Key Insights

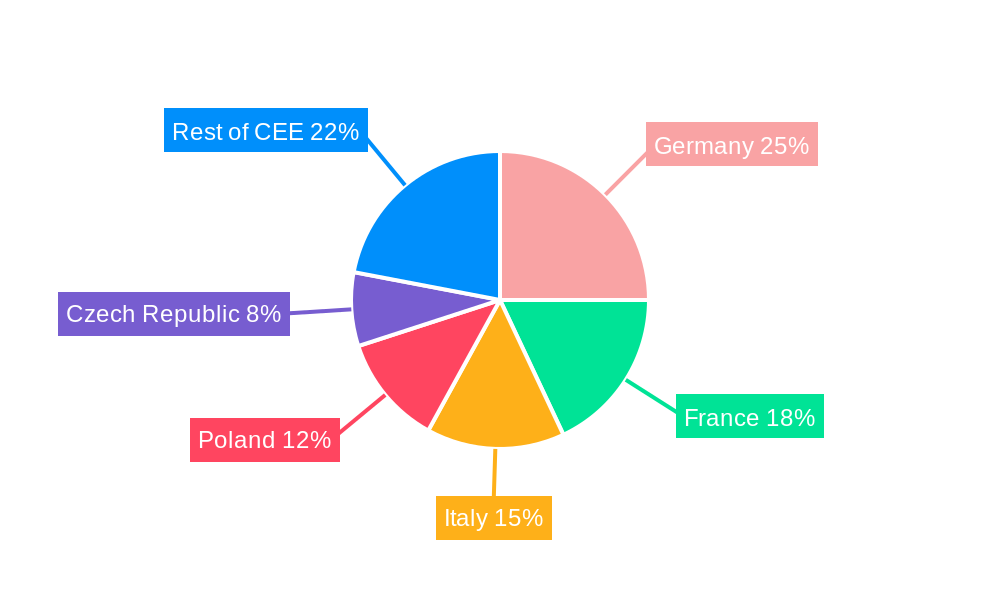

The Central and Eastern European e-bicycle market, though presently smaller than its Western European counterpart, is poised for substantial growth. This expansion is propelled by heightened environmental consciousness, government initiatives supporting sustainable mobility, and increasing consumer purchasing power. The two-wheeler segment, specifically electric scooters, is a significant growth driver due to their affordability and urban commuting suitability. Initial infrastructure gaps and higher upfront costs are being addressed by innovative financing solutions and the expanding charging network. While Germany, France, and Italy are projected to lead the overall European market, Poland, the Czech Republic, and other Central and Eastern European nations represent significant, largely untapped growth opportunities, supported by rising public awareness and favorable government policies.

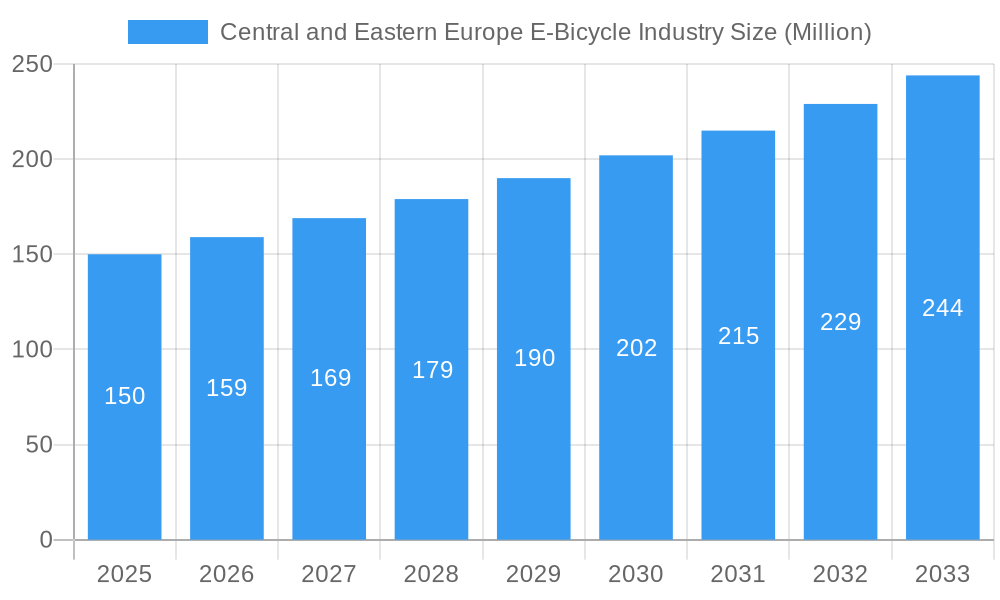

Central and Eastern Europe E-Bicycle Industry Market Size (In Billion)

The Central and Eastern European e-bicycle market is projected to achieve a Compound Annual Growth Rate (CAGR) of 10.1%. This robust growth rate indicates a significant market expansion, reaching a size of 84.25 billion by the base year of 2025. Key industry players are prioritizing product innovation, focusing on advancements in battery technology, integrated connectivity features, and aesthetically appealing designs to attract a broader consumer base. Market segmentation is expected to diversify with the introduction of specialized e-bikes, such as cargo and e-mountain variants, further fueling market expansion. Increased competition is anticipated, with both established manufacturers and emerging brands striving to capture market share.

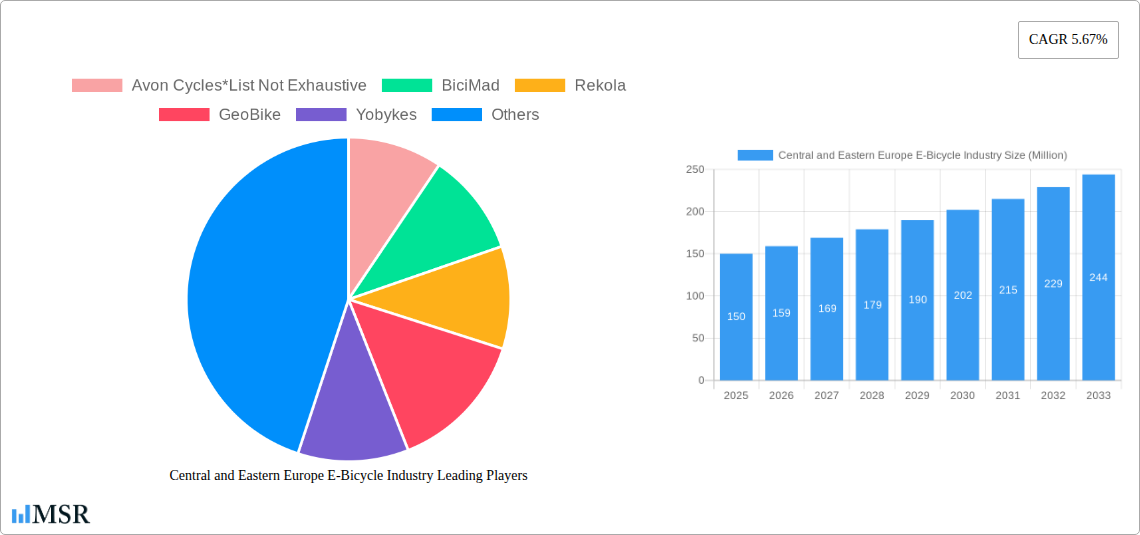

Central and Eastern Europe E-Bicycle Industry Company Market Share

Central and Eastern Europe E-Bicycle Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Central and Eastern European (CEE) e-bicycle industry, offering invaluable insights for stakeholders seeking to navigate this rapidly evolving market. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report delivers crucial data on market size, growth drivers, competitive landscape, and future opportunities. Key segments analyzed include motorcycles and scooters within the two-wheeler category. Leading players like Avon Cycles, BiciMad, Rekola, GeoBike, Yobykes, and VOI Scooter are profiled, providing a granular understanding of market dynamics.

Central and Eastern Europe E-Bicycle Industry Market Concentration & Dynamics

The CEE e-bicycle market exhibits a moderately concentrated landscape, with a few key players holding significant market share. However, the market is witnessing increasing competition from both established and emerging players. Innovation is driven by a growing ecosystem of startups and research institutions focused on battery technology, motor efficiency, and smart features. Regulatory frameworks vary across CEE countries, impacting market access and growth. Substitute products like traditional bicycles and public transport present challenges, yet the increasing focus on sustainability and micromobility is fostering e-bicycle adoption. End-user trends indicate a shift towards higher-performance, feature-rich e-bikes, while M&A activity remains relatively low with an estimated xx number of deals in the last five years, resulting in a xx% market share consolidation.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% of market share (2024).

- Innovation Ecosystem: Active, with significant investment in battery technology and smart features.

- Regulatory Framework: Varies across countries, impacting market entry and growth.

- Substitute Products: Traditional bicycles and public transport.

- End-User Trends: Demand for higher-performance and smart e-bikes.

- M&A Activity: Relatively low, with xx deals recorded in 2019-2024.

Central and Eastern Europe E-Bicycle Industry Industry Insights & Trends

The CEE e-bicycle market is experiencing robust growth, driven by rising environmental concerns, government initiatives promoting sustainable transport, and increasing disposable incomes. The market size reached an estimated $xx Million in 2024 and is projected to reach $xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. Technological disruptions, particularly in battery technology and connectivity, are significantly enhancing e-bicycle performance and user experience. Evolving consumer behavior reflects a preference for convenience, affordability, and eco-friendly transportation solutions, further fueling market expansion. This trend is coupled with increased urbanisation and the rising popularity of e-bikes as a last-mile solution.

Key Markets & Segments Leading Central and Eastern Europe E-Bicycle Industry

Poland currently holds the dominant position in the CEE e-bicycle market, owing to strong economic growth, burgeoning urban populations, and supportive government policies. Germany and Czech Republic also contribute significantly. Within the two-wheeler segment, e-scooters are experiencing faster growth than e-motorcycles, due to their affordability and ease of use in urban environments.

- Dominant Region: Poland

- Growth Drivers (Poland):

- Strong economic growth

- Increasing urbanization

- Government initiatives supporting sustainable transport

- Expanding e-commerce driving last-mile delivery demand

- Dominant Segment: E-scooters (faster growth than e-motorcycles).

Central and Eastern Europe E-Bicycle Industry Product Developments

Recent product innovations focus on improved battery technology offering longer ranges and faster charging times, integration of smart features such as GPS tracking and anti-theft systems, and lightweight yet durable frame designs. These advancements are enhancing the overall user experience and driving market competitiveness. The integration of connected features, such as smartphone apps for navigation and diagnostics, are becoming increasingly common, further propelling market growth.

Challenges in the Central and Eastern Europe E-Bicycle Industry Market

The CEE e-bicycle market faces challenges including inconsistent regulatory frameworks across different countries, potentially leading to fragmented market access. Supply chain disruptions, particularly concerning battery components, can impact production and pricing. Intense competition from both established and new entrants, coupled with price sensitivity among consumers, also pose significant challenges. These factors collectively impact market expansion and profitability.

Forces Driving Central and Eastern Europe E-Bicycle Industry Growth

Technological advancements in battery technology and motor efficiency are paramount drivers, enhancing performance and range. Government incentives and subsidies promoting sustainable transportation, alongside rising environmental awareness among consumers, are boosting adoption rates. Furthermore, the growth of e-commerce is increasing the demand for last-mile delivery solutions, creating a significant market for e-bikes among businesses and logistics providers.

Long-Term Growth Catalysts in the Central and Eastern Europe E-Bicycle Industry

Long-term growth hinges on continuous technological innovation, specifically in battery life, charging infrastructure, and smart features. Strategic partnerships between e-bike manufacturers and infrastructure providers, expanding charging networks, and exploring new markets within the CEE region will foster growth. Expanding into rural areas with government support will unlock a new customer base.

Emerging Opportunities in Central and Eastern Europe E-Bicycle Industry

The burgeoning shared mobility sector presents significant opportunities for e-bike rental and subscription services. The development of specialized e-bikes for specific applications, such as cargo transportation and tourism, also offers potential. Targeting niche markets and exploring diverse consumer segments beyond urban populations can unlock further growth possibilities.

Leading Players in the Central and Eastern Europe E-Bicycle Industry Sector

- Avon Cycles

- BiciMad

- Rekola

- GeoBike

- Yobykes

- VOI Scooter

Key Milestones in Central and Eastern Europe E-Bicycle Industry Industry

- 2020: Introduction of government subsidies for e-bike purchases in Poland.

- 2021: Launch of a major e-bike sharing program in Prague.

- 2022: Several new e-bike models with extended range batteries launched.

- 2023: Significant investment in e-bike charging infrastructure in major cities.

Strategic Outlook for Central and Eastern Europe E-Bicycle Industry Market

The CEE e-bicycle market exhibits significant long-term growth potential, driven by technological innovation, supportive government policies, and a growing environmentally conscious population. Companies focusing on technological advancements, strategic partnerships, and expansion into underserved markets are poised for success in this dynamic landscape. The focus should be on sustainable and efficient solutions, addressing supply chain and regulatory challenges.

Central and Eastern Europe E-Bicycle Industry Segmentation

-

1. Two-Wheeler Type

- 1.1. Motorcycles

- 1.2. Scooter

Central and Eastern Europe E-Bicycle Industry Segmentation By Geography

- 1. Hungary

- 2. Poland

- 3. Czech Republic

- 4. Others

Central and Eastern Europe E-Bicycle Industry Regional Market Share

Geographic Coverage of Central and Eastern Europe E-Bicycle Industry

Central and Eastern Europe E-Bicycle Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growth of The Global Automotive Turbocharger Market

- 3.3. Market Restrains

- 3.3.1. Increasing Complexity of Modern Vehicles

- 3.4. Market Trends

- 3.4.1. Rise in the Demand of Green Transportation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Central and Eastern Europe E-Bicycle Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 5.1.1. Motorcycles

- 5.1.2. Scooter

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Hungary

- 5.2.2. Poland

- 5.2.3. Czech Republic

- 5.2.4. Others

- 5.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 6. Hungary Central and Eastern Europe E-Bicycle Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 6.1.1. Motorcycles

- 6.1.2. Scooter

- 6.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 7. Poland Central and Eastern Europe E-Bicycle Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 7.1.1. Motorcycles

- 7.1.2. Scooter

- 7.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 8. Czech Republic Central and Eastern Europe E-Bicycle Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 8.1.1. Motorcycles

- 8.1.2. Scooter

- 8.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 9. Others Central and Eastern Europe E-Bicycle Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 9.1.1. Motorcycles

- 9.1.2. Scooter

- 9.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Avon Cycles*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 BiciMad

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Rekola

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 GeoBike

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Yobykes

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 VOI Scooter

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Avon Cycles*List Not Exhaustive

List of Figures

- Figure 1: Central and Eastern Europe E-Bicycle Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Central and Eastern Europe E-Bicycle Industry Share (%) by Company 2025

List of Tables

- Table 1: Central and Eastern Europe E-Bicycle Industry Revenue billion Forecast, by Two-Wheeler Type 2020 & 2033

- Table 2: Central and Eastern Europe E-Bicycle Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Central and Eastern Europe E-Bicycle Industry Revenue billion Forecast, by Two-Wheeler Type 2020 & 2033

- Table 4: Central and Eastern Europe E-Bicycle Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Central and Eastern Europe E-Bicycle Industry Revenue billion Forecast, by Two-Wheeler Type 2020 & 2033

- Table 6: Central and Eastern Europe E-Bicycle Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Central and Eastern Europe E-Bicycle Industry Revenue billion Forecast, by Two-Wheeler Type 2020 & 2033

- Table 8: Central and Eastern Europe E-Bicycle Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Central and Eastern Europe E-Bicycle Industry Revenue billion Forecast, by Two-Wheeler Type 2020 & 2033

- Table 10: Central and Eastern Europe E-Bicycle Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Central and Eastern Europe E-Bicycle Industry?

The projected CAGR is approximately 10.1%.

2. Which companies are prominent players in the Central and Eastern Europe E-Bicycle Industry?

Key companies in the market include Avon Cycles*List Not Exhaustive, BiciMad, Rekola, GeoBike, Yobykes, VOI Scooter.

3. What are the main segments of the Central and Eastern Europe E-Bicycle Industry?

The market segments include Two-Wheeler Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 84.25 billion as of 2022.

5. What are some drivers contributing to market growth?

The Growth of The Global Automotive Turbocharger Market.

6. What are the notable trends driving market growth?

Rise in the Demand of Green Transportation.

7. Are there any restraints impacting market growth?

Increasing Complexity of Modern Vehicles.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Central and Eastern Europe E-Bicycle Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Central and Eastern Europe E-Bicycle Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Central and Eastern Europe E-Bicycle Industry?

To stay informed about further developments, trends, and reports in the Central and Eastern Europe E-Bicycle Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence