Key Insights

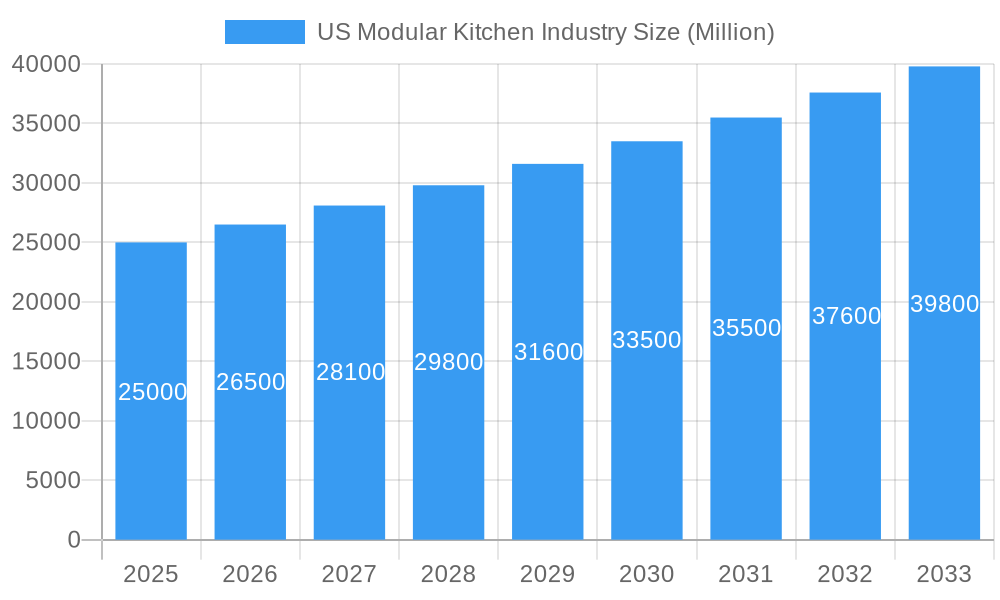

The US modular kitchen market is poised for robust expansion, projecting a Compound Annual Growth Rate (CAGR) of 5.2%. Driven by escalating urbanization, rising disposable incomes, and a pronounced consumer preference for contemporary, space-saving designs, the market is anticipated to reach $8.35 billion by 2024. Growing demand for bespoke solutions and smart kitchen appliances is spurring innovation. Manufacturers are responding with a diverse array of designs, including L-shape, U-shape, and straight configurations, alongside a comprehensive selection of floor, wall, and tall storage cabinets. While traditional distribution channels through contractors and builders remain significant, the online segment is experiencing notable growth. Key industry players, such as IKEA, SieMatic, and Hettich, are engaged in intense competition, capitalizing on established brand equity and superior product quality. Despite challenges posed by material costs and supply chain volatility, the market outlook is overwhelmingly positive. The sustained emphasis on personalization and smart technology integration indicates a clear trajectory towards higher-value, technologically advanced modular kitchen systems. This trend, coupled with the increasing desire for aesthetically pleasing and highly functional kitchen environments in both new constructions and renovations, will be a pivotal driver of future market growth.

US Modular Kitchen Industry Market Size (In Billion)

US market growth is forecast to exceed global averages, attributed to its elevated disposable income levels and high homeownership rates. A segmented market analysis, examining design variations, product categories, and distribution channels, offers critical intelligence for strategic marketing initiatives. Identifying and capitalizing on regional demand fluctuations will be paramount for optimizing market penetration and tailoring product portfolios. The growing imperative for sustainable and eco-friendly materials is also emerging as a significant growth catalyst, with companies actively prioritizing environmentally conscious options to align with escalating consumer preferences. In-depth research into specific consumer needs across various demographic segments will be essential for manufacturers to refine their product offerings and enhance marketing efficacy.

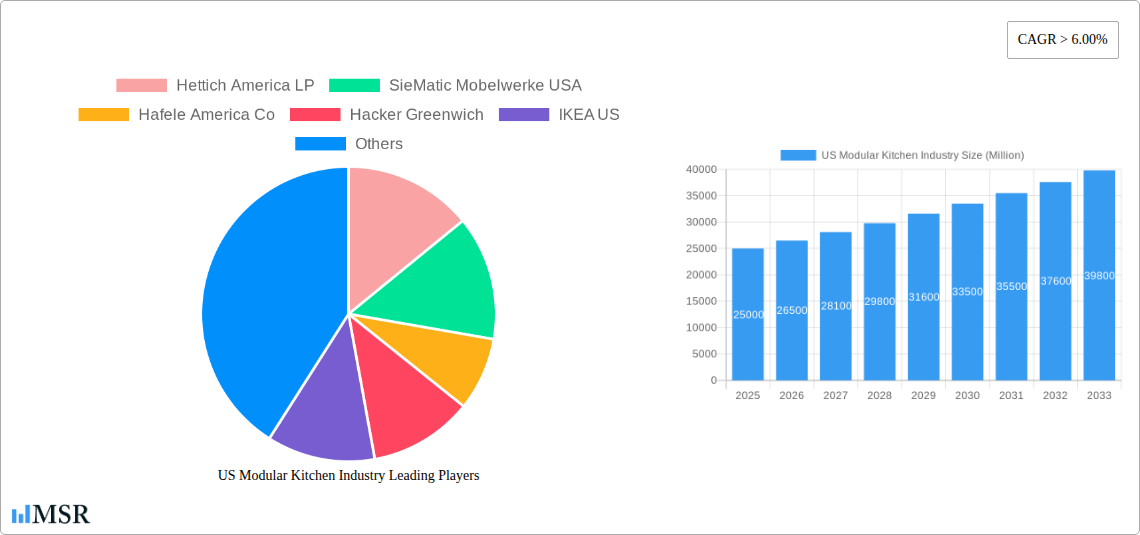

US Modular Kitchen Industry Company Market Share

US Modular Kitchen Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the US modular kitchen industry, encompassing market size, growth drivers, key players, and future trends. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an essential resource for industry stakeholders, investors, and anyone seeking to understand this dynamic market. The US modular kitchen market, valued at $xx Million in 2024, is projected to reach $xx Million by 2033, exhibiting a CAGR of xx%.

US Modular Kitchen Industry Market Concentration & Dynamics

The US modular kitchen market is characterized by a mix of large multinational corporations and smaller, specialized companies. Market concentration is moderate, with the top five players holding an estimated xx% market share in 2024. Innovation within the sector is driven by advancements in materials, design software, and manufacturing technologies. Regulatory frameworks, including building codes and safety standards, significantly impact product design and distribution. Substitute products, such as custom-built kitchens, compete based on perceived quality and design flexibility. End-user trends favor sustainable, smart, and aesthetically pleasing designs, reflecting a growing emphasis on personalized living spaces. M&A activity in the industry has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024.

- Market Share: Top 5 players: xx% (2024)

- M&A Deals: xx (2019-2024)

- Key Innovation Areas: Smart kitchen technology, sustainable materials, advanced design software.

US Modular Kitchen Industry Industry Insights & Trends

The US modular kitchen market's growth is fueled by several factors: rising disposable incomes, increasing urbanization, and a growing preference for modern, functional kitchen designs. Technological disruptions, such as the integration of smart appliances and digital design tools, are transforming the industry. Consumer behavior is shifting towards personalized designs, eco-friendly materials, and greater emphasis on kitchen functionality. The market is segmented by design (L-shape, U-shape, straight, others), product type (floor cabinets, wall cabinets, tall storage cabinets, others), and distribution channel (offline, online). The robust growth of the online channel is particularly noteworthy.

Key Markets & Segments Leading US Modular Kitchen Industry

The US modular kitchen market is geographically diverse, with strong demand across major metropolitan areas. L-shaped and U-shaped kitchen designs remain dominant, reflecting the popularity of open-concept floor plans. Floor cabinets and wall cabinets continue to represent the largest product segments. Offline distribution channels, primarily through contractors and builders, remain the dominant sales method. However, online sales are experiencing significant growth driven by e-commerce platforms and improved digital marketing strategies.

- Dominant Design: L-Shape and U-Shape

- Dominant Product: Floor and Wall Cabinets

- Dominant Distribution Channel: Offline (Contractors, Builders)

- Growth Drivers:

- Rising Disposable Incomes

- Urbanization

- Preference for Modern Kitchen Designs

- Technological Advancements

- Increased Online Sales

US Modular Kitchen Industry Product Developments

Recent product innovations focus on improved functionality, smart technology integration, and sustainable materials. Modular designs provide greater flexibility and customization options. Technological advancements like smart cabinets with integrated charging ports and automated storage solutions are gaining traction, providing competitive advantages to manufacturers who embrace these trends.

Challenges in the US Modular Kitchen Industry Market

The US modular kitchen industry faces challenges including fluctuating raw material costs, supply chain disruptions impacting production timelines and potentially leading to increased costs, and intense competition among established players and new entrants. Regulatory compliance and labor costs also pose significant hurdles. These challenges may affect overall market growth and profitability if not effectively managed.

Forces Driving US Modular Kitchen Industry Growth

Technological innovation, particularly in smart home integration and sustainable materials, is a key growth driver. Favorable economic conditions, including increasing homeownership rates, contribute to market expansion. Government initiatives promoting energy efficiency in buildings further stimulate demand for high-performance modular kitchens.

Challenges in the US Modular Kitchen Industry Market

Long-term growth will be driven by the continuous innovation of smart kitchen technology, strategic partnerships among manufacturers and technology companies, and expansion into new geographic markets with high growth potential. The industry's ability to adapt to evolving consumer demands and preferences will be crucial to sustained success.

Emerging Opportunities in US Modular Kitchen Industry

Emerging opportunities lie in the growing demand for sustainable and eco-friendly kitchen designs, the integration of smart home technology, and increasing customization options. The focus on personalized kitchens caters to a wider range of consumer needs and preferences, creating significant market potential.

Leading Players in the US Modular Kitchen Industry Sector

- Hettich America LP

- SieMatic Mobelwerke USA

- Hafele America Co

- Hacker Greenwich

- IKEA US

- Eggersmann USA

- Boston Cabinets Inc

- Pedini USA

- Snaidero USA

- Lineadecor USA LLC

Key Milestones in US Modular Kitchen Industry Industry

- April 2023: Ikea announces a $2.2 billion investment to expand its US operations, its largest investment in almost four decades. This signals a significant expansion in the market and increased competition.

- August 2022: IKEA US opens a new Planning Studio in Los Angeles, highlighting a shift towards enhanced customer experience and design consultation. This indicates a trend towards personalized design services.

- January 2022: Eggersmann showcases a new product line focusing on luxurious materials, finishes, and organizational features. This demonstrates a focus on high-end market segments and design innovation.

Strategic Outlook for US Modular Kitchen Industry Market

The US modular kitchen market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and increasing investment from major players. Strategic opportunities exist in expanding into niche markets, fostering innovation in sustainable materials and smart kitchen technology, and enhancing the customer experience through personalized design services and improved digital marketing strategies. The market's future success depends on embracing technological innovation, adapting to consumer demands, and effectively managing the challenges posed by supply chain disruptions and competition.

US Modular Kitchen Industry Segmentation

-

1. Design

- 1.1. L Shape

- 1.2. U Shape

- 1.3. Straight

- 1.4. Other Designs

-

2. Product

- 2.1. Floor Cabinet and Wall Cabinets

- 2.2. Tall Storage Cabinets

- 2.3. Other Products

-

3. Distribution Channel

- 3.1. Offline (Contractors, Builders, etc.)

- 3.2. Online

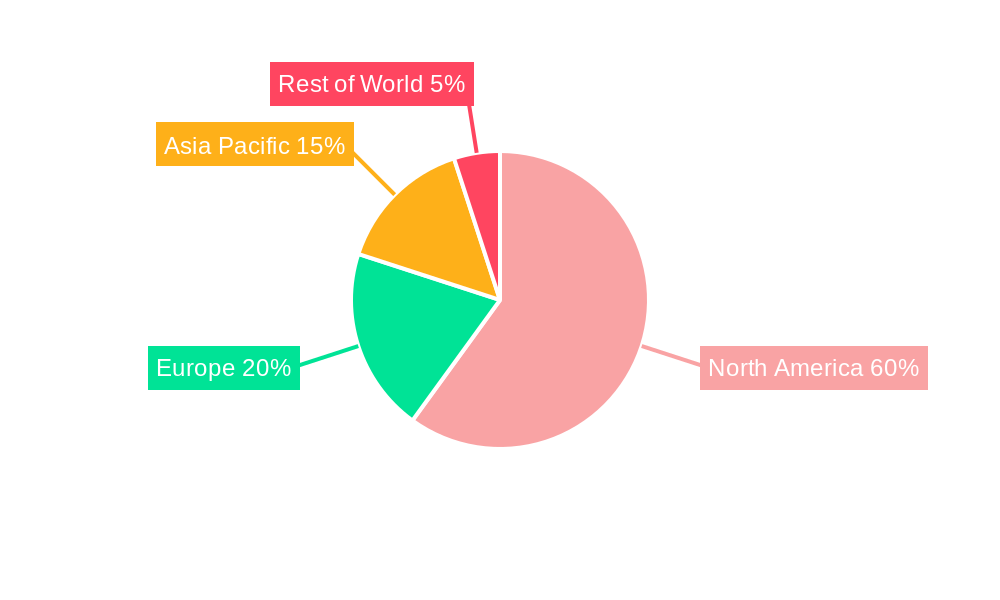

US Modular Kitchen Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Modular Kitchen Industry Regional Market Share

Geographic Coverage of US Modular Kitchen Industry

US Modular Kitchen Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wooden Furniture Products are Preferred in Canadian Households; Rise in the Demand of Furniture Residential Segment

- 3.3. Market Restrains

- 3.3.1. Changes in Consumer Preferences and Behavior

- 3.4. Market Trends

- 3.4.1. U-Shaped Kitchens Are The Most Preferred Modular Kitchen Designs In The United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Modular Kitchen Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Design

- 5.1.1. L Shape

- 5.1.2. U Shape

- 5.1.3. Straight

- 5.1.4. Other Designs

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Floor Cabinet and Wall Cabinets

- 5.2.2. Tall Storage Cabinets

- 5.2.3. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline (Contractors, Builders, etc.)

- 5.3.2. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Design

- 6. North America US Modular Kitchen Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Design

- 6.1.1. L Shape

- 6.1.2. U Shape

- 6.1.3. Straight

- 6.1.4. Other Designs

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Floor Cabinet and Wall Cabinets

- 6.2.2. Tall Storage Cabinets

- 6.2.3. Other Products

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Offline (Contractors, Builders, etc.)

- 6.3.2. Online

- 6.1. Market Analysis, Insights and Forecast - by Design

- 7. South America US Modular Kitchen Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Design

- 7.1.1. L Shape

- 7.1.2. U Shape

- 7.1.3. Straight

- 7.1.4. Other Designs

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Floor Cabinet and Wall Cabinets

- 7.2.2. Tall Storage Cabinets

- 7.2.3. Other Products

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Offline (Contractors, Builders, etc.)

- 7.3.2. Online

- 7.1. Market Analysis, Insights and Forecast - by Design

- 8. Europe US Modular Kitchen Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Design

- 8.1.1. L Shape

- 8.1.2. U Shape

- 8.1.3. Straight

- 8.1.4. Other Designs

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Floor Cabinet and Wall Cabinets

- 8.2.2. Tall Storage Cabinets

- 8.2.3. Other Products

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Offline (Contractors, Builders, etc.)

- 8.3.2. Online

- 8.1. Market Analysis, Insights and Forecast - by Design

- 9. Middle East & Africa US Modular Kitchen Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Design

- 9.1.1. L Shape

- 9.1.2. U Shape

- 9.1.3. Straight

- 9.1.4. Other Designs

- 9.2. Market Analysis, Insights and Forecast - by Product

- 9.2.1. Floor Cabinet and Wall Cabinets

- 9.2.2. Tall Storage Cabinets

- 9.2.3. Other Products

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Offline (Contractors, Builders, etc.)

- 9.3.2. Online

- 9.1. Market Analysis, Insights and Forecast - by Design

- 10. Asia Pacific US Modular Kitchen Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Design

- 10.1.1. L Shape

- 10.1.2. U Shape

- 10.1.3. Straight

- 10.1.4. Other Designs

- 10.2. Market Analysis, Insights and Forecast - by Product

- 10.2.1. Floor Cabinet and Wall Cabinets

- 10.2.2. Tall Storage Cabinets

- 10.2.3. Other Products

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Offline (Contractors, Builders, etc.)

- 10.3.2. Online

- 10.1. Market Analysis, Insights and Forecast - by Design

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hettich America LP

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SieMatic Mobelwerke USA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hafele America Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hacker Greenwich

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IKEA US

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Eggersmann USA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Boston Cabinets Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pedini USA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Snaidero USA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lineadecor USA LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Hettich America LP

List of Figures

- Figure 1: Global US Modular Kitchen Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America US Modular Kitchen Industry Revenue (billion), by Design 2025 & 2033

- Figure 3: North America US Modular Kitchen Industry Revenue Share (%), by Design 2025 & 2033

- Figure 4: North America US Modular Kitchen Industry Revenue (billion), by Product 2025 & 2033

- Figure 5: North America US Modular Kitchen Industry Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America US Modular Kitchen Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 7: North America US Modular Kitchen Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America US Modular Kitchen Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America US Modular Kitchen Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America US Modular Kitchen Industry Revenue (billion), by Design 2025 & 2033

- Figure 11: South America US Modular Kitchen Industry Revenue Share (%), by Design 2025 & 2033

- Figure 12: South America US Modular Kitchen Industry Revenue (billion), by Product 2025 & 2033

- Figure 13: South America US Modular Kitchen Industry Revenue Share (%), by Product 2025 & 2033

- Figure 14: South America US Modular Kitchen Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 15: South America US Modular Kitchen Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America US Modular Kitchen Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: South America US Modular Kitchen Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe US Modular Kitchen Industry Revenue (billion), by Design 2025 & 2033

- Figure 19: Europe US Modular Kitchen Industry Revenue Share (%), by Design 2025 & 2033

- Figure 20: Europe US Modular Kitchen Industry Revenue (billion), by Product 2025 & 2033

- Figure 21: Europe US Modular Kitchen Industry Revenue Share (%), by Product 2025 & 2033

- Figure 22: Europe US Modular Kitchen Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Europe US Modular Kitchen Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe US Modular Kitchen Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe US Modular Kitchen Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa US Modular Kitchen Industry Revenue (billion), by Design 2025 & 2033

- Figure 27: Middle East & Africa US Modular Kitchen Industry Revenue Share (%), by Design 2025 & 2033

- Figure 28: Middle East & Africa US Modular Kitchen Industry Revenue (billion), by Product 2025 & 2033

- Figure 29: Middle East & Africa US Modular Kitchen Industry Revenue Share (%), by Product 2025 & 2033

- Figure 30: Middle East & Africa US Modular Kitchen Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa US Modular Kitchen Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa US Modular Kitchen Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa US Modular Kitchen Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific US Modular Kitchen Industry Revenue (billion), by Design 2025 & 2033

- Figure 35: Asia Pacific US Modular Kitchen Industry Revenue Share (%), by Design 2025 & 2033

- Figure 36: Asia Pacific US Modular Kitchen Industry Revenue (billion), by Product 2025 & 2033

- Figure 37: Asia Pacific US Modular Kitchen Industry Revenue Share (%), by Product 2025 & 2033

- Figure 38: Asia Pacific US Modular Kitchen Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific US Modular Kitchen Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific US Modular Kitchen Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific US Modular Kitchen Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Modular Kitchen Industry Revenue billion Forecast, by Design 2020 & 2033

- Table 2: Global US Modular Kitchen Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 3: Global US Modular Kitchen Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global US Modular Kitchen Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global US Modular Kitchen Industry Revenue billion Forecast, by Design 2020 & 2033

- Table 6: Global US Modular Kitchen Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 7: Global US Modular Kitchen Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global US Modular Kitchen Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global US Modular Kitchen Industry Revenue billion Forecast, by Design 2020 & 2033

- Table 13: Global US Modular Kitchen Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 14: Global US Modular Kitchen Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global US Modular Kitchen Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global US Modular Kitchen Industry Revenue billion Forecast, by Design 2020 & 2033

- Table 20: Global US Modular Kitchen Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 21: Global US Modular Kitchen Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global US Modular Kitchen Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global US Modular Kitchen Industry Revenue billion Forecast, by Design 2020 & 2033

- Table 33: Global US Modular Kitchen Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 34: Global US Modular Kitchen Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global US Modular Kitchen Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global US Modular Kitchen Industry Revenue billion Forecast, by Design 2020 & 2033

- Table 43: Global US Modular Kitchen Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 44: Global US Modular Kitchen Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global US Modular Kitchen Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific US Modular Kitchen Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Modular Kitchen Industry?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the US Modular Kitchen Industry?

Key companies in the market include Hettich America LP, SieMatic Mobelwerke USA, Hafele America Co, Hacker Greenwich, IKEA US, Eggersmann USA, Boston Cabinets Inc, Pedini USA, Snaidero USA, Lineadecor USA LLC.

3. What are the main segments of the US Modular Kitchen Industry?

The market segments include Design, Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.35 billion as of 2022.

5. What are some drivers contributing to market growth?

Wooden Furniture Products are Preferred in Canadian Households; Rise in the Demand of Furniture Residential Segment.

6. What are the notable trends driving market growth?

U-Shaped Kitchens Are The Most Preferred Modular Kitchen Designs In The United States.

7. Are there any restraints impacting market growth?

Changes in Consumer Preferences and Behavior.

8. Can you provide examples of recent developments in the market?

April 2023: Ikea to spend more than two billion euros ($2.2 billion) to expand in the United States. It is the biggest investment in almost four decades in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Modular Kitchen Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Modular Kitchen Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Modular Kitchen Industry?

To stay informed about further developments, trends, and reports in the US Modular Kitchen Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence