Key Insights

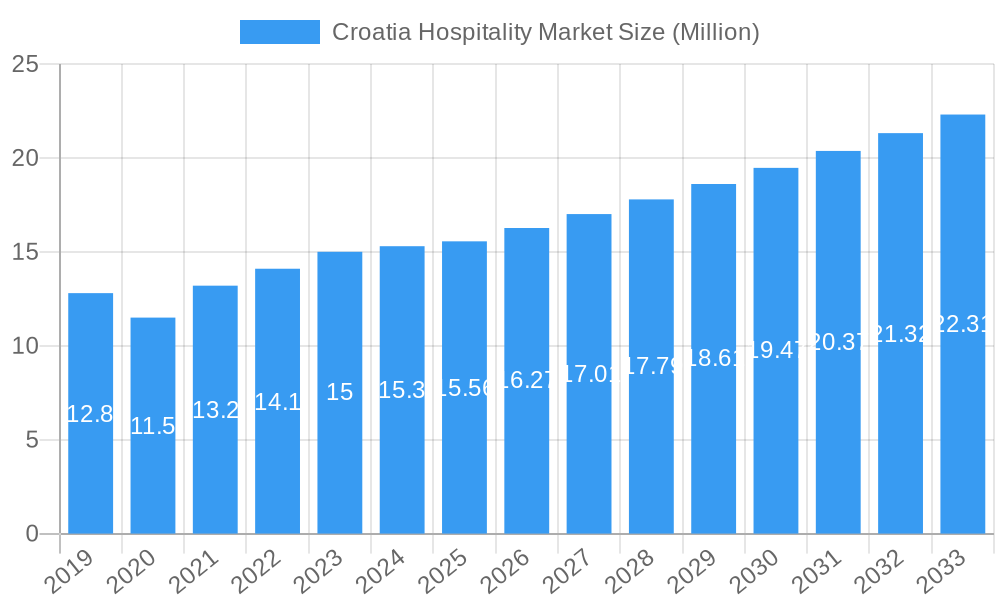

The Croatia Hospitality Market is poised for significant expansion, projected to reach an estimated 15.56 million value units by 2025. This growth trajectory is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 4.56%, indicating sustained development over the forecast period of 2025-2033. Several key drivers are fueling this positive outlook. The country's rich cultural heritage, stunning Adriatic coastline, and growing appeal as a European tourist destination are attracting a diverse range of visitors. Furthermore, increasing investment in tourism infrastructure, including hotel renovations and new developments, is enhancing the overall guest experience. The market is witnessing a notable trend towards diversification, with a rising demand for various accommodation types. While chain hotels continue to dominate, independent hotels are carving out niche markets, and service apartments are gaining traction for their extended-stay convenience. The segment also encompasses a broad spectrum from budget and economy options to mid, upper mid-scale, and ultra-luxury hotels, catering to a wide array of traveler preferences and budgets.

Croatia Hospitality Market Market Size (In Million)

However, the market is not without its challenges. Restraints such as seasonal fluctuations in tourism, potential labor shortages within the hospitality sector, and increasing operational costs for businesses need to be strategically addressed. Despite these headwinds, the inherent attractiveness of Croatia as a travel destination and the ongoing efforts to professionalize the industry are expected to mitigate these impacts. Leading companies like Valamar Riviera, Plava Laguna, and Meli Hotels International are actively shaping the competitive landscape through strategic expansions, service enhancements, and a focus on sustainable tourism practices. The concentration of market players suggests a dynamic yet maturing environment where innovation and customer-centric approaches will be crucial for sustained success and capturing a larger share of this expanding market. The focus on different hotel segments and regions within Croatia, particularly the coastal areas, will be critical for operators to capitalize on emerging opportunities and solidify their market positions.

Croatia Hospitality Market Company Market Share

Croatia Hospitality Market: Deep Dive into Growth, Trends, and Key Players (2019-2033)

This comprehensive report delves into the dynamic Croatia hospitality market, offering in-depth analysis and actionable insights for industry stakeholders. Covering the study period 2019–2033, with base year 2025, this research provides a robust understanding of market concentration, industry trends, segment dominance, product developments, challenges, growth drivers, and emerging opportunities. Discover how leading companies are shaping the Croatian hotel industry and identify strategic pathways for success in this rapidly evolving sector.

Croatia Hospitality Market Market Concentration & Dynamics

The Croatia hospitality market exhibits moderate concentration, with a blend of large hotel chains and a significant number of independent operators. The market is characterized by a growing emphasis on digital transformation and customer experience. Innovation ecosystems are emerging, driven by technology adoption and a focus on sustainable tourism practices. Regulatory frameworks, while generally supportive of tourism, can present varying complexities across different regions. Substitute products, such as vacation rentals and alternative accommodations, continue to pose a competitive challenge. End-user trends are leaning towards personalized experiences, wellness tourism, and eco-friendly options. Mergers and acquisitions (M&A) activities, though not at peak levels, are present as larger players seek to consolidate their market share and expand their portfolios. Anticipated M&A deal counts for the forecast period are estimated at 15-20. Key players like Valamar Riviera and Plava Laguna are actively pursuing strategic acquisitions to enhance their offerings. Market share for the top 5 players is estimated at 35% in the Croatia hotel industry.

Croatia Hospitality Market Industry Insights & Trends

The Croatia hospitality market is poised for significant growth, driven by a robust recovery in international tourism and an increasing domestic travel appetite. The market size for the Croatian hotel industry was valued at approximately $7,500 Million in the historical period, with a projected Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period of 2025–2033. Key growth drivers include the country's stunning coastline, rich cultural heritage, and expanding air connectivity. Technological disruptions are revolutionizing operations, from advanced Property Management Systems (PMS) to AI-powered guest services, enhancing efficiency and guest satisfaction. Evolving consumer behaviors point towards a demand for authentic experiences, sustainable tourism, and seamless digital integration. The Croatia tourism market is also seeing a rise in niche segments like adventure and culinary tourism.

Key Markets & Segments Leading Croatia Hospitality Market

The Croatia hospitality market is led by the Chain Hotels segment, which benefits from established brand recognition, standardized service quality, and significant investment capacity. Independent Hotels, while numerous, are increasingly facing competition from larger chains and curated online platforms. Within the service segments, Mid and Upper mid scale Hotels constitute the largest share of the market, catering to a broad spectrum of travelers.

Chain Hotels:

- Drivers: Brand loyalty, economies of scale in marketing and operations, access to capital for development and renovation, consistent service standards appealing to international travelers.

- Dominance Analysis: Major international and domestic hotel chains are strategically expanding their presence, acquiring existing properties, and developing new ones, particularly in popular coastal and urban destinations. This segment offers a more predictable and often higher-quality experience, attracting a substantial portion of tourist arrivals.

Mid and Upper mid scale Hotels:

- Drivers: Favorable price-to-quality ratio, catering to both leisure and business travelers, widespread availability across diverse locations, offering comfortable amenities and good service without the premium price tag of luxury options.

- Dominance Analysis: This segment forms the backbone of the Croatia tourism market, serving a vast majority of tourists seeking value and comfort. Growth in this segment is closely tied to overall tourism arrival numbers and the diversification of tourist profiles.

Luxury Hotels:

- Drivers: High-net-worth individuals, demand for exclusive experiences, prime locations, bespoke services, and unique amenities.

- Dominance Analysis: While smaller in volume, the luxury segment contributes significantly to revenue and brand perception. Investments in high-end properties and exclusive offerings are crucial for maintaining competitiveness.

Budget and Economy Hotels:

- Drivers: Price sensitivity, backpackers, budget-conscious families, and shorter stays.

- Dominance Analysis: This segment plays a vital role in making Croatia accessible to a wider range of travelers and often complements other segments by offering cost-effective options.

Service Apartments:

- Drivers: Extended stays, families, business travelers seeking self-catering facilities, and a desire for more space and independence.

- Dominance Analysis: This segment is experiencing robust growth, especially in urban centers and popular tourist hubs, as travelers seek greater flexibility and value.

Croatia Hospitality Market Product Developments

The Croatia hospitality market is witnessing innovative product developments focused on enhancing guest experience and operational efficiency. Technology integration, such as smart room controls and personalized digital concierge services, is becoming standard. There's a growing emphasis on sustainable tourism products, including eco-lodges and farm-to-table dining experiences. The adoption of advanced Property Management Systems (PMS) and booking engines by hotel chains is streamlining operations and improving direct bookings, thereby securing a competitive edge in the Croatian hotel industry.

Challenges in the Croatia Hospitality Market Market

The Croatia hospitality market faces several challenges that could temper its growth trajectory. These include seasonal fluctuations in demand, leading to underutilization of capacity during off-peak months. Intense competition from both established players and emerging alternative accommodation providers, such as Airbnb, exerts downward pressure on pricing. Additionally, labor shortages in skilled hospitality roles and rising operational costs, including energy and supplies, present ongoing hurdles for businesses in the Croatia tourism market. Regulatory complexities and the need for continuous infrastructure development in certain regions also contribute to the challenges.

Forces Driving Croatia Hospitality Market Growth

Several key forces are propelling the Croatia hospitality market forward. The country's appeal as a year-round destination is strengthening, supported by investments in off-season attractions and events. Government initiatives promoting tourism development, coupled with EU funding, are facilitating infrastructure upgrades and marketing efforts. A growing emphasis on experiential travel, including culinary, cultural, and adventure tourism, is attracting a diverse range of visitors. Furthermore, the increasing adoption of digital technologies for marketing, bookings, and guest services is enhancing reach and customer engagement within the Croatian hotel industry.

Challenges in the Croatia Hospitality Market Market

Long-term growth catalysts for the Croatia hospitality market lie in its strategic positioning and commitment to sustainability. Continued investment in niche tourism segments, such as health and wellness retreats and MICE (Meetings, Incentives, Conferences, and Exhibitions) facilities, will diversify revenue streams. Embracing green tourism practices and obtaining relevant certifications will appeal to environmentally conscious travelers and differentiate Croatian offerings. Strategic partnerships with tour operators and airlines will further enhance accessibility and promotional reach for the Croatia tourism market.

Emerging Opportunities in Croatia Hospitality Market

Emerging opportunities within the Croatia hospitality market are abundant, driven by evolving traveler preferences and technological advancements. There is a significant opportunity to develop and promote boutique and luxury eco-tourism offerings, capitalizing on Croatia's natural beauty and growing demand for sustainable travel. The expansion of digital platforms for personalized travel planning and booking presents a chance for businesses to enhance direct customer engagement. Furthermore, the potential for year-round tourism can be further unlocked through targeted marketing of cultural heritage sites and winter sports, broadening the appeal beyond the traditional summer season in the Croatian hotel industry.

Leading Players in the Croatia Hospitality Market Sector

- Plava Laguna

- Valamar Riviera

- Bluesun H&R

- Amadria Park

- Liburnia Riviera Hoteli

- Meli Hotels International

- Marriott International

- Park Plaza hotels

- Sol Hotels Meli

- Falkensteiner

Key Milestones in Croatia Hospitality Market Industry

- January 2023: Bluesun Hotels & Resorts adopted Shiji's Infrasys point-of-sales (PoS) systems across all their Hotel F&B Outlets, enhancing operational efficiency and guest service.

- January 2022: The Croatian Plava Laguna company spent 2022 strengthening its brand, indicating strategic repositioning and potential future expansion or service enhancements within the Croatia tourism market.

Strategic Outlook for Croatia Hospitality Market Market

The strategic outlook for the Croatia hospitality market is highly positive, with a focus on sustainable growth and diversification. Key accelerators include continued investment in high-quality infrastructure, particularly in underdeveloped regions, and the further development of niche tourism products like adventure and medical tourism. Embracing digital transformation across all aspects of operations, from booking to in-stay experiences, will be crucial for competitiveness. Strategic collaborations with international travel agencies and a strong emphasis on marketing Croatia as a year-round destination will drive future market potential for the Croatian hotel industry.

Croatia Hospitality Market Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Independent Hotels

-

2. Segment

- 2.1. Service Apartments

- 2.2. Budget and Economy Hotels

- 2.3. Mid and Upper mid scale Hotels

- 2.4. Luxury Hotels

Croatia Hospitality Market Segmentation By Geography

- 1. Croatia

Croatia Hospitality Market Regional Market Share

Geographic Coverage of Croatia Hospitality Market

Croatia Hospitality Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Tourism; Digital Adoption

- 3.3. Market Restrains

- 3.3.1. Labour Shortage

- 3.4. Market Trends

- 3.4.1. The European Grown Brands are Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Croatia Hospitality Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Independent Hotels

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Service Apartments

- 5.2.2. Budget and Economy Hotels

- 5.2.3. Mid and Upper mid scale Hotels

- 5.2.4. Luxury Hotels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Croatia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Plava Laguna

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 6 COMPETITVE INTELLIGENCE6 1 Market Concentration Overview6 2 Company profiles

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Meli Hotels International

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Marriott International**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amadria Park

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Valamar Riviera

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bluesun H&R

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Park Plaza hotels

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Liburnia Riviera Hoteli

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sol Hotels Meli

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Falkensteiner

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Plava Laguna

List of Figures

- Figure 1: Croatia Hospitality Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Croatia Hospitality Market Share (%) by Company 2025

List of Tables

- Table 1: Croatia Hospitality Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Croatia Hospitality Market Revenue Million Forecast, by Segment 2020 & 2033

- Table 3: Croatia Hospitality Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Croatia Hospitality Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Croatia Hospitality Market Revenue Million Forecast, by Segment 2020 & 2033

- Table 6: Croatia Hospitality Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Croatia Hospitality Market?

The projected CAGR is approximately 4.56%.

2. Which companies are prominent players in the Croatia Hospitality Market?

Key companies in the market include Plava Laguna, 6 COMPETITVE INTELLIGENCE6 1 Market Concentration Overview6 2 Company profiles, Meli Hotels International, Marriott International**List Not Exhaustive, Amadria Park, Valamar Riviera, Bluesun H&R, Park Plaza hotels, Liburnia Riviera Hoteli, Sol Hotels Meli, Falkensteiner.

3. What are the main segments of the Croatia Hospitality Market?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.56 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Tourism; Digital Adoption.

6. What are the notable trends driving market growth?

The European Grown Brands are Dominating the Market.

7. Are there any restraints impacting market growth?

Labour Shortage.

8. Can you provide examples of recent developments in the market?

January 2023: Bluesun Hotels & Resorts adopted Shiji's Infrasys point-of-sales (PoS) systems across all their Hotel F&B Outlets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Croatia Hospitality Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Croatia Hospitality Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Croatia Hospitality Market?

To stay informed about further developments, trends, and reports in the Croatia Hospitality Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence