Key Insights

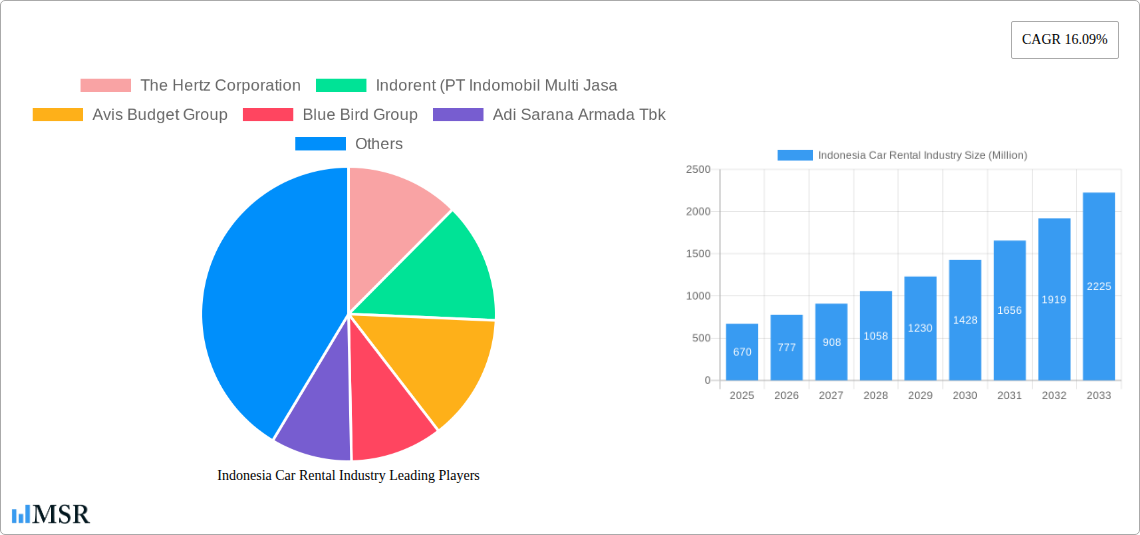

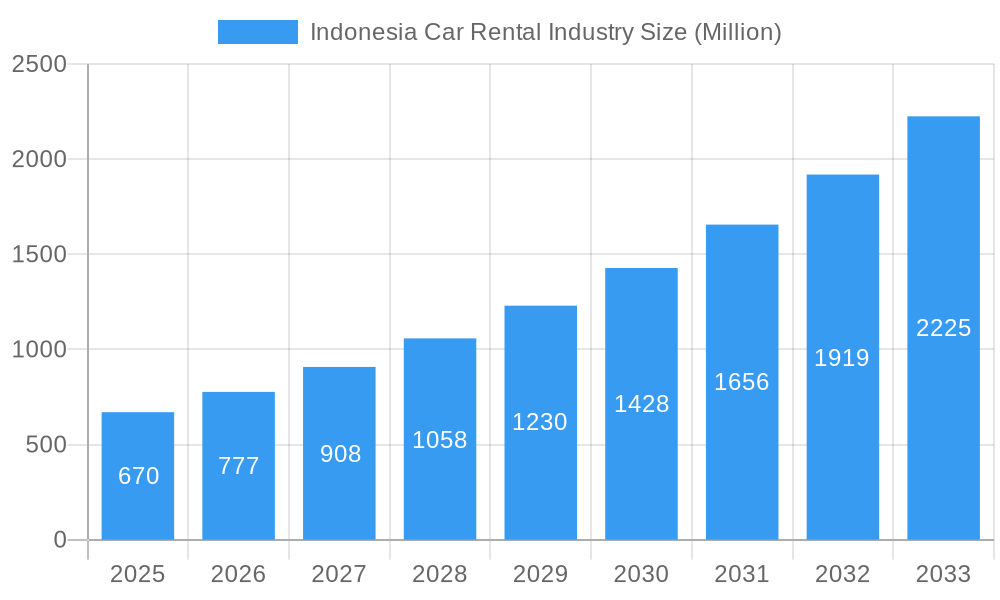

The Indonesian car rental market, valued at $670 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 16.09% from 2025 to 2033. This surge is driven by several key factors. The burgeoning tourism sector in Indonesia, attracting millions of international and domestic travelers annually, fuels significant demand for short-term rentals. Simultaneously, the increasing urbanization and traffic congestion in major cities like Jakarta are prompting more individuals and businesses to opt for convenient car rental solutions for commuting and daily needs, thereby boosting the long-term rental segment. Furthermore, the rise of online booking platforms and mobile applications offers seamless accessibility and price comparisons, driving market penetration and convenience. However, challenges remain. Fluctuations in fuel prices and the availability of affordable public transportation could potentially restrain growth to some extent. Competitive pricing strategies among established players like Hertz, Avis Budget Group, and local companies such as Blue Bird Group and TRAC are shaping the market dynamics.

Indonesia Car Rental Industry Market Size (In Million)

The segmentation of the Indonesian car rental market reveals a clear preference for online bookings, reflecting the growing digital adoption rate. Short-term rentals dominate the market due to tourist activities, but the long-term segment is witnessing steady growth fueled by business needs and individual preferences for flexible transportation options. The tourism application segment remains the largest, while the commuting segment exhibits promising potential for future expansion. The market’s competitive landscape features a mix of international giants and robust local players, indicating a mature market with a diverse range of service offerings and price points. Future growth will likely be influenced by further technological advancements, government regulations concerning transportation, and evolving consumer preferences.

Indonesia Car Rental Industry Company Market Share

Indonesia Car Rental Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Indonesia car rental industry, encompassing market dynamics, key segments, leading players, and future growth prospects. From historical data (2019-2024) to future forecasts (2025-2033), with a base year of 2025, this report is essential for industry stakeholders, investors, and strategic decision-makers. Discover actionable insights into market concentration, technological disruptions, and emerging opportunities in this rapidly evolving sector. The report’s analysis covers key players such as The Hertz Corporation, Indorent (PT Indomobil Multi Jasa), Avis Budget Group, Blue Bird Group, Adi Sarana Armada Tbk, Mitra Pinasthika Mustika Rent, Globe Rent a Car, TRAC, and Europcar Indonesia, and examines segments including online/offline bookings, short-term/long-term rentals, tourism, and commuting applications. The report projects a market size of xx Million USD in 2025, with a CAGR of xx% during the forecast period.

Indonesia Car Rental Industry Market Concentration & Dynamics

The Indonesian car rental market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. While precise figures are difficult to obtain publicly, it's estimated that the top 5 players collectively control approximately xx% of the market in 2025. Innovation in the sector is driven by technological advancements such as online booking platforms and mobile applications, enhancing customer experience and operational efficiency. The regulatory framework, while evolving, generally favors market growth. Substitute products, such as ride-hailing services, pose a competitive challenge, particularly in the short-term rental segment. End-user trends indicate a growing preference for convenient, digitally enabled rental experiences, further fueling innovation. Mergers and acquisitions (M&A) activity has been notable in recent years, demonstrating a dynamic and consolidating market.

- Market Share (2025 Estimate): Top 5 players - xx%

- M&A Deal Count (2019-2024): xx deals

- Key Regulatory Factors: Government policies on vehicle licensing and tourism infrastructure impact market dynamics.

Indonesia Car Rental Industry Industry Insights & Trends

The Indonesian car rental market is experiencing significant growth, driven by several key factors. The rising middle class and increasing disposable incomes fuel demand for personal mobility solutions. Tourism, a significant contributor to the economy, boosts short-term rental demand. Rapid urbanization and improved infrastructure enhance accessibility and convenience for car rentals. Technological disruptions, including the adoption of online booking platforms and fleet management systems, are optimizing operations and expanding market reach. Consumer behavior is shifting towards digitalization, with increased preference for online bookings and contactless services. This trend is further amplified by growing smartphone penetration and digital literacy within the Indonesian population. The market size is estimated at xx Million USD in 2025, reflecting a robust growth trajectory since 2019.

Key Markets & Segments Leading Indonesia Car Rental Industry

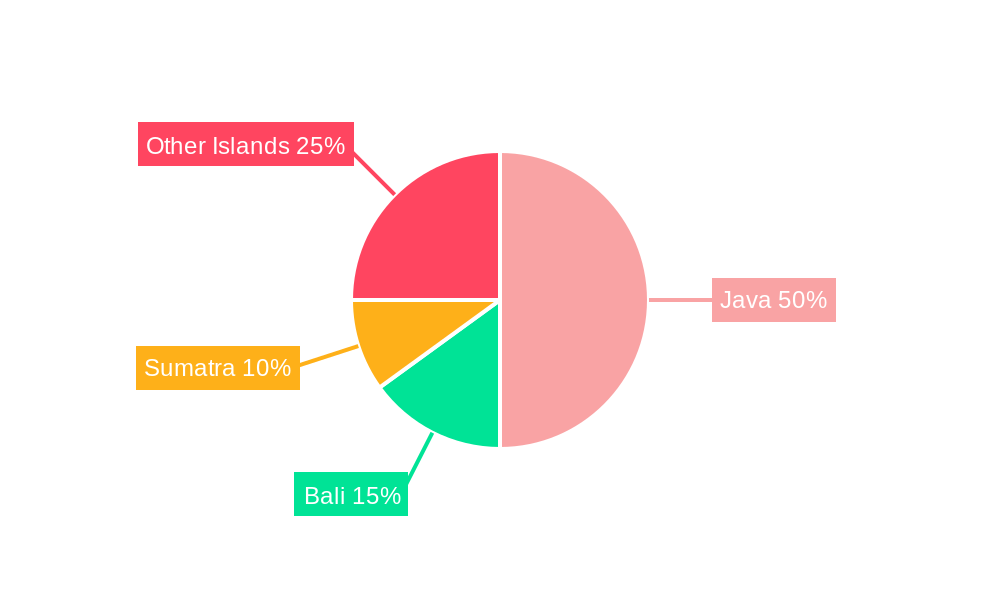

The Indonesian car rental market is geographically diverse, with significant demand across major cities and tourist destinations. Java, as the most populous island, represents the largest market share. However, other islands are witnessing rapid growth, driven by increasing tourism and infrastructure development. Within segments, online bookings are steadily outpacing offline rentals, reflecting the broader trend towards digitalization. Short-term rentals dominate the market, although long-term rentals are experiencing growth driven by business travel and expatriate communities. Tourism is the largest application segment, followed by commuting, especially within urban areas.

- Dominant Region: Java

- Dominant Booking Type: Online

- Dominant Rental Duration: Short-Term

- Dominant Application Type: Tourism

Drivers for Growth:

- Economic Growth: Rising disposable incomes and a growing middle class are major catalysts for increased car rental demand.

- Tourism Growth: Indonesia's vibrant tourism sector significantly contributes to the short-term rental market.

- Infrastructure Development: Improved roads and airports enhance accessibility and convenience for car rentals.

- Urbanization: Increased population density in urban centers fuels the demand for personal mobility solutions.

Indonesia Car Rental Industry Product Developments

Recent product innovations within the Indonesian car rental sector emphasize convenience, technology integration, and customer experience. This includes the development of user-friendly mobile applications for booking and management, GPS integration for navigation, and enhanced fleet management systems for optimized utilization. Companies are increasingly offering add-on services like insurance packages and driver options to cater to diverse customer needs. The focus is on leveraging technology to improve operational efficiency, enhance customer satisfaction, and create a competitive edge in a rapidly evolving market.

Challenges in the Indonesia Car Rental Industry Market

The Indonesian car rental market faces several challenges. Regulatory hurdles, such as licensing requirements and permits, can impact operational efficiency. Supply chain issues, including vehicle availability and maintenance, can disrupt services and increase costs. Intense competition from established players and emerging ride-hailing services puts pressure on pricing and profitability. These challenges need proactive management to ensure sustainable growth for industry players. For example, unpredictable fuel price fluctuations can affect operational costs significantly, impacting profitability and potentially leading to price increases passed on to consumers.

Forces Driving Indonesia Car Rental Industry Growth

Several factors are accelerating the growth of the Indonesian car rental industry. Technological advancements in online booking, mobile apps, and fleet management optimize efficiency and customer experience. Economic growth and rising middle-class incomes fuel demand for personal mobility solutions. Government initiatives supporting tourism and infrastructure development create a favorable environment for the industry's expansion. Specific examples include the government's continued investment in airport infrastructure and the promotion of domestic tourism.

Long-Term Growth Catalysts in the Indonesia Car Rental Industry

Long-term growth in Indonesia's car rental market is fueled by continuous innovation in technology and service offerings. Strategic partnerships, like the one between Blue Bird Group and AngkasaPura I, expand market reach and service diversification. Market expansion into underserved regions and leveraging the growth of e-commerce and digital platforms promise continued growth.

Emerging Opportunities in Indonesia Car Rental Industry

Emerging opportunities include expanding into less-penetrated regions beyond major cities, focusing on sustainable and eco-friendly vehicles, and offering specialized rental services targeting specific niches such as luxury travel or corporate clients. Developing integrated mobility solutions that combine car rental with other transport options can also capture a broader customer base. The adoption of innovative technologies, such as autonomous vehicles, presents a long-term growth potential although the timeline remains uncertain.

Leading Players in the Indonesia Car Rental Industry Sector

- The Hertz Corporation

- Indorent (PT Indomobil Multi Jasa)

- Avis Budget Group

- Blue Bird Group

- Adi Sarana Armada Tbk

- Mitra Pinasthika Mustika Rent

- Globe Rent a Car

- TRAC

- Europcar Indonesia

Key Milestones in Indonesia Car Rental Industry Industry

- June 2022: CARRO's USD 55.7 Million investment in PT Mitra Pinasthika MustikaTBK signifies a major strategic alliance and increased foreign investment in the sector, potentially leading to market consolidation and enhanced services.

- May 2022: The partnership between PT Blue Bird Tbk and PT AngkasaPura I expands Blue Bird's airport transportation services, enhancing its market presence and customer reach within the transportation ecosystem.

Strategic Outlook for Indonesia Car Rental Industry Market

The Indonesian car rental market presents significant long-term growth potential. Continued investment in technology, strategic partnerships, and expansion into new markets will be crucial for success. The focus on enhancing customer experience through digital platforms and value-added services will be key differentiators. The industry will need to adapt to evolving consumer preferences and regulatory changes while navigating competitive pressures to maintain sustainable growth trajectory.

Indonesia Car Rental Industry Segmentation

-

1. Booking Type

- 1.1. Online

- 1.2. Offline

-

2. Rental Duration

- 2.1. Short-term

- 2.2. Long-term

-

3. Application Type

- 3.1. Tourism

- 3.2. Commuting

Indonesia Car Rental Industry Segmentation By Geography

- 1. Indonesia

Indonesia Car Rental Industry Regional Market Share

Geographic Coverage of Indonesia Car Rental Industry

Indonesia Car Rental Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of 2-wheelers across the Globe

- 3.3. Market Restrains

- 3.3.1. Rise in demand of Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Growing Demand for Online Car Rental Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Car Rental Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 5.1.1. Online

- 5.1.2. Offline

- 5.2. Market Analysis, Insights and Forecast - by Rental Duration

- 5.2.1. Short-term

- 5.2.2. Long-term

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Tourism

- 5.3.2. Commuting

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Hertz Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Indorent (PT Indomobil Multi Jasa

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Avis Budget Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Blue Bird Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Adi Sarana Armada Tbk

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitra Pinasthika Mustika Rent

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Globe Rent a Car

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TRAC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Europcar Indonesia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 The Hertz Corporation

List of Figures

- Figure 1: Indonesia Car Rental Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Car Rental Industry Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Car Rental Industry Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 2: Indonesia Car Rental Industry Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 3: Indonesia Car Rental Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 4: Indonesia Car Rental Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Indonesia Car Rental Industry Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 6: Indonesia Car Rental Industry Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 7: Indonesia Car Rental Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 8: Indonesia Car Rental Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Car Rental Industry?

The projected CAGR is approximately 16.09%.

2. Which companies are prominent players in the Indonesia Car Rental Industry?

Key companies in the market include The Hertz Corporation, Indorent (PT Indomobil Multi Jasa, Avis Budget Group, Blue Bird Group, Adi Sarana Armada Tbk, Mitra Pinasthika Mustika Rent, Globe Rent a Car, TRAC, Europcar Indonesia.

3. What are the main segments of the Indonesia Car Rental Industry?

The market segments include Booking Type, Rental Duration, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of 2-wheelers across the Globe.

6. What are the notable trends driving market growth?

Growing Demand for Online Car Rental Services.

7. Are there any restraints impacting market growth?

Rise in demand of Electric Vehicles.

8. Can you provide examples of recent developments in the market?

June 2022: CARRO and PT Mitra Pinasthika MustikaTBK signed a binding agreement to form a strategic alliance. CARRO's SGD 75 million (around USD 55.7 million) investment will result in the company owning 50% of PT Mitra Pinasthika MustikaTBK.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Car Rental Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Car Rental Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Car Rental Industry?

To stay informed about further developments, trends, and reports in the Indonesia Car Rental Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence