Fuel Tank Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Automotive Fuel Tank Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Fuel Tank Industry Revenue Million Forecast, by Capacity 2020 & 2033

- Table 2: Global Automotive Fuel Tank Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 3: Global Automotive Fuel Tank Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 4: Global Automotive Fuel Tank Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Fuel Tank Industry Revenue Million Forecast, by Capacity 2020 & 2033

- Table 6: Global Automotive Fuel Tank Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 7: Global Automotive Fuel Tank Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global Automotive Fuel Tank Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Fuel Tank Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Fuel Tank Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Fuel Tank Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Fuel Tank Industry Revenue Million Forecast, by Capacity 2020 & 2033

- Table 13: Global Automotive Fuel Tank Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 14: Global Automotive Fuel Tank Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Automotive Fuel Tank Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Fuel Tank Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Fuel Tank Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Fuel Tank Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Automotive Fuel Tank Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Automotive Fuel Tank Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Automotive Fuel Tank Industry Revenue Million Forecast, by Capacity 2020 & 2033

- Table 22: Global Automotive Fuel Tank Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 23: Global Automotive Fuel Tank Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 24: Global Automotive Fuel Tank Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: China Automotive Fuel Tank Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Automotive Fuel Tank Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Automotive Fuel Tank Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Automotive Fuel Tank Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Automotive Fuel Tank Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Automotive Fuel Tank Industry Revenue Million Forecast, by Capacity 2020 & 2033

- Table 31: Global Automotive Fuel Tank Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 32: Global Automotive Fuel Tank Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 33: Global Automotive Fuel Tank Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: South America Automotive Fuel Tank Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Automotive Fuel Tank Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Fuel Tank Industry?

The projected CAGR is approximately 4.80%.

2. Which companies are prominent players in the Automotive Fuel Tank Industry?

Key companies in the market include Compagnie Plastic Omnium SE, SKH Metals Lt, Magna International Inc, Fuel Total Systems (FTS) Co Ltd, Aptiv PLC, YAPP Automotive Systems Co Ltd, Yachiyo Industry Co Ltd, Donghee America Inc, Sakamoto Industry Co Ltd, SRD HOLDINGS Ltd, TI Fluid Systems PLC, Kautex Textron GmbH & Co KG.

3. What are the main segments of the Automotive Fuel Tank Industry?

The market segments include Capacity, Material Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.23 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Fuel-efficient Vehicles.

6. What are the notable trends driving market growth?

45-70 Liters Hold Major Market Share.

7. Are there any restraints impacting market growth?

High initial costs may obstruct the growth.

8. Can you provide examples of recent developments in the market?

December 2023: Toyota Motor Corporation partnered with UBE Corporation to develop a new type of polyamide 6 resin called UBE NYLON 1218IU. This innovative resin is used for the plastic liner material in the high-pressure hydrogen tank of the new Toyota Crown fuel-cell vehicle (FCV). The nylon 6 resin meets the stringent requirements to prevent any hydrogen leakage in the FCV's high-pressure hydrogen tank.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Fuel Tank Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Fuel Tank Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Fuel Tank Industry?

To stay informed about further developments, trends, and reports in the Automotive Fuel Tank Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence