Key Insights

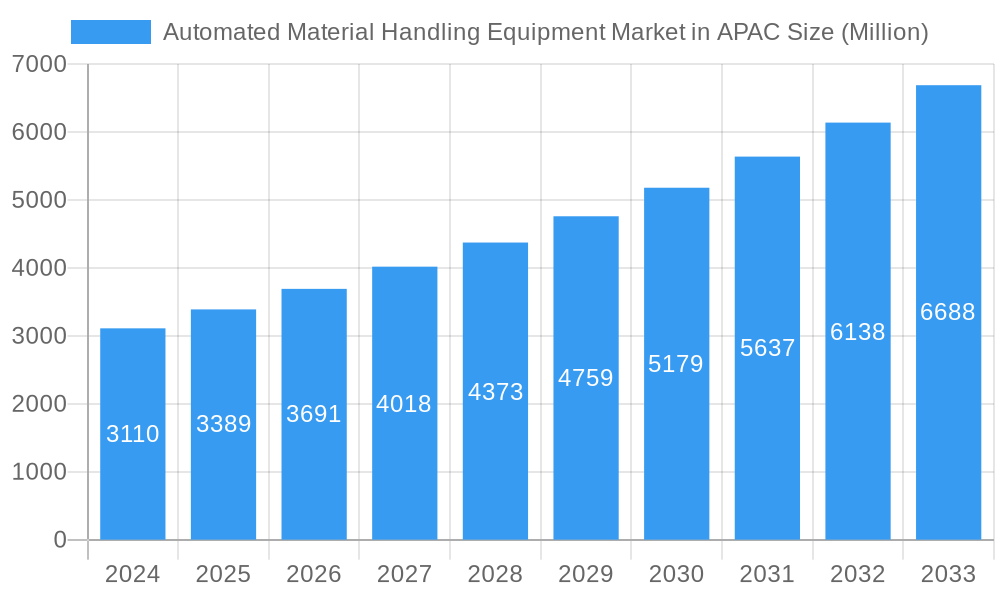

The Automated Material Handling Equipment (AMHE) market in the Asia Pacific (APAC) region is poised for significant expansion, driven by the burgeoning e-commerce sector, rapid industrialization, and a growing emphasis on operational efficiency across various industries. With a projected market size of approximately USD 3.11 billion in 2024, the AMHE landscape in APAC is set to witness a robust Compound Annual Growth Rate (CAGR) of 9.1% through the forecast period of 2025-2033. This sustained growth is fueled by escalating demand for advanced solutions that optimize supply chains, reduce labor costs, and enhance safety in warehousing, manufacturing, and logistics operations. The increasing adoption of robotics, autonomous guided vehicles (AGVs), and automated storage and retrieval systems (AS/RS) by businesses in China, India, Japan, and ASEAN countries underscores the region's commitment to technological advancement in material handling. Furthermore, the push towards Industry 4.0 initiatives and smart manufacturing is compelling businesses to invest in intelligent automation, thereby accelerating market penetration for AMHE.

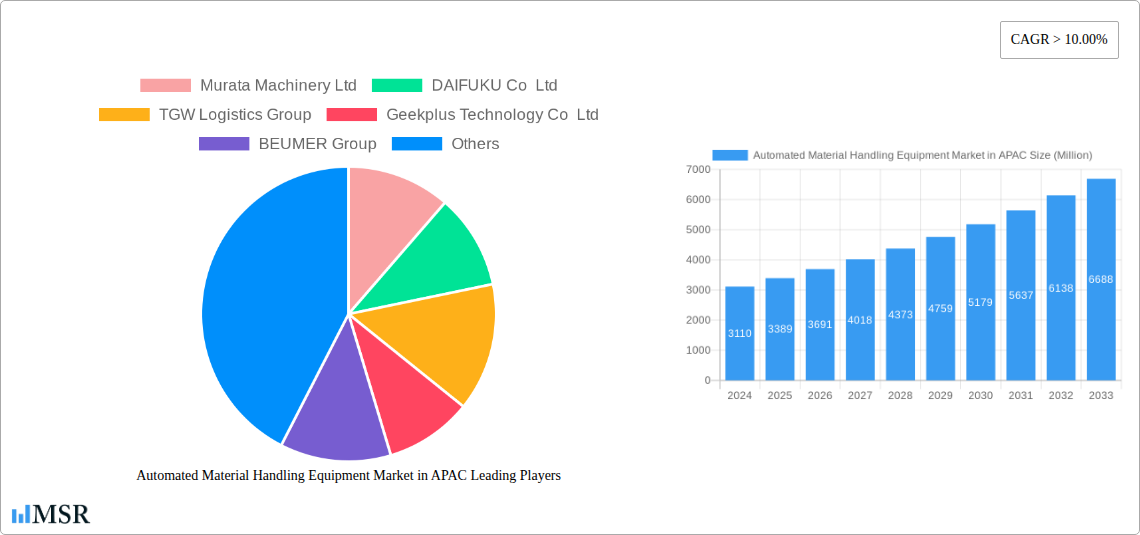

Automated Material Handling Equipment Market in APAC Market Size (In Billion)

The APAC AMHE market is characterized by a diverse range of segments, with Hardware currently holding a substantial market share due to the foundational need for physical automated systems. However, the Services segment, encompassing installation, maintenance, and software integration, is anticipated to grow at a faster pace, reflecting the increasing complexity and interconnectedness of AMHE solutions. Autonomy is shifting rapidly towards Automatic systems, with a decline in purely manual operations. In terms of equipment, Robots and Industrial Trucks are leading the charge in adoption. Key end-user verticals such as Automotive, Food and Beverages, and Airports are major contributors to market growth, driven by specific automation needs related to production, distribution, and passenger/cargo handling. While the market benefits from strong demand, potential restraints include high initial investment costs for smaller enterprises and the need for skilled labor to operate and maintain advanced automated systems. Nevertheless, the overall outlook remains exceptionally positive, with continuous innovation and strategic investments by major players like DAIFUKU Co Ltd, Murata Machinery Ltd, and Geekplus Technology Co Ltd shaping the future of material handling in APAC.

Automated Material Handling Equipment Market in APAC Company Market Share

Automated Material Handling Equipment Market in APAC: Comprehensive Market Analysis and Future Outlook (2019-2033)

This in-depth report delves into the burgeoning Automated Material Handling Equipment (AMHE) market in APAC, providing a comprehensive analysis of its current state and future trajectory. Spanning the historical period of 2019–2024, base year 2025, and forecast period 2025–2033, this study offers invaluable insights for industry stakeholders, investors, and policymakers. We dissect the market by Product Type (Hardware, Software, Services), Autonomy Type (Automatic, Manual), Equipment Type (Robot, Industrial trucks, Conveyor, Others), and End-user Vertical (Airport, Automotive, Food and Beverages, Others). The global AMHE market size is projected to reach USD XXX billion by 2033, with APAC emerging as a pivotal growth engine. The APAC AMHE market size was estimated at USD XXX billion in 2025.

Automated Material Handling Equipment Market in APAC Market Concentration & Dynamics

The APAC Automated Material Handling Equipment market exhibits a dynamic landscape characterized by a moderate to high level of concentration, driven by the presence of both established global players and rapidly emerging regional innovators. Companies like DAIFUKU Co Ltd, Murata Machinery Ltd, and TGW Logistics Group hold significant market share due to their extensive product portfolios and robust distribution networks. The innovation ecosystem is thriving, fueled by advancements in AI, IoT, and robotics, leading to the development of more intelligent and collaborative AMHE solutions. Regulatory frameworks are evolving, with governments increasingly promoting industrial automation to boost productivity and competitiveness. Substitute products, such as manual labor, are gradually being displaced by the superior efficiency and accuracy offered by automated systems. End-user trends are shifting towards flexible, scalable, and integrated AMHE solutions capable of handling diverse product types and operational demands. Mergers and acquisitions (M&A) are becoming increasingly prevalent, with an estimated XX M&A deals recorded in the historical period, aimed at consolidating market presence, acquiring new technologies, and expanding geographical reach.

Automated Material Handling Equipment Market in APAC Industry Insights & Trends

The APAC Automated Material Handling Equipment market is poised for remarkable growth, driven by a confluence of powerful economic, technological, and societal factors. The projected CAGR of XX% for the forecast period underscores the immense potential within this region. A primary growth driver is the relentless pursuit of operational efficiency and cost reduction across various industries. As businesses in APAC strive to remain competitive in a globalized marketplace, the adoption of automated warehousing solutions and intelligent logistics systems becomes indispensable. Technological disruptions are at the forefront of this transformation. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into AMHE is enabling predictive maintenance, optimized routing, and real-time decision-making. The proliferation of the Internet of Things (IoT) allows for seamless connectivity and data exchange between AMHE devices, supply chain management software, and enterprise resource planning (ERP) systems, creating a truly interconnected operational environment. Evolving consumer behaviors, particularly the surge in e-commerce, are placing unprecedented demands on supply chains. This necessitates faster order fulfillment, increased accuracy, and the ability to handle a wider variety of SKUs, all of which are expertly addressed by advanced AMHE. The rise of robotics in logistics and the deployment of autonomous mobile robots (AMRs) are revolutionizing warehouse operations, enabling greater flexibility and adaptability. Furthermore, government initiatives promoting Industry 4.0 and smart manufacturing are actively encouraging the adoption of automated solutions, further accelerating market expansion. The market size of AMHE in APAC is expected to reach USD XXX billion by 2033, a testament to these powerful trends.

Key Markets & Segments Leading Automated Material Handling Equipment Market in APAC

The APAC Automated Material Handling Equipment market is a vibrant tapestry of growth, with distinct regions and segments spearheading its expansion. China stands out as the dominant country, fueled by its massive manufacturing base, rapidly growing e-commerce sector, and significant investments in Industry 4.0 initiatives. The Automotive sector remains a key vertical, demanding sophisticated material handling solutions for complex assembly lines and parts distribution. The Food and Beverages industry is also a significant contributor, driven by the need for stringent hygiene standards, efficient cold chain management, and rapid order processing to meet consumer demand.

The Product Type segment sees strong demand across Hardware, Software, and Services. Hardware components like Robots (including collaborative robots and AMRs) and advanced Conveyors are crucial for automating physical tasks. The Software segment, encompassing warehouse management systems (WMS), fleet management software, and AI-driven optimization tools, plays a vital role in orchestrating these operations. The Services segment, including installation, maintenance, and integration, is gaining prominence as businesses seek end-to-end solutions.

In terms of Autonomy Type, Automatic systems are experiencing exponential growth, eclipsing Manual operations due to their inherent efficiency, safety, and scalability. This shift is particularly evident in high-volume operations and sectors requiring precision.

The Equipment Type segment showcases the dominance of Robots and Conveyors. Robots, especially AMRs and articulated robots, are transforming warehouse operations with their versatility and ability to work alongside humans. Advanced Conveyor systems, including sortation and sortation conveyors, are essential for high-throughput environments. The "Others" category, encompassing Automated Storage and Retrieval Systems (AS/RS) and automated guided vehicles (AGVs), also contributes significantly to market growth.

Drivers for dominance in these segments include:

- Economic Growth and Industrialization: Rapid economic expansion across APAC countries fuels investment in manufacturing and logistics infrastructure.

- E-commerce Boom: The insatiable demand for online retail necessitates efficient and scalable warehousing and fulfillment solutions.

- Labor Shortages and Rising Labor Costs: Automation provides a viable solution to address labor scarcity and mitigate escalating labor expenses.

- Government Support and Incentives: Proactive government policies promoting automation and smart manufacturing are a significant catalyst.

- Technological Advancements: Continuous innovation in robotics, AI, and IoT makes AMHE more sophisticated, affordable, and accessible.

- Infrastructure Development: Investments in modern logistics hubs and transportation networks create a conducive environment for AMHE adoption.

Automated Material Handling Equipment Market in APAC Product Developments

Product innovation in the APAC AMHE market is characterized by a relentless drive towards greater intelligence, flexibility, and sustainability. Companies are increasingly developing collaborative robots (cobots) designed to work safely alongside human operators, enhancing productivity without compromising safety. Advancements in autonomous mobile robots (AMRs) are enabling dynamic route planning and obstacle avoidance, offering unparalleled flexibility in warehouse layouts. The integration of advanced AI and machine learning algorithms into AMHE software is facilitating predictive analytics, real-time optimization of workflows, and intelligent decision-making. Furthermore, there is a growing focus on developing energy-efficient conveyor systems and modular AMHE solutions that can be easily reconfigured to adapt to changing operational needs. These innovations are crucial for maintaining a competitive edge and meeting the evolving demands of various end-user verticals.

Challenges in the Automated Material Handling Equipment Market in APAC Market

Despite the robust growth, the APAC Automated Material Handling Equipment market faces several hurdles. The initial capital investment for sophisticated AMHE systems can be substantial, posing a barrier for small and medium-sized enterprises (SMEs). Integration complexity with existing legacy systems and infrastructure can also be a significant challenge, requiring specialized expertise and considerable time. Workforce training and upskilling are critical; a shortage of skilled personnel to operate, maintain, and manage these advanced systems can hinder adoption. Furthermore, cybersecurity concerns related to connected AMHE devices and the sensitive data they handle require robust security protocols. Regulatory inconsistencies across different APAC nations can also create complexities for manufacturers and integrators operating in multiple markets.

Forces Driving Automated Material Handling Equipment Market in APAC Growth

The APAC Automated Material Handling Equipment market is propelled by several potent forces. The burgeoning e-commerce sector's demand for faster fulfillment and increased accuracy is a paramount driver. The ongoing Industry 4.0 revolution and government initiatives promoting smart manufacturing are creating a fertile ground for automation adoption. Furthermore, the increasing need for operational efficiency, cost reduction, and improved safety across diverse industries, from automotive to food and beverages, is compelling businesses to invest in AMHE. The availability of advanced technologies like AI, IoT, and robotics makes these solutions more sophisticated and adaptable. The increasing global competition also compels APAC businesses to enhance their supply chain capabilities through automation.

Challenges in the Automated Material Handling Equipment Market in APAC Market

Long-term growth catalysts for the APAC Automated Material Handling Equipment market include continued technological innovation, particularly in the areas of AI-powered automation and human-robot collaboration. The increasing focus on sustainable supply chains will drive demand for energy-efficient AMHE solutions. Strategic partnerships and collaborations between AMHE providers and end-users will foster tailored solutions and accelerate adoption. Furthermore, the expansion of AMHE into emerging economies within APAC, coupled with increasing awareness of its benefits, will unlock new growth avenues. The development of more user-friendly interfaces and simpler integration processes will also broaden market accessibility.

Emerging Opportunities in Automated Material Handling Equipment Market in APAC

Emerging opportunities in the APAC Automated Material Handling Equipment market are abundant. The continued growth of 3PL (Third-Party Logistics) providers seeking to enhance their service offerings presents a significant opportunity. The increasing demand for cold chain logistics in the food and beverage sector, driven by consumer preferences for fresh produce, will spur the adoption of specialized AMHE. The development and deployment of autonomous delivery robots for last-mile logistics in urban areas represent a nascent but rapidly growing segment. Furthermore, the growing adoption of circular economy principles will create opportunities for AMHE solutions that facilitate reverse logistics and product refurbishment. The increasing focus on worker well-being and ergonomics will also drive the adoption of AMHE that reduces physically demanding tasks.

Leading Players in the Automated Material Handling Equipment Market in APAC Sector

- Murata Machinery Ltd

- DAIFUKU Co Ltd

- TGW Logistics Group

- Geekplus Technology Co Ltd

- BEUMER Group

- Siasun Robot & Automation Co Ltd

- Toyota Industries Corporation

- Kardex Group

- Noblelift Intelligent Equipment Co Ltd

- XCMG Construction Machinery Co Ltd

- Cargotec corporation

Key Milestones in Automated Material Handling Equipment Market in APAC Industry

- 2019: Increased investment in warehouse automation by major e-commerce players in China and Southeast Asia.

- 2020: Surge in demand for automated solutions in food and beverage processing due to pandemic-related labor shortages and safety concerns.

- 2021: Significant advancements in AMR technology, offering greater flexibility and integration capabilities.

- 2022: Growing focus on AI-powered WMS and predictive maintenance solutions within the APAC AMHE landscape.

- 2023: Expansion of AMHE adoption into new verticals such as pharmaceuticals and electronics manufacturing.

- 2024: Increased M&A activities as larger players seek to consolidate market share and acquire innovative technologies.

Strategic Outlook for Automated Material Handling Equipment Market in APAC Market

The strategic outlook for the APAC Automated Material Handling Equipment market is overwhelmingly positive, driven by sustained technological innovation and evolving industry demands. Key growth accelerators include the continued integration of AI and IoT for smarter, more adaptive AMHE systems. Strategic alliances between technology providers and end-users will be crucial for developing bespoke solutions that address specific operational challenges. The expansion of AMHE into emerging economies within APAC and the growing awareness of its long-term ROI will unlock substantial untapped potential. Furthermore, the increasing emphasis on sustainability and resilience within supply chains will drive demand for eco-friendly and robust AMHE solutions. The market is expected to witness a paradigm shift towards highly integrated, data-driven, and human-centric automation.

Automated Material Handling Equipment Market in APAC Segmentation

-

1. Product Type

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Autonomy Type

- 2.1. Automatic

- 2.2. Manual

-

3. Equipment Type

- 3.1. Robot

- 3.2. Industrial trucks

- 3.3. Conveyor

- 3.4. Others

-

4. End-user Vertical Type

- 4.1. Airport

- 4.2. Automotive

- 4.3. Food and Beverages

- 4.4. Others

Automated Material Handling Equipment Market in APAC Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Automated Material Handling Equipment Market in APAC Regional Market Share

Geographic Coverage of Automated Material Handling Equipment Market in APAC

Automated Material Handling Equipment Market in APAC REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Buyers Inclination Toward Affordable Used Cars to Fuel the Market Growth

- 3.3. Market Restrains

- 3.3.1 Technology Advances

- 3.3.2 Older Used Cars May Lack the Latest Features

- 3.4. Market Trends

- 3.4.1. Electric Material Handling Equipment are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automated Material Handling Equipment Market in APAC Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Autonomy Type

- 5.2.1. Automatic

- 5.2.2. Manual

- 5.3. Market Analysis, Insights and Forecast - by Equipment Type

- 5.3.1. Robot

- 5.3.2. Industrial trucks

- 5.3.3. Conveyor

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by End-user Vertical Type

- 5.4.1. Airport

- 5.4.2. Automotive

- 5.4.3. Food and Beverages

- 5.4.4. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Automated Material Handling Equipment Market in APAC Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by Autonomy Type

- 6.2.1. Automatic

- 6.2.2. Manual

- 6.3. Market Analysis, Insights and Forecast - by Equipment Type

- 6.3.1. Robot

- 6.3.2. Industrial trucks

- 6.3.3. Conveyor

- 6.3.4. Others

- 6.4. Market Analysis, Insights and Forecast - by End-user Vertical Type

- 6.4.1. Airport

- 6.4.2. Automotive

- 6.4.3. Food and Beverages

- 6.4.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Automated Material Handling Equipment Market in APAC Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by Autonomy Type

- 7.2.1. Automatic

- 7.2.2. Manual

- 7.3. Market Analysis, Insights and Forecast - by Equipment Type

- 7.3.1. Robot

- 7.3.2. Industrial trucks

- 7.3.3. Conveyor

- 7.3.4. Others

- 7.4. Market Analysis, Insights and Forecast - by End-user Vertical Type

- 7.4.1. Airport

- 7.4.2. Automotive

- 7.4.3. Food and Beverages

- 7.4.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Automated Material Handling Equipment Market in APAC Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by Autonomy Type

- 8.2.1. Automatic

- 8.2.2. Manual

- 8.3. Market Analysis, Insights and Forecast - by Equipment Type

- 8.3.1. Robot

- 8.3.2. Industrial trucks

- 8.3.3. Conveyor

- 8.3.4. Others

- 8.4. Market Analysis, Insights and Forecast - by End-user Vertical Type

- 8.4.1. Airport

- 8.4.2. Automotive

- 8.4.3. Food and Beverages

- 8.4.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Automated Material Handling Equipment Market in APAC Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Services

- 9.2. Market Analysis, Insights and Forecast - by Autonomy Type

- 9.2.1. Automatic

- 9.2.2. Manual

- 9.3. Market Analysis, Insights and Forecast - by Equipment Type

- 9.3.1. Robot

- 9.3.2. Industrial trucks

- 9.3.3. Conveyor

- 9.3.4. Others

- 9.4. Market Analysis, Insights and Forecast - by End-user Vertical Type

- 9.4.1. Airport

- 9.4.2. Automotive

- 9.4.3. Food and Beverages

- 9.4.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Automated Material Handling Equipment Market in APAC Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Hardware

- 10.1.2. Software

- 10.1.3. Services

- 10.2. Market Analysis, Insights and Forecast - by Autonomy Type

- 10.2.1. Automatic

- 10.2.2. Manual

- 10.3. Market Analysis, Insights and Forecast - by Equipment Type

- 10.3.1. Robot

- 10.3.2. Industrial trucks

- 10.3.3. Conveyor

- 10.3.4. Others

- 10.4. Market Analysis, Insights and Forecast - by End-user Vertical Type

- 10.4.1. Airport

- 10.4.2. Automotive

- 10.4.3. Food and Beverages

- 10.4.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Murata Machinery Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DAIFUKU Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TGW Logistics Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Geekplus Technology Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BEUMER Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siasun Robot & Automation Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Toyota Industries Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kardex Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Noblelift Intelligent Equipment Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 XCMG Construction Machinery Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Cargotec corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Murata Machinery Ltd

List of Figures

- Figure 1: Global Automated Material Handling Equipment Market in APAC Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Automated Material Handling Equipment Market in APAC Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: North America Automated Material Handling Equipment Market in APAC Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Automated Material Handling Equipment Market in APAC Revenue (undefined), by Autonomy Type 2025 & 2033

- Figure 5: North America Automated Material Handling Equipment Market in APAC Revenue Share (%), by Autonomy Type 2025 & 2033

- Figure 6: North America Automated Material Handling Equipment Market in APAC Revenue (undefined), by Equipment Type 2025 & 2033

- Figure 7: North America Automated Material Handling Equipment Market in APAC Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 8: North America Automated Material Handling Equipment Market in APAC Revenue (undefined), by End-user Vertical Type 2025 & 2033

- Figure 9: North America Automated Material Handling Equipment Market in APAC Revenue Share (%), by End-user Vertical Type 2025 & 2033

- Figure 10: North America Automated Material Handling Equipment Market in APAC Revenue (undefined), by Country 2025 & 2033

- Figure 11: North America Automated Material Handling Equipment Market in APAC Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Automated Material Handling Equipment Market in APAC Revenue (undefined), by Product Type 2025 & 2033

- Figure 13: South America Automated Material Handling Equipment Market in APAC Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: South America Automated Material Handling Equipment Market in APAC Revenue (undefined), by Autonomy Type 2025 & 2033

- Figure 15: South America Automated Material Handling Equipment Market in APAC Revenue Share (%), by Autonomy Type 2025 & 2033

- Figure 16: South America Automated Material Handling Equipment Market in APAC Revenue (undefined), by Equipment Type 2025 & 2033

- Figure 17: South America Automated Material Handling Equipment Market in APAC Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 18: South America Automated Material Handling Equipment Market in APAC Revenue (undefined), by End-user Vertical Type 2025 & 2033

- Figure 19: South America Automated Material Handling Equipment Market in APAC Revenue Share (%), by End-user Vertical Type 2025 & 2033

- Figure 20: South America Automated Material Handling Equipment Market in APAC Revenue (undefined), by Country 2025 & 2033

- Figure 21: South America Automated Material Handling Equipment Market in APAC Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Automated Material Handling Equipment Market in APAC Revenue (undefined), by Product Type 2025 & 2033

- Figure 23: Europe Automated Material Handling Equipment Market in APAC Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Europe Automated Material Handling Equipment Market in APAC Revenue (undefined), by Autonomy Type 2025 & 2033

- Figure 25: Europe Automated Material Handling Equipment Market in APAC Revenue Share (%), by Autonomy Type 2025 & 2033

- Figure 26: Europe Automated Material Handling Equipment Market in APAC Revenue (undefined), by Equipment Type 2025 & 2033

- Figure 27: Europe Automated Material Handling Equipment Market in APAC Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 28: Europe Automated Material Handling Equipment Market in APAC Revenue (undefined), by End-user Vertical Type 2025 & 2033

- Figure 29: Europe Automated Material Handling Equipment Market in APAC Revenue Share (%), by End-user Vertical Type 2025 & 2033

- Figure 30: Europe Automated Material Handling Equipment Market in APAC Revenue (undefined), by Country 2025 & 2033

- Figure 31: Europe Automated Material Handling Equipment Market in APAC Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa Automated Material Handling Equipment Market in APAC Revenue (undefined), by Product Type 2025 & 2033

- Figure 33: Middle East & Africa Automated Material Handling Equipment Market in APAC Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Middle East & Africa Automated Material Handling Equipment Market in APAC Revenue (undefined), by Autonomy Type 2025 & 2033

- Figure 35: Middle East & Africa Automated Material Handling Equipment Market in APAC Revenue Share (%), by Autonomy Type 2025 & 2033

- Figure 36: Middle East & Africa Automated Material Handling Equipment Market in APAC Revenue (undefined), by Equipment Type 2025 & 2033

- Figure 37: Middle East & Africa Automated Material Handling Equipment Market in APAC Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 38: Middle East & Africa Automated Material Handling Equipment Market in APAC Revenue (undefined), by End-user Vertical Type 2025 & 2033

- Figure 39: Middle East & Africa Automated Material Handling Equipment Market in APAC Revenue Share (%), by End-user Vertical Type 2025 & 2033

- Figure 40: Middle East & Africa Automated Material Handling Equipment Market in APAC Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East & Africa Automated Material Handling Equipment Market in APAC Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Automated Material Handling Equipment Market in APAC Revenue (undefined), by Product Type 2025 & 2033

- Figure 43: Asia Pacific Automated Material Handling Equipment Market in APAC Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: Asia Pacific Automated Material Handling Equipment Market in APAC Revenue (undefined), by Autonomy Type 2025 & 2033

- Figure 45: Asia Pacific Automated Material Handling Equipment Market in APAC Revenue Share (%), by Autonomy Type 2025 & 2033

- Figure 46: Asia Pacific Automated Material Handling Equipment Market in APAC Revenue (undefined), by Equipment Type 2025 & 2033

- Figure 47: Asia Pacific Automated Material Handling Equipment Market in APAC Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 48: Asia Pacific Automated Material Handling Equipment Market in APAC Revenue (undefined), by End-user Vertical Type 2025 & 2033

- Figure 49: Asia Pacific Automated Material Handling Equipment Market in APAC Revenue Share (%), by End-user Vertical Type 2025 & 2033

- Figure 50: Asia Pacific Automated Material Handling Equipment Market in APAC Revenue (undefined), by Country 2025 & 2033

- Figure 51: Asia Pacific Automated Material Handling Equipment Market in APAC Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by Autonomy Type 2020 & 2033

- Table 3: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by Equipment Type 2020 & 2033

- Table 4: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by End-user Vertical Type 2020 & 2033

- Table 5: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 7: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by Autonomy Type 2020 & 2033

- Table 8: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by Equipment Type 2020 & 2033

- Table 9: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by End-user Vertical Type 2020 & 2033

- Table 10: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: United States Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Canada Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Mexico Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 15: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by Autonomy Type 2020 & 2033

- Table 16: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by Equipment Type 2020 & 2033

- Table 17: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by End-user Vertical Type 2020 & 2033

- Table 18: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: Brazil Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Argentina Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 23: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by Autonomy Type 2020 & 2033

- Table 24: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by Equipment Type 2020 & 2033

- Table 25: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by End-user Vertical Type 2020 & 2033

- Table 26: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Germany Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: France Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Italy Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Spain Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Russia Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Benelux Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Nordics Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 37: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by Autonomy Type 2020 & 2033

- Table 38: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by Equipment Type 2020 & 2033

- Table 39: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by End-user Vertical Type 2020 & 2033

- Table 40: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: Turkey Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Israel Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: GCC Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: North Africa Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: South Africa Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 48: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by Autonomy Type 2020 & 2033

- Table 49: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by Equipment Type 2020 & 2033

- Table 50: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by End-user Vertical Type 2020 & 2033

- Table 51: Global Automated Material Handling Equipment Market in APAC Revenue undefined Forecast, by Country 2020 & 2033

- Table 52: China Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 53: India Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Japan Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 55: South Korea Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: ASEAN Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 57: Oceania Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Automated Material Handling Equipment Market in APAC Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automated Material Handling Equipment Market in APAC?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Automated Material Handling Equipment Market in APAC?

Key companies in the market include Murata Machinery Ltd, DAIFUKU Co Ltd, TGW Logistics Group, Geekplus Technology Co Ltd, BEUMER Group, Siasun Robot & Automation Co Ltd, Toyota Industries Corporation, Kardex Group, Noblelift Intelligent Equipment Co Ltd, XCMG Construction Machinery Co Ltd, Cargotec corporation.

3. What are the main segments of the Automated Material Handling Equipment Market in APAC?

The market segments include Product Type, Autonomy Type, Equipment Type, End-user Vertical Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Buyers Inclination Toward Affordable Used Cars to Fuel the Market Growth.

6. What are the notable trends driving market growth?

Electric Material Handling Equipment are Driving the Market.

7. Are there any restraints impacting market growth?

Technology Advances. Older Used Cars May Lack the Latest Features.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automated Material Handling Equipment Market in APAC," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automated Material Handling Equipment Market in APAC report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automated Material Handling Equipment Market in APAC?

To stay informed about further developments, trends, and reports in the Automated Material Handling Equipment Market in APAC, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence