Key Insights

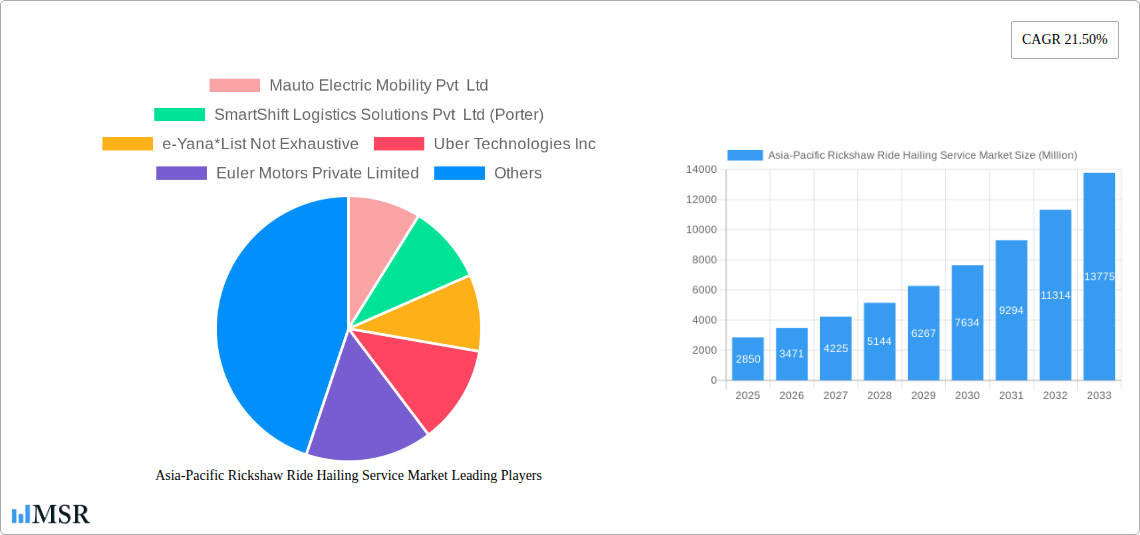

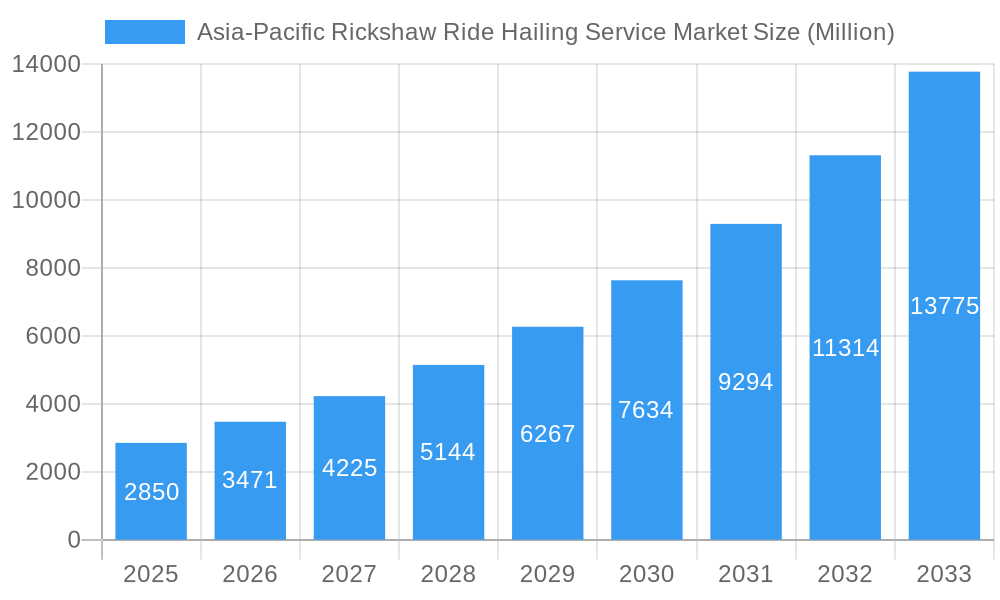

The Asia-Pacific Rickshaw Ride Hailing Service Market is poised for robust expansion, projected to reach an estimated market size of approximately USD 2,850 million by 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 21.50% anticipated through 2033. This dynamic growth is fueled by several key drivers, including the escalating demand for convenient and affordable last-mile connectivity, particularly in densely populated urban centers across the region. The increasing penetration of smartphones and widespread internet access has democratized the ride-hailing landscape, empowering a vast user base to access rickshaw services through intuitive online platforms. Furthermore, the growing adoption of cashless payment methods, such as e-money and e-wallets, is streamlining transactions and enhancing the overall user experience, directly contributing to market expansion. The shift towards electric propulsion in rickshaws is also a significant trend, aligning with regional sustainability goals and reducing operational costs for operators, thus driving further adoption.

Asia-Pacific Rickshaw Ride Hailing Service Market Market Size (In Billion)

The market segmentation reveals a strong emphasis on both freight and logistics, alongside passenger commuting, indicating the dual utility of rickshaw services in the Asia-Pacific region. The dominance of online booking channels reflects the evolving consumer preferences for digital convenience. While the market is experiencing significant tailwinds, certain restraints, such as fluctuating fuel prices (for ICE rickshaws), evolving regulatory frameworks in different countries, and infrastructure limitations in some areas, need to be navigated. However, the strong presence of established players like Uber Technologies Inc., Ola Cabs, Grab, and DiDi Chuxing, alongside emerging innovators like Mauto Electric Mobility Pvt Ltd and Euler Motors Private Limited, underscores the competitive intensity and the significant investment flowing into this sector. The Asia-Pacific region, with its large population and developing economies, presents a fertile ground for the continued growth and innovation within the rickshaw ride-hailing service market.

Asia-Pacific Rickshaw Ride Hailing Service Market Company Market Share

This comprehensive report, Asia-Pacific Rickshaw Ride Hailing Service Market, offers an in-depth analysis of a rapidly evolving sector. Covering the study period 2019–2033, with a base year of 2025, this research provides granular insights into market dynamics, key trends, and future projections. The report meticulously examines the historical period 2019–2024 and the estimated year 2025, culminating in a detailed forecast period from 2025–2033. Stakeholders seeking to understand and capitalize on the burgeoning Asia-Pacific rickshaw ride hailing service market will find actionable intelligence on market size, growth drivers, competitive landscapes, and emerging opportunities.

Asia-Pacific Rickshaw Ride Hailing Service Market Market Concentration & Dynamics

The Asia-Pacific rickshaw ride hailing market exhibits a dynamic concentration, characterized by a mix of established global players and agile local innovators. Market concentration is influenced by regulatory landscapes and the rapid adoption of digital platforms for passenger commuting and freight and logistics. Innovation ecosystems are flourishing, driven by advancements in e-mobility and the integration of Electric Propulsion Type vehicles. The rise of smart mobility solutions is reshaping urban transportation. Regulatory frameworks are increasingly adapting to support organized ride-hailing services while ensuring safety and fair competition. Substitute products, primarily traditional taxis and public transport, continue to face pressure from the convenience and efficiency offered by rickshaw ride-hailing. End-user trends indicate a strong preference for cashless payment and e-money/e-wallet options, reflecting a broader shift towards digital transactions. Mergers and acquisitions (M&A) activities, while not yet dominating, are anticipated to increase as companies seek to consolidate market share and expand their geographical reach. Key M&A deal counts are expected to rise as strategic partnerships become crucial for scaling operations and accessing new user bases in this competitive market.

Asia-Pacific Rickshaw Ride Hailing Service Market Industry Insights & Trends

The Asia-Pacific rickshaw ride hailing service market is poised for substantial growth, projected to reach USD 15,000 Million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 15.6% during the forecast period 2025–2033. This upward trajectory is fueled by a confluence of factors, including rapid urbanization, a burgeoning middle class, and increasing smartphone penetration across the region. The passenger commuting segment continues to be a dominant application, driven by the need for affordable and accessible last-mile connectivity in densely populated urban centers. Simultaneously, the freight and logistics application is gaining significant traction, with rickshaws proving to be efficient for short-distance deliveries, especially within congested cityscapes. Technological disruptions are at the forefront of this market's evolution. The integration of advanced AI and machine learning algorithms for route optimization, dynamic pricing, and enhanced user experience is becoming standard. The shift towards electric propulsion type rickshaws is a major trend, driven by government incentives, environmental concerns, and a growing consumer preference for sustainable transportation. This transition is not only reducing operational costs for service providers but also contributing to cleaner urban environments. The increasing adoption of online booking platforms and e-money/e-wallet payment methods is revolutionizing how consumers access and pay for these services, offering unparalleled convenience and security. The offline booking segment, while still relevant in certain demographics, is steadily declining as digital literacy and access to smartphones improve. The market is witnessing a significant increase in demand for on-demand services, pushing companies to enhance their fleet management and driver networks. The growth of e-commerce and its associated delivery needs further bolsters the demand for rickshaw-based logistics solutions. Emerging economies within the Asia-Pacific region, with their large and young populations, represent significant untapped potential for ride-hailing services. Regulatory support and government initiatives aimed at promoting public transport and reducing carbon emissions are also playing a crucial role in shaping the industry's future.

Key Markets & Segments Leading Asia-Pacific Rickshaw Ride Hailing Service Market

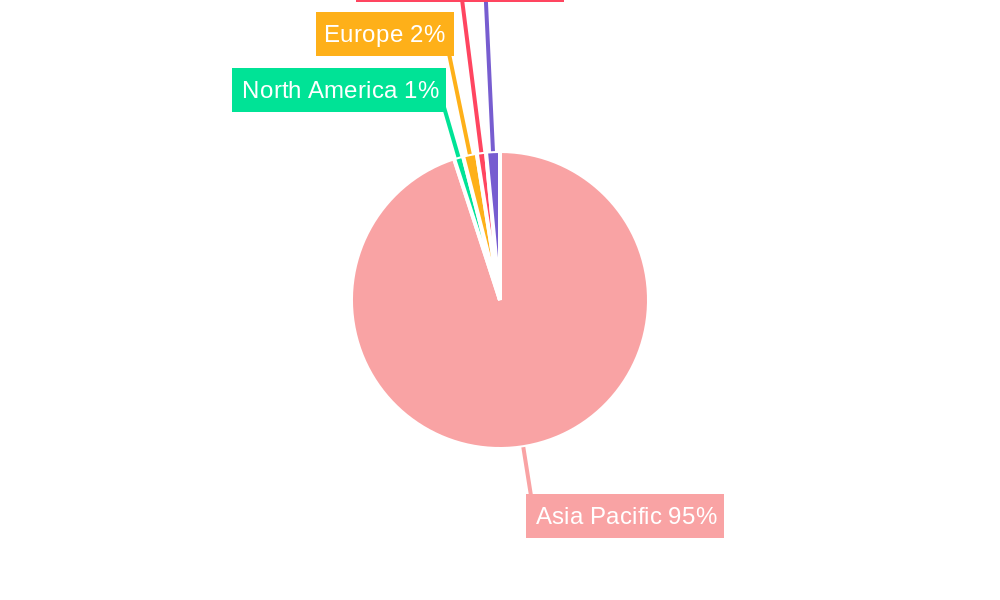

The Asia-Pacific rickshaw ride hailing service market is characterized by strong regional dominance and the significant impact of specific segments. Southeast Asia emerges as a leading region, driven by countries like Indonesia, Vietnam, and the Philippines, where rickshaws, or their local equivalents, are an integral part of the transportation ecosystem. India also holds a substantial market share due to the widespread adoption of ride-hailing apps for both personal and commercial use.

Dominant Segments:

- Application: Passenger Commuting: This segment leads due to the ever-increasing demand for affordable, convenient, and accessible urban transportation. The affordability of rickshaw rides compared to other modes makes them a popular choice for daily commutes, especially for students and low-to-middle-income groups.

- Booking Type: Online: The proliferation of smartphones and internet connectivity has dramatically shifted consumer preference towards online booking. This offers users the convenience of booking a ride anytime, anywhere, with real-time tracking and fare estimation.

- Payment: E-Money / E-Wallet: Consumers are increasingly opting for cashless transactions, embracing digital payment methods for their speed, security, and ease of use. This aligns with broader digital transformation trends across the Asia-Pacific region.

- Propulsion Type: Electric: While Internal Combustion Engine (ICE) rickshaws are still prevalent, the Electric Propulsion Type is rapidly gaining momentum. Government initiatives promoting green transportation, coupled with lower running costs for electric vehicles, are driving this shift. This segment is expected to witness the highest growth rate in the coming years.

Detailed Dominance Analysis:

- Economic Growth & Urbanization: Rapid economic development in countries like India and Vietnam has led to increased disposable incomes and a surge in urban populations. This fuels the demand for efficient and affordable mobility solutions, with rickshaws fitting this need perfectly.

- Infrastructure Development: While infrastructure varies, the relatively lower infrastructure requirements for rickshaws compared to cars make them more adaptable to diverse urban and semi-urban environments. The availability of charging infrastructure for electric rickshaws is a key factor in their growing adoption.

- Regulatory Support & Government Initiatives: Several governments in the region are actively promoting ride-hailing services and encouraging the adoption of electric vehicles. Subsidies for electric rickshaws and favorable policies for ride-hailing platforms are significant drivers of growth.

- Cost-Effectiveness: The inherent cost-effectiveness of rickshaws, both in terms of initial investment and operational expenses, makes them an attractive option for both operators and consumers. This affordability is a critical factor in their widespread use.

Asia-Pacific Rickshaw Ride Hailing Service Market Product Developments

Product innovations in the Asia-Pacific rickshaw ride hailing service market are primarily focused on enhancing efficiency, sustainability, and user experience. The development of more advanced electric rickshaws with improved battery life and faster charging capabilities is a key trend. Smart features, such as GPS integration for real-time tracking, in-app communication tools between riders and drivers, and digitized payment options, are becoming standard. The integration of IoT devices for fleet management, predictive maintenance, and performance monitoring is also gaining traction. These advancements aim to improve operational efficiency for ride-hailing companies and provide a safer, more convenient, and technologically superior service for consumers, thereby enhancing their competitive edge in this dynamic market.

Challenges in the Asia-Pacific Rickshaw Ride Hailing Service Market Market

The Asia-Pacific rickshaw ride hailing service market faces several challenges that could impede its growth. Regulatory fragmentation across different countries and even within cities creates compliance complexities. Supply chain disruptions, particularly for electric vehicle components, can affect fleet expansion and maintenance. Intense competition from existing ride-hailing giants and traditional transport services puts pressure on pricing and profitability. Furthermore, ensuring driver safety and providing adequate training remains a critical concern. The infrastructure for charging electric rickshaws is still nascent in many areas, posing a barrier to widespread adoption.

Forces Driving Asia-Pacific Rickshaw Ride Hailing Service Market Growth

Several forces are propelling the growth of the Asia-Pacific rickshaw ride hailing service market. Technological advancements, including the widespread adoption of smartphones and the development of robust ride-hailing platforms, are fundamental drivers. The increasing urbanization across the region necessitates efficient and affordable last-mile connectivity solutions, a niche well-filled by rickshaws. Government initiatives promoting e-mobility and sustainable transportation, alongside growing environmental consciousness among consumers, are significantly boosting the demand for electric rickshaws. The expanding gig economy also provides a pool of drivers eager to find flexible employment opportunities.

Challenges in the Asia-Pacific Rickshaw Ride Hailing Service Market Market

Long-term growth catalysts for the Asia-Pacific rickshaw ride hailing service market lie in continued technological innovation and strategic market expansion. The development of smarter, more connected electric rickshaws with enhanced safety features and extended range will be crucial. Partnerships between ride-hailing platforms and electric vehicle manufacturers can accelerate the transition to sustainable fleets. Expanding into tier-2 and tier-3 cities, where the need for affordable transportation is immense, presents a significant opportunity. Furthermore, integrating rickshaw services with other forms of public and private transportation can create a more seamless and efficient mobility ecosystem.

Emerging Opportunities in Asia-Pacific Rickshaw Ride Hailing Service Market

Emerging opportunities in the Asia-Pacific rickshaw ride hailing service market are diverse. The integration of rickshaw services into broader smart city initiatives offers potential for improved urban mobility management. The increasing demand for hyper-local delivery services presents a substantial growth avenue for the freight and logistics application. Innovations in battery swapping technology for electric rickshaws could alleviate range anxiety and speed up turnaround times. Furthermore, the development of specialized rickshaw services, such as those catering to tourists or individuals with specific mobility needs, could unlock new market segments.

Leading Players in the Asia-Pacific Rickshaw Ride Hailing Service Market Sector

- Mauto Electric Mobility Pvt Ltd

- SmartShift Logistics Solutions Pvt Ltd (Porter)

- e-Yana

- Uber Technologies Inc

- Euler Motors Private Limited

- Jugnoo (Socomo Technologies Pvt Ltd)

- Gojek tech

- Grab

- DiDi Chuxing (Beijing Xiaoju Technology Co Ltd)

- Ola Cabs (ANI Technologies Pvt Ltd)

Key Milestones in Asia-Pacific Rickshaw Ride Hailing Service Market Industry

- 2021: Uber India announced its commitment to increasing its electric vehicle fleet to 3,000 e-vehicles, signaling a strong adoption of e-mobility and green technology trends in the country. This initiative included plans to establish dedicated charging infrastructures and strategic partnerships with Original Equipment Manufacturers (OEMs) to streamline operations.

- 2022: Grab expanded its electric motorcycle and rickshaw pilot programs in several Southeast Asian markets, aiming to reduce carbon emissions and operational costs.

- 2023: Gojek launched a new fleet of electric rickshaws in Jakarta, focusing on last-mile delivery services and passenger commuting, with integrated fast-charging solutions.

- 2024: DiDi Chuxing announced significant investments in developing smart charging solutions for electric two- and three-wheelers in select Asian cities, aiming to improve the efficiency of its electric fleet.

- 2025 (Projected): Ola Cabs is expected to further expand its electric rickshaw offerings across India, supported by government subsidies and an increasing consumer demand for eco-friendly transport options.

Strategic Outlook for Asia-Pacific Rickshaw Ride Hailing Service Market Market

The strategic outlook for the Asia-Pacific rickshaw ride hailing service market is exceptionally positive, driven by a confluence of technological advancements, favorable demographics, and increasing sustainability consciousness. The market is set to witness accelerated growth through strategic partnerships that enhance fleet electrification and charging infrastructure development. Companies that focus on optimizing their digital platforms for seamless user experiences, particularly in online booking and cashless payment methods, will gain a competitive advantage. The expansion into underserved urban and semi-urban areas, coupled with a diversified service portfolio encompassing both passenger commuting and freight and logistics, will be key to unlocking future market potential. The report anticipates continued innovation in electric rickshaw technology, making them an even more compelling and sustainable mobility solution for the region.

Asia-Pacific Rickshaw Ride Hailing Service Market Segmentation

-

1. Application

- 1.1. Freight and Logistics

- 1.2. Passenger Commuting

-

2. Booking Type

- 2.1. Online

- 2.2. Offline

-

3. Payment

- 3.1. Cashless

- 3.2. E-Money / E-Wallet

-

4. Propulsion Type

- 4.1. Electric

- 4.2. Internal Combustion Engine

Asia-Pacific Rickshaw Ride Hailing Service Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Rickshaw Ride Hailing Service Market Regional Market Share

Geographic Coverage of Asia-Pacific Rickshaw Ride Hailing Service Market

Asia-Pacific Rickshaw Ride Hailing Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Inclusion of E-bikes in the Sharing Fleet

- 3.3. Market Restrains

- 3.3.1. Limited Infrastructure May Hinder Market Growth

- 3.4. Market Trends

- 3.4.1 Rising Tourism

- 3.4.2 Leisure Traveling and Logistics Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Rickshaw Ride Hailing Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Freight and Logistics

- 5.1.2. Passenger Commuting

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Payment

- 5.3.1. Cashless

- 5.3.2. E-Money / E-Wallet

- 5.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.4.1. Electric

- 5.4.2. Internal Combustion Engine

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mauto Electric Mobility Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SmartShift Logistics Solutions Pvt Ltd (Porter)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 e-Yana*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Uber Technologies Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Euler Motors Private Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jugnoo (Socomo Technologies Pvt Ltd )

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gojek tech

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Grab

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DiDi Chuxing (Beijing Xiaoju Technology Co Ltd )

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ola Cabs (ANI Technologies Pvt Ltd)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Mauto Electric Mobility Pvt Ltd

List of Figures

- Figure 1: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Rickshaw Ride Hailing Service Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 3: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Payment 2020 & 2033

- Table 4: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 5: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 8: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Payment 2020 & 2033

- Table 9: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 10: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: China Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Japan Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: South Korea Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: India Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Australia Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: New Zealand Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Indonesia Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Malaysia Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Singapore Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Thailand Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Vietnam Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Philippines Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Rickshaw Ride Hailing Service Market?

The projected CAGR is approximately 21.50%.

2. Which companies are prominent players in the Asia-Pacific Rickshaw Ride Hailing Service Market?

Key companies in the market include Mauto Electric Mobility Pvt Ltd, SmartShift Logistics Solutions Pvt Ltd (Porter), e-Yana*List Not Exhaustive, Uber Technologies Inc, Euler Motors Private Limited, Jugnoo (Socomo Technologies Pvt Ltd ), Gojek tech, Grab, DiDi Chuxing (Beijing Xiaoju Technology Co Ltd ), Ola Cabs (ANI Technologies Pvt Ltd).

3. What are the main segments of the Asia-Pacific Rickshaw Ride Hailing Service Market?

The market segments include Application, Booking Type, Payment, Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Inclusion of E-bikes in the Sharing Fleet.

6. What are the notable trends driving market growth?

Rising Tourism. Leisure Traveling and Logistics Sector.

7. Are there any restraints impacting market growth?

Limited Infrastructure May Hinder Market Growth.

8. Can you provide examples of recent developments in the market?

In 2021, Uber India announced increasing its electric vehicle fleet to 3,000 e-vehicles due to trending e-mobility and green technology trends in the country. The company also has plans to establish charging infrastructures and partnered with OEM to smoothen its operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Rickshaw Ride Hailing Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Rickshaw Ride Hailing Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Rickshaw Ride Hailing Service Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Rickshaw Ride Hailing Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence