Key Insights

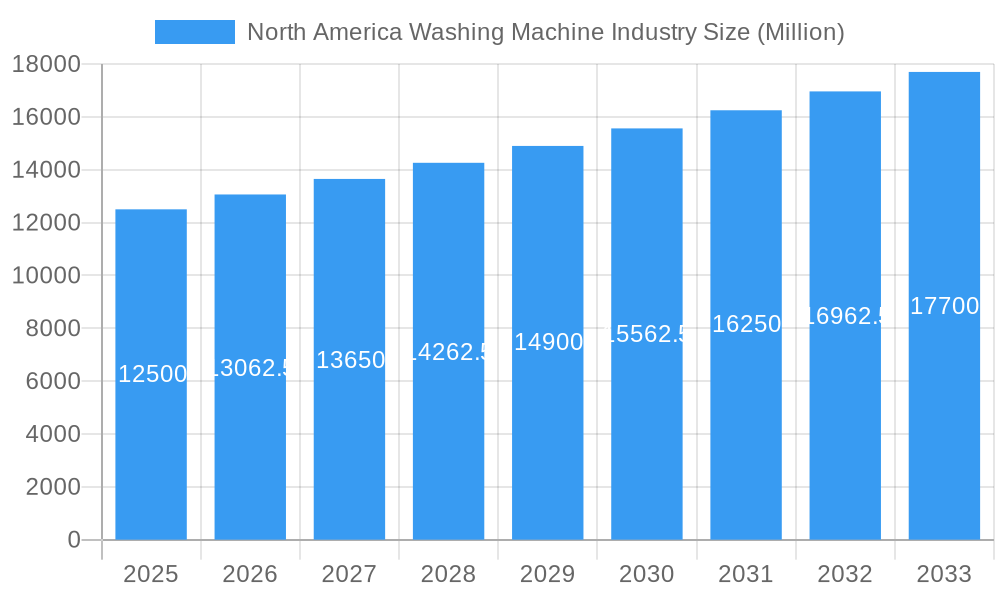

The North American washing machine market is set for substantial growth, propelled by consumer demand for advanced, energy-efficient appliances. The market is projected to reach $17.3 billion by 2025, with a CAGR of 3.5%. Key growth drivers include rising disposable incomes, smart home integration preferences, and a strong focus on sustainability. Manufacturers are innovating with AI fabric care, steam cycles, and remote connectivity. Ongoing replacement of older models and new household formations will sustain expansion, alongside a trend towards larger capacity and front-load washers for enhanced performance and efficiency.

North America Washing Machine Industry Market Size (In Billion)

The North American washing machine industry is expected to see sustained growth, driven by continuous innovation and increasing consumer awareness of energy conservation and environmental impact. The rising popularity of smart washing machines offers enhanced convenience and cost savings. Government initiatives promoting energy efficiency and evolving building codes further stimulate market expansion. The consistent replacement of outdated appliances, coupled with the integration of IoT for a connected laundry experience, will shape future market trends.

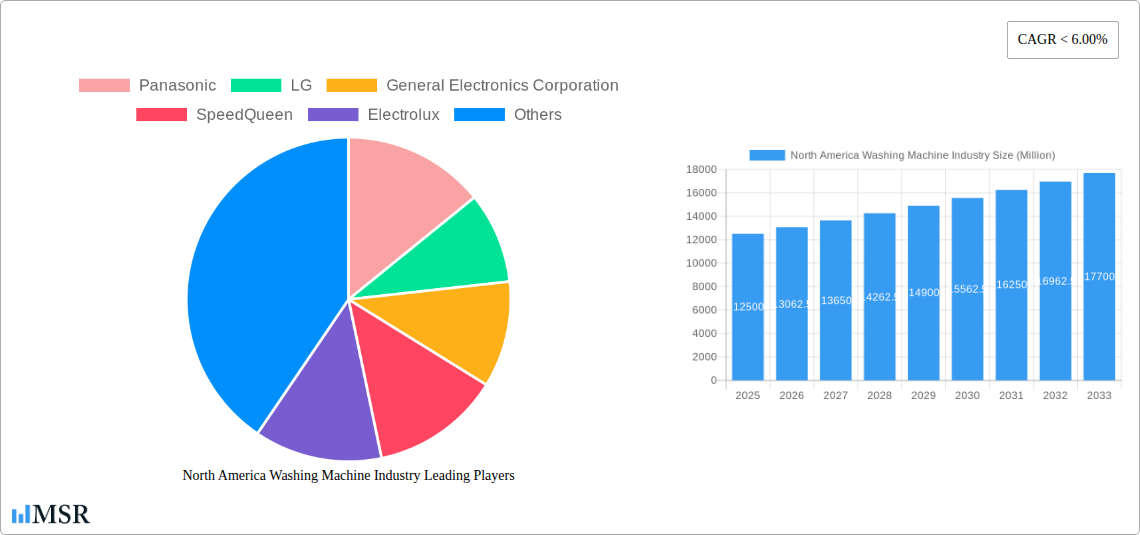

North America Washing Machine Industry Company Market Share

This report provides an in-depth analysis of the North American washing machine market, a sector characterized by significant growth and innovation. Explore market concentration, industry insights, key segments, product developments, challenges, growth drivers, emerging opportunities, leading players, and pivotal milestones. With a base year of 2025 and a forecast period extending to 2033, this report offers actionable intelligence for washing machine manufacturers, appliance distributors, retailers, and investors seeking to leverage evolving consumer demands and technological advancements in the North American appliance sector.

North America Washing Machine Industry Market Concentration & Dynamics

The North America washing machine industry exhibits a moderate to high market concentration, with a few dominant players holding significant market share. Key companies like Whirlpool, LG, and Samsung consistently lead in innovation and sales volume. The competitive landscape is characterized by intense rivalry in fully automatic washing machines, particularly in the front load segment. Innovation ecosystems are thriving, fueled by research and development in smart appliance technology, energy efficiency, and advanced cleaning solutions. Regulatory frameworks, primarily focusing on energy conservation and safety standards, are influencing product design and market entry. Substitute products, such as laundry services and compact washing solutions, exert some pressure but are not yet posing a significant threat to the core market. End-user trends are increasingly leaning towards convenience, smart features, and sustainable appliance options. Mergers and acquisition (M&A) activities, though not excessively high in recent years, have played a role in consolidating market positions and expanding product portfolios. The market size for North America washing machines is estimated to be over $15,000 Million in the base year 2025, with M&A deal counts historically ranging between 2-5 major transactions annually.

North America Washing Machine Industry Industry Insights & Trends

The North America washing machine market is on an upward trajectory, driven by a confluence of factors. The market size is projected to reach over $22,000 Million by the end of the forecast period in 2033, demonstrating a robust Compound Annual Growth Rate (CAGR) of approximately 4.5% from the base year 2025. Key growth drivers include increasing disposable incomes, a growing preference for advanced domestic appliances that offer convenience and time-saving solutions, and a steady demand for replacements of older, less efficient units. Technological disruptions are at the forefront, with the integration of Artificial Intelligence (AI) for optimized wash cycles, IoT connectivity for remote control and diagnostics, and the development of quieter, more energy-efficient models. Evolving consumer behaviors are also significantly impacting the market. Consumers are increasingly prioritizing sustainability, seeking out Energy Star certified washing machines and those with eco-friendly wash options. There's a growing demand for larger capacity machines to accommodate growing household sizes and a rising interest in specialized washing machines designed for specific fabric types or allergy sufferers. The shift towards front load washing machines continues, owing to their perceived superior cleaning performance and water efficiency, though top load washing machines retain a significant share due to their affordability and ease of use. The penetration of fully automatic washing machines is consistently outpacing that of semi-automatic washing machines as consumers seek greater automation and convenience in their household chores.

Key Markets & Segments Leading North America Washing Machine Industry

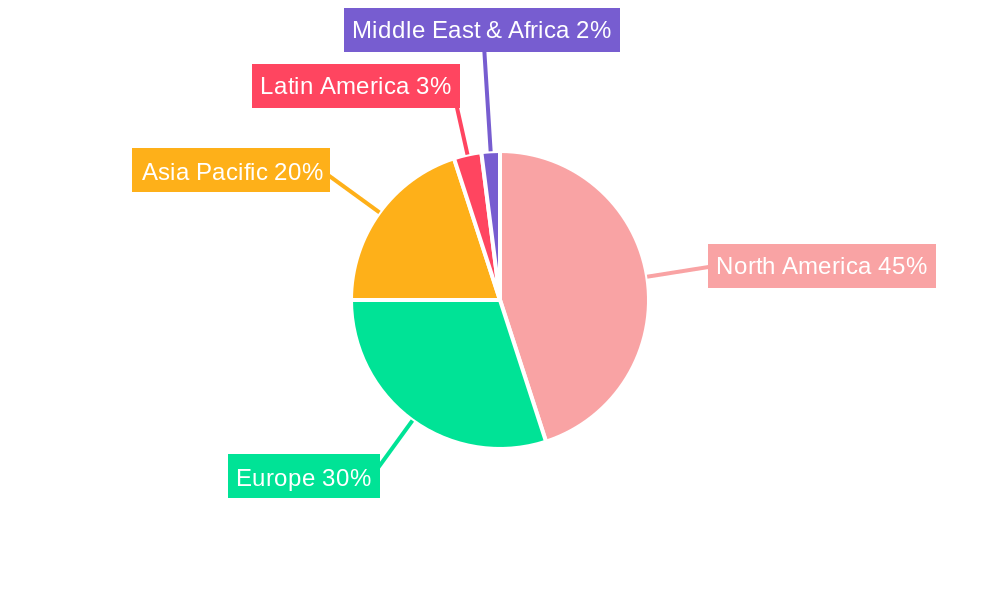

The North America washing machine industry is dominated by the United States, which accounts for the largest market share due to its strong economic base and high consumer spending power. Within this expansive market, fully automatic washing machines represent the leading segment, driven by the demand for convenience and advanced features.

- Segments Driving Dominance:

- Type: The Front Load segment continues to gain traction, valued at over $8,000 Million in the base year 2025, due to its superior cleaning efficiency, water and energy savings, and gentler fabric care.

- Technology: Fully Automatic machines, estimated at over $12,000 Million in 2025, are the primary choice for consumers seeking ease of use and sophisticated washing programs.

- Distribution Channel: Multi-brand Stores remain a significant channel, contributing over $6,000 Million in 2025, offering consumers a wide selection and competitive pricing. However, the Online distribution channel is experiencing rapid growth, projected to reach over $4,000 Million by 2025, fueled by e-commerce convenience and competitive online pricing.

Detailed analysis reveals that the preference for front load washing machines is amplified by their integration of smart technologies and energy-saving features, aligning with growing consumer consciousness regarding environmental impact and utility costs. The dominance of fully automatic technology is directly correlated with the busy lifestyles of North American consumers who prioritize time-saving appliances. While specialty stores cater to niche markets and offer personalized advice, the sheer volume and convenience offered by multi-brand retail outlets and the burgeoning online marketplace continue to drive sales. The Other Distribution Channel, which includes direct-to-consumer sales and smaller independent retailers, also contributes to the overall market landscape. Leading companies like Whirlpool, LG, and Samsung are strategically present across all these channels, ensuring broad market reach.

North America Washing Machine Industry Product Developments

Product innovation in the North America washing machine industry is primarily focused on enhancing user experience and sustainability. Advancements include AI-powered sensors that optimize wash cycles based on load size and fabric type, resulting in improved cleaning performance and energy efficiency. Smart connectivity through Wi-Fi enables remote control, diagnostics, and personalized washing recommendations via smartphone apps. Furthermore, manufacturers are introducing quieter operation technologies, advanced steam cycles for sanitization and wrinkle reduction, and eco-friendly detergents compatibility. The market relevance of these developments is high, as they directly address consumer demands for convenience, efficiency, and advanced features.

Challenges in the North America Washing Machine Industry Market

The North America washing machine industry faces several challenges. Supply chain disruptions, particularly those impacting semiconductor availability, can lead to production delays and increased costs. Intense price competition among manufacturers, especially in the mid-range segment, can squeeze profit margins. Evolving consumer expectations for more advanced features at lower price points necessitate continuous R&D investment. Additionally, the increasing cost of raw materials such as steel and plastic further exerts pressure on profitability. Quantifiable impacts include an estimated 5-10% increase in production costs due to material price volatility and potential 1-2 month delays in product delivery due to supply chain bottlenecks.

Forces Driving North America Washing Machine Industry Growth

Several forces are propelling the growth of the North America washing machine industry. Technological advancements, particularly in smart and connected appliances, are a significant driver, appealing to a tech-savvy consumer base. The growing emphasis on energy efficiency and water conservation aligns with consumer and regulatory preferences, boosting demand for eco-friendly models. Economic factors, including rising disposable incomes and a strong housing market, support consumer spending on home appliances. Furthermore, the consistent need for appliance replacement due to the lifespan of existing units creates a steady demand stream. The increasing adoption of online retail channels is also facilitating greater market access and consumer reach.

Challenges in the North America Washing Machine Industry Market

Long-term growth catalysts for the North America washing machine industry lie in continued innovation and strategic market expansion. The development of next-generation smart washing machines with predictive maintenance capabilities and enhanced fabric care technologies will be crucial. Partnerships between appliance manufacturers and utility companies to promote energy-efficient models offer significant potential. Expansion into emerging market segments, such as compact and space-saving solutions for urban dwellers, represents another avenue for sustained growth. The focus on circular economy principles, including enhanced recyclability and durability of appliances, will also resonate with environmentally conscious consumers and contribute to brand loyalty.

Emerging Opportunities in North America Washing Machine Industry

Emerging opportunities in the North America washing machine industry are abundant. The burgeoning demand for connected home ecosystems presents a significant opportunity for integrated smart laundry solutions. Innovations in AI-driven fabric care that can identify and customize wash programs for specific garments are gaining traction. The increasing prevalence of small households and urban living is creating a market for more compact and multi-functional washing machines. Furthermore, the growing awareness around health and hygiene is driving demand for washing machines with advanced sanitization features, such as steam or UV sterilization cycles. The exploration of sustainable materials and manufacturing processes also presents a valuable opportunity for brands to differentiate themselves.

Leading Players in the North America Washing Machine Industry Sector

- Panasonic

- LG

- General Electronics Corporation

- SpeedQueen

- Electrolux

- Haier

- Whirlpool

- Amana Corporation

- Samsung

- Midea

- Hitachi

Key Milestones in North America Washing Machine Industry Industry

- 2020: White-Westinghouse International, a division of Electrolux Home Products, Inc., partnered with Superplastronics Pvt. Ltd. (SPPL) to launch its washing machine range (7 kg, 6 kg, and 9 kg) in the Indian market via Amazon.in. This marked a significant market expansion strategy for Electrolux, demonstrating a commitment to entering new geographical territories through strategic collaborations and online retail platforms.

Strategic Outlook for North America Washing Machine Industry Market

The strategic outlook for the North America washing machine industry is one of sustained growth and technological evolution. Key growth accelerators include the continued integration of smart home technology, the development of highly energy-efficient and sustainable appliance models, and the expansion of product offerings to cater to diverse consumer needs, from compact solutions to high-capacity, feature-rich machines. Strategic opportunities lie in leveraging data analytics to personalize consumer experiences, forging partnerships with smart home ecosystems, and focusing on a circular economy approach to product design and lifecycle management. The market is expected to benefit from ongoing consumer demand for convenience, innovation, and eco-conscious products.

North America Washing Machine Industry Segmentation

-

1. Type

- 1.1. Front Load

- 1.2. Top Load

-

2. Technology

- 2.1. Semi-Automatic

- 2.2. Fully Automatic

-

3. Distribution Channel

- 3.1. Multi-brand Stores

- 3.2. Specialty Stores

- 3.3. Online

- 3.4. Other Distribution Channel

- 4. Market Concentration Overview

-

5. Company Profiles

- 5.1. Midea

- 5.2. Panasonic

- 5.3. Electrolux

- 5.4. General Electronics Corporation

- 5.5. LG

- 5.6. Samsung

- 5.7. Whirlpool

- 5.8. Haier

- 5.9. Hitachi

- 5.10. SpeedQueen

- 5.11. Amana Corporation

North America Washing Machine Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Washing Machine Industry Regional Market Share

Geographic Coverage of North America Washing Machine Industry

North America Washing Machine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Urbanization and the trend towards smaller living spaces in cities are driving demand for compact and space-saving washing machines. Appliances that offer efficient washing while fitting into smaller laundry areas are gaining popularity.

- 3.3. Market Restrains

- 3.3.1 The washing machine market is highly competitive

- 3.3.2 with numerous domestic and international brands offering a wide range of products. Intense competition can lead to price pressure

- 3.3.3 impacting profit margins for manufacturers and retailers.

- 3.4. Market Trends

- 3.4.1 The integration of smart technology is a major trend in the North American washing machine market. Smart washing machines offer features such as remote control via smartphones

- 3.4.2 voice commands

- 3.4.3 and connectivity with home automation systems. These features enhance convenience and user experience.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Washing Machine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Front Load

- 5.1.2. Top Load

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Semi-Automatic

- 5.2.2. Fully Automatic

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Multi-brand Stores

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.3.4. Other Distribution Channel

- 5.4. Market Analysis, Insights and Forecast - by Market Concentration Overview

- 5.5. Market Analysis, Insights and Forecast - by Company Profiles

- 5.5.1. Midea

- 5.5.2. Panasonic

- 5.5.3. Electrolux

- 5.5.4. General Electronics Corporation

- 5.5.5. LG

- 5.5.6. Samsung

- 5.5.7. Whirlpool

- 5.5.8. Haier

- 5.5.9. Hitachi

- 5.5.10. SpeedQueen

- 5.5.11. Amana Corporation

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Panasonic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Electronics Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SpeedQueen

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Electrolux

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Haier

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Whirlpool

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amana Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Samsung

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Midea

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hitachi

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Panasonic

List of Figures

- Figure 1: North America Washing Machine Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Washing Machine Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Washing Machine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Washing Machine Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 3: North America Washing Machine Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Washing Machine Industry Revenue billion Forecast, by Market Concentration Overview 2020 & 2033

- Table 5: North America Washing Machine Industry Revenue billion Forecast, by Company Profiles 2020 & 2033

- Table 6: North America Washing Machine Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: North America Washing Machine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: North America Washing Machine Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 9: North America Washing Machine Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: North America Washing Machine Industry Revenue billion Forecast, by Market Concentration Overview 2020 & 2033

- Table 11: North America Washing Machine Industry Revenue billion Forecast, by Company Profiles 2020 & 2033

- Table 12: North America Washing Machine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United States North America Washing Machine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Washing Machine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Washing Machine Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Washing Machine Industry?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the North America Washing Machine Industry?

Key companies in the market include Panasonic, LG, General Electronics Corporation, SpeedQueen, Electrolux, Haier, Whirlpool, Amana Corporation, Samsung, Midea, Hitachi.

3. What are the main segments of the North America Washing Machine Industry?

The market segments include Type, Technology, Distribution Channel, Market Concentration Overview, Company Profiles.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Urbanization and the trend towards smaller living spaces in cities are driving demand for compact and space-saving washing machines. Appliances that offer efficient washing while fitting into smaller laundry areas are gaining popularity..

6. What are the notable trends driving market growth?

The integration of smart technology is a major trend in the North American washing machine market. Smart washing machines offer features such as remote control via smartphones. voice commands. and connectivity with home automation systems. These features enhance convenience and user experience..

7. Are there any restraints impacting market growth?

The washing machine market is highly competitive. with numerous domestic and international brands offering a wide range of products. Intense competition can lead to price pressure. impacting profit margins for manufacturers and retailers..

8. Can you provide examples of recent developments in the market?

In 2020, White-Westinghouse International, a division of Electrolux Home Products, Inc. and one of the leading consumer appliance company collaborated with Superplastronics Pvt. Ltd. (SPPL) to enter into the Indian market with the launch of its washing machines range of 7 kg, 6 Kg and 9 kg washing machine category on Amazon.in.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Washing Machine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Washing Machine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Washing Machine Industry?

To stay informed about further developments, trends, and reports in the North America Washing Machine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence