Key Insights

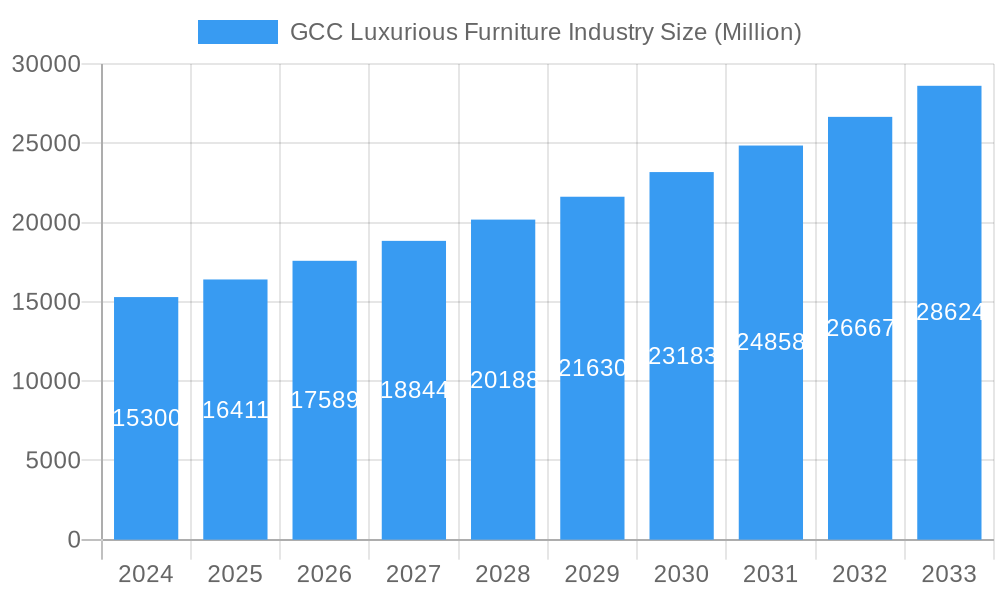

The GCC luxurious furniture market is poised for substantial growth, projected to reach an estimated USD 15.3 billion in 2024, exhibiting a robust Compound Annual Growth Rate (CAGR) of 7.2% through 2033. This expansion is fueled by a burgeoning demand for premium home and commercial furnishings, driven by rising disposable incomes, a growing expatriate population, and an increasing emphasis on interior aesthetics among affluent consumers in the region. The market is witnessing a significant shift towards bespoke and technologically integrated furniture solutions, catering to the discerning tastes of its clientele. Key growth drivers include ambitious infrastructure development projects, the establishment of high-end hospitality and retail spaces, and a discernible trend among consumers to invest in durable, high-quality pieces that reflect their status and lifestyle. The demand for opulent lighting, comfortable seating solutions like sofas and chairs, and meticulously crafted tables and cabinets are at the forefront of this market surge.

GCC Luxurious Furniture Industry Market Size (In Billion)

The competitive landscape is dynamic, with a blend of established global brands and prominent regional players actively shaping the market. Companies are focusing on expanding their distribution networks, with a notable presence in home centers, exclusive flagship stores, and increasingly, through sophisticated online retail platforms that offer personalized customer experiences. The residential segment continues to be a primary revenue generator, but the commercial sector, encompassing luxury hotels, corporate offices, and high-end retail establishments, is exhibiting accelerated growth. While the market presents numerous opportunities, challenges such as the high cost of imported raw materials and increasing competition from local manufacturers offering competitive pricing and design can impact profit margins. Nevertheless, the overarching trend of aspirational consumption and the continuous pursuit of sophisticated living and working environments will continue to propel the GCC luxurious furniture market forward, with Saudi Arabia and the United Arab Emirates leading the expansion.

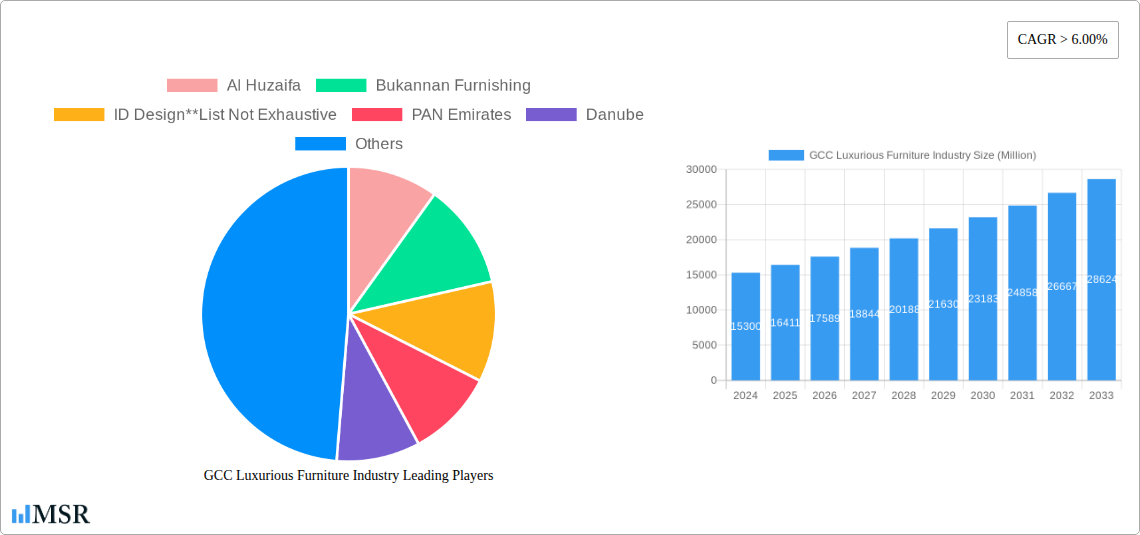

GCC Luxurious Furniture Industry Company Market Share

GCC Luxurious Furniture Industry Market Analysis: 2019–2033

This comprehensive report offers an in-depth analysis of the GCC Luxurious Furniture Industry, covering the period from 2019 to 2033, with 2025 as the base and estimated year. Delve into market dynamics, key trends, dominant segments, product innovations, challenges, growth drivers, and emerging opportunities. This report is an indispensable resource for industry stakeholders, investors, and businesses seeking to understand and capitalize on the burgeoning luxury furniture market in the Gulf Cooperation Council.

GCC Luxurious Furniture Industry Market Concentration & Dynamics

The GCC Luxurious Furniture Industry exhibits a moderately concentrated market structure, with a few dominant players alongside a growing number of niche and emerging brands. Market share distribution is dynamic, influenced by brand reputation, product innovation, and strategic expansion. For instance, leading brands like IKEA, Home Center, and PAN Home (formerly PAN Emirates) hold significant shares across various segments, while specialized luxury providers such as Al Huzaifa, Bukannan Furnishing, ID Design, Luxe Living, and B&B Italia cater to high-net-worth individuals and premium commercial projects. The innovation ecosystem is fueled by an increasing demand for bespoke designs, smart furniture solutions, and sustainable materials, with an estimated XX billion in R&D investments annually. Regulatory frameworks in the GCC are becoming more sophisticated, focusing on quality standards, import duties, and consumer protection, impacting operational costs and market entry strategies. Substitute products, primarily mid-range furniture and imported mass-produced items, pose a constant competitive threat, yet the unique selling proposition of luxury furniture—craftsmanship, premium materials, and exclusivity—continues to command its premium. End-user trends reveal a growing preference for personalized experiences, omnichannel retail, and environmentally conscious products. Merger and acquisition (M&A) activities are anticipated to increase as larger players seek to consolidate market positions and acquire innovative smaller companies. The historical M&A deal count stands at XX, with projections of YY deals within the forecast period, valued at an estimated ZZ billion.

GCC Luxurious Furniture Industry Industry Insights & Trends

The GCC Luxurious Furniture Industry is poised for substantial growth, projected to reach a market size of approximately $XX billion by 2033, with a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This robust expansion is driven by a confluence of economic prosperity, evolving consumer lifestyles, and significant investments in the region's hospitality and real estate sectors. Increased disposable incomes among affluent populations in Saudi Arabia, the United Arab Emirates, Kuwait, and Qatar are a primary growth catalyst, fostering a demand for high-end, aesthetically pleasing, and functional furniture. Technological disruptions are reshaping the industry, with the integration of smart home technology into furniture pieces, offering enhanced convenience and luxury. Virtual reality (VR) and augmented reality (AR) are becoming instrumental in the design and sales process, allowing consumers to visualize furniture in their spaces before purchase. Evolving consumer behaviors are characterized by a heightened appreciation for craftsmanship, sustainability, and unique designs. Consumers are increasingly seeking furniture that reflects their personal style and values, leading to a surge in demand for bespoke and custom-made pieces. The influence of social media and interior design influencers further shapes preferences, creating trends around specific aesthetics and brands. The market size in the historical period (2019–2024) was estimated at $XX billion, demonstrating a steady upward trajectory. The base year (2025) market size is projected at $XX billion, providing a strong foundation for future growth. The estimated year (2025) further solidifies this projection, indicating a confident outlook for the industry. Key sub-segments like bedroom furniture, seating solutions (chairs and sofas), and decorative accessories are experiencing particularly strong demand. The rise of eco-friendly and sustainable furniture options is also a significant emerging trend, aligning with global environmental consciousness and government initiatives within the GCC. This shift necessitates a focus on material sourcing and production processes that minimize environmental impact. Furthermore, the burgeoning tourism sector and the development of ultra-luxury hotels and residences are creating a consistent demand for high-quality, aesthetically superior furniture solutions.

Key Markets & Segments Leading GCC Luxurious Furniture Industry

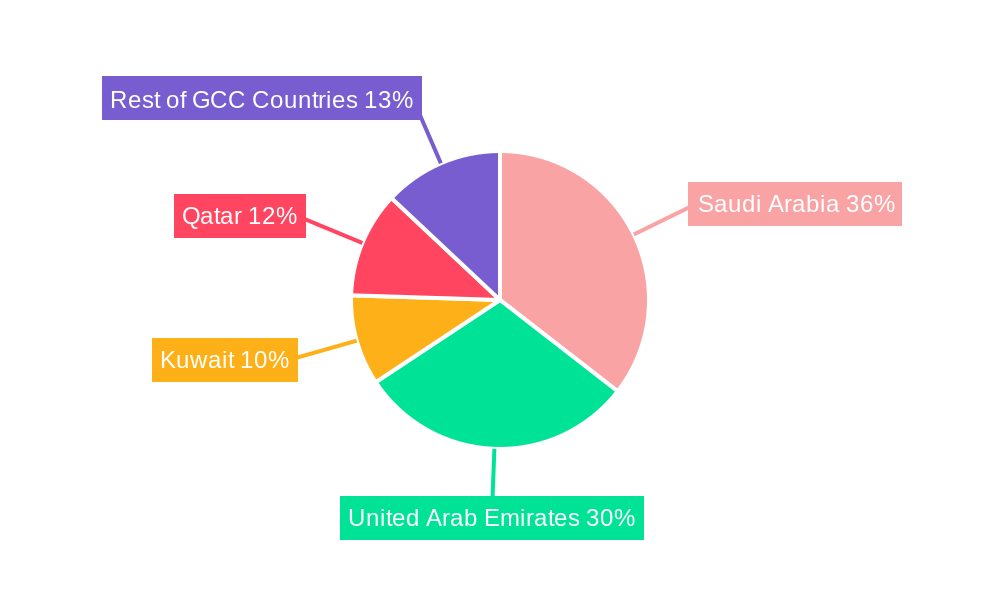

The United Arab Emirates consistently emerges as a dominant market within the GCC Luxurious Furniture Industry, driven by its status as a global hub for tourism, luxury retail, and real estate development. Saudi Arabia follows closely, with significant investments in Vision 2030 projects fueling demand for both residential and commercial luxury furnishings. Qatar and Kuwait also represent substantial markets, characterized by high per capita income and a strong preference for premium goods.

Geography Dominance:

- United Arab Emirates: Boasts a sophisticated retail infrastructure, a large expatriate population with high spending power, and a continuous influx of luxury tourism, driving demand for high-end furniture in residences, hotels, and commercial spaces.

- Saudi Arabia: Vision 2030 initiatives, including giga-projects like NEOM and Red Sea Project, are creating unprecedented demand for luxury furniture in residential, hospitality, and corporate sectors. Economic diversification away from oil is also boosting consumer spending.

- Kuwait: A mature market with a high concentration of affluent households that value quality and brand prestige in their home furnishings.

- Qatar: Hosting major international events and experiencing significant infrastructure development, leading to sustained demand for luxury interiors in both residential and commercial properties.

- Rest of GCC Countries: While smaller individually, Oman, Bahrain, and other smaller GCC nations contribute to the overall market with their growing affluent segments and luxury real estate projects.

Product Type Dominance:

- Bedroom Furniture: The bedroom remains a sanctuary for luxury, with high demand for opulent bed frames, custom wardrobes, and premium mattresses.

- Chairs and Sofas: Upholstered seating solutions, crafted from the finest leathers and fabrics, are central to luxurious living and commercial spaces.

- Accessories: Decorative items, including high-end lighting fixtures, rugs, and art pieces, are crucial for completing the luxury aesthetic.

- Cabinets: Bespoke cabinets and display units that combine functionality with exquisite design are highly sought after.

- Tables: Dining tables, coffee tables, and side tables made from premium materials like marble, exotic woods, and metals are integral to luxury interiors.

- Lighting: Statement lighting fixtures are essential for ambiance and design, with a strong demand for artistic and technologically advanced options.

End User Dominance:

- Residential: The primary driver, fueled by the construction of luxury villas, penthouses, and high-end apartments, and a growing demand for home renovation and interior upgrades among affluent households.

- Commercial: A significant segment driven by the hospitality industry (luxury hotels, resorts), corporate offices seeking prestigious interiors, and high-end retail establishments.

Distribution Channel Dominance:

- Home Centers: Brands like IKEA and Home Center leverage their extensive reach to offer a blend of accessible luxury and mid-to-high-end furniture, catering to a broad spectrum of consumers.

- Flagship Stores: Luxury brands maintain exclusive flagship stores in prime retail locations, offering a curated experience and showcasing their premium collections.

- Specialty Stores: Boutiques and design-focused showrooms that curate unique and high-end furniture pieces, often catering to specific design aesthetics.

- Online: The e-commerce channel is rapidly growing, with dedicated luxury furniture platforms and online stores of established brands offering convenience and wider selection.

GCC Luxurious Furniture Industry Product Developments

Product development in the GCC Luxurious Furniture Industry is increasingly focused on incorporating advanced materials, sustainable practices, and smart technology. Innovations in bespoke furniture manufacturing, allowing for unparalleled customization in terms of dimensions, finishes, and upholstery, are a key differentiator. The integration of smart home functionalities, such as adjustable lighting, integrated charging ports, and automated reclining mechanisms in sofas, is gaining traction. Furthermore, there's a growing emphasis on artisanal craftsmanship and the use of ethically sourced, eco-friendly materials, appealing to a conscious luxury consumer. Applications range from exclusive residential interiors to opulent hotel suites and high-profile corporate spaces, all demanding unique and high-quality furnishings. These advancements aim to enhance user experience, aesthetic appeal, and environmental responsibility, providing a competitive edge in a discerning market.

Challenges in the GCC Luxurious Furniture Industry Market

The GCC Luxurious Furniture Industry faces several challenges, including the volatile nature of commodity prices for raw materials like exotic woods and metals, impacting production costs. Supply chain disruptions, exacerbated by global logistics issues, can lead to extended lead times and increased shipping expenses. The intense competition from both established international luxury brands and local manufacturers, coupled with a growing demand for affordable luxury, puts pressure on pricing strategies. Stringent import regulations and customs duties in some GCC countries can also add to the cost of goods. Furthermore, the availability of skilled labor for intricate craftsmanship and specialized installation remains a concern, potentially hindering scalability.

Forces Driving GCC Luxurious Furniture Industry Growth

Several forces are propelling the GCC Luxurious Furniture Industry forward. Economic diversification initiatives and significant government investments in mega-projects across the GCC are creating substantial demand for high-end residential, hospitality, and commercial spaces. Rising disposable incomes and a growing affluent consumer base, particularly in Saudi Arabia and the UAE, are fueling a desire for premium home furnishings that reflect status and personal style. The burgeoning tourism sector and the continuous development of world-class hotels and resorts necessitate sophisticated and luxurious interior designs. Evolving lifestyle trends, with an increased focus on home comfort, entertainment, and personalized living spaces, further amplify the demand for bespoke and high-quality furniture.

Challenges in the GCC Luxurious Furniture Industry Market

Long-term growth catalysts for the GCC Luxurious Furniture Industry lie in continuous innovation and market expansion. Embracing digital transformation, including advanced e-commerce platforms and augmented reality for virtual try-ons, will be crucial for reaching a wider audience. Strategic partnerships with interior designers, architects, and real estate developers will open doors to exclusive projects and consistent demand. Furthermore, exploring new product categories, such as smart furniture and sustainable luxury lines, can tap into emerging consumer preferences. Geographic expansion within and beyond the GCC, while understanding local market nuances, will also be a key driver.

Emerging Opportunities in GCC Luxurious Furniture Industry

Emerging opportunities in the GCC Luxurious Furniture Industry are abundant. The increasing demand for sustainable and ethically produced furniture presents a significant niche market for eco-conscious brands. The rise of the "smart home" concept is creating opportunities for integrated furniture solutions that offer convenience and advanced functionality. Furthermore, the growing preference for personalized and bespoke pieces opens avenues for customization services and made-to-order furniture. The expansion of the luxury hospitality sector, coupled with an increasing number of affluent individuals seeking unique home aesthetics, will continue to drive demand for high-end, statement furniture pieces. The development of smaller, more niche luxury furniture brands that focus on specific design styles or materials also presents a promising avenue for market entry and growth.

Leading Players in the GCC Luxurious Furniture Industry Sector

- Al Huzaifa

- Bukannan Furnishing

- ID Design

- PAN Emirates

- Danube

- IKEA

- Home Center

- Luxe Living

- B&B Italia

- Royal Furniture

Key Milestones in GCC Luxurious Furniture Industry Industry

- June 2023: Daze Furniture, the leading furniture brand known for its bespoke collection of furniture, lighting, and home accessories, is poised to revolutionise the luxury furniture segment in the UAE.

- May 2023: PAN Emirates, a premier home furnishings and online furniture shopping store in UAE, has rebranded itself as PAN Home. The rebranding effort includes a complete makeover, signaling a more modernised perspective for PAN Home.

Strategic Outlook for GCC Luxurious Furniture Industry Market

The strategic outlook for the GCC Luxurious Furniture Industry is exceptionally positive, characterized by sustained growth driven by robust economic development and an evolving affluent consumer base. Key growth accelerators include the continuous expansion of luxury real estate and hospitality sectors, demanding increasingly sophisticated and high-quality furnishings. Embracing technological advancements, such as AI-powered design tools and immersive online shopping experiences, will be pivotal for market leadership. Furthermore, a strategic focus on sustainability and ethical sourcing will resonate with the conscious luxury consumer, creating a distinct competitive advantage. Diversification of product portfolios to include smart furniture and personalized design solutions will cater to evolving lifestyle demands, ensuring long-term market relevance and profitability.

GCC Luxurious Furniture Industry Segmentation

-

1. Product Type

- 1.1. Lighting

- 1.2. Tables

- 1.3. Chairs and Sofas

- 1.4. Accessories

- 1.5. Bedroom

- 1.6. Cabinets

- 1.7. Other Products

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Home Centers

- 3.2. Flagship Stores

- 3.3. Specialty Stores

- 3.4. Online

- 3.5. Other Distribution Channels

-

4. Geography

- 4.1. Saudi Arabia

- 4.2. United Arab Emirates

- 4.3. Kuwait

- 4.4. Qatar

- 4.5. Rest of GCC Countries

GCC Luxurious Furniture Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Kuwait

- 4. Qatar

- 5. Rest of GCC Countries

GCC Luxurious Furniture Industry Regional Market Share

Geographic Coverage of GCC Luxurious Furniture Industry

GCC Luxurious Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumer Trend for Luxury Furniture; Real Estate Development

- 3.3. Market Restrains

- 3.3.1. High Import Taxes and Duties; High Cost of Raw Materials

- 3.4. Market Trends

- 3.4.1. Changing Consumer Preferences Toward Luxury Goods Like Luxury Furniture

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Luxurious Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Lighting

- 5.1.2. Tables

- 5.1.3. Chairs and Sofas

- 5.1.4. Accessories

- 5.1.5. Bedroom

- 5.1.6. Cabinets

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Home Centers

- 5.3.2. Flagship Stores

- 5.3.3. Specialty Stores

- 5.3.4. Online

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Kuwait

- 5.4.4. Qatar

- 5.4.5. Rest of GCC Countries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.5.2. United Arab Emirates

- 5.5.3. Kuwait

- 5.5.4. Qatar

- 5.5.5. Rest of GCC Countries

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Saudi Arabia GCC Luxurious Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Lighting

- 6.1.2. Tables

- 6.1.3. Chairs and Sofas

- 6.1.4. Accessories

- 6.1.5. Bedroom

- 6.1.6. Cabinets

- 6.1.7. Other Products

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Home Centers

- 6.3.2. Flagship Stores

- 6.3.3. Specialty Stores

- 6.3.4. Online

- 6.3.5. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Saudi Arabia

- 6.4.2. United Arab Emirates

- 6.4.3. Kuwait

- 6.4.4. Qatar

- 6.4.5. Rest of GCC Countries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Arab Emirates GCC Luxurious Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Lighting

- 7.1.2. Tables

- 7.1.3. Chairs and Sofas

- 7.1.4. Accessories

- 7.1.5. Bedroom

- 7.1.6. Cabinets

- 7.1.7. Other Products

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Home Centers

- 7.3.2. Flagship Stores

- 7.3.3. Specialty Stores

- 7.3.4. Online

- 7.3.5. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Saudi Arabia

- 7.4.2. United Arab Emirates

- 7.4.3. Kuwait

- 7.4.4. Qatar

- 7.4.5. Rest of GCC Countries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Kuwait GCC Luxurious Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Lighting

- 8.1.2. Tables

- 8.1.3. Chairs and Sofas

- 8.1.4. Accessories

- 8.1.5. Bedroom

- 8.1.6. Cabinets

- 8.1.7. Other Products

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Home Centers

- 8.3.2. Flagship Stores

- 8.3.3. Specialty Stores

- 8.3.4. Online

- 8.3.5. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Saudi Arabia

- 8.4.2. United Arab Emirates

- 8.4.3. Kuwait

- 8.4.4. Qatar

- 8.4.5. Rest of GCC Countries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Qatar GCC Luxurious Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Lighting

- 9.1.2. Tables

- 9.1.3. Chairs and Sofas

- 9.1.4. Accessories

- 9.1.5. Bedroom

- 9.1.6. Cabinets

- 9.1.7. Other Products

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Home Centers

- 9.3.2. Flagship Stores

- 9.3.3. Specialty Stores

- 9.3.4. Online

- 9.3.5. Other Distribution Channels

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Saudi Arabia

- 9.4.2. United Arab Emirates

- 9.4.3. Kuwait

- 9.4.4. Qatar

- 9.4.5. Rest of GCC Countries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of GCC Countries GCC Luxurious Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Lighting

- 10.1.2. Tables

- 10.1.3. Chairs and Sofas

- 10.1.4. Accessories

- 10.1.5. Bedroom

- 10.1.6. Cabinets

- 10.1.7. Other Products

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Home Centers

- 10.3.2. Flagship Stores

- 10.3.3. Specialty Stores

- 10.3.4. Online

- 10.3.5. Other Distribution Channels

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Saudi Arabia

- 10.4.2. United Arab Emirates

- 10.4.3. Kuwait

- 10.4.4. Qatar

- 10.4.5. Rest of GCC Countries

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Al Huzaifa

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bukannan Furnishing

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ID Design**List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PAN Emirates

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Danube

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 IKEA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Home Center

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Luxe Living

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 B&B Italia

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Royal Furniture

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Al Huzaifa

List of Figures

- Figure 1: Global GCC Luxurious Furniture Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Saudi Arabia GCC Luxurious Furniture Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: Saudi Arabia GCC Luxurious Furniture Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Saudi Arabia GCC Luxurious Furniture Industry Revenue (undefined), by End User 2025 & 2033

- Figure 5: Saudi Arabia GCC Luxurious Furniture Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: Saudi Arabia GCC Luxurious Furniture Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 7: Saudi Arabia GCC Luxurious Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: Saudi Arabia GCC Luxurious Furniture Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 9: Saudi Arabia GCC Luxurious Furniture Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 10: Saudi Arabia GCC Luxurious Furniture Industry Revenue (undefined), by Country 2025 & 2033

- Figure 11: Saudi Arabia GCC Luxurious Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: United Arab Emirates GCC Luxurious Furniture Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 13: United Arab Emirates GCC Luxurious Furniture Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: United Arab Emirates GCC Luxurious Furniture Industry Revenue (undefined), by End User 2025 & 2033

- Figure 15: United Arab Emirates GCC Luxurious Furniture Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: United Arab Emirates GCC Luxurious Furniture Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 17: United Arab Emirates GCC Luxurious Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: United Arab Emirates GCC Luxurious Furniture Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 19: United Arab Emirates GCC Luxurious Furniture Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 20: United Arab Emirates GCC Luxurious Furniture Industry Revenue (undefined), by Country 2025 & 2033

- Figure 21: United Arab Emirates GCC Luxurious Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Kuwait GCC Luxurious Furniture Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 23: Kuwait GCC Luxurious Furniture Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Kuwait GCC Luxurious Furniture Industry Revenue (undefined), by End User 2025 & 2033

- Figure 25: Kuwait GCC Luxurious Furniture Industry Revenue Share (%), by End User 2025 & 2033

- Figure 26: Kuwait GCC Luxurious Furniture Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 27: Kuwait GCC Luxurious Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 28: Kuwait GCC Luxurious Furniture Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 29: Kuwait GCC Luxurious Furniture Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Kuwait GCC Luxurious Furniture Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Kuwait GCC Luxurious Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Qatar GCC Luxurious Furniture Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 33: Qatar GCC Luxurious Furniture Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Qatar GCC Luxurious Furniture Industry Revenue (undefined), by End User 2025 & 2033

- Figure 35: Qatar GCC Luxurious Furniture Industry Revenue Share (%), by End User 2025 & 2033

- Figure 36: Qatar GCC Luxurious Furniture Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 37: Qatar GCC Luxurious Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Qatar GCC Luxurious Furniture Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 39: Qatar GCC Luxurious Furniture Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Qatar GCC Luxurious Furniture Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Qatar GCC Luxurious Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 43: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue (undefined), by End User 2025 & 2033

- Figure 45: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 47: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 48: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 49: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 50: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue (undefined), by Country 2025 & 2033

- Figure 51: Rest of GCC Countries GCC Luxurious Furniture Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 5: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 7: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 9: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 12: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 13: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 17: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 18: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 22: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 23: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 24: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 25: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 27: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 28: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: Global GCC Luxurious Furniture Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Luxurious Furniture Industry?

The projected CAGR is approximately 7.13%.

2. Which companies are prominent players in the GCC Luxurious Furniture Industry?

Key companies in the market include Al Huzaifa, Bukannan Furnishing, ID Design**List Not Exhaustive, PAN Emirates, Danube, IKEA, Home Center, Luxe Living, B&B Italia, Royal Furniture.

3. What are the main segments of the GCC Luxurious Furniture Industry?

The market segments include Product Type, End User, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumer Trend for Luxury Furniture; Real Estate Development.

6. What are the notable trends driving market growth?

Changing Consumer Preferences Toward Luxury Goods Like Luxury Furniture.

7. Are there any restraints impacting market growth?

High Import Taxes and Duties; High Cost of Raw Materials.

8. Can you provide examples of recent developments in the market?

June 2023: Daze Furniture, the leading furniture brand known for its bespoke collection of furniture, lighting, and home accessories, is poised to revolutionise the luxury furniture segment in the UAE.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Luxurious Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Luxurious Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Luxurious Furniture Industry?

To stay informed about further developments, trends, and reports in the GCC Luxurious Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence