Key Insights

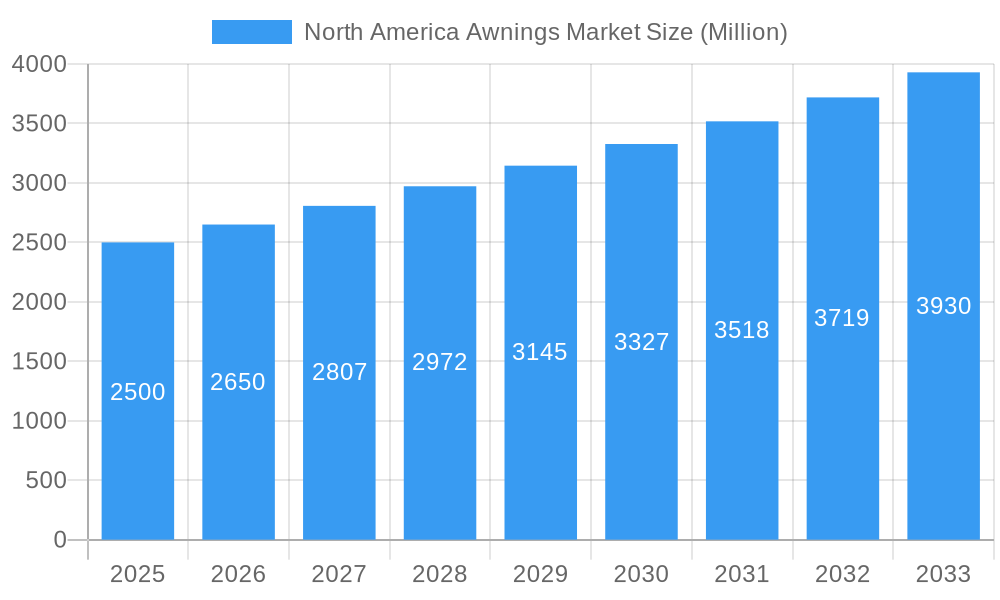

The North America awnings market is experiencing significant expansion, propelled by escalating consumer demand for energy-efficient and aesthetically appealing outdoor enhancements. Key growth drivers include rising energy costs, prompting homeowners and businesses to adopt awnings as a cost-effective solution for reducing cooling expenses by mitigating heat penetration. The burgeoning popularity of outdoor living spaces, particularly in residential areas, further stimulates demand for awnings that elevate comfort and style. Innovations in materials and designs, including the increasing adoption of retractable and smart awnings, offer enhanced convenience and control over sun exposure, contributing to market growth. The expansion of commercial applications, such as restaurants and hotels creating attractive outdoor seating, also bolsters the overall market. The North America awnings market size was valued at $11042.7 million in the base year 2025, with a projected compound annual growth rate (CAGR) of 6.2%.

North America Awnings Market Market Size (In Billion)

Projected to expand through 2033, the North America awnings market will likely be influenced by technological advancements in durability and energy efficiency, alongside growing awareness of the environmental benefits of reduced energy consumption. Potential government incentives promoting energy efficiency could also impact growth. Segmentation is expected to continue across material types (e.g., fabric, metal), product types (retractable, fixed), and applications (residential, commercial). Robust competition among manufacturers will likely focus on product innovation, distribution network expansion, and targeted marketing. Sustained economic growth in North America is anticipated to further support the market's trajectory.

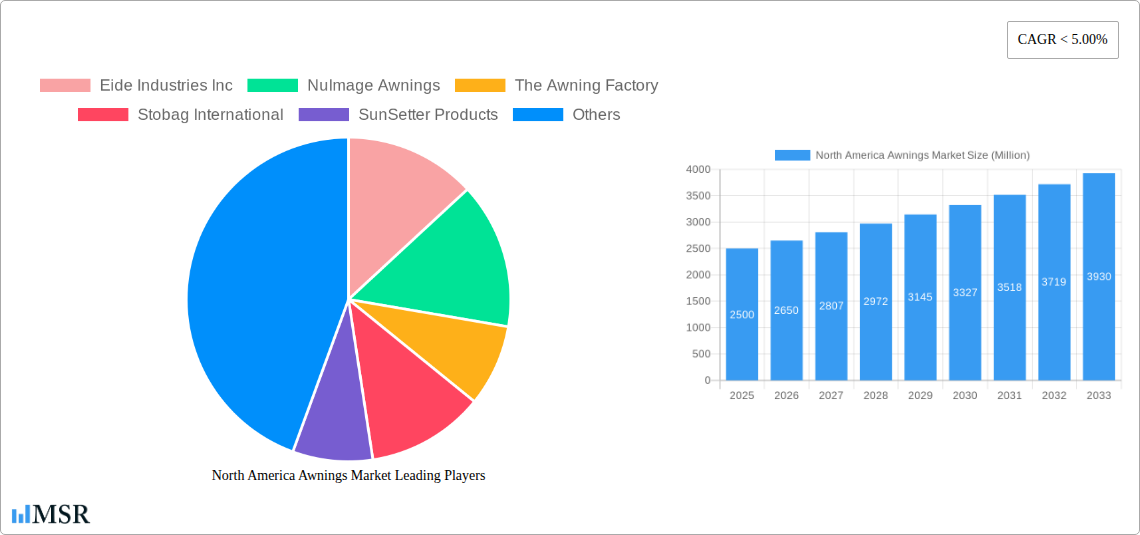

North America Awnings Market Company Market Share

North America Awnings Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America awnings market, covering market size, growth drivers, key segments, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is essential for industry stakeholders, including manufacturers, suppliers, distributors, investors, and market researchers seeking to understand and capitalize on the opportunities within this dynamic market. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

North America Awnings Market Market Concentration & Dynamics

The North America awnings market exhibits a moderately concentrated landscape, with several large players and a number of smaller regional players competing for market share. Market concentration is influenced by factors including economies of scale, brand recognition, and technological innovation. The market is characterized by ongoing mergers and acquisitions (M&A) activity, reflecting consolidation trends and efforts to expand market reach and product portfolios. For instance, the acquisition of Girard Systems and Girard Products LLC by LCI Industries in March 2022 significantly impacted the motorized awning segment.

- Market Share: The top 5 players hold an estimated xx% market share collectively in 2025.

- M&A Activity: An average of xx M&A deals were recorded annually during the historical period (2019-2024).

- Innovation: Innovation focuses on smart awnings, automated controls, and durable materials.

- Regulatory Framework: Building codes and safety regulations influence product design and installation.

- Substitute Products: Pergolas, canopies, and other shading solutions pose competitive pressure.

- End-User Trends: Increasing demand for energy efficiency and outdoor living spaces are key drivers.

North America Awnings Market Industry Insights & Trends

The North America awnings market is experiencing robust growth driven by several key factors. The increasing preference for outdoor living spaces, coupled with rising disposable incomes and heightened awareness of the benefits of sun protection, are fueling market expansion. Technological advancements, such as the incorporation of smart features and automated controls in retractable awnings, are further enhancing the appeal and functionality of these products. Moreover, the growing adoption of energy-efficient building practices and the increasing prevalence of commercial establishments are contributing to market growth. The market size was valued at xx Million in 2024, and it is expected to reach xx Million by 2033.

Key Markets & Segments Leading North America Awnings Market

The United States constitutes the largest segment of the North America awnings market, driven by high consumer spending and a robust construction industry. The residential application segment holds a significant share, followed by the commercial segment. Retractable awnings dominate the product type segment, owing to their versatility and adaptability to various architectural styles.

- By Country:

- United States: High demand from residential and commercial sectors. Strong construction activity and favorable economic conditions drive growth.

- Canada: Relatively smaller market size compared to the US, but steady growth is expected due to increasing consumer spending on home improvements.

- By Product Type:

- Retractable Awnings: High demand due to versatility and ease of use. Technological advancements drive premiumization.

- Stationary Awnings: Cost-effective and durable option, particularly for fixed installations.

- By Application:

- Residential: Strong growth due to rising disposable income and increased preference for outdoor living spaces.

- Commercial: Steady growth fueled by increasing number of commercial buildings and emphasis on aesthetics.

North America Awnings Market Product Developments

Recent product innovations focus on enhancing aesthetics, durability, and functionality. Smart awnings with integrated sensors and automated controls are gaining popularity, offering convenience and energy efficiency. Manufacturers are also introducing awnings made from sustainable and eco-friendly materials to meet the growing demand for environmentally conscious products. These developments are creating a competitive edge for manufacturers and catering to evolving customer preferences.

Challenges in the North America Awnings Market Market

The North America awnings market faces challenges such as fluctuations in raw material prices, increasing labor costs, and intense competition. Supply chain disruptions and logistical hurdles also pose significant operational challenges. Furthermore, stringent building codes and safety regulations add complexity to product development and market entry. These factors can impact profitability and overall market growth. The estimated impact of these challenges on market growth is a reduction of xx% in CAGR.

Forces Driving North America Awnings Market Growth

The market is driven by several factors, including increased focus on outdoor living, technological advancements, and the growing adoption of energy-efficient buildings. Government incentives and initiatives supporting energy conservation further boost demand. The increasing popularity of motorized and retractable awnings is also a crucial driver of growth.

Challenges in the North America Awnings Market Market (Long-Term Growth Catalysts)

Long-term growth hinges on innovation in materials, designs, and smart technologies. Strategic partnerships and collaborations between manufacturers and technology providers can accelerate product development and market penetration. Expanding into new geographic markets and diversifying product portfolios are key to sustained growth.

Emerging Opportunities in North America Awnings Market

Opportunities exist in the development of smart awnings with integrated sensors and automated controls, expansion into new market segments (e.g., hospitality, healthcare), and the adoption of sustainable materials. Targeting environmentally conscious consumers and focusing on customized solutions will further enhance market penetration.

Leading Players in the North America Awnings Market Sector

- Eide Industries Inc

- NuImage Awnings

- The Awning Factory

- Stobag International

- SunSetter Products

- Marygrove Awnings

- Awning Company of America Inc

- Thompson Awnings Company

- Carroll Awning Company

- Sunair Awnings

Key Milestones in North America Awnings Market Industry

- March 2022: LCI Industries' acquisition of Girard Systems and Girard Products LLC expands the motorized awning segment.

- November 2021: The Awning Factory's factory expansion in Orlando indicates growth in the commercial awning sector.

Strategic Outlook for North America Awnings Market Market

The North America awnings market presents significant long-term growth potential. Continued innovation, strategic partnerships, and expansion into new market segments will be crucial for success. Focusing on sustainable materials, smart technologies, and customized solutions will create new opportunities for manufacturers and drive market growth.

North America Awnings Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

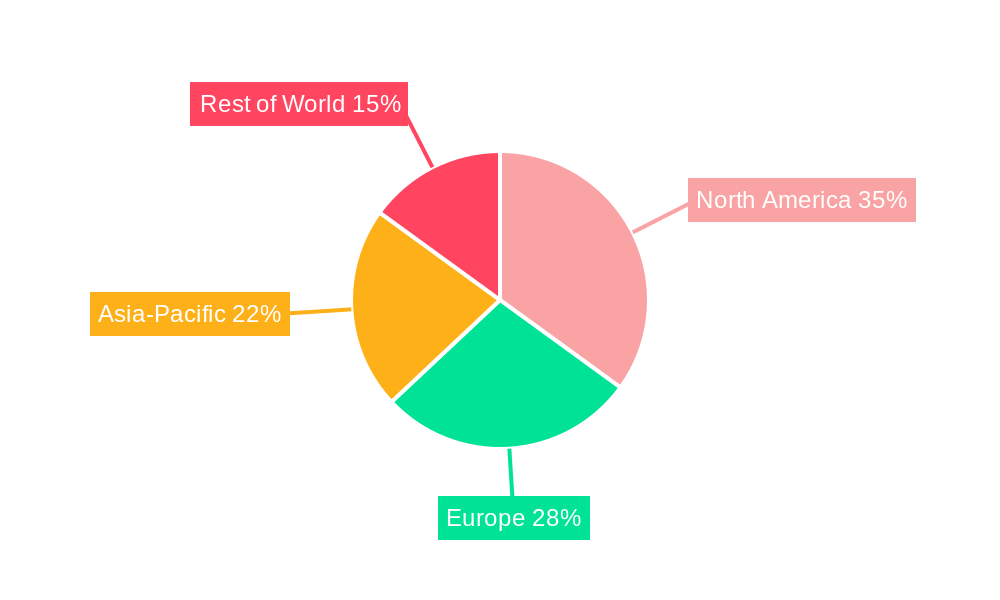

North America Awnings Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Awnings Market Regional Market Share

Geographic Coverage of North America Awnings Market

North America Awnings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Aesthetically Appealing Products to Fuel the Growth of the Stone Flooring Market; Demand for Stone Floors as a Decorative Tool in the Construction Industry

- 3.3. Market Restrains

- 3.3.1. High Initial Cost; Lack of Skilled Labor

- 3.4. Market Trends

- 3.4.1. Residential Application Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Awnings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Eide Industries Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NuImage Awnings

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Awning Factory

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Stobag International

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SunSetter Products

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Marygrove Awnings

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Awning Company of America Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thompson Awnings Company**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Carroll Awning Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sunair Awnings

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Eide Industries Inc

List of Figures

- Figure 1: North America Awnings Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Awnings Market Share (%) by Company 2025

List of Tables

- Table 1: North America Awnings Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Awnings Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Awnings Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Awnings Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Awnings Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Awnings Market Revenue million Forecast, by Region 2020 & 2033

- Table 7: North America Awnings Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Awnings Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Awnings Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Awnings Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Awnings Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Awnings Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: United States North America Awnings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Awnings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Awnings Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Awnings Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the North America Awnings Market?

Key companies in the market include Eide Industries Inc, NuImage Awnings, The Awning Factory, Stobag International, SunSetter Products, Marygrove Awnings, Awning Company of America Inc, Thompson Awnings Company**List Not Exhaustive, Carroll Awning Company, Sunair Awnings.

3. What are the main segments of the North America Awnings Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 11042.7 million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Aesthetically Appealing Products to Fuel the Growth of the Stone Flooring Market; Demand for Stone Floors as a Decorative Tool in the Construction Industry.

6. What are the notable trends driving market growth?

Residential Application Dominates the Market.

7. Are there any restraints impacting market growth?

High Initial Cost; Lack of Skilled Labor.

8. Can you provide examples of recent developments in the market?

March 2022 - LCI Industries which, supplies, domestically and internationally, a broad array of highly engineered components for the leading original equipment manufacturers in the recreation and transportation product markets, and the related aftermarkets of those industries, announced that its subsidiary, Lippert Components Manufacturing, Inc., has acquired substantially all of the business assets of Girard Systems and Girard Products LLC, a manufacturer and distributor of proprietary awnings and tankless water heaters for OEMs. Having created a significant niche in the motorized segment of the market, Girard's patented awnings are featured on many of the premier Class A motorized units. Girard's strategically-placed locations in Alabama, California, and Indiana make it well-positioned to serve customers across the U.S. as it continues to grow.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Awnings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Awnings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Awnings Market?

To stay informed about further developments, trends, and reports in the North America Awnings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence