Key Insights

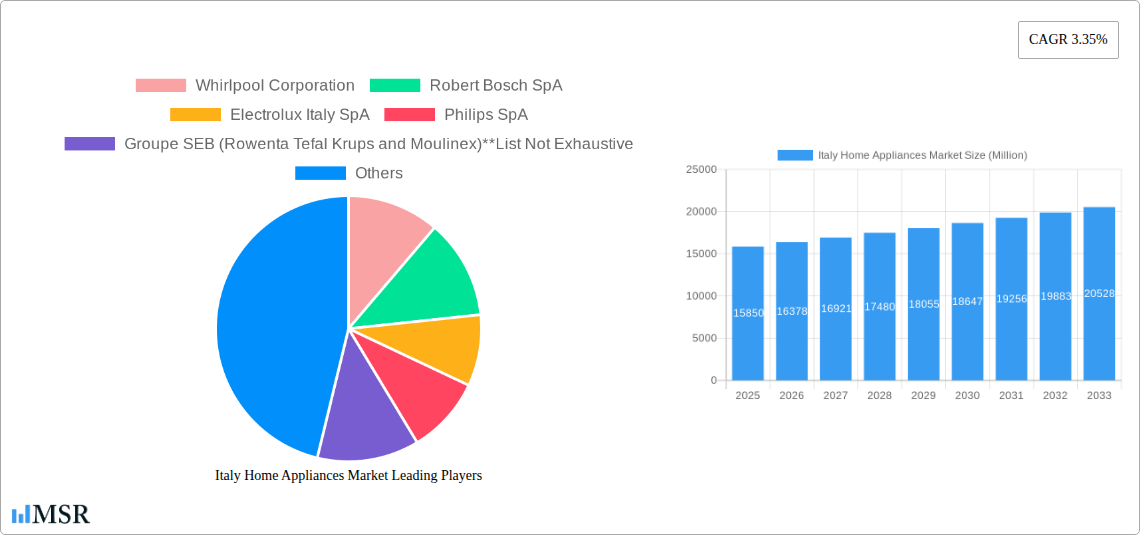

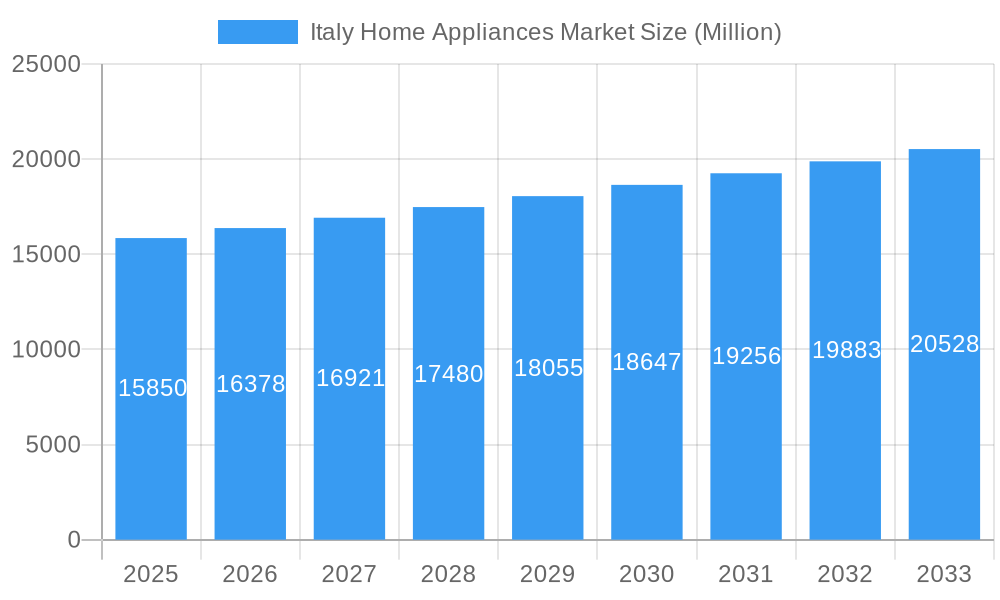

The Italian home appliances market is poised for steady growth, projected to reach an estimated USD 15,850 Million by the end of 2025, expanding at a Compound Annual Growth Rate (CAGR) of 3.35% through 2033. This expansion is underpinned by several key drivers, including rising disposable incomes, an increasing focus on energy efficiency and smart home technologies, and a strong demand for innovative and aesthetically pleasing kitchen and laundry appliances. Consumers are increasingly investing in higher-end models that offer enhanced functionality, convenience, and sustainability. Furthermore, government incentives aimed at promoting energy-efficient appliance upgrades and the growing trend of home renovation projects are contributing significantly to market momentum. The post-pandemic shift towards more comfortable and functional living spaces continues to influence purchasing decisions, with consumers prioritizing durable, technologically advanced, and aesthetically integrated appliances that enhance their daily lives.

Italy Home Appliances Market Market Size (In Billion)

Despite the positive outlook, the market faces certain restraints. While innovation is a key driver, the high cost of advanced smart appliances can be a barrier for a segment of the population. Additionally, fluctuations in raw material prices and global supply chain disruptions can impact manufacturing costs and product availability, potentially leading to price volatility. Intense competition among both established global players like Whirlpool, Bosch, and Electrolux, and emerging domestic brands also pressures profit margins. The market is segmented across production, consumption, imports, exports, and price trends, with notable activity in areas like smart refrigerators, induction cooktops, and high-efficiency washing machines. Italy's strong manufacturing base and discerning consumer base create a dynamic environment for home appliance innovation and adoption, making it a crucial market within the European landscape.

Italy Home Appliances Market Company Market Share

This in-depth report provides a definitive analysis of the Italy home appliances market, offering strategic insights into production, consumption, imports, exports, and price trends. Covering the historical period (2019–2024) and projecting growth through 2033 with a base and estimated year of 2025, this study is essential for appliance manufacturers, distributors, retailers, and investors seeking to capitalize on the dynamic Italian market. We delve into key market drivers, emerging opportunities, competitive landscapes, and technological advancements shaping the future of Italian household appliances.

Italy Home Appliances Market Market Concentration & Dynamics

The Italy home appliances market exhibits a moderate to high level of market concentration, with key players like Whirlpool Corporation, Robert Bosch SpA, Electrolux Italy SpA, Groupe SEB, and De'Longhi SpA holding significant market share. The competitive landscape is characterized by intense rivalry in product innovation, pricing strategies, and distribution networks. Innovation ecosystems are driven by a focus on energy efficiency, smart home integration, and sustainable product design. Regulatory frameworks, such as those pertaining to energy labeling and product safety, play a crucial role in shaping market dynamics. The presence of substitute products is limited for core appliances, but innovation in related smart home devices and energy-saving solutions presents indirect competition. End-user trends are increasingly leaning towards premium features, convenience, and eco-friendly options. Merger and acquisition (M&A) activities, while not consistently high, are strategic moves by leading companies to expand their product portfolios and market reach. For instance, the acquisition of LEANFA by MUEGGE signifies consolidation in specialized technology sectors impacting the broader appliance ecosystem. Quantifiable impacts of M&A deals and detailed market share percentages for leading players are meticulously detailed within the full report.

Italy Home Appliances Market Industry Insights & Trends

The Italy home appliances market is poised for robust growth, driven by a confluence of factors including rising disposable incomes, increasing urbanization, and a growing consumer preference for advanced, energy-efficient, and aesthetically pleasing appliances. The market size is projected to reach approximately €XX Million by 2025, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. Technological disruptions are at the forefront, with the integration of the Internet of Things (IoT) transforming traditional appliances into smart, connected devices. This includes features like remote control, personalized settings, and predictive maintenance, enhancing user experience and convenience. The increasing awareness surrounding environmental sustainability is fueling demand for eco-friendly appliances with low energy consumption and longer lifespans, aligning with stringent EU energy efficiency directives. Evolving consumer behaviors are characterized by a greater emphasis on premiumization, with consumers willing to invest in high-end appliances that offer superior performance, durability, and design. The demand for smaller, more adaptable appliances for compact living spaces is also a significant trend, especially in urban centers. Furthermore, the shift towards online retail channels for appliance purchases is gaining momentum, necessitating robust e-commerce strategies from manufacturers and retailers. The report provides detailed analysis of market size evolution and CAGR projections.

Key Markets & Segments Leading Italy Home Appliances Market

The Italy home appliances market is segmented across several critical areas, each presenting unique growth dynamics and opportunities.

Production Analysis:

- Dominant Regions: Northern Italy, particularly regions like Lombardy and Veneto, are the primary hubs for appliance manufacturing due to established industrial infrastructure, skilled labor, and proximity to key suppliers.

- Drivers: Strong manufacturing base, access to advanced technology, and supportive government initiatives for industrial innovation are key drivers.

Consumption Analysis:

- Dominant Regions: High population density and higher disposable incomes in Northern and Central Italy drive significant consumer demand for a wide range of home appliances.

- Drivers: Urbanization, increasing household formation, and a growing middle class with a preference for modern amenities fuel consumption.

Import Market Analysis (Value & Volume):

- Dominant Product Categories: Major kitchen appliances (refrigerators, ovens, dishwashers) and smaller domestic appliances (coffee makers, vacuum cleaners) represent significant import volumes and values.

- Drivers: Demand for specialized or niche products not readily available domestically, competitive pricing from international manufacturers, and the desire for cutting-edge technology. The value of imports is influenced by premium brand offerings, while volume is driven by essential household necessities.

Export Market Analysis (Value & Volume):

- Dominant Product Categories: High-quality Italian-designed and manufactured appliances, particularly in categories like cooking ranges and premium small appliances, command strong export markets.

- Drivers: Renowned Italian design and craftsmanship, brand reputation for quality and durability, and established distribution networks in key international markets like Europe and North America.

Price Trend Analysis:

- Key Influences: Raw material costs, energy prices, technological advancements, brand positioning, and promotional activities significantly impact price trends across various appliance segments.

- Drivers: Inflationary pressures on raw materials can lead to price increases, while increased competition and the introduction of more affordable models can exert downward pressure. The report details price fluctuations and forecasting for various appliance categories.

Italy Home Appliances Market Product Developments

The Italy home appliances market is witnessing a surge in product innovation focused on enhancing user convenience, energy efficiency, and smart connectivity. Manufacturers are introducing appliances with advanced features such as AI-powered cooking assistants, self-cleaning functions, and integrated smart home ecosystems, allowing seamless control via mobile devices. For example, Whirlpool Corporation's Whirlpool Space 400 Total No Frost built-in combined refrigerator exemplifies this trend with its spacious 400-liter capacity and Push To Open technology, offering optimized food preservation and space utilization. The emphasis on sustainability is evident in the development of appliances with reduced energy and water consumption, aligning with stringent environmental regulations and consumer demand for eco-conscious choices. These product developments not only offer a competitive edge to companies but also cater to the evolving needs and preferences of modern Italian households.

Challenges in the Italy Home Appliances Market Market

The Italy home appliances market faces several challenges that can impede growth and profitability. These include intense price competition, particularly from low-cost imported goods, which puts pressure on profit margins for domestic manufacturers. Fluctuations in raw material costs and supply chain disruptions, exacerbated by geopolitical events, can lead to increased production expenses and delays. Moreover, stringent environmental regulations, while driving innovation, also necessitate significant investment in research and development to meet compliance standards. The evolving regulatory landscape requires continuous adaptation from manufacturers.

Forces Driving Italy Home Appliances Market Growth

Several key forces are propelling the Italy home appliances market forward. Technological advancements, especially the integration of smart home capabilities and AI, are creating a demand for more sophisticated and connected appliances, enhancing user convenience and functionality. Growing consumer awareness and demand for energy-efficient products, driven by environmental concerns and rising energy costs, are pushing manufacturers to develop and market eco-friendly appliances. Furthermore, increasing disposable incomes and a rising standard of living contribute to higher consumer spending on premium and feature-rich home appliances.

Challenges in the Italy Home Appliances Market Market

Long-term growth catalysts in the Italy home appliances market are rooted in sustained innovation and strategic market expansion. The continuous development of smarter, more sustainable, and energy-efficient appliances will be crucial in meeting evolving consumer expectations and regulatory demands. Partnerships between appliance manufacturers and technology providers will foster the creation of integrated smart home solutions, unlocking new revenue streams and enhancing consumer loyalty. Expanding into emerging distribution channels, such as direct-to-consumer (DTC) online sales and partnerships with smart home installers, will also be vital for future growth.

Emerging Opportunities in Italy Home Appliances Market

Emerging opportunities in the Italy home appliances market lie in the burgeoning demand for sustainable and energy-efficient products, driven by both consumer awareness and regulatory incentives. The rapid adoption of smart home technologies presents a significant avenue for growth, with consumers seeking integrated and connected living experiences. The premium segment, characterized by high-performance, aesthetically pleasing, and feature-rich appliances, continues to offer substantial growth potential. Furthermore, exploring niche markets, such as compact appliances for urban dwellers or specialized kitchen equipment, can unlock new customer bases.

Leading Players in the Italy Home Appliances Market Sector

- Whirlpool Corporation

- Robert Bosch SpA

- Electrolux Italy SpA

- Philips SpA

- Groupe SEB

- De'Longhi SpA

- Miele

- Haier AEG

- Panasonic Industry Europe GmbH

- Bsh Elettrodomestici SpA

- Candy Group

Key Milestones in Italy Home Appliances Market Industry

- October 2022: MUEGGE, a manufacturer of microwave and plasma technology, expanded into Italy with the acquisition of LEANFA, an Italian manufacturer of solid-state microwave and high-frequency generators, signaling consolidation in specialized technology.

- January 2022: Whirlpool Corporation introduced the Whirlpool Space 400 Total No Frost built-in combined refrigerator with Push To Open technology. This appliance boasts 400 liters of capacity and 75 cm of width, offering greater capacity and space optimization for food preservation to consumers.

Strategic Outlook for Italy Home Appliances Market Market

The strategic outlook for the Italy home appliances market is characterized by a strong emphasis on innovation, sustainability, and digital integration. Key growth accelerators include the continued development of smart appliances that offer enhanced convenience and connectivity, catering to the evolving demands of tech-savvy consumers. The increasing focus on energy efficiency and eco-friendly products, driven by both regulatory mandates and consumer consciousness, presents a significant opportunity for companies that can deliver on these fronts. Furthermore, strategic partnerships and collaborations, particularly within the smart home ecosystem, will be crucial for expanding market reach and offering integrated solutions. The market is expected to witness further consolidation and a focus on premiumization, as manufacturers strive to differentiate themselves in a competitive landscape.

Italy Home Appliances Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Italy Home Appliances Market Segmentation By Geography

- 1. Italy

Italy Home Appliances Market Regional Market Share

Geographic Coverage of Italy Home Appliances Market

Italy Home Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Household Disposable Income Drives the Market; Changing Lifestyles Drives the Market

- 3.3. Market Restrains

- 3.3.1. Repairing Challenges; Infrastructure and Space Limitations

- 3.4. Market Trends

- 3.4.1 Retailing Grows Through Online Channel

- 3.4.2 While Traditional Supply Chain Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Home Appliances Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Whirlpool Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Robert Bosch SpA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Electrolux Italy SpA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Philips SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Groupe SEB (Rowenta Tefal Krups and Moulinex)**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 De'Longhi SpA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Miele

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Haier AEG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Panasonic Industry Europe GmbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bsh Elettrodomestici SpA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Candy Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Whirlpool Corporation

List of Figures

- Figure 1: Italy Home Appliances Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Italy Home Appliances Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Home Appliances Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Italy Home Appliances Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Italy Home Appliances Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Italy Home Appliances Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Italy Home Appliances Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Italy Home Appliances Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Italy Home Appliances Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Italy Home Appliances Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Italy Home Appliances Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Italy Home Appliances Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Italy Home Appliances Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Italy Home Appliances Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Home Appliances Market?

The projected CAGR is approximately 3.66%.

2. Which companies are prominent players in the Italy Home Appliances Market?

Key companies in the market include Whirlpool Corporation, Robert Bosch SpA, Electrolux Italy SpA, Philips SpA, Groupe SEB (Rowenta Tefal Krups and Moulinex)**List Not Exhaustive, De'Longhi SpA, Miele, Haier AEG, Panasonic Industry Europe GmbH, Bsh Elettrodomestici SpA, Candy Group.

3. What are the main segments of the Italy Home Appliances Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Household Disposable Income Drives the Market; Changing Lifestyles Drives the Market.

6. What are the notable trends driving market growth?

Retailing Grows Through Online Channel. While Traditional Supply Chain Dominates the Market.

7. Are there any restraints impacting market growth?

Repairing Challenges; Infrastructure and Space Limitations.

8. Can you provide examples of recent developments in the market?

In October 2022, MUEGGE, a manufacturer of microwave and plasma technology, expanded into Italy with the acquisition of LEANFA, an Italian manufacturer of solid-state microwave and high-frequency generators.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Home Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Home Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Home Appliances Market?

To stay informed about further developments, trends, and reports in the Italy Home Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence