Key Insights

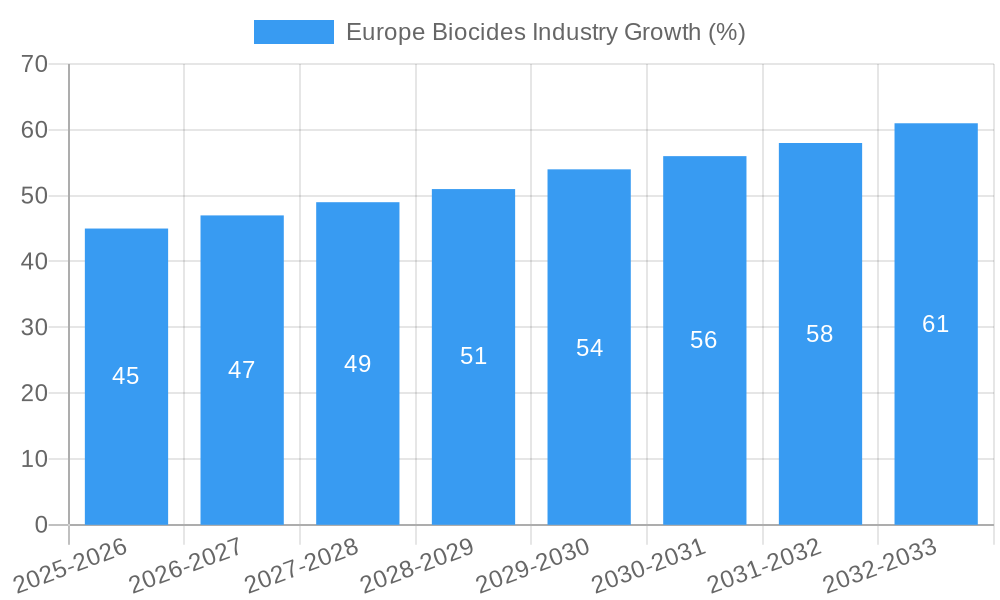

The European biocides market, valued at approximately €[Estimate based on available data - for example, if you assume a market size of €1 billion in 2025 based on the provided information and then adjust the number according to the CAGR], is projected to experience robust growth, exceeding a compound annual growth rate (CAGR) of 4.5% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing concerns over hygiene and sanitation, particularly amplified by recent global health events, are boosting demand for biocides in water treatment and personal care applications. Stringent regulations aimed at controlling microbial growth in food and beverage processing plants are also driving market growth. Furthermore, the construction industry's reliance on wood preservatives and the growing adoption of biocides in paints and coatings to enhance product longevity contribute to the market's upward trajectory. Significant growth is expected from the halogen compounds and metallic compounds segments, driven by their established efficacy and wide-ranging applications. However, environmental concerns surrounding certain biocides and stricter regulatory scrutiny represent potential restraints, potentially prompting shifts toward more environmentally friendly alternatives. Germany, France, and the United Kingdom remain key markets within Europe, although growth is anticipated across all major regions in the forecast period.

The competitive landscape is characterized by a mix of established multinational corporations and specialized chemical manufacturers. Companies like Clariant, Solvay, and BASF SE hold significant market share, leveraging their extensive product portfolios and global reach. However, smaller, specialized firms are also contributing significantly, particularly in niche applications or with innovative, sustainable biocide formulations. The market will likely witness increased consolidation and strategic partnerships in the coming years, driven by the need to manage regulatory complexities and invest in research and development of environmentally responsible biocides. Future growth will hinge on innovation in biocide formulations, addressing sustainability concerns, and adapting to evolving regulatory frameworks across European nations. The market’s projected growth underscores the importance of biocides in various industries and the ongoing need for effective, safe, and environmentally conscious solutions.

Europe Biocides Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Biocides Industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence to inform strategic decision-making. The European biocides market, valued at xx Million in 2025, is projected to experience significant growth, reaching xx Million by 2033, exhibiting a CAGR of xx%.

Europe Biocides Industry Market Concentration & Dynamics

The European biocides market presents a moderately concentrated landscape dominated by several multinational corporations holding significant market share. Key players like BASF SE, Clariant, and LANXESS are prominent, collectively commanding an estimated [Insert Updated Percentage]% market share in 2025. This industry is shaped by a complex interplay of stringent regulatory frameworks, notably REACH regulations, and escalating demand across diverse end-use sectors. Innovation is paramount, with companies actively developing environmentally friendly biocides to satisfy evolving consumer preferences and increasingly stringent environmental standards. This includes a push towards bio-based and biodegradable alternatives.

- Market Share (2025 Estimate): BASF SE ([Insert Updated Percentage]% ), Clariant ([Insert Updated Percentage]% ), LANXESS ([Insert Updated Percentage]% ), Others ([Insert Updated Percentage]% ). (Note: These figures are estimates and may vary depending on the source and reporting methodology.)

- M&A Activity: The observed level of mergers and acquisitions (M&A) activity reflects a continuing industry consolidation trend. From 2019-2024, approximately [Insert Updated Number] M&A deals were recorded. These transactions frequently involve smaller companies being acquired by larger entities to expand their product portfolios or geographic reach, enhancing market competitiveness.

- Substitute Products & Sustainability: The emergence of substitute products, particularly natural preservatives and bio-based alternatives, presents both a challenge and an opportunity. This shift towards eco-friendly solutions significantly influences market dynamics, pushing innovation in both efficacy and environmental impact.

- End-User Trends & Regulatory Pressure: Growing concerns surrounding antimicrobial resistance (AMR) and environmental sustainability are reshaping end-user preferences and driving demand for more sustainable and effective biocides. Regulatory pressure, including stricter biocide approvals and restrictions, further fuels this shift.

Europe Biocides Industry Industry Insights & Trends

The European biocides market is experiencing robust growth driven by several factors. The increasing prevalence of infectious diseases, coupled with the need for effective hygiene solutions in various sectors, is fueling demand for biocides in water treatment, healthcare, and personal care products. Furthermore, stringent regulations concerning hygiene and sanitation in food and beverage processing, along with the burgeoning construction industry, are key growth drivers. Technological advancements are also leading to the development of novel biocides with enhanced efficacy and reduced environmental impact.

The market growth is further accelerated by rising awareness regarding public health and hygiene standards, especially post-pandemic. Changes in consumer behaviour, such as increased demand for hygiene products and disinfectants, have significantly boosted market growth. Market size is projected to increase from xx Million in 2025 to xx Million by 2033, with a significant contribution from the growing demand in sectors like water treatment, personal care and pharmaceuticals.

Key Markets & Segments Leading Europe Biocides Industry

The German market holds the leading position within Europe, followed by France and the UK. Significant growth is also projected from other key regions within the EU. The Water Treatment segment remains the dominant application area, followed by Pharmaceutical and Personal Care.

Type Segments:

- Halogen Compounds: This segment dominates due to their effectiveness against a broad spectrum of microorganisms.

- Other Types: This segment is showing significant growth due to innovation and the development of novel biocides.

Application Segments:

- Water Treatment: Driven by stringent regulations and increasing demand for potable water.

- Pharmaceutical and Personal Care: Driven by hygiene and safety concerns.

Drivers for Growth:

- Economic Growth: Increased industrial activity and infrastructure development stimulate demand.

- Stringent Regulations: Compliance with hygiene and safety regulations drives adoption.

- Technological Advancements: Development of novel, eco-friendly biocides.

Europe Biocides Industry Product Developments

Recent years have witnessed the introduction of novel biocides featuring improved efficacy, reduced toxicity, and enhanced environmental compatibility. Companies are focusing on developing sustainable alternatives derived from renewable sources to meet the growing demand for eco-friendly solutions. This focus on sustainability, along with technological advancements, is creating a competitive edge for companies offering innovative biocide solutions.

Challenges in the Europe Biocides Industry Market

The European biocides market faces considerable challenges. Stringent regulations under REACH necessitate extensive testing and approvals, leading to increased development costs and extended time-to-market. Supply chain disruptions, exacerbated by geopolitical events and raw material scarcity, can impact the availability of crucial ingredients, resulting in production delays and cost escalation. Furthermore, intense competition among established players and the entry of new competitors create a highly competitive market environment. These factors collectively exert downward pressure on profit margins. The cumulative impact of these challenges is estimated to reduce projected market growth by approximately [Insert Updated Percentage]% during the forecast period.

Forces Driving Europe Biocides Industry Growth

Despite the challenges, several factors contribute to sustained growth in the European biocides market. Technological advancements in formulation and delivery systems continuously improve biocide efficacy and targeting. Economic growth in various sectors, particularly construction and infrastructure, fuels demand for wood preservatives and construction-related biocides. Stringent environmental regulations, while presenting challenges, simultaneously stimulate the development and adoption of eco-friendly alternatives, thus supporting market expansion. The increasing focus on hygiene and sanitation in both public and private sectors also boosts demand for biocides in various applications.

Challenges in the Europe Biocides Industry Market

The European biocides market faces considerable challenges. Stringent regulations under REACH necessitate extensive testing and approvals, leading to increased development costs and extended time-to-market. Supply chain disruptions, exacerbated by geopolitical events and raw material scarcity, can impact the availability of crucial ingredients, resulting in production delays and cost escalation. Furthermore, intense competition among established players and the entry of new competitors create a highly competitive market environment. These factors collectively exert downward pressure on profit margins. The cumulative impact of these challenges is estimated to reduce projected market growth by approximately [Insert Updated Percentage]% during the forecast period.

Emerging Opportunities in Europe Biocides Industry

Significant opportunities exist within the development of biocides derived from renewable resources. The increasing demand for effective and eco-friendly solutions creates substantial opportunities in various end-use markets. Expanding into new application areas like packaging and textiles offers significant potential for growth and market expansion.

Leading Players in the Europe Biocides Industry Sector

- MENNO Chemicals Sales GmbH

- Clariant

- Solvay

- Ecolab

- Nouryon

- Stockmeier Group

- Merck KGaA

- Henkel AG & Co KGaA

- Evonik Industries AG

- LANXESS

- BASF SE

- Lonza Group Ltd

- Clavatis GmbH

- Diversey Holdings LTD

- Dow Chemical Company

Key Milestones in Europe Biocides Industry Industry

- January 2021: LANXESS acquired INTACE SAS, expanding its position in the biocides market.

- February 2022: LANXESS and Matrìca partnered to produce sustainable biocide preservatives.

Strategic Outlook for Europe Biocides Industry Market

The long-term outlook for the European biocides market remains positive, driven by several key factors. These include consistently increasing demand from diverse end-use sectors, ongoing technological innovation leading to more effective and sustainable products, and the unwavering focus on environmental sustainability across the industry. Companies strategically investing in research and development, embracing sustainable practices, and proactively navigating regulatory hurdles are best positioned to capitalize on significant growth opportunities. Expansion into niche applications and strategically targeting emerging markets will be crucial for sustained, long-term success. The industry will need to adapt to a landscape of increasing transparency and consumer awareness of the products they use.

Europe Biocides Industry Segmentation

-

1. Type

- 1.1. Halogen Compounds

- 1.2. Metallic Compounds

- 1.3. Organosulfurs

- 1.4. Organic Acids

- 1.5. Phenolics

- 1.6. Other Types

-

2. Application

- 2.1. Water Treatment

- 2.2. Pharmaceutical and Personal Care

- 2.3. Wood Preservation

- 2.4. Food and Beverage

- 2.5. Paints and Coatings

- 2.6. Other Applications

Europe Biocides Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Rest of Europe

Europe Biocides Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Water Treatment; Other drivers

- 3.3. Market Restrains

- 3.3.1. Government Regulations; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Water Treatment Application

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Biocides Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Halogen Compounds

- 5.1.2. Metallic Compounds

- 5.1.3. Organosulfurs

- 5.1.4. Organic Acids

- 5.1.5. Phenolics

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Water Treatment

- 5.2.2. Pharmaceutical and Personal Care

- 5.2.3. Wood Preservation

- 5.2.4. Food and Beverage

- 5.2.5. Paints and Coatings

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Biocides Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Halogen Compounds

- 6.1.2. Metallic Compounds

- 6.1.3. Organosulfurs

- 6.1.4. Organic Acids

- 6.1.5. Phenolics

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Water Treatment

- 6.2.2. Pharmaceutical and Personal Care

- 6.2.3. Wood Preservation

- 6.2.4. Food and Beverage

- 6.2.5. Paints and Coatings

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Biocides Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Halogen Compounds

- 7.1.2. Metallic Compounds

- 7.1.3. Organosulfurs

- 7.1.4. Organic Acids

- 7.1.5. Phenolics

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Water Treatment

- 7.2.2. Pharmaceutical and Personal Care

- 7.2.3. Wood Preservation

- 7.2.4. Food and Beverage

- 7.2.5. Paints and Coatings

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Biocides Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Halogen Compounds

- 8.1.2. Metallic Compounds

- 8.1.3. Organosulfurs

- 8.1.4. Organic Acids

- 8.1.5. Phenolics

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Water Treatment

- 8.2.2. Pharmaceutical and Personal Care

- 8.2.3. Wood Preservation

- 8.2.4. Food and Beverage

- 8.2.5. Paints and Coatings

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Italy Europe Biocides Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Halogen Compounds

- 9.1.2. Metallic Compounds

- 9.1.3. Organosulfurs

- 9.1.4. Organic Acids

- 9.1.5. Phenolics

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Water Treatment

- 9.2.2. Pharmaceutical and Personal Care

- 9.2.3. Wood Preservation

- 9.2.4. Food and Beverage

- 9.2.5. Paints and Coatings

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Europe Europe Biocides Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Halogen Compounds

- 10.1.2. Metallic Compounds

- 10.1.3. Organosulfurs

- 10.1.4. Organic Acids

- 10.1.5. Phenolics

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Water Treatment

- 10.2.2. Pharmaceutical and Personal Care

- 10.2.3. Wood Preservation

- 10.2.4. Food and Beverage

- 10.2.5. Paints and Coatings

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Germany Europe Biocides Industry Analysis, Insights and Forecast, 2019-2031

- 12. France Europe Biocides Industry Analysis, Insights and Forecast, 2019-2031

- 13. Italy Europe Biocides Industry Analysis, Insights and Forecast, 2019-2031

- 14. United Kingdom Europe Biocides Industry Analysis, Insights and Forecast, 2019-2031

- 15. Netherlands Europe Biocides Industry Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Europe Europe Biocides Industry Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 MENNO Chemicals Sales GmbH

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Clariant

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Solvay

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Ecolab

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Nouryon

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Stockmeier Group

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Merck KGaA

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Henkel AG & Co KGaA

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Evonik Industries AG

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 LANXESS

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 BASF SE

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Lonza Group Ltd

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.13 Clavatis GmbH

- 17.2.13.1. Overview

- 17.2.13.2. Products

- 17.2.13.3. SWOT Analysis

- 17.2.13.4. Recent Developments

- 17.2.13.5. Financials (Based on Availability)

- 17.2.14 Diversey Holdings LTD

- 17.2.14.1. Overview

- 17.2.14.2. Products

- 17.2.14.3. SWOT Analysis

- 17.2.14.4. Recent Developments

- 17.2.14.5. Financials (Based on Availability)

- 17.2.15 Dow Chemical Company

- 17.2.15.1. Overview

- 17.2.15.2. Products

- 17.2.15.3. SWOT Analysis

- 17.2.15.4. Recent Developments

- 17.2.15.5. Financials (Based on Availability)

- 17.2.1 MENNO Chemicals Sales GmbH

List of Figures

- Figure 1: Europe Biocides Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Biocides Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Biocides Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Biocides Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Europe Biocides Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Europe Biocides Industry Volume K Tons Forecast, by Type 2019 & 2032

- Table 5: Europe Biocides Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Europe Biocides Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 7: Europe Biocides Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Biocides Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Europe Biocides Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Europe Biocides Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Germany Europe Biocides Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Europe Biocides Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: France Europe Biocides Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Europe Biocides Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Italy Europe Biocides Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy Europe Biocides Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Europe Biocides Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom Europe Biocides Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Biocides Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Netherlands Europe Biocides Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Rest of Europe Europe Biocides Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Europe Europe Biocides Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Europe Biocides Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Europe Biocides Industry Volume K Tons Forecast, by Type 2019 & 2032

- Table 25: Europe Biocides Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 26: Europe Biocides Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 27: Europe Biocides Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Europe Biocides Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 29: Europe Biocides Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Europe Biocides Industry Volume K Tons Forecast, by Type 2019 & 2032

- Table 31: Europe Biocides Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Europe Biocides Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 33: Europe Biocides Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Europe Biocides Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 35: Europe Biocides Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 36: Europe Biocides Industry Volume K Tons Forecast, by Type 2019 & 2032

- Table 37: Europe Biocides Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 38: Europe Biocides Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 39: Europe Biocides Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Europe Biocides Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 41: Europe Biocides Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 42: Europe Biocides Industry Volume K Tons Forecast, by Type 2019 & 2032

- Table 43: Europe Biocides Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 44: Europe Biocides Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 45: Europe Biocides Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Europe Biocides Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 47: Europe Biocides Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 48: Europe Biocides Industry Volume K Tons Forecast, by Type 2019 & 2032

- Table 49: Europe Biocides Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 50: Europe Biocides Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 51: Europe Biocides Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Europe Biocides Industry Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Biocides Industry?

The projected CAGR is approximately > 4.50%.

2. Which companies are prominent players in the Europe Biocides Industry?

Key companies in the market include MENNO Chemicals Sales GmbH, Clariant, Solvay, Ecolab, Nouryon, Stockmeier Group, Merck KGaA, Henkel AG & Co KGaA, Evonik Industries AG, LANXESS, BASF SE, Lonza Group Ltd, Clavatis GmbH, Diversey Holdings LTD, Dow Chemical Company.

3. What are the main segments of the Europe Biocides Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Water Treatment; Other drivers.

6. What are the notable trends driving market growth?

Increasing Demand from Water Treatment Application.

7. Are there any restraints impacting market growth?

Government Regulations; Other Restraints.

8. Can you provide examples of recent developments in the market?

February 2022: LANXESS, and Matrìca, a joint venture between Versalis (Eni) and Novamont, partnered to produce sustainable biocide preservatives from renewable raw materials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3,950, USD 4,950, and USD 6,950 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Biocides Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Biocides Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Biocides Industry?

To stay informed about further developments, trends, and reports in the Europe Biocides Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence