Key Insights

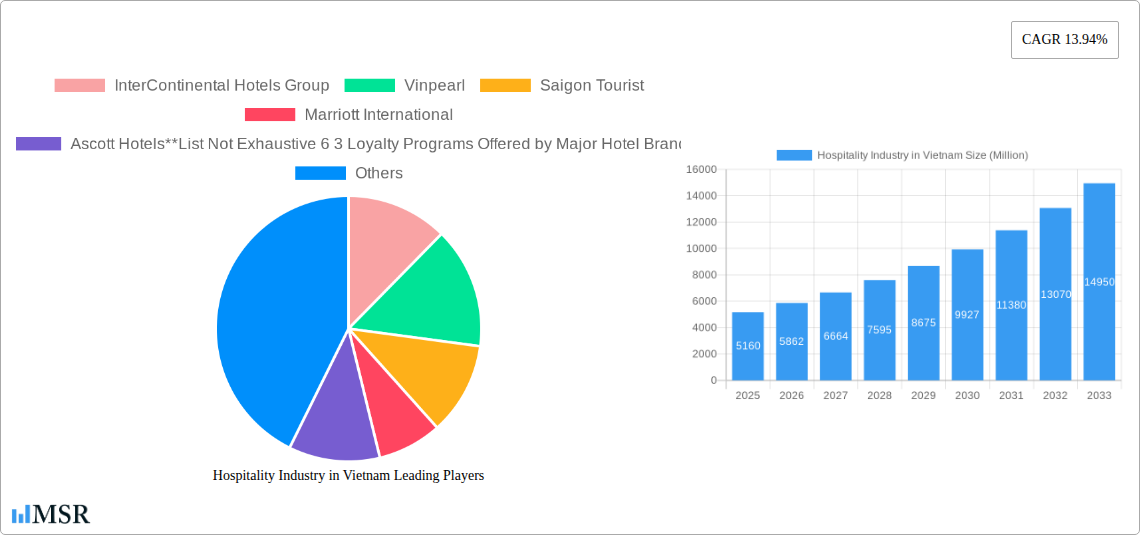

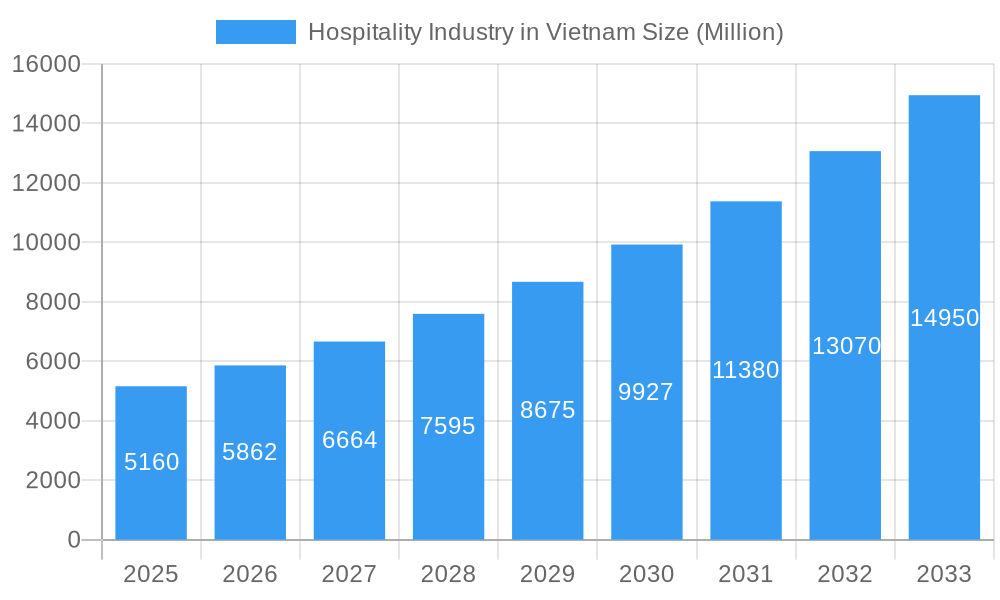

The Vietnamese hospitality industry, valued at $5.16 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 13.94% from 2025 to 2033. This expansion is driven by several key factors. Firstly, Vietnam's burgeoning tourism sector, fueled by increasing disposable incomes, both domestically and internationally, is significantly boosting demand for hotel accommodations across all segments. Secondly, strategic government initiatives aimed at improving infrastructure and promoting tourism are creating a favorable environment for investment and expansion within the industry. The rise of budget-friendly and mid-scale hotels caters to a broader spectrum of travelers, while the luxury segment continues to attract high-spending tourists, contributing to the overall market growth. Furthermore, the increasing popularity of loyalty programs offered by major hotel brands like InterContinental Hotels Group, Marriott International, and Accor Hotels is enhancing customer retention and driving repeat business. The segmentation of the market into chain and independent hotels, along with variations in service offerings (service apartments, budget hotels, mid-scale hotels, and luxury hotels), provides diverse options for consumers and allows for tailored marketing strategies within each niche.

Hospitality Industry in Vietnam Market Size (In Billion)

However, the industry also faces certain challenges. While the growth is significant, potential restraints could include the global economic climate, potential fluctuations in tourism due to geopolitical events, and competition from the rapidly growing numbers of short-term rental accommodations like Airbnb. Nevertheless, the consistent growth in international and domestic tourist arrivals coupled with ongoing infrastructure improvements suggests that the Vietnamese hospitality sector is poised for continued expansion in the coming years. The presence of established international brands alongside local players like Vinpearl and Muong Thanh Hospitality signifies a dynamic and competitive landscape, fostering innovation and improvement within the industry. The strategic diversification within the market, covering all price points and accommodation styles, positions Vietnam as a significant player in the Southeast Asian hospitality market.

Hospitality Industry in Vietnam Company Market Share

Unlock Vietnam's Thriving Hospitality Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of Vietnam's dynamic hospitality industry, covering market size, segmentation, key players, and future growth prospects. From budget hotels to luxury resorts, this study unveils the forces shaping this lucrative sector and presents actionable insights for stakeholders. The report covers the period 2019-2033, with a focus on 2025, and features data on key players like InterContinental Hotels Group, Vinpearl, Marriott International, and Accor Hotels, among others. This report is ideal for investors, hospitality professionals, and anyone seeking to understand the Vietnamese hospitality landscape.

Hospitality Industry in Vietnam Market Concentration & Dynamics

Vietnam's hospitality market exhibits a moderately concentrated structure, with both international chains and domestic players vying for market share. The market share of the top five players (estimated at xx%) indicates consolidation, although a significant portion (xx%) remains fragmented among independent hotels and smaller chains. Innovation in the sector is driven by technology adoption, particularly in areas such as online booking, revenue management systems, and customer relationship management (CRM). Regulatory frameworks, while generally supportive of foreign investment, are constantly evolving, impacting licensing and operational procedures. Substitute products such as homestays and vacation rentals exert pressure, particularly in the budget segment.

End-user trends show a growing preference for experiential travel, wellness tourism, and sustainable practices. Mergers and acquisitions (M&A) activity has been moderate in recent years, with approximately xx M&A deals concluded between 2019 and 2024. Key drivers for M&A include expansion strategies, brand consolidation, and access to new markets.

- Market Concentration: Top 5 players hold an estimated xx% market share.

- M&A Activity: Approximately xx deals between 2019 and 2024.

- Innovation Focus: Technology adoption, online booking, revenue management.

- Regulatory Landscape: Supportive but evolving, impacting licensing and operations.

Hospitality Industry in Vietnam Industry Insights & Trends

Vietnam's hospitality market experienced robust growth between 2019 and 2024, with the market size reaching approximately $xx Million in 2024. The Compound Annual Growth Rate (CAGR) during this period is estimated at xx%. Several factors contributed to this growth including rising disposable incomes, increased domestic and international tourism, and significant infrastructure development, such as improved airport connectivity and new transportation links. Technological disruptions are reshaping the sector. The proliferation of online travel agencies (OTAs) and the adoption of digital marketing strategies have transformed booking patterns and customer engagement.

Consumer behavior is shifting towards personalization and convenience. Customers are increasingly seeking unique experiences, tailored services, and seamless digital interactions. Sustainability and responsible tourism are emerging as key considerations, influencing accommodation choices and travel planning. The industry is also adapting to the changing needs of remote workers and extended-stay travelers, resulting in increased demand for serviced apartments and co-working spaces. Future growth is projected to continue, with the market size expected to reach $xx Million in 2025 and $xx Million by 2033, fueled by ongoing infrastructure improvements and an expanding middle class.

Key Markets & Segments Leading Hospitality Industry in Vietnam

The Southern region of Vietnam, encompassing Ho Chi Minh City and popular coastal destinations like Nha Trang and Phu Quoc, is currently the dominant market segment, contributing the largest share of revenue. This is primarily driven by strong economic activity, robust tourism growth, and significant investments in infrastructure and hospitality projects.

- By Type:

- Chain Hotels: Dominated by international brands such as Marriott International, InterContinental Hotels Group, and Accor Hotels, benefiting from brand recognition and established distribution networks.

- Independent Hotels: Maintain a significant presence, particularly in smaller cities and niche markets, offering localized experiences.

- By Segment:

- Luxury Hotels: Driven by high-spending international and domestic tourists seeking premium experiences and amenities.

- Mid and Upper-Mid Scale Hotels: This segment displays consistent growth, catering to a broad range of travelers seeking value for money and quality services.

- Budget and Economy Hotels: Represents a large segment, fueled by price-conscious travelers and budget-oriented tourism.

- Service Apartments: Demonstrating growth, catering to extended-stay travelers, remote workers, and families.

Drivers for Growth:

- Robust economic growth driving disposable incomes.

- Increased domestic and international tourism.

- Significant infrastructure development, including improved airport connectivity.

- Growing preference for experiential travel and wellness tourism.

Hospitality Industry in Vietnam Product Developments

Recent innovations focus on enhancing guest experience through technological integration. Smart room technologies, personalized service options via mobile apps, and data-driven revenue management systems are enhancing operational efficiency and customer satisfaction. The rise of wellness tourism has sparked the development of specialized resorts and spas offering holistic experiences. Competitive edges are being achieved through unique branding, sustainable practices, and strategic partnerships with local communities.

Challenges in the Hospitality Industry in Vietnam Market

The Vietnamese hospitality sector faces challenges such as seasonal fluctuations in tourism, dependence on international markets, and potential skill shortages in certain areas. Regulatory complexities and evolving compliance requirements can also pose operational hurdles. Competitive pressures from both established international chains and local players necessitate continuous innovation and efficient cost management. These factors can impact profitability and long-term growth potential.

Forces Driving Hospitality Industry in Vietnam Growth

Strong economic growth, a burgeoning middle class, and increased foreign investment are key factors driving the expansion of Vietnam's hospitality sector. The government's focus on tourism development through improved infrastructure and visa policies provides further impetus. Technological advancements in areas like online booking and personalized service enhance customer experience and operational efficiency.

Long-Term Growth Catalysts in the Hospitality Industry in Vietnam

Long-term growth will be propelled by continued infrastructure investments in tourism hotspots, strategic partnerships between international and local players, and the development of niche tourism segments such as eco-tourism and wellness tourism. Innovation in hospitality technology and the expansion into new markets, such as MICE (Meetings, Incentives, Conferences, and Exhibitions), will also drive future growth.

Emerging Opportunities in Hospitality Industry in Vietnam

Emerging trends highlight the potential for growth in sustainable tourism, wellness-focused resorts, and experiential travel packages. The development of smart hotels utilizing IoT technology offers opportunities for enhanced efficiency and customer engagement. Leveraging digital marketing strategies to reach international markets and cater to a growing number of millennial and Gen Z travelers presents significant potential.

Leading Players in the Hospitality Industry in Vietnam Sector

- InterContinental Hotels Group

- Vinpearl

- Saigon Tourist

- Marriott International

- Ascott Hotels

- Accor Hotels

- Diamond Bay Resort & Spa

- Muong Thanh Hospitality

- H&K Hospitality

- A25 Hotel Group

Key Milestones in Hospitality Industry in Vietnam Industry

- November 2023: Marriott International launches three upscale hotels in Nha Trang, Da Nang, and Hoi An, expanding its luxury portfolio and enhancing Vietnam's appeal as a high-end tourism destination.

- August 2023: Fusion Hotel Group unveils Ixora Ho Tram by Fusion, a luxury wellness resort showcasing the growing interest in wellness tourism and the expansion of high-end offerings in Southern Vietnam.

Strategic Outlook for Hospitality Industry in Vietnam Market

Vietnam's hospitality sector holds immense potential for sustained growth, driven by increasing tourism, economic development, and technological advancements. Strategic opportunities lie in capitalizing on emerging trends, embracing sustainable practices, and leveraging technology to enhance customer experience and operational efficiency. Focus on niche market segments and strategic partnerships can maximize returns and establish a competitive advantage in this dynamic landscape.

Hospitality Industry in Vietnam Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Independent Hotels

-

2. Segment

- 2.1. Service Apartments

- 2.2. Budget and Economy Hotels

- 2.3. Mid and Upper Mid Scale Hotels

- 2.4. Luxury Hotels

Hospitality Industry in Vietnam Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hospitality Industry in Vietnam Regional Market Share

Geographic Coverage of Hospitality Industry in Vietnam

Hospitality Industry in Vietnam REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth in Tourism is Driving the Market4.; Hotel Development in the Country Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. 4.; Lack Of Skilled Labour Is A Challenge For The Market4.; Regulatory Environment for Investors is a Challenge for Hospitality Sector

- 3.4. Market Trends

- 3.4.1. Rise in the Number of Visitors to the Country is Driving the Hospitality Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hospitality Industry in Vietnam Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Independent Hotels

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Service Apartments

- 5.2.2. Budget and Economy Hotels

- 5.2.3. Mid and Upper Mid Scale Hotels

- 5.2.4. Luxury Hotels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hospitality Industry in Vietnam Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Chain Hotels

- 6.1.2. Independent Hotels

- 6.2. Market Analysis, Insights and Forecast - by Segment

- 6.2.1. Service Apartments

- 6.2.2. Budget and Economy Hotels

- 6.2.3. Mid and Upper Mid Scale Hotels

- 6.2.4. Luxury Hotels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Hospitality Industry in Vietnam Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Chain Hotels

- 7.1.2. Independent Hotels

- 7.2. Market Analysis, Insights and Forecast - by Segment

- 7.2.1. Service Apartments

- 7.2.2. Budget and Economy Hotels

- 7.2.3. Mid and Upper Mid Scale Hotels

- 7.2.4. Luxury Hotels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Hospitality Industry in Vietnam Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Chain Hotels

- 8.1.2. Independent Hotels

- 8.2. Market Analysis, Insights and Forecast - by Segment

- 8.2.1. Service Apartments

- 8.2.2. Budget and Economy Hotels

- 8.2.3. Mid and Upper Mid Scale Hotels

- 8.2.4. Luxury Hotels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Hospitality Industry in Vietnam Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Chain Hotels

- 9.1.2. Independent Hotels

- 9.2. Market Analysis, Insights and Forecast - by Segment

- 9.2.1. Service Apartments

- 9.2.2. Budget and Economy Hotels

- 9.2.3. Mid and Upper Mid Scale Hotels

- 9.2.4. Luxury Hotels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Hospitality Industry in Vietnam Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Chain Hotels

- 10.1.2. Independent Hotels

- 10.2. Market Analysis, Insights and Forecast - by Segment

- 10.2.1. Service Apartments

- 10.2.2. Budget and Economy Hotels

- 10.2.3. Mid and Upper Mid Scale Hotels

- 10.2.4. Luxury Hotels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 InterContinental Hotels Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Vinpearl

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Saigon Tourist

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Marriott International

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ascott Hotels**List Not Exhaustive 6 3 Loyalty Programs Offered by Major Hotel Brand

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Accor Hotels

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Diamond Bay Resort & Spa

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Muong Thanh Hospitality

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 H&K Hospitality

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 A25 Hotel Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 InterContinental Hotels Group

List of Figures

- Figure 1: Global Hospitality Industry in Vietnam Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hospitality Industry in Vietnam Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Hospitality Industry in Vietnam Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Hospitality Industry in Vietnam Revenue (Million), by Segment 2025 & 2033

- Figure 5: North America Hospitality Industry in Vietnam Revenue Share (%), by Segment 2025 & 2033

- Figure 6: North America Hospitality Industry in Vietnam Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Hospitality Industry in Vietnam Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Hospitality Industry in Vietnam Revenue (Million), by Type 2025 & 2033

- Figure 9: South America Hospitality Industry in Vietnam Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Hospitality Industry in Vietnam Revenue (Million), by Segment 2025 & 2033

- Figure 11: South America Hospitality Industry in Vietnam Revenue Share (%), by Segment 2025 & 2033

- Figure 12: South America Hospitality Industry in Vietnam Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Hospitality Industry in Vietnam Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Hospitality Industry in Vietnam Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Hospitality Industry in Vietnam Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Hospitality Industry in Vietnam Revenue (Million), by Segment 2025 & 2033

- Figure 17: Europe Hospitality Industry in Vietnam Revenue Share (%), by Segment 2025 & 2033

- Figure 18: Europe Hospitality Industry in Vietnam Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Hospitality Industry in Vietnam Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Hospitality Industry in Vietnam Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa Hospitality Industry in Vietnam Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Hospitality Industry in Vietnam Revenue (Million), by Segment 2025 & 2033

- Figure 23: Middle East & Africa Hospitality Industry in Vietnam Revenue Share (%), by Segment 2025 & 2033

- Figure 24: Middle East & Africa Hospitality Industry in Vietnam Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Hospitality Industry in Vietnam Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Hospitality Industry in Vietnam Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific Hospitality Industry in Vietnam Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Hospitality Industry in Vietnam Revenue (Million), by Segment 2025 & 2033

- Figure 29: Asia Pacific Hospitality Industry in Vietnam Revenue Share (%), by Segment 2025 & 2033

- Figure 30: Asia Pacific Hospitality Industry in Vietnam Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Hospitality Industry in Vietnam Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hospitality Industry in Vietnam Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Hospitality Industry in Vietnam Revenue Million Forecast, by Segment 2020 & 2033

- Table 3: Global Hospitality Industry in Vietnam Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Hospitality Industry in Vietnam Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Hospitality Industry in Vietnam Revenue Million Forecast, by Segment 2020 & 2033

- Table 6: Global Hospitality Industry in Vietnam Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Hospitality Industry in Vietnam Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Hospitality Industry in Vietnam Revenue Million Forecast, by Segment 2020 & 2033

- Table 12: Global Hospitality Industry in Vietnam Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Hospitality Industry in Vietnam Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Hospitality Industry in Vietnam Revenue Million Forecast, by Segment 2020 & 2033

- Table 18: Global Hospitality Industry in Vietnam Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Hospitality Industry in Vietnam Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Hospitality Industry in Vietnam Revenue Million Forecast, by Segment 2020 & 2033

- Table 30: Global Hospitality Industry in Vietnam Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Hospitality Industry in Vietnam Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Hospitality Industry in Vietnam Revenue Million Forecast, by Segment 2020 & 2033

- Table 39: Global Hospitality Industry in Vietnam Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Hospitality Industry in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hospitality Industry in Vietnam?

The projected CAGR is approximately 13.94%.

2. Which companies are prominent players in the Hospitality Industry in Vietnam?

Key companies in the market include InterContinental Hotels Group, Vinpearl, Saigon Tourist, Marriott International, Ascott Hotels**List Not Exhaustive 6 3 Loyalty Programs Offered by Major Hotel Brand, Accor Hotels, Diamond Bay Resort & Spa, Muong Thanh Hospitality, H&K Hospitality, A25 Hotel Group.

3. What are the main segments of the Hospitality Industry in Vietnam?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.16 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth in Tourism is Driving the Market4.; Hotel Development in the Country Drives the Market Growth.

6. What are the notable trends driving market growth?

Rise in the Number of Visitors to the Country is Driving the Hospitality Industry.

7. Are there any restraints impacting market growth?

4.; Lack Of Skilled Labour Is A Challenge For The Market4.; Regulatory Environment for Investors is a Challenge for Hospitality Sector.

8. Can you provide examples of recent developments in the market?

November 2023: Marriott International recently revealed the launch of three upscale hotels in sought-after vacation spots in Vietnam. These comprise the Nha Trang Marriott Resort & Spa on Hon Tre Island, the Danang Marriott Resort & Spa in Non-Nuoc Beach Villas, and the Renaissance Hoi An Resort & Spa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hospitality Industry in Vietnam," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hospitality Industry in Vietnam report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hospitality Industry in Vietnam?

To stay informed about further developments, trends, and reports in the Hospitality Industry in Vietnam, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence