Key Insights

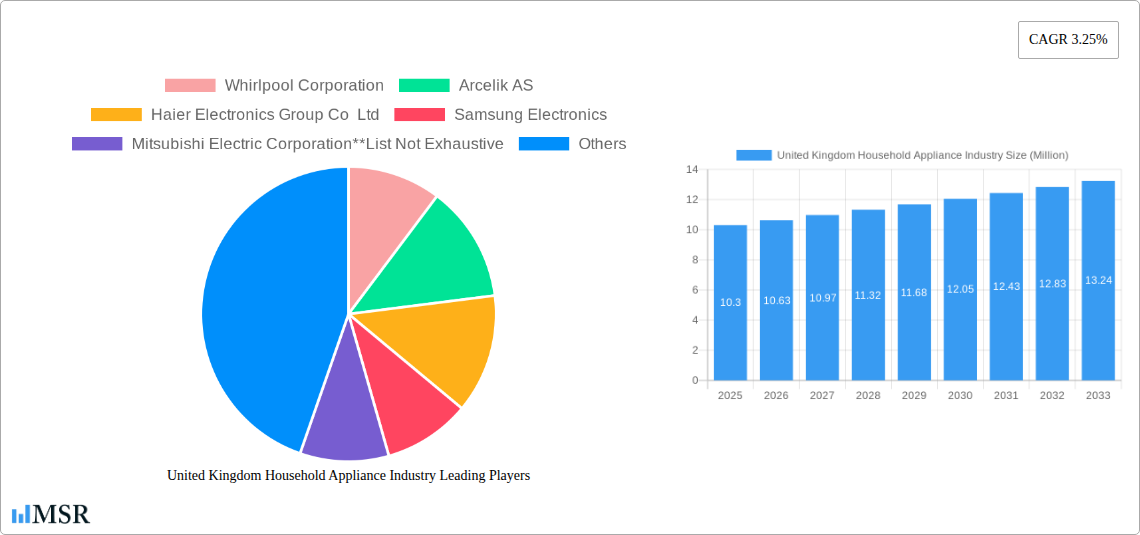

The United Kingdom household appliance market is poised for steady growth, projected to reach $10.30 million by 2025, with a Compound Annual Growth Rate (CAGR) of 3.25% over the forecast period of 2025-2033. This expansion is primarily driven by evolving consumer preferences for energy-efficient and technologically advanced appliances, alongside a sustained demand for durable goods. The increasing disposable income in the UK, coupled with a growing emphasis on home improvement and smart home integration, are significant tailwinds for the market. Furthermore, government initiatives promoting energy conservation and the replacement of older, less efficient models are also contributing to market dynamism. The market's robust performance is further supported by strong import and export activities, indicating a healthy global trade network for household appliances within the UK.

United Kingdom Household Appliance Industry Market Size (In Million)

Despite the positive outlook, the market faces certain restraints. Rising raw material costs and supply chain disruptions, exacerbated by global economic uncertainties, can impact manufacturers' profit margins and lead to price fluctuations. However, the sector is actively adapting through technological innovation and strategic partnerships, focusing on product diversification and sustainable manufacturing practices. Key players such as Whirlpool Corporation, Samsung Electronics, and LG Electronics are continuously introducing new product lines incorporating smart features and enhanced energy efficiency, catering to the discerning UK consumer. The production and consumption analyses reveal a balanced market, with significant domestic demand supported by international trade flows. Price trends are expected to show a moderate upward trajectory, influenced by input costs and the premiumization of appliance features.

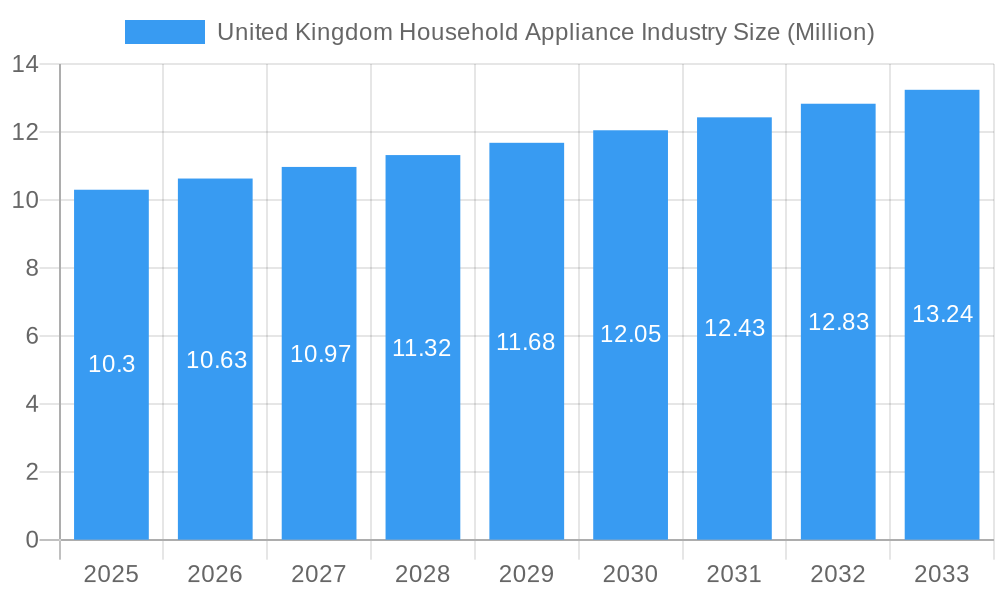

United Kingdom Household Appliance Industry Company Market Share

United Kingdom Household Appliance Industry Market Analysis and Forecast: 2019-2033

Unlock critical insights into the dynamic United Kingdom household appliance market with this comprehensive report. Covering a robust study period from 2019 to 2033, with a base and estimated year of 2025, this analysis delves deep into production, consumption, import/export dynamics, pricing trends, and pivotal industry developments. Discover key market drivers, emerging opportunities, and the strategic landscape shaped by leading players in the UK home appliance sector.

United Kingdom Household Appliance Industry Market Concentration & Dynamics

The United Kingdom household appliance market exhibits a moderate to high concentration, with a few dominant players holding significant market share. Key companies like Whirlpool Corporation, Arcelik AS, Haier Electronics Group Co Ltd, Samsung Electronics, and Mitsubishi Electric Corporation are instrumental in shaping market dynamics, alongside other notable entities such as BSH Hausgeräte GmbH, Electrolux AB, LG Electronics, Panasonic Corporation, and Gorenje Group. Innovation ecosystems are robust, driven by continuous R&D in energy efficiency, smart home integration, and user convenience. The regulatory framework, particularly concerning energy labeling and environmental standards, plays a crucial role in product development and consumer purchasing decisions. Substitute products, though less prevalent in core appliance categories, emerge in niche areas like portable cooling or specialized cooking gadgets. End-user trends are heavily influenced by growing environmental consciousness, demand for connected appliances, and a desire for aesthetically pleasing, space-saving designs. Merger and acquisition (M&A) activities, while not constant, have historically been strategic, aimed at consolidating market position, expanding product portfolios, or gaining access to new technologies. The report provides detailed market share analysis for key players and quantifies M&A deal counts within the study period to illustrate strategic consolidation.

United Kingdom Household Appliance Industry Industry Insights & Trends

The United Kingdom household appliance industry is experiencing robust growth, projected to achieve a market size of over £15,000 Million by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 5.2% during the forecast period of 2025–2033. This expansion is fueled by several converging factors. A primary driver is the increasing disposable income and a rising standard of living among UK households, leading to greater investment in quality and feature-rich home appliances. The growing adoption of smart home technology is profoundly reshaping consumer preferences. Consumers are increasingly seeking connected appliances that offer remote control, automation, and enhanced energy management capabilities, driving demand for innovative, internet-enabled refrigerators, washing machines, ovens, and dishwashers. Furthermore, heightened environmental awareness and stringent government regulations concerning energy efficiency are pushing manufacturers to develop and market eco-friendly appliances. Products with higher energy ratings are not only becoming a regulatory necessity but also a key selling point for environmentally conscious consumers. Technological disruptions, such as advancements in AI for personalized appliance performance, induction cooking technologies, and advanced refrigeration systems, are creating new product categories and upgrading existing ones. Evolving consumer behaviors, including a greater emphasis on convenience, durability, and aesthetic appeal, further contribute to market growth. The shift towards smaller living spaces in urban areas also drives demand for compact, multi-functional, and highly efficient appliances. The post-pandemic era has also seen a sustained interest in home improvement, with consumers investing more in their living spaces, including upgrading their kitchen and laundry appliances. The replacement cycle for older, less efficient appliances also presents a continuous demand stream, particularly as energy costs rise and new, more efficient models become available.

Key Markets & Segments Leading United Kingdom Household Appliance Industry

The Refrigeration segment is a dominant force within the United Kingdom household appliance industry, driven by essential household needs and continuous innovation. The Consumption Analysis for this segment reveals a strong demand for energy-efficient models, smart refrigerators with advanced storage solutions, and integrated freezer-refrigerator units. Economic growth in the UK, coupled with a steady increase in household formation, underpins this demand. Furthermore, the Import Market Analysis (Value & Volume) highlights the significant role of imported appliances, particularly from Asian markets like South Korea and China, which offer competitive pricing and advanced technological features. For instance, the value of imported refrigeration units is estimated to reach over £2,000 Million by 2025, with substantial volume growth driven by competitive pricing strategies.

The Kitchen Appliances segment, encompassing ovens, hobs, dishwashers, and microwaves, also commands a substantial market share. Production Analysis within the UK focuses on high-end, integrated kitchen solutions that cater to premium consumer segments. Drivers for this segment include a growing interest in home cooking, driven by culinary trends and the desire for enhanced kitchen functionality. The Export Market Analysis (Value & Volume), while smaller than imports, shows a steady demand for specialized, high-quality British-made cooking appliances in niche European markets. The Price Trend Analysis indicates a gradual increase in prices, largely influenced by rising raw material costs and technological advancements, particularly in smart kitchen appliances, with projected average price increases of 3-4% annually.

The Laundry Appliances segment, including washing machines and dryers, continues to be a vital part of the market. The consumption analysis is strongly influenced by the need for energy-efficient and water-saving technologies, driven by environmental concerns and rising utility costs. Drivers include the increasing prevalence of smaller households and a demand for quieter, more compact, and versatile laundry solutions. The import market is significant, with a substantial volume of mid-range and budget-friendly options entering the UK.

United Kingdom Household Appliance Industry Product Developments

Product innovation in the UK household appliance sector is rapidly evolving. Key advancements include the widespread integration of Internet of Things (IoT) technology, enabling smart connectivity for remote control, diagnostics, and personalized settings across refrigerators, washing machines, and ovens. The development of energy-efficient technologies, such as advanced compressors for refrigeration and eco-modes for laundry appliances, is a significant focus, driven by both consumer demand and regulatory pressures. Induction hobs and advanced oven technologies, offering precise temperature control and faster cooking times, are gaining traction. Furthermore, manufacturers are prioritizing user-friendly interfaces, aesthetic appeal, and sustainable materials in their designs, catering to modern consumer preferences and environmental consciousness.

Challenges in the United Kingdom Household Appliance Industry Market

The United Kingdom household appliance industry faces several significant challenges. Supply chain disruptions, exacerbated by global geopolitical events and logistical complexities, continue to impact raw material availability and delivery timelines, leading to increased production costs. Rising energy prices not only affect operational costs for manufacturers but also influence consumer purchasing decisions, potentially dampening demand for higher-ticket items. Intense competitive pressure, both from domestic and international players, necessitates continuous innovation and aggressive pricing strategies. Stringent environmental regulations and evolving energy efficiency standards, while promoting sustainability, require substantial investment in research and development to meet compliance. The impact of inflation on consumer spending power presents a further restraint, potentially leading to a slowdown in discretionary purchases of new appliances.

Forces Driving United Kingdom Household Appliance Industry Growth

Several key forces are propelling the growth of the United Kingdom household appliance industry. Technological advancements, particularly in smart home integration, AI-powered features, and energy efficiency, are creating new product categories and enhancing the appeal of existing ones. Growing consumer awareness and demand for sustainable and eco-friendly products are driving the adoption of appliances with higher energy ratings and reduced environmental impact. The increasing disposable income and a rising standard of living in the UK allow households to invest in premium, feature-rich appliances. Furthermore, government initiatives and regulations promoting energy efficiency and smart technology adoption create a favorable market environment. The continuous need for appliance replacement and upgrades due to wear and tear or technological obsolescence also contributes to consistent market demand.

Challenges in the United Kingdom Household Appliance Industry Market

Long-term growth catalysts in the United Kingdom household appliance market are deeply intertwined with innovation and market expansion. The continued evolution of smart home ecosystems and the integration of AI will unlock new functionalities and user experiences, driving demand for connected appliances. Partnerships between appliance manufacturers and technology companies will foster the development of more sophisticated and integrated home solutions. Market expansions into emerging consumer segments, such as the demand for multi-functional, space-saving appliances in urban dwellings, will create new avenues for growth. Furthermore, a focus on circular economy principles and sustainable product lifecycles, including repairability and recycling initiatives, will appeal to environmentally conscious consumers and align with future regulatory trends.

Emerging Opportunities in United Kingdom Household Appliance Industry

Emerging opportunities within the United Kingdom household appliance industry are ripe for exploration. The burgeoning smart home market, with its focus on seamless integration and automation, presents a significant avenue for growth, particularly in the development of interoperable appliance ecosystems. Personalized appliance experiences, leveraging AI to learn user habits and optimize performance, will cater to evolving consumer preferences for tailored solutions. The increasing demand for compact and multi-functional appliances in smaller urban living spaces offers a niche but growing market segment. Furthermore, sustainable and ethically sourced materials in appliance manufacturing are becoming a key differentiator, attracting a growing segment of environmentally conscious consumers. The after-sales service and maintenance market, especially for connected appliances, also presents an opportunity for recurring revenue streams and enhanced customer loyalty.

Leading Players in the United Kingdom Household Appliance Industry Sector

- Whirlpool Corporation

- Arcelik AS

- Haier Electronics Group Co Ltd

- Samsung Electronics

- Mitsubishi Electric Corporation

- Gorenje Group

- BSH Hausgeräte GmbH

- Electrolux AB

- Panasonic Corporation

- LG Electronics

Key Milestones in United Kingdom Household Appliance Industry Industry

- May 2022: Whirlpool Corporation launched WoW Studios, a new marketing organization designed to infuse magic into the home appliance consumer.

- February 2022: Spectrum Brands acquired Tristar's Appliance and Cookware Business and combined it with its Home and Personal Care segment.

Strategic Outlook for United Kingdom Household Appliance Industry Market

The strategic outlook for the United Kingdom household appliance industry is one of sustained growth and innovation. The market is poised for expansion driven by the increasing adoption of smart technologies, a growing emphasis on energy efficiency, and evolving consumer preferences for convenience and sustainability. Manufacturers who can effectively integrate AI and IoT capabilities into their product lines, while also prioritizing eco-friendly designs and materials, will be well-positioned for success. Strategic partnerships and collaborations, particularly with technology firms, will be crucial for developing integrated smart home solutions. Furthermore, a focus on expanding into niche markets, such as compact appliances for urban living, and enhancing the after-sales service experience will unlock new revenue streams and foster customer loyalty. The industry's future lies in its ability to adapt to changing consumer needs and regulatory landscapes, ensuring it remains at the forefront of technological advancement and consumer satisfaction.

United Kingdom Household Appliance Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

United Kingdom Household Appliance Industry Segmentation By Geography

- 1. United Kingdom

United Kingdom Household Appliance Industry Regional Market Share

Geographic Coverage of United Kingdom Household Appliance Industry

United Kingdom Household Appliance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization is Driving the Market; Rising Disposable Income is Driving the Market

- 3.3. Market Restrains

- 3.3.1 Price Sensitivity of Consumers is Restraining the Market; Saturation of the Market

- 3.3.2 with Availability of Wide Range of Brands and Products

- 3.4. Market Trends

- 3.4.1. Innovative Products are Driving the Sales Volume of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Household Appliance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Whirlpool Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Arcelik AS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Haier Electronics Group Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Samsung Electronics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mitsubishi Electric Corporation**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gorenje Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BSH Hausgeräte GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Electrolux AB

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Panasonic Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LG Electronics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Whirlpool Corporation

List of Figures

- Figure 1: United Kingdom Household Appliance Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Kingdom Household Appliance Industry Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Household Appliance Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: United Kingdom Household Appliance Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: United Kingdom Household Appliance Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: United Kingdom Household Appliance Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: United Kingdom Household Appliance Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: United Kingdom Household Appliance Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: United Kingdom Household Appliance Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: United Kingdom Household Appliance Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: United Kingdom Household Appliance Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: United Kingdom Household Appliance Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: United Kingdom Household Appliance Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: United Kingdom Household Appliance Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Household Appliance Industry?

The projected CAGR is approximately 3.25%.

2. Which companies are prominent players in the United Kingdom Household Appliance Industry?

Key companies in the market include Whirlpool Corporation, Arcelik AS, Haier Electronics Group Co Ltd, Samsung Electronics, Mitsubishi Electric Corporation**List Not Exhaustive, Gorenje Group, BSH Hausgeräte GmbH, Electrolux AB, Panasonic Corporation, LG Electronics.

3. What are the main segments of the United Kingdom Household Appliance Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization is Driving the Market; Rising Disposable Income is Driving the Market.

6. What are the notable trends driving market growth?

Innovative Products are Driving the Sales Volume of the Market.

7. Are there any restraints impacting market growth?

Price Sensitivity of Consumers is Restraining the Market; Saturation of the Market. with Availability of Wide Range of Brands and Products.

8. Can you provide examples of recent developments in the market?

In May 2022, Whirlpool corporation launched WoW Studios, a new marketing organization designed to infuse magic into the home appliance consumer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Household Appliance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Household Appliance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Household Appliance Industry?

To stay informed about further developments, trends, and reports in the United Kingdom Household Appliance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence