Key Insights

The India office furniture market, valued at approximately ₹X billion (estimated based on provided CAGR and market size data, assuming a reasonable starting point for 2019) in 2025, is experiencing robust growth, exceeding a 10% Compound Annual Growth Rate (CAGR). This expansion is fueled by several key drivers. A burgeoning IT sector and a growing number of startups are significantly increasing demand for modern and ergonomic office furniture. The rise of co-working spaces and flexible work arrangements also contributes to this growth, creating a need for adaptable and easily reconfigurable furniture solutions. Furthermore, increasing disposable incomes and a shift towards professional work environments are driving consumer preference for higher-quality, aesthetically pleasing office furniture. The market is segmented by material (wood, metal, plastics, others), product type (seating, storage, workstations, tables, accessories), and distribution channel (offline, online). The strong presence of both established multinational companies like Herman Miller and Teknion, and domestic players such as Nilkamal and Godrej Interio, indicates a competitive landscape with opportunities for both established and emerging brands. Regional variations exist, with growth potentially higher in rapidly developing metropolitan areas across the nation.

However, certain restraints might impact growth. Fluctuations in raw material prices, particularly wood and metal, can affect production costs and profitability. Economic downturns could also lead to reduced investment in office furniture. Furthermore, increasing environmental concerns are prompting a need for sustainable and eco-friendly materials and manufacturing processes, placing pressure on manufacturers to adapt. Competition is intense, requiring companies to continuously innovate and offer value-added services, particularly in the online retail space, to maintain market share. The forecast for 2025-2033 projects continued market expansion, with opportunities for growth across all segments, particularly in the adoption of smart office furniture technologies and increased demand for customized solutions. The continued growth of India's economy and the ongoing shift towards modern office spaces indicate a positive long-term outlook for the industry.

India Office Furniture Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the India office furniture market, offering valuable insights for stakeholders including manufacturers, investors, and industry professionals. Covering the period from 2019 to 2033, with a base year of 2025, this report forecasts market trends and growth opportunities. The analysis encompasses key segments including seating, storage, workstations, and tables, across various materials like wood, metal, and plastic, and distribution channels (offline and online). Leading players like Teknion, Nilkamal, Usha Furniture, Durian, and Spacewood Office Solutions are profiled, alongside an examination of market dynamics and emerging trends. Download now to gain a competitive edge!

India Office Furniture Industry Market Concentration & Dynamics

The Indian office furniture market exhibits a moderately concentrated landscape, with a few dominant players commanding significant market share. Nilkamal and Godrej Interio, for instance, hold a substantial portion of the market, while several smaller players cater to niche segments. The market is characterized by an increasingly competitive environment with a mix of domestic and international players. The level of innovation varies across segments; for instance, workstation design incorporates technological advancements while seating solutions focus on ergonomic improvements. The regulatory framework largely focuses on safety and quality standards. Substitute products include repurposed home furniture or co-working spaces, though these present limited competition to dedicated office furniture.

- Market Share: Nilkamal and Godrej Interio (Combined): xx% ; Others: xx%

- M&A Activity: A total of xx M&A deals were recorded during the historical period (2019-2024), primarily focused on smaller companies being acquired by larger entities to expand market reach and product portfolios.

- End-User Trends: A shift towards hybrid work models is driving demand for adaptable and flexible furniture solutions. Growing emphasis on employee well-being fuels interest in ergonomic furniture.

- Innovation Ecosystem: Collaboration between furniture manufacturers and technology companies is resulting in smart office solutions incorporating IoT and automation.

India Office Furniture Industry Insights & Trends

The Indian office furniture market is experiencing robust growth, driven by factors such as rising urbanization, a growing economy, and increasing office spaces. The market size in 2025 is estimated at INR xx Million, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions are evident in the form of smart office furniture solutions that incorporate technology for enhanced functionality and efficiency. Evolving consumer behaviors reflect a preference for sustainable and ergonomic products, which are influencing product design and material choices. The increasing adoption of co-working spaces is also shaping the demand for flexible and adaptable furniture solutions. Furthermore, the government's emphasis on infrastructure development indirectly boosts the market.

Key Markets & Segments Leading India Office Furniture Industry

The office furniture market in India is largely driven by metropolitan areas such as Mumbai, Delhi, Bengaluru, and Chennai, reflecting the concentration of commercial activities. Within segments, the seating segment (office chairs, guest chairs, etc.) commands the largest market share, followed by workstations and storage units.

Key Growth Drivers:

- Economic Growth: A robust GDP growth rate fuels expansion across all segments.

- Infrastructure Development: Government initiatives focusing on infrastructure and smart cities boost commercial real estate development and, in turn, the demand for office furniture.

- Urbanization: The migration of population from rural to urban areas fuels the demand for housing and commercial spaces, including offices.

Segment Dominance:

- By Material: Wood remains the most preferred material, followed by metal and plastic.

- By Product: The seating segment continues to hold the largest share, driven by the demand for ergonomic chairs and guest seating.

- By Distribution Channel: Offline channels such as dealers and distributors still dominate the market, although online sales are steadily gaining traction.

India Office Furniture Industry Product Developments

Significant product innovations are occurring in the Indian office furniture market, driven by technology and consumer preferences. Manufacturers are increasingly adopting smart technologies, such as IoT-enabled furniture and modular designs that enhance flexibility and adaptability. Ergonomic designs emphasizing employee well-being are becoming increasingly prominent. New materials are being introduced that are both sustainable and durable, adding to the competitive edge in the marketplace.

Challenges in the India Office Furniture Industry Market

The Indian office furniture market faces challenges such as fluctuations in raw material prices, increasing competition, and supply chain disruptions. Regulatory compliance related to safety and environmental standards also poses difficulties for manufacturers. Furthermore, the rising cost of logistics can impact profitability, and intense competition from both domestic and international brands puts downward pressure on pricing. These factors collectively result in a projected overall impact of xx% reduction in profit margins over the next 5 years.

Forces Driving India Office Furniture Industry Growth

Several factors contribute to the growth of the India office furniture market. Technological advancements, particularly in ergonomics and smart office solutions, create new product categories and drive demand. Government initiatives supporting infrastructure and smart cities propel growth in commercial real estate and, consequently, office furniture needs. Economic growth translates into increased disposable income and corporate spending, fueling investments in office spaces and furnishings. Furthermore, the rising popularity of co-working spaces further contributes to market expansion.

Long-Term Growth Catalysts in the India Office Furniture Industry

Long-term growth hinges on continuous innovation, strategic partnerships, and expansion into new markets. Focusing on sustainable and eco-friendly products will be key, as will exploring untapped markets such as smaller towns and cities. The development of customized and modular furniture solutions caters to the evolving needs of the modern workplace. Collaborative ventures with technology companies can lead to the creation of innovative smart office furniture, fostering market expansion.

Emerging Opportunities in India Office Furniture Industry

Emerging trends such as the increasing demand for flexible workspaces and the rising adoption of smart office technology present significant opportunities. The growing focus on sustainable and ergonomic furniture creates a niche for eco-conscious manufacturers. Expanding into untapped regional markets and targeting the SME segment can offer lucrative growth potential. The development of specialized furniture for particular industries, such as healthcare or education, could also unlock new market segments.

Leading Players in the India Office Furniture Industry Sector

- Teknion

- Nilkamal

- Usha Furniture

- Durian

- Spacewood Office Solutions

- Herman Miller

- AFC Furniture Solutions

- Stellar Furniture

- Wipro Furniture

- FeatherLite

- Indo Innovations

- Boss Cabin

- Damro

- Sentiment Furniture Systems India

Key Milestones in India Office Furniture Industry Industry

- 2020: Increased demand for home office furniture due to the pandemic.

- 2021: Several companies launched new product lines focusing on ergonomic designs and smart office solutions.

- 2022: A notable increase in M&A activity among smaller players.

- 2023: Growing adoption of sustainable and eco-friendly materials by major manufacturers.

- 2024: Significant investment in enhancing online sales channels.

Strategic Outlook for India Office Furniture Industry Market

The India office furniture market is poised for sustained growth, driven by economic expansion, urbanization, and technological advancements. Strategic opportunities lie in focusing on innovation, sustainability, and expanding into new markets. Companies that successfully adapt to changing consumer preferences and embrace technology will gain a competitive edge. The long-term outlook remains positive, with significant potential for growth and expansion within the sector.

India Office Furniture Industry Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Plastics

- 1.4. Others

-

2. Products

- 2.1. Seating

- 2.2. Storage Units (Bins & Shelves, Cabinets, Others)

- 2.3. Workstat

- 2.4. Tables (

- 2.5. Other Accessories

-

3. Distribution Channel

- 3.1. Offline

- 3.2. Online

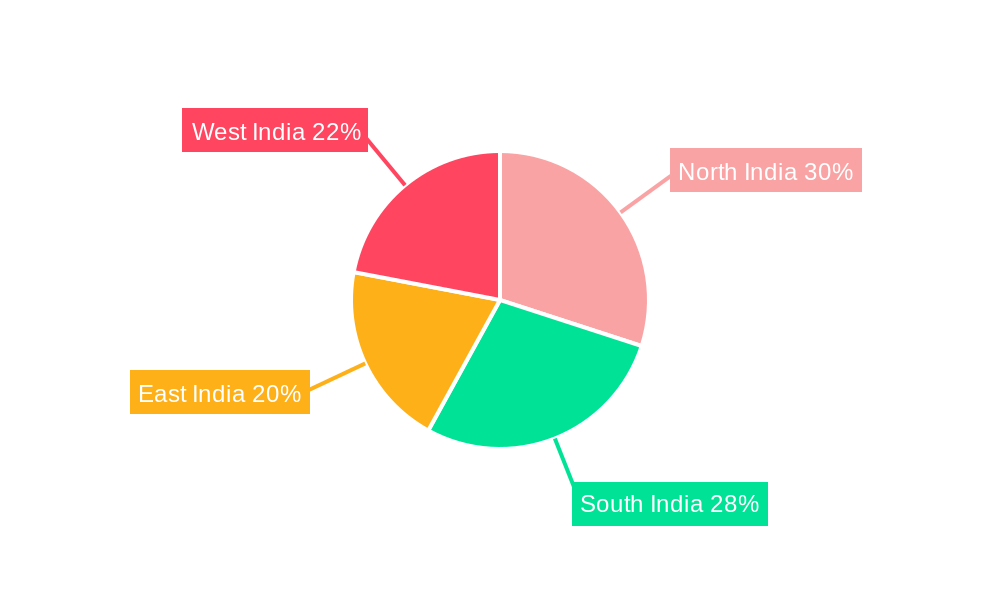

India Office Furniture Industry Segmentation By Geography

- 1. India

India Office Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Comfort and Convenience; Growing Awareness of Energy Efficiency

- 3.3. Market Restrains

- 3.3.1. Seasonal Demand Fluctuations; Safety Concerns Related to Overheating or Electrical Malfunctions

- 3.4. Market Trends

- 3.4.1. Increase in The Number of Office Furniture Imports

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Plastics

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Products

- 5.2.1. Seating

- 5.2.2. Storage Units (Bins & Shelves, Cabinets, Others)

- 5.2.3. Workstat

- 5.2.4. Tables (

- 5.2.5. Other Accessories

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline

- 5.3.2. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North India India Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Teknion

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Nilkamal

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Usha Furniture

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Durian

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Spacewood Office Solutions*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Herman Miller

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 AFC Furniture Solutions

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Stellar Furniture

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Wipro Furniture

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 FeatherLite

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Indo Innovations

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Boss Cabin

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Damro

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Sentiment Furniture Systems India

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 Teknion

List of Figures

- Figure 1: India Office Furniture Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Office Furniture Industry Share (%) by Company 2024

List of Tables

- Table 1: India Office Furniture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Office Furniture Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 3: India Office Furniture Industry Revenue Million Forecast, by Products 2019 & 2032

- Table 4: India Office Furniture Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: India Office Furniture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Office Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North India India Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South India India Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: East India India Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West India India Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Office Furniture Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 12: India Office Furniture Industry Revenue Million Forecast, by Products 2019 & 2032

- Table 13: India Office Furniture Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: India Office Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Office Furniture Industry?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the India Office Furniture Industry?

Key companies in the market include Teknion, Nilkamal, Usha Furniture, Durian, Spacewood Office Solutions*List Not Exhaustive, Herman Miller, AFC Furniture Solutions, Stellar Furniture, Wipro Furniture, FeatherLite, Indo Innovations, Boss Cabin, Damro, Sentiment Furniture Systems India.

3. What are the main segments of the India Office Furniture Industry?

The market segments include Material, Products, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Comfort and Convenience; Growing Awareness of Energy Efficiency.

6. What are the notable trends driving market growth?

Increase in The Number of Office Furniture Imports.

7. Are there any restraints impacting market growth?

Seasonal Demand Fluctuations; Safety Concerns Related to Overheating or Electrical Malfunctions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Office Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Office Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Office Furniture Industry?

To stay informed about further developments, trends, and reports in the India Office Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence