Key Insights

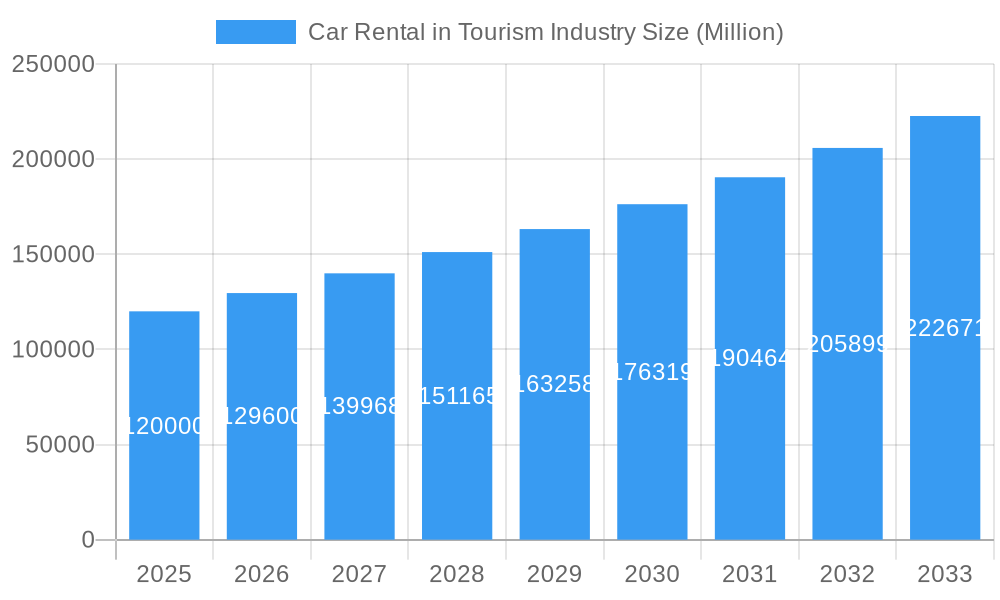

The Car Rental in Tourism Industry is projected for significant expansion, anticipated to reach a market size of $129.66 billion by 2024, with an estimated CAGR of 9.77% from 2024 to 2033. This growth is propelled by the robust global tourism sector, rising disposable incomes, and a growing preference for independent travel. Car rentals offer unparalleled convenience and cost-effectiveness for destination exploration, making them essential for contemporary travel. Budget segments are expected to lead, while premium rentals will cater to demand for enhanced travel experiences. The increasing adoption of digital booking platforms signifies a shift towards accessibility and comparative ease, further supported by the preference for self-drive options that grant tourists freedom and flexibility.

Car Rental in Tourism Industry Market Size (In Billion)

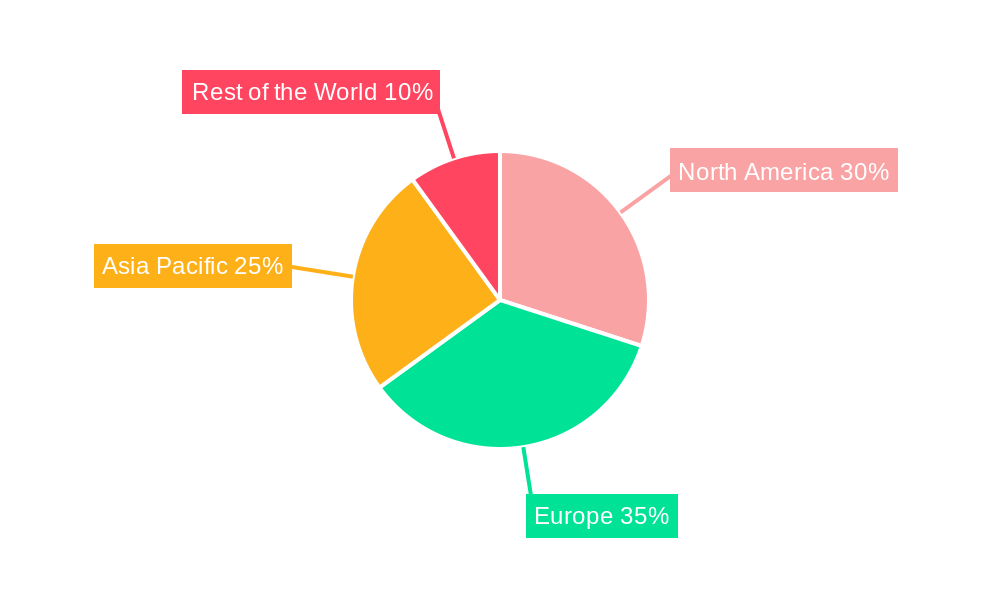

Key trends influencing the Car Rental in Tourism Industry include the integration of advanced technologies like AI-powered booking systems, contactless services, and intelligent fleet management. The increasing adoption of electric vehicles (EVs) in rental fleets aligns with sustainability objectives and appeals to eco-conscious travelers. Strategic alliances with online travel agencies and hospitality providers are vital for expanding market reach and offering comprehensive travel packages. Market growth is being influenced by factors such as fuel price volatility, competition from ride-sharing services, and evolving regulatory frameworks. These challenges are being addressed through dynamic pricing, diversified services, and customer loyalty initiatives. The Asia Pacific region, particularly China and India, is poised for dynamic growth due to rapid urbanization, an expanding middle class, and developing tourism infrastructure.

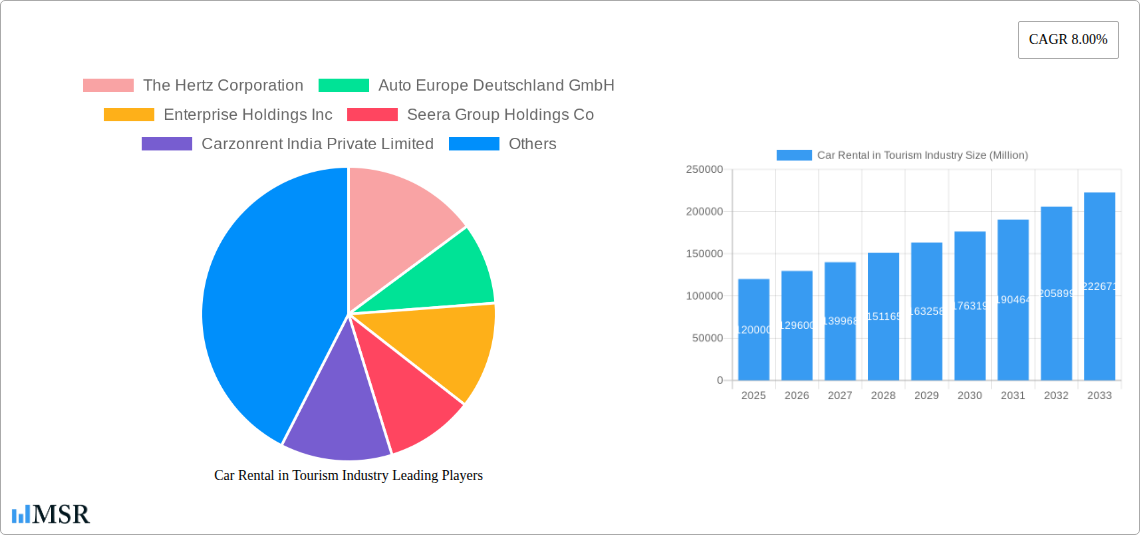

Car Rental in Tourism Industry Company Market Share

Unlocking Global Mobility: Comprehensive Report on Car Rental in Tourism Industry Market (2019-2033)

This in-depth car rental market report delivers critical insights into the tourism industry's car rental sector, meticulously analyzing market dynamics, growth drivers, emerging trends, and competitive landscapes from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this report is your essential guide to understanding and capitalizing on opportunities within the global car rental market, vehicle rental services, and travel and tourism mobility solutions. Explore detailed analysis of key players, regional dominance, and transformative industry developments shaping the future of car hire for leisure travel and business travel.

Car Rental in Tourism Industry Market Concentration & Dynamics

The car rental in tourism industry exhibits a moderate to high level of market concentration, with a few dominant players holding significant market share. Key companies like The Hertz Corporation, Enterprise Holdings Inc, Avis Budget Group Inc, and Europcar Mobility Group consistently vie for top positions. The innovation ecosystem is vibrant, fueled by technological advancements in booking platforms, fleet management, and vehicle electrification. Regulatory frameworks, while varying by region, generally focus on consumer protection, safety standards, and environmental compliance. Substitute products, such as ride-sharing services and public transportation, pose a constant challenge, necessitating strategic differentiation by car rental providers. End-user trends reveal a growing preference for flexible rental periods and seamless digital experiences. Mergers and acquisitions (M&A) activities, such as Volkswagen's acquisition interest in Europcar, underscore the industry's consolidation phase and strategic realignments. The M&A deal count has seen a steady increase, reflecting the pursuit of market expansion and enhanced operational efficiency.

Car Rental in Tourism Industry Industry Insights & Trends

The car rental in tourism industry is projected for substantial growth, driven by the rebound of global tourism post-pandemic and the increasing demand for personalized travel experiences. The market size is estimated to reach USD 150 Billion by the end of the forecast period, with a Compound Annual Growth Rate (CAGR) of approximately 7.5% from the base year 2025. Technological disruptions are revolutionizing the sector, from AI-powered dynamic pricing and personalized booking recommendations to the integration of IoT for real-time vehicle tracking and maintenance. The rise of electric vehicles (EVs) and the increasing availability of charging infrastructure are also significant trends, catering to environmentally conscious travelers. Evolving consumer behaviors are characterized by a strong preference for online booking channels, exemplified by platforms like Auto Europe Deutschland GmbH and Sixt SE, which offer user-friendly interfaces and a wide selection of vehicles. The demand for self-driven options remains robust, providing travelers with the freedom and flexibility to explore destinations at their own pace. Furthermore, the integration of car rental services with broader travel platforms and hotel bookings is becoming increasingly common, creating a more holistic travel solution. The rental agencies sector is also adapting by offering various subscription models and flexible leasing options, catering to both short-term and long-term needs. The growing importance of digital transformation, including mobile apps for booking, unlocking, and returning vehicles, is setting new benchmarks for customer convenience and operational efficiency across the travel and tourism mobility landscape.

Key Markets & Segments Leading Car Rental in Tourism Industry

The car rental in tourism industry market is experiencing significant dominance from several key regions and segments, each contributing to the overall growth trajectory.

Geographic Dominance:

- North America: Continues to be a leading market, driven by a mature tourism infrastructure, strong economic conditions, and a high propensity for car ownership and rental among both domestic and international travelers. The widespread availability of rental locations at major airports and tourist hubs, coupled with robust digital adoption, solidifies its position.

- Europe: A close second, benefiting from a high volume of intra-European travel, diverse destinations, and established car rental networks. The increasing focus on sustainable tourism also fuels demand for electric and hybrid rental vehicles.

Dominant Segments:

- Vehicle Type:

- Economy: This segment consistently leads due to its affordability and suitability for budget-conscious travelers and families. The high volume of rentals for short trips and city exploration contributes significantly to its market share.

- Luxury/Premium: While smaller in volume, this segment commands higher revenue per rental and is driven by business travelers, affluent tourists, and those seeking enhanced comfort and prestige during their journeys. The growing trend of experiential travel also boosts demand for premium vehicles for special occasions or unique road trips.

- Booking Mode:

- Online: This mode has overwhelmingly captured market share. The convenience of comparing prices, selecting vehicles, and completing bookings from anywhere at any time through websites and mobile applications has made it the preferred choice for the vast majority of customers. Platforms like ZoomCar Inc and Carzonrent India Private Limited have heavily invested in their online presence.

- End User:

- Self Driven: This remains the most popular end-user segment. Travelers value the independence and flexibility that self-drive options provide, allowing them to customize their itineraries and explore at their own pace. This is particularly crucial in regions with expansive road networks and diverse attractions.

- Rental Agencies: While end-users predominantly opt for self-drive, rental agencies themselves play a crucial role in facilitating the overall rental process and managing fleets. Their efficiency and customer service directly impact the user experience.

- Vehicle Type:

The growth in these segments is propelled by factors such as rising disposable incomes, increased global travel and tourism activities, economic development in emerging markets, and continuous technological advancements in booking and fleet management systems. The convenience of online car rental and the appeal of self-driven exploration are key pillars supporting the sustained growth of these dominant segments within the car rental tourism industry.

Car Rental in Tourism Industry Product Developments

Recent product developments in the car rental in tourism industry are heavily focused on enhancing customer experience and embracing technological advancements. Companies are introducing intuitive mobile applications that streamline the entire rental process, from booking and contactless pick-up/drop-off to in-car navigation and support. The integration of electric vehicles (EVs) into fleets is a significant trend, aligning with sustainability goals and meeting the growing demand for eco-friendly travel options. Innovations in fleet management, including predictive maintenance and real-time vehicle tracking, are improving operational efficiency and vehicle availability. Furthermore, the emergence of car subscription services, offering flexible monthly terms without long-term commitments, is expanding the appeal of car rentals beyond traditional short-term hires, as seen with ekar's innovative offerings.

Challenges in the Car Rental in Tourism Industry Market

The car rental in tourism industry faces several challenges that impact its growth and profitability. Regulatory hurdles vary significantly across regions, leading to complex compliance requirements and potential operational limitations. Supply chain issues, particularly concerning vehicle availability and manufacturing delays, can disrupt fleet expansion and maintenance plans, as highlighted by the EV transition and semiconductor shortages. Intense competitive pressures from both traditional players and emerging mobility solutions like ride-sharing services necessitate continuous innovation and competitive pricing strategies. The rising cost of vehicle acquisition and maintenance, coupled with increasing fuel prices or electricity costs for EVs, also poses a significant financial strain. Furthermore, managing customer expectations for seamless digital experiences and personalized service in a highly fragmented market requires substantial investment in technology and customer support.

Forces Driving Car Rental in Tourism Industry Growth

Several powerful forces are driving the growth of the car rental in tourism industry. The resurgence of global tourism, post-pandemic, is a primary catalyst, with an increasing number of travelers seeking convenient and flexible mobility solutions. Technological advancements in digital booking platforms, mobile applications, and fleet management systems are enhancing customer experience and operational efficiency. The growing adoption of electric vehicles (EVs) and the expansion of charging infrastructure are attracting environmentally conscious travelers and aligning with global sustainability initiatives. Economic growth in emerging markets is increasing disposable incomes and fostering a greater demand for travel and personal mobility. Furthermore, strategic partnerships between car rental companies, airlines, and hospitality providers are creating integrated travel packages that boost rental uptake.

Challenges in the Car Rental in Tourism Industry Market

The car rental in tourism industry market faces persistent challenges that require strategic navigation. The ongoing shift towards alternative mobility solutions such as ride-hailing and car-sharing services presents a competitive threat, demanding innovative service offerings and competitive pricing from traditional rental companies. Economic volatility and inflation can impact consumer spending on travel, thereby affecting rental demand and profitability. The increasing complexity of regulatory landscapes across different countries adds to operational costs and can hinder expansion efforts. Furthermore, the environmental impact and sustainability concerns associated with conventional internal combustion engine vehicles necessitate significant investment in fleet electrification and eco-friendly practices. Managing the ** fluctuating demand** tied to seasonal tourism patterns and unpredictable global events also poses operational challenges.

Emerging Opportunities in Car Rental in Tourism Industry

The car rental in tourism industry is poised to capitalize on several emerging opportunities. The growing trend of sustainable tourism is creating demand for electric and hybrid vehicle fleets, presenting a significant opportunity for companies that invest in eco-friendly mobility. The rise of "workations" and remote work is fueling demand for longer-term car rentals and flexible mobility solutions that cater to digital nomads. The integration of car rental services with broader travel and lifestyle platforms offers a chance to create bundled offerings and enhance customer loyalty. Furthermore, the expansion of car subscription models, providing flexible one-to-nine-month rental terms, appeals to a wider customer base seeking alternatives to traditional ownership. Opportunities also exist in leveraging big data analytics to personalize customer experiences, optimize pricing, and improve fleet management efficiency. The development of autonomous vehicle rental services, though nascent, represents a future frontier for transformative growth.

Leading Players in the Car Rental in Tourism Industry Sector

- The Hertz Corporation

- Auto Europe Deutschland GmbH

- Enterprise Holdings Inc

- Seera Group Holdings Co

- Carzonrent India Private Limited

- Sixt SE

- ZoomCar Inc

- Europcar Mobility Group

- Avis Budget Group Inc

Key Milestones in Car Rental in Tourism Industry Industry

- January 2022: ekar, the Middle East's mobility company, launched operations in Thailand, starting with Bangkok and planning wider expansion, introducing its proprietary car subscription service for one-to-nine-month terms with no down payments via its app.

- December 2021: Volkswagen announced plans to acquire Europcar in France for USD 3.4 billion through Green Mobility Holding, in which Volkswagen will own two-thirds.

- November 2021: Hertz rentals partnered with Tesla Motors, pledging to supply 100,000 Model 3s by 2022, with plans to rent half to Uber drivers.

- July 2021: Key'n Go, operated by Goldcar (Europcar Mobility Group's low-cost brand), enhanced its 100% digital, safe, and fast vehicle booking, pick-up, and return solution at 35 key leisure airports across Southern Europe.

- February 2021: Theeb Rent a Car, a Saudi-based company, expanded its fleet by adding over 1,700 cars, including luxury brands like BMW and Mercedes, alongside economic models from Chevrolet, Kia, Ford, Nissan, Toyota, and Hyundai, featuring new 2021 models.

Strategic Outlook for Car Rental in Tourism Industry Market

The strategic outlook for the car rental in tourism industry market is characterized by a strong emphasis on digital transformation, fleet electrification, and enhanced customer centricity. Companies will focus on expanding their online presence and mobile capabilities to offer seamless booking and pick-up/drop-off experiences. Investing in and integrating electric and hybrid vehicles into fleets will be crucial to cater to sustainability demands and future regulatory requirements. Strategic partnerships with travel aggregators, airlines, and hospitality providers will unlock new revenue streams and customer acquisition channels. Furthermore, exploring flexible rental models, such as subscription services and on-demand mobility solutions, will be key to capturing evolving consumer preferences and diversifying market reach. The future of car rental in tourism will be defined by agility, innovation, and a commitment to providing sustainable and convenient mobility solutions.

Car Rental in Tourism Industry Segmentation

-

1. Vehicle Type

- 1.1. Economy

- 1.2. Luxury/Premium

-

2. Booking Mode

- 2.1. Online

- 2.2. Offline

-

3. End User

- 3.1. Self Driven

- 3.2. Rental Agencies

Car Rental in Tourism Industry Segmentation By Geography

-

1. North America

- 1.1. United states

- 1.2. Canada

- 1.3. Rest of North america

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Norway

- 2.6. Netherlands

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Car Rental in Tourism Industry Regional Market Share

Geographic Coverage of Car Rental in Tourism Industry

Car Rental in Tourism Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Use of Aluminum in Die Casting Equipment to Increase Market Demand

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Online Booking Expected to Witness Significant Growth during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Car Rental in Tourism Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Economy

- 5.1.2. Luxury/Premium

- 5.2. Market Analysis, Insights and Forecast - by Booking Mode

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Self Driven

- 5.3.2. Rental Agencies

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Car Rental in Tourism Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Economy

- 6.1.2. Luxury/Premium

- 6.2. Market Analysis, Insights and Forecast - by Booking Mode

- 6.2.1. Online

- 6.2.2. Offline

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Self Driven

- 6.3.2. Rental Agencies

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Car Rental in Tourism Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Economy

- 7.1.2. Luxury/Premium

- 7.2. Market Analysis, Insights and Forecast - by Booking Mode

- 7.2.1. Online

- 7.2.2. Offline

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Self Driven

- 7.3.2. Rental Agencies

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Car Rental in Tourism Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Economy

- 8.1.2. Luxury/Premium

- 8.2. Market Analysis, Insights and Forecast - by Booking Mode

- 8.2.1. Online

- 8.2.2. Offline

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Self Driven

- 8.3.2. Rental Agencies

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Car Rental in Tourism Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Economy

- 9.1.2. Luxury/Premium

- 9.2. Market Analysis, Insights and Forecast - by Booking Mode

- 9.2.1. Online

- 9.2.2. Offline

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Self Driven

- 9.3.2. Rental Agencies

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 The Hertz Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Auto Europe Deutschland GmbH

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Enterprise Holdings Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Seera Group Holdings Co

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Carzonrent India Private Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Sixt SE

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 ZoomCar Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Europcar Mobility Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Avis Budget Group Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 The Hertz Corporation

List of Figures

- Figure 1: Global Car Rental in Tourism Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Car Rental in Tourism Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 3: North America Car Rental in Tourism Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Car Rental in Tourism Industry Revenue (billion), by Booking Mode 2025 & 2033

- Figure 5: North America Car Rental in Tourism Industry Revenue Share (%), by Booking Mode 2025 & 2033

- Figure 6: North America Car Rental in Tourism Industry Revenue (billion), by End User 2025 & 2033

- Figure 7: North America Car Rental in Tourism Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Car Rental in Tourism Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Car Rental in Tourism Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Car Rental in Tourism Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 11: Europe Car Rental in Tourism Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Car Rental in Tourism Industry Revenue (billion), by Booking Mode 2025 & 2033

- Figure 13: Europe Car Rental in Tourism Industry Revenue Share (%), by Booking Mode 2025 & 2033

- Figure 14: Europe Car Rental in Tourism Industry Revenue (billion), by End User 2025 & 2033

- Figure 15: Europe Car Rental in Tourism Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Car Rental in Tourism Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Car Rental in Tourism Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Car Rental in Tourism Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 19: Asia Pacific Car Rental in Tourism Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Asia Pacific Car Rental in Tourism Industry Revenue (billion), by Booking Mode 2025 & 2033

- Figure 21: Asia Pacific Car Rental in Tourism Industry Revenue Share (%), by Booking Mode 2025 & 2033

- Figure 22: Asia Pacific Car Rental in Tourism Industry Revenue (billion), by End User 2025 & 2033

- Figure 23: Asia Pacific Car Rental in Tourism Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Car Rental in Tourism Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Car Rental in Tourism Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Car Rental in Tourism Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 27: Rest of the World Car Rental in Tourism Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Rest of the World Car Rental in Tourism Industry Revenue (billion), by Booking Mode 2025 & 2033

- Figure 29: Rest of the World Car Rental in Tourism Industry Revenue Share (%), by Booking Mode 2025 & 2033

- Figure 30: Rest of the World Car Rental in Tourism Industry Revenue (billion), by End User 2025 & 2033

- Figure 31: Rest of the World Car Rental in Tourism Industry Revenue Share (%), by End User 2025 & 2033

- Figure 32: Rest of the World Car Rental in Tourism Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of the World Car Rental in Tourism Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Car Rental in Tourism Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Car Rental in Tourism Industry Revenue billion Forecast, by Booking Mode 2020 & 2033

- Table 3: Global Car Rental in Tourism Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Global Car Rental in Tourism Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Car Rental in Tourism Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Car Rental in Tourism Industry Revenue billion Forecast, by Booking Mode 2020 & 2033

- Table 7: Global Car Rental in Tourism Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Global Car Rental in Tourism Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United states Car Rental in Tourism Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Car Rental in Tourism Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of North america Car Rental in Tourism Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Car Rental in Tourism Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 13: Global Car Rental in Tourism Industry Revenue billion Forecast, by Booking Mode 2020 & 2033

- Table 14: Global Car Rental in Tourism Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 15: Global Car Rental in Tourism Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Car Rental in Tourism Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Car Rental in Tourism Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Car Rental in Tourism Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Car Rental in Tourism Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Norway Car Rental in Tourism Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Netherlands Car Rental in Tourism Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of Europe Car Rental in Tourism Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Global Car Rental in Tourism Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 24: Global Car Rental in Tourism Industry Revenue billion Forecast, by Booking Mode 2020 & 2033

- Table 25: Global Car Rental in Tourism Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 26: Global Car Rental in Tourism Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 27: China Car Rental in Tourism Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: India Car Rental in Tourism Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Japan Car Rental in Tourism Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Korea Car Rental in Tourism Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Car Rental in Tourism Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Car Rental in Tourism Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 33: Global Car Rental in Tourism Industry Revenue billion Forecast, by Booking Mode 2020 & 2033

- Table 34: Global Car Rental in Tourism Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 35: Global Car Rental in Tourism Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: South America Car Rental in Tourism Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Middle East and Africa Car Rental in Tourism Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Car Rental in Tourism Industry?

The projected CAGR is approximately 9.77%.

2. Which companies are prominent players in the Car Rental in Tourism Industry?

Key companies in the market include The Hertz Corporation, Auto Europe Deutschland GmbH, Enterprise Holdings Inc, Seera Group Holdings Co, Carzonrent India Private Limited, Sixt SE, ZoomCar Inc, Europcar Mobility Group, Avis Budget Group Inc.

3. What are the main segments of the Car Rental in Tourism Industry?

The market segments include Vehicle Type, Booking Mode, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 129.66 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Use of Aluminum in Die Casting Equipment to Increase Market Demand.

6. What are the notable trends driving market growth?

Online Booking Expected to Witness Significant Growth during the Forecast Period.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

In January 2022, ekar, the Middle East's mobility company, launched its operations in Thailand starting with Bangkok and with plans to expand into other countries. ekar is launching its proprietary car subscription service which offers cars from one to nine-month terms for a single monthly subscription cost with no down payments or long-term commitments via the ekar app.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Car Rental in Tourism Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Car Rental in Tourism Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Car Rental in Tourism Industry?

To stay informed about further developments, trends, and reports in the Car Rental in Tourism Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence