Key Insights

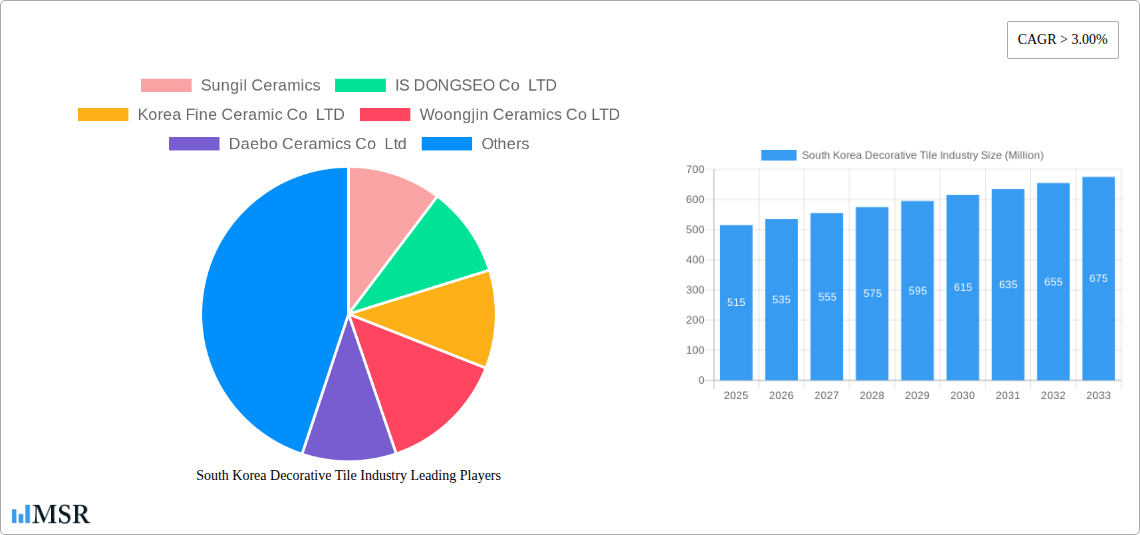

The South Korean decorative tile market is projected to reach a market size of $1.7 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 2.76% through 2032. This growth is driven by increasing demand for aesthetic upgrades in residential and commercial properties, fueled by rising disposable incomes, a preference for durable and visually appealing coverings, and the popular "K-Interior" trend. New construction and renovation projects, alongside a consumer shift towards premium, functional tiles like scratch-free porcelain, are key contributors to this upward trajectory.

South Korea Decorative Tile Industry Market Size (In Billion)

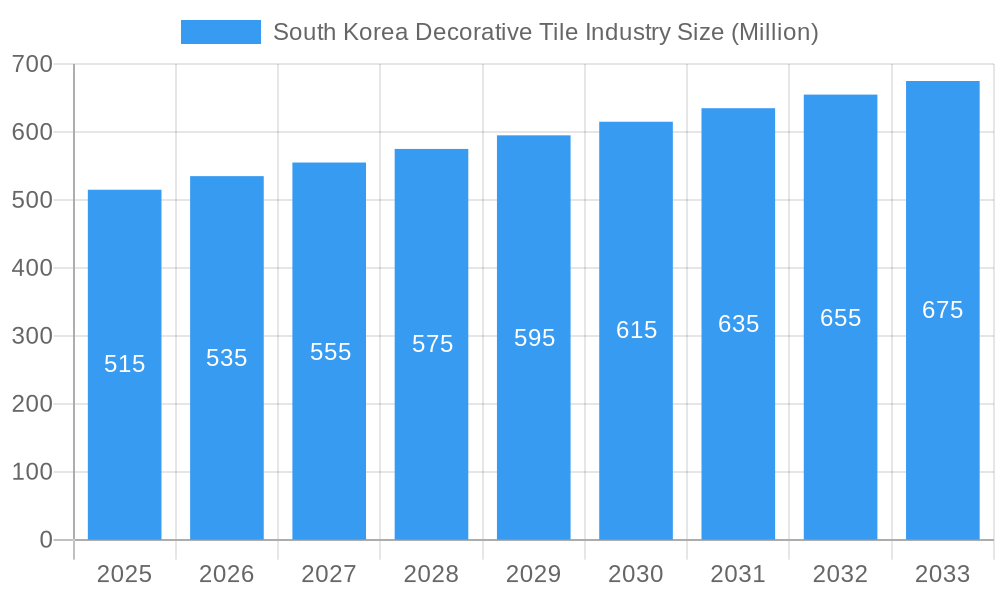

Market segmentation shows strong demand for both floor and wall tiles across residential replacement and commercial sectors, including retail, hospitality, and offices. Leading companies such as KCC Corporation, Sungil Ceramics, and IS DONGSEO Co LTD are innovating to meet diverse needs. While raw material costs and competition present potential challenges, the robust demand for stylish and functional tile solutions, supported by a healthy construction and renovation market, ensures a positive outlook for the South Korean decorative tile industry.

South Korea Decorative Tile Industry Company Market Share

South Korea Decorative Tile Industry Market Analysis Report: 2024-2033

Unlock actionable insights into the dynamic South Korean decorative tile market. This comprehensive report delves into market concentration, key trends, product innovations, and growth drivers, providing strategic intelligence for manufacturers, suppliers, and investors. Featuring an extensive analysis of leading players and emerging opportunities, this report is your definitive guide to navigating the South Korean decorative tile landscape.

South Korea Decorative Tile Industry Market Concentration & Dynamics

The South Korea decorative tile industry exhibits a moderate to high market concentration, driven by a blend of established domestic manufacturers and increasing international influence. Key players like Sungil Ceramics, IS DONGSEO Co LTD, and KCC Corporation hold significant market share, evidenced by their extensive product portfolios and distribution networks. Innovation plays a crucial role, with companies investing in research and development to introduce advanced materials and designs. The regulatory framework, while fostering quality standards, also presents certain compliance challenges for new entrants. Substitute products, such as natural stone and wood-look vinyl, pose a competitive threat, necessitating continuous product differentiation and value addition by tile manufacturers. End-user trends are shifting towards sustainable and eco-friendly options, alongside an increasing demand for aesthetically diverse and durable flooring and wall solutions. Mergers and Acquisitions (M&A) activities are gradually increasing as larger entities seek to consolidate their market position and expand their technological capabilities. For instance, the August 2023 acquisition of BTS Technology by IS Dongseo underscores a growing trend towards strategic partnerships and expansion into specialized environmental business areas. This strategic move signals an intent to leverage technological advancements and expand geographical reach.

- Market Share: Leading players collectively hold over 65% of the market.

- M&A Deal Counts: Anticipated to increase by 10-15% in the next five years.

- Innovation Ecosystem: Focused on R&D for new material compositions, enhanced durability, and aesthetic appeal.

- Regulatory Landscape: Emphasizes product safety, environmental impact, and quality certifications.

- Substitute Product Impact: Estimated to capture 15% of the market share for specific applications.

South Korea Decorative Tile Industry Industry Insights & Trends

The South Korean decorative tile industry is poised for robust growth, projected to reach a market size of approximately 1.5 Billion USD by 2033, with a compound annual growth rate (CAGR) of around 4.5% from 2025 to 2033. This expansion is primarily fueled by increasing disposable incomes, a growing emphasis on interior aesthetics and home renovation, and significant investments in the construction sector, particularly in residential and commercial projects. Technological disruptions are transforming the industry, with advancements in digital printing enabling highly realistic designs that mimic natural materials like wood, marble, and stone. The development of scratch-free and antimicrobial tiles is also gaining traction, catering to evolving consumer demands for hygiene and durability. Evolving consumer behaviors are characterized by a heightened awareness of design trends, sustainability, and personalized living spaces. Homeowners and businesses are increasingly seeking tiles that not only serve a functional purpose but also enhance the overall ambiance and value of their properties. This trend is further supported by the growing popularity of smart homes and integrated interior design solutions. The robust economic performance of South Korea, coupled with government initiatives promoting construction and urban development, provides a fertile ground for the decorative tile market's sustained growth. Furthermore, the increasing adoption of eco-friendly materials and manufacturing processes is becoming a critical factor influencing purchasing decisions, pushing manufacturers to innovate in sustainable product offerings. The market is witnessing a steady increase in demand for larger format tiles and unique textures, reflecting a sophisticated consumer preference.

- Market Size (Estimated 2033): 1.5 Billion USD

- CAGR (2025-2033): 4.5%

- Market Growth Drivers: Rising disposable income, robust construction activity, and demand for aesthetic enhancements.

- Technological Disruptions: Digital printing, enhanced material durability, and antimicrobial coatings.

- Consumer Behavior Shifts: Focus on personalization, sustainability, and smart home integration.

- Economic Influence: Stable economic growth and government infrastructure development projects.

Key Markets & Segments Leading South Korea Decorative Tile Industry

The South Korean decorative tile industry is predominantly led by the Porcelain segment within Product Type, driven by its exceptional durability, low water absorption, and versatility in replicating various aesthetics. In terms of Application, Floor Tiles command the largest market share, accounting for over 55% of the overall demand, due to their essential role in residential, commercial, and industrial spaces. The New Construction segment under Construction Type is a significant contributor, fueled by ongoing urbanization and infrastructure development projects, though the Replacement & Renovation sector is rapidly growing as homeowners invest in modernizing their living and working environments. From an End-User Type perspective, Residential Replacement holds a substantial portion, reflecting the increasing trend of home improvement and interior redesigns.

- Dominant Product Type: Porcelain Tiles

- Drivers: Superior durability, water resistance, and a wide range of design options.

- Market Dominance Analysis: Porcelain tiles are favored for both high-traffic areas and aesthetic-driven residential projects, making them a staple in interior design.

- Dominant Application: Floor Tiles

- Drivers: Essential for both functional and aesthetic purposes in all construction types. Economic growth and infrastructure development projects significantly boost demand.

- Market Dominance Analysis: The ubiquitous need for durable and attractive flooring in homes, offices, retail spaces, and public areas ensures the sustained dominance of floor tiles.

- Dominant Construction Type: New Construction

- Drivers: Rapid urbanization, government housing initiatives, and commercial real estate development.

- Market Dominance Analysis: Large-scale residential complexes, commercial buildings, and public infrastructure projects directly translate into significant demand for decorative tiles.

- Dominant End-User Type: Residential Replacement

- Drivers: Growing disposable incomes, desire for updated living spaces, and increased awareness of interior design trends.

- Market Dominance Analysis: Homeowners are increasingly investing in renovations and upgrades to enhance their living environments, driving demand for stylish and high-quality replacement tiles.

- Emerging Segment: Scratch Free Tiles

- Drivers: Consumer demand for low-maintenance and long-lasting surfaces, especially in high-traffic residential and commercial settings.

- Market Dominance Analysis: While not yet dominant, scratch-free tile technology is rapidly gaining traction due to its practical benefits and perceived value, indicating future growth potential.

South Korea Decorative Tile Industry Product Developments

Product innovation in the South Korean decorative tile industry is centered on enhancing performance, aesthetics, and sustainability. Companies are increasingly developing scratch-free and highly durable porcelain tiles that offer superior resistance to wear and tear, catering to the demand for long-lasting solutions. Advancements in digital printing technology allow for an unprecedented realism in replicating natural materials like marble, wood, and stone, offering a wider palette of design possibilities. Furthermore, there's a growing focus on eco-friendly manufacturing processes and materials, including recycled content and low-VOC emissions, aligning with global sustainability trends and consumer preferences for environmentally conscious products.

Challenges in the South Korea Decorative Tile Industry Market

The South Korean decorative tile market faces several challenges that impact its growth trajectory. Intense price competition from both domestic and international manufacturers can squeeze profit margins. Fluctuations in raw material costs, particularly for clay and energy, can disrupt production economics. Furthermore, stringent environmental regulations and the need for sustainable practices necessitate significant investment in cleaner production technologies. The increasing demand for substitutes like natural stone and engineered wood also presents a competitive hurdle. Supply chain disruptions, exacerbated by global events, can impact lead times and availability.

- Price Sensitivity: High competition leads to pressure on pricing.

- Raw Material Volatility: Fluctuations in key input costs.

- Environmental Compliance: Investment required for sustainable manufacturing.

- Substitute Materials: Competition from natural stone and wood.

- Supply Chain Resilience: Vulnerability to global logistical challenges.

Forces Driving South Korea Decorative Tile Industry Growth

Several key forces are propelling the growth of the South Korean decorative tile industry. The robust construction sector, driven by government initiatives for urban development and housing, provides a consistent demand base. Rising disposable incomes and a growing middle class translate into increased consumer spending on home improvement and renovation, fueling demand for aesthetically pleasing tiles. Technological advancements, particularly in digital printing and material science, enable the creation of innovative designs and enhanced product functionalities, attracting a wider customer base. The increasing focus on interior design and aesthetics within both residential and commercial spaces also plays a significant role, with consumers seeking to elevate their environments.

- Construction Sector Expansion: Ongoing infrastructure projects and new housing developments.

- Consumer Spending Power: Higher disposable incomes driving home renovation.

- Technological Innovation: Digital printing and advanced material development.

- Aesthetic Trends: Growing consumer appreciation for interior design.

Challenges in the South Korea Decorative Tile Industry Market

Long-term growth in the South Korean decorative tile industry will be significantly influenced by continued innovation in sustainable materials and production processes. This includes exploring options for recycled content and reducing energy consumption during manufacturing. Strategic partnerships and collaborations with architects, interior designers, and construction firms can help create new market opportunities and tailor product offerings to specific project needs. Furthermore, expanding into niche markets such as smart tiles with integrated functionalities or highly specialized decorative finishes can offer a competitive edge. Investing in digital marketing and e-commerce platforms will also be crucial to reach a broader customer base and enhance brand visibility.

Emerging Opportunities in South Korea Decorative Tile Industry

Emerging opportunities in the South Korean decorative tile industry lie in catering to the growing demand for eco-friendly and sustainable tiling solutions. The market is also ripe for innovation in smart tiles that can offer features like integrated lighting, heating, or sensor capabilities. The residential renovation and remodeling sector presents a significant opportunity as consumers increasingly invest in upgrading their living spaces. Furthermore, the development of large-format tiles with unique textures and patterns is gaining traction, offering new design possibilities. Expansion into commercial segments like hospitality, healthcare, and retail, with specialized tile requirements, also offers considerable growth potential.

- Sustainable & Eco-friendly Tiles: Growing consumer preference for environmentally conscious products.

- Smart Tile Technology: Integration of smart features for enhanced functionality.

- Residential Renovation Market: Increased investment in home improvement.

- Large-Format & Textured Tiles: Demand for innovative design elements.

- Specialized Commercial Applications: Tailored solutions for hospitality, healthcare, and retail.

Leading Players in the South Korea Decorative Tile Industry Sector

- Sungil Ceramics

- IS DONGSEO Co LTD

- Korea Fine Ceramic Co LTD

- Woongjin Ceramics Co LTD

- Daebo Ceramics Co Ltd

- Kukdong Ceramics Co Ltd

- Gai International Co Ltd

- Sam Won Corporation

- Hanyoung Ceramic Co LTD

- KCC Corporation

Key Milestones in South Korea Decorative Tile Industry Industry

- August 2023: IS Dongseo acquired BTS Technology at the BTS Technology factory in Poland. BTS Technology is a recycling specialist in the environmental business field with 4 corporations in Slovakia, Poland and Hungary.

- October 2022: The South Korea-based Sujeong Ceramics, started to provide free estimation services for products such as tiles, toilet bowls, sinks, faucets, and others.

Strategic Outlook for South Korea Decorative Tile Industry Market

The strategic outlook for the South Korean decorative tile industry is characterized by sustained growth driven by innovation, sustainability, and evolving consumer demands. Key accelerators include the continued expansion of the construction sector, a strong focus on home renovation, and the adoption of advanced manufacturing technologies. Companies that prioritize eco-friendly product development, invest in digital printing capabilities, and leverage smart home integration trends will be well-positioned for success. Furthermore, strategic collaborations with designers and developers, alongside a robust online presence, will be crucial for capturing market share and expanding reach. The industry is expected to see a rise in the adoption of high-performance, aesthetically diverse, and sustainable tiling solutions, catering to a sophisticated and environmentally conscious consumer base.

South Korea Decorative Tile Industry Segmentation

-

1. Product Type

- 1.1. Glazed

- 1.2. Porcelain

- 1.3. Scratch Free

- 1.4. Other Products

-

2. Application

- 2.1. Floor Tiles

- 2.2. Wall Tiles

- 2.3. Other Applications

-

3. Construction Type

- 3.1. New Construction

- 3.2. Replacement & Renovation

-

4. End-User Type

- 4.1. Residential Replacement

- 4.2. Commercial

South Korea Decorative Tile Industry Segmentation By Geography

- 1. South Korea

South Korea Decorative Tile Industry Regional Market Share

Geographic Coverage of South Korea Decorative Tile Industry

South Korea Decorative Tile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Construction and Renovation Activities; Growing Potential in the German Online Furniture Market

- 3.3. Market Restrains

- 3.3.1. High Competition Among Players in the Market; High Price of Supply Chain and Logistics

- 3.4. Market Trends

- 3.4.1. Commercial Sector is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Decorative Tile Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Glazed

- 5.1.2. Porcelain

- 5.1.3. Scratch Free

- 5.1.4. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Floor Tiles

- 5.2.2. Wall Tiles

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Construction Type

- 5.3.1. New Construction

- 5.3.2. Replacement & Renovation

- 5.4. Market Analysis, Insights and Forecast - by End-User Type

- 5.4.1. Residential Replacement

- 5.4.2. Commercial

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sungil Ceramics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IS DONGSEO Co LTD

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Korea Fine Ceramic Co LTD

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Woongjin Ceramics Co LTD

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Daebo Ceramics Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kukdong Ceramics Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gai International Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sam Won Corporation**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hanyoung Ceramic Co LTD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 KCC Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sungil Ceramics

List of Figures

- Figure 1: South Korea Decorative Tile Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Korea Decorative Tile Industry Share (%) by Company 2025

List of Tables

- Table 1: South Korea Decorative Tile Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: South Korea Decorative Tile Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: South Korea Decorative Tile Industry Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 4: South Korea Decorative Tile Industry Revenue billion Forecast, by End-User Type 2020 & 2033

- Table 5: South Korea Decorative Tile Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: South Korea Decorative Tile Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: South Korea Decorative Tile Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: South Korea Decorative Tile Industry Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 9: South Korea Decorative Tile Industry Revenue billion Forecast, by End-User Type 2020 & 2033

- Table 10: South Korea Decorative Tile Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Decorative Tile Industry?

The projected CAGR is approximately 2.76%.

2. Which companies are prominent players in the South Korea Decorative Tile Industry?

Key companies in the market include Sungil Ceramics, IS DONGSEO Co LTD, Korea Fine Ceramic Co LTD, Woongjin Ceramics Co LTD, Daebo Ceramics Co Ltd, Kukdong Ceramics Co Ltd, Gai International Co Ltd, Sam Won Corporation**List Not Exhaustive, Hanyoung Ceramic Co LTD, KCC Corporation.

3. What are the main segments of the South Korea Decorative Tile Industry?

The market segments include Product Type, Application, Construction Type, End-User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Construction and Renovation Activities; Growing Potential in the German Online Furniture Market.

6. What are the notable trends driving market growth?

Commercial Sector is Driving the Market.

7. Are there any restraints impacting market growth?

High Competition Among Players in the Market; High Price of Supply Chain and Logistics.

8. Can you provide examples of recent developments in the market?

August 2023: IS Dongseo acquired BTS Technology at the BTS Technology factory in Poland. BTS Technology is a recycling specialist in the environmental business field with 4 corporations in Slovakia, Poland and Hungary.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Decorative Tile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Decorative Tile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Decorative Tile Industry?

To stay informed about further developments, trends, and reports in the South Korea Decorative Tile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence