Key Insights

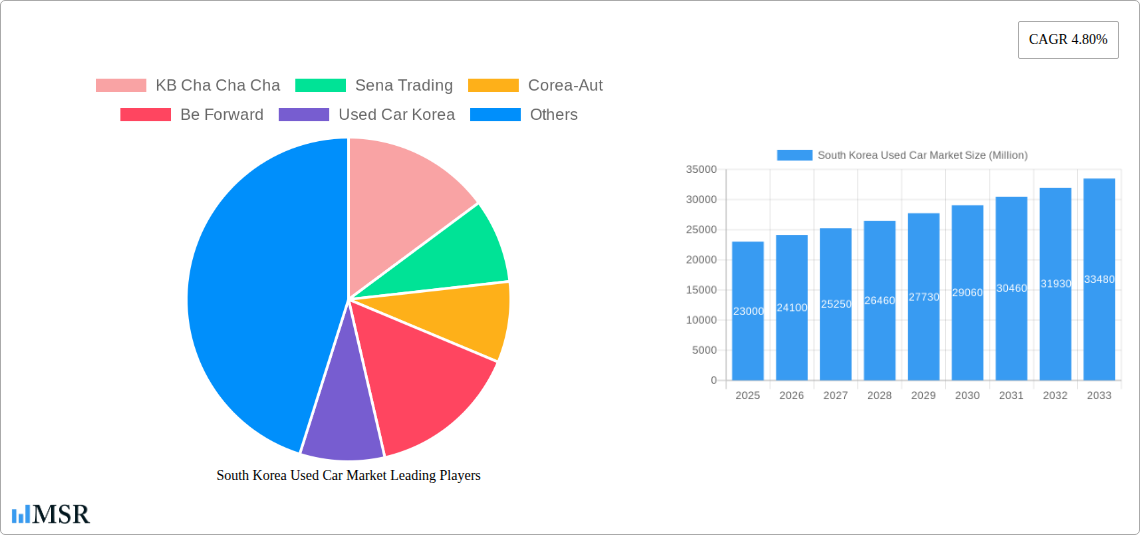

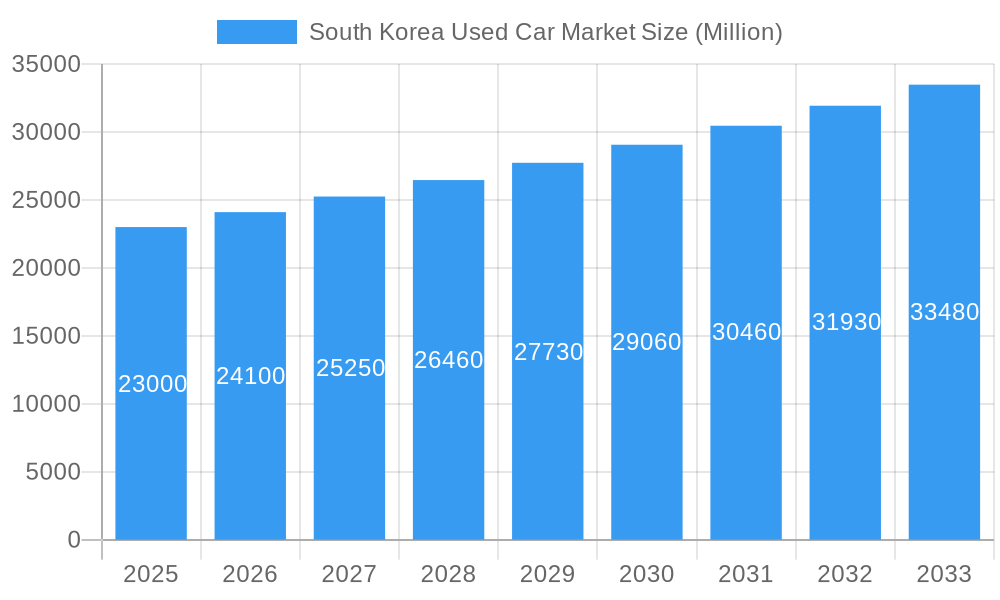

The South Korean used car market is poised for robust expansion, projected to reach a substantial market size of approximately USD 23,000 million by 2025, with a steady Compound Annual Growth Rate (CAGR) of 4.80% anticipated through 2033. This sustained growth is primarily propelled by a confluence of factors. A significant driver is the increasing consumer demand for affordable and accessible mobility solutions, especially in a market where new car prices continue to escalate. The burgeoning popularity of online platforms for buying and selling pre-owned vehicles is also a major catalyst, offering convenience, wider selection, and transparent pricing to consumers. Furthermore, advancements in vehicle technology and the growing availability of certified pre-owned programs are building greater consumer trust in the used car sector. The market is witnessing a dynamic shift, with a notable trend towards the growing adoption of electric and hybrid vehicles within the used car segment, reflecting broader automotive industry sustainability initiatives and government incentives. This transition is opening new avenues for growth and innovation in the sector.

South Korea Used Car Market Market Size (In Billion)

However, the market is not without its challenges. The presence of unorganized vendors, while offering competitive pricing, can sometimes lead to concerns regarding vehicle quality and service standards, creating a segment of the market where trust and standardization are still developing. Nonetheless, the organized sector is actively addressing these concerns through enhanced quality checks and customer service. The increasing popularity of subscription-based car models and ride-sharing services also presents a potential restraint, as some consumers may opt for flexible usage models over outright ownership. Despite these considerations, the overall outlook for the South Korean used car market remains highly positive, driven by persistent demand for value-driven transportation and the continuous innovation within the industry to cater to evolving consumer preferences. The market is segmented across various vehicle types, including hatchbacks, sedans, and sports utility vehicles, and offers diverse fuel options, from traditional petrol and diesel to increasingly popular electric and alternative fuels like LPG and CNG.

South Korea Used Car Market Company Market Share

South Korea Used Car Market: Comprehensive Analysis & Forecast (2019–2033)

Unlock invaluable insights into the burgeoning South Korea used car market with this in-depth report. Featuring meticulous analysis of market dynamics, key trends, and future projections from 2019–2033, this report is your definitive guide to navigating this rapidly evolving sector. We delve into critical segments, emerging opportunities, and the strategic landscape, providing actionable intelligence for stakeholders including organized used car dealers, unorganized used car vendors, and online used car platforms in South Korea. Understand the impact of electric vehicle (EV) used cars, petrol used cars, and diesel used cars, and gain a competitive edge in the South Korean automotive aftermarket.

South Korea Used Car Market Market Concentration & Dynamics

The South Korea used car market exhibits a moderate to high concentration, with key organized players like Encar, K Car, and Hyundai Glovis dominating a significant portion of the market share. These major entities leverage advanced digital platforms, extensive dealership networks, and robust remarketing strategies to maintain their leadership. For instance, Encar is estimated to hold over 50% of the online used car market share. Innovation is a significant driver, with companies actively investing in AI-powered vehicle inspection, blockchain for transparent history reporting, and enhanced online purchasing experiences. The regulatory framework is evolving to promote fairness and transparency, particularly concerning vehicle history and mileage reporting, which positively impacts consumer confidence in pre-owned vehicles. Substitute products, such as new car leasing programs and ride-sharing services, present a competitive challenge, but the affordability and accessibility of used cars continue to underpin their enduring appeal. End-user trends show a growing preference for value-for-money, eco-friendly used electric vehicles, and certified pre-owned (CPO) programs offering warranty and peace of mind. Mergers and acquisitions (M&A) activities are on the rise as larger players seek to consolidate their market presence and expand their service offerings. K Car's acquisition of Pickplus in 2022 exemplified this trend, strengthening its offline auction capabilities. While M&A deal counts are not precisely quantifiable without specific transaction data, the strategic intent is evident.

South Korea Used Car Market Industry Insights & Trends

The South Korea used car market is poised for substantial growth, projected to reach an estimated XX Million USD in 2025, with a robust Compound Annual Growth Rate (CAGR) of approximately XX% between 2025 and 2033. This expansion is fueled by a confluence of factors, including increasing disposable incomes, a growing demand for affordable mobility solutions, and a burgeoning interest in sustainable transportation. The online used car sales channel has witnessed a dramatic surge, driven by enhanced digital infrastructure, user-friendly interfaces, and the convenience of remote purchasing. Platforms like Autowini Inc. and Used Car Korea have been instrumental in this digital transformation, offering a vast inventory and streamlined buying processes. Technological disruptions are reshaping the industry, with the integration of AI for vehicle diagnostics, virtual reality (VR) for virtual showroom experiences, and data analytics for personalized customer recommendations. These innovations are enhancing transparency, efficiency, and customer satisfaction. Evolving consumer behaviors are characterized by a greater emphasis on value, reliability, and environmental consciousness. This has led to an increased demand for well-maintained, certified pre-owned vehicles, particularly used electric cars and fuel-efficient models. The aging vehicle parc in South Korea also contributes to a consistent demand for replacement vehicles, further bolstering the used car market. The market is also experiencing a significant influx of organized used car vendors who offer professional inspection, refurbishment, and warranty services, thereby building trust and attracting a broader customer base. The government's push towards a circular economy and the increasing availability of affordable used EVs are also key growth enablers.

Key Markets & Segments Leading South Korea Used Car Market

The organized vendor segment is unequivocally leading the South Korea used car market, driven by its ability to offer greater transparency, reliability, and comprehensive after-sales services compared to the unorganized sector. Companies like K Car, Encar, and Hyundai Glovis have established robust operational frameworks, including certified inspection processes, warranty provisions, and extensive remarketing channels, which resonate strongly with consumers seeking value and peace of mind. The online sales channel is experiencing exponential growth, outpacing traditional offline sales channels. This shift is propelled by factors such as convenience, wider inventory access, and competitive pricing facilitated by digital platforms. Encar, with its dominant online presence, exemplifies this trend.

Vehicle Type Dominance:

- Sedans continue to hold a significant market share due to their versatility, affordability, and widespread appeal across various demographics. They remain a preferred choice for daily commuting and family use.

- Hatchbacks are gaining traction, particularly in urban areas, owing to their fuel efficiency and compact size, catering to a growing segment of young professionals and environmentally conscious buyers.

- Sports Utility Vehicles (SUVs) are witnessing steady demand, driven by their perceived safety, spaciousness, and suitability for diverse driving conditions.

Vendor Type Dominance:

- Organized Vendors: Their dominance stems from trust-building initiatives, professional vehicle grading systems, and extended warranty offerings. Brands like KB Cha Cha Cha and Aj Sell Car are prominent examples.

- Unorganized Vendors: While facing increasing competition, they continue to cater to a price-sensitive segment, offering a wider range of older or budget-friendly vehicles, though often with fewer guarantees.

Fuel Type Dominance:

- Petrol remains the leading fuel type due to its widespread availability and established infrastructure.

- Diesel vehicles continue to hold a considerable market share, especially for larger vehicles and commercial applications, though facing some environmental scrutiny.

- Electric used cars are a rapidly growing segment, fueled by government incentives, decreasing battery costs, and increasing environmental awareness. This segment is expected to witness significant growth in the forecast period.

- Other Fuel Types (LPG, CNG, etc.): These segments are smaller but cater to niche markets and specific fleet applications.

Sales Channel Dominance:

- Online Channels: The ease of browsing, comparing, and purchasing vehicles online, coupled with virtual inspection options and nationwide delivery services, is driving this segment's rapid expansion.

- Offline Channels: Traditional dealerships and physical showrooms still play a role, offering a tangible experience for buyers who prefer to inspect vehicles in person. However, their dominance is gradually eroding as online platforms mature.

South Korea Used Car Market Product Developments

Product developments in the South Korea used car market are increasingly focused on enhancing transparency and customer confidence. Companies are investing in advanced diagnostic tools and AI-powered inspection systems to provide accurate vehicle health reports. The integration of blockchain technology for immutable vehicle history records is gaining traction, offering unprecedented traceability. Furthermore, the rise of certified pre-owned (CPO) programs by major automakers and dealerships, such as those offered by Han Sung Motor for Mercedes-Benz, signifies a trend towards offering higher quality, warrantied used vehicles. The market is also seeing an uptick in the refurbishment and sale of used electric vehicles, with specialized services emerging to address battery health and charging infrastructure compatibility.

Challenges in the South Korea Used Car Market Market

Key challenges facing the South Korea used car market include regulatory hurdles related to stringent emissions standards for older vehicles and evolving import/export regulations. Supply chain disruptions, exacerbated by global chip shortages, can impact the availability of desirable used car models. Competitive pressures from new car manufacturers offering attractive leasing deals and the continued growth of the ride-sharing industry also present significant restraints. Quantifiable impacts include longer inventory holding periods and increased marketing costs to attract buyers.

Forces Driving South Korea Used Car Market Growth

Several forces are driving the growth of the South Korea used car market. Economic factors, including rising inflation and the need for cost-effective transportation, make used cars an attractive option for consumers. Technological advancements in vehicle diagnostics and online sales platforms are enhancing convenience and transparency. Furthermore, government initiatives promoting eco-friendly vehicles and a circular economy are indirectly boosting the demand for used EVs and fuel-efficient models. The increasing popularity of online used car marketplaces like Encar and K Car is also a significant growth catalyst.

Challenges in the South Korea Used Car Market Market

Long-term growth catalysts in the South Korea used car market will be driven by continuous innovation in digital platforms, enabling seamless online transactions and enhanced customer support. Partnerships between automakers and used car remarketing specialists will further solidify the market. The expansion of certified pre-owned (CPO) programs, offering extended warranties and rigorous inspections, will build greater consumer trust. Moreover, the increasing acceptance and availability of used electric vehicles will unlock a substantial growth segment, aligning with global sustainability trends.

Emerging Opportunities in South Korea Used Car Market

Emerging opportunities in the South Korea used car market are vast. The used electric vehicle (EV) segment presents a significant growth avenue, driven by declining battery costs and increasing environmental consciousness. Cross-border used car exports, particularly to regions with high demand and limited domestic supply, offer substantial potential, as evidenced by the surge in shipments to Russia. The development of specialized remarketing services for luxury and performance used cars also represents a lucrative niche. Furthermore, the integration of IoT and AI for predictive maintenance in used vehicles can create new service revenue streams for dealerships.

Leading Players in the South Korea Used Car Market Sector

- KB Cha Cha Cha

- Sena Trading

- Corea-Aut

- Be Forward

- Used Car Korea

- Aj Sell Car

- K Car

- Pickplus

- Han Sung Motor

- Robert's Used Car

- Car Vision

- Autowini Inc

- Encar

- Hyundai Glovis

- PicknBuy

Key Milestones in South Korea Used Car Market Industry

- February 2023: The Korean International Trade Association (KITA) reported a staggering 1,163% surge in South Korea's used vehicle exports to Russia in 2022, a direct consequence of new car release bans amid the Ukraine war. Russia accounted for 4.9% of overall overseas shipments, totaling 19,626 used vehicles. This highlights a significant international demand driver.

- August 2022: Han Sung Motor consolidated its Mercedes-Benz service operations by integrating the Yongdap and Seongdong Service Centers. This strategic move created South Korea's largest service facility for Mercedes-Benz, enhancing repair capabilities for both new and used vehicles and reinforcing brand loyalty.

- January 2022: Hyundai Glovis launched "Autobell," an online platform for used car sales in South Korea. This diversification into the online used car market demonstrates a strategic shift towards digital channels and aims to capture a larger share of the rapidly growing online segment.

Strategic Outlook for South Korea Used Car Market Market

The strategic outlook for the South Korea used car market is overwhelmingly positive, characterized by sustained growth driven by evolving consumer preferences and technological integration. The increasing demand for affordable mobility, coupled with the growing acceptance of used electric vehicles, presents significant opportunities. Key growth accelerators include the continued expansion of online sales platforms like Encar and K Car, which enhance accessibility and transparency. Furthermore, strategic collaborations between organized used car dealers and technology providers for advanced vehicle inspection and data analytics will be crucial. The market's future potential lies in leveraging digital innovation to build trust, streamline processes, and cater to the discerning South Korean consumer, solidifying its position as a mature and dynamic automotive aftermarket sector.

South Korea Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedans

- 1.3. Sports U

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Fuel Type

- 3.1. Petrol

- 3.2. Diesel

- 3.3. Electric

- 3.4. Other Fuel Types (LPG, CNG, etc.)

-

4. Sales Channel

- 4.1. Online

- 4.2. Offline

South Korea Used Car Market Segmentation By Geography

- 1. South Korea

South Korea Used Car Market Regional Market Share

Geographic Coverage of South Korea Used Car Market

South Korea Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Digital Technologies; Others

- 3.3. Market Restrains

- 3.3.1. Presence of Various Unorganized Used Car Dealers in the Market

- 3.4. Market Trends

- 3.4.1. Rising Adoption of Digital Technologies Will Foster the Growth of the Target Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Used Car Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedans

- 5.1.3. Sports U

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Petrol

- 5.3.2. Diesel

- 5.3.3. Electric

- 5.3.4. Other Fuel Types (LPG, CNG, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 KB Cha Cha Cha

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sena Trading

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Corea-Aut

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Be Forward

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Used Car Korea

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aj Sell Car

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 K Car

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pickplus

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Han Sung Motor

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Robert's Used Car

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Car Vision

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Autowini Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Encar

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Hyundai Glovis

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 PicknBuy

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 KB Cha Cha Cha

List of Figures

- Figure 1: South Korea Used Car Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Korea Used Car Market Share (%) by Company 2025

List of Tables

- Table 1: South Korea Used Car Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: South Korea Used Car Market Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 3: South Korea Used Car Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 4: South Korea Used Car Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 5: South Korea Used Car Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: South Korea Used Car Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 7: South Korea Used Car Market Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 8: South Korea Used Car Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 9: South Korea Used Car Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 10: South Korea Used Car Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Used Car Market?

The projected CAGR is approximately 4.80%.

2. Which companies are prominent players in the South Korea Used Car Market?

Key companies in the market include KB Cha Cha Cha, Sena Trading, Corea-Aut, Be Forward, Used Car Korea, Aj Sell Car, K Car, Pickplus, Han Sung Motor, Robert's Used Car, Car Vision, Autowini Inc, Encar, Hyundai Glovis, PicknBuy.

3. What are the main segments of the South Korea Used Car Market?

The market segments include Vehicle Type, Vendor Type, Fuel Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 23 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Digital Technologies; Others.

6. What are the notable trends driving market growth?

Rising Adoption of Digital Technologies Will Foster the Growth of the Target Market.

7. Are there any restraints impacting market growth?

Presence of Various Unorganized Used Car Dealers in the Market.

8. Can you provide examples of recent developments in the market?

February 2023: The Korean International Trade Association (KITA) released a report stating South Korea's used vehicle exports to Russia skyrocketed by 1,163% in 2022 as new car releases were banned amid the ongoing war in Ukraine. Further, the association also revealed that Russia contributed to 4.9% of the overall overseas used car shipments from South Korea, totaling a unit shipment of 19,626 used vehicles in 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Used Car Market?

To stay informed about further developments, trends, and reports in the South Korea Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence