Key Insights

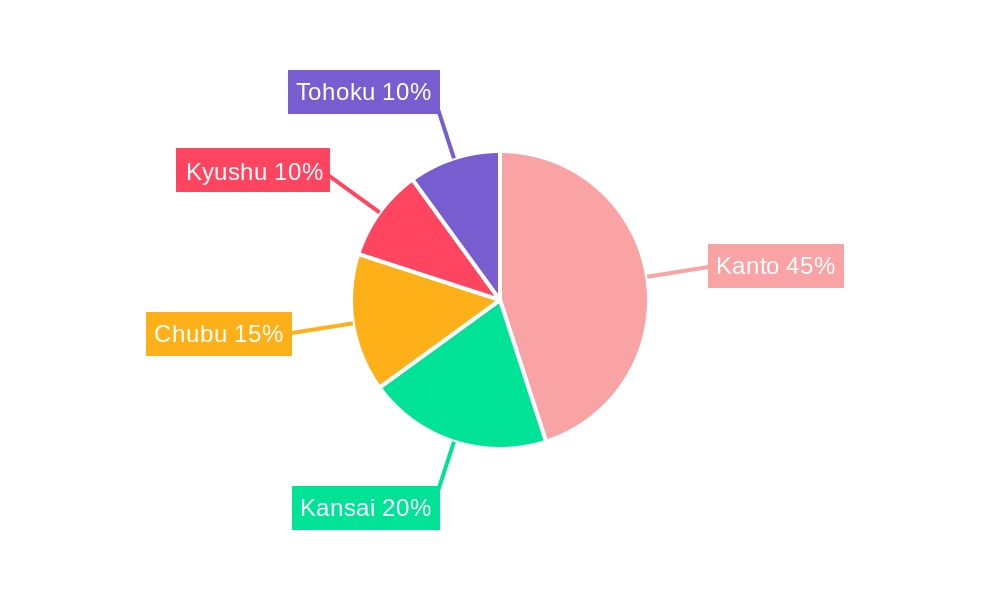

The Japan electric car market is projected for significant expansion, driven by government mandates, stringent emissions regulations, and rising environmental consciousness. Japan's advanced automotive sector fosters innovation in EVs. While Battery Electric Vehicles (BEVs) currently lead, other segments like Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs), and Fuel Cell Electric Vehicles (FCEVs) are expected to grow, supported by advancements in battery technology, charging infrastructure, and more accessible models. The Kanto region is anticipated to remain the largest market, followed by Kansai and Chubu.

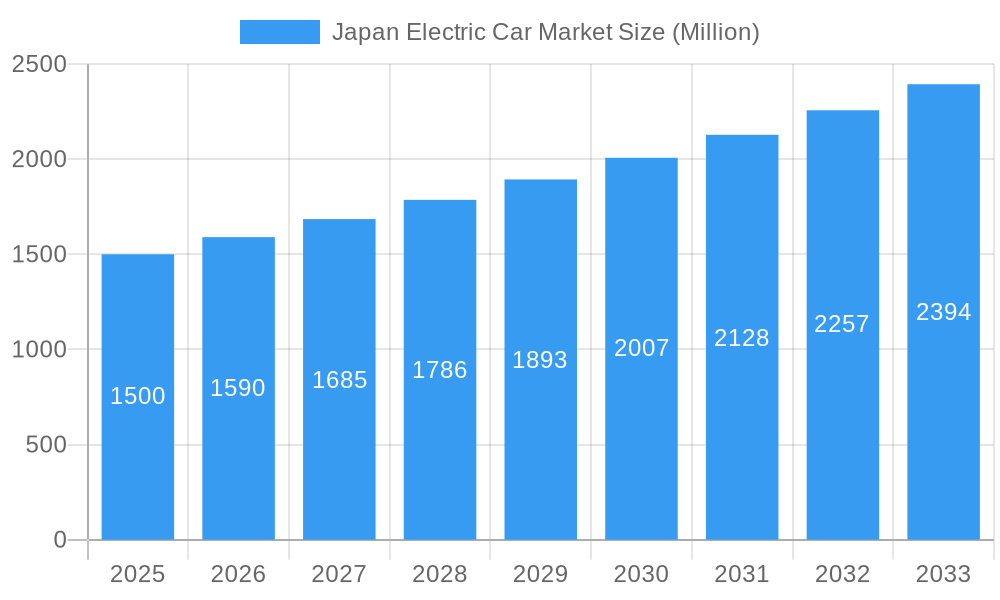

Japan Electric Car Market Market Size (In Billion)

Challenges include high upfront costs, limited charging availability outside urban centers, and consumer range anxiety. Competition from established Japanese automakers and international players like Tesla is intensifying. Strategic partnerships between manufacturers and infrastructure providers are crucial for accelerated adoption. Continued government support through subsidies will be vital. Market growth depends on these initiatives and technological progress in batteries and charging.

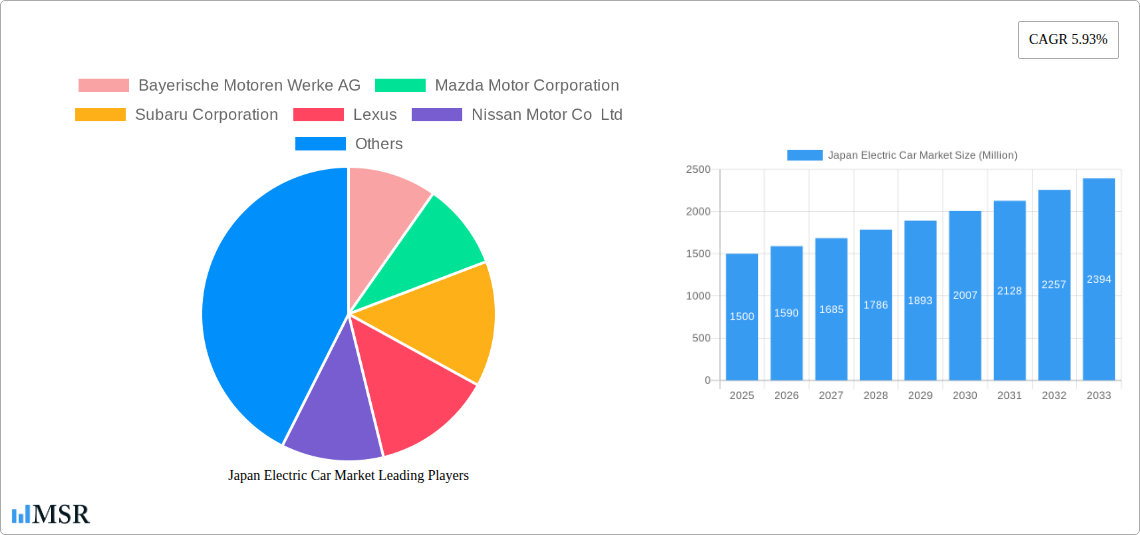

Japan Electric Car Market Company Market Share

Japan Electric Car Market: 2024-2033 Forecast - Strategic Analysis

This comprehensive report analyzes the Japan Electric Car Market from 2024 to 2033. It provides critical insights for stakeholders, including manufacturers, investors, and policymakers, navigating the evolving EV landscape in Japan. Leveraging extensive data and industry expertise, the report forecasts market trends and identifies key growth opportunities. Focusing on BEV, HEV, PHEV, and FCEV passenger cars, and featuring key players like Toyota, Nissan, and Tesla, this report is essential for understanding Japan's current and future electric car market. The analysis includes recent developments such as Tesla's strategic expansions in battery production and charging infrastructure.

Market Size: 43.22 billion

CAGR: 17.2%

Japan Electric Car Market Market Concentration & Dynamics

This section delves into the competitive landscape of Japan's electric car market, examining market concentration, innovation ecosystems, regulatory frameworks, substitute products, end-user trends, and mergers & acquisitions (M&A) activities. The market is characterized by a high level of competition amongst both domestic and international players.

Market Share: Toyota and Nissan currently hold the largest market shares, but other manufacturers like Honda, Mazda, and Mitsubishi are actively expanding their EV portfolios. The combined market share of the top three players is estimated at xx% in 2025. Tesla’s market share is steadily increasing, projected to reach xx% by 2033. The emergence of new entrants and the growing popularity of BEVs are expected to intensify competition.

Innovation Ecosystems: Japan boasts a robust ecosystem of research institutions and technology developers that are driving innovation in battery technology, charging infrastructure, and vehicle design.

Regulatory Framework: Government incentives and regulations play a crucial role in shaping the market, driving the adoption of electric vehicles. Strict emission regulations are pushing manufacturers to invest heavily in EVs.

Substitute Products: Hybrid vehicles (HEVs) continue to be a popular alternative to fully electric vehicles (BEVs), representing a significant portion of the market.

End-User Trends: The growing preference for environmentally friendly vehicles and the increasing affordability of EVs are driving adoption. Consumer concerns about charging infrastructure and range anxiety are gradually diminishing.

M&A Activity: The number of M&A deals in the Japanese electric car market has seen a moderate increase in recent years, mostly focused on battery technology and charging infrastructure. An estimated xx M&A deals occurred between 2019 and 2024.

Japan Electric Car Market Industry Insights & Trends

The Japan Electric Car Market is poised for significant growth driven by several key factors. The market size is projected to reach xx Million units by 2033, registering a CAGR of xx% during the forecast period (2025-2033). Technological advancements in battery technology, such as improved energy density and faster charging times, are accelerating adoption. The declining cost of batteries is also making EVs more affordable, attracting a wider range of consumers. Government initiatives and incentives are crucial in boosting demand. Furthermore, evolving consumer behaviors, including a rising preference for sustainable transportation, are propelling the market. The growth is expected to be particularly strong in the BEV segment. However, challenges remain, including limited charging infrastructure in certain areas and consumer concerns about range and charging time. Government policies continue to influence consumer adoption and manufacturing investments.

Key Markets & Segments Leading Japan Electric Car Market

The passenger car segment dominates the Japanese electric car market, accounting for the lion's share of sales. Within the fuel category, BEVs are experiencing the most rapid growth, although HEVs continue to hold a substantial share due to established infrastructure and consumer familiarity.

Drivers for Passenger Car Segment Dominance:

- High demand for personal vehicles.

- Established infrastructure and supply chain for passenger cars.

- Wide variety of models and price points available.

Drivers for BEV Segment Growth:

- Increasing affordability of batteries.

- Improved battery technology leading to longer range and faster charging.

- Government incentives promoting BEV adoption.

Dominance Analysis: The BEV segment is projected to significantly outperform other segments in terms of growth. The dominance of passenger cars is expected to continue, although the share of commercial electric vehicles may increase modestly.

Japan Electric Car Market Product Developments

Recent product innovations focus on enhancing battery technology, improving vehicle range, and incorporating advanced driver-assistance systems (ADAS). The development of solid-state batteries and fast-charging technology is shaping the competitive landscape. Manufacturers are also focusing on improving vehicle design and aesthetics to attract customers. These advancements are giving manufacturers a strong competitive edge, aiming for better energy efficiency and enhanced driving experience.

Challenges in the Japan Electric Car Market Market

The Japan electric car market faces several challenges. Limited charging infrastructure outside major cities remains a significant barrier. Supply chain disruptions, especially for battery components, continue to pose a risk. High initial purchase prices compared to internal combustion engine (ICE) vehicles and consumer range anxiety impact adoption rates. The competition between domestic and international players further intensifies pressure. These factors collectively constrain market growth, reducing the speed of electric vehicle transition.

Forces Driving Japan Electric Car Market Growth

Key drivers of market growth include government incentives, increasing environmental awareness among consumers, technological advancements in battery technology, and the decreasing cost of EVs. The Japanese government's commitment to reducing carbon emissions further bolsters this positive trend. Improved battery technology leads to greater range and faster charging, mitigating consumer concerns.

Long-Term Growth Catalysts in Japan Electric Car Market

Long-term growth will be driven by continued innovation in battery technology, the expansion of charging infrastructure, and the development of more affordable electric vehicles. Strategic partnerships between automakers and battery manufacturers will accelerate technological advancements. The expansion into new markets and the increasing adoption of electric vehicles in commercial fleets contribute to overall long-term growth.

Emerging Opportunities in Japan Electric Car Market

Emerging opportunities include the growth of the commercial vehicle segment, the adoption of Vehicle-to-Grid (V2G) technology, and the development of autonomous driving capabilities in electric vehicles. The growing demand for electric buses and trucks offers significant potential. V2G technology enables EVs to feed energy back into the grid, enhancing grid stability and profitability.

Leading Players in the Japan Electric Car Market Sector

Key Milestones in Japan Electric Car Market Industry

- October 2023: Tesla entered into a nickel supply agreement with Prony Resources for 42,000 tonnes of nickel, securing a key battery component. This strengthens Tesla's battery production capacity and market position.

- November 2023: Tesla acquired US-based SiILion battery, a battery manufacturer, aiming to enhance its battery production capabilities in the US market. This acquisition has significant implications for Tesla's expansion plans and overall competitiveness.

- November 2023: Tesla opened a new electric vehicle super-charging station between the Bay Area and Los Angeles, expanding its charging infrastructure and improving accessibility for EV users. This demonstrates Tesla's commitment to supporting EV adoption and enhancing the user experience.

Strategic Outlook for Japan Electric Car Market Market

The future of the Japan electric car market looks promising. Continued government support, technological advancements, and increasing consumer awareness are expected to drive significant growth. Strategic partnerships between automakers and technology companies will be critical for success. The market will likely see increasing competition, with both established players and new entrants vying for market share. The focus on sustainability and innovation will further shape the market's trajectory. The potential for growth is immense, particularly in the BEV segment and related supporting infrastructure.

Japan Electric Car Market Segmentation

-

1. Vehicle Configuration

-

1.1. Passenger Cars

- 1.1.1. Hatchback

- 1.1.2. Multi-purpose Vehicle

- 1.1.3. Sedan

- 1.1.4. Sports Utility Vehicle

-

1.1. Passenger Cars

-

2. Fuel Category

- 2.1. BEV

- 2.2. FCEV

- 2.3. HEV

- 2.4. PHEV

Japan Electric Car Market Segmentation By Geography

- 1. Japan

Japan Electric Car Market Regional Market Share

Geographic Coverage of Japan Electric Car Market

Japan Electric Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasingly Focused On Reducing Vehicle Weight To Improve Fuel Efficiency; Cost-effectiveness

- 3.3. Market Restrains

- 3.3.1. Competitiveness Of Alternative Materials

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Electric Car Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 5.1.1. Passenger Cars

- 5.1.1.1. Hatchback

- 5.1.1.2. Multi-purpose Vehicle

- 5.1.1.3. Sedan

- 5.1.1.4. Sports Utility Vehicle

- 5.1.1. Passenger Cars

- 5.2. Market Analysis, Insights and Forecast - by Fuel Category

- 5.2.1. BEV

- 5.2.2. FCEV

- 5.2.3. HEV

- 5.2.4. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bayerische Motoren Werke AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mazda Motor Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Subaru Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lexus

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nissan Motor Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Daihatsu Motor Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Daimler AG (Mercedes-Benz AG)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Volvo Car A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tesla Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Toyota Motor Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Honda Motor Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Mitsubishi Motors Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Bayerische Motoren Werke AG

List of Figures

- Figure 1: Japan Electric Car Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan Electric Car Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Electric Car Market Revenue billion Forecast, by Vehicle Configuration 2020 & 2033

- Table 2: Japan Electric Car Market Revenue billion Forecast, by Fuel Category 2020 & 2033

- Table 3: Japan Electric Car Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Japan Electric Car Market Revenue billion Forecast, by Vehicle Configuration 2020 & 2033

- Table 5: Japan Electric Car Market Revenue billion Forecast, by Fuel Category 2020 & 2033

- Table 6: Japan Electric Car Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Electric Car Market?

The projected CAGR is approximately 17.2%.

2. Which companies are prominent players in the Japan Electric Car Market?

Key companies in the market include Bayerische Motoren Werke AG, Mazda Motor Corporation, Subaru Corporation, Lexus, Nissan Motor Co Ltd, Daihatsu Motor Co Ltd, Daimler AG (Mercedes-Benz AG), Volvo Car A, Tesla Inc, Toyota Motor Corporation, Honda Motor Co Ltd, Mitsubishi Motors Corporation.

3. What are the main segments of the Japan Electric Car Market?

The market segments include Vehicle Configuration, Fuel Category.

4. Can you provide details about the market size?

The market size is estimated to be USD 43.22 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasingly Focused On Reducing Vehicle Weight To Improve Fuel Efficiency; Cost-effectiveness.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competitiveness Of Alternative Materials.

8. Can you provide examples of recent developments in the market?

November 2023: Tesla has acquired US-based start-up SiILion battery (Battery manufacturer) to excel the battery production in US.November 2023: Tesla opened its single-point electric vehicle super-charging station between the Bay Area and Los Angeles areas in the US.October 2023: Tesla entered into a nickel supply agreement with Prony Resources, in which Prony will supply around 42,000 tonnes of nickel to Tesla.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Electric Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Electric Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Electric Car Market?

To stay informed about further developments, trends, and reports in the Japan Electric Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence