Key Insights

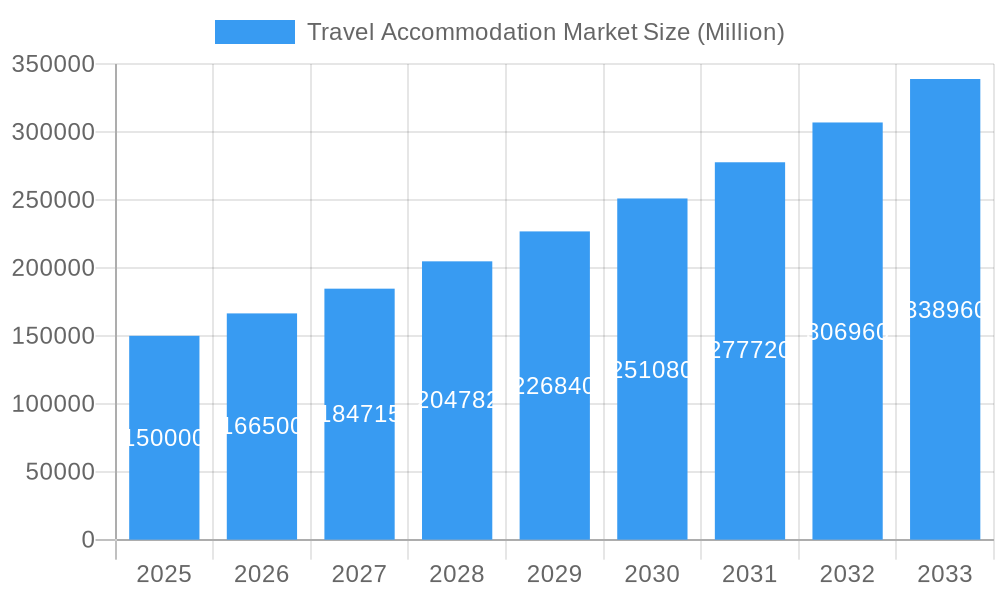

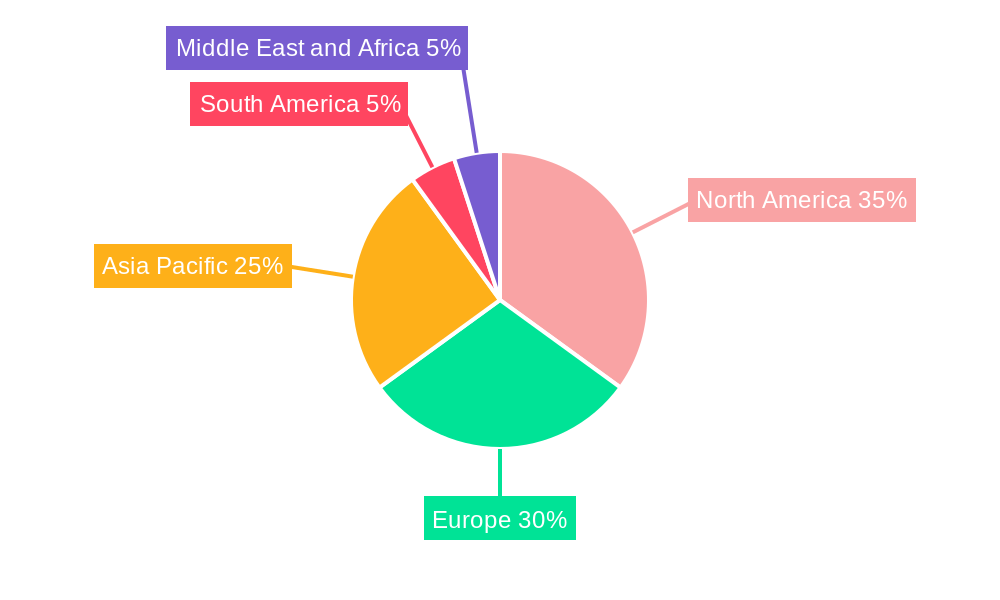

The global travel accommodation market is poised for significant expansion, projected to reach $961.6 billion by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 9.56%. This growth is propelled by increasing global disposable incomes, a surge in leisure travel, and the rising demand for unique travel experiences. The market is segmented by booking platform (mobile applications and websites) and booking mode (third-party online travel agencies and direct bookings). Mobile booking is experiencing rapid adoption due to its convenience and accessibility, often surpassing traditional website bookings. The increasing popularity of budget-friendly options such as hostels and vacation rentals, alongside the widespread use of online booking platforms, are key market dynamics. Market restraints include economic volatility, geopolitical instability, and seasonal fluctuations. However, the diversification of accommodation choices, advancements in booking technology, and personalized travel recommendations are mitigating these challenges. North America and Asia-Pacific are leading markets, with Asia-Pacific exhibiting substantial growth potential driven by emerging economies. The competitive environment is dynamic, featuring established players and specialized new entrants.

Travel Accommodation Market Market Size (In Billion)

The travel accommodation sector is highly fragmented, accommodating diverse business models. Online travel agencies (OTAs) such as Booking.com, Expedia, and TripAdvisor lead the third-party booking segment through advanced technology and marketing. Direct bookings via hotel websites and apps are also growing as businesses aim to strengthen customer relationships and reduce reliance on intermediaries. Alternative accommodation providers, including Airbnb and vacation rental platforms, are significantly disrupting the traditional hotel industry by offering travelers a wider array of choices. Geographic growth is notable in North America and Europe, while the Asia-Pacific region demonstrates strong potential fueled by a growing middle class and increased travel frequency. Technological innovation, sustainable tourism, and adaptation to evolving consumer preferences for personalized and unique travel experiences will continue to shape market expansion.

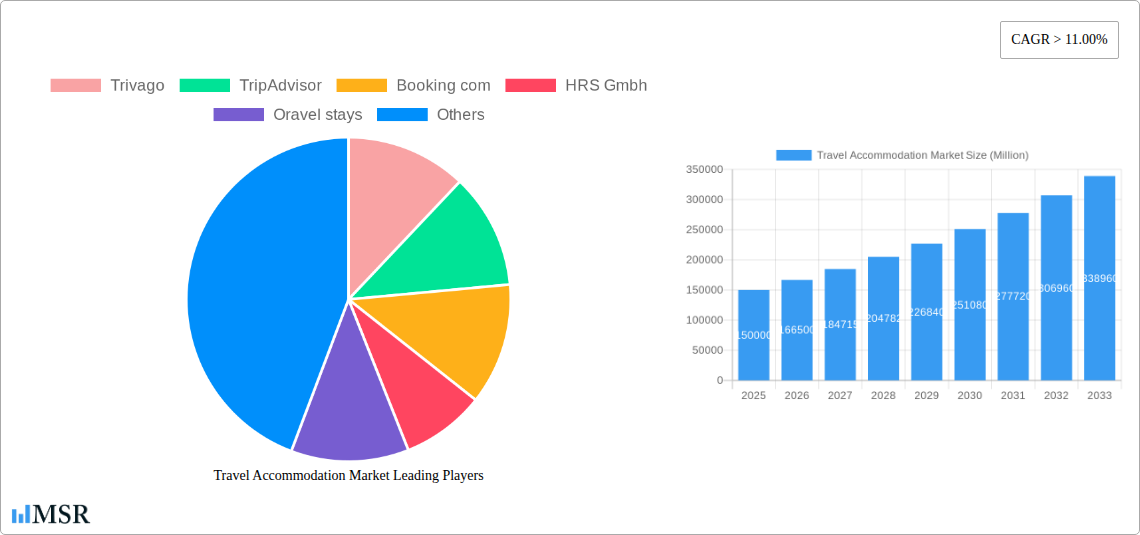

Travel Accommodation Market Company Market Share

Travel Accommodation Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the global Travel Accommodation Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033. The market is segmented by platform (mobile application, website) and booking mode (third-party online portals, direct/captive portals). Key players analyzed include Trivago, TripAdvisor, Booking.com, HRS GmbH, Oravel Stays, Airbnb, AccorHotels, Agoda, Hotels.com, Expedia, and OUI sncf. This report projects a market size of xx Million in 2025 and a CAGR of xx% during the forecast period.

Travel Accommodation Market Concentration & Dynamics

The Travel Accommodation Market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Booking.com and Expedia, for example, command substantial portions of the online travel booking segment. However, the market displays a dynamic competitive landscape, characterized by continuous innovation, strategic partnerships, and mergers & acquisitions (M&A) activity.

- Market Share: Booking.com holds an estimated xx% market share in 2025, followed by Expedia with xx%, and Airbnb with xx%. The remaining market share is distributed amongst numerous smaller players and niche providers.

- M&A Activity: The historical period (2019-2024) witnessed xx M&A deals, primarily driven by consolidation efforts and expansion into new markets. This trend is expected to continue during the forecast period.

- Innovation Ecosystem: The market is characterized by a thriving innovation ecosystem, with companies constantly developing new technologies to enhance user experience, optimize pricing strategies, and expand their product offerings.

- Regulatory Frameworks: Varying regulatory frameworks across different regions influence market dynamics. Compliance and licensing requirements pose challenges, especially for smaller players operating in multiple jurisdictions.

- Substitute Products: The rise of alternative accommodation options, such as homestays and unique lodging experiences, presents a competitive challenge to traditional hotel chains and online travel agencies.

- End-User Trends: The increasing preference for personalized travel experiences, coupled with a growing reliance on mobile booking platforms, shapes market evolution.

Travel Accommodation Market Industry Insights & Trends

The global Travel Accommodation Market is experiencing robust growth, driven by several key factors. The rising disposable incomes in emerging economies, increased leisure travel spending, and the growing adoption of online travel booking platforms contribute significantly to market expansion. Technological disruptions, such as the proliferation of mobile apps and AI-powered personalization, are reshaping consumer behavior and industry dynamics. The market size reached xx Million in 2024 and is projected to reach xx Million by 2033. This growth is largely influenced by:

- Technological Disruptions: The implementation of AI-powered chatbots for customer service, the use of big data analytics for demand forecasting, and personalized recommendations are driving efficiency and customer satisfaction.

- Evolving Consumer Behaviors: Increased preference for experiential travel, sustainable tourism options, and the demand for flexible booking policies shape the accommodation landscape.

- Market Growth Drivers: Economic growth in key regions, the expansion of air travel connectivity, and government initiatives to promote tourism are all fueling market growth.

Key Markets & Segments Leading Travel Accommodation Market

The Asia-Pacific region holds a dominant position in the global Travel Accommodation Market, driven by robust economic growth, expanding middle class, and increasing domestic and international tourism. Within this region, countries like China and India represent key growth markets.

By Platform:

- Mobile Applications: The mobile application segment is experiencing significant growth, driven by increased smartphone penetration and user preference for convenience and accessibility.

- Websites: Desktop websites remain a crucial booking channel, especially for users preferring detailed information and comparison tools.

By Mode of Booking:

- Third-Party Online Portals: These platforms represent a significant segment, offering a wide selection of accommodations and competitive pricing.

- Direct/Captive Portals: Hotel chains and independent accommodation providers are increasingly focusing on direct bookings to improve margins and customer relationships.

Drivers for Dominant Regions:

- Economic Growth: Strong economic performance in key regions fuels travel spending.

- Infrastructure Development: Improved transportation infrastructure enhances connectivity and facilitates tourism.

- Government Initiatives: Tourism promotion policies and visa facilitation programs boost international travel.

Travel Accommodation Market Product Developments

The Travel Accommodation Market is witnessing rapid product innovation, with a focus on enhancing user experience and expanding service offerings. This includes the integration of augmented reality (AR) and virtual reality (VR) technologies for virtual property tours, the development of personalized travel itineraries, and the adoption of blockchain technology for secure transactions. These advancements provide competitive edges, attracting and retaining customers.

Challenges in the Travel Accommodation Market Market

The Travel Accommodation Market faces several challenges. Fluctuations in currency exchange rates impact international travel, while regulatory changes and compliance issues create uncertainty. Supply chain disruptions, such as those experienced during the pandemic, can lead to capacity constraints and price volatility. Furthermore, intense competition among established players and the emergence of new entrants put pressure on profitability. These factors collectively impact market growth.

Forces Driving Travel Accommodation Market Growth

Several factors drive the long-term growth of the Travel Accommodation Market. Technological advancements, particularly in the areas of AI and big data, enhance operational efficiency and personalize customer experiences. Favorable economic conditions in key markets increase travel spending, while supportive government policies stimulate tourism. The continued expansion of air travel connectivity also plays a vital role.

Challenges in the Travel Accommodation Market Market

Long-term growth catalysts include strategic partnerships between travel companies and technology providers, creating innovative solutions. The expansion into new and emerging markets, coupled with the development of sustainable and responsible travel options, creates promising opportunities.

Emerging Opportunities in Travel Accommodation Market

Emerging opportunities exist in niche travel segments, such as eco-tourism and adventure travel. The adoption of innovative technologies, like AI-powered concierge services and personalized travel recommendations, unlocks new revenue streams. The growing demand for unique and authentic travel experiences also presents opportunities for smaller accommodation providers.

Leading Players in the Travel Accommodation Market Sector

- Trivago

- TripAdvisor

- Booking.com

- HRS GmbH

- Oravel Stays

- Airbnb

- AccorHotels

- Agoda

- Hotels.com

- Expedia

- OUI sncf

Key Milestones in Travel Accommodation Market Industry

- 2020: The COVID-19 pandemic significantly impacted the travel industry, leading to widespread travel restrictions and a sharp decline in bookings.

- 2021: The industry began a gradual recovery, with the introduction of new safety protocols and vaccination programs.

- 2022: Increased vaccination rates and relaxed travel restrictions led to a surge in travel demand.

- 2023: The industry continues its recovery, with innovation and technology driving efficiency and customer experience. (Specific examples of product launches or mergers would be listed here if available).

Strategic Outlook for Travel Accommodation Market Market

The Travel Accommodation Market holds significant long-term growth potential, fueled by continued technological advancements, increasing disposable incomes in emerging markets, and the evolving preferences of travelers. Strategic opportunities lie in leveraging data analytics, personalization, and sustainable tourism initiatives to capture market share and enhance profitability. Focus on providing unique and experiential travel offerings will also be crucial for success in the coming years.

Travel Accommodation Market Segmentation

-

1. Platform

- 1.1. Mobile application

- 1.2. Website

-

2. Mode of booking

- 2.1. Third party online portals

- 2.2. Direct/captive portals

Travel Accommodation Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Travel Accommodation Market Regional Market Share

Geographic Coverage of Travel Accommodation Market

Travel Accommodation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Health and Wellness Trends is Driving the Market; Cultural Exploration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Long-Distances are Physically Demanding which in return Restraining the Market

- 3.4. Market Trends

- 3.4.1. Rising Internet Usage Pushing Customers Towards Online Accommodation in France.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Travel Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Mobile application

- 5.1.2. Website

- 5.2. Market Analysis, Insights and Forecast - by Mode of booking

- 5.2.1. Third party online portals

- 5.2.2. Direct/captive portals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. North America Travel Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 6.1.1. Mobile application

- 6.1.2. Website

- 6.2. Market Analysis, Insights and Forecast - by Mode of booking

- 6.2.1. Third party online portals

- 6.2.2. Direct/captive portals

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 7. South America Travel Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 7.1.1. Mobile application

- 7.1.2. Website

- 7.2. Market Analysis, Insights and Forecast - by Mode of booking

- 7.2.1. Third party online portals

- 7.2.2. Direct/captive portals

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 8. Europe Travel Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 8.1.1. Mobile application

- 8.1.2. Website

- 8.2. Market Analysis, Insights and Forecast - by Mode of booking

- 8.2.1. Third party online portals

- 8.2.2. Direct/captive portals

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 9. Middle East & Africa Travel Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 9.1.1. Mobile application

- 9.1.2. Website

- 9.2. Market Analysis, Insights and Forecast - by Mode of booking

- 9.2.1. Third party online portals

- 9.2.2. Direct/captive portals

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 10. Asia Pacific Travel Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 10.1.1. Mobile application

- 10.1.2. Website

- 10.2. Market Analysis, Insights and Forecast - by Mode of booking

- 10.2.1. Third party online portals

- 10.2.2. Direct/captive portals

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Trivago

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TripAdvisor

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Booking com

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HRS Gmbh

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Oravel stays

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AirBnb

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AccorHotels

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Agoda**List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hotels com

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Expedia

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 OUI sncf

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Trivago

List of Figures

- Figure 1: Global Travel Accommodation Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Travel Accommodation Market Revenue (billion), by Platform 2025 & 2033

- Figure 3: North America Travel Accommodation Market Revenue Share (%), by Platform 2025 & 2033

- Figure 4: North America Travel Accommodation Market Revenue (billion), by Mode of booking 2025 & 2033

- Figure 5: North America Travel Accommodation Market Revenue Share (%), by Mode of booking 2025 & 2033

- Figure 6: North America Travel Accommodation Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Travel Accommodation Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Travel Accommodation Market Revenue (billion), by Platform 2025 & 2033

- Figure 9: South America Travel Accommodation Market Revenue Share (%), by Platform 2025 & 2033

- Figure 10: South America Travel Accommodation Market Revenue (billion), by Mode of booking 2025 & 2033

- Figure 11: South America Travel Accommodation Market Revenue Share (%), by Mode of booking 2025 & 2033

- Figure 12: South America Travel Accommodation Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Travel Accommodation Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Travel Accommodation Market Revenue (billion), by Platform 2025 & 2033

- Figure 15: Europe Travel Accommodation Market Revenue Share (%), by Platform 2025 & 2033

- Figure 16: Europe Travel Accommodation Market Revenue (billion), by Mode of booking 2025 & 2033

- Figure 17: Europe Travel Accommodation Market Revenue Share (%), by Mode of booking 2025 & 2033

- Figure 18: Europe Travel Accommodation Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Travel Accommodation Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Travel Accommodation Market Revenue (billion), by Platform 2025 & 2033

- Figure 21: Middle East & Africa Travel Accommodation Market Revenue Share (%), by Platform 2025 & 2033

- Figure 22: Middle East & Africa Travel Accommodation Market Revenue (billion), by Mode of booking 2025 & 2033

- Figure 23: Middle East & Africa Travel Accommodation Market Revenue Share (%), by Mode of booking 2025 & 2033

- Figure 24: Middle East & Africa Travel Accommodation Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Travel Accommodation Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Travel Accommodation Market Revenue (billion), by Platform 2025 & 2033

- Figure 27: Asia Pacific Travel Accommodation Market Revenue Share (%), by Platform 2025 & 2033

- Figure 28: Asia Pacific Travel Accommodation Market Revenue (billion), by Mode of booking 2025 & 2033

- Figure 29: Asia Pacific Travel Accommodation Market Revenue Share (%), by Mode of booking 2025 & 2033

- Figure 30: Asia Pacific Travel Accommodation Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Travel Accommodation Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Travel Accommodation Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 2: Global Travel Accommodation Market Revenue billion Forecast, by Mode of booking 2020 & 2033

- Table 3: Global Travel Accommodation Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Travel Accommodation Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 5: Global Travel Accommodation Market Revenue billion Forecast, by Mode of booking 2020 & 2033

- Table 6: Global Travel Accommodation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Travel Accommodation Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 11: Global Travel Accommodation Market Revenue billion Forecast, by Mode of booking 2020 & 2033

- Table 12: Global Travel Accommodation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Travel Accommodation Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 17: Global Travel Accommodation Market Revenue billion Forecast, by Mode of booking 2020 & 2033

- Table 18: Global Travel Accommodation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Travel Accommodation Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 29: Global Travel Accommodation Market Revenue billion Forecast, by Mode of booking 2020 & 2033

- Table 30: Global Travel Accommodation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Travel Accommodation Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 38: Global Travel Accommodation Market Revenue billion Forecast, by Mode of booking 2020 & 2033

- Table 39: Global Travel Accommodation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Travel Accommodation Market?

The projected CAGR is approximately 9.56%.

2. Which companies are prominent players in the Travel Accommodation Market?

Key companies in the market include Trivago, TripAdvisor, Booking com, HRS Gmbh, Oravel stays, AirBnb, AccorHotels, Agoda**List Not Exhaustive, Hotels com, Expedia, OUI sncf.

3. What are the main segments of the Travel Accommodation Market?

The market segments include Platform, Mode of booking.

4. Can you provide details about the market size?

The market size is estimated to be USD 961.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Health and Wellness Trends is Driving the Market; Cultural Exploration is Driving the Market.

6. What are the notable trends driving market growth?

Rising Internet Usage Pushing Customers Towards Online Accommodation in France..

7. Are there any restraints impacting market growth?

Long-Distances are Physically Demanding which in return Restraining the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Travel Accommodation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Travel Accommodation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Travel Accommodation Market?

To stay informed about further developments, trends, and reports in the Travel Accommodation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence