Key Insights

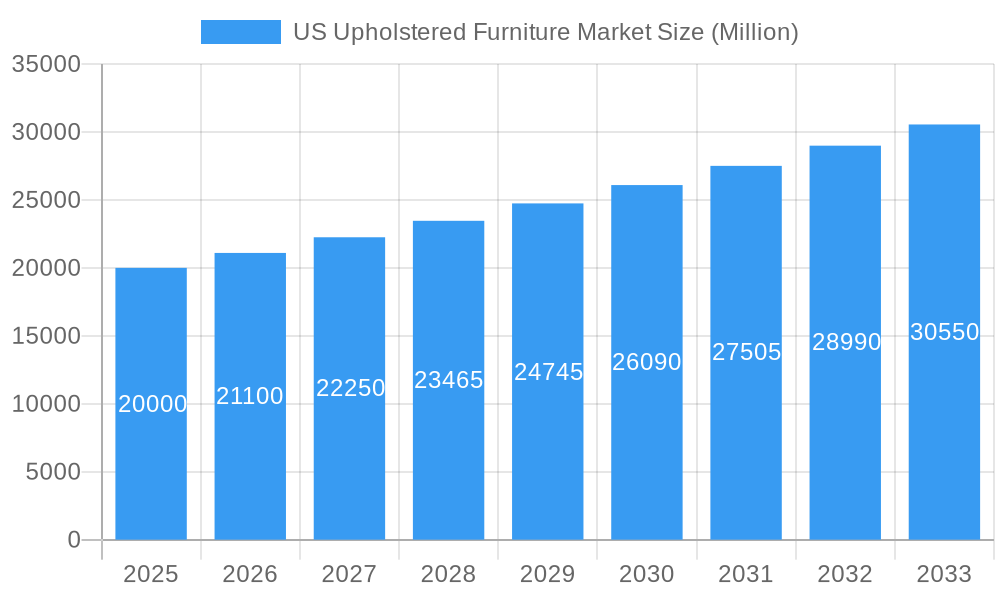

The U.S. upholstered furniture market is poised for robust growth, estimated to be valued at approximately $20 billion. With a projected Compound Annual Growth Rate (CAGR) exceeding 5.50% from 2025 through 2033, this sector demonstrates strong underlying demand and expansionary potential. This growth is primarily fueled by evolving consumer preferences for home comfort and aesthetic appeal, a sustained interest in home renovation and interior redesign, and the increasing influence of online retail channels offering wider selections and convenient purchasing options. The rise of smaller living spaces in urban areas also contributes, driving demand for versatile and space-saving upholstered furniture solutions. Furthermore, a growing emphasis on sustainable and ethically sourced materials is shaping product development and consumer choices, presenting both opportunities and challenges for manufacturers.

US Upholstered Furniture Market Market Size (In Billion)

The market's trajectory is further shaped by several key trends, including a notable surge in custom and personalized upholstery options, allowing consumers to tailor furniture to their specific tastes and décor. The integration of smart technology into upholstered pieces, such as built-in charging ports and adjustable comfort features, is also gaining traction. However, the market faces potential headwinds from fluctuating raw material costs, particularly for fabrics and components, which can impact profit margins and pricing strategies. Supply chain disruptions, though easing, can still pose challenges to timely production and delivery. Despite these restraints, leading companies like Mayo Furniture, Bassett Furniture, and Kincaid are actively innovating and expanding their product lines, focusing on design, durability, and sustainability to capture market share. The analysis of production, consumption, import/export dynamics, and price trends will offer a comprehensive understanding of the market's intricate workings and future outlook.

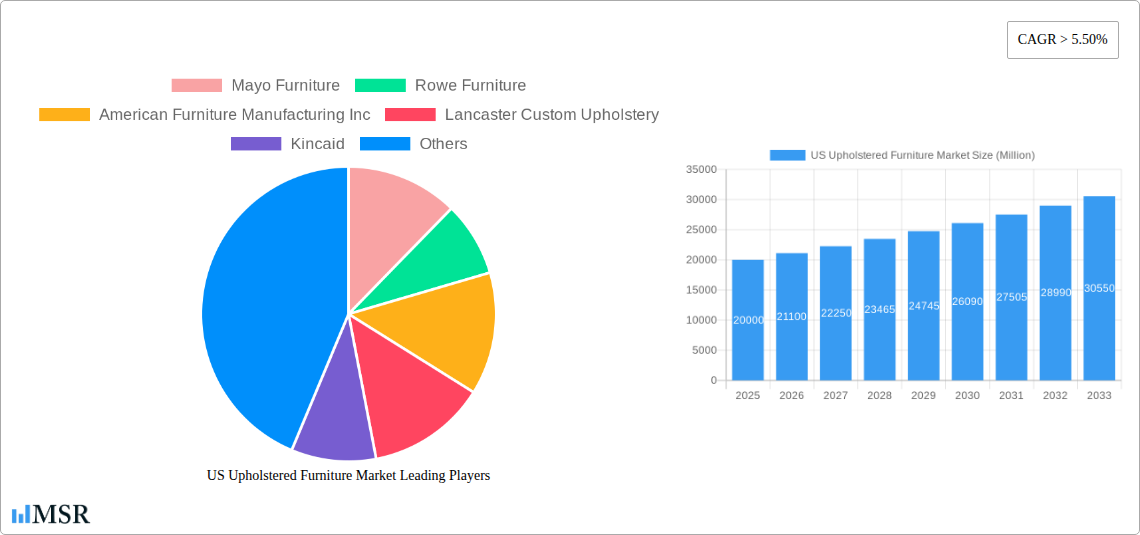

US Upholstered Furniture Market Company Market Share

This in-depth analysis delves into the US upholstered furniture market, providing critical insights for manufacturers, retailers, investors, and industry stakeholders. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025, this report offers an exhaustive examination of market trends, competitive landscapes, and future growth trajectories. Gain actionable intelligence on production, consumption, imports, exports, pricing, and key industry developments to inform your strategic decisions in this dynamic sector.

US Upholstered Furniture Market Market Concentration & Dynamics

The US upholstered furniture market exhibits a moderate to high market concentration, with a significant share held by established players. Innovation is driven by a blend of traditional craftsmanship and the adoption of new materials and manufacturing technologies. The regulatory framework primarily focuses on safety standards and environmental compliance, influencing product design and material sourcing. Substitute products, such as modular sofas and beanbag chairs, pose a growing challenge, particularly in niche segments. End-user trends are increasingly leaning towards customization, sustainability, and smart furniture integration. Mergers and Acquisitions (M&A) activities have been strategic, aimed at expanding market reach, product portfolios, and operational efficiencies. For instance, a notable number of M&A deal counts in the historical period indicate consolidation and the pursuit of market leadership. Companies like Mayo Furniture, Rowe Furniture, and American Furniture Manufacturing Inc. are key players navigating these dynamics.

US Upholstered Furniture Market Industry Insights & Trends

The US upholstered furniture market size is projected to witness robust growth, driven by several key factors. Economic growth and rising disposable incomes continue to be primary market growth drivers, fueling consumer spending on home furnishings. The residential construction sector, a significant indicator of demand for new furniture, plays a crucial role. Technological disruptions, including advancements in 3D printing for prototyping and customization, and the integration of smart technologies like embedded charging ports and adjustable features, are reshaping product offerings. Evolving consumer behaviors, such as a heightened preference for online purchasing channels and a growing demand for ethically sourced and sustainable materials, are compelling manufacturers to adapt their business models and product lines. The CAGR for the forecast period reflects a steady upward trend, indicating sustained market expansion. The influence of interior design trends, including the demand for minimalist aesthetics, maximalist statements, and biophilic design, further shapes consumer preferences and product innovation.

Key Markets & Segments Leading US Upholstered Furniture Market

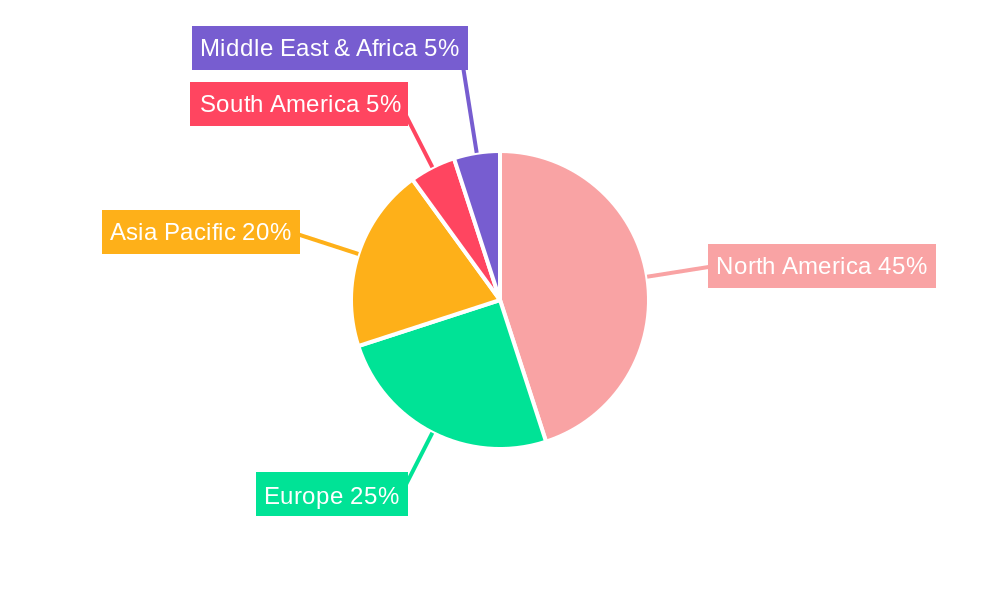

The US upholstered furniture market is dominated by several key regions and segments, showcasing varied growth patterns and consumption trends.

- Production Analysis: The Southeast region of the United States remains a dominant hub for upholstered furniture manufacturing, benefiting from a long-standing tradition of furniture making, skilled labor, and established supply chains. This region leads in the production of a wide range of upholstered goods, from sofas and sectionals to chairs and ottomans.

- Consumption Analysis: Urban and suburban areas across the nation exhibit the highest consumption rates. Factors such as housing market strength, demographic shifts (e.g., millennial homeownership), and evolving lifestyle preferences significantly influence consumption patterns. The North American upholstered furniture market as a whole represents a substantial consumer base.

- Import Market Analysis (Value & Volume): Asia, particularly China and Vietnam, continues to be a major source of imported upholstered furniture, driven by cost efficiencies. However, there's a discernible trend towards diversifying import sources and increasing domestic production to mitigate supply chain risks. The import market analysis highlights significant value and volume, impacting domestic pricing and competition.

- Export Market Analysis (Value & Volume): While the US is a net importer of upholstered furniture, select manufacturers with unique designs or premium offerings are carving out niche export markets, particularly in Canada and Mexico. The export market analysis indicates a smaller but growing segment of value-added exports.

- Price Trend Analysis: The price trend analysis reveals fluctuations influenced by raw material costs (e.g., foam, fabric, wood), labor expenses, and transportation logistics. Inflationary pressures and supply chain disruptions have historically led to price increases, while competitive market dynamics can exert downward pressure on prices for certain product categories.

US Upholstered Furniture Market Product Developments

Recent product developments in the US upholstered furniture market are characterized by an emphasis on comfort, durability, and aesthetic versatility. Innovations include the incorporation of performance fabrics resistant to stains and wear, the use of sustainable and recycled materials, and advanced ergonomic designs for enhanced user experience. The integration of modular components allows for greater customization and adaptability to various living spaces, a key competitive edge. Many manufacturers are exploring smart furniture features, such as integrated USB ports and adjustable seating positions, catering to the tech-savvy consumer.

Challenges in the US Upholstered Furniture Market Market

The US upholstered furniture market faces several significant challenges. These include:

- Supply Chain Disruptions: Volatility in global supply chains for raw materials like foam, textiles, and timber, along with rising shipping costs, directly impacts production timelines and costs.

- Rising Input Costs: Inflationary pressures on raw materials, energy, and labor contribute to increased manufacturing expenses, potentially affecting profit margins and retail prices.

- Intense Competition: The market is highly competitive, with a mix of domestic manufacturers and lower-cost imports, creating price pressures and demanding continuous innovation and cost management.

- Sustainability Demands: Growing consumer and regulatory pressure for eco-friendly products necessitates investment in sustainable materials and production processes, which can be costly to implement.

Forces Driving US Upholstered Furniture Market Growth

Several powerful forces are driving the growth of the US upholstered furniture market. These include:

- Housing Market Recovery and Growth: An active housing market, with increased home sales and new constructions, directly correlates with higher demand for new furniture.

- Consumer Spending and Disposable Income: A healthy economy and rising disposable incomes empower consumers to invest in home furnishings that enhance their living spaces.

- Evolving Consumer Preferences: The desire for personalized living spaces, comfort, and stylish aesthetics fuels demand for a wide array of upholstered furniture options.

- E-commerce Expansion: The increasing accessibility and convenience of online retail channels are opening new avenues for furniture sales and reaching a broader customer base.

Challenges in the US Upholstered Furniture Market Market

Long-term growth catalysts for the US upholstered furniture market are deeply rooted in innovation and strategic market expansion. The ongoing development of sustainable and eco-friendly materials, such as recycled textiles and bio-based foams, presents a significant opportunity to capture environmentally conscious consumer segments. Furthermore, the continued integration of smart home technologies into furniture pieces will drive demand for more functional and technologically advanced products. Strategic partnerships and collaborations, both within the industry and with complementary sectors, can unlock new distribution channels and customer bases.

Emerging Opportunities in US Upholstered Furniture Market

Emerging opportunities within the US upholstered furniture market lie in several key areas. The growing demand for customizable and made-to-order furniture presents a significant avenue for growth, allowing manufacturers to cater to individual consumer preferences. The expansion of the direct-to-consumer (DTC) model, particularly through e-commerce platforms, offers a direct channel to reach consumers and build brand loyalty. Furthermore, the increasing focus on sustainable and ethically sourced products is creating a niche for manufacturers committed to environmental responsibility. The rise of the rental market and co-living spaces also presents an opportunity for durable, versatile, and cost-effective upholstered furniture solutions.

Leading Players in the US Upholstered Furniture Market Sector

- Mayo Furniture

- Rowe Furniture

- American Furniture Manufacturing Inc.

- Lancaster Custom Upholstery

- Kincaid

- Lazar Industries

- Style Upholstery

- Hickory White

- Benchmark Upholstery

- Stickley

- Bassett Furniture

Key Milestones in US Upholstered Furniture Market Industry

- May 2023: Bassett Furniture Industries partnered with Acuative to support its growing need for efficient, state-of-the-art networking communications and security technology. Bassett is a 121-year-old manufacturer of home furnishings with 60 corporately owned retail stores across the U.S.

- September 2022: Bassett Furniture acquired the capital stock of Noa Home Inc., a mid-priced e-commerce furniture retailer headquartered in Montreal, Canada. Noa has operations in Canada, Australia, Singapore, and the United Kingdom and had net revenues of approximately C$19.1 million for its most recent fiscal year.

- November 2022: Hickory Furniture Collective acquired Old Hickory Furniture Company in Shelbyville, Indiana. With this acquisition, Hickory Furniture Collective is now the largest maker of hickory furniture worldwide. Hickory Furniture Collective was formed in 2018 with three brands: Hickory Furniture Designs, Flat Rock Furniture, and Rocky Top Furniture. Now, Old Hickory Furniture Company joins the family of brands, all proudly made in the USA.

Strategic Outlook for US Upholstered Furniture Market Market

The strategic outlook for the US upholstered furniture market is optimistic, driven by a continued focus on product innovation, sustainability, and customer-centric strategies. Manufacturers that embrace digital transformation, enhance their e-commerce capabilities, and offer personalized product options will be well-positioned for future growth. The increasing consumer preference for sustainable and ethically produced goods presents a significant opportunity for companies investing in eco-friendly materials and transparent supply chains. Strategic acquisitions and partnerships will likely continue to shape the competitive landscape, enabling companies to expand their market reach and diversify their product portfolios. The market is expected to see sustained demand driven by home improvement trends and evolving lifestyle needs.

US Upholstered Furniture Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

US Upholstered Furniture Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Upholstered Furniture Market Regional Market Share

Geographic Coverage of US Upholstered Furniture Market

US Upholstered Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the online sales of upholstered furniture; Customizations available of high-quality and cost-effective

- 3.3. Market Restrains

- 3.3.1. Factors such as increased manufacturing complexity and labor shortage.

- 3.4. Market Trends

- 3.4.1. Upholstered Furniture Dominates Wooden Residential Furniture in the United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Upholstered Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America US Upholstered Furniture Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America US Upholstered Furniture Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe US Upholstered Furniture Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa US Upholstered Furniture Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific US Upholstered Furniture Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Mayo Furniture

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rowe Furniture

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 American Furniture Manufacturing Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lancaster Custom Upholstery

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kincaid

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lazar Industries

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Style Upholstery**List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hickory White

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Benchmark Upholstery

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Stickley

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bassett Furniture

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Mayo Furniture

List of Figures

- Figure 1: Global US Upholstered Furniture Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Upholstered Furniture Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America US Upholstered Furniture Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America US Upholstered Furniture Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America US Upholstered Furniture Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America US Upholstered Furniture Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America US Upholstered Furniture Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America US Upholstered Furniture Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America US Upholstered Furniture Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America US Upholstered Furniture Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America US Upholstered Furniture Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America US Upholstered Furniture Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America US Upholstered Furniture Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America US Upholstered Furniture Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America US Upholstered Furniture Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America US Upholstered Furniture Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America US Upholstered Furniture Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America US Upholstered Furniture Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America US Upholstered Furniture Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America US Upholstered Furniture Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America US Upholstered Furniture Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America US Upholstered Furniture Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America US Upholstered Furniture Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America US Upholstered Furniture Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America US Upholstered Furniture Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe US Upholstered Furniture Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe US Upholstered Furniture Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe US Upholstered Furniture Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe US Upholstered Furniture Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe US Upholstered Furniture Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe US Upholstered Furniture Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe US Upholstered Furniture Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe US Upholstered Furniture Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe US Upholstered Furniture Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe US Upholstered Furniture Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe US Upholstered Furniture Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe US Upholstered Furniture Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa US Upholstered Furniture Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa US Upholstered Furniture Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa US Upholstered Furniture Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa US Upholstered Furniture Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa US Upholstered Furniture Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa US Upholstered Furniture Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa US Upholstered Furniture Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa US Upholstered Furniture Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa US Upholstered Furniture Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa US Upholstered Furniture Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa US Upholstered Furniture Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa US Upholstered Furniture Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific US Upholstered Furniture Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific US Upholstered Furniture Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific US Upholstered Furniture Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific US Upholstered Furniture Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific US Upholstered Furniture Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific US Upholstered Furniture Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific US Upholstered Furniture Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific US Upholstered Furniture Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific US Upholstered Furniture Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific US Upholstered Furniture Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific US Upholstered Furniture Market Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific US Upholstered Furniture Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Upholstered Furniture Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global US Upholstered Furniture Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global US Upholstered Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global US Upholstered Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global US Upholstered Furniture Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global US Upholstered Furniture Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global US Upholstered Furniture Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global US Upholstered Furniture Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global US Upholstered Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global US Upholstered Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global US Upholstered Furniture Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global US Upholstered Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global US Upholstered Furniture Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global US Upholstered Furniture Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global US Upholstered Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global US Upholstered Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global US Upholstered Furniture Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global US Upholstered Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global US Upholstered Furniture Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global US Upholstered Furniture Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global US Upholstered Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global US Upholstered Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global US Upholstered Furniture Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global US Upholstered Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global US Upholstered Furniture Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global US Upholstered Furniture Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global US Upholstered Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global US Upholstered Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global US Upholstered Furniture Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global US Upholstered Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global US Upholstered Furniture Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global US Upholstered Furniture Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global US Upholstered Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global US Upholstered Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global US Upholstered Furniture Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global US Upholstered Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific US Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Upholstered Furniture Market?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the US Upholstered Furniture Market?

Key companies in the market include Mayo Furniture, Rowe Furniture, American Furniture Manufacturing Inc, Lancaster Custom Upholstery, Kincaid, Lazar Industries, Style Upholstery**List Not Exhaustive, Hickory White, Benchmark Upholstery, Stickley, Bassett Furniture.

3. What are the main segments of the US Upholstered Furniture Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the online sales of upholstered furniture; Customizations available of high-quality and cost-effective.

6. What are the notable trends driving market growth?

Upholstered Furniture Dominates Wooden Residential Furniture in the United States.

7. Are there any restraints impacting market growth?

Factors such as increased manufacturing complexity and labor shortage..

8. Can you provide examples of recent developments in the market?

May 2023: Bassett Furniture Industries partnered with Acuative to support its growing need for efficient, state-of-the-art networking communications and security technology. Bassett is a 121-year-old manufacturer of home furnishings with 60 corporately owned retail stores across the U.S.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Upholstered Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Upholstered Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Upholstered Furniture Market?

To stay informed about further developments, trends, and reports in the US Upholstered Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence