Key Insights

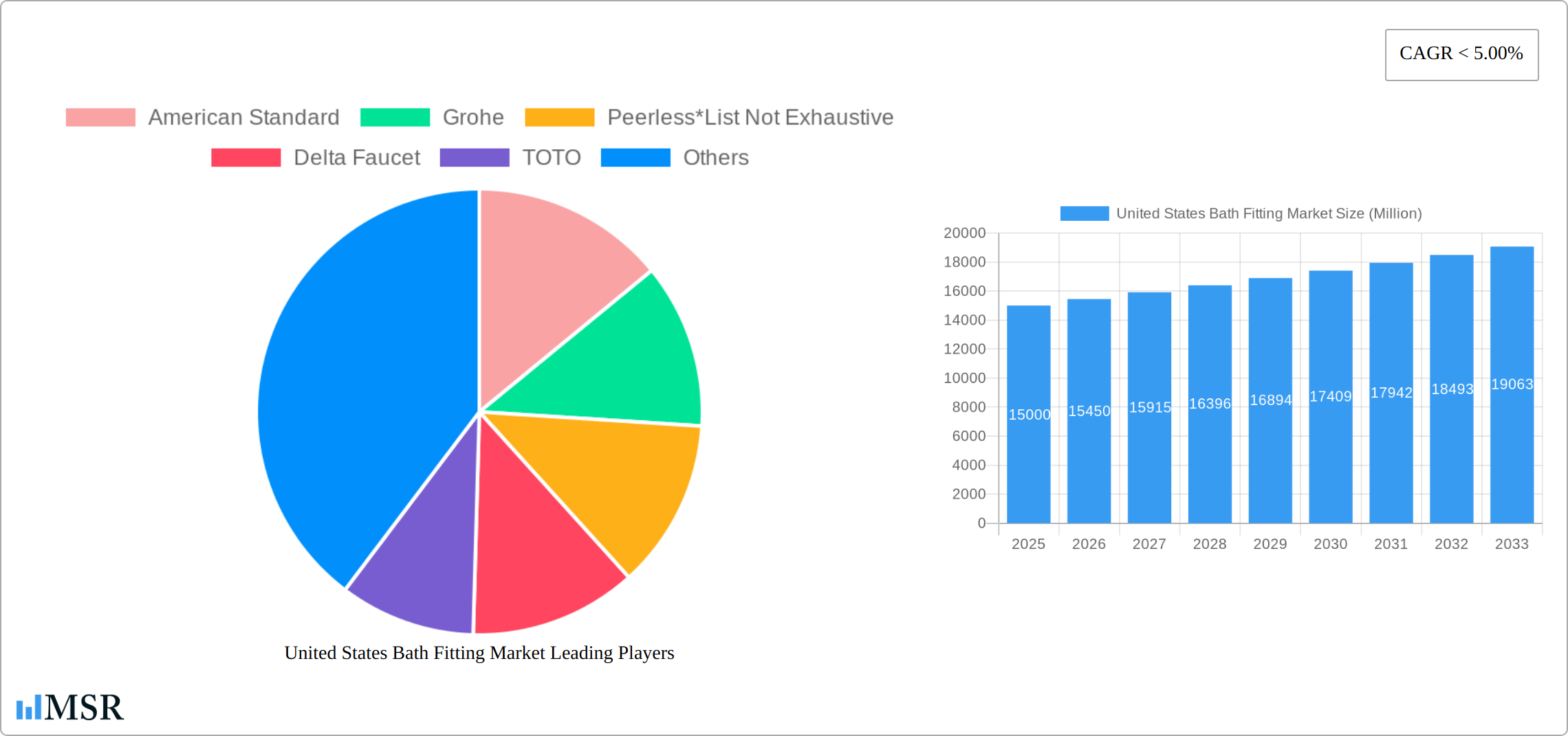

The United States bath fitting market, including faucets, showerheads, tubs, and accessories, is projected to reach $22.53 billion by 2025, exhibiting a CAGR of 4.7% from 2025 to 2033. This robust growth is driven by increasing disposable incomes, a strong focus on home improvement and bathroom renovations, and rising demand for sophisticated and aesthetically pleasing fixtures. Technological advancements, such as smart bathroom solutions and water-efficient designs, alongside the growing trend of aging-in-place renovations, further bolster market expansion. New construction and ongoing remodeling activities are expected to sustain this upward trajectory, fueled by continuous improvements in design, functionality, and material innovation.

United States Bath Fitting Market Market Size (In Billion)

The forecast period of 2025-2033 anticipates sustained market expansion, with key drivers including elevated construction activity, particularly in multi-family housing, persistent home renovation trends, and the growing adoption of sustainable and eco-friendly bath fittings. Stringent building codes and a heightened emphasis on water conservation will continue to stimulate demand for low-flow fixtures. Intense market competition among established brands and new entrants is expected, with innovation, strategic alliances, and focused marketing efforts shaping market dynamics. While regional variations exist, consistent growth is anticipated across the US market.

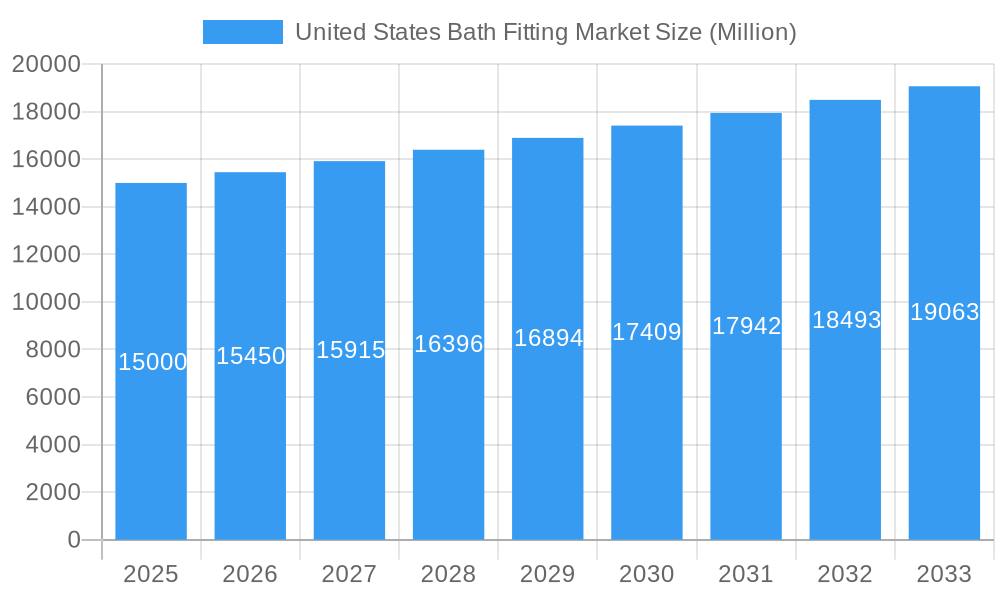

United States Bath Fitting Market Company Market Share

United States Bath Fitting Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the United States bath fitting market, offering crucial insights for stakeholders, investors, and industry professionals. The study covers the period from 2019 to 2033, with a focus on the estimated year 2025 and a forecast period spanning 2025-2033. The report segments the market by product type (faucets, showers, bathtubs, shower enclosures, and other products), distribution channel (multi-brand stores, exclusive stores, online stores, and other channels), and end-user (residential and commercial). Key players like American Standard, Grohe, Peerless, Delta Faucet, TOTO, Kohler, Kraus, and Pfister are analyzed, providing a holistic view of this dynamic market valued at xx Million in 2025.

United States Bath Fitting Market Market Concentration & Dynamics

The US bath fitting market presents a moderately concentrated landscape, dominated by a few key players who collectively hold a substantial market share. American Standard, Kohler, and Delta Faucet are prominent examples, commanding an estimated [Insert precise percentage]% of the market in 2025. However, the competitive intensity is heightened by the presence of numerous smaller players and regional brands. Market dynamics are shaped by a robust innovation ecosystem fueled by continuous investment in water-saving technologies, seamless smart home integration, and aesthetically superior designs. Regulatory frameworks, notably water efficiency standards like WaterSense, significantly influence product development and overall market behavior. The emergence of substitute products, including rainfall showerheads and advanced shower systems, is impacting market segmentation. End-user trends reflect a growing preference for luxury and sustainable products, driven by increased disposable incomes and a heightened awareness of environmental concerns. While merger and acquisition (M&A) activity has been moderate in recent years, with approximately [Insert precise number] deals recorded between 2019 and 2024, these activities primarily focused on strengthening distribution networks and expanding product portfolios to enhance market reach and competitiveness.

- Market Share (2025): Top 3 players: [Insert precise percentage]%

- M&A Deal Count (2019-2024): [Insert precise number]

- Key Innovation Areas: Water efficiency, smart home integration, design aesthetics, sustainable materials.

- Regulatory Influence: WaterSense certification, building codes, California's Title 20.

United States Bath Fitting Market Industry Insights & Trends

The US bath fitting market is demonstrating robust growth, propelled by several key factors. The market size is estimated at [Insert precise figure] Million USD in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of [Insert precise percentage]% during the projected period (2025-2033). Rising disposable incomes, particularly within the residential sector, are a primary growth driver, stimulating demand for higher-quality and technologically advanced bathroom fixtures. Technological advancements, such as the integration of smart functionalities and water-saving technologies, are reshaping consumer preferences and driving innovation. Evolving consumer behaviors clearly indicate a shift towards sustainable and eco-friendly products, alongside a preference for customized and personalized bathroom designs. The expanding presence of online retail channels has also significantly contributed to market growth, providing consumers with a wider selection and competitive pricing. Furthermore, the ongoing renovation and new construction activities in both residential and commercial sectors are providing sustained demand for bath fittings.

Key Markets & Segments Leading United States Bath Fitting Market

The residential segment decisively dominates the US bath fitting market, accounting for an estimated [Insert precise percentage]% of the total market value in 2025. This dominance is fueled by rising homeownership rates, increasing household incomes, and a growing preference for home improvement and renovation projects. The faucets segment leads in terms of product type, due to its ubiquitous presence in nearly every bathroom. Online stores are experiencing rapid growth as a distribution channel, driven by the convenience and broad reach offered by e-commerce platforms. Growth in the commercial sector is also being driven by an increase in hospitality and healthcare construction and renovation.

Key Drivers by Segment:

- Residential: Rising disposable incomes, home renovation trends, new construction activities, smart home adoption.

- Commercial: Hotel renovations, new commercial construction projects, healthcare facility upgrades.

- Faucets: High demand, ease of installation and affordability compared to other products, diverse design options.

- Online Stores: Convenience, wider selection, competitive pricing, improved customer reviews and ratings.

Dominance Analysis:

The residential segment's substantial market share underscores the critical importance of targeting homeowners through well-defined marketing strategies and innovative product development. The strong performance of online stores highlights the growing influence of digital channels within the bath fitting market, necessitating a robust online presence for businesses to thrive.

United States Bath Fitting Market Product Developments

Recent product developments in the US bath fitting market showcase a strong emphasis on water conservation, smart technology integration, and enhanced design aesthetics. Manufacturers are introducing water-efficient faucets and showerheads that comply with stringent water conservation regulations, while simultaneously offering innovative features such as touchless operation and digital temperature control. The integration of smart home technology allows users to control bath fittings remotely via smartphone apps, further enhancing convenience and user experience. The focus on sustainable materials and manufacturing processes is also gaining traction as consumers increasingly demand environmentally friendly products.

Challenges in the United States Bath Fitting Market Market

The US bath fitting market faces several challenges, including fluctuations in raw material prices, which impact manufacturing costs and profitability. Supply chain disruptions caused by global events and logistical challenges have also affected product availability and delivery times. Intense competition from both domestic and international manufacturers necessitates continuous innovation and strategic pricing to maintain market share. Furthermore, stringent regulatory compliance requirements and evolving consumer preferences can present hurdles for businesses. These factors collectively contribute to an unpredictable business environment.

Forces Driving United States Bath Fitting Market Growth

Several factors are driving the growth of the US bath fitting market, including increasing disposable incomes leading to higher spending on home improvement and new construction projects. Government initiatives promoting water conservation stimulate demand for water-efficient products. Technological advancements, such as smart home integration and water-saving features, enhance consumer appeal and drive market expansion. Finally, the growing popularity of online retail channels expands market access and consumer reach.

Challenges in the United States Bath Fitting Market Market

Long-term growth catalysts include strategic partnerships between manufacturers and distributors to optimize supply chains and distribution networks, fostering innovation through R&D investments in water-saving technologies, smart features, and sustainable materials, and expansion into new market segments, such as the hospitality industry, by developing specialized products.

Emerging Opportunities in United States Bath Fitting Market

Emerging opportunities lie in the growing adoption of smart home technology, the rising demand for sustainable and eco-friendly products, and the expansion of online retail channels. The market shows potential for growth in specialized product segments, such as accessible bathroom fittings for aging populations. Furthermore, customization options and personalized bathroom design solutions are gaining traction, creating further opportunities for manufacturers.

Leading Players in the United States Bath Fitting Market Sector

- American Standard

- Grohe

- Peerless

- Delta Faucet

- TOTO

- Kohler

- Kraus

- Pfister

Key Milestones in United States Bath Fitting Market Industry

- 2020: Introduction of new water-saving technologies by major manufacturers.

- 2021: Increased adoption of online retail channels and contactless purchasing.

- 2022: Growing emphasis on sustainable and eco-friendly product development and marketing.

- 2023: Launch of smart home integrated bath fitting systems with enhanced voice control and app integration.

- 2024: Significant M&A activity consolidating the market and driving innovation.

Strategic Outlook for United States Bath Fitting Market Market

The US bath fitting market presents a significant growth opportunity for manufacturers focusing on innovation, sustainability, and digitalization. Future market potential is driven by increasing urbanization, rising homeownership rates, and continued focus on improving home aesthetics and comfort. Strategic opportunities lie in expanding product portfolios to include smart and sustainable options, enhancing online presence and customer engagement, and establishing strong distribution networks to reach a wider consumer base.

United States Bath Fitting Market Segmentation

-

1. Product

- 1.1. Faucets

- 1.2. Showers

- 1.3. Bathtubs

- 1.4. Showers Enclosures

- 1.5. Other Product Types

-

2. Distribution Channel

- 2.1. Multi- brand Stores

- 2.2. Exclusive Store

- 2.3. Online Stores

- 2.4. Other Distribution Channels

-

3. End Users

- 3.1. Residential

- 3.2. Commercial

United States Bath Fitting Market Segmentation By Geography

- 1. United States

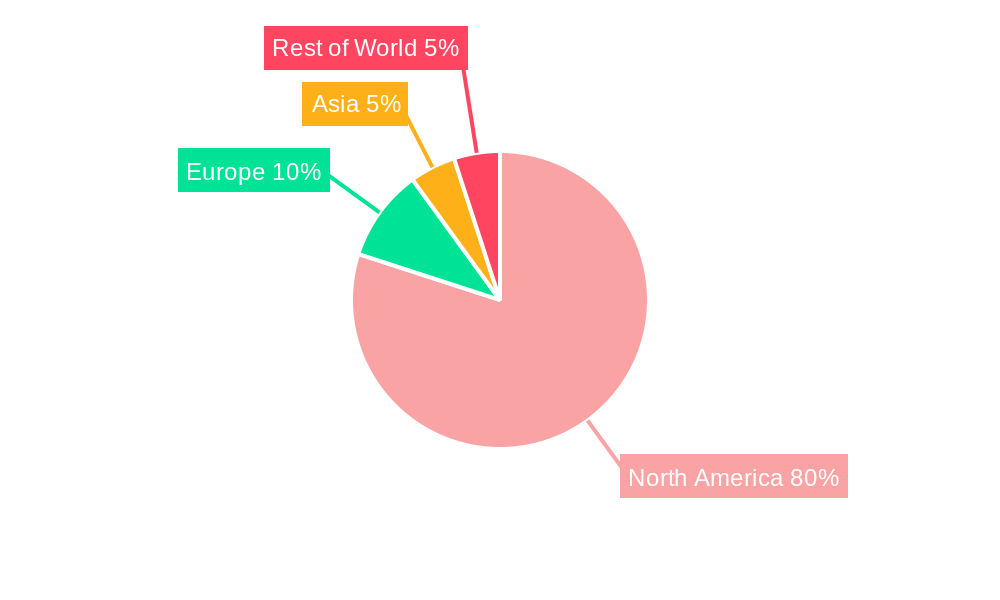

United States Bath Fitting Market Regional Market Share

Geographic Coverage of United States Bath Fitting Market

United States Bath Fitting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Convenient Kitchen Appliances

- 3.3. Market Restrains

- 3.3.1. Preference for Traditional Manual Methods of Food Preparation

- 3.4. Market Trends

- 3.4.1. Rising Urbanization And Construction Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Bath Fitting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Faucets

- 5.1.2. Showers

- 5.1.3. Bathtubs

- 5.1.4. Showers Enclosures

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Multi- brand Stores

- 5.2.2. Exclusive Store

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by End Users

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 American Standard

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Grohe

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Peerless*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Delta Faucet

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TOTO

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kohler

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kraus

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pfister

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 American Standard

List of Figures

- Figure 1: United States Bath Fitting Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Bath Fitting Market Share (%) by Company 2025

List of Tables

- Table 1: United States Bath Fitting Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: United States Bath Fitting Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: United States Bath Fitting Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 4: United States Bath Fitting Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United States Bath Fitting Market Revenue billion Forecast, by Product 2020 & 2033

- Table 6: United States Bath Fitting Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: United States Bath Fitting Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 8: United States Bath Fitting Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Bath Fitting Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the United States Bath Fitting Market?

Key companies in the market include American Standard, Grohe, Peerless*List Not Exhaustive, Delta Faucet, TOTO, Kohler, Kraus, Pfister.

3. What are the main segments of the United States Bath Fitting Market?

The market segments include Product, Distribution Channel, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.53 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Convenient Kitchen Appliances.

6. What are the notable trends driving market growth?

Rising Urbanization And Construction Activities.

7. Are there any restraints impacting market growth?

Preference for Traditional Manual Methods of Food Preparation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Bath Fitting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Bath Fitting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Bath Fitting Market?

To stay informed about further developments, trends, and reports in the United States Bath Fitting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence