Key Insights

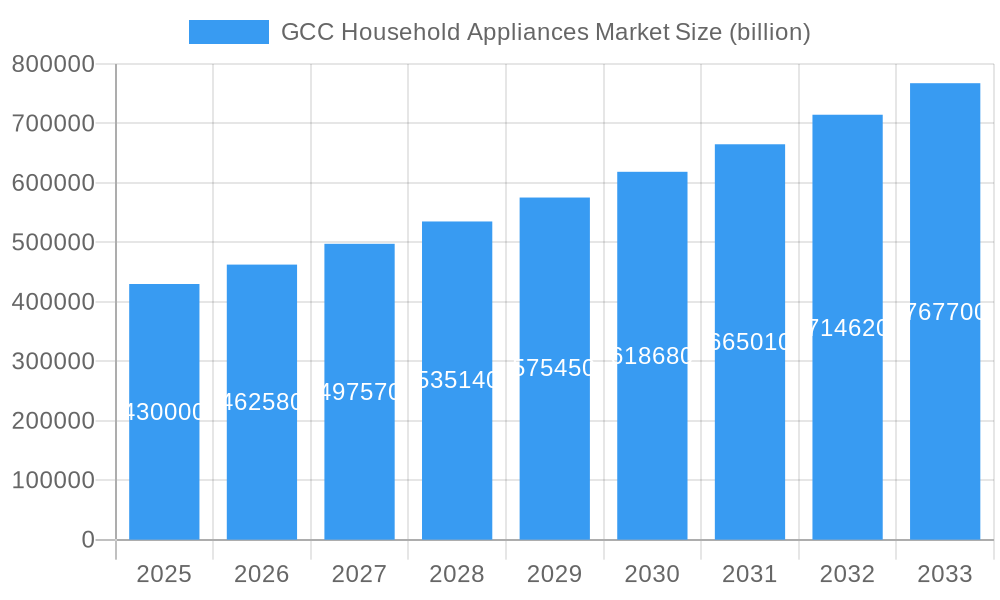

The GCC Household Appliances Market is poised for substantial growth, projected to reach $430 billion by 2025, driven by a robust CAGR of 7.6%. This expansion is fueled by a confluence of factors, including rising disposable incomes across the region, a growing expatriate population demanding modern living conveniences, and an increasing focus on smart home technology adoption. The demand for energy-efficient and technologically advanced appliances is on the rise, pushing manufacturers to innovate and cater to evolving consumer preferences for convenience, aesthetics, and sustainability. Investments in residential infrastructure and construction projects, particularly in countries like the UAE and Saudi Arabia, are further bolstering the market by creating new demand for a wide array of home appliances. The market's dynamism is also shaped by a growing consumer awareness and preference for premium and feature-rich products, contributing to an upward trajectory in sales and market value.

GCC Household Appliances Market Market Size (In Billion)

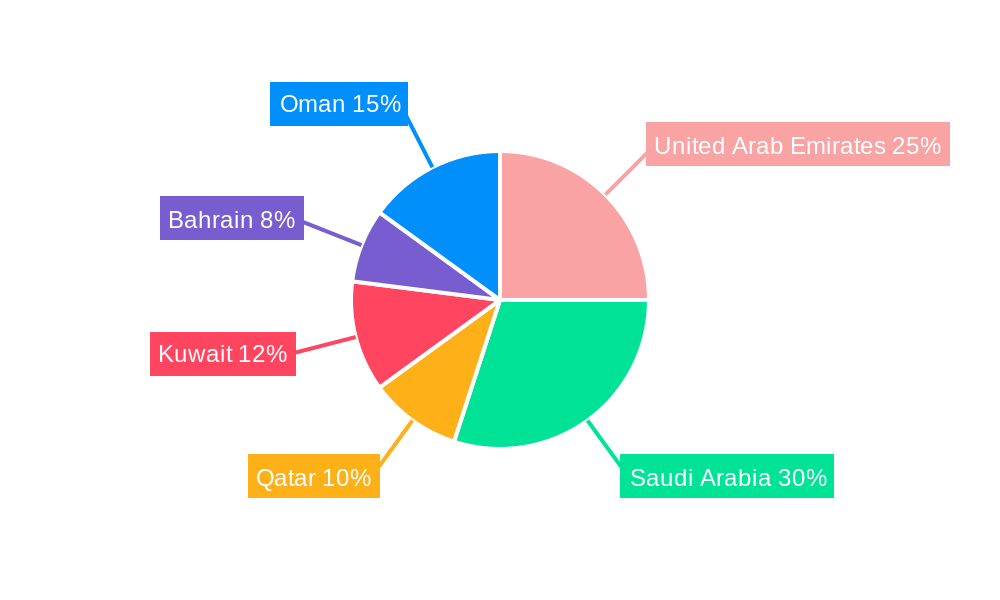

The competitive landscape features prominent global players like Panasonic, LG, Samsung, and Bosch, who are actively introducing innovative products and expanding their distribution networks to capture market share. The market is segmented across various product categories, with Refrigerators, Washing Machines, and Air Conditioners leading the demand, reflecting their essential role in modern households. Distribution channels are also diversifying, with a significant shift towards online sales and a continued strong presence of multi-branded and specialty retailers. Geographically, the United Arab Emirates and Saudi Arabia represent the largest markets, driven by their advanced economies and large consumer bases, followed by other GCC nations like Qatar, Kuwait, Bahrain, and Oman, all exhibiting steady growth. Emerging trends include the integration of AI and IoT in appliances for enhanced functionality and energy management, alongside a growing emphasis on eco-friendly and durable products.

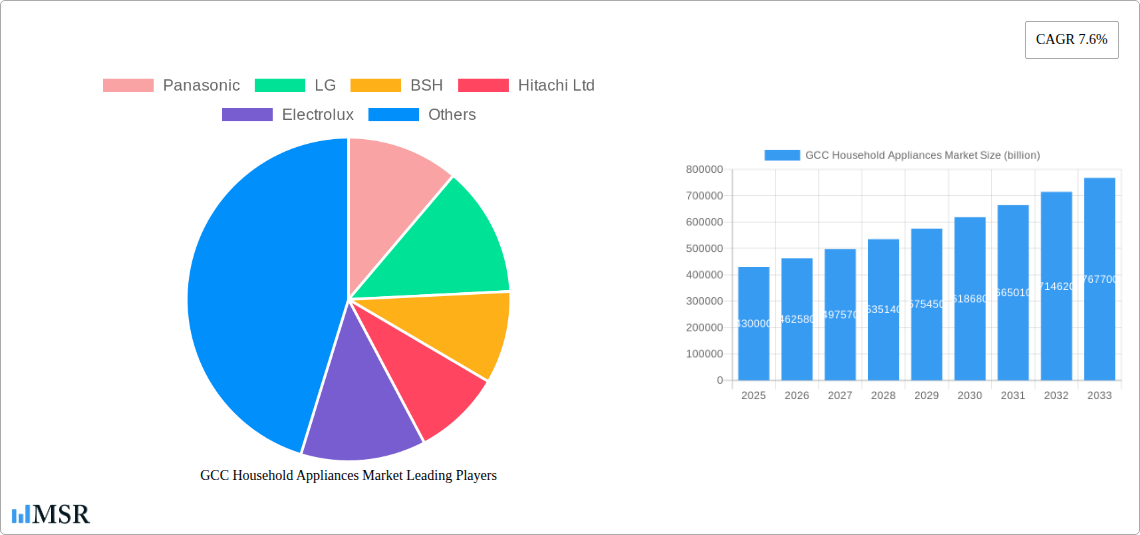

GCC Household Appliances Market Company Market Share

This in-depth report provides an indispensable analysis of the GCC household appliances market, offering critical insights for appliance manufacturers, retailers, distributors, and investors. Delve into the burgeoning Middle East appliance market and uncover opportunities within refrigerators, washing machines, air conditioners, and more. With a study period spanning 2019–2033 and a base year of 2025, this report forecasts GCC appliance market growth driven by economic prosperity and evolving consumer lifestyles. Key players like Samsung, LG, Bosch, Panasonic, Whirlpool, and Hitachi Ltd are meticulously analyzed, alongside emerging trends in smart home appliances and sustainable kitchen appliances.

GCC Household Appliances Market Market Concentration & Dynamics

The GCC household appliances market exhibits a moderate to high level of market concentration, with a few key players dominating significant market shares. Leading companies like Samsung, LG, BSH, Hitachi Ltd, Electrolux, Bosch, and Whirlpool collectively hold a substantial portion of the market. The market share of these giants is driven by extensive product portfolios, strong brand recognition, and robust distribution networks across the region. Innovation ecosystems are actively developing, fueled by increasing consumer demand for advanced features and energy efficiency. Regulatory frameworks, while evolving, generally support market entry and competition. The threat of substitute products is relatively low in the core appliance categories, though innovation in energy-saving technologies can influence consumer choices. End-user trends are shifting towards smart home integration, convenience, and premium product offerings. Mergers and Acquisitions (M&A) activities are less frequent but can significantly impact market dynamics when they occur, consolidating market power. The M&A deal count is expected to remain moderate, focusing on strategic partnerships or niche acquisitions. Understanding these dynamics is crucial for navigating the competitive landscape of the GCC appliance industry.

- Key Market Share Holders: Samsung, LG, BSH, Hitachi Ltd, Electrolux, Bosch, Whirlpool.

- Innovation Focus: Smart home integration, energy efficiency, durability.

- Regulatory Environment: Evolving standards for energy consumption and safety.

- Substitute Product Landscape: Limited in core functionalities, increasing in efficiency and smart features.

- End-User Trends: Growing demand for premium, connected, and aesthetically pleasing appliances.

- M&A Activity: Strategic partnerships and niche acquisitions are more probable than large-scale consolidations.

GCC Household Appliances Market Industry Insights & Trends

The GCC household appliances market is poised for significant growth, projected to reach an estimated market size of over $20 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025–2033. This expansion is primarily driven by robust economic development across the GCC nations, characterized by rising disposable incomes, increasing urbanization, and a growing expatriate population that fuels demand for modern living spaces. The Middle East appliance market is witnessing a technological revolution, with smart home appliances taking center stage. Features such as remote control via mobile applications, voice command integration, and AI-powered functionalities are becoming increasingly sought after. This trend is directly linked to the burgeoning adoption of smart home ecosystems and the desire for enhanced convenience and efficiency.

Consumer behavior is also undergoing a notable transformation. There is a pronounced shift towards premium and energy-efficient appliances. Consumers are increasingly willing to invest in high-quality, durable products that offer long-term cost savings and environmental benefits. The younger demographic, in particular, is a key driver of this trend, valuing innovative features and brands that align with their modern lifestyles. Furthermore, the rise of online retail channels is reshaping the distribution landscape, offering consumers wider product selection and competitive pricing. This accessibility is significantly boosting sales, especially for newer and more specialized appliance categories. The ongoing infrastructure development in countries like Saudi Arabia, with its ambitious Vision 2030 initiatives, is creating new housing projects and commercial developments, directly translating into sustained demand for a wide array of household appliances. The GCC appliance market size is a testament to the region's economic vitality and its commitment to modernizing living standards.

Key Markets & Segments Leading GCC Household Appliances Market

The GCC household appliances market is experiencing dynamic growth across various segments and geographies. Saudi Arabia is emerging as a dominant market, driven by its large population, significant infrastructure investments under Vision 2030, and a rapidly growing middle class with increasing purchasing power. The United Arab Emirates also holds a substantial share, fueled by its status as a global hub for tourism and business, a high expatriate population, and a strong demand for premium and technologically advanced appliances.

Dominant Product Segments:

- Refrigerators & Freezers: These remain perennial best-sellers due to the hot climate and the necessity for efficient food preservation. The demand for larger capacity and energy-efficient models is particularly high. For instance, Whirlpool's IntelliFresh Pro Bottom Mount Refrigerator, with its Advanced Adaptive Intelligence Technology, exemplifies the trend towards smart cooling solutions.

- Air Conditioners: Essential for the GCC's climate, air conditioners represent a significant and consistently growing segment. Innovation in energy efficiency and smart control features are key differentiators.

- Washing Machines: As household sizes and disposable incomes increase, so does the demand for advanced washing machines offering diverse wash cycles and energy savings.

- Cookers and Ovens: With a growing interest in home cooking and entertaining, premium and smart ovens and cookers are gaining traction.

Leading Distribution Channels:

- Multi-Branded Stores: These traditional retail outlets continue to command a significant market share, offering consumers a wide range of brands and product comparisons.

- Online: The e-commerce segment is experiencing exponential growth, driven by convenience, competitive pricing, and the availability of detailed product information. This channel is increasingly becoming crucial for reaching a wider customer base.

- Specialty Retailers: Catering to niche markets or specific product categories, these retailers offer curated selections and expert advice.

Geographical Dominance:

- Saudi Arabia: Leads due to population size and extensive development projects.

- United Arab Emirates: Follows closely, driven by its cosmopolitan nature and high disposable incomes.

- Qatar & Kuwait: Exhibit strong growth due to significant expatriate populations and high per capita income.

The growth in these segments is propelled by factors such as increasing urbanization, a rising standard of living, government initiatives promoting energy efficiency, and the continuous influx of new technologies that enhance user experience and convenience.

GCC Household Appliances Market Product Developments

Product innovation in the GCC household appliances market is primarily focused on enhancing user convenience, energy efficiency, and connectivity. Smart appliances are a major trend, with refrigerators offering advanced cooling technologies and connectivity features, such as Whirlpool's IntelliFresh Pro Bottom Mount Refrigerator that adapts to usage patterns. Washing machines are incorporating AI for optimized cycles, while ovens and cookers are featuring advanced cooking presets and remote control capabilities. The development of sleek, aesthetically pleasing designs that complement modern interiors is also a key focus for manufacturers seeking to capture the premium segment of the market.

Challenges in the GCC Household Appliances Market Market

The GCC household appliances market faces several challenges that can impact growth and profitability. Intense competition among both international and local players can lead to price wars and reduced profit margins. Fluctuations in raw material costs and supply chain disruptions, exacerbated by global events, can affect production costs and lead times. Furthermore, evolving energy efficiency standards and regulations require continuous investment in research and development to ensure product compliance, which can be a significant barrier for smaller players.

Forces Driving GCC Household Appliances Market Growth

Several forces are propelling the GCC household appliances market forward. A strong economic performance across the region, characterized by high disposable incomes and significant government investments in infrastructure and real estate, is a primary driver. The increasing urbanization and the demand for modern, technologically advanced homes create a robust market for sophisticated appliances. Furthermore, a growing awareness and preference for energy-efficient and sustainable products, coupled with the expansion of online retail channels, are significantly boosting sales. The influx of expatriates also contributes to consistent demand for a wide range of appliances.

Challenges in the GCC Household Appliances Market Market

Long-term growth catalysts for the GCC household appliances market lie in continued technological innovation and strategic market expansion. The ongoing development of smart home ecosystems presents a significant opportunity for manufacturers to integrate their products seamlessly, offering consumers enhanced convenience and control. Partnerships and collaborations, such as the joint venture between Arçelik and Hitachi, can facilitate market penetration and expand product offerings. As economies diversify and disposable incomes continue to rise, there will be a sustained demand for premium, feature-rich appliances. Furthermore, exploring untapped segments within the region and focusing on after-sales service and customer support will solidify brand loyalty and market presence.

Emerging Opportunities in GCC Household Appliances Market

Emerging opportunities in the GCC household appliances market are abundant, driven by evolving consumer preferences and technological advancements. The increasing demand for connected appliances and the expansion of the smart home market present significant growth potential. As consumers become more environmentally conscious, there is a growing opportunity for manufacturers of energy-efficient appliances and those utilizing sustainable materials. Furthermore, the expansion of e-commerce platforms continues to create new avenues for reaching a wider customer base and offering diverse product selections. The development of innovative financing options and attractive after-sales services can also unlock new customer segments.

Leading Players in the GCC Household Appliances Market Sector

- Panasonic

- LG

- BSH

- Hitachi Ltd

- Electrolux

- Bosch

- Whirlpool

- Samsung

- Panasonic Corporation

Key Milestones in GCC Household Appliances Market Industry

- July 2021: Arçelik A.Ş. (ARCLK:IST, "Arçelik") and Hitachi Global Life Solutions, Inc. ("Hitachi GLS") announced the launch of a new joint venture company, Arçelik Hitachi Home Appliances B.V. This venture aims to expand into countries like Saudi Arabia, Qatar, and Kuwait, providing manufacturing, sales, and after-sales service for Hitachi branded home appliances, impacting market competition and regional presence.

- May 2021: Whirlpool Corporation launched the IntelliFresh Pro Bottom Mount Refrigerator, powered by Advanced Adaptive Intelligence Technology. This product innovation highlights the growing trend of smart cooling solutions and consumer demand for appliances that adapt to varied household needs and environmental conditions, influencing product development strategies across the sector.

Strategic Outlook for GCC Household Appliances Market Market

The strategic outlook for the GCC household appliances market is exceptionally promising, underpinned by sustained economic growth and a strong consumer appetite for modern, technologically advanced products. Key growth accelerators include the continued integration of smart home technology, which will drive demand for connected refrigerators, washing machines, and other appliances. Manufacturers focusing on energy-efficient and eco-friendly appliances will also find a receptive market. Expanding distribution channels, particularly through robust online platforms and strategic partnerships, will be crucial for market penetration. Furthermore, investing in localized product development that caters to the specific needs and preferences of the GCC consumer base, coupled with exceptional after-sales service, will be vital for long-term success and capturing future market potential.

GCC Household Appliances Market Segmentation

-

1. Product

- 1.1. Refrigerators

- 1.2. Freezers

- 1.3. Dishwashing Machines

- 1.4. Washing Machines

- 1.5. Cookers and Ovens

- 1.6. Air Conditioners

- 1.7. Others

-

2. Distribution Channel

- 2.1. Multi-Branded Stores

- 2.2. Specialty Retailers

- 2.3. Online

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. United Arab Emirates

- 3.2. Saudi Arabia

- 3.3. Bahrain

- 3.4. Oman

- 3.5. Qatar

- 3.6. Kuwait

GCC Household Appliances Market Segmentation By Geography

- 1. United Arab Emirates

- 2. Saudi Arabia

- 3. Bahrain

- 4. Oman

- 5. Qatar

- 6. Kuwait

GCC Household Appliances Market Regional Market Share

Geographic Coverage of GCC Household Appliances Market

GCC Household Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Energy efficiency of Ice Maker are Driving the Market

- 3.3. Market Restrains

- 3.3.1. Rising price of Ice Makers are affecting the market

- 3.4. Market Trends

- 3.4.1. Smart Homes and Smart Technology is Driving the Growth of Major Appliances

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Household Appliances Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Refrigerators

- 5.1.2. Freezers

- 5.1.3. Dishwashing Machines

- 5.1.4. Washing Machines

- 5.1.5. Cookers and Ovens

- 5.1.6. Air Conditioners

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Multi-Branded Stores

- 5.2.2. Specialty Retailers

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United Arab Emirates

- 5.3.2. Saudi Arabia

- 5.3.3. Bahrain

- 5.3.4. Oman

- 5.3.5. Qatar

- 5.3.6. Kuwait

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.4.2. Saudi Arabia

- 5.4.3. Bahrain

- 5.4.4. Oman

- 5.4.5. Qatar

- 5.4.6. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United Arab Emirates GCC Household Appliances Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Refrigerators

- 6.1.2. Freezers

- 6.1.3. Dishwashing Machines

- 6.1.4. Washing Machines

- 6.1.5. Cookers and Ovens

- 6.1.6. Air Conditioners

- 6.1.7. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Multi-Branded Stores

- 6.2.2. Specialty Retailers

- 6.2.3. Online

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United Arab Emirates

- 6.3.2. Saudi Arabia

- 6.3.3. Bahrain

- 6.3.4. Oman

- 6.3.5. Qatar

- 6.3.6. Kuwait

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Saudi Arabia GCC Household Appliances Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Refrigerators

- 7.1.2. Freezers

- 7.1.3. Dishwashing Machines

- 7.1.4. Washing Machines

- 7.1.5. Cookers and Ovens

- 7.1.6. Air Conditioners

- 7.1.7. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Multi-Branded Stores

- 7.2.2. Specialty Retailers

- 7.2.3. Online

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United Arab Emirates

- 7.3.2. Saudi Arabia

- 7.3.3. Bahrain

- 7.3.4. Oman

- 7.3.5. Qatar

- 7.3.6. Kuwait

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Bahrain GCC Household Appliances Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Refrigerators

- 8.1.2. Freezers

- 8.1.3. Dishwashing Machines

- 8.1.4. Washing Machines

- 8.1.5. Cookers and Ovens

- 8.1.6. Air Conditioners

- 8.1.7. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Multi-Branded Stores

- 8.2.2. Specialty Retailers

- 8.2.3. Online

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United Arab Emirates

- 8.3.2. Saudi Arabia

- 8.3.3. Bahrain

- 8.3.4. Oman

- 8.3.5. Qatar

- 8.3.6. Kuwait

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Oman GCC Household Appliances Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Refrigerators

- 9.1.2. Freezers

- 9.1.3. Dishwashing Machines

- 9.1.4. Washing Machines

- 9.1.5. Cookers and Ovens

- 9.1.6. Air Conditioners

- 9.1.7. Others

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Multi-Branded Stores

- 9.2.2. Specialty Retailers

- 9.2.3. Online

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United Arab Emirates

- 9.3.2. Saudi Arabia

- 9.3.3. Bahrain

- 9.3.4. Oman

- 9.3.5. Qatar

- 9.3.6. Kuwait

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Qatar GCC Household Appliances Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Refrigerators

- 10.1.2. Freezers

- 10.1.3. Dishwashing Machines

- 10.1.4. Washing Machines

- 10.1.5. Cookers and Ovens

- 10.1.6. Air Conditioners

- 10.1.7. Others

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Multi-Branded Stores

- 10.2.2. Specialty Retailers

- 10.2.3. Online

- 10.2.4. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. United Arab Emirates

- 10.3.2. Saudi Arabia

- 10.3.3. Bahrain

- 10.3.4. Oman

- 10.3.5. Qatar

- 10.3.6. Kuwait

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Kuwait GCC Household Appliances Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. Refrigerators

- 11.1.2. Freezers

- 11.1.3. Dishwashing Machines

- 11.1.4. Washing Machines

- 11.1.5. Cookers and Ovens

- 11.1.6. Air Conditioners

- 11.1.7. Others

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Multi-Branded Stores

- 11.2.2. Specialty Retailers

- 11.2.3. Online

- 11.2.4. Other Distribution Channels

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. United Arab Emirates

- 11.3.2. Saudi Arabia

- 11.3.3. Bahrain

- 11.3.4. Oman

- 11.3.5. Qatar

- 11.3.6. Kuwait

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Panasonic

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 LG

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 BSH

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Hitachi Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Electrolux

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Bosch**List Not Exhaustive

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Whirlpool

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Samsung

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Panasonic Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Panasonic

List of Figures

- Figure 1: Global GCC Household Appliances Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: United Arab Emirates GCC Household Appliances Market Revenue (billion), by Product 2025 & 2033

- Figure 3: United Arab Emirates GCC Household Appliances Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: United Arab Emirates GCC Household Appliances Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: United Arab Emirates GCC Household Appliances Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: United Arab Emirates GCC Household Appliances Market Revenue (billion), by Geography 2025 & 2033

- Figure 7: United Arab Emirates GCC Household Appliances Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: United Arab Emirates GCC Household Appliances Market Revenue (billion), by Country 2025 & 2033

- Figure 9: United Arab Emirates GCC Household Appliances Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Saudi Arabia GCC Household Appliances Market Revenue (billion), by Product 2025 & 2033

- Figure 11: Saudi Arabia GCC Household Appliances Market Revenue Share (%), by Product 2025 & 2033

- Figure 12: Saudi Arabia GCC Household Appliances Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 13: Saudi Arabia GCC Household Appliances Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: Saudi Arabia GCC Household Appliances Market Revenue (billion), by Geography 2025 & 2033

- Figure 15: Saudi Arabia GCC Household Appliances Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Saudi Arabia GCC Household Appliances Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Saudi Arabia GCC Household Appliances Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Bahrain GCC Household Appliances Market Revenue (billion), by Product 2025 & 2033

- Figure 19: Bahrain GCC Household Appliances Market Revenue Share (%), by Product 2025 & 2033

- Figure 20: Bahrain GCC Household Appliances Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 21: Bahrain GCC Household Appliances Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Bahrain GCC Household Appliances Market Revenue (billion), by Geography 2025 & 2033

- Figure 23: Bahrain GCC Household Appliances Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Bahrain GCC Household Appliances Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Bahrain GCC Household Appliances Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Oman GCC Household Appliances Market Revenue (billion), by Product 2025 & 2033

- Figure 27: Oman GCC Household Appliances Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: Oman GCC Household Appliances Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Oman GCC Household Appliances Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Oman GCC Household Appliances Market Revenue (billion), by Geography 2025 & 2033

- Figure 31: Oman GCC Household Appliances Market Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Oman GCC Household Appliances Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Oman GCC Household Appliances Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Qatar GCC Household Appliances Market Revenue (billion), by Product 2025 & 2033

- Figure 35: Qatar GCC Household Appliances Market Revenue Share (%), by Product 2025 & 2033

- Figure 36: Qatar GCC Household Appliances Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 37: Qatar GCC Household Appliances Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Qatar GCC Household Appliances Market Revenue (billion), by Geography 2025 & 2033

- Figure 39: Qatar GCC Household Appliances Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Qatar GCC Household Appliances Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Qatar GCC Household Appliances Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Kuwait GCC Household Appliances Market Revenue (billion), by Product 2025 & 2033

- Figure 43: Kuwait GCC Household Appliances Market Revenue Share (%), by Product 2025 & 2033

- Figure 44: Kuwait GCC Household Appliances Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 45: Kuwait GCC Household Appliances Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Kuwait GCC Household Appliances Market Revenue (billion), by Geography 2025 & 2033

- Figure 47: Kuwait GCC Household Appliances Market Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Kuwait GCC Household Appliances Market Revenue (billion), by Country 2025 & 2033

- Figure 49: Kuwait GCC Household Appliances Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Household Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global GCC Household Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global GCC Household Appliances Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global GCC Household Appliances Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global GCC Household Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 6: Global GCC Household Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global GCC Household Appliances Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global GCC Household Appliances Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global GCC Household Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 10: Global GCC Household Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global GCC Household Appliances Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global GCC Household Appliances Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global GCC Household Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 14: Global GCC Household Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global GCC Household Appliances Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global GCC Household Appliances Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global GCC Household Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 18: Global GCC Household Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global GCC Household Appliances Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global GCC Household Appliances Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global GCC Household Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 22: Global GCC Household Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global GCC Household Appliances Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Global GCC Household Appliances Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Global GCC Household Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 26: Global GCC Household Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 27: Global GCC Household Appliances Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Global GCC Household Appliances Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Household Appliances Market?

The projected CAGR is approximately 7.6%.

2. Which companies are prominent players in the GCC Household Appliances Market?

Key companies in the market include Panasonic, LG, BSH, Hitachi Ltd, Electrolux, Bosch**List Not Exhaustive, Whirlpool, Samsung, Panasonic Corporation.

3. What are the main segments of the GCC Household Appliances Market?

The market segments include Product, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 430 billion as of 2022.

5. What are some drivers contributing to market growth?

Energy efficiency of Ice Maker are Driving the Market.

6. What are the notable trends driving market growth?

Smart Homes and Smart Technology is Driving the Growth of Major Appliances.

7. Are there any restraints impacting market growth?

Rising price of Ice Makers are affecting the market.

8. Can you provide examples of recent developments in the market?

On July 2021, Arçelik A.Ş. (ARCLK:IST, "Arçelik") and Hitachi Global Life Solutions, Inc. ("Hitachi GLS") announced the launch of a new joint venture company, Arçelik Hitachi Home Appliances B.V. Arçelik Hitachi Home Appliances provides manufacturing, sales, and after-sales service for Hitachi branded home appliances (refrigerators, washing machines and vacuum cleaners, etc.). It is aimed to expand into the countries like Saudi Arabia, Qatar and Kuwait.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Household Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Household Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Household Appliances Market?

To stay informed about further developments, trends, and reports in the GCC Household Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence