Key Insights

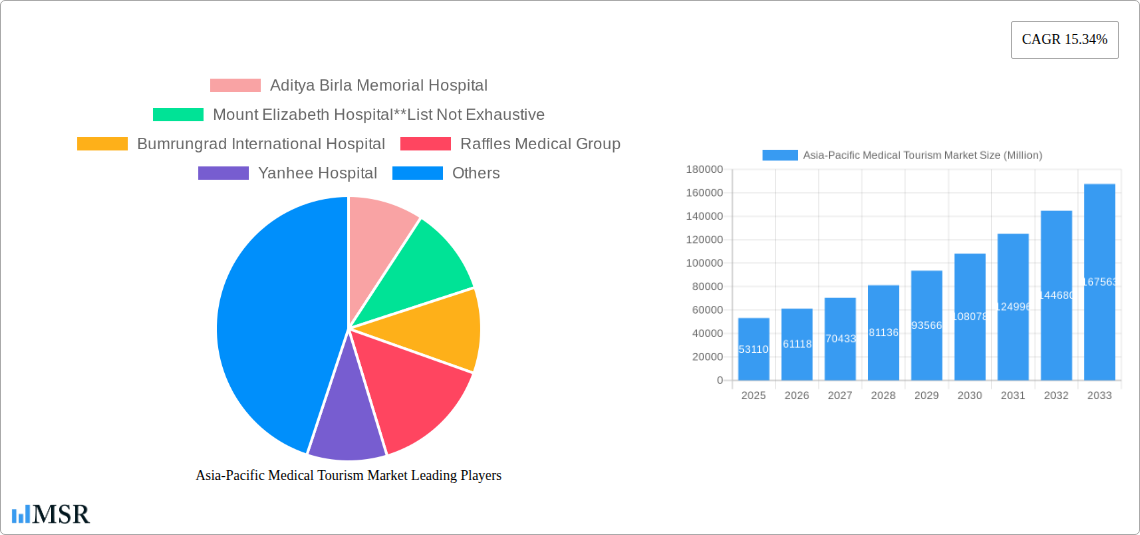

The Asia-Pacific medical tourism market is experiencing robust growth, projected to reach a market size of $53.11 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 15.34% from 2025 to 2033. This surge is driven by several key factors. Firstly, the region boasts a substantial number of advanced medical facilities offering high-quality care at significantly lower costs compared to Western nations. This cost advantage is a major draw for medical tourists seeking procedures like dental work, cosmetic treatments, cardiovascular surgeries, orthopedic treatments, neurological procedures, cancer treatments, and fertility treatments. Secondly, improvements in regional healthcare infrastructure and increasing medical expertise, particularly in countries like India, Singapore, and Thailand, further fuel market expansion. The rising prevalence of chronic diseases and the increasing demand for specialized medical care contribute to the high demand for medical tourism services. Finally, favorable government policies and initiatives aimed at promoting medical tourism in several Asia-Pacific nations are creating a supportive ecosystem for the industry's growth.

Asia-Pacific Medical Tourism Market Market Size (In Billion)

However, the market faces certain challenges. While the quality of care is improving, concerns about healthcare standards and infrastructure variations across different countries within the region persist. Furthermore, language barriers, cultural differences, and logistical complexities associated with international travel can pose hurdles for some patients. The competitive landscape is dynamic, with both public and private healthcare providers vying for market share. The dominance of India and China is expected to continue, but countries like Singapore and Thailand will also play a significant role due to their advanced infrastructure and reputation for high-quality services. The market segmentation by treatment type and service provider will significantly impact the overall growth trajectory. The ongoing efforts to improve regulatory frameworks and address quality concerns will be crucial in fostering further market expansion and attracting a broader range of medical tourists in the future.

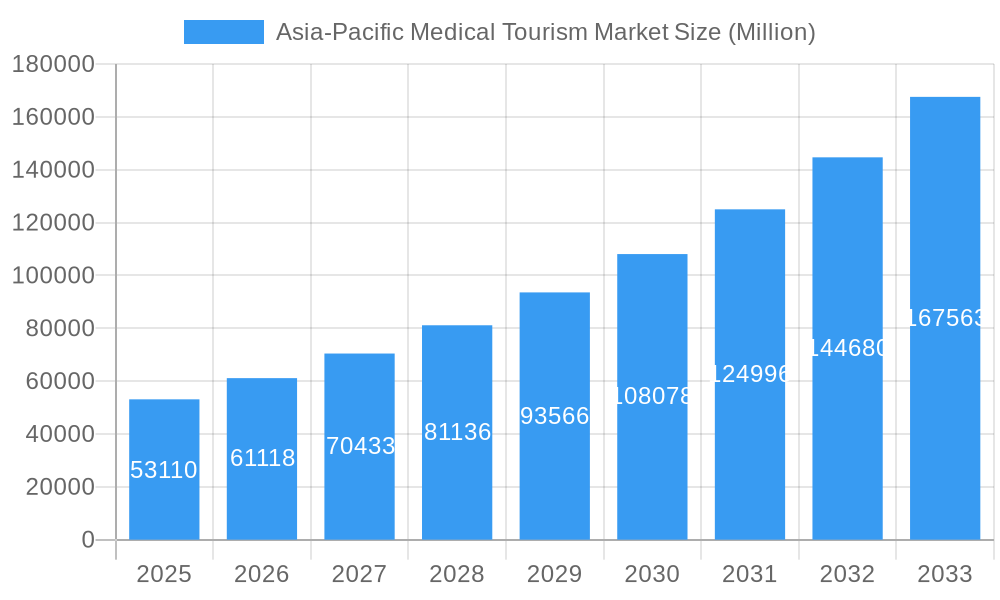

Asia-Pacific Medical Tourism Market Company Market Share

Asia-Pacific Medical Tourism Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific medical tourism market, covering the period 2019-2033. It offers actionable insights into market dynamics, key segments, leading players, and future growth opportunities, empowering stakeholders to make informed strategic decisions. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). The base year for this report is 2025, with historical data spanning 2019-2024. Key players analyzed include Aditya Birla Memorial Hospital, Mount Elizabeth Hospital, Bumrungrad International Hospital, Raffles Medical Group, Yanhee Hospital, Sunway Medical Centre, KPJ Healthcare Berhad, Apollo Hospital Enterprise Limited, Fortis Healthcare Limited, and Asian Heart Institute.

Asia-Pacific Medical Tourism Market Concentration & Dynamics

The Asia-Pacific medical tourism market exhibits a moderately concentrated landscape, with a few large players holding significant market share. However, the market is also characterized by a high degree of fragmentation, particularly amongst smaller, specialized clinics and hospitals. Innovation ecosystems vary across countries, with Singapore and India leading in technological advancements and medical infrastructure. Regulatory frameworks differ significantly across the region, influencing market access and investment decisions. Substitute products, such as telemedicine and remote healthcare services, are posing a challenge, while the growing trend toward personalized medicine creates new opportunities. End-user trends, driven by rising disposable incomes and increasing health awareness, are boosting demand. M&A activities are frequent, reflecting the ongoing consolidation and expansion efforts of major players. In the past five years, there have been approximately xx M&A deals, with an average deal size of approximately xx Million. Market share data for the top five players is as follows:

- Player 1: xx%

- Player 2: xx%

- Player 3: xx%

- Player 4: xx%

- Player 5: xx%

Asia-Pacific Medical Tourism Market Industry Insights & Trends

The Asia-Pacific medical tourism market is experiencing robust growth, driven by several factors. Rising disposable incomes, particularly in emerging economies like India and China, are fueling demand for high-quality, affordable healthcare services. Technological advancements, such as minimally invasive surgical techniques and advanced diagnostic tools, are enhancing the quality of care and attracting international patients. Evolving consumer behaviors, including increased health awareness and a willingness to travel for specialized treatments, are also contributing to market expansion. The market size in 2025 is estimated at xx Million, representing significant growth compared to xx Million in 2019. This growth is attributed to factors such as: increasing affordability of medical treatments, improved medical infrastructure in several countries, and rising awareness about medical tourism opportunities. The market is projected to witness a steady growth trajectory, owing to the continuous improvement in medical services. Technological disruptions, such as the adoption of AI-powered diagnostic tools and robotic surgery, are transforming the industry and creating new opportunities for growth.

Key Markets & Segments Leading Asia-Pacific Medical Tourism Market

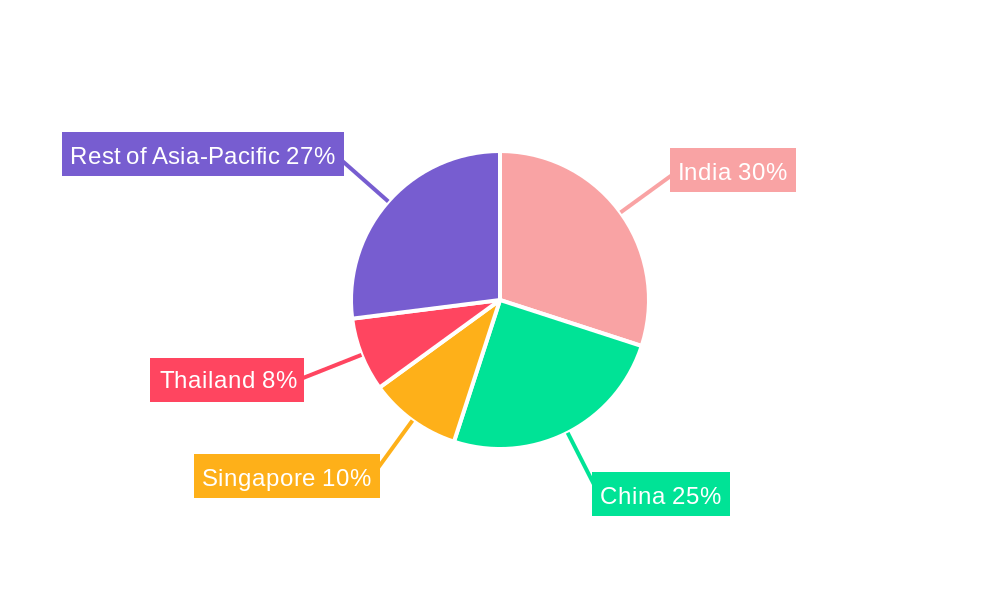

India and Singapore are currently the dominant markets within the Asia-Pacific region, driven by factors such as advanced medical infrastructure, skilled medical professionals, and cost-effective treatment options. However, China and Indonesia are emerging as significant players, experiencing rapid growth in medical tourism due to improving healthcare infrastructure and increasing disposable incomes.

By Treatment Type:

- Dominant Segments: Cosmetic treatment and dental treatment currently hold the largest market share, driven by high demand and relatively lower costs compared to other treatments.

- Growth Drivers:

- Economic growth: Rising disposable incomes in many countries enable more people to afford medical tourism.

- Improved infrastructure: Investment in medical infrastructure, including advanced technology and facilities, enhances the quality of care.

- Specialized treatments: Availability of specialized treatments not readily available in patients' home countries drives medical tourism.

By Service Provider:

- Dominant Segment: Private hospitals and clinics dominate the market, offering higher quality services and advanced technology.

- Growth Drivers:

- Government initiatives: Government support and investment in the healthcare sector foster growth.

- Increased awareness: Public awareness campaigns on medical tourism contribute to market expansion.

By Country:

- India: Strong growth driven by cost-effective treatments and a large pool of skilled medical professionals.

- Singapore: High-quality healthcare services and advanced medical technology attract high-spending patients.

- China: Rapid growth fueled by rising disposable incomes and increasing demand for advanced medical treatments.

- Indonesia: Emerging market with significant growth potential due to its large population and developing medical infrastructure.

- Rest of Asia-Pacific: Significant growth potential driven by increasing health awareness and improving healthcare standards.

Asia-Pacific Medical Tourism Market Product Developments

The Asia-Pacific medical tourism market is witnessing significant product innovations, particularly in minimally invasive surgical techniques, advanced diagnostic technologies, and personalized medicine. Telemedicine is also gaining traction, offering remote consultations and post-operative care. These advancements provide competitive advantages to providers, attracting patients seeking the latest treatments and technologies.

Challenges in the Asia-Pacific Medical Tourism Market

Several challenges impede the growth of the Asia-Pacific medical tourism market. Stricter visa regulations in some countries can limit patient access. Supply chain disruptions, especially concerning medical devices and pharmaceuticals, can impact service delivery. Intense competition among providers necessitates continuous innovation and investment in quality improvement. The varying regulatory frameworks across countries also pose a challenge for providers seeking to expand their operations. These factors collectively impose constraints on the industry’s overall expansion.

Forces Driving Asia-Pacific Medical Tourism Market Growth

The Asia-Pacific medical tourism market is driven by several factors: technological advancements such as robotic surgery and AI-powered diagnostics; economic factors including rising disposable incomes and improved healthcare insurance coverage; and supportive government policies such as investment in medical infrastructure and streamlined visa processes. These combined forces are fostering considerable growth within the sector.

Long-Term Growth Catalysts in the Asia-Pacific Medical Tourism Market

Long-term growth in the Asia-Pacific medical tourism market will be fueled by continued technological innovations, strategic partnerships between healthcare providers and international agencies, and expansion into new, underserved markets. The development of specialized medical tourism packages that cater to specific needs will further drive market expansion.

Emerging Opportunities in Asia-Pacific Medical Tourism Market

Emerging opportunities include the growing demand for wellness tourism, integrating traditional medicine practices with modern healthcare, and the rise of medical tourism packages targeting specific demographics. Furthermore, the increasing utilization of telehealth and virtual consultations creates new avenues for service delivery and market penetration.

Leading Players in the Asia-Pacific Medical Tourism Market Sector

Key Milestones in Asia-Pacific Medical Tourism Market Industry

- October 2022: Apollo Hospitals acquired a 60% stake in an Ayurveda hospital chain, signifying expansion into complementary medicine and potential for enhanced service offerings.

- May 2022: Fortis Healthcare planned to add around 1,500 new beds, indicating significant capacity expansion and potential to handle increased patient volume.

Strategic Outlook for Asia-Pacific Medical Tourism Market

The Asia-Pacific medical tourism market presents significant future potential, driven by increasing demand, technological advancements, and strategic partnerships. Providers that can offer high-quality, cost-effective services and leverage technological innovations will be well-positioned for growth. Focusing on niche segments and expanding into underserved markets will also offer substantial opportunities for expansion and profitability.

Asia-Pacific Medical Tourism Market Segmentation

-

1. Treatment Type

- 1.1. Dental Treatment

- 1.2. Cosmetic Treatment

- 1.3. Cardiovascular Treatment

- 1.4. Orthopedic Treatment

- 1.5. Neurological Treatment

- 1.6. Cancer Treatment

- 1.7. Fertility Treatment

- 1.8. Other Treatments

-

2. Service Provider

- 2.1. Public

- 2.2. Private

Asia-Pacific Medical Tourism Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Medical Tourism Market Regional Market Share

Geographic Coverage of Asia-Pacific Medical Tourism Market

Asia-Pacific Medical Tourism Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Tourist Arrivals; Quality and Service Standards

- 3.3. Market Restrains

- 3.3.1. Skill Shortages and Labor Costs; Regulatory Challenges and Administrative Burdens

- 3.4. Market Trends

- 3.4.1 Increasing Demand for Affordable Healthcare (Oncology

- 3.4.2 Cardiovascular Diseases

- 3.4.3 and Cosmetic Surgery) is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Medical Tourism Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Treatment Type

- 5.1.1. Dental Treatment

- 5.1.2. Cosmetic Treatment

- 5.1.3. Cardiovascular Treatment

- 5.1.4. Orthopedic Treatment

- 5.1.5. Neurological Treatment

- 5.1.6. Cancer Treatment

- 5.1.7. Fertility Treatment

- 5.1.8. Other Treatments

- 5.2. Market Analysis, Insights and Forecast - by Service Provider

- 5.2.1. Public

- 5.2.2. Private

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Treatment Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aditya Birla Memorial Hospital

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mount Elizabeth Hospital**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bumrungrad International Hospital

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Raffles Medical Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Yanhee Hospital

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sunway Medical Centre

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 KPJ Healthcare Berhad

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Apollo Hospital Enterprise Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fortis Healthcare Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Asian Heart Institute

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Aditya Birla Memorial Hospital

List of Figures

- Figure 1: Asia-Pacific Medical Tourism Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Medical Tourism Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Medical Tourism Market Revenue Million Forecast, by Treatment Type 2020 & 2033

- Table 2: Asia-Pacific Medical Tourism Market Revenue Million Forecast, by Service Provider 2020 & 2033

- Table 3: Asia-Pacific Medical Tourism Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific Medical Tourism Market Revenue Million Forecast, by Treatment Type 2020 & 2033

- Table 5: Asia-Pacific Medical Tourism Market Revenue Million Forecast, by Service Provider 2020 & 2033

- Table 6: Asia-Pacific Medical Tourism Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Medical Tourism Market?

The projected CAGR is approximately 15.34%.

2. Which companies are prominent players in the Asia-Pacific Medical Tourism Market?

Key companies in the market include Aditya Birla Memorial Hospital, Mount Elizabeth Hospital**List Not Exhaustive, Bumrungrad International Hospital, Raffles Medical Group, Yanhee Hospital, Sunway Medical Centre, KPJ Healthcare Berhad, Apollo Hospital Enterprise Limited, Fortis Healthcare Limited, Asian Heart Institute.

3. What are the main segments of the Asia-Pacific Medical Tourism Market?

The market segments include Treatment Type, Service Provider.

4. Can you provide details about the market size?

The market size is estimated to be USD 53.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Tourist Arrivals; Quality and Service Standards.

6. What are the notable trends driving market growth?

Increasing Demand for Affordable Healthcare (Oncology. Cardiovascular Diseases. and Cosmetic Surgery) is Driving the Market.

7. Are there any restraints impacting market growth?

Skill Shortages and Labor Costs; Regulatory Challenges and Administrative Burdens.

8. Can you provide examples of recent developments in the market?

October 2022: Apollo Hospitals acquired a 60% stake in the Ayurveda hospital chain. Apollo Hospitals will use the primary investment to upgrade existing centers, set up new centers, strengthen enterprise platforms, and for digital health initiatives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Medical Tourism Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Medical Tourism Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Medical Tourism Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Medical Tourism Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence