Key Insights

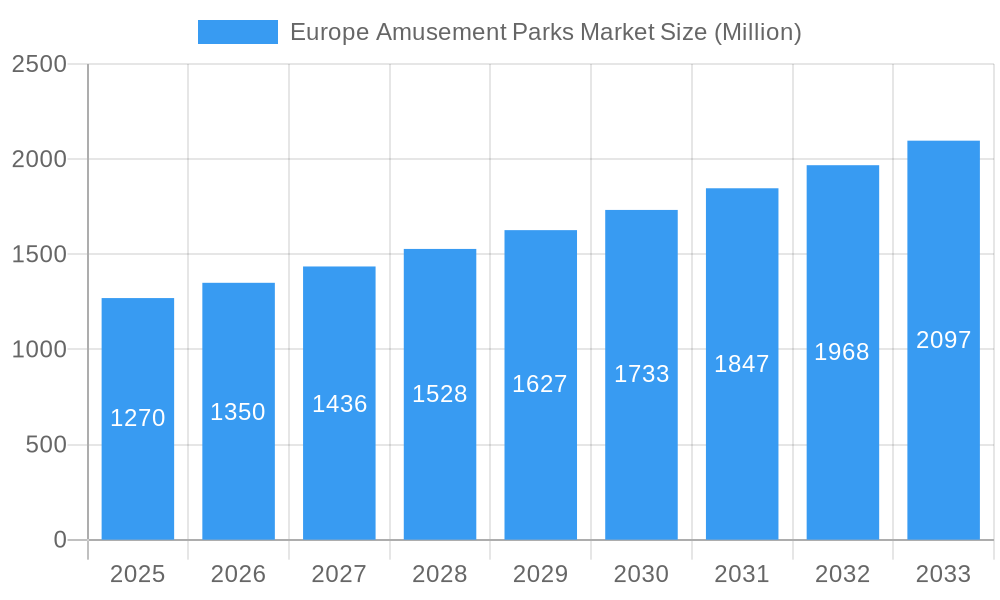

The European amusement park market, valued at €1.27 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.10% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, rising disposable incomes across Europe, particularly in key markets like Germany, France, and the United Kingdom, empower consumers to allocate more spending towards leisure and entertainment. Secondly, the continuous innovation in ride technology and park experiences, featuring thrilling new attractions and immersive themed areas, attracts both repeat visitors and new demographics. Furthermore, strategic marketing campaigns focusing on family-friendly experiences and targeted age groups (e.g., promotional packages for young adults and seniors) are driving market expansion. The segment breakdown reveals a diverse market; while mechanical and water rides remain popular, the “other rides” category, encompassing virtual reality and interactive experiences, is showing strong growth potential. Germany, France, and the UK represent the largest markets within Europe, although other countries are also contributing to overall growth. However, the market faces certain restraints. Economic downturns can impact consumer spending on discretionary entertainment, and increasing operating costs (including staff wages and maintenance) can compress profit margins. Competition amongst established players like Europa-Park, Disneyland Paris, and others is fierce, demanding continuous innovation and investment to stay ahead. The market's success also hinges on effective risk management, particularly regarding safety protocols and regulatory compliance.

Europe Amusement Parks Market Market Size (In Billion)

The segmentation by age group offers valuable insights. The 19-35 age group is expected to remain a significant contributor to revenue due to their disposable income and willingness to spend on leisure. However, targeting families with children (up to 18 years) and older adults (51-65 years) through tailored offers is crucial for maintaining a broad customer base. Revenue streams are diversified across tickets, food and beverage, merchandise, and hotels/resorts. Maximizing revenue from ancillary sources is a critical strategy for park operators, creating integrated entertainment packages that offer a seamless and enjoyable experience for visitors. The future success of the European amusement park market depends on operators adapting to changing consumer preferences, incorporating technological advancements, and effectively managing operational costs and risks. Sustainable practices and environmentally friendly operations are also gaining importance as an increasing number of consumers favor ethical and responsible businesses.

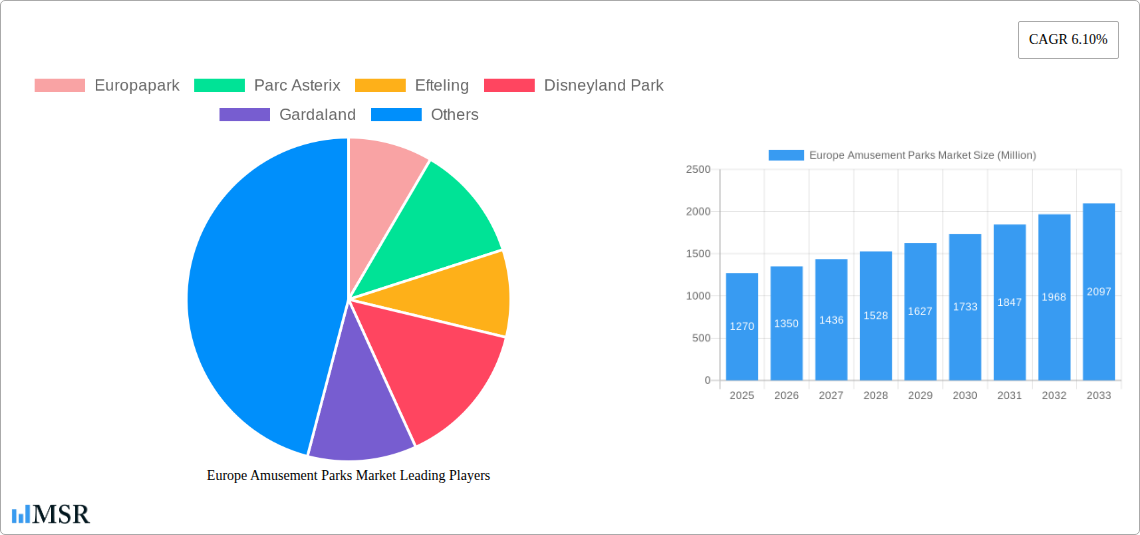

Europe Amusement Parks Market Company Market Share

Europe Amusement Parks Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Amusement Parks Market, covering the period 2019-2033, with a focus on 2025. Discover key market trends, leading players, and growth opportunities within this dynamic sector. The report utilizes extensive data and insights to deliver actionable intelligence for industry stakeholders, investors, and strategic decision-makers.

Europe Amusement Parks Market Market Concentration & Dynamics

This section analyzes the competitive landscape of the European amusement park industry, examining market concentration, innovation, regulatory aspects, substitute offerings, and end-user trends. The study period (2019-2024) reveals a moderately concentrated market, with key players like Europapark, Disneyland Paris, and Efteling holding significant market share. However, the market exhibits a dynamic character, influenced by factors such as:

Market Share Distribution: Europapark holds an estimated xx% market share in 2025, followed by Disneyland Paris with xx% and Efteling with xx%. Other significant players include Parc Asterix, Gardaland, Tivoli Gardens, Grona Lund, PortAventura, Futuroscope, and Walibi, collectively accounting for the remaining xx% of the market.

Innovation Ecosystem: Continuous innovation in ride technology, themed experiences, and digital integration drives market growth. The emergence of virtual reality (VR) and augmented reality (AR) experiences within parks is a prominent example.

Regulatory Framework: Strict safety regulations and environmental concerns significantly impact park operations and investments. Compliance costs and licensing requirements vary across different European countries.

Substitute Products: Alternative leisure activities, such as theme parks, water parks, and indoor entertainment venues, pose a competitive threat, influencing the market growth trajectory.

End-User Trends: Changing demographics and evolving consumer preferences towards immersive experiences and personalized entertainment shape the market’s demand dynamics.

M&A Activities: The report identifies xx M&A deals within the study period (2019-2024), indicating a moderate level of consolidation within the industry. These deals are largely driven by expansion strategies and market share consolidation.

Europe Amusement Parks Market Industry Insights & Trends

The European amusement park market is characterized by steady growth, driven by rising disposable incomes, increased tourism, and technological advancements. The market size reached approximately €xx Million in 2024 and is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching €xx Million by 2033. Several key factors contribute to this positive outlook:

The market's growth is primarily fueled by the rising disposable incomes within Europe, particularly in countries like Germany, France, and the UK. This increase in spending capacity has enabled consumers to allocate larger portions of their budget to leisure and entertainment activities, including amusement parks. Additionally, an increase in domestic and international tourism has further bolstered visitor numbers at many European amusement parks.

Technological innovations, such as the integration of AR/VR technologies into rides and attractions, offer immersive and interactive experiences that are gaining popularity among a wider range of age groups. Furthermore, the industry's ongoing efforts in improving infrastructure and accessibility, coupled with a strong emphasis on safety and security, positively impact consumer confidence and visit frequency.

Consumer behavior is shifting towards curated experiences, personalized services, and enhanced convenience. Parks that adopt data-driven strategies, invest in improved guest relations, and provide digital booking and payment options gain a competitive edge.

Key Markets & Segments Leading Europe Amusement Parks Market

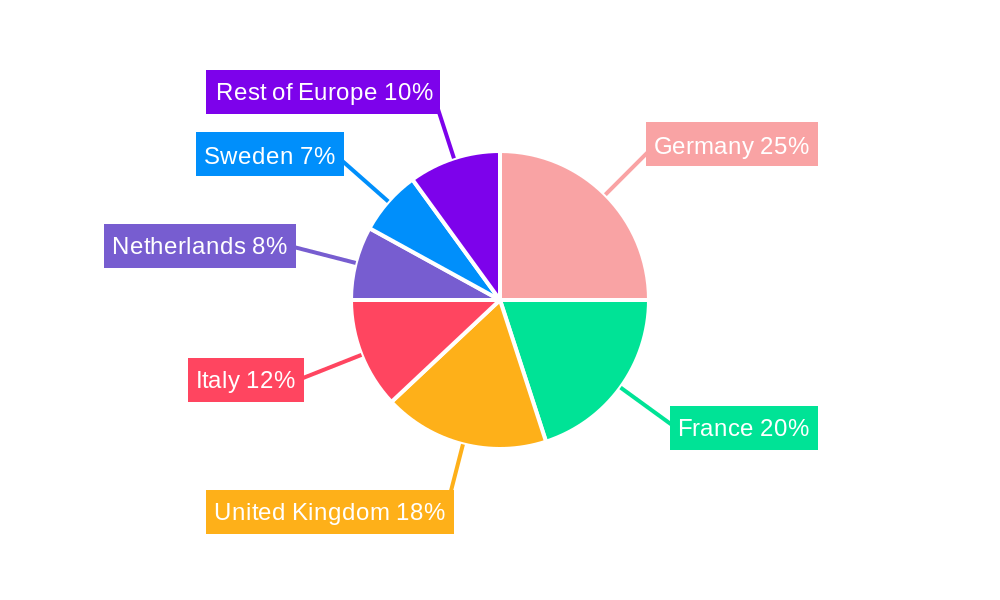

The European amusement park market is geographically diverse, with significant contributions from various countries and segments.

Dominant Regions/Countries:

- Germany: Germany, with its robust economy and high tourist footfall, represents a major market. Europapark's significant presence strengthens this position.

- France: Disneyland Paris's substantial contribution makes France another key market.

- United Kingdom: The UK market experiences steady growth, albeit potentially impacted by economic fluctuations.

- Rest of Europe: Countries like Spain (PortAventura), Italy (Gardaland), the Netherlands (Efteling), and Scandinavia (Tivoli Gardens, Grona Lund) collectively represent a considerable market segment.

Dominant Segments:

- By Rides: Mechanical rides continue to be the mainstay, accounting for xx% of the market. Water rides contribute xx%, while other rides (e.g., dark rides, simulator rides) contribute the remaining xx%.

- By Age: The 19-35 age group constitutes the largest segment, with xx% market share, followed by the 36-50 age group (xx%) and the under-18 age group (xx%). The older age groups (51-65 and over 65) represent smaller, but growing, segments.

- By Revenue Source: Ticket sales remain the primary revenue source (xx%), followed by food and beverage (xx%), merchandise (xx%), and hotels and resorts (xx%). Other sources of revenue, such as corporate events and sponsorships, contribute the remaining xx%.

Growth Drivers:

- Economic Growth: Rising disposable incomes and tourism boost spending on leisure.

- Infrastructure Development: Investments in transportation and park facilities enhance accessibility.

- Technological Advancements: Immersive technologies and digital innovations enhance the visitor experience.

Europe Amusement Parks Market Product Developments

Recent product innovations focus on enhancing visitor experience through technological integrations. VR/AR experiences, interactive rides, and personalized digital engagement are gaining traction. Improved ride safety features and themed areas also remain key development areas. Competition drives innovation in offering unique and memorable experiences to attract and retain customers. Sustainability initiatives, such as the construction of eco-friendly facilities and the reduction of carbon footprint, are becoming increasingly important.

Challenges in the Europe Amusement Parks Market Market

The European amusement park market faces several challenges:

- Seasonality: Revenue is heavily dependent on favorable weather conditions and tourist seasons, resulting in fluctuations throughout the year.

- High Operating Costs: Maintenance, staffing, and safety regulations contribute to significant operational expenses.

- Intense Competition: The market is competitive, requiring parks to continually innovate and offer unique experiences to attract visitors.

- Economic Downturns: Economic recessions can significantly impact visitor numbers and spending. The estimated impact of potential economic downturns on the market size is a reduction of xx% in the worst-case scenario.

Forces Driving Europe Amusement Parks Market Growth

Key growth drivers include:

- Technological Advancements: Integration of VR/AR and other technologies enhances the visitor experience.

- Economic Growth: Rising disposable incomes across Europe lead to increased discretionary spending on leisure and entertainment.

- Government Initiatives: Tourism promotion campaigns and infrastructure investments bolster the industry.

Long-Term Growth Catalysts in Europe Amusement Parks Market

Long-term growth will be fueled by innovations in immersive technologies, strategic partnerships (e.g., with movie studios or gaming companies), and expansion into new markets or demographics. Sustainability initiatives and personalized experiences will play a crucial role in shaping future growth.

Emerging Opportunities in Europe Amusement Parks Market

Emerging opportunities include:

- Hyper-Personalization: Tailoring experiences based on individual preferences using data analytics.

- Expansion into Niche Markets: Catering to specific interests, such as eco-tourism or specific age groups.

- Integration of Mobile Technologies: Using mobile apps for booking, navigation, and interactive experiences.

Leading Players in the Europe Amusement Parks Market Sector

Key Milestones in Europe Amusement Parks Market Industry

- October 2023: Disneyland Paris announces a €1.4 billion investment in its movie-themed park, signaling significant confidence in the market's future.

- December 2023: Efteling announces the Danse Macabre attraction, demonstrating commitment to innovation and sustainability.

Strategic Outlook for Europe Amusement Parks Market Market

The European amusement park market shows strong potential for continued growth, driven by technological advancements, rising disposable incomes, and increasing tourism. Strategic opportunities lie in embracing personalized experiences, integrating new technologies, and focusing on sustainability to attract and retain visitors. Companies that adapt to changing consumer preferences and invest in innovative offerings will be well-positioned for success.

Europe Amusement Parks Market Segmentation

-

1. Rides

- 1.1. Mechanical Rides

- 1.2. Water Rides

- 1.3. Other Rides

-

2. Age

- 2.1. Up To 18 Years

- 2.2. 19 To 35 Years

- 2.3. 36 To 50 Years

- 2.4. 51 To 65 Years

- 2.5. More Than 65 Years

-

3. Revenue Source

- 3.1. Tickets

- 3.2. Food and Beverage

- 3.3. Merchandise

- 3.4. Hotels and Resorts

- 3.5. Others

Europe Amusement Parks Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Amusement Parks Market Regional Market Share

Geographic Coverage of Europe Amusement Parks Market

Europe Amusement Parks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in the online travel agencies in Russia; Due to factors including digital trends and technical improvements

- 3.2.2 the online booking industry is undergoing significant transformation

- 3.3. Market Restrains

- 3.3.1. Booking Cancellation

- 3.4. Market Trends

- 3.4.1. Rising Attention Toward the Theme-Based Amusement Parks

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Amusement Parks Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Rides

- 5.1.1. Mechanical Rides

- 5.1.2. Water Rides

- 5.1.3. Other Rides

- 5.2. Market Analysis, Insights and Forecast - by Age

- 5.2.1. Up To 18 Years

- 5.2.2. 19 To 35 Years

- 5.2.3. 36 To 50 Years

- 5.2.4. 51 To 65 Years

- 5.2.5. More Than 65 Years

- 5.3. Market Analysis, Insights and Forecast - by Revenue Source

- 5.3.1. Tickets

- 5.3.2. Food and Beverage

- 5.3.3. Merchandise

- 5.3.4. Hotels and Resorts

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Rides

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Europapark

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Parc Asterix

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Efteling

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Disneyland Park

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gardaland

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tivoli Gardens

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Grona Lund

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PortAventura

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Futuroscope

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Walibi**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Europapark

List of Figures

- Figure 1: Europe Amusement Parks Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Amusement Parks Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Amusement Parks Market Revenue Million Forecast, by Rides 2020 & 2033

- Table 2: Europe Amusement Parks Market Revenue Million Forecast, by Age 2020 & 2033

- Table 3: Europe Amusement Parks Market Revenue Million Forecast, by Revenue Source 2020 & 2033

- Table 4: Europe Amusement Parks Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Amusement Parks Market Revenue Million Forecast, by Rides 2020 & 2033

- Table 6: Europe Amusement Parks Market Revenue Million Forecast, by Age 2020 & 2033

- Table 7: Europe Amusement Parks Market Revenue Million Forecast, by Revenue Source 2020 & 2033

- Table 8: Europe Amusement Parks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Amusement Parks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Amusement Parks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Amusement Parks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Amusement Parks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Amusement Parks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Amusement Parks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Amusement Parks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Amusement Parks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Amusement Parks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Amusement Parks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Amusement Parks Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Amusement Parks Market?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the Europe Amusement Parks Market?

Key companies in the market include Europapark, Parc Asterix, Efteling, Disneyland Park, Gardaland, Tivoli Gardens, Grona Lund, PortAventura, Futuroscope, Walibi**List Not Exhaustive.

3. What are the main segments of the Europe Amusement Parks Market?

The market segments include Rides, Age, Revenue Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the online travel agencies in Russia; Due to factors including digital trends and technical improvements. the online booking industry is undergoing significant transformation.

6. What are the notable trends driving market growth?

Rising Attention Toward the Theme-Based Amusement Parks.

7. Are there any restraints impacting market growth?

Booking Cancellation.

8. Can you provide examples of recent developments in the market?

In October 2023, Disneyland Paris announced an investment exceeding USD 1.5 billion (Euro 1.4 billion) in its movie-themed park over the preceding five years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Amusement Parks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Amusement Parks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Amusement Parks Market?

To stay informed about further developments, trends, and reports in the Europe Amusement Parks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence