Key Insights

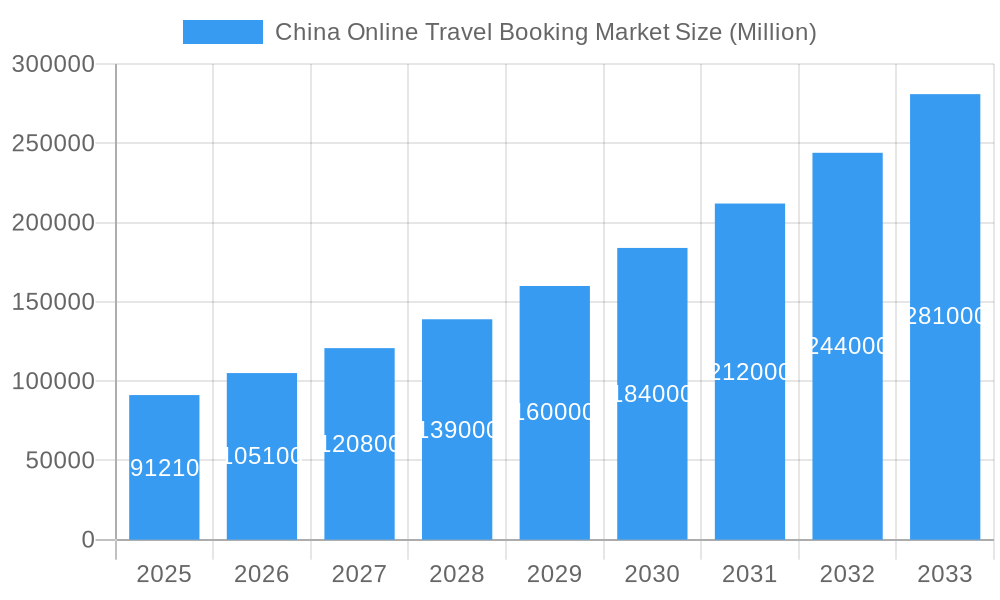

The China online travel booking market is experiencing robust growth, projected to reach a market size of $91.21 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 15.25% from 2025 to 2033. This expansion is fueled by several key factors. The increasing penetration of smartphones and internet access across China's vast population has significantly broadened the market's reach, making online travel booking increasingly convenient and accessible. Furthermore, a burgeoning middle class with rising disposable incomes is driving demand for leisure travel, both domestically and internationally. The preference for online booking platforms, offering competitive pricing, diverse options, and user-friendly interfaces, further contributes to market growth. Strong government support for tourism infrastructure development also plays a significant role. However, challenges remain; increased competition among established players like LY.com, Trip.com Group Ltd, and Meituan Dianping, alongside emerging competitors, creates a dynamic and competitive landscape. Fluctuations in the global economy and potential unforeseen events, such as pandemics, can impact travel demand and market stability. Segmentation analysis reveals a robust market across booking modes (direct vs. travel agents), platforms (desktop vs. mobile/tablet), and service types (accommodation, tickets, packages, and others). Mobile booking, in particular, is a rapidly growing segment, reflecting the increasing mobile penetration within China.

China Online Travel Booking Market Market Size (In Billion)

The market's future trajectory hinges on the continued expansion of the middle class, technological advancements enhancing the user experience, and sustained government support for the tourism sector. Effective strategies for major players will involve leveraging advanced technologies like AI and big data analytics for personalized recommendations and targeted marketing. Addressing consumer concerns regarding data privacy and security will also be crucial for maintaining trust and sustained growth. The competitive landscape suggests that companies must prioritize innovation, offering unique value propositions, and building strong brand loyalty to succeed in this rapidly evolving market. Continued investment in marketing and customer service will be essential to capture market share and maintain a competitive edge. The long-term outlook for the China online travel booking market remains positive, underpinned by the country's expanding economy and the growing popularity of online travel services.

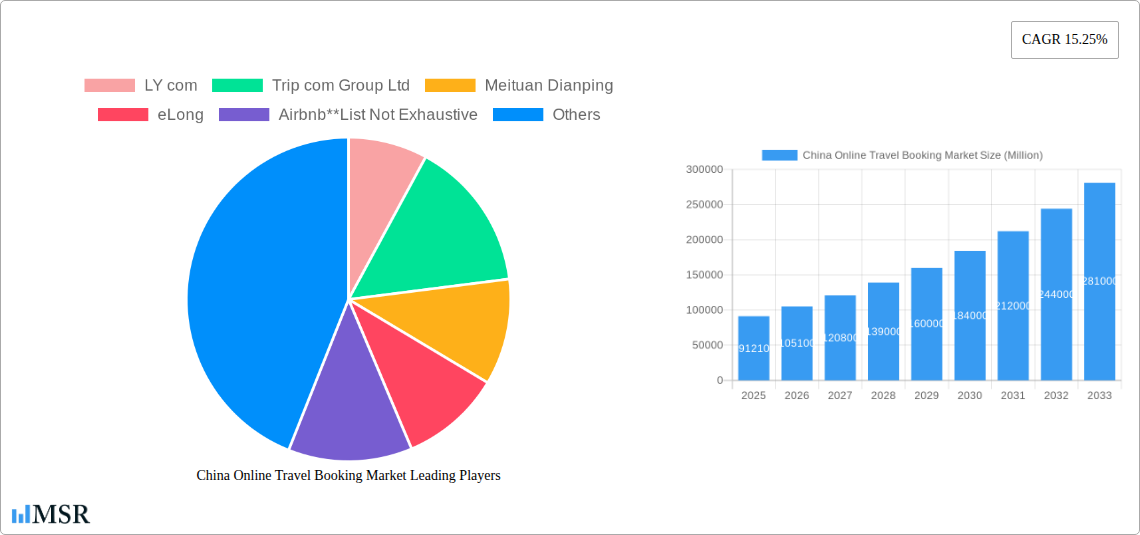

China Online Travel Booking Market Company Market Share

Unlock the Potential: China Online Travel Booking Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the dynamic China online travel booking market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to capitalize on its immense growth potential. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's current state and future trajectory. The report leverages rigorous data analysis and industry expertise to deliver actionable intelligence on market size, segmentation, key players, and emerging trends. Expect detailed breakdowns by booking mode (direct booking, travel agents), platform (desktop, mobile/tablet), and service type (accommodation, tickets, packages, other services).

China Online Travel Booking Market Market Concentration & Dynamics

This section analyzes the competitive landscape of the China online travel booking market, evaluating market concentration, innovation, regulatory frameworks, substitute products, end-user trends, and mergers and acquisitions (M&A) activity. The market is characterized by a high degree of competition among established players and new entrants. Key players such as Trip.com Group Ltd, LY.com, Meituan Dianping, and Ctrip hold significant market share, although the exact figures fluctuate. The market exhibits a moderate level of concentration, with a few dominant players and a long tail of smaller operators.

Market Share (Estimated 2025):

- Trip.com Group Ltd: 25%

- LY.com: 15%

- Meituan Dianping: 12%

- Ctrip: 10%

- Others: 38%

M&A Activity (2019-2024): xx deals, indicating a moderately active consolidation phase. These deals often involve smaller players being acquired by larger ones to expand market reach and service offerings. The regulatory environment plays a significant role in shaping M&A activity, with authorities scrutinizing deals to ensure fair competition. Innovation is a key driver of competition, with companies constantly seeking to improve their platforms and offerings. The emergence of new technologies, such as AI-powered personalization, is changing the game. Consumer trends, such as increasing mobile usage and a preference for personalized travel experiences, are also shaping the market. Substitute products, such as peer-to-peer accommodation platforms, pose a challenge to traditional players.

China Online Travel Booking Market Industry Insights & Trends

The China online travel booking market experienced robust growth during the historical period (2019-2024), driven by factors such as rising disposable incomes, increasing internet and smartphone penetration, and a growing preference for convenient online booking options. The market size in 2024 is estimated at xx Million USD, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the historical period. This growth is expected to continue during the forecast period (2025-2033), albeit at a slightly moderated pace, with the market size projected to reach xx Million USD by 2033, representing a CAGR of xx%. Technological disruptions, such as the rise of mobile booking platforms and AI-powered travel planning tools, are transforming the industry landscape. Evolving consumer behaviors, including a preference for personalized travel experiences and increasing demand for unique travel products, are shaping future market trends. The increasing adoption of mobile-first strategies and the integration of innovative technologies such as augmented reality and virtual reality are reshaping customer interactions and creating new avenues for growth. The growing emphasis on sustainability and responsible tourism is also impacting consumer choices.

Key Markets & Segments Leading China Online Travel Booking Market

The Mobile/Tablet platform dominates the China online travel booking market, reflecting the widespread smartphone penetration in the country. The Accommodation Booking segment is the largest by service type, driven by a strong domestic and international tourism sector. Direct Booking is also a significant segment, highlighting the increasing preference for consumers booking directly with service providers.

Key Market Drivers:

- Economic Growth: Rising disposable incomes fuel increased travel spending.

- Infrastructure Development: Improved transportation networks facilitate travel.

- Technological Advancements: Mobile booking and AI-powered services enhance convenience.

- Government Initiatives: Tourism promotion policies encourage domestic and international travel.

Dominance Analysis: The mobile platform's dominance stems from its convenience and accessibility, enabling bookings on the go. The dominance of Accommodation Booking is fuelled by a large and active tourism market, with a significant number of domestic and international travelers. Direct Booking showcases consumers' growing inclination to bypass intermediaries for better deals and control over their travel arrangements.

China Online Travel Booking Market Product Developments

Recent product innovations include AI-powered personalized travel recommendations, virtual reality tours, and integrated travel planning tools. These advancements enhance user experience and create a competitive edge. Companies are increasingly investing in developing mobile-first platforms and integrating seamless payment gateways to cater to the growing demand for convenient and personalized travel experiences. This focus on innovation and technology adoption is crucial for companies to maintain market competitiveness and appeal to the evolving preferences of travelers.

Challenges in the China Online Travel Booking Market Market

The market faces challenges such as increasing competition, regulatory hurdles, and potential supply chain disruptions from unforeseen circumstances. These factors can impact profitability and growth trajectory, necessitating proactive strategies to mitigate potential risks. The constantly evolving regulatory landscape also presents challenges for companies needing to comply with updated guidelines. Fluctuations in global events can also influence the number of bookings and the overall economic outlook. These issues require the development of robust risk-management strategies and close monitoring of regulatory changes. For example, the impact of stringent visa requirements or unexpected geopolitical events can affect consumer confidence and overall travel volume.

Forces Driving China Online Travel Booking Market Growth

Technological advancements, such as the proliferation of mobile booking apps and AI-powered travel planning tools, are key drivers. Economic factors such as rising disposable incomes and government initiatives to promote tourism further stimulate growth. Relaxation in travel restrictions after the COVID-19 pandemic has also presented significant opportunities for resurgence. The continuous integration of innovative technologies and strategies to enhance user experience will create a positive ripple effect across the sector.

Challenges in the China Online Travel Booking Market Market

Long-term growth will be fueled by sustained technological innovation, strategic partnerships with airlines and hotels, and expansion into new markets. Investment in personalized service offerings, leveraging data analytics for a more intuitive user experience, and diversification across various travel packages will remain critical for long-term success. Focusing on niche tourism segments and exploring sustainable and responsible tourism practices can also offer unique long-term opportunities for continued growth.

Emerging Opportunities in China Online Travel Booking Market

Emerging opportunities include the growth of niche tourism, the integration of blockchain technology for secure transactions, and the rise of personalized travel planning services catering to specific interests. Further development in augmented reality (AR) and virtual reality (VR) experiences to provide immersive pre-travel previews, and focus on sustainable and responsible tourism models, are expected to drive significant future growth. The increasing demand for curated travel experiences that cater to niche interests, such as adventure tourism, cultural tourism, or wellness tourism, also presents a considerable opportunity.

Leading Players in the China Online Travel Booking Market Sector

- LY.com

- Trip.com Group Ltd

- Meituan Dianping

- eLong

- Airbnb

- Fliggy

- Tuniu

- Didi Chuxing

- Qunar

- Mafengwo

- Lvmama

Key Milestones in China Online Travel Booking Market Industry

- July 2021: Trip.com became the first OTA to offer Eurail and Interrail Train Passes, expanding its product offerings and attracting a wider customer base.

- February 2022: CWT launched myCWT, a platform aimed at simplifying business travel in China, showcasing innovation in the B2B4E segment.

Strategic Outlook for China Online Travel Booking Market Market

The China online travel booking market presents significant growth potential driven by technological advancements, rising disposable incomes, and a growing preference for online booking. Strategic opportunities lie in leveraging technological innovation to enhance customer experience, expanding into niche markets, and forging strategic partnerships to broaden service offerings. Companies that can adapt to evolving consumer preferences and successfully navigate the regulatory landscape will be best positioned for success in this dynamic market.

China Online Travel Booking Market Segmentation

-

1. Service Type

- 1.1. Accommodation Booking

- 1.2. Travel Tickets Booking

- 1.3. Holiday Package Booking

- 1.4. Other Services

-

2. Mode of Booking

- 2.1. Direct Booking

- 2.2. Travel Agents

-

3. Platform

- 3.1. Desktop

- 3.2. Mobile/Tablet

China Online Travel Booking Market Segmentation By Geography

- 1. China

China Online Travel Booking Market Regional Market Share

Geographic Coverage of China Online Travel Booking Market

China Online Travel Booking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Regulations are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Increasing Internet Penetration in China is Helping in Market Expansion

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Online Travel Booking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Accommodation Booking

- 5.1.2. Travel Tickets Booking

- 5.1.3. Holiday Package Booking

- 5.1.4. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 5.2.1. Direct Booking

- 5.2.2. Travel Agents

- 5.3. Market Analysis, Insights and Forecast - by Platform

- 5.3.1. Desktop

- 5.3.2. Mobile/Tablet

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LY com

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Trip com Group Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Meituan Dianping

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 eLong

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Airbnb**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fliggy

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tuniu

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Didi Chuxing

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Qunar

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mafengwo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Lvmama

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 LY com

List of Figures

- Figure 1: China Online Travel Booking Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Online Travel Booking Market Share (%) by Company 2025

List of Tables

- Table 1: China Online Travel Booking Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: China Online Travel Booking Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 3: China Online Travel Booking Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: China Online Travel Booking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: China Online Travel Booking Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: China Online Travel Booking Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 7: China Online Travel Booking Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 8: China Online Travel Booking Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Online Travel Booking Market?

The projected CAGR is approximately 15.25%.

2. Which companies are prominent players in the China Online Travel Booking Market?

Key companies in the market include LY com, Trip com Group Ltd, Meituan Dianping, eLong, Airbnb**List Not Exhaustive, Fliggy, Tuniu, Didi Chuxing, Qunar, Mafengwo, Lvmama.

3. What are the main segments of the China Online Travel Booking Market?

The market segments include Service Type, Mode of Booking, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 91.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Internet Penetration in China is Helping in Market Expansion.

7. Are there any restraints impacting market growth?

Government Regulations are Restraining the Market.

8. Can you provide examples of recent developments in the market?

February 2022: CWT launched myCWT, a flagship platform in China aimed at simplifying business travel for companies and employees. CWT is a global B2B4E travel management specialist based in the United States. The myCWT platform offers extensive international and domestic travel content, including rail, flights, hotels, and ground transportation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Online Travel Booking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Online Travel Booking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Online Travel Booking Market?

To stay informed about further developments, trends, and reports in the China Online Travel Booking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence