Key Insights

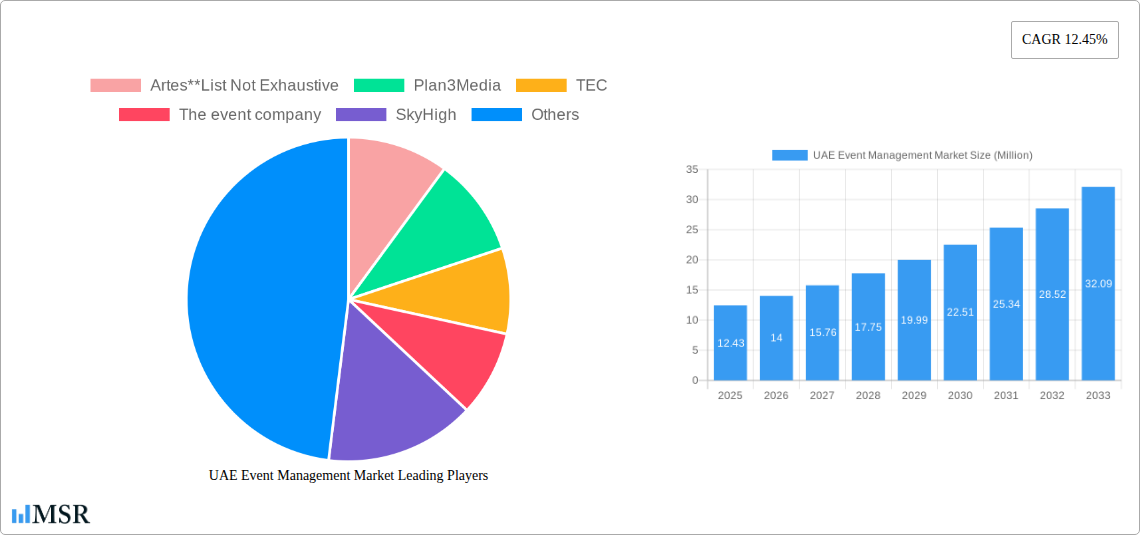

The UAE event management market, valued at $12.43 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 12.45% from 2025 to 2033. This expansion is fueled by several key drivers. The UAE's strategic location, world-class infrastructure, and commitment to tourism significantly contribute to the market's attractiveness. A burgeoning population with high disposable incomes, coupled with a growing preference for experiential activities, further fuels demand for diverse events, ranging from large-scale concerts and festivals to corporate meetings and exhibitions. The government's proactive initiatives to promote tourism and large-scale events also play a vital role. Segmentation reveals a diverse landscape; corporate events constitute a significant portion, alongside a substantial individual consumer segment. Music concerts and festivals are highly popular event types, generating substantial revenue through ticket sales, sponsorships, and broadcasting rights. Competition is dynamic, with established players like Artes, Plan3Media, TEC, and others vying for market share. However, maintaining profitability requires adept management of operational costs and successful acquisition of sponsorship and broadcasting deals. The market is also influenced by factors such as global economic conditions and fluctuating tourism numbers.

UAE Event Management Market Market Size (In Million)

The forecast period (2025-2033) anticipates continued market expansion driven by the sustained growth of tourism and the diversification of the UAE economy. However, challenges exist; competition is fierce and successful companies need to innovate to remain ahead. Successfully navigating regulatory frameworks and ensuring sustainable event practices will be crucial. The market's growth will also depend on the ability of event management companies to adapt to evolving consumer preferences and technological advancements. This includes leveraging digital marketing, data analytics, and sustainable practices to enhance the event experience and maximize returns. The focus on leveraging emerging technologies for event management, coupled with successful partnerships, will be key factors defining the growth trajectory over the forecast period.

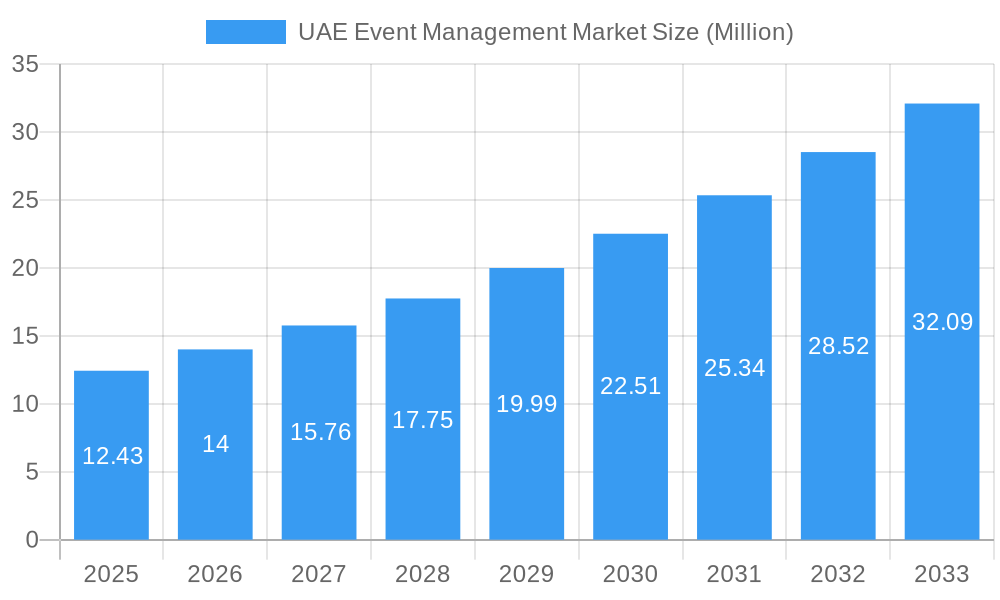

UAE Event Management Market Company Market Share

UAE Event Management Market: A Comprehensive Report (2019-2033)

This meticulously researched report provides a deep dive into the dynamic UAE event management market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this lucrative sector. With a comprehensive analysis spanning the period 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report unveils the market's size, growth trajectory, key segments, leading players, and emerging opportunities. The report leverages extensive primary and secondary research to deliver actionable intelligence, enabling informed decision-making and strategic planning. The UAE's vibrant event landscape, fuelled by significant investments in infrastructure and a burgeoning tourism sector, presents a compelling opportunity for growth. This report dissects the market's intricacies, offering a clear roadmap for success.

UAE Event Management Market Concentration & Dynamics

The UAE event management market exhibits a moderately concentrated landscape, with a few large players commanding significant market share. However, a multitude of smaller and medium-sized enterprises (SMEs) also contribute substantially to the overall market activity. Market share data reveals that the top five players collectively hold approximately xx% of the market, indicating room for both expansion by existing players and entry by new entrants. Innovation within the sector is driven by technological advancements in event planning software, virtual and hybrid event platforms, and data analytics tools for better audience engagement and ROI measurement. The regulatory framework, while generally supportive, presents some challenges, particularly concerning licensing and permits. Substitute products, such as online webinars and virtual conferences, are gaining traction, impacting the traditional event management sector. End-user trends reveal a shift towards experiential events and personalized experiences, pushing event organizers to innovate and deliver unique value propositions. M&A activity in the sector has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024, primarily focused on consolidation and expansion into new market segments.

- Market Concentration: Top 5 players hold approximately xx% market share (2024).

- Innovation Ecosystem: Strong focus on technology integration, particularly virtual/hybrid events and data analytics.

- Regulatory Framework: Generally supportive but requires streamlining in some areas.

- Substitute Products: Online webinars and virtual conferences pose a competitive challenge.

- M&A Activity: Approximately xx deals recorded between 2019 and 2024.

UAE Event Management Market Industry Insights & Trends

The UAE event management market is experiencing robust growth, driven by several key factors. The country’s strategic location, world-class infrastructure, and government initiatives promoting tourism and business events contribute significantly to market expansion. The market size is estimated at xx Million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, such as the rise of virtual and hybrid events, are reshaping the industry, forcing event management companies to adapt and embrace new technologies. Evolving consumer behaviors, including increased demand for personalized experiences and sustainable practices, are also impacting the market. The rising popularity of niche events and experiences is also creating new growth opportunities for specialized event organizers. This dynamic landscape presents both challenges and opportunities for players in the UAE event management market.

Key Markets & Segments Leading UAE Event Management Market

The UAE event management market is segmented by end-user (corporate, individual, public), event type (music concerts, festivals, sports, exhibitions and conferences, corporate events and seminars, other types), and revenue source (tickets, sponsorships, advertising, broadcasting, other sources of revenue). While all segments contribute significantly, the corporate events sector represents the largest share of the market, driven by the robust growth of the UAE's business sector. The dominance of Dubai as a major events hub significantly influences market activity. Economic growth, particularly in tourism and hospitality, is a primary driver of market expansion across all segments. Government initiatives to promote large-scale events further boost growth.

- By End-User: Corporate events hold the largest market share, followed by public and individual events.

- By Type: Exhibitions and conferences, followed by corporate events and seminars, dominate the market.

- By Revenue Source: Ticket sales are a primary revenue source, followed by sponsorships and advertising.

- Growth Drivers:

- Strong economic growth, particularly in tourism and hospitality.

- Government initiatives promoting large-scale events and tourism.

- Development of world-class infrastructure.

UAE Event Management Market Product Developments

Recent years have witnessed notable product innovations in the UAE event management sector. Event technology companies are developing sophisticated software for event planning, registration, and attendee management. The integration of virtual and augmented reality (VR/AR) technologies is enhancing attendee engagement and creating immersive experiences. These advancements are improving efficiency, reducing costs, and offering competitive advantages to event management companies. The focus is shifting towards sustainable event practices and data-driven decision-making to optimize ROI for clients.

Challenges in the UAE Event Management Market Market

The UAE event management market faces several challenges. Stringent regulatory requirements and licensing procedures can present hurdles for new entrants and smaller businesses. Supply chain disruptions, particularly in sourcing materials and staffing, can impact event delivery and costs. Intense competition among established players and new entrants creates pressure on pricing and profitability. These challenges require careful strategic planning and adaptability to overcome. The impact of these challenges can reduce profit margins by approximately xx% in some cases.

Forces Driving UAE Event Management Market Growth

Several factors are driving growth in the UAE event management market. Technological advancements, such as AI-powered event planning tools and virtual reality experiences, are enhancing the efficiency and appeal of events. The flourishing economy, driven by significant investments in infrastructure and diversification initiatives, creates a conducive environment for events. Government support through initiatives designed to promote tourism and business events further accelerates market growth. The UAE's strategic location and strong connectivity attract both domestic and international events.

Long-Term Growth Catalysts in the UAE Event Management Market

Long-term growth in the UAE event management market will be fueled by continued innovation in event technology and sustainable practices. Strategic partnerships between event management companies and technology providers will lead to more efficient and engaging events. Expanding into new market segments, such as niche events and corporate social responsibility initiatives, will create opportunities for growth. Furthermore, the UAE's ongoing efforts to position itself as a leading global events destination will contribute to long-term market expansion.

Emerging Opportunities in UAE Event Management Market

Emerging opportunities abound in the UAE event management market. The growing demand for personalized and experiential events presents a prime opportunity for event organizers to create unique and memorable experiences. The integration of technology for enhanced audience engagement and data analytics for improved ROI measurement will shape future market trends. New markets, such as virtual and hybrid events, continue to emerge, offering exciting opportunities for innovation.

Leading Players in the UAE Event Management Market Sector

- Artes

- Plan3Media

- TEC

- The event company

- SkyHigh

- Great Wall Events

- GM Events

- M&N

- CWE

- Emerald

Key Milestones in UAE Event Management Market Industry

- May 2023: Identity, a UK-based events agency, expands into the UAE, opening two new offices, signifying increased international interest and competition.

- December 2022: Dubai Chamber of Commerce launches a new Events Business Group, aiming to strengthen Dubai's position as a global events hub, indicating strong government support for the sector.

Strategic Outlook for UAE Event Management Market Market

The UAE event management market holds significant growth potential over the coming years, driven by a strong economic outlook, continuous infrastructure development, and government support. Strategic opportunities exist for event organizers to leverage technology, create immersive experiences, and cater to evolving consumer preferences. Focusing on sustainability and data-driven decision-making will be crucial for long-term success in this dynamic and competitive market. The market is expected to reach xx Million by 2033, representing substantial growth and investment opportunities.

UAE Event Management Market Segmentation

-

1. Type

- 1.1. Music Concerts

- 1.2. Festivals

- 1.3. Sports

- 1.4. Exhibitions and Conferences

- 1.5. Corporate Events and Seminars

- 1.6. Other Types

-

2. Source of Revenue

- 2.1. Tickets

- 2.2. Sponsorships

- 2.3. Advertising

- 2.4. Broadcasting

- 2.5. Other Sources of Revenue

-

3. End User

- 3.1. Corporate

- 3.2. Individual

- 3.3. Public

UAE Event Management Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Event Management Market Regional Market Share

Geographic Coverage of UAE Event Management Market

UAE Event Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Regulations are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Expanding Hospitality Industry is Booming the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Event Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Music Concerts

- 5.1.2. Festivals

- 5.1.3. Sports

- 5.1.4. Exhibitions and Conferences

- 5.1.5. Corporate Events and Seminars

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Source of Revenue

- 5.2.1. Tickets

- 5.2.2. Sponsorships

- 5.2.3. Advertising

- 5.2.4. Broadcasting

- 5.2.5. Other Sources of Revenue

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Corporate

- 5.3.2. Individual

- 5.3.3. Public

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UAE Event Management Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Music Concerts

- 6.1.2. Festivals

- 6.1.3. Sports

- 6.1.4. Exhibitions and Conferences

- 6.1.5. Corporate Events and Seminars

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Source of Revenue

- 6.2.1. Tickets

- 6.2.2. Sponsorships

- 6.2.3. Advertising

- 6.2.4. Broadcasting

- 6.2.5. Other Sources of Revenue

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Corporate

- 6.3.2. Individual

- 6.3.3. Public

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UAE Event Management Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Music Concerts

- 7.1.2. Festivals

- 7.1.3. Sports

- 7.1.4. Exhibitions and Conferences

- 7.1.5. Corporate Events and Seminars

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Source of Revenue

- 7.2.1. Tickets

- 7.2.2. Sponsorships

- 7.2.3. Advertising

- 7.2.4. Broadcasting

- 7.2.5. Other Sources of Revenue

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Corporate

- 7.3.2. Individual

- 7.3.3. Public

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UAE Event Management Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Music Concerts

- 8.1.2. Festivals

- 8.1.3. Sports

- 8.1.4. Exhibitions and Conferences

- 8.1.5. Corporate Events and Seminars

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Source of Revenue

- 8.2.1. Tickets

- 8.2.2. Sponsorships

- 8.2.3. Advertising

- 8.2.4. Broadcasting

- 8.2.5. Other Sources of Revenue

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Corporate

- 8.3.2. Individual

- 8.3.3. Public

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UAE Event Management Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Music Concerts

- 9.1.2. Festivals

- 9.1.3. Sports

- 9.1.4. Exhibitions and Conferences

- 9.1.5. Corporate Events and Seminars

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Source of Revenue

- 9.2.1. Tickets

- 9.2.2. Sponsorships

- 9.2.3. Advertising

- 9.2.4. Broadcasting

- 9.2.5. Other Sources of Revenue

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Corporate

- 9.3.2. Individual

- 9.3.3. Public

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UAE Event Management Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Music Concerts

- 10.1.2. Festivals

- 10.1.3. Sports

- 10.1.4. Exhibitions and Conferences

- 10.1.5. Corporate Events and Seminars

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Source of Revenue

- 10.2.1. Tickets

- 10.2.2. Sponsorships

- 10.2.3. Advertising

- 10.2.4. Broadcasting

- 10.2.5. Other Sources of Revenue

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Corporate

- 10.3.2. Individual

- 10.3.3. Public

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Artes**List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Plan3Media

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TEC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The event company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SkyHigh

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Great Wall Events

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GM Events

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 M&N

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CWE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Emerald

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Artes**List Not Exhaustive

List of Figures

- Figure 1: Global UAE Event Management Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UAE Event Management Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America UAE Event Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America UAE Event Management Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 5: North America UAE Event Management Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 6: North America UAE Event Management Market Revenue (Million), by End User 2025 & 2033

- Figure 7: North America UAE Event Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America UAE Event Management Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America UAE Event Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America UAE Event Management Market Revenue (Million), by Type 2025 & 2033

- Figure 11: South America UAE Event Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America UAE Event Management Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 13: South America UAE Event Management Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 14: South America UAE Event Management Market Revenue (Million), by End User 2025 & 2033

- Figure 15: South America UAE Event Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: South America UAE Event Management Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America UAE Event Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe UAE Event Management Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Europe UAE Event Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe UAE Event Management Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 21: Europe UAE Event Management Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 22: Europe UAE Event Management Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Europe UAE Event Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Europe UAE Event Management Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe UAE Event Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa UAE Event Management Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East & Africa UAE Event Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East & Africa UAE Event Management Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 29: Middle East & Africa UAE Event Management Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 30: Middle East & Africa UAE Event Management Market Revenue (Million), by End User 2025 & 2033

- Figure 31: Middle East & Africa UAE Event Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East & Africa UAE Event Management Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa UAE Event Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific UAE Event Management Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Asia Pacific UAE Event Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific UAE Event Management Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 37: Asia Pacific UAE Event Management Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 38: Asia Pacific UAE Event Management Market Revenue (Million), by End User 2025 & 2033

- Figure 39: Asia Pacific UAE Event Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: Asia Pacific UAE Event Management Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific UAE Event Management Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Event Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global UAE Event Management Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 3: Global UAE Event Management Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global UAE Event Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global UAE Event Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global UAE Event Management Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 7: Global UAE Event Management Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global UAE Event Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global UAE Event Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global UAE Event Management Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 14: Global UAE Event Management Market Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global UAE Event Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global UAE Event Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global UAE Event Management Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 21: Global UAE Event Management Market Revenue Million Forecast, by End User 2020 & 2033

- Table 22: Global UAE Event Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global UAE Event Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global UAE Event Management Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 34: Global UAE Event Management Market Revenue Million Forecast, by End User 2020 & 2033

- Table 35: Global UAE Event Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global UAE Event Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 43: Global UAE Event Management Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 44: Global UAE Event Management Market Revenue Million Forecast, by End User 2020 & 2033

- Table 45: Global UAE Event Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific UAE Event Management Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Event Management Market?

The projected CAGR is approximately 12.45%.

2. Which companies are prominent players in the UAE Event Management Market?

Key companies in the market include Artes**List Not Exhaustive, Plan3Media, TEC, The event company, SkyHigh, Great Wall Events, GM Events, M&N, CWE, Emerald.

3. What are the main segments of the UAE Event Management Market?

The market segments include Type, Source of Revenue, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.43 Million as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Expanding Hospitality Industry is Booming the Market.

7. Are there any restraints impacting market growth?

Government Regulations are Restraining the Market.

8. Can you provide examples of recent developments in the market?

May 2023: Identity, one of the UK’s leading full-service events agencies, announced the expansion of its business to the Middle East with the opening of two new offices in the United Arab Emirates.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Event Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Event Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Event Management Market?

To stay informed about further developments, trends, and reports in the UAE Event Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence