Key Insights

The Japan home furniture market is projected to reach $23.02 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 2.52%. This expansion is driven by several key factors, including rising disposable incomes, urbanization, and the increasing adoption of online shopping channels. The growing demand for high-quality, stylish, and space-saving furniture solutions reflects evolving consumer preferences and living arrangements. The market is segmented by application (kitchen, living room, bedroom, etc.) and distribution channel (online, specialty stores, supermarkets, etc.). Key players include IKEA, Nitori, and Muji, alongside numerous niche Japanese brands. Despite challenges such as fluctuating raw material costs, the market outlook remains positive, with online retail poised for significant growth.

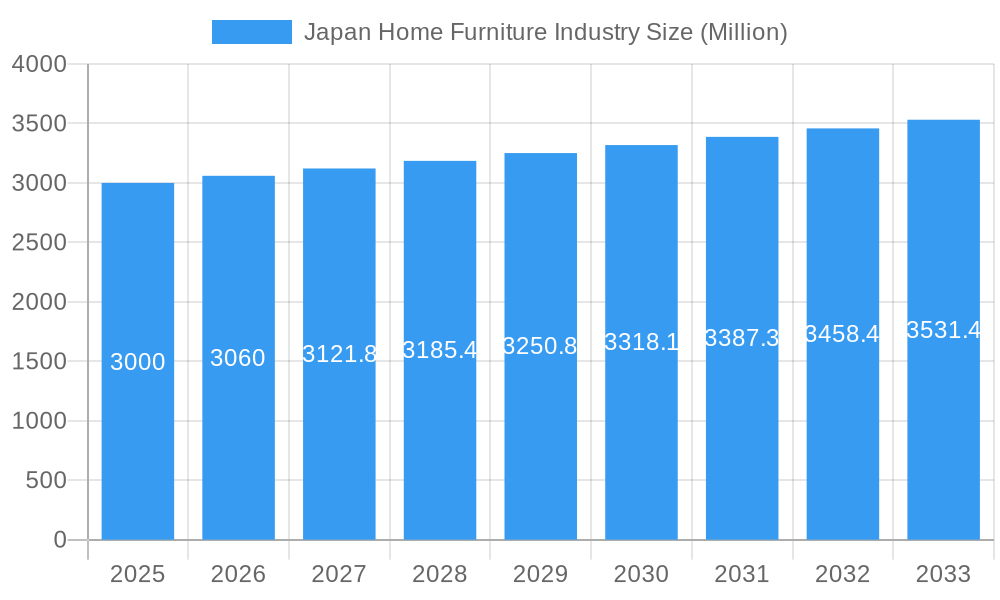

Japan Home Furniture Industry Market Size (In Billion)

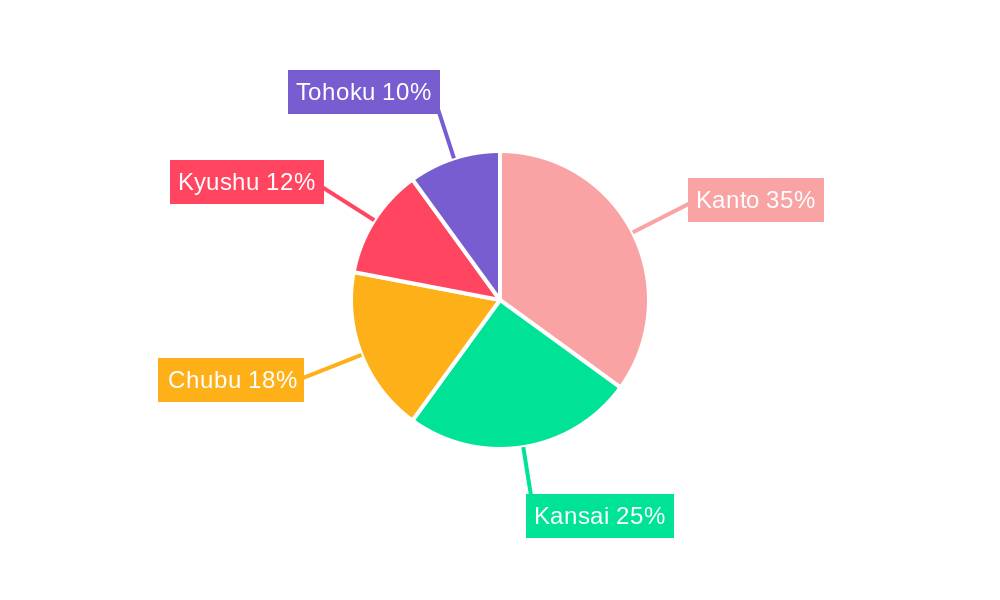

Regionally, Kanto, Kansai, and Chubu are leading markets, supported by population density and economic activity. Emerging opportunities are evident in Kyushu and Tohoku, fueled by increasing disposable incomes and infrastructure development. Intense competition necessitates innovation, effective marketing, and a focus on customer experience. A growing interest in sustainable and ethically sourced furniture presents further opportunities for environmentally conscious brands. The forecast period (2025-2033) anticipates sustained growth, particularly in online sales and specialized furniture segments catering to modern lifestyles.

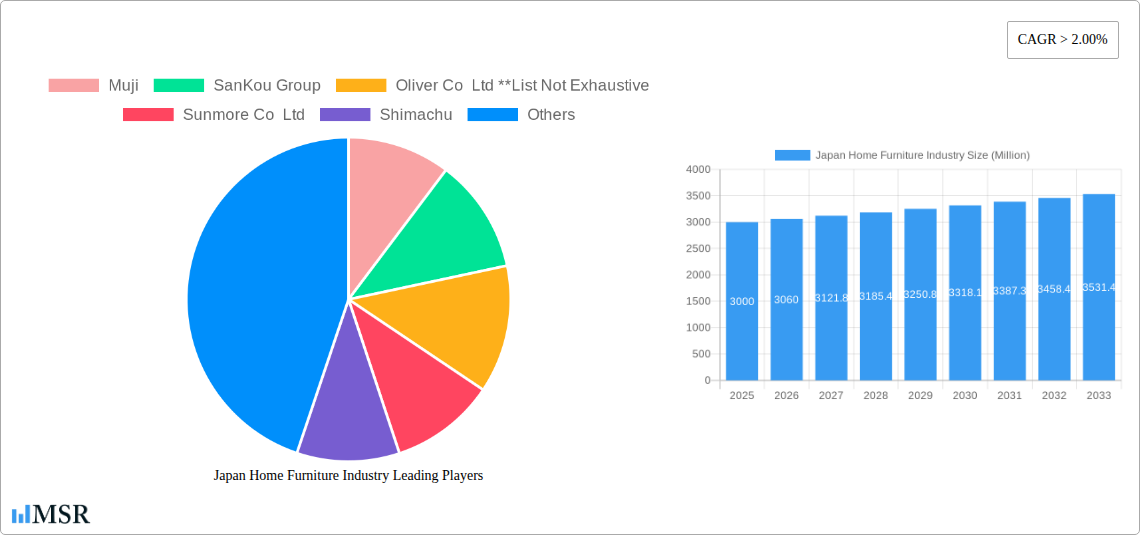

Japan Home Furniture Industry Company Market Share

Japan Home Furniture Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Japan Home Furniture Industry, covering market dynamics, key segments, leading players, and future growth prospects. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report utilizes data from the historical period (2019-2024) to project market trends and identify opportunities for stakeholders. The market size is expected to reach xx Million by 2025, with a CAGR of xx% during the forecast period.

Japan Home Furniture Industry Market Concentration & Dynamics

The Japanese home furniture market exhibits a moderately concentrated structure, with several large players like Nitori Furniture and IKEA holding significant market share. However, a multitude of smaller, specialized companies cater to niche segments. The market is characterized by a dynamic interplay between established players and emerging businesses. Innovation is driven by both domestic and international companies, with a focus on sustainable materials, smart home integration, and design innovation. Regulatory frameworks, primarily focused on safety and environmental standards, influence manufacturing processes and product design. Substitute products, such as repurposed furniture and imported options, exert some pressure, though consumer preference for quality and design often mitigates this.

- Market Share: Nitori Furniture holds approximately xx% market share, while IKEA commands approximately xx%. Other significant players such as Muji and Karimoku contribute to a consolidated xx% share, leaving the remainder to smaller players.

- M&A Activity: The number of M&A deals in the period 2019-2024 was approximately xx, indicating a moderate level of consolidation. This activity is primarily driven by expansion strategies and the acquisition of specialized competencies.

- End-User Trends: Increasing urbanization and a growing preference for minimalist and multifunctional furniture are shaping consumer demand. The emphasis on sustainability and eco-friendly products is further influencing purchasing decisions.

Japan Home Furniture Industry Industry Insights & Trends

The Japan Home Furniture Industry is experiencing a period of transformation, driven by several key factors. The market size, currently valued at xx Million, is projected to reach xx Million by 2033. This growth is fueled by evolving consumer preferences, technological advancements, and economic expansion. Specifically, the increasing disposable income of the middle class fuels the demand for high-quality, stylish furniture. The shift towards online shopping and the adoption of e-commerce platforms have also significantly impacted distribution channels. Technological disruptions, like the introduction of smart furniture and personalized design tools, are changing the industry landscape. Further, the rising popularity of minimalist and sustainable designs is influencing consumer choices, leading manufacturers to adopt eco-friendly practices and innovative materials. The market exhibits regional variations in growth rates, with urban centers demonstrating a higher growth rate compared to rural areas.

Key Markets & Segments Leading Japan Home Furniture Industry

The living room and dining room furniture segment currently dominates the market, accounting for approximately xx% of the total revenue in 2025. This is followed by bedroom furniture (xx%) and kitchen furniture (xx%). Online distribution is showing strong growth, while specialty stores continue to maintain a significant market share.

Segment Drivers:

- Living Room & Dining Room Furniture: Growing preference for modern and stylish designs, increasing disposable income, and renovation projects drive this segment.

- Bedroom Furniture: Rising urbanization and a preference for space-saving furniture.

- Online Distribution: Convenience, wider product selection, and competitive pricing fuel online sales.

Dominance Analysis:

The dominance of the living room and dining room furniture segment reflects the emphasis on social spaces within the Japanese home. The rise of online channels underscores the shift in consumer shopping habits, demanding flexible and convenient purchasing options.

Japan Home Furniture Industry Product Developments

Recent product innovations focus on incorporating technology into furniture, such as smart home integration and adjustable features. Sustainable materials and eco-friendly manufacturing processes are also gaining traction, reflecting increasing environmental awareness among consumers. These advancements enhance product functionality, durability, and appeal, providing a competitive edge in the market.

Challenges in the Japan Home Furniture Industry Market

The industry faces challenges including increasing material costs, fluctuating exchange rates impacting import/export dynamics, and intense competition from both domestic and international brands. Supply chain disruptions and labor shortages can further hinder production and delivery timelines, affecting market performance. Moreover, stringent regulatory compliance requirements and evolving consumer preferences necessitate continuous innovation and adaptation.

Forces Driving Japan Home Furniture Industry Growth

Key growth drivers include rising disposable incomes, increasing urbanization, and technological advancements facilitating smart home integration. Government initiatives promoting sustainable manufacturing practices and supportive policies for the furniture industry also contribute to market expansion. The increasing adoption of online retail channels further facilitates industry growth, offering broader reach and consumer convenience.

Long-Term Growth Catalysts in the Japan Home Furniture Industry

Long-term growth hinges on continued innovation in materials, design, and technology. Strategic partnerships and collaborations with technology companies will enable smart home integration and the personalization of furniture solutions. Expanding into new market segments and diversifying product offerings will further fuel growth.

Emerging Opportunities in Japan Home Furniture Industry

The growing demand for customizable furniture, smart home integration, and sustainable products presents lucrative opportunities. Expanding into niche markets, such as co-living spaces or smaller apartments, can unlock significant growth potential. Capitalizing on rising consumer preferences for eco-friendly materials and responsible manufacturing practices will enhance brand value and appeal to the environmentally conscious consumer.

Leading Players in the Japan Home Furniture Industry Sector

- Muji

- SanKou Group

- Oliver Co Ltd

- Sunmore Co Ltd

- Shimachu

- Cassina Ixc Ltd

- Nitori Furniture

- IKEA

- Kashiwa

- Karimoku

Key Milestones in Japan Home Furniture Industry Industry

- March 2022: Nitori Retail opens its first Singapore outlet, signifying international expansion and market diversification.

- April 2022: IKEA and H&M's partnership to create a design incubator demonstrates a commitment to fostering innovation and supporting smaller manufacturers. This signals a focus on sustainability and nurturing the broader design ecosystem.

Strategic Outlook for Japan Home Furniture Industry Market

The Japan Home Furniture Industry is poised for sustained growth, driven by technological advancements, evolving consumer preferences, and strategic partnerships. Companies that prioritize innovation, sustainability, and customer-centric approaches will be best positioned to capitalize on the significant market opportunities that lie ahead. The focus should be on offering customized, smart, and environmentally conscious products and enhancing supply chain efficiency to adapt to evolving market dynamics.

Japan Home Furniture Industry Segmentation

-

1. Application

- 1.1. Kitchen Furniture

- 1.2. Living Room and Dining Room Furniture

- 1.3. Bedroom Furniture

- 1.4. Other Furniture

-

2. Distribution Channel

- 2.1. Supermarkets & Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Japan Home Furniture Industry Segmentation By Geography

- 1. Japan

Japan Home Furniture Industry Regional Market Share

Geographic Coverage of Japan Home Furniture Industry

Japan Home Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Number of E-Commerce Users is Driving the Market; Increase in Residential Construction is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Volatile Raw Material Prices; Low Replacement Demand

- 3.4. Market Trends

- 3.4.1. Expansion of Single Person Homes

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Home Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Kitchen Furniture

- 5.1.2. Living Room and Dining Room Furniture

- 5.1.3. Bedroom Furniture

- 5.1.4. Other Furniture

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets & Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Muji

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SanKou Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Oliver Co Ltd **List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sunmore Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shimachu

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cassina Ixc Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nitori Furniture

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IKEA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kashiwa

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Karimoku

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Muji

List of Figures

- Figure 1: Japan Home Furniture Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan Home Furniture Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Home Furniture Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Japan Home Furniture Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Japan Home Furniture Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Japan Home Furniture Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Japan Home Furniture Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Japan Home Furniture Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Home Furniture Industry?

The projected CAGR is approximately 2.52%.

2. Which companies are prominent players in the Japan Home Furniture Industry?

Key companies in the market include Muji, SanKou Group, Oliver Co Ltd **List Not Exhaustive, Sunmore Co Ltd, Shimachu, Cassina Ixc Ltd, Nitori Furniture, IKEA, Kashiwa, Karimoku.

3. What are the main segments of the Japan Home Furniture Industry?

The market segments include Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.02 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth in Number of E-Commerce Users is Driving the Market; Increase in Residential Construction is Driving the Market.

6. What are the notable trends driving market growth?

Expansion of Single Person Homes.

7. Are there any restraints impacting market growth?

Volatile Raw Material Prices; Low Replacement Demand.

8. Can you provide examples of recent developments in the market?

April 2022: IKEA and H&M are partnered to create an 'ideas factory' on the high street that aims to seek out, mentor and promote designers and small-scale manufacturers in London.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Home Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Home Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Home Furniture Industry?

To stay informed about further developments, trends, and reports in the Japan Home Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence