Key Insights

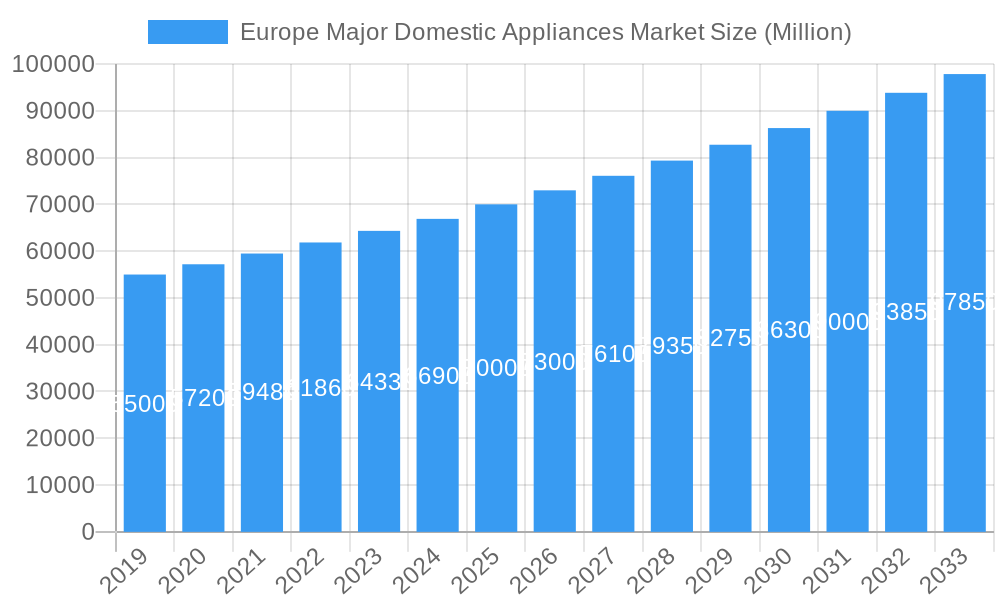

The Europe Major Domestic Appliances Market is projected to reach $237.05 billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 6.06% for the forecast period 2025-2033. This expansion is driven by increasing consumer disposable incomes, a growing demand for energy-efficient and smart appliances, and a rise in home renovation activities. Evolving regulations promoting sustainability and product longevity are also shaping market trends towards premium and eco-friendly options.

Europe Major Domestic Appliances Market Market Size (In Billion)

The forecast period (2025-2033) will witness accelerated innovation in smart home technology, with AI-powered appliances offering enhanced energy efficiency and personalized user experiences. Demand for integrated, built-in appliances is expected to rise, aligning with modern kitchen aesthetics. Growth rates will vary across European countries, influenced by economic conditions and technology adoption. The increasing focus on sustainability, circular economy principles, and product repairability will further shape consumer choices and product development, ensuring continued growth in the Europe Major Domestic Appliances Market.

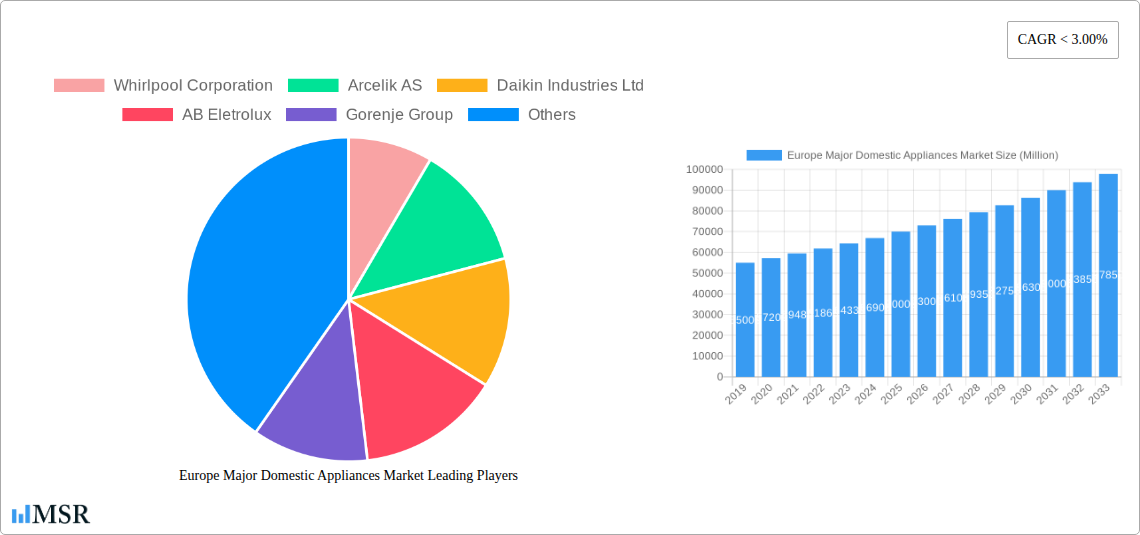

Europe Major Domestic Appliances Market Company Market Share

Europe Major Domestic Appliances Market: Comprehensive Insights & Strategic Outlook (2019-2033)

This in-depth report provides a definitive analysis of the Europe Major Domestic Appliances Market, offering unparalleled insights into growth drivers, competitive landscapes, and future trends. Covering the study period of 2019–2033, with a base year and estimated year of 2025, this report is essential for stakeholders seeking to navigate this dynamic sector. We delve into crucial segments including Refrigerators, Freezers, Dishwashers, Clothes Dryers, Washing Machines, Large Cooking Appliances, and Others, alongside distribution channels such as Supermarkets, Specialty Stores, Online, and Other Distribution Channels. Leverage our expert analysis for strategic decision-making in the evolving European home appliance industry.

Europe Major Domestic Appliances Market Market Concentration & Dynamics

The Europe Major Domestic Appliances Market exhibits a moderate to high level of market concentration, characterized by the presence of both established global players and strong regional manufacturers. Innovation ecosystems are thriving, with companies investing heavily in R&D to develop energy-efficient, smart, and connected appliances. Regulatory frameworks, particularly those concerning energy efficiency standards (e.g., EU Ecodesign Directive) and environmental impact, significantly influence product development and market access. Substitute products, while not directly replacing major domestic appliances, can impact purchasing decisions, such as the rise of compact or multi-functional devices in smaller living spaces. End-user trends are shifting towards sustainability, smart home integration, and premium features. Mergers and Acquisitions (M&A) activities are a key dynamic. For instance, the January 2023 Arcelik AS and Whirlpool Corporation agreement to form a new European home appliances business signifies major consolidation efforts. This strategic move, where Ardutch B.V. (Arcelik's subsidiary) will hold 75% and Whirlpool EMEA Holdings LLC (Whirlpool's subsidiary) 25% of the new entity, is expected to reshape market share distribution. The frequency of M&A deals and the market share of key players will be crucial metrics to monitor in understanding future market consolidation.

Europe Major Domestic Appliances Market Industry Insights & Trends

The Europe Major Domestic Appliances Market is poised for significant growth, driven by a confluence of technological advancements, evolving consumer behaviors, and favorable economic conditions. The market size is projected to reach USD 115,800 Million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 4.7% from 2025 to 2033. Key growth drivers include the increasing demand for energy-efficient appliances, spurred by rising energy costs and environmental consciousness. Consumers are actively seeking products that reduce their carbon footprint and utility bills, leading to a surge in demand for appliances with higher energy ratings. The integration of smart technology and the Internet of Things (IoT) is another significant trend. Smart refrigerators, connected washing machines, and AI-powered cooking appliances are gaining traction as consumers embrace the convenience and enhanced functionality of connected homes. This technological disruption is not only improving user experience but also creating new revenue streams through subscription services and data analytics.

Furthermore, evolving consumer behaviors are shaping product preferences. There is a growing demand for aesthetically pleasing appliances that complement modern interior design, leading to a rise in premium and customizable options. The focus on health and wellness is also influencing the appliance market, with an increasing interest in appliances that support healthy living, such as advanced air purifiers integrated into HVAC systems and refrigerators with enhanced food preservation capabilities. The Historical Period (2019-2024) saw a steady recovery and growth post-pandemic, with consumers investing in home upgrades. The Forecast Period (2025-2033) is expected to witness accelerated growth, fueled by innovation and sustained consumer demand for technologically advanced and sustainable solutions. The estimated year of 2025 serves as a critical benchmark for assessing current market standing and future trajectories. Key players like Whirlpool Corporation, Arcelik AS, Samsung Electronics Co Ltd, and LG Electronics are at the forefront of these innovations, continually introducing new products that cater to these evolving demands. The market is also witnessing a trend towards modularity and flexibility in appliance design, allowing consumers to adapt their appliances to changing needs. The increasing disposable income in certain European regions further supports the demand for higher-end, feature-rich appliances.

Key Markets & Segments Leading Europe Major Domestic Appliances Market

The Europe Major Domestic Appliances Market is led by Western European countries, with Germany, the United Kingdom, France, and Italy forming the largest consuming nations. Economic stability, high disposable incomes, and a strong consumer appetite for technological innovation and premium products are the primary drivers behind their dominance. Germany, in particular, boasts a robust manufacturing base and a sophisticated consumer market that values quality and energy efficiency, making it a cornerstone of the Europe Major Domestic Appliances Market.

Within product segments, Refrigerators and Washing Machines consistently hold the largest market share due to their essential nature in every household.

Refrigerators:

- Drivers: Growing demand for advanced features like multi-door configurations, energy-saving technologies (e.g., inverter compressors), and smart functionalities for inventory management and temperature control.

- Dominance Analysis: The segment is driven by the continuous need for food preservation and the increasing adoption of premium, larger capacity models in affluent households. Samsung Electronics Co Ltd's Bespoke Infinite Line refrigerator launch underscores the trend towards customization and high-end offerings.

Washing Machines:

- Drivers: Focus on water and energy efficiency, faster wash cycles, and smart connectivity for remote operation and diagnostics.

- Dominance Analysis: Essential household appliance with consistent demand. Innovations in drum design and detergent dispensing systems are key differentiators.

Dishwashers are also a significant segment, experiencing steady growth propelled by convenience and advancements in cleaning technology.

- Dishwashers:

- Drivers: Increased adoption in households seeking time-saving solutions and improved hygiene. Energy-efficient models and quieter operation are major selling points.

- Dominance Analysis: Growing penetration in mid-income households as a standard appliance.

Large Cooking Appliances, including ovens and hobs, are witnessing a shift towards induction technology and smart connectivity for precise cooking and enhanced safety. Clothes Dryers are gaining traction, particularly in regions with less favorable climates, with a focus on heat pump technology for energy savings. The "Others" category, encompassing smaller domestic appliances often integrated or sold alongside major ones, also contributes to the overall market value.

In terms of distribution channels, the Online segment is experiencing exponential growth, offering consumers convenience, wider product selection, and competitive pricing.

- Online:

- Drivers: E-commerce proliferation, ease of comparison, home delivery services, and promotional offers.

- Dominance Analysis: Rapidly gaining market share from traditional retail, especially for appliance research and initial purchase decisions.

Specialty Stores also play a vital role, offering expert advice and premium product displays, while Supermarkets cater to a broader audience with more accessible options.

Europe Major Domestic Appliances Market Product Developments

The Europe Major Domestic Appliances Market is characterized by rapid product innovation. Companies are heavily investing in R&D to enhance energy efficiency, integrate smart home capabilities, and improve user experience. Key developments include the proliferation of AI-powered appliances that can learn user preferences and optimize performance. Samsung's Bespoke Infinite Line refrigerator exemplifies this trend, offering customizable configurations and advanced cooling technologies. Energy-saving innovations, such as heat pump technology in dryers and highly efficient compressors in refrigerators, are becoming standard. Furthermore, the focus on sustainability is driving the development of appliances made from recycled materials and designed for longer lifespans and easier repairability. These advancements are not only improving product functionality but also enhancing their aesthetic appeal, aligning with modern interior design trends and catering to the discerning European consumer.

Challenges in the Europe Major Domestic Appliances Market Market

The Europe Major Domestic Appliances Market faces several challenges that can impede growth. Foremost among these are stringent regulatory frameworks, particularly concerning energy efficiency and environmental impact, which necessitate continuous and costly product redesign. Supply chain disruptions, exacerbated by geopolitical instability and raw material price volatility, pose a significant threat to production timelines and cost management. Competitive pressures from both established giants and emerging players, especially from lower-cost manufacturing regions, drive down profit margins. Furthermore, the increasing complexity of smart appliance technology can create barriers for less tech-savvy consumers, leading to a digital divide in adoption. The market size and CAGR can be negatively impacted by these persistent issues.

Forces Driving Europe Major Domestic Appliances Market Growth

Several key forces are propelling the Europe Major Domestic Appliances Market forward. Technological advancements, particularly in smart home integration and AI, are creating highly desirable and functional appliances. The growing consumer awareness and demand for sustainability are driving the adoption of energy-efficient and eco-friendly products. Favorable economic conditions in key European nations, including rising disposable incomes and a strong housing market, support consumer spending on durable goods. Government initiatives and subsidies promoting energy efficiency also act as a significant catalyst for market expansion.

Challenges in the Europe Major Domestic Appliances Market Market

Long-term growth catalysts in the Europe Major Domestic Appliances Market are anchored in continuous innovation and strategic market expansion. The ongoing shift towards connected homes and the increasing adoption of smart appliances create sustained demand for integrated solutions. Furthermore, the growing emphasis on circular economy principles, including appliance repairability and recycling, presents an opportunity for manufacturers to build brand loyalty and differentiate themselves. Partnerships between appliance manufacturers and smart home platform providers will be crucial for creating seamless user experiences. Exploring new market segments and catering to niche consumer demands, such as specialized appliances for smaller living spaces or specific culinary needs, will also drive sustained growth.

Emerging Opportunities in Europe Major Domestic Appliances Market

Emerging opportunities in the Europe Major Domestic Appliances Market are abundant. The burgeoning demand for energy-efficient and eco-friendly appliances, driven by environmental consciousness and rising energy prices, presents a significant growth avenue. The increasing adoption of smart home technology and the Internet of Things (IoT) is creating a market for connected and intelligent appliances offering enhanced convenience and functionality. Furthermore, the growing trend of premiumization and customization in consumer goods extends to home appliances, with consumers seeking aesthetically pleasing and personalized products. The development of appliances with advanced health and wellness features, such as improved air and water purification, also represents a promising niche.

Leading Players in the Europe Major Domestic Appliances Market Sector

- Whirlpool Corporation

- Arcelik AS

- Daikin Industries Ltd

- AB Eletrolux

- Gorenje Group

- Samsung Electronics Co Ltd

- Candy Group

- Miele

- BSH Hausgerate GmbH

- LG Electronics

Key Milestones in Europe Major Domestic Appliances Market Industry

- January 2023: Arcelik's wholly-owned subsidiary Ardutch B.V and Whirlpool Corporation's wholly-owned subsidiary Whirlpool EMEA Holdings LLC have signed a definitive Contribution Agreement to create a new standalone business in the European home appliances sector. After the transfers, 75 percent of the newly formed company will be allocated to Ardutch B.V. and 25 percent to Whirlpool.

- January 2023: Samsung has announced the global launch of a new column refrigerators named the Bespoke Infinite Line refrigerator. The company's built-in refrigerator will be available with a choice of fridge, freezer, or wine cellar models.

Strategic Outlook for Europe Major Domestic Appliances Market Market

The Europe Major Domestic Appliances Market is set for robust growth, driven by innovation and evolving consumer demands. Strategic opportunities lie in enhancing the integration of smart technologies and AI to offer intuitive and personalized user experiences. Focusing on sustainability through energy-efficient designs, the use of recycled materials, and extended product lifecycles will be crucial for capturing market share. Expanding product portfolios to include specialized appliances addressing niche consumer needs, such as compact solutions for urban living or advanced health and wellness features, will also be a key growth accelerator. Manufacturers who can successfully navigate the complex regulatory landscape and invest in robust supply chains will be well-positioned for long-term success. Furthermore, strategic collaborations with smart home ecosystem providers will be vital in shaping the future of connected living.

Europe Major Domestic Appliances Market Segmentation

-

1. Product

- 1.1. Refrigerators

- 1.2. Freezers

- 1.3. Dishwashers

- 1.4. Clothes Dryers

- 1.5. Washing Machines

- 1.6. Large Cooking Appliances

- 1.7. Others

-

2. Distribution Channel

- 2.1. Supermarkets

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Europe Major Domestic Appliances Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

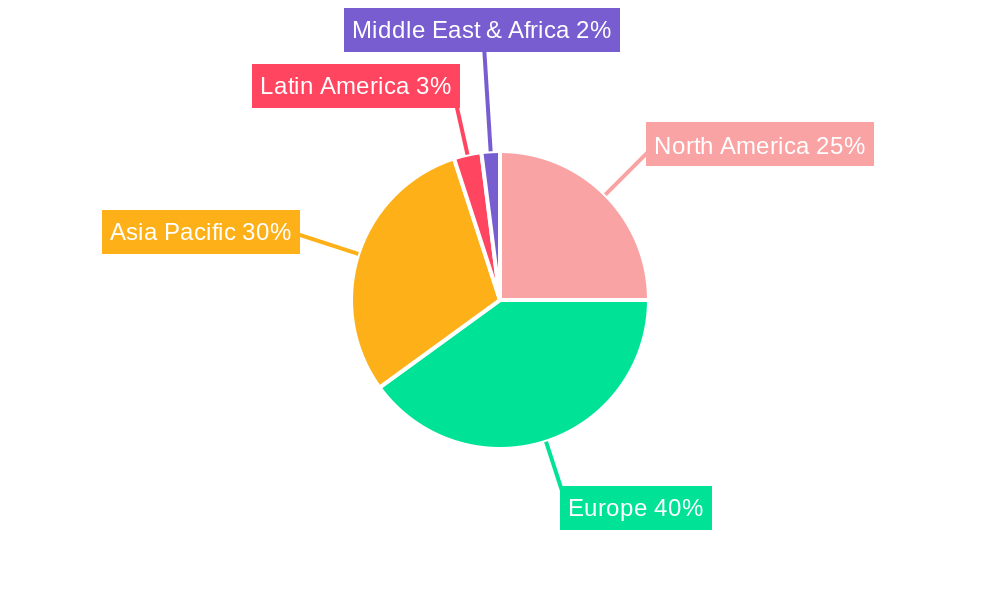

Europe Major Domestic Appliances Market Regional Market Share

Geographic Coverage of Europe Major Domestic Appliances Market

Europe Major Domestic Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Residential Construction; Increased Penetration of Smart Appliances

- 3.3. Market Restrains

- 3.3.1. Saturation in Adoption of Major Appliances

- 3.4. Market Trends

- 3.4.1. Growth in Smart Appliances is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Major Domestic Appliances Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Refrigerators

- 5.1.2. Freezers

- 5.1.3. Dishwashers

- 5.1.4. Clothes Dryers

- 5.1.5. Washing Machines

- 5.1.6. Large Cooking Appliances

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Whirlpool Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Arcelik AS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Daikin Industries Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AB Eletrolux

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gorenje Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Samsung Electronics Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Candy Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Miele**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BSH Hausgerate GmbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LG Electronics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Whirlpool Corporation

List of Figures

- Figure 1: Europe Major Domestic Appliances Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Major Domestic Appliances Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Major Domestic Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Europe Major Domestic Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Europe Major Domestic Appliances Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Major Domestic Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Europe Major Domestic Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Major Domestic Appliances Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Major Domestic Appliances Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Major Domestic Appliances Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Major Domestic Appliances Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Major Domestic Appliances Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Major Domestic Appliances Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Major Domestic Appliances Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Major Domestic Appliances Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Major Domestic Appliances Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Major Domestic Appliances Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Major Domestic Appliances Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Major Domestic Appliances Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Major Domestic Appliances Market?

The projected CAGR is approximately 6.06%.

2. Which companies are prominent players in the Europe Major Domestic Appliances Market?

Key companies in the market include Whirlpool Corporation, Arcelik AS, Daikin Industries Ltd, AB Eletrolux, Gorenje Group, Samsung Electronics Co Ltd, Candy Group, Miele**List Not Exhaustive, BSH Hausgerate GmbH, LG Electronics.

3. What are the main segments of the Europe Major Domestic Appliances Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 237.05 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Residential Construction; Increased Penetration of Smart Appliances.

6. What are the notable trends driving market growth?

Growth in Smart Appliances is Driving the Market.

7. Are there any restraints impacting market growth?

Saturation in Adoption of Major Appliances.

8. Can you provide examples of recent developments in the market?

January 2023: Arcelik's wholly-owned subsidiary Ardutch B.V and Whirlpool Corporation's wholly-owned subsidiary Whirlpool EMEA Holdings LLC have signed a definitive Contribution Agreement to create a new standalone business in the European home appliances sector. After the transfers, 75 percent of the newly formed company will be allocated to Ardutch B.V. and 25 percent to Whirlpool.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Major Domestic Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Major Domestic Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Major Domestic Appliances Market?

To stay informed about further developments, trends, and reports in the Europe Major Domestic Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence