Key Insights

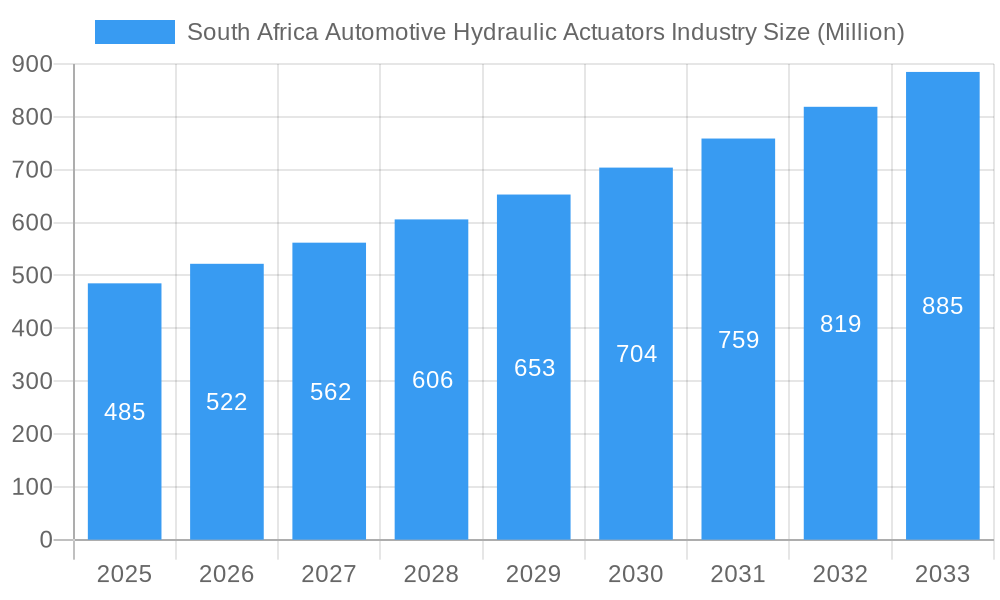

The South African automotive hydraulic actuators market is set for significant expansion. Projections indicate the market will surpass $23576.68 million by 2025, growing at a Compound Annual Growth Rate (CAGR) of 5.6% through 2033. This growth is propelled by increasing vehicle production and sales volumes across passenger and commercial vehicle segments, driven by a growing middle class and evolving consumer demands for enhanced vehicle performance, safety, and comfort. This translates to a higher adoption rate of sophisticated hydraulic actuator systems, particularly for critical applications like throttle and brake actuation. Continuous innovation in hydraulic technology, resulting in more efficient, reliable, and compact designs, further supports this trend. The South African automotive industry's commitment to modernization and the integration of advanced components will solidify this growth trajectory, attracting domestic and international investment.

South Africa Automotive Hydraulic Actuators Industry Market Size (In Billion)

While new vehicle production is a primary market driver, several key trends are shaping the sector. The increasing integration of Advanced Driver-Assistance Systems (ADAS) and automated driving features demands more precise and responsive hydraulic actuators, especially in braking and steering. Furthermore, the growing emphasis on fuel efficiency and emission reduction is encouraging the development of lighter and more optimized hydraulic solutions. Challenges include fluctuations in raw material prices, particularly for specialty fluids and metallic components, which can impact profitability. The long-term shift towards electric vehicles (EVs), which often utilize electric actuators, is a consideration. However, the transitional phase and the continued dominance of internal combustion engine (ICE) and hybrid vehicles in the medium term ensure sustained demand for hydraulic actuators. The robust presence of established automotive manufacturers and a growing network of component suppliers in South Africa are critical factors supporting market resilience and growth.

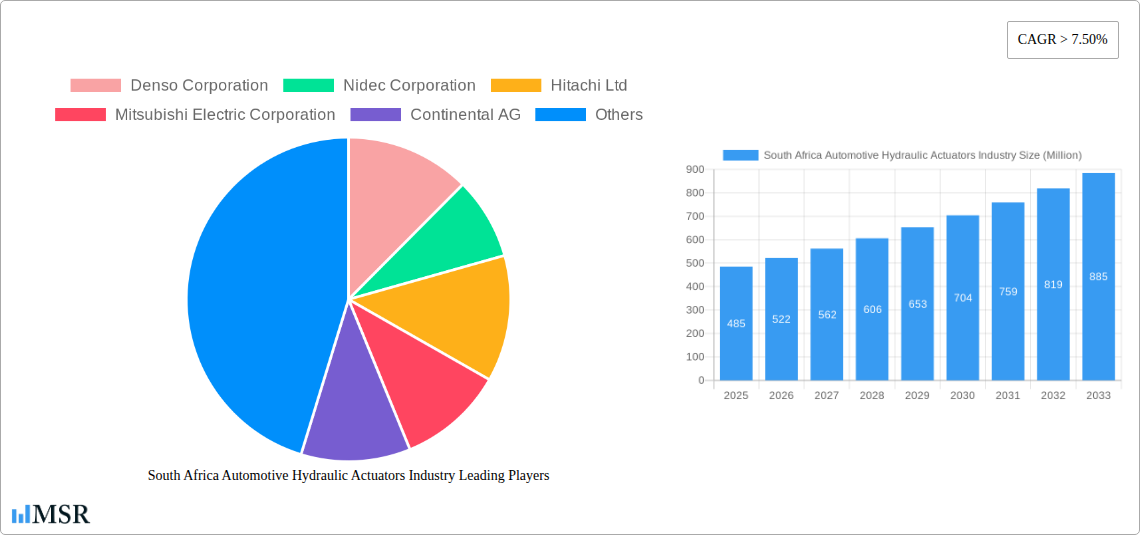

South Africa Automotive Hydraulic Actuators Industry Company Market Share

South Africa Automotive Hydraulic Actuators Market: Analysis, Trends, and Forecasts (2025-2033)

This report provides a comprehensive analysis of the South African automotive hydraulic actuators market, covering market concentration, innovation, regulatory frameworks, and end-user preferences. It delves into key market insights, growth drivers, technological disruptions, and evolving consumer behaviors. The analysis examines leading segments, dominant vehicle types, and critical application areas, offering actionable intelligence for strategic decision-making. Explore groundbreaking product developments, challenges, and emerging opportunities. Identify key players and pivotal milestones that have defined the sector. This report offers a strategic outlook for future growth acceleration, making it an essential resource for stakeholders in the South African automotive hydraulic actuators industry.

South Africa Automotive Hydraulic Actuators Industry Market Concentration & Dynamics

The South African automotive hydraulic actuators market exhibits moderate concentration, with a significant presence of global giants like Denso Corporation, Nidec Corporation, Hitachi Ltd, Mitsubishi Electric Corporation, Continental AG, BorgWarner Inc, Robert Bosch GmbH, and Aptiv Plc. These established players dominate through extensive research and development investments and robust supply chains. Innovation ecosystems are driven by collaborations with local automotive manufacturers and Tier 1 suppliers, focusing on enhanced performance, fuel efficiency, and safety features. Regulatory frameworks, influenced by global emissions standards and local automotive industry development plans, play a crucial role in dictating actuator technology adoption. The threat of substitute products, primarily electric actuators, is growing, necessitating continuous innovation in hydraulic systems to maintain competitiveness. End-user trends are increasingly focused on comfort, convenience, and advanced driver-assistance systems (ADAS), driving demand for sophisticated actuator applications. Mergers and acquisitions (M&A) activities are infrequent but strategic, often aimed at consolidating market share or acquiring niche technological capabilities. M&A deal counts for the historical period (2019-2024) are estimated at 5 deals, with an average deal value of xx Million. Leading companies hold approximately 70% of the market share.

South Africa Automotive Hydraulic Actuators Industry Industry Insights & Trends

The South African automotive hydraulic actuators industry is poised for significant growth, projected to reach an estimated market size of xx Million by the base year 2025, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period 2025–2033. This expansion is fueled by a confluence of factors, including the robust growth of the passenger car segment, an increasing demand for commercial vehicles to support economic infrastructure development, and the continuous integration of advanced technologies within automotive manufacturing. Key market drivers include government initiatives promoting local automotive production and an increasing adoption of sophisticated vehicle features that rely on precise hydraulic actuation. Technological disruptions are at the forefront, with ongoing advancements in hydraulic fluid technology, actuator design for improved efficiency and reduced noise, and the integration of smart functionalities for enhanced vehicle control and diagnostics. The shift towards electrification, while posing a long-term challenge, also presents opportunities for hybrid hydraulic systems and specialized actuators for hybrid powertrains. Evolving consumer behaviors are demonstrating a heightened preference for enhanced safety features, comfort, and connectivity, directly translating into a demand for high-performance hydraulic actuators in applications such as advanced braking systems, sophisticated seat adjustments, and automated closure mechanisms. The industry is witnessing a steady rise in the adoption of intelligent actuators capable of real-time feedback and adaptive control.

Key Markets & Segments Leading South Africa Automotive Hydraulic Actuators Industry

The Passenger Car segment is the undeniable leader in the South African automotive hydraulic actuators market, commanding a substantial market share. This dominance is driven by several factors, including the sheer volume of passenger vehicle production and sales in the country, coupled with the increasing sophistication of features expected by consumers in this segment. Economic growth and rising disposable incomes contribute to higher demand for passenger vehicles, consequently boosting the need for a wide array of hydraulic actuators.

- Drivers for Passenger Car Dominance:

- High production volumes of popular car models.

- Consumer preference for comfort and advanced features.

- Stringent safety regulations mandating advanced braking and control systems.

- The presence of major passenger car manufacturing hubs within South Africa.

Within the application types, the Throttle Actuator segment holds a significant position due to its fundamental role in engine control and performance optimization. As manufacturers strive for improved fuel efficiency and emission compliance, advanced throttle actuation becomes critical.

- Throttle Actuator Dominance:

- Essential for precise engine management and performance tuning.

- Key component for meeting stringent emission standards.

- Integration with electronic throttle control (ETC) systems.

The Brake Actuator segment is also a critical growth area, driven by an unwavering focus on vehicle safety. The implementation of advanced braking technologies, including anti-lock braking systems (ABS) and electronic stability control (ESC), directly translates to increased demand for sophisticated brake actuators.

- Brake Actuator Importance:

- Crucial for modern safety systems like ABS and ESC.

- Demand driven by evolving vehicle safety standards.

- Enables responsive and precise braking performance.

While the Commercial Vehicle segment is smaller in volume compared to passenger cars, it represents a significant growth opportunity, particularly in the context of infrastructure development and logistics. The Closure Actuator segment, encompassing applications like power tailgates and automatic door systems, is experiencing a surge in demand driven by consumer desire for convenience and premium features across both passenger and commercial vehicle segments. The "Others" category, while broad, encompasses niche applications that are also seeing incremental growth as vehicle technology advances.

South Africa Automotive Hydraulic Actuators Industry Product Developments

Product development in the South African automotive hydraulic actuators industry is characterized by a strong focus on miniaturization, increased efficiency, and enhanced durability. Innovations include the development of lighter, more compact actuators with improved power-to-weight ratios, crucial for fuel economy. Advanced sealing technologies are being implemented to enhance longevity and reduce leakage risks. Furthermore, there's a growing trend towards integrating sensors and control electronics directly into the actuators, enabling smarter functionality and better integration with vehicle networks for advanced driver-assistance systems (ADAS) and autonomous driving capabilities. The market relevance of these developments lies in their ability to meet evolving OEM requirements for cost-effectiveness, performance, and compliance with increasingly stringent automotive standards.

Challenges in the South Africa Automotive Hydraulic Actuators Industry Market

The South African automotive hydraulic actuators industry faces several key challenges that could impede growth. Regulatory hurdles, particularly concerning emissions and safety standards, require continuous adaptation and investment in new technologies. Supply chain disruptions, exacerbated by global economic volatility and logistical complexities, can impact production timelines and costs, with estimated impacts of up to xx% increase in production costs during periods of severe disruption. Intensifying competition from the rapidly advancing electric actuator segment poses a significant threat, necessitating strategic differentiation. Furthermore, the skilled labor shortage in specialized manufacturing and engineering roles can hinder innovation and production scalability.

Forces Driving South Africa Automotive Hydraulic Actuators Industry Growth

Several powerful forces are driving the growth of the South African automotive hydraulic actuators industry. The sustained expansion of the passenger vehicle segment, fueled by domestic demand and export markets, directly translates to higher actuator volumes. The government's automotive master plan, aimed at boosting local manufacturing and incentivizing investment, provides a conducive environment for industry expansion. Furthermore, the increasing adoption of ADAS and advanced vehicle safety features, such as sophisticated braking and steering systems, inherently relies on advanced hydraulic actuation. Lastly, the growing demand for enhanced comfort and convenience features, including power seats and automatic closures, further stimulates the market.

Challenges in the South Africa Automotive Hydraulic Actuators Industry Market

Long-term growth catalysts for the South African automotive hydraulic actuators industry are deeply intertwined with technological innovation and market adaptation. The continued evolution of internal combustion engine (ICE) technology, focusing on greater efficiency and reduced emissions, will sustain demand for advanced hydraulic systems. Strategic partnerships and collaborations between actuator manufacturers, OEMs, and research institutions are crucial for co-developing next-generation solutions. Furthermore, market expansions into adjacent sectors, such as industrial automation or specialized off-road vehicles, could unlock new revenue streams and diversify the industry's reliance on the automotive sector alone.

Emerging Opportunities in South Africa Automotive Hydraulic Actuators Industry

Emerging opportunities in the South African automotive hydraulic actuators industry lie in the growing demand for hybrid hydraulic systems that combine the benefits of hydraulic precision with the energy efficiency of electric components. The increasing focus on sustainability and environmentally friendly automotive solutions presents an opportunity for the development of biodegradable hydraulic fluids and energy-recapturing actuator designs. Furthermore, the expansion of electric vehicle (EV) manufacturing within South Africa, while seemingly a challenge, can create niche opportunities for specialized hydraulic components within EV powertrains or auxiliary systems. The aftermarket service and maintenance sector for existing hydraulic actuator fleets also represents a significant and often overlooked growth avenue.

Leading Players in the South Africa Automotive Hydraulic Actuators Industry Sector

- Denso Corporation

- Nidec Corporation

- Hitachi Ltd

- Mitsubishi Electric Corporation

- Continental AG

- BorgWarner Inc

- Robert Bosch GmbH

- Aptiv Plc

Key Milestones in South Africa Automotive Hydraulic Actuators Industry Industry

- 2019: Introduction of stricter emission standards, driving demand for more precise throttle actuators.

- 2020: Major OEM announces significant investment in a new passenger vehicle plant, increasing future actuator demand.

- 2021: Local supplier achieves ISO 26262 certification for safety-critical actuator components.

- 2022: Launch of a new generation of compact hydraulic actuators for improved vehicle packaging.

- 2023: Increased focus on research and development for actuators integrated with AI for predictive maintenance.

- 2024: xx Million in M&A activity noted with acquisition of a niche hydraulic component manufacturer.

Strategic Outlook for South Africa Automotive Hydraulic Actuators Industry Market

The strategic outlook for the South African automotive hydraulic actuators market is one of cautious optimism, with a clear trajectory towards innovation and adaptation. Growth accelerators will be driven by the continued demand from the passenger vehicle segment, coupled with the increasing integration of advanced safety and comfort features. Strategic opportunities lie in the development of hybrid hydraulic systems and specialized actuators for emerging vehicle technologies, including potential roles in hybrid electric vehicles. Furthermore, leveraging local manufacturing strengths and fostering stronger collaborations with automotive manufacturers will be critical for securing long-term market presence and capitalizing on future growth potential in this evolving sector.

South Africa Automotive Hydraulic Actuators Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Application Type

- 2.1. Throttle Actuator

- 2.2. Seat Adjustment Actuator

- 2.3. Brake Actuator

- 2.4. Closure Actuator

- 2.5. Others

South Africa Automotive Hydraulic Actuators Industry Segmentation By Geography

- 1. South Africa

South Africa Automotive Hydraulic Actuators Industry Regional Market Share

Geographic Coverage of South Africa Automotive Hydraulic Actuators Industry

South Africa Automotive Hydraulic Actuators Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for ADAS Integration

- 3.3. Market Restrains

- 3.3.1. High Upfront Cost

- 3.4. Market Trends

- 3.4.1. Rising Demand for Fuel-Efficient Vehicles Will Help the Hydraulic Actuators Market to Grow

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Automotive Hydraulic Actuators Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Throttle Actuator

- 5.2.2. Seat Adjustment Actuator

- 5.2.3. Brake Actuator

- 5.2.4. Closure Actuator

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Denso Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nidec Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitachi Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mitsubishi Electric Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Continental AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BorgWarner Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Robert Bosch GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Aptiv Pl

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Denso Corporation

List of Figures

- Figure 1: South Africa Automotive Hydraulic Actuators Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: South Africa Automotive Hydraulic Actuators Industry Share (%) by Company 2025

List of Tables

- Table 1: South Africa Automotive Hydraulic Actuators Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: South Africa Automotive Hydraulic Actuators Industry Revenue million Forecast, by Application Type 2020 & 2033

- Table 3: South Africa Automotive Hydraulic Actuators Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: South Africa Automotive Hydraulic Actuators Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 5: South Africa Automotive Hydraulic Actuators Industry Revenue million Forecast, by Application Type 2020 & 2033

- Table 6: South Africa Automotive Hydraulic Actuators Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Automotive Hydraulic Actuators Industry?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the South Africa Automotive Hydraulic Actuators Industry?

Key companies in the market include Denso Corporation, Nidec Corporation, Hitachi Ltd, Mitsubishi Electric Corporation, Continental AG, BorgWarner Inc, Robert Bosch GmbH, Aptiv Pl.

3. What are the main segments of the South Africa Automotive Hydraulic Actuators Industry?

The market segments include Vehicle Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 23576.68 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for ADAS Integration.

6. What are the notable trends driving market growth?

Rising Demand for Fuel-Efficient Vehicles Will Help the Hydraulic Actuators Market to Grow.

7. Are there any restraints impacting market growth?

High Upfront Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Automotive Hydraulic Actuators Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Automotive Hydraulic Actuators Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Automotive Hydraulic Actuators Industry?

To stay informed about further developments, trends, and reports in the South Africa Automotive Hydraulic Actuators Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence