Key Insights

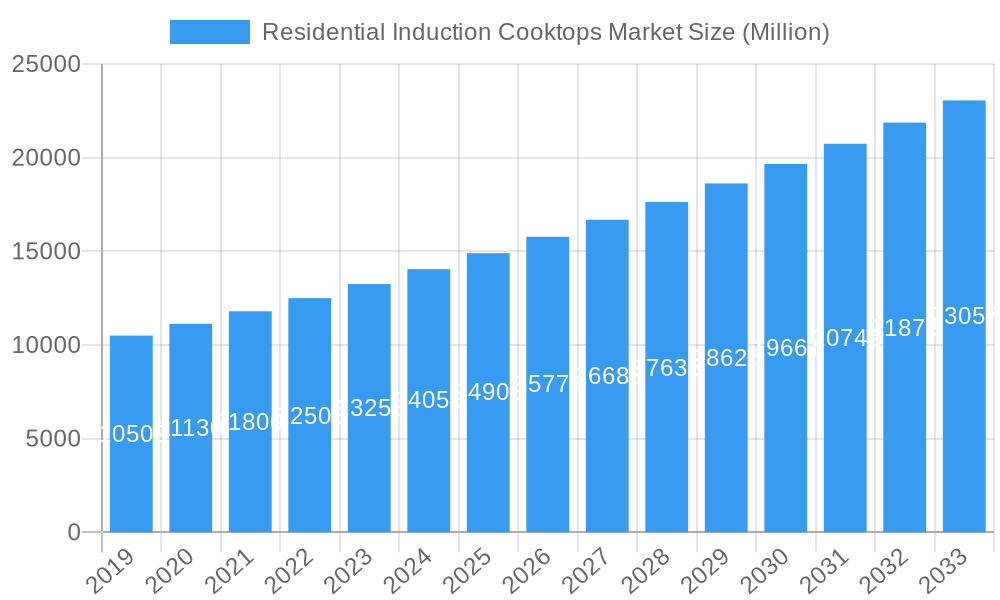

The global Residential Induction Cooktops market is forecast to reach $23.6 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 4.6% through 2033. This growth is driven by evolving consumer preferences for energy-efficient, safer, and high-performance kitchen appliances. Key factors include precise temperature control, faster cooking times, rising disposable incomes in emerging economies, and the aesthetic appeal of modern kitchen designs.

Residential Induction Cooktops Market Market Size (In Billion)

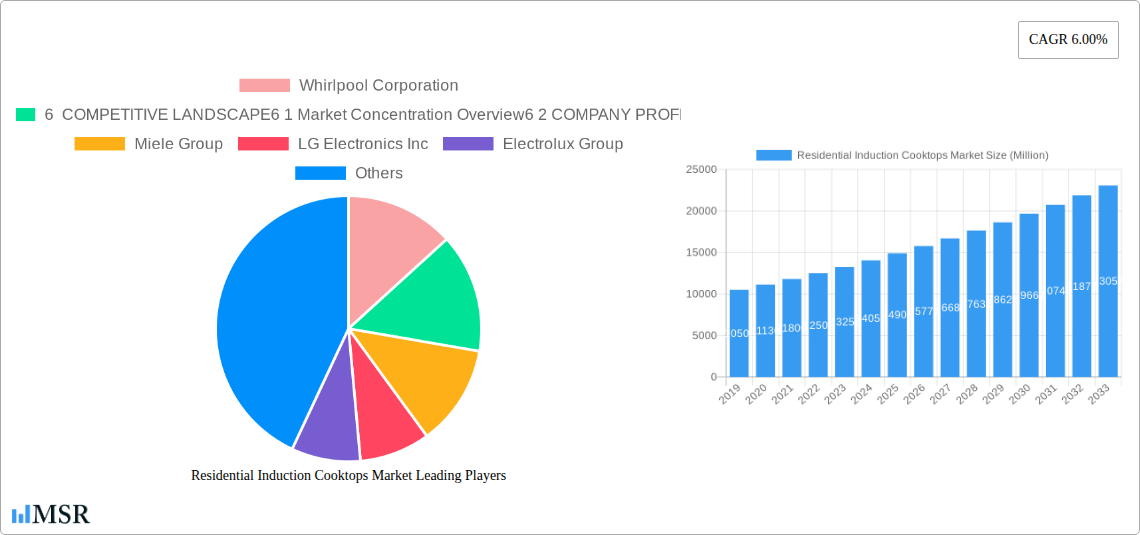

The market is segmented by product type, with Built-In Induction Cooktops leading due to seamless integration. Free-Standing and Portable options are also gaining popularity for flexible cooking solutions. Distribution channels are diversifying, with a significant shift towards Online sales, complemented by Supermarkets/Hypermarkets and Specialty Stores. Leading players like Whirlpool Corporation, Miele Group, LG Electronics Inc., Electrolux Group, and Robert Bosch GmbH are driving competition through innovation and strategic initiatives. While higher initial costs and cookware compatibility present challenges, ongoing technological advancements and consumer education are mitigating these factors, fostering sustained market expansion.

Residential Induction Cooktops Market Company Market Share

Residential Induction Cooktops Market Analysis: Growth Drivers, Industry Trends, and Future Outlook (2019-2033)

This report provides an in-depth analysis of the residential induction cooktops market, covering market concentration, key segments, product innovations, growth drivers, and competitive landscape. With a study period from 2019 to 2033, a base year of 2025, and a forecast period from 2025 to 2033, this report offers critical data for stakeholders. The global residential induction cooktops market size is projected for significant growth, propelled by increasing consumer awareness, smart home integration, and a preference for enhanced safety and cooking efficiency.

Residential Induction Cooktops Market Market Concentration & Dynamics

The residential induction cooktops market exhibits a moderate to high level of market concentration, with a few dominant global players alongside a growing number of regional and specialized manufacturers. Innovation ecosystems are thriving, driven by continuous research and development in areas such as energy efficiency, smart features, and user interface design. Regulatory frameworks in key markets are increasingly favoring energy-saving appliances, indirectly boosting the adoption of induction technology. Substitute products, primarily gas and electric coil cooktops, still hold considerable market share, but their dominance is gradually eroding due to the superior performance and safety features of induction. End-user trends point towards a growing demand for premium, integrated kitchen solutions and a willingness to invest in appliances that offer convenience and sustainability. Merger and acquisition (M&A) activities are observed, albeit sporadically, as companies aim to expand their product portfolios, geographic reach, and technological capabilities. For instance, the market has seen strategic alliances and acquisitions aimed at bolstering market share and consolidating leadership. The competitive landscape is intense, characterized by product differentiation and aggressive marketing strategies.

- Market Share: Leading players like Whirlpool Corporation, Robert Bosch GmbH, and Electrolux Group command significant market shares.

- M&A Deal Counts: While specific deal counts are proprietary, the trend indicates strategic consolidation and expansion efforts.

Residential Induction Cooktops Market Industry Insights & Trends

The residential induction cooktops market is experiencing robust growth, fueled by a confluence of technological advancements, evolving consumer preferences, and increasing environmental consciousness. The global residential induction cooktops market growth is underpinned by the inherent advantages of induction technology, including faster heating times, superior energy efficiency compared to traditional electric and gas cooktops, and enhanced safety features like the absence of open flames and cool-to-touch surfaces. As consumers become more aware of the environmental impact of their choices, the energy-saving attributes of induction cooktops are becoming a significant purchasing factor. The rise of the smart home ecosystem further propels this market, with manufacturers integrating Wi-Fi connectivity, app control, and AI-powered cooking assistants into their offerings. This allows users to remotely monitor and control their cooktops, access recipes, and optimize cooking processes, aligning with the growing desire for convenience and modern living. The CAGR of the residential induction cooktops market is estimated to be strong, reflecting sustained demand and innovation. Economic development in emerging economies also plays a crucial role, as rising disposable incomes lead to increased spending on home appliances and kitchen upgrades. Furthermore, government incentives and regulations promoting energy-efficient appliances are creating a favorable market environment. The transition away from fossil fuels and the growing popularity of electric cooking are also significant tailwinds.

Key Markets & Segments Leading Residential Induction Cooktops Market

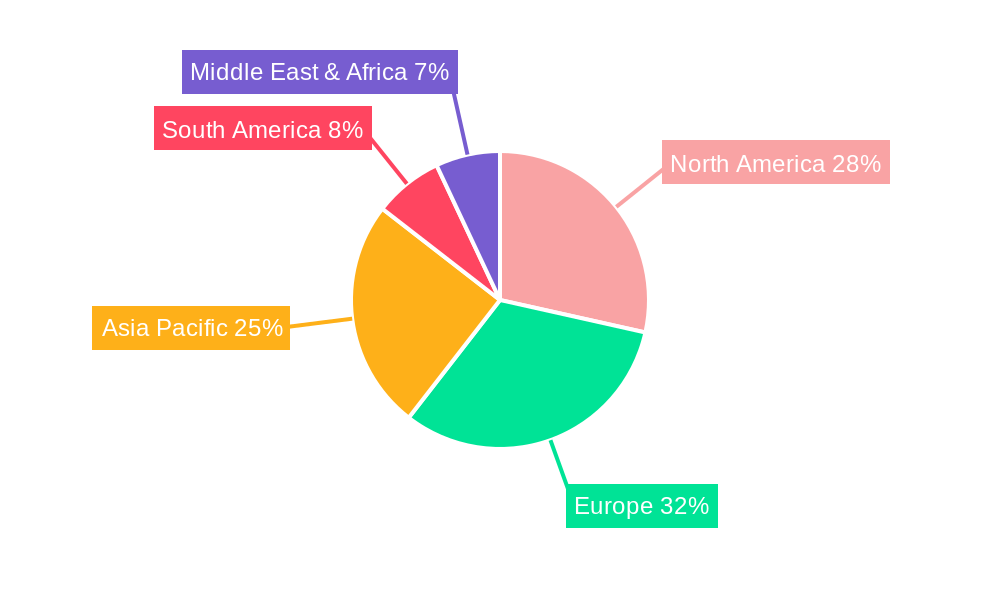

North America and Europe currently dominate the residential induction cooktops market, driven by high disposable incomes, advanced technological adoption, and a strong emphasis on kitchen modernization and energy efficiency. Countries like the United States, Germany, and the United Kingdom are at the forefront of this trend. The built-in induction cooktops segment is particularly influential in these regions, catering to the demand for seamless and integrated kitchen designs prevalent in contemporary homes and renovations.

Dominant Region: North America

- Drivers: High consumer spending power, strong preference for premium kitchen appliances, government initiatives promoting energy efficiency, and widespread adoption of smart home technology.

- Detailed Dominance Analysis: The North American market is characterized by a strong demand for sophisticated kitchen appliances that offer both aesthetic appeal and functional superiority. The prevalence of kitchen renovations and new home constructions further fuels the sales of built-in induction cooktops. Consumer awareness regarding the safety and efficiency benefits of induction cooking is high, leading to a preference over traditional alternatives.

Dominant Segment (Type): Built-In Induction Cooktops

- Drivers: Architectural trends favoring integrated kitchens, demand for sleek and modern aesthetics, superior performance and safety features, and convenience of installation in custom cabinetry.

- Detailed Dominance Analysis: Built-in induction cooktops offer a streamlined look that appeals to homeowners seeking a modern and uncluttered kitchen environment. Their seamless integration with countertops provides a premium finish. The superior cooking performance, precise temperature control, and enhanced safety features make them a preferred choice for discerning consumers undertaking kitchen upgrades or building new homes.

Dominant Distribution Channel: Specialty Stores and Online

- Drivers: Expertise offered by specialty appliance retailers, ability to showcase premium products, and the convenience and wide selection available through e-commerce platforms.

- Detailed Dominance Analysis: Specialty stores provide a crucial touchpoint for consumers seeking detailed product information, demonstrations, and personalized advice on high-end appliances like induction cooktops. Simultaneously, the online channel offers unparalleled convenience, competitive pricing, and a vast selection, attracting a significant portion of buyers who are well-researched and confident in their purchase decisions.

Residential Induction Cooktops Market Product Developments

The residential induction cooktops market is continuously shaped by innovative product developments focused on enhancing user experience, safety, and energy efficiency. Manufacturers are integrating advanced features such as intuitive touch controls, multiple cooking zones with flexible configurations, and precise temperature management for delicate cooking tasks. Smart connectivity, enabling control via mobile apps and voice assistants, is becoming a standard offering in premium models, allowing users to preheat, adjust settings, and receive notifications remotely. The inclusion of sophisticated safety features like child locks, boil-dry protection, and automatic shut-off systems further solidifies induction's appeal. The market also sees advancements in aesthetics, with sleek, minimalist designs and durable ceramic-glass surfaces becoming the norm, complementing modern kitchen décor.

Challenges in the Residential Induction Cooktops Market Market

Despite the strong growth trajectory, the residential induction cooktops market faces several challenges. The higher initial cost of induction cooktops compared to traditional electric or gas models remains a significant barrier for price-sensitive consumers. Consumer awareness and education regarding the benefits and proper usage of induction technology are still developing in some regions, leading to hesitations. Furthermore, installation requirements, such as the need for dedicated electrical circuits and compatible cookware, can add to the overall cost and complexity for consumers. Supply chain disruptions and component availability can also impact production and pricing.

- Higher Initial Investment: A significant deterrent for a segment of the consumer base.

- Consumer Education Gap: Need for greater awareness about benefits and functionality.

- Installation Complexities: Potential need for specialized electrical work and cookware.

- Supply Chain Volatility: Risk of production delays and price fluctuations.

Forces Driving Residential Induction Cooktops Market Growth

The residential induction cooktops market is propelled by a powerful combination of factors. Technological innovation stands out, with advancements in energy efficiency, faster heating, and integrated smart features making induction cooktops increasingly attractive. Growing environmental awareness and a desire for sustainable living encourage consumers to opt for energy-saving appliances. Rising disposable incomes in both developed and emerging economies translate into increased spending on premium kitchen upgrades. Furthermore, government initiatives and stricter energy efficiency regulations are favoring the adoption of induction technology. The inherent safety benefits – no open flame, cooler surfaces – appeal to families with children and those prioritizing kitchen safety.

Challenges in the Residential Induction Cooktops Market Market

Long-term growth catalysts for the residential induction cooktops market lie in continued technological evolution and strategic market expansion. Manufacturers are investing in research and development to further enhance energy efficiency and introduce novel functionalities, such as advanced food sensing technologies and self-cleaning features. Partnerships between appliance manufacturers and smart home platform providers will deepen integration and user convenience, creating a more cohesive smart kitchen experience. Geographic expansion into emerging markets, where awareness and adoption are still nascent, presents significant untapped potential. Simplifying installation processes and developing more affordable entry-level models will be crucial for broadening market reach and overcoming price sensitivity.

Emerging Opportunities in Residential Induction Cooktops Market

Emerging opportunities in the residential induction cooktops market are abundant, driven by evolving consumer lifestyles and technological integration. The increasing demand for integrated kitchen solutions and the rise of modular kitchen designs create a fertile ground for built-in induction cooktops. The growing popularity of sustainable and healthy cooking practices aligns perfectly with the precise temperature control and efficiency of induction. Furthermore, the expansion of the smart home ecosystem offers opportunities to develop more sophisticated, app-controlled, and AI-enhanced cooking experiences. The development of energy-efficient, compact, and portable induction cooktops can tap into the growing rental market and smaller living spaces. Catering to specific dietary needs and culinary preferences through app-based recipe integration and personalized cooking guidance also presents a significant opportunity.

Leading Players in the Residential Induction Cooktops Market Sector

- Whirlpool Corporation

- Robert Bosch GmbH

- Electrolux Group

- LG Electronics Inc

- Miele Group

- Koninklijke Philips N V

- Panasonic Corporation

- Sub-Zero Group Inc

- SMEG S p A

- TTK Prestige Ltd

- Haier Group

- Bajaj Electricals Ltd

- Videocon Industries Limited

- Fisher & Paykel Appliances Holdings Ltd

- Glen Dimplex Home Appliances Ltd

- Daewoo Electronics Corporation

- Morphy Richards

- Inalsa Appliances

- Kenwood Limited

- Butterfly Gandhimathi Appliances Limited

Key Milestones in Residential Induction Cooktops Market Industry

- January 2023: Preethi launched the Prestige Iris 2.0 Induction Cooktop, lauded for its satisfactory performance across features like auto-off settings, multiple preset menus, ease of use, safety, aesthetics, and variable time settings, positioning it as a strong contender in the overall market.

- August 2022: Kent RO Systems Ltd. introduced the Kent Jewel induction cooktop, featuring a 2000-watt power capacity and eight pre-set menus for various cooking needs including fry, curry, keep warm, roti, water, soup, rice, and milk boiling.

Strategic Outlook for Residential Induction Cooktops Market Market

The strategic outlook for the residential induction cooktops market is overwhelmingly positive, driven by sustained demand for efficient, safe, and smart kitchen appliances. Key growth accelerators include continuous innovation in smart home integration, with a focus on seamless connectivity and AI-powered cooking assistance. The market will also benefit from the ongoing global shift towards energy-efficient and sustainable home solutions. Manufacturers are expected to strategically expand their product portfolios to include a wider range of price points and feature sets, thereby capturing a broader consumer base. Geographic expansion into developing economies, coupled with localized marketing efforts to educate consumers, will be crucial for unlocking future growth potential. Strategic partnerships with home builders and interior designers will also play a vital role in embedding induction cooktops into new residential constructions and renovation projects.

Residential Induction Cooktops Market Segmentation

-

1. Type

- 1.1. Built-In Induction Cooktops

- 1.2. Free-Standing and Portable Induction Cooktops

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Residential Induction Cooktops Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. South America

- 2.1. Brazil

- 2.2. Mexico

- 2.3. Other South American Countries

-

3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. United Kingdom

- 3.4. Other European Countries

-

4. Asia Pacific

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Other Asia Pacific Countries

- 5. Middle East

-

6. United Arab Emirates

- 6.1. Saudi Arabia

- 6.2. South Africa

- 6.3. Other Middle Eastern and African Countries

Residential Induction Cooktops Market Regional Market Share

Geographic Coverage of Residential Induction Cooktops Market

Residential Induction Cooktops Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Household Disposable Income Drives The Market; Changing Lifestyles and Time Constraints Drives The Market

- 3.3. Market Restrains

- 3.3.1. High Initial Costs; Infrastructure and Space Limitations

- 3.4. Market Trends

- 3.4.1. Sustainability and Energy Efficiency is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Residential Induction Cooktops Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Built-In Induction Cooktops

- 5.1.2. Free-Standing and Portable Induction Cooktops

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Asia Pacific

- 5.3.5. Middle East

- 5.3.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Residential Induction Cooktops Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Built-In Induction Cooktops

- 6.1.2. Free-Standing and Portable Induction Cooktops

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Specialty Stores

- 6.2.3. Online

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Residential Induction Cooktops Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Built-In Induction Cooktops

- 7.1.2. Free-Standing and Portable Induction Cooktops

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Specialty Stores

- 7.2.3. Online

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Residential Induction Cooktops Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Built-In Induction Cooktops

- 8.1.2. Free-Standing and Portable Induction Cooktops

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Specialty Stores

- 8.2.3. Online

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Asia Pacific Residential Induction Cooktops Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Built-In Induction Cooktops

- 9.1.2. Free-Standing and Portable Induction Cooktops

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Specialty Stores

- 9.2.3. Online

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Residential Induction Cooktops Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Built-In Induction Cooktops

- 10.1.2. Free-Standing and Portable Induction Cooktops

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Specialty Stores

- 10.2.3. Online

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. United Arab Emirates Residential Induction Cooktops Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Built-In Induction Cooktops

- 11.1.2. Free-Standing and Portable Induction Cooktops

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Supermarkets/Hypermarkets

- 11.2.2. Specialty Stores

- 11.2.3. Online

- 11.2.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Whirlpool Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 6 COMPETITIVE LANDSCAPE6 1 Market Concentration Overview6 2 COMPANY PROFILES

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Miele Group

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 LG Electronics Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Electrolux Group

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Koninklijke Philips N V

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Other Companies (Daewoo Electronics Corporation Fisher & Paykel Appliances Holdings Ltd Glen Dimplex Home Appliances Ltd Videocon Industries Limited Bajaj Electricals Ltd Haier Group Morphy Richards Inalsa Appliances Kenwood Limited and Butterfly Gandhimathi Appliances Limited)**List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Robert Bosch GmbH

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 SMEG S p A

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 TTK Prestige Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Sub-Zero Group Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Panasonic Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Whirlpool Corporation

List of Figures

- Figure 1: Global Residential Induction Cooktops Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Residential Induction Cooktops Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Residential Induction Cooktops Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Residential Induction Cooktops Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Residential Induction Cooktops Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Residential Induction Cooktops Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Residential Induction Cooktops Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Residential Induction Cooktops Market Revenue (billion), by Type 2025 & 2033

- Figure 9: South America Residential Induction Cooktops Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Residential Induction Cooktops Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: South America Residential Induction Cooktops Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America Residential Induction Cooktops Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Residential Induction Cooktops Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Residential Induction Cooktops Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Europe Residential Induction Cooktops Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Residential Induction Cooktops Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Europe Residential Induction Cooktops Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe Residential Induction Cooktops Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Residential Induction Cooktops Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Asia Pacific Residential Induction Cooktops Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Asia Pacific Residential Induction Cooktops Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Residential Induction Cooktops Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Residential Induction Cooktops Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Asia Pacific Residential Induction Cooktops Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Residential Induction Cooktops Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Residential Induction Cooktops Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East Residential Induction Cooktops Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East Residential Induction Cooktops Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Middle East Residential Induction Cooktops Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East Residential Induction Cooktops Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Residential Induction Cooktops Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: United Arab Emirates Residential Induction Cooktops Market Revenue (billion), by Type 2025 & 2033

- Figure 33: United Arab Emirates Residential Induction Cooktops Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: United Arab Emirates Residential Induction Cooktops Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 35: United Arab Emirates Residential Induction Cooktops Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 36: United Arab Emirates Residential Induction Cooktops Market Revenue (billion), by Country 2025 & 2033

- Figure 37: United Arab Emirates Residential Induction Cooktops Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Residential Induction Cooktops Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Residential Induction Cooktops Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Residential Induction Cooktops Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Residential Induction Cooktops Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Residential Induction Cooktops Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Residential Induction Cooktops Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Residential Induction Cooktops Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Residential Induction Cooktops Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Residential Induction Cooktops Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global Residential Induction Cooktops Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global Residential Induction Cooktops Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Brazil Residential Induction Cooktops Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico Residential Induction Cooktops Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Other South American Countries Residential Induction Cooktops Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Global Residential Induction Cooktops Market Revenue billion Forecast, by Type 2020 & 2033

- Table 16: Global Residential Induction Cooktops Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 17: Global Residential Induction Cooktops Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Germany Residential Induction Cooktops Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: France Residential Induction Cooktops Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Residential Induction Cooktops Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Other European Countries Residential Induction Cooktops Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Residential Induction Cooktops Market Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Global Residential Induction Cooktops Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 24: Global Residential Induction Cooktops Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: China Residential Induction Cooktops Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Japan Residential Induction Cooktops Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: India Residential Induction Cooktops Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Other Asia Pacific Countries Residential Induction Cooktops Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Residential Induction Cooktops Market Revenue billion Forecast, by Type 2020 & 2033

- Table 30: Global Residential Induction Cooktops Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Residential Induction Cooktops Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Global Residential Induction Cooktops Market Revenue billion Forecast, by Type 2020 & 2033

- Table 33: Global Residential Induction Cooktops Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Residential Induction Cooktops Market Revenue billion Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Residential Induction Cooktops Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: South Africa Residential Induction Cooktops Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Other Middle Eastern and African Countries Residential Induction Cooktops Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Residential Induction Cooktops Market?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the Residential Induction Cooktops Market?

Key companies in the market include Whirlpool Corporation, 6 COMPETITIVE LANDSCAPE6 1 Market Concentration Overview6 2 COMPANY PROFILES, Miele Group, LG Electronics Inc, Electrolux Group, Koninklijke Philips N V, Other Companies (Daewoo Electronics Corporation Fisher & Paykel Appliances Holdings Ltd Glen Dimplex Home Appliances Ltd Videocon Industries Limited Bajaj Electricals Ltd Haier Group Morphy Richards Inalsa Appliances Kenwood Limited and Butterfly Gandhimathi Appliances Limited)**List Not Exhaustive, Robert Bosch GmbH, SMEG S p A, TTK Prestige Ltd, Sub-Zero Group Inc, Panasonic Corporation.

3. What are the main segments of the Residential Induction Cooktops Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Household Disposable Income Drives The Market; Changing Lifestyles and Time Constraints Drives The Market.

6. What are the notable trends driving market growth?

Sustainability and Energy Efficiency is Driving the Market Growth.

7. Are there any restraints impacting market growth?

High Initial Costs; Infrastructure and Space Limitations.

8. Can you provide examples of recent developments in the market?

In January 2023: Preethi lanced a new product Prestige Iris 2.0 Induction Cooktop 2023. This product by Prestige Iris comes under the best overall category for satisfactory performance across features like auto-off settings, multiple preset menus, ease of use, safety, looks, and variable time settings

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Residential Induction Cooktops Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Residential Induction Cooktops Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Residential Induction Cooktops Market?

To stay informed about further developments, trends, and reports in the Residential Induction Cooktops Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence